The History Book Club discussion

PRESIDENTIAL SERIES

>

THE DISCUSSION IS OPEN - WEEK FOUR - PRESIDENTIAL SERIES: UNREASONABLE MEN - May 2nd - May 8th - Chapter Four- The Panic - (pages 79 - 106) - No Spoilers, please

I must admit: I had a hard time understanding the different currency proposals at the beginning of the chapter. In general, I don't understand macroeconomics all that well, but this video helped me understand the economy as well as the safeguards that are currently in place that prevented 2008 from being as bad as 1929 or 1907:

I must admit: I had a hard time understanding the different currency proposals at the beginning of the chapter. In general, I don't understand macroeconomics all that well, but this video helped me understand the economy as well as the safeguards that are currently in place that prevented 2008 from being as bad as 1929 or 1907:https://www.youtube.com/watch?v=PHe0b...

Bentley - I was looking over your math for the damage incurred during the great earthquake. I believe the math is indeed correct but I think you have to take into consideration that the damage is different these days. Think about the technology in place in buildings and cars. The cost of everything is much greater and there would be more to replace.

Bentley - I was looking over your math for the damage incurred during the great earthquake. I believe the math is indeed correct but I think you have to take into consideration that the damage is different these days. Think about the technology in place in buildings and cars. The cost of everything is much greater and there would be more to replace. We just had severe hail storms in the past few weeks. The estimated cost is around $2.5 billion and that's mainly cars and building windows / skylights. We are not nearly as devastated.

In today's market, what would an earthquake the size of the 1906 do to our economy today?

Kressel wrote: "I must admit: I had a hard time understanding the different currency proposals at the beginning of the chapter. In general, I don't understand macroeconomics all that well, but this video helped me..."

Kressel wrote: "I must admit: I had a hard time understanding the different currency proposals at the beginning of the chapter. In general, I don't understand macroeconomics all that well, but this video helped me..."Thanks for that - I am going to be watching that video.

There are indeed safeguards and it seems like we had a day where trading had to halt not too long ago. Here is a quick article about when the market "halts" and when it "pauses".

http://www.thestreet.com/story/132647...

Teri wrote: "Bentley - I was looking over your math for the damage incurred during the great earthquake. I believe the math is indeed correct but I think you have to take into consideration that the damage is d..."

Yes you are correct in that the math is right (actual cash value at the time) but the replacement cost for the same buildings today would have been far greater. Excellent point Teri

Yes you are correct in that the math is right (actual cash value at the time) but the replacement cost for the same buildings today would have been far greater. Excellent point Teri

Kressel wrote: "I must admit: I had a hard time understanding the different currency proposals at the beginning of the chapter. In general, I don't understand macroeconomics all that well, but this video helped me..."

Try the Khan Academy videos I posted - they are much better at understanding the nitty gritty for novices.

Thank you for the link - I did look at it and think that the Khan material is better.

Try the Khan Academy videos I posted - they are much better at understanding the nitty gritty for novices.

Thank you for the link - I did look at it and think that the Khan material is better.

Nick wrote: "It's almost surreal to read this chapter after living through the 2008 Financial Crisis. Cannon's quote could have just as easily come from Nancy Pelosi in late 2007. I doubt she would say the same..."

Excellent post Nick but don't forget as Teri pointed out - outside books need citations - we are here to help.

Excellent post Nick but don't forget as Teri pointed out - outside books need citations - we are here to help.

Bentley wrote: "Nick wrote: "It's almost surreal to read this chapter after living through the 2008 Financial Crisis. Cannon's quote could have just as easily come from Nancy Pelosi in late 2007. I doubt she would..."

Bentley wrote: "Nick wrote: "It's almost surreal to read this chapter after living through the 2008 Financial Crisis. Cannon's quote could have just as easily come from Nancy Pelosi in late 2007. I doubt she would..."I thought I did. Not sure why her citation looks different from mine.

Ah - Teri is doing it the HBC way which includes the book cover, the author's photo (when available) and the author's link. You have the book link which is the book title as a link. We don't use that unless the book does not have a book image for its cover.

Just type normally with the body of the text and just add the proper citations at the bottom - easier that way. In message one of each and every thread - I have links to the Citations thread which gives examples and the Mechanics of the board thread which gives you the nitty gritty. If you do it properly on the right hand side of the screen - you will see all of the books cited on the thread, all of the authors, how many times they are mentioned on this thread and links to other threads in the HBC where the author and book are discussed. Your post then becomes searchable and is never lost because the powerful goodreads software captures your citation and cross populates the entire HBC site as well as goodreads. Very powerful and that is why we ask you to do it this way. Also we like the look of the book covers - larger and very clickable.

Just type normally with the body of the text and just add the proper citations at the bottom - easier that way. In message one of each and every thread - I have links to the Citations thread which gives examples and the Mechanics of the board thread which gives you the nitty gritty. If you do it properly on the right hand side of the screen - you will see all of the books cited on the thread, all of the authors, how many times they are mentioned on this thread and links to other threads in the HBC where the author and book are discussed. Your post then becomes searchable and is never lost because the powerful goodreads software captures your citation and cross populates the entire HBC site as well as goodreads. Very powerful and that is why we ask you to do it this way. Also we like the look of the book covers - larger and very clickable.

It is fascinating to see La Follette and TR approach reform in different ways. TR is seeing the political field, while La Follette is more the idealist reformer.

It is fascinating to see La Follette and TR approach reform in different ways. TR is seeing the political field, while La Follette is more the idealist reformer. Even today, politicians sometimes gets criticized for "half a loaf." Ted Kennedy was like that. He felt at least it got some progress, while others said it had to be all or nothing.

