The History Book Club discussion

PRESIDENTIAL SERIES

>

THE DISCUSSION IS OPEN - WEEK FOUR - PRESIDENTIAL SERIES: UNREASONABLE MEN - May 2nd - May 8th - Chapter Four- The Panic - (pages 79 - 106) - No Spoilers, please

I have been reading all the posts since yesterday and checking out the links. Thank you Bentley and everyone. So much interesting reading and the kahnacademy links are great. Thank you Christopher for the clip on "Too Big to Fail'. Very helpful in understanding economics.

I have been reading all the posts since yesterday and checking out the links. Thank you Bentley and everyone. So much interesting reading and the kahnacademy links are great. Thank you Christopher for the clip on "Too Big to Fail'. Very helpful in understanding economics.

Another fascinating discussion. Thanks all. This was a fun chapter to write. Lots of drama, as Jordan pointed out, and it was a challenge to wrap my head around 100-year-old economic theory. (You won't find modern economists talking about currency elasticity.)

Another fascinating discussion. Thanks all. This was a fun chapter to write. Lots of drama, as Jordan pointed out, and it was a challenge to wrap my head around 100-year-old economic theory. (You won't find modern economists talking about currency elasticity.)I did much of my research at the Morgan Library in Manhattan, which includes the mansion where old Pierpont met with all those bankers late into the night. I came out with a more nuanced appreciation for Morgan. He was a rapacious capitalist but principled (if misguided) in his vision for an economic order in which government and monopolistic corporation worked hand-in-hand to promote prosperity. His actions during the panic were heroic, in my opinion, but also made it quite clear that this was no way to run a monetary system. Question for readers: What were your impressions of Morgan?

PS For a great, readable biography of Morgan, I recommend The House of Morgan: An American Banking Dynasty and the Rise of Modern Finance by Ron Chernow, which he wrote long before his Hamilton fame.

PPS Bentley, I realized that this is another chapter where I jump back in time at the beginning.

by

by

Ron Chernow

Ron Chernow

The TR-LF conflict was overshadowed in this chapter, and I appreciate Bryan and Helga taking note of it. This period was the closest they ever came to working together to achieve shared goals. It was enlightening and a little heartbreaking to see this alliance fall apart over the coal bill. They seem to sail right past each other, each wrapped up in his own biases. TR doesn't listen to LF's argument and interprets his criticism as a slight on his courage. LF assumes that TR disagrees with him because he has been brainwashed by the Standpatters p85-87.

The TR-LF conflict was overshadowed in this chapter, and I appreciate Bryan and Helga taking note of it. This period was the closest they ever came to working together to achieve shared goals. It was enlightening and a little heartbreaking to see this alliance fall apart over the coal bill. They seem to sail right past each other, each wrapped up in his own biases. TR doesn't listen to LF's argument and interprets his criticism as a slight on his courage. LF assumes that TR disagrees with him because he has been brainwashed by the Standpatters p85-87.

Vincent wrote: "did farmers really schuck the corn before shipping in those days?? - to keep the wrap for fertilizer or to reduce the weight for selling and shipping..."

Vincent wrote: "did farmers really schuck the corn before shipping in those days?? - to keep the wrap for fertilizer or to reduce the weight for selling and shipping..."Thanks for this question, Vincent. Throughout the book, I tried to enrich the narrative with historical details, which often took me in interesting directions. The sources mention that "crop" harvests drained New York's currency supply, but I wanted to tell readers which crops. They aren't all harvested in October. So I was googling and reading farmers almanacs about crop schedules. In the case of corn, I also described how it was harvested. It was indeed shucked, though I can't tell you why they shucked it. From This is the Way it Used to be in the Early 1900's by Marjorie Kahl Lawrence p61 (The book isn't in Goodreads, but I included the google books link)

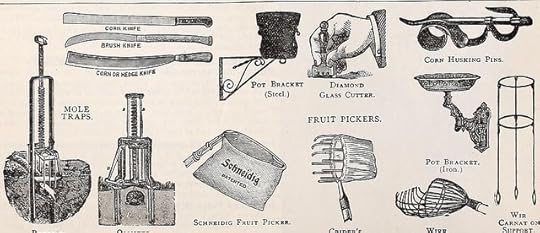

In the old days, corn was picked by hand. Especially if the farmer had several boys, they picked corn all by hand. They would hitch up the horses to the wagon and drive out into the field. They would put high boards up on one side of the wagon so that they didn't throw the ears over the side and out on the ground. You could hear the corn picking. Thump! Thump! Thump! Nobody would think anybody could pull ears of corn off the stalks and throw them into the wagon that fast, but they could. They wore husking pins on their thumbs. This was a piece of steel pointed on one end almost like a beer can opener. The steel piece was fastened onto leather which went over the man's thumb. It fit along the outside of his thumb and with the point he would loosen the husks at the end of the ear and pull them back, twist off the husks and throw the clean ear into the wagon.

