H.A. Larson's Blog, page 16

April 8, 2021

It's Always Good to Come Home

I returned home this past weekend from a much-needed vacation and it felt great. Getting out for some travel and adventure is amazing but nothing beats coming home at the end. It was good to sleep in my bed again and be surrounded by familiar things.

As for the trip itself, my daughter and I flew down to Texas to spend a week with my Mom. It was one of those win-win-win situations. The reasons being, I had enough airline miles to fly down for free; we stayed with my mom, thereby getting free lodging; my mom has been going through a rough patch so it was good to be there for emotional support; and Texas is a big place with lots of fun things to do. We went to a few national parks and were able to celebrate my grandma's birthday with her before we flew back home.

It's also been incredibly nice not working a second job. I have my evenings free again and it's allowed me to be around to make dinner, take care of household chores, and prepare for our move. As far as that move is concerned, we can start moving in at the end of next week! I'm so excited to be starting a new chapter of my life and it is significant for me as it's a new beginning. After all that I've been through in my adult life thus far, it feels great to get a fresh start and to have solid goals that I'm working on. Most importantly, I can do it all for myself. My life is my own and I can live it and plan it how I choose, and it's the most liberating feeling in the universe.

Like I mentioned in this previous post, it's a busy period for me so things will be relatively quiet while I move into my new place and clear out/clean up the old one. Until then, have a great rest of your week, my friends.

Published on April 08, 2021 03:43

March 27, 2021

Having more Time

It's been a week now since I worked my last shift at my second job, and I have to say that it's been pretty great. It was nice to end my workday at my regular job and just deal with normal, everyday stuff this week. I've been doing the dishes every day and making dinner for my daughter and myself every night. It may seem little, but it's significant for me. I feel more relaxed than I have in months.

I also noticed that I'm more focused on my full-time job now that I'm not so tired and I actually wrote almost every day. It's wonderful to see myself shifting back into my old routine. Now, to just get moved and settled into my new place.

Until then, though, vacation in the Lone Star State is calling me. We have some pretty exciting plans and I can't wait to get started.

Have a great weekend, friends, and I'll see you in a little over a week.

Published on March 27, 2021 03:25

March 20, 2021

My FIRE Journey: Two important things I did while paying off Debt

Recently, I talked about how I paid off over 20k in debt over a 15 month period. Paying off this debt was essential to my future as I embarked on a new life as a single mom of one*. But, truth be told, there were two other goals I was working on, in conjunction with my debt repayment, that were just as important. Let's talk about them.

1. I Built an Emergency Fund

The reason I had gotten into debt in the first place was that I had nothing set aside for emergency purposes. Sure, I was saving regularly for well over a decade but it was on a very small scale, and what little I had saved up I invested in an existing retirement account. While this was smart on my part, it left me nothing to fall back on. Sure enough, I had a series of misfortunes and had to rely pretty heavily on credit cards for a few years. This led to my large debt load.

When I hatched a plan to aggressively pay off my debts, I knew I that had to put myself in a better position. I needed to have liquid cash reserves on hand in case I fell on hard times again. So, while I was paying off debt, I began building an emergency fund (EF). As of today, should anything happen, I have the equivalent of four months of living expenses saved up to fall back on. By the end of summer, I will be at my first major EF goal of six months of living expenses saved. By Spring of next year, if not earlier, I hope to have a year's worth of living expenses saved up. That is my ultimate goal.

2. I Aggressively Invested

I knew that I couldn't just save money. Sure, I need an EF, but I also need to grow my money for retirement. With this in mind, I began investing as much as I could into a handful of investment accounts, both old and new. By the last quarter of 2020, between my employer-sponsored retirement accounts and my self-funded ones, I was investing 40% of my income. By the end of this year, I want that number to be at 50%, and sometime within the next five years, I want that number to be around 75%.