It was fascinating to read how La Follette approached getting a bill passed and how La follette and TR joined forces to get the railroad safety bill passed on page 85. He drafted a bill prohibiting railroad employees from working more than 16 consecutive hours. It was ingenious how he used roll call on the core amendment and it worked because the senators were on record on their stance. TR praised him and gave him more support on some issues. La Follette was concerned about the safety of the people and would stand against big corporations. He was a true reformer.

It was fascinating to read how La Follette approached getting a bill passed and how La follette and TR joined forces to get the railroad safety bill passed on page 85. He drafted a bill prohibiting railroad employees from working more than 16 consecutive hours. It was ingenious how he used roll call on the core amendment and it worked because the senators were on record on their stance. TR praised him and gave him more support on some issues. La Follette was concerned about the safety of the people and would stand against big corporations. He was a true reformer.

Hi, everyone. I also had heard about the 1906 earthquake, but through a source other than history. There's a great movie with Clark Gable, Spencer Tracy, and Jeannette McDonald called "San Francisco." Realizing it's all theatrics, it does have some good footage of the earthquake and fire. I never tied the earthquake to the Panic of 1907. This is a great chapter and look forward to discussing more.

Hi, everyone. I also had heard about the 1906 earthquake, but through a source other than history. There's a great movie with Clark Gable, Spencer Tracy, and Jeannette McDonald called "San Francisco." Realizing it's all theatrics, it does have some good footage of the earthquake and fire. I never tied the earthquake to the Panic of 1907. This is a great chapter and look forward to discussing more.

Bentley wrote: "Topics for Discussion:

Bentley wrote: "Topics for Discussion:1. How many of you heard of the 1906 Earthquake of 1906? I think we are all familiar with the California propensity for earthquakes - but how many of you realized the extent..."

Apparently, when it comes to financial crises, there us nothing new under the sun. Here are my answers to discussion questions in messages 9 and 10:

What are your thoughts about Uncle Joe or this quote? Do you agree or disagree? Why or why not? This seemed so regional as if he were the head of the House which had nothing to do with New York or Wall Street - out of sight - out of mind.

Today, this sort of quote would've been laughable. Even a little financial and economic literacy would be enough to know that our economy is incredibly interconnected. However, Uncle Joe could be forgiven because the globalization of financial markets was a relatively new thing in the world. Financial panics before typically were regional affairs. But as railroads, telegraphs, and telephones were connecting the world, markets across the country and around the world were becoming intertwined. Most people probably didn't have any idea about this at the time. So, let's give Uncle Joe the benefit of a doubt on this gaffe.

1. How many of you heard of the 1906 Earthquake of 1906? I think we are all familiar with the California propensity for earthquakes - but how many of you realized the extent of this disaster or that it caused the Panic of 1907? Or that it had such an effect on our GNP (a drop of 11%) - Or that unemployment settled in and jumped from 3 to 8%. Or that deflation set in? How would you explain the differences between inflation and deflation to a fellow group member? What is GNP?

I had heard about the 1906 San Francisco earthquake from documentaries on Pres. Roosevelt's presidency and the second volume of Edmund Morris' three-volume biography of Theodore Roosevelt, Theodore Rex, but I don't know much about the specifics of it. I'll have to look into Bentley's book recommendation. However, like all financial crises, the Earthquake was only one factor, not the cause. The immediate cause was the run on the banks caused by the Knickerbocker stock market collapse. The draining of financial resources away from New York to the West Coast was made a small financial bump into a full-blown crisis.

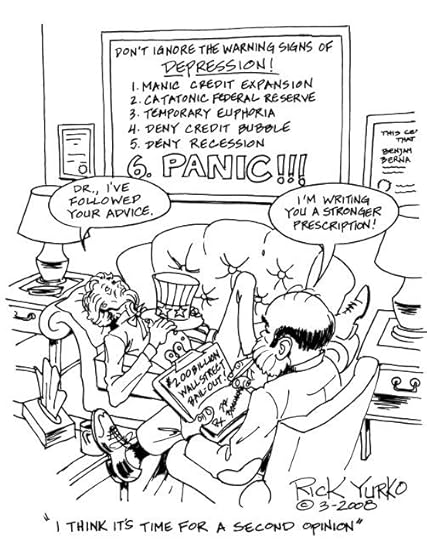

2. There are always signs or red flags that disaster is around the corner. Why were these red flags ignored? What were the red flags in 1894?, 1906?, 1907 - before the Panic and before that recession?, before the Crash of 1929? Before the Depression? Before the Recession of 2008?

I can't speak to the red flags behind the the previous crises or the Great Depression. For the 2008 recession, I would direct people to some great books and movies about it, The Big Short and Too Big to Fail. The HBO movie, Too Big to Fail has the best explanation for the 2008 crisis I've seen (the link is below). Also, Timothy Geithner's autobiography, Stress Test gives his perspective of the crisis as head of the Federal Reserve of New York and then Pres. Obama's first Treasury Secretary. There's also Ben Bernanke's autobiography, The Courage to Act, but I haven't read it to give an opinion to its value.

Bottom line, the cause for this crisis as explained by Mr. Woolraich was the credit crunch caused by the 1906 Earthquake's siphoning of financial resources from New York to the West Coast and the fact that America still had multiple forms of currency with varying degrees of value and not all of them backed by the U.S. Government. The run on the banks caused by the collapse of the Knickerbocker stock market was the match that started the fire.

3. What is the environment set for disaster that the author is describing? What were the signs - why were they ignored? What set this financial implosion into motion? What if anything could have stopped it before it began?

I gave my explanations for the cause of the 1907 panic based on Mr. Woolraich's book above. The question is, could it have been avoided if Rep. Fowler's currency bill had been passed? Possibly. His bill was first introduced in 1903 (p. 81), four years before the panic. So it could've been helpful during the crisis. However, without a central bank to effectively increase the money supply during the panic, which is what the Federal Reserve did in 2008, I am skeptical that this bill alone would have been implemented successfully.