Husking pin from Dreer's autumn catalogue 1907:

Vincent wrote: " the whole subject of bank notes and how they died - was that here or after the Federal Reserve was established?"

Vincent wrote: " the whole subject of bank notes and how they died - was that here or after the Federal Reserve was established?"Technically, banknotes never died. That $20 bill in your pocket with a soon-to-be-obsolete picture of Andrew Jackson is a banknote collectively backed by federal reserve banks. But old-school banknotes backed and identified by a single bank were discontinued in 1935.

Helga wrote: "I have been reading all the posts since yesterday and checking out the links. Thank you Bentley and everyone. So much interesting reading and the kahnacademy links are great. Thank you Christopher ..."

You are welcome Helga

You are welcome Helga

Thank you Michael - for your weighing in on the old bank notes. I personally do not think that Andrew Jackson should have been shelved in favor of Tubman but I know some disagree.

Also for making the distinction for Vincent between the old school banknotes backed and identified by a single bank.

The corn husking details were quite interesting too.

I think TR was right in his assessment of LaFollette and what he was doing and how he was doing it. It is too bad that they could not have continued working better together if possible for the sake of the country but I can understand how and why it fell apart based upon how TR would have viewed a man like LaFollette. Although many, many people admire a crusader including many who voted LaFollette as being one of the best - most influential Senators. I often think of crusaders as zealots...going overboard or becoming excessive in their zeal to get what they want. Single mindedness no matter what the consequences or fall out. Certainly not TR's kind of man. And TR was not perfect either - he had flaws - was more a tactician versus being that strategic. I see LaFollette as being the opposite.

Also for making the distinction for Vincent between the old school banknotes backed and identified by a single bank.

The corn husking details were quite interesting too.

I think TR was right in his assessment of LaFollette and what he was doing and how he was doing it. It is too bad that they could not have continued working better together if possible for the sake of the country but I can understand how and why it fell apart based upon how TR would have viewed a man like LaFollette. Although many, many people admire a crusader including many who voted LaFollette as being one of the best - most influential Senators. I often think of crusaders as zealots...going overboard or becoming excessive in their zeal to get what they want. Single mindedness no matter what the consequences or fall out. Certainly not TR's kind of man. And TR was not perfect either - he had flaws - was more a tactician versus being that strategic. I see LaFollette as being the opposite.

Bentley wrote: "I often think of crusaders as zealots...going overboard or becoming excessive in their zeal to get what they want. Single mindedness no matter what the consequences or fall out."

Bentley wrote: "I often think of crusaders as zealots...going overboard or becoming excessive in their zeal to get what they want. Single mindedness no matter what the consequences or fall out."Thank you, Bentley. Mine own belief is that crusaders are an essential part of American history. I think of people like Henry Ward Beecher, Susan B. Anthony, and Martin Luther King Jr. who were so influential in pushing the country forward. That is not to say that crusaders make good presidents or that they are more important than pragmatists, just that they have an important role to play in creating change.

I knew you would (smile) and I agree with you in part. Especially about not making good presidents. They do create change while leading folks down a path - sometimes "kicking and screaming".

They are catalysts.

They are catalysts.

Vincent wrote: "What is GNP? - In msg 68 Jordan said “GNP measures all the production of all Americans (or American-owned company) regardless of where they live in the world.” - I didn’t know that it included outside the USA - but I did think that it included all goods and services therefore including government spending - I think that must be correct as American Defense contractors report that income so wouldn’t military payroll be included and state and local payrolls etc.?? - I will try to look but any clarification from you folks?..."

Vincent wrote: "What is GNP? - In msg 68 Jordan said “GNP measures all the production of all Americans (or American-owned company) regardless of where they live in the world.” - I didn’t know that it included outside the USA - but I did think that it included all goods and services therefore including government spending - I think that must be correct as American Defense contractors report that income so wouldn’t military payroll be included and state and local payrolls etc.?? - I will try to look but any clarification from you folks?..."In response to message 73:

You're correct in your thinking Vincent, as far as I know. Government spending is included in calculating both GDP and GNP. I found a simple explanation in the article below explaining how those equations work. Once upon a time I had them memorized for exams. ;-) The question with determining those amounts is asking which country you want to measure because that determines if the spending/earning is domestic or foreign. There's a good example of an American/Canadian relationship in the article.

"How to Calculate GNP" by Jeffrey Glen on Investor Guide

Michael wrote: "Question for readers: What were your impressions of Morgan?..."

Michael wrote: "Question for readers: What were your impressions of Morgan?..."In response to message 103:

I quite liked him after this chapter. While keeping in mind that his actions were not completely altruistic, they were admirable. His reputation (and his coffers) were enough to steer change in a complicated, tense situation. I can't imagine one person bringing that sort of impact today. I have been fascinated by the big names of the Gilded Age/Progressive Era for a while and often found in my reading that the larger-than-life wealthy business leaders were significantly more complex than the general populace acknowledged or wanted to admit. I have a soft spot for Andrew Carnegie in particular though because he's was my research topic half a year so I knew a bit about Morgan from that exchange.