3. Bonus: Side Quest

There was something else I did while doing the other three (debt repayment, saving, and investing). It's not a necessary goal, like the other three, but it's smart, beneficial, and falls in line with my frugal, FIRE-loving self, and that is supply stockpiling. My part-time job was in a grocery store and one of their perks was a 10% discount on almost everything in the store. Since I worked there several times a week, I was able to stay abreast of sales. For instance, in one three-day period, they had canned corn, canned green beans, canned kidney beans, and canned chili beans for $0.39. At the same time, they had their store brand of pasta for $0.69. Those were extremely cheap prices and with my discount, I saved 4 cents on the canned goods and 7 cents on the pasta. This means I only paid 35 cents a can for the canned goods and 62 cents for boxes of pasta. I would also scout sales and slashed prices at other stores. I was in a store once that had a super sale on shampoo and conditioner, so I stocked up on those. These are all items with a long shelf life, so I will be able to use them for some time to come. There's all to be gained and nothing to be lost from this practice.

Paying off debt is incredibly important, but taking steps to save for the future and invest in your retirement will help ensure that you stay debt-free. So if being debt-free is your goal, hatch a plan and implement it, but make sure you invest and build an EF at the same time.

I hope you have a great weekend!

*I have two children, but only one lives at home. The other is grown and on his own.

Published on March 20, 2021 06:31

March 18, 2021

Going Barefoot

I'm on my feet a lot. Between my walking goal of 100 miles a month and my obsessive love of hiking, my feet are, literally, put through their paces. Since I use my feet so much, I've been conscious about taking good care of them. This is even more true due to the fact that I have flat feet.

See, having flat feet has meant that I have a host of issues that stem from it, such as overpronation, Morton's Neuroma, lower back pain, and sciatic nerve issues. These last three, in particular, create problems when I hike or walk past a certain distance.

I was told by a few people that I would need "surgery" or "orthopedic footwear" and I thought, "Those are my only options?" I always strive to fix issues naturally whenever possible, and this time was no different. I started doing some research and came across minimalist footwear. The more I read about it, the more I learned. Minimalist footwear allows your feet to walk as if you're barefoot and allow your toes to spread out. The shoes I have been wearing for years to walk and hike in, in particular, have cushioned, raised soles, higher heels, and arch support that completely cradle my feet. While this sounds pretty great on the surface, what it really means is that I'm not standing flat-footed, ever, so my center of gravity was always off. On top of that, my feet were so flat that I had ZERO arches - hence the arch support in my shoes (and my socks!) and my supportive shoes didn't really allow my arch muscles to do anything. Well, the research showed me that if I wore minimalist shoes, that over time my arch would come back? Say what?! Yes, if you think about it, it makes sense. Think of it like this: if you work out your arm muscles, they get big and strong, and if you quit working out your arm muscles, they go back to being weaker. So, if I wore shoes with no support and allowed my arch muscles to actually do the job they were intended for, then they should come back. Right?

In July of last year, I decided to give the minimalist shoes a try. I started off with this pair of sandals. Flat as hell with no support and a paper-thin sole. Every tiny pebble I walked on hurt my feet. It was a hard, sometimes painful, adjustment but I was determined to fix my feet.

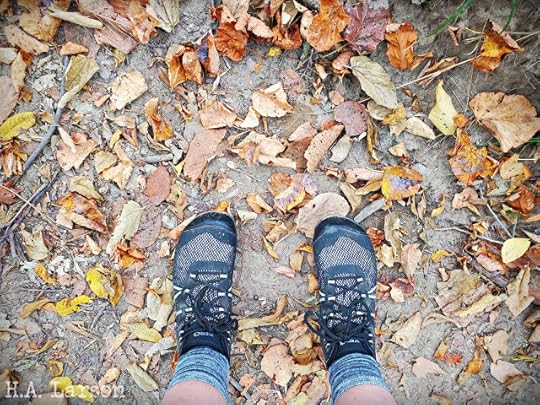

I wish I had taken a close-up of my feet, but this picture shows me the first time in these shoes. You can tell that my feet are flat. They are squished to the ground like a pancake and my toes are all pointing inward from years of tapered shoes. It didn't take long for me to get a pair of minimalist tennis shoes and hiking boots as well.

