H.A. Larson's Blog, page 17

February 19, 2021

The Write Life: Back in the Saddle

Good morning and welcome to the Write Life! It's been a few weeks since my last post, but working a lot of hours every week at two jobs doesn't leave me a lot of extra time. Fortunately, my second job has slowed hours for the next few months, which happen to be my last few months. It's a nice breather that has allowed me much-needed time to ease back into my writing life.

I've written a few articles for Slime&Grime as well as an editorial for a state group's newsletter. I also dusted off one of the books I have in various stages of completion and am working out the plot details. If I'm still grooving on it, I'm going to dive back in. Either that or I will look through another of the books I've started, or I might just start a new book altogether.

I have been busy working on a book, but it's a different kind of book. It's a short book about basic urban prepping, another topic close to my heart. I feel that it's always better to be overprepared than underprepared and I've been a prepper for years. Not an extreme one, mind you, but a minimalist one. And, since I live in the city, prepping can take on a different quality and tone. I'll definitely keep you updated on its progress.

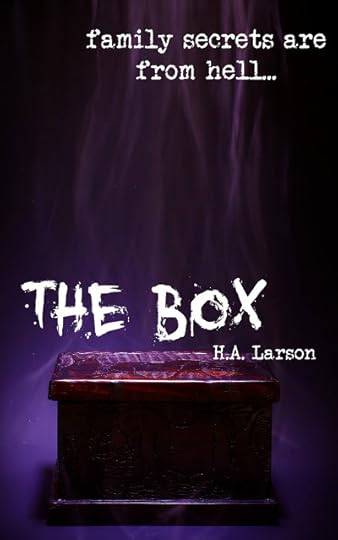

One significant thing I've done in recent weeks was to take a look at my already-published books. Every once in a while, I decide it's time they all get a new cover. Putting a new cover on a book is not only easy in the self-publishing world, but a quick way to breathe new life into an old book. This is nothing new for me as I have done this three times previously with each book. Here's how I updated The Box:

Cool, huh?

I think my biggest cover difference was for The Melody. I never really did like any of the covers I made for that book, so I really feel like this one, finally, suits it best! Take a look:

What do you think? Let me know in the comments.

If you want to take a look at my other updated covers, head over to the My Body of Work section of this blog. There, you can also find the links to all my books if you're interested in reading any of them!

So, it appears that I truly am back in the saddle again. It's been such a long, hard road to get back here, but after the journey, I really feel like myself again. Thanks to you all for sticking with me all these years, through thick and thin. Your support and encouraging words in comments, messages, and emails have meant the world to me! I'll be posting on my regular schedule again starting next week. Until then, Happy Friday, and have a great weekend!

Published on February 19, 2021 04:19

February 4, 2021

The Art of Being Unhappy

A picture that does NOT make me unhappy.

A picture that does NOT make me unhappy.I was reading an article not long ago and a quote from it really stood out to me. I don't remember it exactly, but the gist of it was about being distracted by your unhappiness. Why it stood out to me was because it resonated with me in a deep way. I, myself, have been so distracted by my own unhappiness, that it was hard to do much of anything for a few years. Even now, it can be difficult to move past it at times.

This got me thinking about how I tend to dwell on the negative, which I imagine plays into or is a result of the distraction that my unhappiness causes. Oddly enough, when I finished that article, I read another one that talked about how to make changes in your life that are positive and how your own negativity is preventing you from achieving your goals.

Between these two articles, I realized that being unhappy had become like an art form for me, making it easier to perpetuate a seemingly neverending stream of unhappiness. The unhappiness positions me to be negative, which then prevents me from reaching dreams. Not all of them, mind you, but a few of them for sure.

Does this mean I don't have legitimate reasons for being unhappy? Definitely not. Shitty things happen and it's okay to feel down about it. What I've learned, however, is that I can't dwell on those things for very long or the unhappiness cycle will start. My best bet, then, is to give myself some time to deal with the issue - not a lot but enough to think through it - and then move on. This is a healthy balance that allows me to tackle problems without bottling them up for an explosion later.