Jordan could you place a copy of you post in the glossary. I always go back and place any posts that are ancillary posts in the glossary too for easier reference than going through all of the weekly threads trying to find things. (message 113 with the link)

I really should remind everybody to do that as well. It is very helpful.

I really should remind everybody to do that as well. It is very helpful.

Bentley wrote: "Jordan could you place a copy of you post in the glossary. I always go back and place any posts that are ancillary posts in the glossary too for easier reference than going through all of the weekl..."

Bentley wrote: "Jordan could you place a copy of you post in the glossary. I always go back and place any posts that are ancillary posts in the glossary too for easier reference than going through all of the weekl..."Done! I hope it helps. :-)

Yes, I will have to go through and ask folks who posted links to also place them in the glossary. Thank you so much Jordan - it will help folks when they want to refer to something that they saw here that was not a specific comment.

Thanks, Bentley, for the information on the earthquake - I wish the book had gone into more detail! (Although I know that wasn't part of the book's thesis) I didn't realize that the earthquake was a cause of the 1907 panic.

Thanks, Bentley, for the information on the earthquake - I wish the book had gone into more detail! (Although I know that wasn't part of the book's thesis) I didn't realize that the earthquake was a cause of the 1907 panic. I am having a lot of trouble understanding all the economics that are involved in monetary policy - elastic/inelastic currency is too confusing for me. But I can certainly see why more government control over money is necessary.

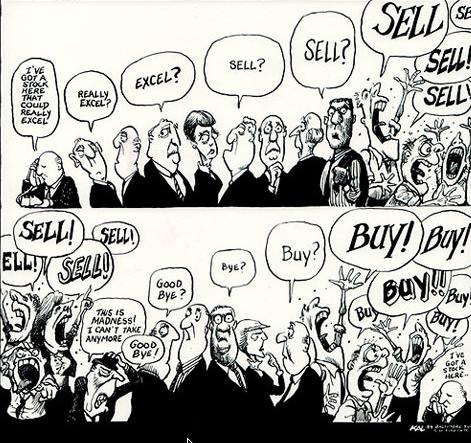

I understand what Cannon meant about most people not caring about Wall Street. Today we have such immediate communication systems that when a Kardashian sneezes, we all buy stock in Kleenex. But in the early 1900s, people wouldn't have known about what was happening and probably wouldn't have understood the technicalities of banking and finance anyway.

I think that a common thread in all financial downturns is greed. We always want more...and sometimes, like with United Copper, our methods of getting more are dangerous.

Crisis, I think, changes a dynamic. As I read about TR's decision to ok the US Steel bid for TC& I, I remember Bush 43 realizing that the government had to do something about the financial crisis. It meant he had to back up on some GOP principles and he got criticized for it. Bush understood that if he didn't do some action by the Fed government, it would be disastrous.

Crisis, I think, changes a dynamic. As I read about TR's decision to ok the US Steel bid for TC& I, I remember Bush 43 realizing that the government had to do something about the financial crisis. It meant he had to back up on some GOP principles and he got criticized for it. Bush understood that if he didn't do some action by the Fed government, it would be disastrous.

Yes, crisis brings new considerations and sometime "emergency measures" - Very true.

And in that situation would most probably led to not only a depression but a real risk to the country's security and ability to function globally.

Great point Bryan.

And in that situation would most probably led to not only a depression but a real risk to the country's security and ability to function globally.

Great point Bryan.

When I was as a school teacher so of my co-workers told me that during the Great Depression and money was scarce they were paid in "notes or coupons" from the city. They could take those notes to businesses in in the same city and purchase items from the stores. The stores could then take the notes and pay their city taxes. I thought that this was an interesting way to provide currency or "notes" to people. Money was very scarce even if you had work.

When I was as a school teacher so of my co-workers told me that during the Great Depression and money was scarce they were paid in "notes or coupons" from the city. They could take those notes to businesses in in the same city and purchase items from the stores. The stores could then take the notes and pay their city taxes. I thought that this was an interesting way to provide currency or "notes" to people. Money was very scarce even if you had work. One of the problems with bank notes from banks across the country was counterfeiting. The 1860's it was estimated that 1/3 of the currency in the US. Source

That made it more difficult for banks to issue notes. Can you imagine having $20,00 bills from 100 different banks.

I did find an article in Google Books from California in Dec. of 1906.

Article

I am wondering if this might be part of the reason that banks did not issue more notes.

Thank you Rachel but make sure to do a correct citation since it is an outside book.

You have the book cover added which is great but also add the author's photo and the author's link which is part of our standard. There are links in message one of each thread which will take you to threads which will help you. One is called Citations and the other is called Mechanics of the Board.