These are my feet six months later. You can see how big of a difference there is between the two photos. My feet are defined and muscular, and you can see how I have some arches again! My toes are also more spread out, as they were when I was born. My son even commented, "Mom, your feet have arches!" I can definitely feel it now when I go hiking as I can do several miles and not have the usual issues pop up. Of course, I have yet to do a hike longer than 5 miles since this last photo was taken. I've also noticed that when I stop on rocks and things, it doesn't bother my feet as much, so my soles have gotten tougher.

I now own several kinds of minimalist shoes for every occasion. I'll take pictures of my feet a year in so you can see how much of a difference there may be and I'll keep you posted on how well I can do major hikes. I still support the idea of wearing proper shoes...it's just that now the kind of shoe is different.

If you're interested in trying out minimalist, zero-drop shoes for yourself, I highly recommend Xero Shoes. Start gradually and work your way up, and I think you'll be pleasantly surprised.

Published on March 18, 2021 10:57

March 13, 2021

Heading into a Busy Period

Spring is upon us and, while it's possible to get that one last freak snowstorm, I'm engaged in Spring things. I started the process a few months ago, but I'm fully invested in Spring cleaning. While this is something I do every year - getting rid of unwanted items and doing heavy cleaning projects - this year is a bit different. This time, Spring cleaning holds a new purpose and a new meaning.

Next month, I'll be moving into a gorgeous, updated, and modern-looking apartment that's almost the same size as the rental house I've lived in for nearly 11 years. This means, of course, that I have 11 years' worth of crap to divvie up with the ex, decide on what to keep, and either sell or give away the rest. Truth be told, I'm not taking a whole lot from here, but rather I'm going to get new-to-me items. It will be the first time in more than two decades that I have my very own place and I'm soooo excited.

I already have different living room furniture worked out, and I'm planning the layout in my head. I've always wanted a wine rack, so I found a Groupon for a fantastic deal on good wines and after I picked out my wines, I scoured Craigslist for a wine rack to hold them all. I was super-successful in this endeavor and it all just adds to my excitement. You guys know me, though, so you know that I'm striving to find free hand-me-downs or gently-used items that I can purchase inexpensively.

Before I move, however, I have some things to do. First, I'm wrapping up my last week at my second job next week. This, of course, means that I can have my nights and weekends back, but more importantly, that I will have paid off my debt! This is also exciting news as I can move forward with my daughter without that hanging over my head. I also have a couple of writing gigs to complete.

After my last shift at my second job, I'll have about a week to pack and get ready to fly with my daughter to Texas to visit my Mom for a week. I had enough points from credit card churning to get the flights for free and since it's my daughter's spring break that week, we wanted to go somewhere warm. It will also mean free lodging and a chance to visit my mom and my grandma. We're actually going to do some real tourist things this time, something I haven't gotten to do much of during my visits to the Lone Star State. I'm looking forward to my first traveling of this year.

When I return, I will start cleaning out the house and have one of three planned garage sales. I can start moving into my new place on April 16th, so my daughter and I will lug smaller items over when we have time. April will be busy cleaning, selling, and moving.

On May 1st, my friends and family will gather with trailers to help me move the rest of my items into my new place. I'll spend the rest of that weekend and the following weeknights getting my apartment together. Our lease on the old house is up at the end of May, so we'll spend time getting it super-cleaned, make any minor repairs, and finish getting rid of or moving the remaining items. I'm grateful to have that month and a half span to move and finalize everything.

May will be busy for that reason, but also because I have an event every single weekend planned - sometimes things just work out that way. I'm looking forward to June when my daughter will go with my parents on a trip to Missouri and leave me a week of alone time in my apartment to relax and enjoy some much-needed downtime.

While I'm going to be busy for the next few months, I'm thrilled about all of it. A new life waits around the corner and I'm more than ready.