I also decided that since I've addressed my distraction on my unhappiness, that I need to do other things that can help me combat it. To head it off at the pass, if you will. There are many things that a person can do to achieve this, but I've settled on the ones that I feel will work best for me. Let me explain them briefly:

1. I Started Keeping a Gratefulness Journal

Dwelling on the negative things in my life can detract from all the positive things. I figured that if I shifted my focus from thinking about negative things to positive things, that it would shed some light on the fact that my life is pretty great. Putting down those great things where I can see and read them whenever I want is a fantastic reminder. I happened to have a cute journal I had purchased several years ago and had only made a few entries, so it was perfect for this purpose. Right there I had my first grateful thing: something I wanted, I already had.

2. I Set an End Date for my Second Job

I picked up a second job back in August of last year to help me pay off all my debt, with the exception of my student loans. While I found a bright side to working that second job, after several months of working many hours a week and sacrificing my nights and weekends, I'm ready to be done. My mood going to my second job used to be upbeat, but lately, I find myself loathing it. Fortunately, I'm almost done paying off that debt, so I calculated when I can give notice and quit. This has perked up my mood significantly as I can see the proverbial light at the end of the tunnel.

3. I Quit Being Lazy About Stuff

This is a recurring issue that I have. Every day, I have a morning and a night face routine, as well as three supplements I take. I often find myself being lazy and will end up only doing my morning face routine - if that. These are all simple tasks and not doing them over time leads to feelings of failure. I've made a concerted effort to stay on top of these daily, and I've taken steps to help me stay on track. They may be simple, but they mean a lot. Self-care is one way to feel happier, both mentally and physically.

4. I Quit Beating Myself up About Things

I am my own worst critic, and I can often loathe myself for my failings. For instance, I became a vegan in 2015, but over the past couple of years, I've found myself slipping into eating dairy and eggs (by way of baked goods) more often than I cared to admit. I kept it to myself and would berate myself for this a few times a week. Eventually, I just realized that I am solidly a vegetarian and that I should just embrace it. I eat a vegan 90% of the time and the other 10% I eat some cheese and dairy. And you know what? That's okay.

I also decided to quit beating myself up about gaining back some weight over quarantine. It happens. In that vein, I made a vow to not worry if I decided to overindulge one day. It's not enough to bring down the whole boat.

I don't beat myself up for not writing like I used to, either. It is what it is, whatever that looks like on any given day, and I've accepted that. I can't and won't push myself into anything I'm not ready for. When and if I'm ready to thrust myself back into writing furtively, then I will.

5. I Decided that my Mental and Physical Health are Incredibly Important

This item goes hand in hand a bit with the last two items. I saw how far I had fallen off the wagon this time and made yet another vow to climb back on. This time, I'm not dieting but rather I am putting my mental and physical health first. How am I supposed to accomplish all the things I want in life if I feel like crap in body and mind? I now spend time preparing myself healthy foods instead of just grabbing whatever is easy and convenient. Even if it's just a few extra minutes that I don't feel like I have in the morning, I do it anyway. The end result is that I eat better. When I eat better, I feel better, and when I feel better I feel more confident and happy.

6. I Decided to Not take Abuse from Anyone

This includes me. When I'm unhappy, I'm not as confident, making it easier to be a pushover. I knew right away that I needed to end this kind of behavior - whether it's coming from someone else or from me - dead in its tracks whenever it happens. Doing this boosts me up mentally, and helps me with my confidence. And having confidence can lead to feelings of happiness.

As you may have noticed, you see the same words a handful of times during this post. Words like confidence, feelings, and health. There's a reason for this: they are some of the components of a happy life. When you have confidence, acknowledge & deal with your feelings, and make your health a priority, you're bound to be happy. While every day is a challenge - after all, it's not easy to enmesh oneself in daily habits - I am more than ready for it. My well-being and my future depend on it.

Published on February 04, 2021 09:14

January 23, 2021

Sometimes You Just Have to Make Your Own Dreams Come True

A good friend of mine is always on the lookout for Prince Charming. She's always hunting for that one guy who's going to swoop in, get rid of her problems, and make her dreams come true. This has been going on for years and, needless to say, she always comes up disappointed. There are a few reasons as to why this is, but they detract from the point.

If you rely on someone else to make your dreams come true, you're going to be frustrated and disappointed - just like my friend. Why? Because you're basically hoping for a miracle. Is there someone out there who can make your dreams come true? Maybe, but more than likely not.

Having such a fantasy is also unrealistic and will put high expectations on anyone you do end up dating. It's okay to have expectations, but they need to be realistic. After all, you wouldn't want to have expectations of you that aren't reasonable either, so don't put them on anyone else.