Please edit your citation. Just type normally in the comment box and add the citation at the bottom (like we did here). Thank you.

by

by

Harry Lembeck

Harry Lembeck

You have the book cover added which is great but also add the author's photo and the author's link which is part of our standard. There are links in message one of each thread which will take you to threads which will help you. One is called Citations and the other is called Mechanics of the Board.

Please edit your citation. Just type normally in the comment box and add the citation at the bottom (like we did here). Thank you.

by

by

Harry Lembeck

Harry Lembeck

Jim wrote: "When I was as a school teacher so of my co-workers told me that during the Great Depression and money was scarce they were paid in "notes or coupons" from the city. They could take those notes to b..."

Jim that is very interesting - I never heard of that before - Fascinating.

Very interesting links.

Jim that is very interesting - I never heard of that before - Fascinating.

Very interesting links.

I came upon this book yesterday at the library, I thought people would be interested since its about the Brownville case

I came upon this book yesterday at the library, I thought people would be interested since its about the Brownville case  By

By

Harry Lembeck

Harry Lembeck

Robyn wrote: "Bentley wrote: "The Year was 1906:

Robyn wrote: "Bentley wrote: "The Year was 1906:The Great 1906 San Francisco Earthquake

5:12 AM - April 18, 1906

San Francisco City Hall after the 1906 Earthquake. (from Steenbrugge Collection of the UC Berke..."

I was also surprised by the lack of actual money being a problem. I didn't know the banks had their own currency. I hardly ever use cash anymore. We can pay with our phones and watches now in addition to our credit and debit cards, so I can't believe that having insufficient paper money would be a problem for us now. That was pretty cool history as well as all the other history dropped on us in this chapter.

I once read a book on the worst natural disasters in the US and it listed the 1906 quake. That was the first time I had heard about it, but being a Californian, it does come up almost every time we have a quake. I don't think I understood the full impact of the quake then or really now.

Happy to be reading the book with you Robyn!

We have quite a few photos of the quake and a lot of links to primary photos, etc and write ups. Check out the beginning of this thread Jason.

For anyone interested in learning more about Belle La Follette, an influential reformer and suffragist in her own right, biographer Nancy C. Unger will be speaking about her on C-SPAN3, Saturday, May 07 9:00pm EDT.

For anyone interested in learning more about Belle La Follette, an influential reformer and suffragist in her own right, biographer Nancy C. Unger will be speaking about her on C-SPAN3, Saturday, May 07 9:00pm EDT.Belle La Follette is a fascinating, under-appreciated pioneer of progressivism and women's rights, and Unger is an excellent speaker, so I'm sure it will be a very interesting talk.

by Nancy C. Unger (no picture)

by Nancy C. Unger (no picture)

Bentley wrote: "Bryan wrote: "It is fascinating to see La Follette and TR approach reform in different ways. TR is seeing the political field, while La Follette is more the idealist reformer.

Bentley wrote: "Bryan wrote: "It is fascinating to see La Follette and TR approach reform in different ways. TR is seeing the political field, while La Follette is more the idealist reformer. Even today, politic..."

Thanks for all of the additional material again Bentley. I'm finally reading all of the posts this week and your comments made me think of something that's been on my mind in the last week. I fear we could see a similar situation in the upcoming election this fall in where at this point, Bernie Sanders statistically can't win the nomination, however, will Hillary be able to somehow embrace some of Bernie's platform in order to convince a good portion of Bernie's strong following to vote for her if she wins the nomination. It could lead to a situation where the older conservative crowd still comes out to vote party, regardless of it being Trump and the younger Bernie supports simply choose not to vote. It's both fascinating and scary at the same time.

Anyway, back to this weeks chapters, I certainly knew of the 1906 earthquake. I related to an earlier post, I remember exactly where I was when the 1989 one struck and all of the flashbacks to this.

I also think that it seems to me that nearly all of the financial economic meltdowns in our country have been proceeded by eras of more and more decreased regulation and a more laissez faire attitude by the government. We absolutely need to have regulations in place. There is a tipping point always on how much our people will tolerate, but no regulation nearly always leads to a bad and sadly predictable result.

Tomi wrote: "I have to say that the opening paragraph to this chapter was so descriptive! Beautifully written."

Tomi wrote: "I have to say that the opening paragraph to this chapter was so descriptive! Beautifully written."Thank you, Tomi. I'm blushing a little bit, literally. I loved writing this section.

Yes David - almost like the whole country "and the banks" are singing let the good times roll. By the way you are welcome - I am not sure what folks will do but there are a fair number of Republicans who will not vote for the Republican candidate as well - so quite a conundrum - although the Bernie and Hillary voters do have a lot more in common.

And Michael we are not able to see you blush in this virtual environment. I thought this was one of your best chapters - all of them are good - but this one had a lot of punch.

And Michael we are not able to see you blush in this virtual environment. I thought this was one of your best chapters - all of them are good - but this one had a lot of punch.

This comment is a bit off topic, but early in the conversation several people discussed how the government including TR should have seen signs of the up coming depression in 1906.