4. What do you think is the common thread between all of these financial downturns in the United States or anywhere in the world for that matter? What sets them into motion? Are their causes different but their symptoms the same?

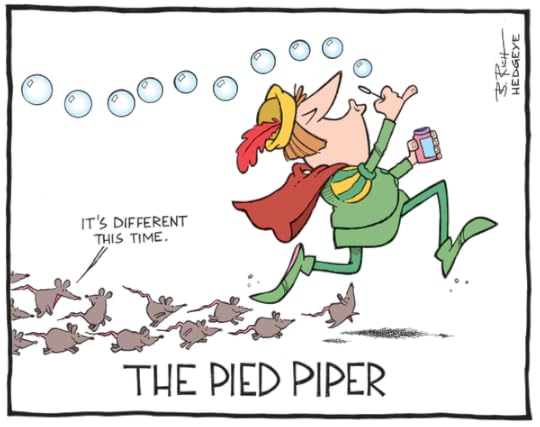

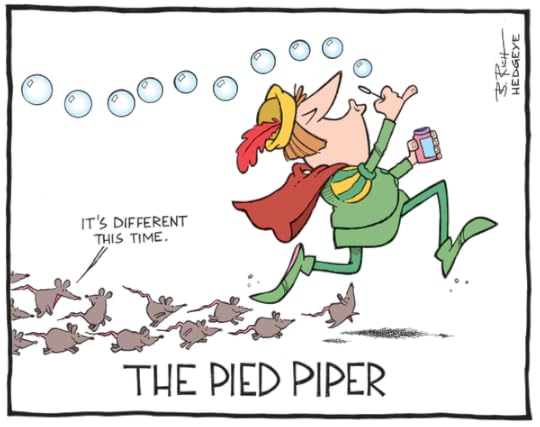

There is a book that came out not long after the 2008 financial crisis, This Time is Different, which examines the history of financial panics going back centuries. The cause is basically always the same: investors believe that the price of some good will always keep going up and thus keep putting more money into it. Then the laws of finance take over and the prices start going down, wiping out the value of people's investments. This causes a credit crunch that keeps everyone, from investors to average people, from accessing credit, which then causes runs on banks. There are always other factors that make things worse, but the immediate cause is always overly optimistic valuations of some commodity. I guess you could also call it hubris.

5. Why was representative Charles N. Fowler so obsessed with currency? He had been elected in 1894 during the peak of a terrible depression. A panic had started it. An ambitious rope company tried to corner the hemp market. It failed. The failure precipitated a stock market slump, which led to bank runs, which wrecked the economy and doomed Americans to four years of misery - the worst depression since the nation's founding. The source of the problem, Fowler believed was "inelastic currency". (page 80 of Unreasonable Men)

While Rep. Fowler's belief's about inelastic currency are well documented here, it's hard to place any actual motivation on why he wanted to get his bill passed. Obviously there was the suffering that Americans experienced in the depression of 1894, but was that his only motivation? A little more light on Rep. Fowler's background might have shed more light on his motivations.

6. What do you think "inelastic currency" means? Why was the New York banking community, particularly Morgan not enthusiastic about Fowler's solution? What did they want and who were their allies?

The differences between the economic terms elastic and inelastic always confused me, so searching my economic knowledge a little bit and a basic economics book, Economics, published by Barron's, helped me come to this answer: the terms elastic and inelastic refer to how responsive something is to the laws of demand and supply. In a perfect model of supply and demand, for each increase in the demand of some good, the price should go up one unit.

The problem that Rep. Fowler saw with the supply of money in his time was that the supply of money was inelastic, meaning that whether the price of money went up or down, the supply of money would stay the same. Thus, when investors would need more money in a financial panic, the price of money would go up, but its supply would stay the same. Thus, credit would be too expensive for investors. His idea to make more money available to investors in the midst of a panic is a basic tenet of economics today.

If anyone wants topmost some graphs illustrating these last points of mine, I would greatly appreciate it.

Here is the link to the scene from Too Big to Fail that I mentioned above:

https://youtu.be/fk6dUaZXXug

by

by

Edmund Morris

Edmund Morris  by

by

Michael Lewis

Michael Lewis by

by

Andrew Ross Sorkin

Andrew Ross Sorkin by

by

Timothy F. Geithner

Timothy F. Geithner by

by

Ben S. Bernanke

Ben S. Bernanke by Carmen M. Reinhart(no photo)

by Carmen M. Reinhart(no photo) by Walter J. Wessels(no photo)

by Walter J. Wessels(no photo)

Two little things that I had never heard before. I mentioned the "curbstone" brokers (Thanks Bentley for the great images.)

Two little things that I had never heard before. I mentioned the "curbstone" brokers (Thanks Bentley for the great images.)The second was the flow of money out of the East and into the West when the crops came up for sale in the fall. I had never heard that previously. I would think the money in the East (banking, trusts, industry, trade with Europe and stock market would far surpass the money from crops in the west.

Just thinking about it and trying to understand if that was part of the strain on money. ( I did find two references.) Money and Crops

I also found this: "The outflow of capital necessary to finance crop shipments from the Midwest to the East Coast in September or October usually left the New York City money market squeezed for cash. As a result, short-term interest rates in New York City were prone to spike upward in autumn."

Source

You learn something every day.

Bentley wrote: "Try the Khan Academy videos I posted - they are much better at understanding the nitty gritty for novices.

Bentley wrote: "Try the Khan Academy videos I posted - they are much better at understanding the nitty gritty for novices.Thank you for the link - I did look at it and think that the Khan material is better."

