Matthew Yglesias's Blog, page 2487

November 27, 2010

Kenyan Bicycle Socialism

Apparently the Capital Bikeshare network includes a secret station located inside the White House security perimeter:

Located just inside the gate on State Place at 17th St, NW the station can only be used by those who can actually get inside the White House's security perimeter. And it's for that reason, not national security, that it doesn't show up on the map. DDOT doesn't want users making plans based on that station and then finding they can't get to it.

According to DDOT the station, which only has 9 docks, does get used by daily commuters.

This seems in some ways like it would put a large hole in White House security procedures.

What's Going On?

These "What's Going On Here?" signs at NYC construction sites (which seem to be a Bloomberg-era innovation that I don't recall from growing up) are pretty cool:

People like to know what's happening in their community and I think feel better about change if they feel like they're in the loop. This is a good idea that DC and other cities should adopt.

When's It Coming

I first saw signs saying when the next train is coming in Russia. Then I saw them in DC. Then I saw them on the L train in New York. And yesterday I say them on the 6 train, which I used to ride every day to high school:

In my view providing this kind of information is a total game-changer for mass transit. In Amsterdam the streetcar stops have similar information and in Germany it's frequent to provide this sort of data at bus stops. Adding this to buses is, in particular, a relatively low-cost way of adding a ton of value to your city's transit system.

November 26, 2010

Non-Partisan Elections for DC

Mike DeBonis has an excellent piece in the Washington Post about the folly of holding partisan municipal elections in Washington, DC. If I have any disagreement it's that the conclusion that "The problem in the District is that parties add no value to our politics" is too weak. Partisan elections subtract value from our politics by effectively disenfranchising the 10-20 percent of the population that registers Green or Democratic.

Partisan elections also subtract value from our politics by introducing an irrelevant heuristic into the mix. I remember when I told people that I was voting for a Republican for an at-large City Council seat a couple of years ago they were outraged—a Republican!—but of course the legal status of abortion or the merits of invading Iraq weren't on the ballot in City Council race.

In general, I think political parties and partisanship are useful mechanisms for democratic mediation. So my ideal scenario would actually be for DC to have two-party politics with something like a "Growth and Development Party" pitted against a "Preservation and Community Party" which I think roughly captures an actual ideological disagreement that's relevant to city government. But insofar as that's not possible, it'd be best to imitate the many other cities (DeBonis cites Chicago, LA, and Houston) who go non-partisan for these offices.

Leonhardt on China

This David Leonhardt piece on efforts to build a consumer culture in China is just fantastic. There so much right here in these two grafs:

What's striking about Wuqi is just how serious its officials are about making this transition happen — and yet how difficult it nonetheless will be. The Wuqi International Hotel was as comfortable as most Marriotts or Hiltons in the United States, but the surrounding streets had the dusty feel of a backwater. The hardware, liquor and food stores down the block were each the size of a storage closet and about as well lighted. In the evenings, when Wuqi residents gathered in a public square to talk or perform exercises together, many of the stores were closed. The parents I met were thrilled that high school was free but were still saving an enormous portion of their modest incomes to pay for college or a new home. Those savings create a self-reinforcing cycle, in which stores don't flourish because people don't shop much and people don't shop much partly because there aren't many good stores. As Feng Zhendong, Wuqi's reform-minded Communist Party secretary, says, "There's only so much to spend on."

Then there was the hotel itself. During my first night there, I don't think I saw a single other guest — in the lobby, the restaurant, the elevator or on the 19th floor. After I used the hotel gym, the front desk called to ask if I would be using it the next morning as well. In that case, someone would make sure it was unlocked.

There's so much right in here. One thing is that not only is consumption a low share of Chinese GDP, the productivity of the retail sector is lousy. Of course parts of China have fancy international chain stores, but the more "authentic" streets I saw not only had these tiny stores but on average they had zero customers at any given time. Then you have in the empty hotels the problems of an economy that's still heavily planned. Over-investment in certain kinds of prestige projects? Or maybe it's over-investment in things that don't compete with incumbent firms. Wuqi doesn't have a pre-existing Western-style business hotel that's averse to seeing a new one open up. The whole thing is moving at an unprecedented speed, and I don't think anyone really understands how to keep it going.