This comment is a bit off topic, but early in the conversation several people discussed how the government including TR should have seen signs of the up coming depression in 1906. I was watching CNBC today with their coverage of Puerto Rico's default on the bond repayment. < a href="http://www.cnbc.com/2016/05/01/puerto... Puroto Rico's bonds were in theory the safetest bonds you could purchase. Bond purchasers were willing to take a lower interest rate for the security of these bonds. You may have seen a commercial featuring a lady saying she has lost all of her retirement money on those bonds and wants Congress to bail out PR,

Add that to the fact that several states in the United States are deeply in debt. Illinois may also not be able to cover their three billion dept.

Lastly, earlier this week one on financial consultants said people should sell all their stocks and move their money into gold.

Are these pointers that we may see a recession in 2017?

My point is that it is hard for anyone to see all the signals and read them correctly. Perhaps, TR didn't see all the signs because they were hidden from sight.

Bentley wrote: "Topics for Discussion:

Bentley wrote: "Topics for Discussion:1. How many of you heard of the 1906 Earthquake of 1906? I think we are all familiar with the California propensity for earthquakes - but how many of you realized the extent of this disaster or that it caused the Panic of 1907?

I lived in California when I was a kid. Minor tremors were common and we pretty much ignored them. I never experienced a major earthquake. I read about the 1906 earthquake and can’t imagine what it would have been like to live through that. Had no clue that it affected the economy so much.

What are your thoughts about Uncle Joe or this quote? Do you agree or disagree? Why or why not?

I believe that at the time in question I can agree with Uncle Joe. The common people did not care about wall street or high finance. That was the world of the rich and powerful. Today it is quite different. Everybody dabbles in the stock market and is aware of the goings on in wall street, mainly through the tons of information that we can gather via tv, internet, social media, etc.

2. What do you think is the common thread between all of these financial downturns in the United States or anywhere in the world for that matter? What sets them into motion? Are their causes different but their symptoms the same?

I think a common thing is if people are in dire straits and do not spend the money they earn on other than bare essentials, or do not trust the banks and so hoard their money away in mattresses or in their attic or whatever. If the banks can’t invest the people’s money, they cannot pay their loans and a snowball effect happens.

3. Why was representative Charles N. Fowler so obsessed with currency? He had been elected in 1894 during the peak of a terrible depression. A panic had started it. An ambitious rope company tried to corner the hemp market. It failed. The failure precipitated a stock market slump, which led to bank runs, which wrecked the economy and doomed Americans to four years of misery - the worst depression since the nation's founding. The source of the problem, Fowler believed was "inelastic currency". (page 80 of Unreasonable Men)

I think this question answers itself. Mr. Fowler lived through the 4 years of depression and so was obsessed with currency. I think anyone living through a depression would be very attuned to the role of money in their lives.

4. What do you think "inelastic currency" means?

I think that inelastic currency is a concept where there is a set amount of currency that cannot be altered. I think that nowadays the government can print more money and have it backed by gold reserves, etc. but in the time of TR this wasn’t an option

Also, I watched some of the Khan Academy videos and enjoyed them. I also listen to a Podcast on NPR called "Planet Money" which is an enjoyable way to learn about today's economy.

Michael asked what we thought of Morgan? I can say from personal experience that Morgan is held in the highest regard in some circles. The company I work for especially thinks of Morgan as a great man (without any faults). I've always struggled with Morgan's legacy. He did contribute to society in many meaningful ways; however, his business and ethics destroyed an untold number of lives as well.

Michael asked what we thought of Morgan? I can say from personal experience that Morgan is held in the highest regard in some circles. The company I work for especially thinks of Morgan as a great man (without any faults). I've always struggled with Morgan's legacy. He did contribute to society in many meaningful ways; however, his business and ethics destroyed an untold number of lives as well.It's interesting to compare Uncle Joe's comment about the average person not thinking about Wall Street to today. I would argue that since the Great Recession more people think about Wall Street than in Uncle Joe's time.

While not a topic listed for discussion, reading these pages made me think of the following:

When discussing who the public dislikes more (Wall Street or the Federal Government), how has public perception changed between the panic in 1907 to the Great Recession (if it has even changed at all)?

Jim wrote: "This comment is a bit off topic, but early in the conversation several people discussed how the government including TR should have seen signs of the up coming depression in 1906.

Jim wrote: "This comment is a bit off topic, but early in the conversation several people discussed how the government including TR should have seen signs of the up coming depression in 1906. I was watching ..."

Just a comment on Puerto Rican Bonds - first is that they are tax free of both Federal and local income taxes - state and for some of us city too. - so that is why they really attract investment especially by those in higher tax brackets. Unlike State bonds which are usually tax free in the issuing state (of local taxes) that does not follow if one relocates to another state whereas that tax free status follows PR bonds - and Guam, and Virgin Islands bonds - wherever you are in the States.

This can be attractive if one buys a bond with a 20 year or more maturity.