Relying on someone else to realize your dreams also takes away from your own strengths and abilities. You're basically telling the world that you're incapable of doing things without someone else's help. You doom yourself to a life of sadness and not realizing your own potential by thinking like this.

When I was married, I had a handful of years where I had high hopes that the two of us would realize my dreams. My dreams. Let that sink in. The truth of the matter is, sometimes you just have to make your own dreams come true. I came to this realization, so that's what I'm doing. Working on my own dreams not only gives me strength and focus, but it allows me to do exactly what I need to do in order to achieve my goals.

I don't need anyone else to help me realize my dreams, and neither does my friend. She just doesn't realize it yet.

Published on January 23, 2021 06:51

January 18, 2021

Coffee Talk: Time, Net Worth, and Writing

Good morning! I realize it's been a while since I posted last, but that just seems to be my life these days. While there are definitive upsides to working two jobs, there are downsides as well. The upsides are that I'm making the extra money I need to pay down debt and I keep myself active, but the major downside is that I don't have as much time to do or engage in other things. One of those things is this blog and writing, but I still manage to do both - albeit it much less frequently. I miss seeing my friends as often or spending more time in leisure pursuits, but the trade-off is worth it. Besides, I'd rather sacrifice now to get where I want to be in the future. That future includes me retiring early and living the life of an adventurer-traveler, so it will all pay off in the end. And honestly, I do have some downtime, but I use that downtime to read, hang out with my daughter (more her than my son because my son lives on his own in a different town), and get important things done - like my laundry and doing food prep.

A few years ago, I talked about net worth in a post from my Basic Financial Fitness series. I started tracking my own Net Worth back in 2017 when I started using the Mint app. At that time, I barely had any assets but I had a hefty amount of student loans and other debt (car loan, credit cards, doctor bill, etc.). I remember looking at my incredibly negative net worth and feeling depressed. While I quit using Mint a year ago (I was admittedly a bit nervous aggregating all my account information in one place), I started a series of Excel worksheets, compiled in a workbook, to track my debt and my savings. When I began pursuing FIRE in August of last year, I decided I needed to pick up a second job to aggressively pay down debt. At the same time, I also decided I would start keeping track of my net worth again, so I made a spreadsheet for that and added it to my workbook. After my last paycheck, I'm happy to report that I am on the positive side of net worth. Granted, it's a low net worth, but for once in my adult life, my assets exceed my debt load. I have one last thing to pay off before I tackle my student loans, but I'm getting there. On top of all that, I've been saving around 40% of my regular income as well as employer-sponsored retirement with both jobs. The increase in my savings/retirement accounts is beginning to rapidly overtake my diminishing debt. I will be excited when I am debt-free and will begin saving as much of my income as possible.

Believe it or not, I am writing. Granted, it's a slow-moving process, but I am writing nonetheless. Since I don't have the same kind of time I had before to work on novellas, I spend time, instead, fleshing out and writing bits and pieces of short stories. While I had been putting out a few short stories as series in my monthly newsletters, I've decided to write them and polish them to send to publishers at some point. I'm also still toying with the idea of a book of short stories - something I started working on a while back as well. Who knows how my short stories will end up being released, but rest assured they will be released when the time comes. And even though I'm writing at a much slower pace, it still makes me proud and happy that I'm writing regularly at all. If you've been following my blog for any time, you know exactly what I am talking about. My creative process is always there, a small wheel of ideas constantly spinning somewhere in the recesses of my mind.

I do have some things to share with you coming up - time allowing - so as always, keep your eyes here in the coming weeks. Have a great week!

Published on January 18, 2021 07:15

January 5, 2021

Saving Money and Being Less Wasteful

I've always been a fairly frugal person, but after I leaped into the FIRE, my frugality has definitely ramped up. One of the discoveries on my journey is that there are always ways one can be more frugal and, in the process, save more money - a tenet of FIRE.

Another aspect of FIRE that I'm learning from scratch - unlike my frugality - is minimalism. Minimalism is a life approach that aims to live simply, frugally, and less wastefully. It's no surprise, then, that the road to financial independence is paved minimally.

Here are things I'm doing to be frugal, be less wasteful, and save money.