I started watching the Khan videos last night. The material is more academic and nitty-gritty, as you say, but the illustrations are more professional on the other video, and the narration is more fast-paced. What I'd really like to see now are animations depicting what Glass-Steagol achieved for the economy, what repeal of it did to the economy, and what Hillary Clinton is proposing now to replace it.

Kressel - the one you posted is a nice high level overview - for those folks who want to look under the hood and find out how things tick - the Khan material helps them. Also the Khan material is teachable material and builds on kernels of information so that you sequence the learning and understand the concepts by breaking them down into palatable and understandable core concepts.

Not saying that your post was not a nice addition but for real understanding I think folks need more. Yours was very very professionally done and I enjoyed it.

As far as what any of the primary candidates are proposing - that is not a subject for this thread and Glass-Steagall was not enacted until 1933. 1933 is not the subject of this thread - and of course it was repealed - in today's primaries - we are hearing from Sanders to bring it back and Elizabeth Warren and others:

For those of you who want to know what this is about:

The Glass-Steagall Act, also known as the Banking Act of 1933 (48 Stat. 162), was passed by Congress in 1933 and prohibits commercial banks from engaging in the investment business. It was enacted as an emergency response to the failure of nearly 5,000 banks during the Great Depression.

Not saying that your post was not a nice addition but for real understanding I think folks need more. Yours was very very professionally done and I enjoyed it.

As far as what any of the primary candidates are proposing - that is not a subject for this thread and Glass-Steagall was not enacted until 1933. 1933 is not the subject of this thread - and of course it was repealed - in today's primaries - we are hearing from Sanders to bring it back and Elizabeth Warren and others:

For those of you who want to know what this is about:

The Glass-Steagall Act, also known as the Banking Act of 1933 (48 Stat. 162), was passed by Congress in 1933 and prohibits commercial banks from engaging in the investment business. It was enacted as an emergency response to the failure of nearly 5,000 banks during the Great Depression.

Ah Econ, how I've missed you! Back in my college years, I spent many days debating Economics policies (I was in school during the aftermath of the 2008 Recession.) and many more nights trying to understand it all.

Ah Econ, how I've missed you! Back in my college years, I spent many days debating Economics policies (I was in school during the aftermath of the 2008 Recession.) and many more nights trying to understand it all. I agree with Uncle Joe's quote, in that the average person could care less about the people working on Wall Street. In fact, there's been increasing animosity toward Wall Street for years. However, caring less does not equate to not feeling the effect of Wall Street's actions as 2008 showed.

1.) Living in California now, the 1906 quake lives on in collective memory as 'the one' that could happen again. The city I live in though was not particularly affected by the tremors. I actually did know about the quake being one of the triggers for the 1907 Panic solely because of my college studies. The 1907 Panic is still a big topic in learning about economic history and an example used often to show 'simple' connections across world money markets (London insurance money connected to San Francisco that is and how that jumped back to affecting New York banking, which jumped to the Midwest/West with crops). We used to do tracing exercises like that more than I care to remember. ;)

I'll try and tackle inflation/deflation/GNP (although those Khan Academy videos are fabulous for this). Inflation means the money in your pocket buys less because the cost of goods and services is higher. The Federal Reserve actually aims for inflation to be about 1-2% for reasons much to complicated to go into here. Deflation means your money buys more goods and services because their price is lower; however, deflation isn't good because it increases the burden of any debt you have. GNP measures all the production of all Americans (or American-owned company) regardless of where they live in the world. GDP just refers to what is produced within the borders of the country. So, these measures can be different. I always thought of it as the value of American citizens work in the world. America's GNP tends to be higher than its GDP because of how much production Americans (and their companies) do outside of the US. China, with tons of foreign-owned businesses producing within their borders, has a bigger GDP than GNP.

2.) One of my professors always stressed how booms create panics or busts, which is fatalistic sounding but usually true with a lot of economic downturns. Booms create optimism which can blind people to risks and overvaluation of how long the boom will last. The optimism makes it easier for people to underestimate consequences or misunderstanding of impact, which played into the 2008 Recession with the mortgage debacles.

3.) America's monetary system was already creating issues before the 1906 quake, which Rep. Fowler attempted to 'fix' (debatable on how effective it was) but the lack of a central bank didn't give the country any weapons to combat a spooked market. The quake's eating up of London and New York money combined with United Copper's failure to successfully corner the market were felt quickly but the liquidity of money itself was a big issue. Solutions like Fowler's rankled the power scheme of banks but a central bank wasn't favorable to a lot of Americans. Someone had to lose eventually.

4.) I mentioned it in #2 but a common thread often mentioned in college was humans are just not the most rational of beings sometimes and economies move in waves, a ripple can become a tsunami.

5.) I don't know much about Fowler's personal history but being elected by people in a time of financial crisis probably leaves its mark on you as an individual and as a representative of the people. Fowler was on to something with his distrust of inelastic currency but he was up against a very powerful banking industry without many allies.

6.) Well, if something is referred to as inelastic in economics it means that the demand and/or supply of that thing doesn't change much if the price of the good increases (maybe because it's considered a necessity and doesn't have substitutes). Applying that to currency (which is a product with its own inherent value) would mean that an inelastic currency's price increases drastically (unnaturally) due to its increased demand but supply is set, stagnant, which causes a currency shortage. The Fed can fix things like this now but the wording 'inelastic currency' makes me think of the gold standard for some reason.

As a side note, I really enjoyed reading this chapter because of the drama in it. Maybe I'm imparting a bit of romanticism to it but the author did so well building up this chapter in the previous one. Chapter four read like a fast-paced rollercoaster of a failed plan for success, a 'hero' with a taciturn demeanor, and obstacles at each turn.

This one is current - so you can see that some things stay the same (smile)

“A rate hike could be appropriate, if the data is as expected," San Francisco Fed Head John Williams remarked yesterday.