They were also generally considered safe as there is the image that they are backed by the Feds - and as it worked out in the end with FannieMae and FreddieMac during the mortgage crisis - these PR bonds may still be secured by the Feds.

Like most people here, I have heard of the great earthquake of 1906, but I was not aware of its larger repercussions.

Like most people here, I have heard of the great earthquake of 1906, but I was not aware of its larger repercussions. One reason why red flags are often ignored might be that it seems difficult to distinguish true red flags from alarmism.

I concur as well that while being familiar with the great earthquake that occurred in San Francisco and the resulting fires and devastation in 1906, I had never seen the direct link with the resulting currency and stock market crisis in 1907 as is clearly portrayed in this chapter.

There is an irony in that the press initially dismissed the disturbance on Wall Street as a "rich man's panic" (p 94) which is in line with the quote from Uncle Joe that opened this chapter questioning all "the howling on Wall Street" and proclaimed the country "don't care what happens to those damned speculators. "

There is an irony in that the press initially dismissed the disturbance on Wall Street as a "rich man's panic" (p 94) which is in line with the quote from Uncle Joe that opened this chapter questioning all "the howling on Wall Street" and proclaimed the country "don't care what happens to those damned speculators. "

Chapter Four begins with another quote from Uncle Joe:

Chapter Four begins with another quote from Uncle Joe:"What in hell does this howling in Wall Street amount to? The country don't care what happens to those damned speculators." --- Uncle Joe

Topic for Discussion:

What are your thoughts about Uncle Joe or this quote? Do you agree or disagree? Why or why not? This seemed so regional as if he were the head of the House which had nothing to do with New York or Wall Street - out of sight - out of mind.

ANSWER: I am not sure how, in that era, the fate of the financial institutions affected the financial well-being of the entire country, but if it is similar to the way in which it currently affects the entire economy, my estimate of his answer is that the man was either dumb as dirt or totally indifferent to the welfare of anyone but himself and his cronies.

Topics for Discussion:

Topics for Discussion:1. How many of you heard of the 1906 Earthquake of 1906? I think we are all familiar with the California propensity for earthquakes - but how many of you realized the extent of this disaster or that it caused the Panic of 1907? Or that it had such an effect on our GNP (a drop of 11%) - Or that unemployment settled in and jumped from 3 to 8%. Or that deflation set in? How would you explain the differences between inflation and deflation to a fellow group member? What is GNP?

ANSWER: I had heard of the earthquake primarily because of the 1936 movie “San Francisco”. I knew that it caused extensive damage but I had no idea that it caused the Panic of 1907 or that it had such a large effect on the GNP or the unemployment rate. Deflation is a decline in prices; inflation is an increase in prices. From Investopedia.com Gross national product (GNP) is an estimate of total value of all the final products and services produced in a given period by the means of production owned by a country's residents.

2. There are always signs or red flags that disaster is around the corner. Why were these red flags ignored?

ANSWER: There were many red flags before the 2007 financial crises. We chose to ignore them because we did not want to make the necessary changes. It is simply easier to choose the path of least effort. We humans have a great tendency to not react until a crisis occurs.

What were the red flags in 1894?, 1906?, 1907 - before the Panic and before that recession?, before the Crash of 1929? Before the Depression? Before the Recession of 2008?

ANSWER: 1894 - According to Wikipedia and several other sources, it is called the panic of 1893. The first clear sign that the economy was in trouble was the Philadelphia and Reading Railroad going into receivership because it had greatly over extended itself. Many other companies also had overextended themselves.

1906 - One of the red flags for 1906 were that “stock market finished the year ¾ of a point lower than it began.”

1907 - Two of the red flags for 1907 were that the stock market was slipping and it was very difficult to obtain loans.

1929 – “As early as March 1929 a few financial experts warned that banks were making too many loans for stock speculation (the buying and selling of stock without regard for its actual value or the strength of the individual company). The Federal Reserve, the U.S. central bank, tried to rein in the country's banks but with no success. Several leaders of industry also noticed that unemployment was quietly on the rise. Nevertheless, despite a few warnings, the stock market headed up and up.

In September an economist for the New York Herald Tribune, Roger Babson, predicted the market was headed for a crash. After his speech stocks wavered and declined a bit. The Federal Reserve again tried to curb the out-of-control pace at which banks were making loans to buy stocks. Though the first seed of doubt had been planted, most investors chose to listen to Charles E. Mitchell, head of New York's National City Bank; John Raskob, financial giant; and J. P. Morgan and Company: These leaders in finance announced that the market's future was overwhelmingly positive. The market's behavior was a bit erratic in early October but nevertheless reached its all-time high on October 10, 1929.” This is from the website Gale U.S. History.

2007 – U.S. was borrowing money from other nations at an astronomical rate. The surplus went to a massive deficit. People were buying houses that were way beyond their means to afford.

2. What do you think is the common thread between all of these financial downturns in the United States or anywhere in the world for that matter? What sets them into motion? Are their causes different but their symptoms the same?

