Asset Location Decisions

WHERE YOU PUT your investments can make a huge difference for your after-tax wealth.

As you know, we have 3 main investment accounts:

Taxable account. A traditional brokerage account where you are taxed every time you dividends or sell investments at a gain.

Tax deferred account. Traditional 401(k), 403(b), and traditional IRAs allow taxes to be deferred to the future. You pay taxes when your investments are withdrawn, and generally come with an immediate tax deduction.

Tax exempt account. Roth IRA, Roth 401(k), and Roth 403(b) allow you to avoid future taxes while providing no immediate tax deduction. The growth of these accounts is tax free.

Asset location

Say, as part of your investment strategy, you want to start putting money in bonds. You have a 401(k), Roth IRA, and a brokerage account. Where do we put them?

Brokerage account

When you hold bonds, like BND (Total Bond Fund ETF), you pay taxes on non-qualified dividends (e.g. interest from the bond) up to a max rate of 37%, plus net investment income tax, if applies. This means that if you receive $1,000 from the bond, you will pay approximately $370 in taxes if you are in the highest tax bracket.

Of course, not all of us are in such bracket, and perhaps a more reasonable number would be ~$220-240 for most people. But is taxable brokerage the right choice for you? Not really. You would be paying $200+ every year, plus state/local taxes.

Personally, I'm 100% invested in equities, because I want to be aggressive with my portfolio in my 20s, but if I did have bonds, I wouldn't hold them in a brokerage account.

Roth IRA/Roth 401k

When you purchase bonds in a Roth IRA, you will not pay taxes on the interest since it’s a tax-free account!

That’s much better than the $200+ in taxes you would pay in a brokerage account.

But is it the best choice? Well, bonds are considered “fixed income” funds, and they don’t grow much. Since Roth IRA is a tax-free account (meaning we pay no taxes when we sell these investments), we want as much growth as possible in it. Bonds would hinder that performance.

So, holding bonds is better than brokerage, but likely not the most ideal place.

Traditional 401(k)/403(b)

By holding bonds in an account like a traditional 401(k)/403(b), the interest income avoids immediate taxation, compounding tax free until withdrawal.

So, we avoid the ~$200+ of taxes and aren’t sacrificing the tax-free compounding like we are with a Roth IRA. This makes the pre-tax 401(k) the perfect location for bonds.

Of course the 401(k)/403(b) choices are limited and are provided by your employer. So, if they don’t offer a bond fund, you might not have a choice.

Some other examples:

REIT stocks/ETFs also pay non-qualified dividends and would follow similar logic like bond funds.

Actively managed funds (I’m strongly against these, as I believe passive funds are the best & lowest fees) have a lot of turnover, so they ideally shouldn’t be in a brokerage account due to capital gain distributions.

Stocks that pay 0% dividends (like Netflix) are the most efficient to hold within the brokerage account, but may need a more robust overall investing plan.

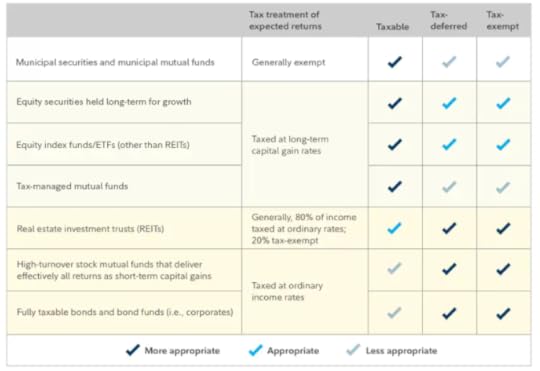

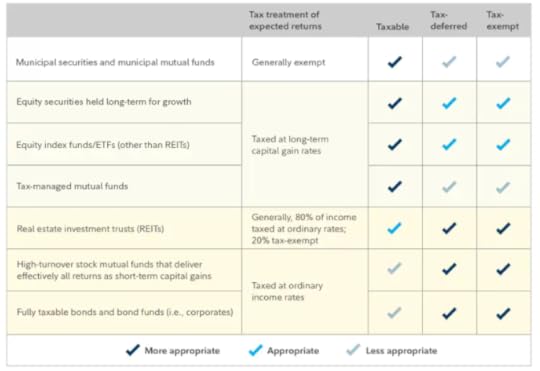

I really like this visual from Fidelity to reference:

But how much does this matter? Vanguard's research finds that a thoughtful asset location strategy can add significantly more value than an equal location strategy. The value added typically ranges from 5 to 30 basis

points of after-tax return, depending on circumstances (e.g. income, portfolio size)

Overall, I hope you think about all of your investments & how they get taxed.