1. I quit buying cans of beans

As a majority plant-based eater, beans are a staple in my diet. Every trip to the grocery store would see me bringing home at least a dozen cans of different kinds of beans. Not only does this add up in cost, but it was almost sickening to see the number of cans that I was putting in the recycle bin each week. Surely there was a better way. Well, it turns out that there is. I invested around $45.00 in an instant pot. With this modern marvel, I can cook dry beans into perfectly tender beans in under an hour! A one-pound bag of beans costs approx $1.50 (less if you buy bigger bags) and will yield roughly 6.5 cups of cooked beans. By contrast, the cheapest can of beans is around $0.75 and yields about 1.75 cups of beans. This means that I pay approximately $0.40 for the same amount of beans that a can of beans provides. If that wasn't sweet enough, I'm cutting down the amount of waste I generate by a large amount.

2. I quit buying paper towels and napkins

I used to think I was doing well financially if I could afford to buy paper towels and/or napkins. After several years, I realized that napkins were useless as I could just use paper towels for the same purpose. Lately, I realized how wasteful and expensive this can be, so I switched to using rags for cleaning up spills - no big deal because I always have rags around for cleaning - and to using cloth napkins. Not only am I saving money by not having to buy these items anymore, but I'm no longer throwing a bunch of dirty paper products in the garbage.

3. I quit using so much soap

Whether it's laundry soap, dish soap, hand soap, or shampoo, it sure seemed like I would frequently replace these items. Almost too frequently. So, I read the backs of the containers and discovered that I was using too much of each of them, particularly laundry soap. Did you know that the cap you use to dispense your laundry soap isn't designed to be filled to the top? Funny how companies give you a much larger cap than what you actually need! If you read the back of the bottle, you'll discover (for the most part) that you only need a fraction of the amount of laundry soap you're using. It's amazing how long a container of laundry soap lasts me now. Also, since I'm not going through these items as quickly, I'm throwing away less packaging.

4. I quit buying store-bought milk

I don't tend to use a lot of (plant-based) milk, still, I think I averaged around 3-4 2-quart containers each month. So, I bought myself a nice 2-quart glass drink container (Anchor Hocking at Walmart for under $5) and started making my own. Oat milk is the cheapest and healthiest plant milk to make, so I make my own. It does lack a bit of oomph so I add some pecans (cheaper in bulk than other nuts) and make mine a bit creamier and richer. I buy the large, generic oats, and use 2 cups of oats and a half cup of pecans to make two quarts at a cost of $0.36 for the oats and $1.06 for the pecans. This means my oat milk comes in at a grand total of $1.42 for 2 quarts. And again, making my own oat milk and storing it in a quality glass container means I'm throwing away much less packaging.

5. I air-dry my clothes

My dryer died early in the summer, and I decided not to try and repair it. It's quite old and last time I tried to fix an appliance, I wasn't able to because the parts for the machine no longer were made. So, I strung up some clothesline on the poles in my backyard and dried my clothes that way. Once the weather turned colder, I purchased a couple of good, metal drying racks to dry them inside. I also hang larger items on hangers and put them on my shower curtain rod. I have a few small fans that I turn on low to help circulate air, and this system works perfectly. And, as it turns out, not using the dryer nearly constantly saves money! It also happens to knock my carbon footprint down by roughly . How about that?

6. I walk as much as possible

You guys already know how much I like to walk for exercise. Because of this, I walk back and forth to my full-time job. But, I also try and walk other places as well. There are a few stores and other places that are fairly close to me that I frequent, so as long as I have time to spare, I will walk there as opposed to driving. Not only does this save me money on gas and wear-and-tear on my car, but it also reduces my carbon footprint significantly.

These are the ways, right now, that I am saving money while being less wasteful. I'm sure I'll pick up other tips and tricks as time goes on, and when I do, I'll make sure to share them with you. Do you have any tips or tricks that you do to save money and/or be less wasteful? Let me know in the comments.

Published on January 05, 2021 12:20

January 1, 2021

Yesterday, Today, and Tomorrow

It doesn't seem like it was that long ago when I sat down and wrote about my 2019 and how much I was looking forward to 2020. Yet, it's been a year ago now, and, man, what a year it was. Even though we dealt with a global pandemic, it was still a year that I can look back on and feel grateful and fortunate for.

I've come a long way from the start of 2018 when I knew something was really wrong. I spent the next three years ('18, '19, and '20) dealing with the entirety of a life that was rough. Over those three years, I suffered, I cried, I learned a lot about myself, I went through big changes, I healed, I became stronger, I became renewed, and I forged a new path. See, my life had ceased to be my own and I was miserably depressed. Over these past three years, I've reclaimed my life and rediscovered myself.

