The Fed is tipping its hand: the QE party is going to end - Let the stock market crash of 2013 - 2014 initiate.

Don’t look now, but Ben Bernanke is warning about excessive risk taking in financial markets, and the use of leverage. Ben is apparently watching for signs of bubbles in asset markets.

“In light of the current low interest rate environment, we are watching particularly closely for instances of ‘reaching for yield’ and other forms of excessive risk-taking, which may affect asset prices and their relationships with fundamentals,” Mr Bernanke said.

I’ve been writing that the Fed must begin to slowly tip its hand that it intends to back away from QE because it knows the point of diminishing returns has been reached. Plus, the Fed knows it must avoid -at all costs- being trapped in a situation where it still has the QE throttles maxxed-out while the US economy enters recession. Were that to occur, the great unwashed would turn desperate because there would be no hope for another magic bullet to save the day. So it must back off the throttles if only to provide the illusion it may come to the rescue once more. The fact that rescue will not work will not be known until further down the road (when someone else has the helm after Ben). Here’s a link to the FT’s article about Ben’s speech –after the market closed on Friday. Link to FT.

As I wrote in last week’s newsletter:

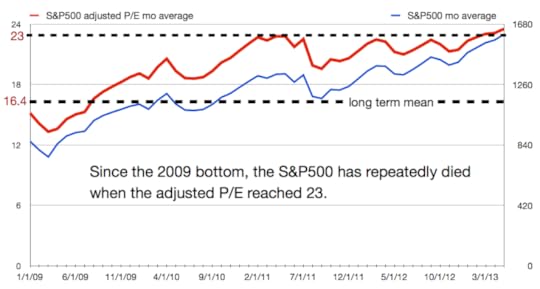

The S&P500 has risen dramatically this year –and none of it from earnings or revenue growth. All of it has been P/E expansion. The adjusted P/E reached 24 last week –46% above the long term average. Bubble!

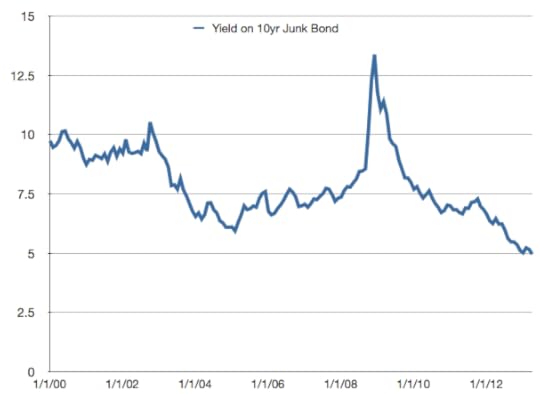

Junk bonds have been bid up in price as investors go in search of yield wherever they can find it — driving junk bond yields down to levels NEVER seen before — to under 5%. Bubble!

And leverage? How about this fact. NYSE margin debt (buying on margin) almost set a new all-time record in March –and without question will set a new all-time record in April and potentially May as well.

The Fed has to take the training wheels off at some point. Best to do it when the stock market has set a new all-time high. Granted it is unfortunate the S&P500 had to be stretched 155 points above the 200-day moving average (a point only exceeded once — March 2000, so you know what to expect next).

Next week should be interesting.