“The economy is offering mixed signals, but favors unemployment data.” –Dennis Lockhart (Atlanta Fed, yesterday)

As Hedgeye CEO Keith McCullough pointed out in today's Early Look:

"Recently reported GDP of 0.5% isn’t in the area code of 'as expected.' I don’t think Williams has a lot of credibility as a Wall St. forecaster."

Source: Hedgeye

“A rate hike could be appropriate, if the data is as expected," San Francisco Fed Head John Williams remarked yesterday.

“The economy is offering mixed signals, but favors unemployment data.” –Dennis Lockhart (Atlanta Fed, yesterday)

As Hedgeye CEO Keith McCullough pointed out in today's Early Look:

"Recently reported GDP of 0.5% isn’t in the area code of 'as expected.' I don’t think Williams has a lot of credibility as a Wall St. forecaster."

Source: Hedgeye

Current: - What I think is interesting about Hedgeye in terms of our discussion of this book is that they purchased President William Taft's mansion as their offices which they have now sold (I have now heard - leased with an option to buy) to Yale. Wouldn't you have thought some historical society would have preserved that location? Before these last two sales it had already been made into a prestigious office building!!! Taft was not born there and I guess he did not live or die there but did own the house. But still?

NEW HAVEN — William Howard Taft was not born there; he did not live or even die there. But for a few years, the 27th president did own the house at 111 Whitney Avenue in New Haven, and that association has conferred on the structure a certain historical gravitas.

http://www.nytimes.com/2013/08/12/nyr...

http://www.cityofnewhaven.com/uploads...

Cartoon of the Day: Slow Grrrrowth!

Source on the above: Hedgeye

by Philip E. Tetlock (no photo)

by Philip E. Tetlock (no photo)

NEW HAVEN — William Howard Taft was not born there; he did not live or even die there. But for a few years, the 27th president did own the house at 111 Whitney Avenue in New Haven, and that association has conferred on the structure a certain historical gravitas.

http://www.nytimes.com/2013/08/12/nyr...

http://www.cityofnewhaven.com/uploads...

Cartoon of the Day: Slow Grrrrowth!

Source on the above: Hedgeye

by Philip E. Tetlock (no photo)

by Philip E. Tetlock (no photo)

Hi All

Hi AllI will try to comment on what I can of this chapter and maybe follow with some direct comments to your different posts

The quote -

What in hell does this howling in Wall Street amount to? The country don't care what happens to those damned speculators. --- Uncle Joe

Even today in the days of so many small individual investors there is the view so often that Wall Street can founder and it is not their problem. - Joe was the son of a country doctor in the midwest and by this time in his life he had seen the world go on without much effect from Wall Street so I think he was more unaware.

I did hear of the earthquake of 1906 and am actually surprised that it was not better known among my fellow travelers on this “unreasonable men” journey - I did not associate the quake with the crash of 1907so I assume I have to open my eyes more.

What is GNP? - In msg 68 Jordan said “GNP measures all the production of all Americans (or American-owned company) regardless of where they live in the world.” - I didn’t know that it included outside the USA - but I did think that it included all goods and services therefore including government spending - I think that must be correct as American Defense contractors report that income so wouldn’t military payroll be included and state and local payrolls etc.?? - I will try to look but any clarification from you folks?

2. There are always signs or red flags that disaster is around the corner. - I would think they were not recognized generally rather than ignored.

My other internal to me question is that with the majority of the country being much more seismic problem free and the short time that California was “part of our game” were we maybe just unprepared to think of the earthquake as being so devastating- economically as well as physically?

3. What is the environment set for disaster that the author is describing? What were the signs - why were they ignored? What set this financial implosion into motion?

One might say that Andrew Jackson getting rid of the Bank of the US took away a vital tool that could have been used to support the economy - the markets.

4. What do you think is the common thread between all of these financial downturns in the United States or anywhere in the world for that matter? maybe “dream wishing” people want things to be a certain way and they believe it will be that way until it blows up on them.

More on William Taft that is interesting - (smile) - from the Yale Alumni magazine:

Big man on campus

After he left the White House, William Howard Taft spent eight years teaching at Yale. He left quite an impression.

By Mark Alden Branch | Mar/Apr 2013

Taft was provided with an extra-wide seat in Woolsey Hall that is still in use. After losing his ticket to an event at Woolsey, Taft said, he tried to convince an usher that he belonged there “by the breadth of my beam and the corresponding breadth of this seat.’

Remainder of article:

https://yalealumnimagazine.com/articl...

Note: Hard to believe that as president he was 355 pounds - the result of compulsive eating during times of stress. Later under President Harding - he got the job he always wanted - being on the Supreme Court as the 10th Chief Justice of the Supreme Court and he lost 80 pounds after he left the White House and went to Yale.

Big man on campus

After he left the White House, William Howard Taft spent eight years teaching at Yale. He left quite an impression.

By Mark Alden Branch | Mar/Apr 2013

Taft was provided with an extra-wide seat in Woolsey Hall that is still in use. After losing his ticket to an event at Woolsey, Taft said, he tried to convince an usher that he belonged there “by the breadth of my beam and the corresponding breadth of this seat.’

Remainder of article:

https://yalealumnimagazine.com/articl...

Note: Hard to believe that as president he was 355 pounds - the result of compulsive eating during times of stress. Later under President Harding - he got the job he always wanted - being on the Supreme Court as the 10th Chief Justice of the Supreme Court and he lost 80 pounds after he left the White House and went to Yale.

Nick wrote: "It's almost surreal to read this chapter after living through the 2008 Financial Crisis. Cannon's quote could have just as easily come from Nancy Pelosi in late 2007. I doubt she would say the same..."