The biggest takeaway from all of this is that I'm determined to live the life I've always wanted for myself and I'm working hard to get there. There were times in the past when I thought it was too late to ever achieve my dreams, but I know now that that just isn't true. My only barrier to my dreams was myself.

A year ago, I proclaimed that 2020 was going to be my year, and, to be sure, I righted my course. Now, I can look forward to 2021 as being the year where I intend to skyrocket in my growth...in all areas. Before I do, however, I need to give a nod to 2020 and all the goodness she brought to me.

1. I Traveled

Travel and adventure go hand-in-hand for me, and it's an integral part of my life. Traveling is what makes me happy, gives me joy & fulfillment, and broadens my horizons. To that end:

I spent Mother's Day weekend taking an adventure with my kids to nab the high points of Nebraska and Kansas with an amazing stop at Pawnee Buttes in Colorado.

In July, I took another joint vacation with my folks to Minnesota. While our main goal was to nab that state's high point, we had a fantastic time checking out sites along Highway 61 as well as the Lutsen Alpine slide and other fun things.

Then, in October, I took a trip with my best friend to the exquisite Grand Hotel and explored it's Michigan home on Mackinac Island. On our way back home, we made pit stops at the high points of Michigan and Wisconsin which means I've now made it to 8 state high points.

Before my travels this last year, I had never been to a single one of the Great Lakes. Now, I've been to three: Lake Superior, Lake Michigan, and Lake Huron.

I was worried that I wouldn't get to a Renaissance Faire in 2020 because of Covid, but the Des Moines Renaissance Faire managed to pull off a great one in the Fall. As a die-hard RF fan, I felt like my year was complete after watching a Joust.

2. I Made Major Life Changes

There comes a time when everyone reevaluates their lives and realizes that there are changes to be made. I was no exception to this and made my own changes. Big changes to be sure, but necessary.

3. I Decided to Pursue FIRE

Back in August, I decided that FIRE (Financial Independence, Retire Early) was the path my life should take and the goal I wanted to achieve. Shortly thereafter, I picked up a second job to pay off debt. This second job saw lots of benefits for me beyond paying debt, although I'm happy to report that I'm nearly debt-free - with the exception of my student loans. I will be financially independent and ready to retire no later than the Fall of 2030, and I'm excited about that chapter of my life.

4. I Kept on 'a Walking

If you've been reading this blog for a while, or follow me on social media, then you know that I have had a goal since April of 2018 to walk at least 100 miles a month. While there were a few short months - there always are - I still hit or was close to my goal each month this year. I closed out December of 2020 with 112.22 miles under the belt, walking a total of 1,250.90 miles in 2020. This was my best year yet, beating out 2019 by three miles. I've now walked a grand total of 3,336.87 miles since I started walking and logging miles in earnest back in April 2018.

5. I Worked on Relationships

I was dealing with so much personal trauma for a few years, that I could barely take care of myself let alone be there for others. When I healed from everything early in 2020, I realized how much I had disconnected from those closest to me. I had to really start being there again for my friends, family, and especially my kids. My kids, more than anyone, needed me and I made sure to be there for them completely. We're now closer than ever and we're all much happier than before. And my friends - who selflessly helped me through my issues while putting their's in the background - had the tables turned as I now focused on them and the things they needed. I feel more connected to them now as well. I've also formed closer bonds with my outlying friends, and I feel like I have one big extended family.

All of this makes me value the importance of the people in my life and the role they play in my well-being.

6. I all but gave up Social Media use

Except for about a month stint using social media after quarantine, I've barely used social media in almost a year. At first, it was hard to give it up, much like other addictions I've had in the past, but over time I adapted. I've adapted so well, in fact, that my desire to use social media platforms is pretty much nil. The end result for me is that I feel more connected to my life. I'm more productive at work and more attentive to others, and I enjoy my time on outings and trips because I'm not constantly connected to my phone. I feel like I have my feet firmly planted in the world, and I wouldn't change that for anything.

While 2020 wasn't perfect, there were many bright spots. Still, there are plenty of things I need to work on in the new year, and I have no qualms about working hard to get there. I hope you can realize your dreams in the coming year, and that you will be able to look back on it and smile.

"May the road rise up to meet you. May the wind be always on your back." - Irish blessing

Published on January 01, 2021 07:01

December 25, 2020

Gud Jul to you and yours

Gud Jul, or Good Yule, to you and yours!