2. What do you think is the common thread between all of these financial downturns in the United States or anywhere in the world for that matter? What sets them into motion? Are their causes different but their symptoms the same? ANSWER: It seems that the common thread is an over extension of credit. People and companies borrow much more than they can pay back. This creates a temporary bubble of inflation where people believe the economy is going gangbusters, but then the people who borrowed more than they are able to pay reach a point that they can no longer pay their creditors. From there, a chain reaction occurs.

Topics for discussion:

Topics for discussion:2. What do you think is the common thread between all of these financial downturns in the United States or anywhere in the world for that matter? What sets them into motion? Are their causes different but their symptoms the same?

One of the big themes of financial crashes has to do with large losses from financial speculators, people manipulating the economy for their own gain. The discussion of short-sellers on page 95 reminded me of the day traders, and the role they played in the collapse of the dot-com bubble and the crash in 2008. Short-selling and day trading are both ways to manipulate the financial system and lead to inflated prices that are bound to burst.

Speed of transaction changes the nature of the beast, but the concept of artificial manipulation remains the same.

This article explains the contribution of day traders to recent market fluctuations and crashes.

1. How many of you heard of the 1906 Earthquake of 1906? I think we are all familiar with the California propensity for earthquakes - but how many of you realized the extent of this disaster or that it caused the Panic of 1907? Or that it had such an effect on our GNP (a drop of 11%) - Or that unemployment settled in and jumped from 3 to 8%. Or that deflation set in? How would you explain the differences between inflation and deflation to a fellow group member? What is GNP? I am going to focus on the earthquake since that is the main thing that I learned from this chapter. I knew of it, but really did not understand it. I never related it to any type of recession/depression. This is actually the first book outside of high school that really discussed it. Very good and enlightening. I do understand the currency issue and the loss of specie. Economics is getting into my vocabulary and reading overall on understanding the economic impetus of nations. Printing money is now our basic method of taking care of loss of cash. The cycle of depression/recession is a common aspect of economies, especially our linked global practices today. More to follow.

1. How many of you heard of the 1906 Earthquake of 1906? I think we are all familiar with the California propensity for earthquakes - but how many of you realized the extent of this disaster or that it caused the Panic of 1907? Or that it had such an effect on our GNP (a drop of 11%) - Or that unemployment settled in and jumped from 3 to 8%. Or that deflation set in? How would you explain the differences between inflation and deflation to a fellow group member? What is GNP? I am going to focus on the earthquake since that is the main thing that I learned from this chapter. I knew of it, but really did not understand it. I never related it to any type of recession/depression. This is actually the first book outside of high school that really discussed it. Very good and enlightening. I do understand the currency issue and the loss of specie. Economics is getting into my vocabulary and reading overall on understanding the economic impetus of nations. Printing money is now our basic method of taking care of loss of cash. The cycle of depression/recession is a common aspect of economies, especially our linked global practices today. More to follow.

1. How many of you heard of the 1906 Earthquake of 1906? I think we are all familiar with the California propensity for earthquakes - but how many of you realized the extent of this disaster or that it caused the Panic of 1907?

1. How many of you heard of the 1906 Earthquake of 1906? I think we are all familiar with the California propensity for earthquakes - but how many of you realized the extent of this disaster or that it caused the Panic of 1907?I had heard of the earthquake but had no idea about its impact on the economy.

What are your thoughts about Uncle Joe or this quote? Do you agree or disagree? Why or why not?

I empathize with Joe. Today, a number of Americans are fed up with bailing out Wall Street for their irresponsible gambling. While many Americans now have a personal stake in Wall Street investments, there is a disconnect between the economy and the stock exchanges. Just because the stock market goes up doesn't mean the economy is doing well, hence the rise of outsiders like Trump and Sanders as presidential candidates.

As we find out more about the Panama Papers, perhaps there will be a worldwide reckoning about how wealth should be generated.

2. What do you think is the common thread between all of these financial downturns in the United States or anywhere in the world for that matter? What sets them into motion? Are their causes different but their symptoms the same?

The common thread seems to be greed, with companies over-extending themselves and ignoring risk controls. Seems to happen over and over...

3. Why was representative Charles N. Fowler so obsessed with currency?

The Panic of 1894 was deep and troubling, and he was a singular politician who wanted to mitigate future panics.