Alzheimer's in South Korea

Pam Belluck offers a South Korea story that's not all about the confrontation with the DPRK:

South Korea is training thousands of people, including children, as "dementia supporters," to recognize symptoms and care for patients. The 11- to 13-year-olds, for instance, were in the government's "Aging-Friendly Comprehensive Experience Hall" outside Seoul. Besides the aging simulation exercise, they viewed a PowerPoint presentation defining dementia and were trained, in the hall's Dementia Experience Center, to perform hand massage in nursing homes.

" 'What did I do with my phone? It's in the refrigerator,' " said one instructor, explaining memory loss. "Have you seen someone like that? They may go missing and die on the street."

As is often the case, I think too much of the discussion in the United States about population aging is about the purely budgetary aspects of it. More elderly people plus a commitment to give money to elderly people = higher taxes or benefit cuts. True enough, but the harder questions concern real resources. More people with the distinctive problems of the elderly, and more need to find better ways of coping with them.

Nobody Wins With Underpriced Parking

I have many transportation-related schemes that involve robbing drivers of unjustly earned subsidies. But my scheme for more demand-responsive on street parking fees (i.e., more expensive meters) is really something drivers should embrace. Price controls are not a favor to buyers or sellers, they're a favor to people who put an extremely low value on their own time and have no problem waiting on endless lines.

Stephen Smith writes about reform in New York:

New York City has some of the most underpriced parking in the nation, and while there have been a few pilot programs (in the UES, the West Village, and Park Slope) to raise rates during peak hours, it looks like Bloomberg is finally pushing to implement Park Smart citywide. Residential metered hourly rates throughout the city will be bumped up to $1 (they were 50¢ just six months ago) and commercial rates will rise to $3 (they were $2 six months ago). Beyond this, peak on-street parking in the busiest commercial zones will cost even more.

The Post loads its article with driver outrage (headline: "Feed it and weep! Meter$ jacked up"; opening line: "Park your wallet right here, drivers."), but at least towards the end they suggest a benefit of the program: "More than half of the business owners and drivers in the area said parking became easier once the more expensive pilot program went into effect."

Right on. The point is that if you price on street parking appropriately, while it may be (more) expensive to park it should also be much more convenient to park. Which means that if a given space is expensive at a given time, that'll be because some people put a really high value on having the right to occupy the space. Then on the back end this increases government revenue and reduces the need to rely on sales taxes or other regressive revenue measures.

Incidentally, someone should hire Stephen Smith.

Obama on the Miami Heat

The president tries to explain what's wrong with Miami:

"It takes some time for the team to come together," Obama said. "There's no 'I' in team. So no matter how good a player is, no matter how good a group of players are, if they haven't played together before they are not going to be as good as a team that has played together a long time."

This is an interesting theory, but as I recall it the 2007-2008 Celtics were excellent as soon as Kevin Garnett hit town. Similarly the 1998-1999 Spurs were great right when Tim Duncan arrived.

How Much Does Ireland Produce?

Can Ireland pay what it owes under any policy regime? One reason to doubt it is that as Simon Johnson argues, a lot of Ireland's GDP is basically tax evasion rather than production:

At least 20 percent of Ireland's G.D.P. is from "ghost corporations" that have little or no real activity in Ireland. Corporate taxes are set at 12.5 percent, but leading global corporations are able to construct complicated schemes involving other offshore tax havens that reduce their effective tax rates to the low single digits.

The Irish insist that raising the corporate tax rate would not generate additional revenue – effectively acknowledging the point that this part of the economy cannot be taxed as part of the anti-crisis policy mix. You will know that reality has finally set in when all the relevant numbers are presented relative to G.N.P., not G.D.P.