Published on March 13, 2021 05:12

March 11, 2021

My FIRE Journey: How I Paid Off over 20k in Debt

If you have ever been in debt, or are currently in debt, you know how it can often feel like you're drowning. I was drowning in January of last year when I knew I wanted to get divorced and had to sit down and figure out the financial reality of that. What I discovered was that I had more debt than I should. Dejected, I knew I couldn't go out into the world as a single mom with all that debt, so I hatched a plan to pay it off and stay debt-free.

Here's what I did, in order:

1. The first thing I did was to consolidate my credit card debt. I got a loan that had a significantly lower interest rate than my credit cards, and I used that loan to pay off the cards. Not only was I saving a boatload in interest, but it was easier and convenient to make one lone payment each month. Unfortunately, I had to use a couple of my cards again for a couple of major car repairs and things of that nature, so I still accumulated some credit card debt after.

2. I made higher than the minimum payment on every debt I had. In some cases, it wasn't much, but every little bit helped. For instance, if I had a minimum card payment of $35, I would make $100 payments. This way you save on interest and pay things off quicker.

3. We didn't get anything in the way of an income tax refund, so I applied both sets of stimulus money (from Covid relief) we received to pay towards debt. We (my ex-husband and I) were both fortunate enough to continue to work our jobs from home, so we didn't need the stimulus to pay our everyday expenses. We used it, then, for this purpose as well. However, if I had received an income tax refund, every cent would have been thrown at debt.

4. By August, I had decided to pursue FIRE, and I realized that at the rate we were going, that we wouldn't be able to pay off our debt within the timeframe we wanted. So, I picked up a second job working 20-25 hours per week. I put EVERY cent I made from that second job to pay off debt and it started a rapid pay off of that debt.

5. As the debt got smaller, I put more money against it. Quite simply, every debt that got paid off made our monthly expenses smaller. This meant that I had increasingly more funds left over after paying bills, so, in addition to my pay from my second job, I was paying as much as I could from our regular paychecks as well. For example, I would pay off a debt that I was paying $100 on each month. Instead of just spending that extra $100, I would apply it to the next debt I was paying off. Each debt I paid off meant more money getting thrown at the next debt. By the time I got down to my last debt - the loan I mentioned in the first point - I was paying around $1200 a month on it.

By the time this month is over, I will have paid around $23,000 off in debt. So, what did I pay off? Everything I could find! I literally figured out everything that had a debt attached to it and paid it off. Here's what they were:

* Credit card consolidation loan* Credit cards that had a balance on them* My car loan* A couple of doctor bills that I had been making small monthly payments on for years* The balance of the cost of our cell phones* A couple of monthly installment plans I had from when I purchased outdoor gear

I can remember when I started this journey how constricted our monthly budget felt, and how we just never seemed to have enough money. I was also feeling so disappointed because I always espoused using credit cards in a responsible manner. But, while I said this, I also said that cards can be useful when you're going through hard times. For a few years, only I worked, and I didn't make a lot of money. Supporting a family of four on one small income was a daunting and nearly impossible task that only worked because I used credit cards to get us by. As things got better financially and as we inched towards divorce, I was able to do what was needed to do to create a plan and stick to it in order to be debt-free. It's amazing to see how much money is truly left over after paying bills each month and with that comes feelings of relief and security.

If you're wanting to pay off your own debt, start today. I'm living proof that you can do it, and do it on a smaller income. Are you working on paying off debt? Let me know in the comments!

Published on March 11, 2021 04:45

How I Paid Off over 20k in Debt

If you have ever been in debt, or are currently in debt, you know how it can often feel like you're drowning. I was drowning in January of last year when I knew I wanted to get divorced and had to sit down and figure out the financial reality of that. What I discovered was that I had more debt than I should. Dejected, I knew I couldn't go out into the world as a single mom with all that debt, so I hatched a plan to pay it off and stay debt-free.