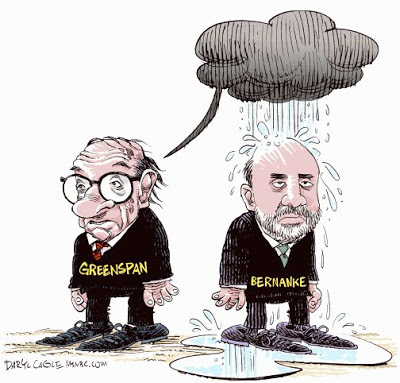

Nick wrote: "It's almost surreal to read this chapter after living through the 2008 Financial Crisis. Cannon's quote could have just as easily come from Nancy Pelosi in late 2007. I doubt she would say the same..."Just a comment that the BIG DIFFERENCE is that Morgan did it with his money and Paulson and Bernanke did it with ours.

One should not fail to understand, I think, the difference between using your money and the money of others.

Gary wrote: "I have definitely heard of the Great Earthquake of 1906. For two reasons: one - when the 1989 San Francisco earthquake occurred, it happened during the national broadcast of the World Series that w..."

Gary wrote: "I have definitely heard of the Great Earthquake of 1906. For two reasons: one - when the 1989 San Francisco earthquake occurred, it happened during the national broadcast of the World Series that w..."We don't have "panics"...we have misplaced trust in the hands of major money movers such as J P Morgan. If a company is a good company it will survive sell offs by creating bargains.

One must I think remember that other than stock issues by a firm the sale and corresponding purchase of shares of stock, regardless of the price, has no influence at all on the balance sheet of the firm involved. Absolutely correct that the company does not change at all when the stock price changes unless it chooses to - or unless that reflects a decline in the confidence in the firm as a provider of its goods and/or services.

So a changing price for a stock makes a firm neither more or less stable.

@Christopher - message 64 - amazing clip - deja vu - great post. And your citations and adds are very helpful.

I would recommend everyone at least watch the clip if not the movie.

Excellent thoughts and post - thank you for taking the time to share everything you shared with us.

I would recommend everyone at least watch the clip if not the movie.

Excellent thoughts and post - thank you for taking the time to share everything you shared with us.

sorry a couple of more comments

sorry a couple of more commentspg 79 para 1 - did farmers really schuck the corn before shipping in those days?? - to keep the wrap for fertilizer or to reduce the weight for selling and shipping? or????

Pg 81 Fowler - the whole subject of bank notes and how they died - was that here or after the Federal Reserve was established?

pg 97 para 5 - TR totally missed a chance to try to stabilize the situation. That said he had no established tools and no precedent to make one think he should. He should have done better to my mind.

pg 100 - 102 - JP Morgan saves the day - for himself and the other banks and the country. Jamie Dimon might have told him to insulate his money and get the government to do it - but they wouldn't have - thank JP!!

Boy why are we missing reading on JP, and John Rockefeller, and Andrew Carnegie, etc in our efforts to understand American History.

Vincent wrote: "Nick wrote: "It's almost surreal to read this chapter after living through the 2008 Financial Crisis. Cannon's quote could have just as easily come from Nancy Pelosi in late 2007. I doubt she would..."

Very good point Vincent and that makes Morgan quite altruistic to a certain degree and why he is remembered by many in a very favorable light despite other things (I guess his faults). He was a generous man as well - Metropolitan got his art collection.

Very good point Vincent and that makes Morgan quite altruistic to a certain degree and why he is remembered by many in a very favorable light despite other things (I guess his faults). He was a generous man as well - Metropolitan got his art collection.

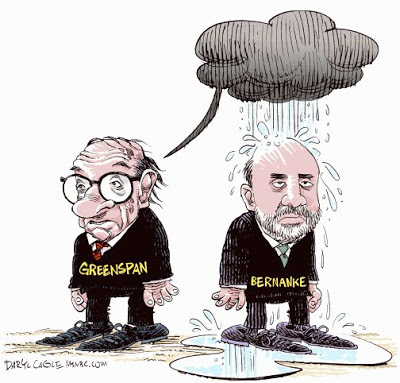

Bentley wrote: "This one is good too from that same time frame: (lol)

Bentley wrote: "This one is good too from that same time frame: (lol)"

These cartoons are great but where is Alan Greenspan who should have been monitoring this through the early George W years as the CMOs deterioriated- an old man (and I am an old man) holding onto his job for lord knows what reason (to impress his young wife???) - but never reacting thru the growing mortgage crisis for how many years 1987 - 2006.

Vincent wrote: "sorry a couple of more comments

pg 79 para 1 - did farmers really chuck the corn before shipping in those days?? - to keep the wrap for fertilizer or to reduce the weight for selling and shipping..."

I agree with you on this one Vincent about TR. I think we should too and we will - we have The First Tycoon: The Epic Life of Cornelius Vanderbilt coming up later this year on the Book of the Month.

by T.J. Stiles (no photo)

by T.J. Stiles (no photo)

pg 79 para 1 - did farmers really chuck the corn before shipping in those days?? - to keep the wrap for fertilizer or to reduce the weight for selling and shipping..."

I agree with you on this one Vincent about TR. I think we should too and we will - we have The First Tycoon: The Epic Life of Cornelius Vanderbilt coming up later this year on the Book of the Month.

by T.J. Stiles (no photo)

by T.J. Stiles (no photo)

Vincent wrote: "Gary wrote: "I have definitely heard of the Great Earthquake of 1906. For two reasons: one - when the 1989 San Francisco earthquake occurred, it happened during the national broadcast of the World ..."

I am not so sure about that Vincent - not sure if you saw that clip on the movie Too Big to Fail that Christopher posted - give a watch.