I'm a Swede by heritage, 50% to be exact, so I grew up with Swedish traditions that I found fascinating as a child. While that fascination never left me, it did get relegated to the background while I celebrated a more modern version of the holidays. Fast forward to the past few years where I've discovered a new-found interest in my Swedish history, particularly the more pagan traditions.

While I celebrated a more minor Yule this year due to my living arrangements, I'm eagerly looking forward to celebrating a full Yule next year when I'm once again in my own home. There's something magical about a traditional Yule, and if there's anything I enjoy, it's something magical.

I hope your holidays have been and will continue to be a wondrous experience. After the year we've had, we sure could use it.

Published on December 25, 2020 10:19

December 12, 2020

Latest Libations: Delving into the NA Beer World

You and I both know how much I enjoy a good beer. I've talked about it here regularly and considering this whole series, it's not really a surprise. But, I've also talked about how I want to cut down my alcohol consumption because let's face it, it's easy to take things too far. I've actually tried giving it up altogether - big fail - and I've also tried tactics like getting into drinking seltzer waters to trick my brain into thinking I was drinking hard seltzer - a drink I got into a few summers ago. This was pretty successful and I actually got into drinking seltzer waters, which are good for you. Unfortunately, I still really missed a good beer now and again, so I started thinking of other options.

I understood that I didn't want to quit drinking entirely, but rather cut my alcohol consumption down to a more occasional thing. There are good reasons for this, but as I've talked about it in detail before, I won't bog this post down with them. At any rate, I started thinking about non-alcoholic (NA) beers. I'm no stranger to NA beers, having found a friend in Coors NA while I was pregnant with my daughter. I've also had O'Douls (the original NA beer), and while I found the Coors NA to be better, they both lacked the flavor of a real, quality, specialty brew. I love stouts, ales, lagers, and goses, to name a few, and there weren't any NA beers of this ilk, that I could find.

So, I turned to the internet for assistance and found a couple of places that brew actual NA beers that seem to look and taste like the real thing. After scoping out a few and thoroughly reading some reviews, I decided to give Bravus Brewing Company a try. Based out of California, they are the only brewery that exclusively brews NA beers, and we're not talking some run-of-the-mill beer either. They brew stouts, IPAs, ales, goses, and others. If that wasn't intriguing enough, they will ship their brews to you. Since it was more cost-effective, they had good reviews, and because it would take a while to get brews when I wanted them, I decided to take the plunge and order three cases of the ones that I wanted the most.

The first one I picked was the White Ale. If you've ever had a Blue Moon and liked it, then you would like this. Ale is a light brew and this style is brewed with orange, making for a crisp, clean, and refreshing taste.

This is what it looks like poured in a glass. Let me tell you, this brew is delicious.

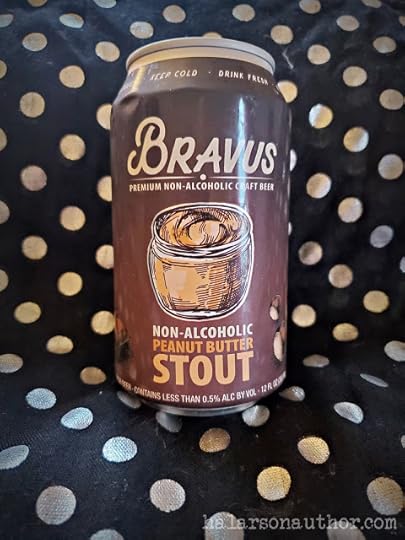

Bravus brews an oatmeal stout, one of my favorite stouts. Stouts, if you aren't aware, are a dark, malted beer. The malting adds a rich taste and color that has a lightly sweet, caramelly taste. When I was shopping on their site, they showcased their limited-run Peanut Butter Stout. I love stouts and I love peanut butter, so instead of ordering their oatmeal stout, I went with this one instead.

It was everything I would want and expect in a stout. Dark, a little heady, and very flavorful. I poured it into my Boulevard glass, a brewery that makes my favorite beers of the alcohol variety, and it looks like a stout!

Last, but certainly not least, I purchased the Raspberry Gose. The main components of a gose are usually citrus, herbal, and a hint of saltiness. This translates into a fruity and sour light beer that is refreshing, especially on a hot day!

