Gea Elika's Blog, page 161

October 11, 2016

11 Things that Make NYC the Best Place to Buy a Home

New York City is considered one of the best cities on Earth. With a thriving cultural scene, an array of residences and endless entertainment, in New York you have anything you could ever want right at your fingertips, any time of the day.

1. Arts & Culture

New York is unrivaled in its arts and culture. With world-renowned museums like The Metropolitan Museum of Art and the Guggenheim, the Big Apple is a top global destination for exhibits and installations. In addition to the city’s museums, there is also a thriving art scene – small galleries are peppered across the greater New York City area featuring a diverse collection of art from local illustrators to nationally known sculptors.

2. Nightlife

In each of the city’s neighborhoods there is a plethora of bars, cocktail lounges and clubs to suit anyone’s preferences. From dives in the East Village to upscale craft cocktail dens in the Lower East Side to nightclubs in the West Village, New York’s nightlife thrives every night of the week in all far corners of the city.

by Marcela on Flickr

3. Food Scene

Restaurants line the streets of New York, corner cafes next to 5-star eateries. Constantly opening, renovating and rebranding, the city’s food scene embraces innovation and creativity. New types of fusion cuisines are welcomed as energetically as a classic burger joint, providing the city’s residents with endless and elite dining opportunities.

4. Transportation

Cabs and buses fill the streets while the subway runs constantly underfoot. In the city that never sleeps the transportation never stops, allowing New Yorkers to get almost anywhere, any time of day.

5. Diversity

No matter the age, race or religion, New Yorkers come in all shapes and sizes. The city epitomizes the American dream, where anyone can make it with determination and hard work and this idea draws in people from all walks of life and from all over the world.

by Marcela on Flickr

6. Parks & Recreation

Central Park is one of the city’s most iconic landmarks. The beauty of the city’s outdoor recreation, however, doesn’t stop there. Small parks are scattered throughout the city in addition to larger green spaces like Madison Square Park, the newly revived South Street Seaport and Riverside Park – all serene havens within the concrete jungle.

7. Retail & Fashion

New York is known as the fashion capital of the world. Shops line Fifth Avenue, trendy boutiques fill the streets of SoHo and the city is taken over several times a year for the excitement of fashion week. Embrace the endless opportunities to express your own style.

8. Affordability

Though New York sometimes thought of as one of the most expensive cities in the world, that is not always the case. According to the Real Deal, in 2015 the average cost of living in New York was $2,586 per square foot, while London and Hong Kong came in at $4,480 and $4,682 per square foot respectively.

9. Film & Entertainment

Though Los Angeles is traditionally thought of as home to the movie industry, New York is quickly gaining ground. More and more films and television shows are being filmed in New York. Because of this, the industry is thriving in the city, with independent films and festivals happening regularly and small, indie theaters prospering.

10. Iconic History

From its time as an early settlement, through the peak of immigration at Ellis Island to the events currently unfolding, New York has always been an epicenter for historical events. Landmark buildings stand next to modern developments, honoring the city’s rich legacy and commemorating the past.

11. Strong Economy

New York is the center of countless fields, from financial institutions on Wall Street to countless advertising agencies and a booming technology scene. Companies are flocking to the Big Apple because of the constantly expanding talent pool and the diversity of industries, resulting in a strong and growing economy that in turn creates strong employment opportunities.

The post 11 Things that Make NYC the Best Place to Buy a Home appeared first on .

October 10, 2016

14 Crucial Tips for First-Time Home Buyers

As you may already know, home buying is an intimidating proposition for the uninitiated. Fortunately, though, there are a number of sensible steps that will help you get onto the right foot. Here are 14 crucial tips to get on track:

1. It’s great to have high expectations, but you should also be realistic; even a brand new home is never “perfect.”

2.Know what you’re looking for in a home before you start shopping, and know your priorities (location, price, number of bedrooms, etc.).

