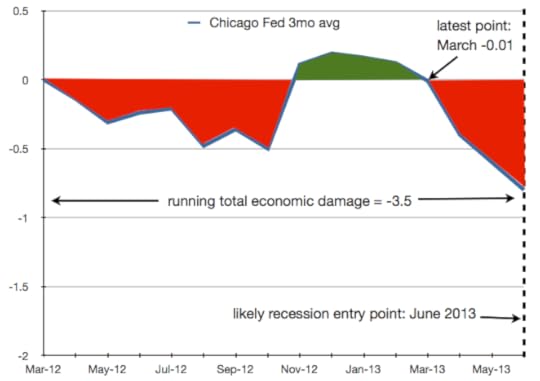

This morning saw the latest Chicago Fed National Activity Index report –always of interest to me. The 3-month rolling average showed continued declines in activity on a national basis -as I’ve been predicting. By the end of July, we’ll have the June data. My forecast calls for a -3.5 running total for the 3-month moving average. It was -2.42 when the US entered the previous recession in December 2007, and -4.4 when the US entered the 2001 recession. The S&P500 tends to peak 1-2 months prior to the economy entering recession. So my April-May call for a secular stock market peak remains in tact (as was made in Greedometer 2.0).

If you found this article by doing a web search for “stock market crash 2013″, relax. The US stock market is not likely to crash this year. This is going to be a topping-out year. The S&P500 will likely end the year only a few % lower than where it began — hardly a crash. 2014 — that’s likely see a crash.

Published on April 22, 2013 07:06