Also here is an article which may help answer some of the questions that you have about GNP and American corporations overseas and how it all adds up:

What is the Gross National Product? (folks, give a read)

http://useconomy.about.com/od/glossar...

Here is one for you:

Source: Aboutmoney

Note to Vincent - the Federal Reserve was not established until 1913 - December I think.

Remember though that Hamilton had started one in 1791 and it did not get chartered again because of being one vote short in each house in 1811 - then there was the war of 1812. Madison started the second bank of the US in 1816 when he became President and that passed by a single vote. Jackson put the kibosh on this in 1829 and so the charter was not renewed in 1836 leading the way to all sorts of shenanigans giving way to the National Banking Act of 1863 with amendments in 1864 and 5. Then there was a jolt in 1907 with the Panic (our book that we are reading) and so in 1908 - the National Monetary Commission was established (Aldridge) - in 1912 America decided that a "money trust" held the money (a few men) - so in 1912 with Wilson - the Glass-Willis proposal was submitted to Wilson - and then finally in 1913 - The Federal Reserve Act of 1913 was signed and The Fed was in action again. And of course Morgan and his crowd wanted the New York branch to be the most powerful.

I am not so sure about that Vincent - not sure if you saw that clip on the movie Too Big to Fail that Christopher posted - give a watch.

Also here is an article which may help answer some of the questions that you have about GNP and American corporations overseas and how it all adds up:

What is the Gross National Product? (folks, give a read)

http://useconomy.about.com/od/glossar...

Here is one for you:

Source: Aboutmoney

Note to Vincent - the Federal Reserve was not established until 1913 - December I think.

Remember though that Hamilton had started one in 1791 and it did not get chartered again because of being one vote short in each house in 1811 - then there was the war of 1812. Madison started the second bank of the US in 1816 when he became President and that passed by a single vote. Jackson put the kibosh on this in 1829 and so the charter was not renewed in 1836 leading the way to all sorts of shenanigans giving way to the National Banking Act of 1863 with amendments in 1864 and 5. Then there was a jolt in 1907 with the Panic (our book that we are reading) and so in 1908 - the National Monetary Commission was established (Aldridge) - in 1912 America decided that a "money trust" held the money (a few men) - so in 1912 with Wilson - the Glass-Willis proposal was submitted to Wilson - and then finally in 1913 - The Federal Reserve Act of 1913 was signed and The Fed was in action again. And of course Morgan and his crowd wanted the New York branch to be the most powerful.

Jordan wrote: "Ah Econ, how I've missed you! Back in my college years, I spent many days debating Economics policies (I was in school during the aftermath of the 2008 Recession.) and many more nights trying to un..."

Some interesting thoughts Jordan - thank you.

Some interesting thoughts Jordan - thank you.

Jim wrote: "Two little things that I had never heard before. I mentioned the "curbstone" brokers (Thanks Bentley for the great images.)

The second was the flow of money out of the East and into the West when ..."

I know Jim and this book pushes you into some of the corners that folks don't really hear or read about.

Thank you very much for the links - very helpful for folks understanding the concepts presented.

The second was the flow of money out of the East and into the West when ..."

I know Jim and this book pushes you into some of the corners that folks don't really hear or read about.

Thank you very much for the links - very helpful for folks understanding the concepts presented.

Francie wrote: "Hi, everyone. I also had heard about the 1906 earthquake, but through a source other than history. There's a great movie with Clark Gable, Spencer Tracy, and Jeannette McDonald called "San Francisc..."

Thank you Francie - not familiar with the movie but I will look for it - is it on Netflix?

Thank you Francie - not familiar with the movie but I will look for it - is it on Netflix?

Helga wrote: "It was fascinating to read how La Follette approached getting a bill passed and how La follette and TR joined forces to get the railroad safety bill passed on page 85. He drafted a bill prohibiting..."

Yes it is very effective

Yes it is very effective

Bryan wrote: "It is fascinating to see La Follette and TR approach reform in different ways. TR is seeing the political field, while La Follette is more the idealist reformer.

Even today, politicians sometimes..."

Kennedy was very effective (he knew how to get things done and get what he wanted passed) - however, I think crusaders are like LaFollette - the mission is everything - never mind the outcome - just go for the jugular and don't settle or surrender.

One other thing that comes to mind - as least from (MHO) - a LaFollette is really in it for the long haul - it is the end game - no matter how long it takes, no matter how many people suffer - they would rather not compromise, not give in an inch and do not care if even some help is blockaded because of their efforts. It is never about a single bill or law or anything - it is always about getting all of the marbles. I think a Ralph Nadar was a crusader and like LaFollette - he was a spoiler in the election when he ran as an independent and did not care that he somehow cost the election for Gore. But on the other hand - he has been mighty effective in many areas of consumer protection and the country owes him a lot in that regard - however he also helped bring us George W. Bush (whether you were for or against that outcome).

An interesting article from Nader's perspective: (Nader's Viewpoint)

https://www.washingtonpost.com/postev...

Source: The Washington Post

Even today, politicians sometimes..."

Kennedy was very effective (he knew how to get things done and get what he wanted passed) - however, I think crusaders are like LaFollette - the mission is everything - never mind the outcome - just go for the jugular and don't settle or surrender.

One other thing that comes to mind - as least from (MHO) - a LaFollette is really in it for the long haul - it is the end game - no matter how long it takes, no matter how many people suffer - they would rather not compromise, not give in an inch and do not care if even some help is blockaded because of their efforts. It is never about a single bill or law or anything - it is always about getting all of the marbles. I think a Ralph Nadar was a crusader and like LaFollette - he was a spoiler in the election when he ran as an independent and did not care that he somehow cost the election for Gore. But on the other hand - he has been mighty effective in many areas of consumer protection and the country owes him a lot in that regard - however he also helped bring us George W. Bush (whether you were for or against that outcome).