Here's what I did, in order:

1. The first thing I did was to consolidate my credit card debt. I got a loan that had a significantly lower interest rate than my credit cards, and I used that loan to pay off the cards. Not only was I saving a boatload in interest, but it was easier and convenient to make one lone payment each month. Unfortunately, I had to use a couple of my cards again for a couple of major car repairs and things of that nature, so I still accumulated some credit card debt after.

2. In the beginning, I made higher than the minimum payment on every debt I had. In some cases, it wasn't much, but every little bit helped. For instance, if I had a minimum card payment of $35, I would make $100 payments. This way you save on interest and pay things off quicker.

3. We didn't get anything in the way of an income tax refund, so I applied both sets of stimulus money (from Covid relief) we received to pay towards debt. We (my ex-husband and I) were both fortunate enough to continue to work our jobs from home, so we didn't need the stimulus to pay our everyday expenses. We used it, then, for this purpose as well. However, if I had received an income tax refund, every cent would have been thrown at debt.

4. By August, I had decided to pursue FIRE, and I realized that at the rate we were going, that we wouldn't be able to pay off our debt within the timeframe we wanted. So, I picked up a second job working 20-25 hours per week. I put EVERY cent I made from that second job to pay off debt and it started a rapid pay off of that debt.

5. As the debt got smaller, I put more money against it. Quite simply, every debt that got paid off made our monthly expenses smaller. This meant that I had increasingly more funds left over after paying bills, so, in addition to my pay from my second job, I was paying as much as I could from our regular paychecks as well. For example, I would pay off a debt that I was paying $100 on each month. Instead of just spending that extra $100, I would apply it to the next debt I was paying off. Each debt I paid off meant more money getting thrown at the next debt. By the time I got down to my last debt - the loan I mentioned in the first point - I was paying around $1200 a month on it.

By the time this month is over, I will have paid around $23,000 off in debt. So, what did I pay off? Everything I could find! I literally figured out everything that had a debt attached to it and paid it off. Here's what they were:

* Credit card consolidation loan* Credit cards that had a balance on them* A couple of doctor bills that I had been making small monthly payments on for years* The balance of the cost of our cell phones* A couple of monthly installment plans I had from when I purchased outdoor gear

I can remember when I started this journey how constricted our monthly budget felt, and how we just never seemed to have enough money. I was also feeling so disappointed because I always espoused using credit cards in a responsible manner. But, while I said this, I also said that cards can be useful when you're going through hard times. For a few years, only I worked, and I didn't make a lot of money. Supporting a family of four on one small income was a daunting and nearly impossible task that only worked because I used credit cards to get us by. As things got better financially and as we inched towards divorce, I was able to do what was needed to do to create a plan and stick to it in order to be debt-free. It's amazing to see how much money is truly left over after paying bills each month and with that comes feelings of relief and security.

If you're wanting to pay off your own debt, start today. I'm living proof that you can do it, and do it on a smaller income. Are you working on paying off debt? Let me know in the comments!

Published on March 11, 2021 04:45

March 7, 2021

Hikes on Warm, Snowy Days

After the bitter cold snap that saw record, freezing temperatures and tons of snow, the weather warmed back up in a rapid 180. The past few weeks have been pleasant and the snow is nearly gone. Right when the cold snap ended, my part-time job cut everyone's hours (business slowed after all the holidays had passed), so I took advantage of these two things to spend as much time outdoors as possible.

Of course, rapidly warming temperatures after freezing cold and snowy temperatures means sloppy mud and ice everywhere so I took walks - as opposed to hiking - in places where I could still be out in nature while avoiding treacherous hiking conditions.

It felt so wonderful to be outside, surrounded by trees and sunshine with the occasional bird singing in the background.

One of my stops was out at a bird refuge and I always enjoy seeing the variety of winged critters.

I even got my daughter out of her teenager pit (i.e. her room) to enjoy a bit of fresh air and sunshine.

Of course, it's warmed up even more in the preceding week, and I didn't wear a jacket once yesterday. While I was working, it was nice to see people in shorts and tank tops purchasing items for grilling and chilling. I'm looking forward to the 70 degrees temperature expected today - for the first time in months - where I plan on taking an actual hike. I noticed that the ground has dried up considerably so this should make for some prime hiking. I'm so excited to get back to the grind after a deep cold period where I spent all my free time working.