When EU authorities try to press Ireland to raise the corporation tax as part of the terms of a bailout deal, this isn't really about increasing Irish government revenue. It's just that the Irish government has, for years, been annoying its OECD peers by operating as a tax haven. Now that Ireland's in a weak position, people want it to act like a better global citizen. But if Ireland actually can't pay its debts, the country is arguably better off acknowledging that sooner rather than later. The alternative is to go through a period of EU-sponsored "extend and pretend" in which policy concessions are extracted and then Ireland defaults anyway.

November 25, 2010

De-Euroizing Spain

Corcoran310 tweets "I really think u should do what u can to get Spain to ditch the euro. a weak Spanish currency would be awesome, I love madrid."

I love Madrid, too. Barcelona is of course excellent but everyone knows that. Madrid is both excellent and underrated. And with currency devaluation, it could be cheap as well. But how to get there? The simplest resolution is to go rogue—quit the Euro, in effect default on debts, suffer the bank runs, and then when the economy's moving assume it'll be possible to work some stuff out.

Another path would be this. The Spanish government has two kinds of accounts payable. One is interest and principle on bonds it's issued in international capital markets. The other is things like salaries, pensions, and transfer payments. Right now, all of this is denominated in Euros. Spain could take its Category 2 obligations and announce that henceforth 50% of all salaries, pensions, transfers, etc. will be paid in Euros and 50% will be paid in newly-issued Españos and also that 1 Españo is equal to 1 Euro in value. Concurrently, the government announces that everyone can now pay 33% of their taxes in Españos and that the minimum wage of €633.30 per month is now 633.3 Españos per month.

So now a bunch of Spanish pensioners, transfer recipients, and public employees are going to have a bunch of worthless Españos in their pockets that they'll be eager to dump. But firms will be eager to accumulate some Españos in order to pay off their tax bill. So the market will establish some kind of exchange rate between the dear Euro and the cheap Españo, and it'll make sense for firms and workers to start accepting Españos as payment for this or that. The government is basically simultaneously engaging in monetary expansion, currency depreciation, austerity budgeting, and minimum wage cuts which I think is about as close as a "all the prescriptions from all the schools of thought" solution as Spain is capable of mustering. Since Spain's heavily indebted private sector has its outstanding debts denominated in Euros, you'll still have a very nasty problem of unbalanced debt deflation but I don't see any way around that.

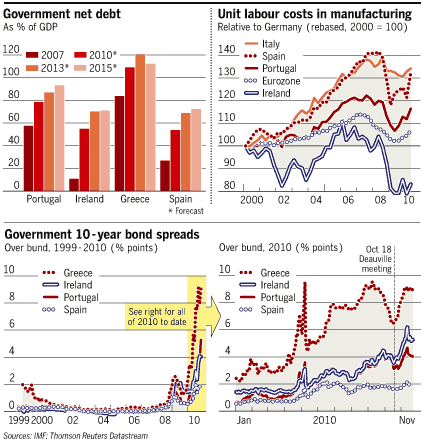

The cheap money should lead to an influx of Northern European tourists, a crash in Spanish consumer purchases of imported goods, and booming exports of Spanish wine. To steal some charts from Martin Wolf the main thing for Spain to recognize is this:

Right now in sovereign debt terms Spain is in okay shape, especially compared to Ireland, Greece, and Portugal. But on the underlying question of labor costs, Spain is in as bad a shape as anyone. Forget the question of whose "fault" the current situation is. Just note that Spain and Germany have seen their labor costs diverge a lot. That means a European Central Bank policy that's appropriate for Germany won't be appropriate for Spain. And yet the ECB will make policy that's deemed appropriate for Germany. So Spain has a big economic problem. And as we've been seeing in Ireland, round after round of austerity budgeting if not paired with monetary expansion will (superficially) forestall debt-repayment issues at the price of making the economic problem even worse.

Long story short the voters in Sweden and the UK owe a debt to the politicians who kept them out of the Euro.

Matthew Yglesias's Blog

- Matthew Yglesias's profile

- 72 followers