4. What do you think "inelastic currency" means?

I remember reading an article about how the 1900 novel The Wonderful Wizard of Oz by L. Frank Baum was written originally not as a children's book but as a metaphor (and critique) of industrial capitalism. The scary yellow brick road represented the dangers of the gold standard, and Dorothy's silver slippers (not ruby red like in the movie) represented the silver standard. All the characters stood in for someone too, such as workers, farmers, and so forth. The silver standard was a populist goal, as silver was mined in the West and would help take away economic and political power from the bankers in the East who held the gold. Silver would be an equalizer of sorts, easing up a tight money supply under the control of Eastern bankersand making it easier for businesses and farmers to get cheaper credit. The money supply would be more elastic then, moving up or down with demand.

by

by

L. Frank Baum

L. Frank Baum

Inelastic currency. Quite an education on money. I know we print scads of money. Enter some digits...presto more money! Which leads to inflation. Tying your money to a gold or silver standard leads to silver certificates or gold certificates (more education on our monetary history there). Our currency went away from gold or silver. An inelastic currency is when the amount of cash dries up. There simply is not enough. The runs on the banks pulled more cash than they had. JP Morgan had to back up numerous banks and institutions with capitol (too big to fall again). Our recent recession looks very similar to this chapter. Looks like this is the norm for us! What happens to that money loaned? Did we ever get it back?

Inelastic currency. Quite an education on money. I know we print scads of money. Enter some digits...presto more money! Which leads to inflation. Tying your money to a gold or silver standard leads to silver certificates or gold certificates (more education on our monetary history there). Our currency went away from gold or silver. An inelastic currency is when the amount of cash dries up. There simply is not enough. The runs on the banks pulled more cash than they had. JP Morgan had to back up numerous banks and institutions with capitol (too big to fall again). Our recent recession looks very similar to this chapter. Looks like this is the norm for us! What happens to that money loaned? Did we ever get it back?

Since I'm somewhat of a disaster freak, I did know about the SF earthquake of 1906 and it's aftermath but, like some others here, never actually connected it with the Panic of '07. What causes panics? A variety of reasons in reality and the right convergence of events, I suppose. Certainly one of the main ones is a sudden drop in consumer confidence both in banks and in the value of stocks.

Since I'm somewhat of a disaster freak, I did know about the SF earthquake of 1906 and it's aftermath but, like some others here, never actually connected it with the Panic of '07. What causes panics? A variety of reasons in reality and the right convergence of events, I suppose. Certainly one of the main ones is a sudden drop in consumer confidence both in banks and in the value of stocks. [image error]

.."Herald Tribune/>

.."Herald Tribune/>What causes that? I think it's hard to define. Those involved in the Market and "in the know" may actually have knowledge that a bank or stock is in trouble for good reasons. The ordinary consumer may suddenly decide that he would feel more comfortable with his money at home in a jar. Today, the constant reporting on the Market and finance in general gives everyone access to information that may make them uncomfortable. In the time frame of our story, there were active manipulations of the market that were virtually unchecked by law so sometimes these things got started by men who were deliberately trying to lower the value of a stock.

I do want to say that I have never had a financial explanation as wonderful as the first two paragraphs of Chapter 5. It's one thing to know the facts about an event, but the pictures that Mr. Wolraich gives us are almost poetical and plant mind photos of crops and money traveling the country with statling clarity.

To Christopher's excellent list of books(message 64) on the 2008 crisis, I would add Michael Lewis' Boomerang and even though it doesn't address the crisis of 2008 directly, his Flash Boys

There are several good books on the Crash of '29 and the following Great Depression but three of my favorites are: The Great Crash 1929 by Kenneth Galbraith, The Forgotten Man: A New History of the Great Depression by Amity Shlaes and The Great Depression by Robert S. McElvaine. The last two cover the entire period of the Depression but also give good descriptions of the Crash.

By the way, Francie is right on the movie San Francisco. Great disaster flick! Don't know about netflix but it shows up on TCM every so often.

by

by

Michael Lewis

Michael Lewis by

by

John Kenneth Galbraith

John Kenneth Galbraith by

by

Amity Shlaes

Amity Shlaes by Robert S. McElvaine ( no photo)

by Robert S. McElvaine ( no photo)

Hi there Pamela - very nice post but the citations are only the book cover, author's photo and the author's link - here is how they should look but a great effort.

both by

both by

Michael Lewis

Michael Lewis

by Robert S. McElvaine (no photo)

by Robert S. McElvaine (no photo)

by

by

Amity Shlaes

Amity Shlaes

by

by

John Kenneth Galbraith

John Kenneth Galbraith

both by

both by

Michael Lewis

Michael Lewis by Robert S. McElvaine (no photo)

by Robert S. McElvaine (no photo) by

by

Amity Shlaes

Amity Shlaes by

by

John Kenneth Galbraith

John Kenneth Galbraith

Books mentioned in this topic

Only Yesterday: An Informal History of the 1920s (other topics)The Great Depression: America 1929-1941 (other topics)

Flash Boys (other topics)

Boomerang: Travels in the New Third World (other topics)

The Forgotten Man: A New History of the Great Depression (other topics)

More...

Authors mentioned in this topic

Frederick Lewis Allen (other topics)John Kenneth Galbraith (other topics)

Amity Shlaes (other topics)

Robert S. McElvaine (other topics)

Michael Lewis (other topics)

More...

The “cur..."

Guess water might have affected the cameras - no I did not come across any but it does not mean they do not exist - I just did not find any.