Bogdan Sheremeta is a licensed CPA based in Illinois with experience at Deloitte and a Fortune 200 multinational.

Bogdan Sheremeta is a licensed CPA based in Illinois with experience at Deloitte and a Fortune 200 multinational.

As you know, we have 3 main investment accounts:

Taxable account. A traditional brokerage account where you are taxed every time you dividends or sell investments at a gain.

Tax deferred account. Traditional 401(k), 403(b), and traditional IRAs allow taxes to be deferred to the future. You pay taxes when your investments are withdrawn, and generally come with an immediate tax deduction.

Tax exempt account. Roth IRA, Roth 401(k), and Roth 403(b) allow you to avoid future taxes while providing no immediate tax deduction. The growth of these accounts is tax free.

Asset location

Say, as part of your investment strategy, you want to start putting money in bonds. You have a 401(k), Roth IRA, and a brokerage account. Where do we put them?

Brokerage account

When you hold bonds, like BND (Total Bond Fund ETF), you pay taxes on non-qualified dividends (e.g. interest from the bond) up to a max rate of 37%, plus net investment income tax, if applies. This means that if you receive $1,000 from the bond, you will pay approximately $370 in taxes if you are in the highest tax bracket.

Of course, not all of us are in such bracket, and perhaps a more reasonable number would be ~$220-240 for most people. But is taxable brokerage the right choice for you? Not really. You would be paying $200+ every year, plus state/local taxes.

Personally, I'm 100% invested in equities, because I want to be aggressive with my portfolio in my 20s, but if I did have bonds, I wouldn't hold them in a brokerage account.

Roth IRA/Roth 401k

When you purchase bonds in a Roth IRA, you will not pay taxes on the interest since it’s a tax-free account!

That’s much better than the $200+ in taxes you would pay in a brokerage account.

But is it the best choice? Well, bonds are considered “fixed income” funds, and they don’t grow much. Since Roth IRA is a tax-free account (meaning we pay no taxes when we sell these investments), we want as much growth as possible in it. Bonds would hinder that performance.

So, holding bonds is better than brokerage, but likely not the most ideal place.

Traditional 401(k)/403(b)

By holding bonds in an account like a traditional 401(k)/403(b), the interest income avoids immediate taxation, compounding tax free until withdrawal.

So, we avoid the ~$200+ of taxes and aren’t sacrificing the tax-free compounding like we are with a Roth IRA. This makes the pre-tax 401(k) the perfect location for bonds.

Of course the 401(k)/403(b) choices are limited and are provided by your employer. So, if they don’t offer a bond fund, you might not have a choice.

Some other examples:

REIT stocks/ETFs also pay non-qualified dividends and would follow similar logic like bond funds.

Actively managed funds (I’m strongly against these, as I believe passive funds are the best & lowest fees) have a lot of turnover, so they ideally shouldn’t be in a brokerage account due to capital gain distributions.

Stocks that pay 0% dividends (like Netflix) are the most efficient to hold within the brokerage account, but may need a more robust overall investing plan.

I really like this visual from Fidelity to reference:

But how much does this matter? Vanguard's research finds that a thoughtful asset location strategy can add significantly more value than an equal location strategy. The value added typically ranges from 5 to 30 basis

points of after-tax return, depending on circumstances (e.g. income, portfolio size)

Overall, I hope you think about all of your investments & how they get taxed.

Bogdan Sheremeta is a licensed CPA based in Illinois with experience at Deloitte and a Fortune 200 multinational.

Bogdan Sheremeta is a licensed CPA based in Illinois with experience at Deloitte and a Fortune 200 multinational.The post Asset Location Decisions appeared first on HumbleDollar.

Published on November 28, 2025 21:57

No comments have been added yet.