An interesting article from Nader's perspective: (Nader's Viewpoint)

https://www.washingtonpost.com/postev...

Source: The Washington Post

Another helpful set of videos from Khan Academy (free) is a set of lessons and videos about Banking and Money as well as Central Banks:

https://www.khanacademy.org/economics...

https://www.khanacademy.org/economics...

Kressel wrote: "I must admit: I had a hard time understanding the different currency proposals at the beginning of the chapter. In general, I don't understand macroeconomics all that well, but this video helped me..."

Kressel - this was not until 1933.

More:

What Is Glass-Steagall? The 82-Year-Old Banking Law That Stirred the Debate

http://www.nytimes.com/2015/10/15/ups...

https://www.washingtonpost.com/repeal...

What is the Gramm-Leach-Bliley Act?

http://www.banking.senate.gov/conf/

http://www.federalreservehistory.org/...

https://www.gpo.gov/fdsys/pkg/PLAW-10...

https://www.govtrack.us/congress/bill...

The Depression’s Unheeded Lessons

http://www.nytimes.com/2015/01/11/ups...

by

by

Barry Eichengreen

Barry Eichengreen

The Volcker Rule

http://www.nytimes.com/topic/subject/...

http://www.nytimes.com/2015/10/09/ups...

Kressel - this was not until 1933.

More:

What Is Glass-Steagall? The 82-Year-Old Banking Law That Stirred the Debate

http://www.nytimes.com/2015/10/15/ups...

https://www.washingtonpost.com/repeal...

What is the Gramm-Leach-Bliley Act?

http://www.banking.senate.gov/conf/

http://www.federalreservehistory.org/...

https://www.gpo.gov/fdsys/pkg/PLAW-10...

https://www.govtrack.us/congress/bill...

The Depression’s Unheeded Lessons

http://www.nytimes.com/2015/01/11/ups...

by

by

Barry Eichengreen

Barry EichengreenThe Volcker Rule

http://www.nytimes.com/topic/subject/...

http://www.nytimes.com/2015/10/09/ups...

I'm sorry I missed last week's thread and late to this one. It was finals week last week, and between that, student papers and final grades - let's just say there are teachers at Universities across the nation just now emerging, blinking and pale, into the sunlight . I have a bit of catching up to do and will be back on track shortly. Please forgive my absence, it looks like there has been great discussion.

I'm sorry I missed last week's thread and late to this one. It was finals week last week, and between that, student papers and final grades - let's just say there are teachers at Universities across the nation just now emerging, blinking and pale, into the sunlight . I have a bit of catching up to do and will be back on track shortly. Please forgive my absence, it looks like there has been great discussion.

Well we miss you - get caught up on Week Three and Week Four so you will be back on track. This thread has the financial focus and last week focused on the journalists and muckraking so two powerful discussions.

Bentley wrote: "Vincent wrote: "Gary wrote: "I have definitely heard of the Great Earthquake of 1906. For two reasons: one - when the 1989 San Francisco earthquake occurred, it happened during the national broadca..."

Bentley wrote: "Vincent wrote: "Gary wrote: "I have definitely heard of the Great Earthquake of 1906. For two reasons: one - when the 1989 San Francisco earthquake occurred, it happened during the national broadca..."Thanks - yes I knew the Federal Reserve was after the panic of 1906/7 - my question was/is if that was the end of the use bank notes as currency. Thanks for the other details

Bentley wrote: "This is a great photo showing the hand signals of these crowds of curb marketers. This New York Curb became the American Stock Exchange eventually (AMEX) and also (NASDAQ)

Bentley wrote: "This is a great photo showing the hand signals of these crowds of curb marketers. This New York Curb became the American Stock Exchange eventually (AMEX) and also (NASDAQ)The “curbstone brokers” ..."

Curbstone brokers - no photos in snow or rain................ just a curious comment

Bentley wrote: "Another helpful set of videos from Khan Academy (free) is a set of lessons and videos about Banking and Money as well as Central Banks:

Bentley wrote: "Another helpful set of videos from Khan Academy (free) is a set of lessons and videos about Banking and Money as well as Central Banks: https://www.khanacademy.org/economics......"

Oh, boy! You've given me a lot to go through! But thanks! It's probably exactly what I need.

Remember we have the author's thread where questions can be asked. The author is with us.

https://www.goodreads.com/topic/show/...

https://www.goodreads.com/topic/show/...

Kressel wrote: "Bentley wrote: "Another helpful set of videos from Khan Academy (free) is a set of lessons and videos about Banking and Money as well as Central Banks:

https://www.khanacademy.org/economics......"

Happy Reading!

https://www.khanacademy.org/economics......"

Happy Reading!

Books mentioned in this topic

Only Yesterday: An Informal History of the 1920s (other topics)The Great Depression: America 1929-1941 (other topics)

Flash Boys (other topics)

Boomerang: Travels in the New Third World (other topics)

The Forgotten Man: A New History of the Great Depression (other topics)

More...

Authors mentioned in this topic

Frederick Lewis Allen (other topics)John Kenneth Galbraith (other topics)

Amity Shlaes (other topics)

Robert S. McElvaine (other topics)

Michael Lewis (other topics)

More...

The effort and tactics put into stopping the collapse by J.P. Morgan reminded me a lot of Ben Bernanke and Hank Paulson's roles in pushing TARP, as presented in Andrew Ross Sorkin's Too Big to Fail: The Inside Story of How Wall Street and Washington Fought to Save the Financial System from Crisis — and Themselves (I watched the HBO film but I'm assuming the book is the same). It's a statement in itself of the size and influence of America's economy today as compared to 100 years ago that the work previously done privately by wealthy bankers (with the acquiescence of political officials) is now done by officials with the acquiescence of the bankers.