I have to tell you that I'm very impressed with the NA beers from Bravus Brewing Company. Not only are they delicious and taste like their alcoholic counterparts, but you'd never be able to tell you were drinking a NA beer. This is the perfect drink for people who don't want to consume alcohol but love to drink beer or would like to fit in at gatherings where everyone else IS drinking. So, say goodbye to that O'Douls and grab yourself a better option!

Published on December 12, 2020 08:31

December 5, 2020

Portrait of Omaha: Gerda's

Recently, I decided to pore through my Google Drive in an effort to make more space. During the process, I came across so many pictures of things I had done and the places I had gone that I had completely forgotten about. One of those places was Gerda's German Restaurant. If you have lived in or visited Omaha on a regular basis, then you no doubt know of Gerda's whether you actually graced the establishment or not.

Gerda was a German woman who met and married an American soldier. Eventually, they made their way to Omaha where Gerda got a loan and opened her German bakery and restaurant. Her jaeger schnitzel was her best-selling item in a cozy place filled with murals of the German countryside, German flags, and other unique items, and her annual Oktoberfest brought 'em in by the 1000s.

For my best friend, Keith, and myself, Gerda's was a place we could come to get a stein or mas of our favorite beers. Mine was Franziskaner Hefeweissbier, and it was on tap at Gerda's. We were served every time by the same waitress (who'd worked there forever) who would always greet us with a smile and complimentary hard rolls with butter - another Gerda's favorite.

This particular visit was a few days after Gerda passed away in 2018. Keith and I shared a few tears with the forever waitress as we reminisced about the place we'd never get to grace again.

The monk that graced the bottles of my favorite beer stood watch in the corner, which I always thought was whimsical.

As it turns out, Gerda's children kept the place open for another year before having to close down permanently. I never went back during that time as I had already said my goodbye during this last visit. More than that, though, I sensed it just wouldn't be the same without being able to say hi to the woman who lived and breathed that restaurant. I miss Gerda's and being able to get a tall, cold glass of Franziskaner.

Ruhe in Frieden, Gerda.

Published on December 05, 2020 06:53

December 3, 2020

Roadtrip Highpointin'

You all know that highpointing is a passion-hobby of mine, and to that end, I've reached 6 out of the 48 state summits I plan to conquer. So far I've attained:

* Black Elk Peak - South Dakota* Signal Hill - Arkansas* Hawkeye Point - Iowa* Panorama Point - Nebraska* Mount Sunflower - Kansas* Eagle Mountain - Minnesota

Well, after October's trip to Mackinac Island, I can now add two more to that list:

* Mt. Arvon - Michigan* Timm's Hill - Wisconsin

I was also hoping to add Charles Mound in Illinois during this same trip, but it's located on private property. The owners only open up the area four weekends a year, and this one wasn't the one. Much as I would've loved to have gone anyway, I would have been trespassing on someone's land and I wasn't about to do that. So, let's check out Mt. Arvon and Timm's Hill.

So here's Mt. Arvon in Michigan. Unfortunately, I didn't quite make it to the very actual top. The weather turned on our way from Mackinac Island to here, and the road was nearly impassable to the top. I had to get out of the car and walk as far to the summit as I could. I was close enough to count it, for me, as I was right there! LOL

After our treacherous journey back out of Mt. Arvon, this was the road on our way down to Wisconsin. It was quite beautiful.

We originally made it to Timm's Hill in Wisconsin at around 7:30 p.m. It was dark and the roads to the parking lot closer to the summit were closed for the Winter. We still tried to find it in the dark but had no luck. We made the decision to head to our motel, which was an hour south. After Mt. Arvon, I was completely dejected, but my best friend told me we could come back up the next morning if I wanted to. And, I wanted to! So, we arrived back the next morning and parked at the gate that closes off the road to the top parking lot.

After we walked about a mile, we reached the top parking area.

Another mile up and we reached the top of Timm's Hill...success! Here's the official USGS marker for it. As a note, I don't always see these markers on high points, but I try and pose with them if I do.

There are two towers at the top of Timms Hill, one wooden and one metal. The metal one has a vertical ladder to the top, while the wooden one has a wooden platform at the top, much like the ones I've seen in many nature places. I climbed partway up the wooden one, but it was slick with ice.

The view over the landscape was a beautiful wintery view.

Next summer, I'm planning on getting two more high points, Missouri and the aforementioned Illinois. I really do love highpointing and can't wait to get some more under my belt!

Published on December 03, 2020 04:40