Welcome to the 2013 stock market top - Let the stock market crash begin

Running out of gas. That’s how I’d describe the latest risk-on rally. I’ll go into this in more detail via examining several Greedometer current input values in this week’s newsletter. But when the market gets this far (nearly 150 points) above the 200-day exponential moving average -and this is somewhat rare- it runs out of gas.

(with thanks to investors intelligence for the data)

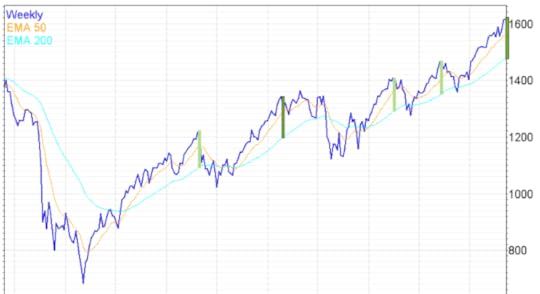

The chart above shows the S&P500 and its 50-day & 200-day e.m.a’s. The current bubble is nearly 150 points above the 200-day e.m.a. I’ve inserted a dark green vertical bar to show the extent of the bubble. Only once since the March 2009 bottom has the S&P500 been so bubble-itious. That was in February 2011 (also marked with a dark green bar). What came next was a couple 90-100 point drops and re-tests until early July. Then a very quick drop of nearly 20% ensued that had to be stopped by the Fed and ECB (again).

Look at the other slightly smaller bubbles (light green bars). Each preceded an S&P500 drop. Yet each drop was stopped by Fed / ECB monetary candy. The monetary cavalry had better ride to the rescue later this year or the stock market might just crash next year (where have I read that will probably happen?).

FYI: in order to find a larger bubble (gap above the 200-day ema), I had to go back to March 2000. You remember March 2000 don’t you? The end of the 18-year non-stop U.S. debt party, and the zenith of the tech bubble. Oh yes, and the beginning of a 47% drop in the S&P500 that -you guessed it- was stopped by myopic fiscal and monetary goodies that merely served to re-inflate a larger bubble.

What’s different now? There’s no fiscal candy coming to stop it this time. Nothing but fiscal tightening as far as the eye can see, actually. And what of the monetary cavalry? Think the Fed will be able to stop this one too?

If you’re still holding long equity positions (big, small, value, growth, domestic , international… I don’t care), consider yourself warned. The Greedometer algorithms cannot make a distinction less than 2 weeks, but today sure looks like a good day for a secular stock market peak. Let the stock market crash of 2013 -2014 begin.