Have a wonderful Sunday and enjoy it!

Published on March 07, 2021 05:49

February 28, 2021

Basic Financial Fitness: How to Survive a Recession

There's been a lot of talk in the financial world, for months now, about whether a "Great Recession" will happen or not. There's no way to know for absolutely sure and experts are divided, but it begs a question: Are you ready for a great recession?

Before we dive into that, let's answer another question: What is a recession? Simply put, a recession is when an economy takes a nosedive. This in turn drives down prices for goods, people lose their jobs increasing unemployment, inflation & interest rates go down, and the stock market loses value. If you remember how financially scary things were when the housing market destroyed the American economy from 2007-2009 then you should know that that was a textbook great recession. With the onset of the global pandemic last year, we've seen all these things going into play, which leaves the door open for a new great recession to take place.

So, how can you prepare for one? The first thing you should do is NOT wait to prepare - start now. Here's what you should be doing (if you aren't already):

1. Pay off any bad debt you have ASAP. Obviously, this doesn't apply to mortgages, but if you have credit card debt, doctor's bills, or anything else of the like, get it paid off. If you can't pay it off, pay it down as aggressively as is feasible.

2. Start that emergency fund. Start putting away as much money as you can. You should have no less than three months' worth of bill money saved up.

3. Start stockpiling shelf-stable food items. Buy cheap canned vegetables, canned fruits, instant mashed potatoes, pantry staples like flour, sugar, coffee, candy, and even some booze.

4. Start stockpiling household goods and supplies. Keep plenty of shampoos, conditioners, body soap, toothpaste, laundry soap, feminine supplies, deodorant, and anything else you can think of. Dollar Tree sells all this stuff pretty cheap, so it's easy to stock up on the cheap stuff. It will get you by.

5. Have a few games and books around. It gives you something to do, keeps your mind off things, and prevents you from spending money going out to do things. Throw a game and potluck night with your friends once a week.

6. Don't spend money on unnecessary things. If you're looking at a big-ticket item, hold off for now. Only spend money on the aforementioned things. After that, only what's necessary.

Will we have a great recession? I don't know, but you don't want to be stuck between a rock and a hard place. If you start preparing yourself now, you can be ready if a recession takes place. And if a recession doesn't happen, well, then you can breathe easy and still be in a better position than you were before. There's sure nothing wrong with that.

Published on February 28, 2021 16:12

February 24, 2021

Closing Another Chapter

Books are often a metaphor for life, mine being no exception - maybe even more so seeing as I'm a writer. Having said that, I'm closing the chapter on the last twenty years of my life and starting a new one. Much like seeing the Sun on the horizon, it's the beginning of a new day, and the possibilities are endless. It took a lot of time, contemplation, and rough days to make it here, but I made it regardless.

So many things have changed - and continue to change - that it almost feels surreal. If you would've told me five years ago that in five years I'd be divorced, that I'd be halfway to being an empty-nester, that I'd have a career that I love, that I'd be almost debt-free, that I'd be moving into my own place, and that I'd finally be pursuing my dreams, I wouldn't have believed you. For sure, I would've wanted those things to happen, but I felt so trapped at the time that it would not have seemed possible.

Yet, here I am, moving in exactly the direction I could have only dreamed about five years ago. The peace and happiness I feel are immeasurable. Indeed, I finally, truly feel like myself again and it's oh-so-good to be back. Even better, this is having a ripple effect on my life, leading me to treat my physical health better, to start writing in earnest again, and to have better relationships with those closest to me.

I'm excited for my future and all the possibilities it holds. No looking back, only looking forward.

I hope you're having a great week and looking forward to the weekend. I'm working, once again, on a book I started after The Box and it's going to be a fun ride. I'll be posting an excerpt within the next few months, so make sure you stay tuned for that!

Published on February 24, 2021 06:35