3.Review your credit reports and make sure your finances are in order. You’ll need cash upfront for a down payment, closing costs as well as a capital reserve of 6 months – it’s also best to have 1 year of your mortgage and building associated expenses in savings.

4.Get prequalified for a mortgage with the lender of your choice; this gives you credibility when negotiating for a property.

5.Pick one or two trusted friends if you find you want a second opinion—too much conflicting advice can keep you from making a decision.

6.Set a realistic time frame for moving into your new home: How much time is left on your lease? Can you sublet if necessary? Do you need to sell an existing home?

by Wally Gobetz on Flickr

7.Consider the big picture. Will you buy a starter home knowing you want to trade up in a few years, or a long-term family home? This will narrow your search, and guide the type of mortgage that works best for you.

8.Avoid overleveraging to buy the most expensive home you qualify for; you’ll want money for decorating, maintenance, and a rainy-day fund.

9.Try to negotiate repairs by seller into the contract; sometimes, however, a home is sold “as is,” so you are responsible for repairs after you close on the property.

10.Find a buyer’s agent you feel comfortable with and trust, and whose style and principles align with yours. Consider choosing an exclusive buyer’s agent who never lists properties, who works for you and watches out for your best interests. Listing agents are obligated to protect the seller’s interests.

by Nelson Pavlovsky on Flickr

11.Don’t be afraid to pull the trigger when you find the right home. Second-guessing interest rates or changes in the housing market often lead to disappointment, and great properties don’t stay on the market long.

12.Don’t expect the impossible—there’s no such thing as a perfect apartment. If you find a place that meets your most important needs, you can change or repair the minor flaws.

13.Negotiate for the best price, but avoid insulting the seller with ridiculously low offers or too many contingencies. You may end up losing the property.

14.Develop a realistic post-purchase budget that includes funds for decorating, maintenance, and repairs. Even new homes come with move-in expenses.

Expect a little buyer’s remorse at first. Buying a home is a huge commitment and it’s normal to doubt yourself before the satisfaction of owning your own home sets in.

Avoiding Rookie First-Time Home Buyer Mistakes

With any complicated activity that involves finances and various levels of bureaucracy, the margin of error can be rather slim. Real estate is no exception, and there are many mistakes to be made when you’re buying your first home. Watch out for these mistakes:

1.Although it may be tempting, buying the best house on the block is never recommended.

2.Applying with only one mortgage lender and missing a great deal by not shopping around for the best mortgage.

3.Succumbing to “decision paralysis” and losing your dream home to another buyer.

4.Representing yourself and forfeiting the help and guidance of an exclusive buyer’s agent.

5.Being unfamiliar with what makes an offer attractive to a seller.

6.Ignoring the resale potential of a property; the average first-time home buyer stays in his home just four years.

The post 14 Crucial Tips for First-Time Home Buyers appeared first on .

October 9, 2016

How to Live Eco-friendly in New York City

The world is going greener and New York City is at the forefront. Not only is living eco-friendly – doing whatever you can to reduce your environmental footprint – good for the environment, can actually save you some greenbacks as well. Here are 7 super easy things you can do to green your NYC life without giving up the things you love.

1. Green your commute

Citibike’s ever-expanding network of over 8,000 cycles can take you all around the city for crazy cheap. Plus, your heart, lungs, and beer belly will all thank you in the long run. You can sign up for a day or a 3 day pass for as low as $12 or you can go all the way with an annual pass for $155. Not so keen on biking in the rain? Skip the Uber and go for a GoGreenRide, a taxi company that uses hybrid cars.

2. Shop greener

With a city as vibrant as New York, it’s no surprise that there is a massive range of eco-friendly stores and restaurants out there. The Fat Radish is fantastic if you’re looking for something to eat, and you can head over to Kaight for local, organic fashion. Ordering in? No problem – with Seamless, you can actually forgo plastic cutlery and napkins with your order (and let’s be honest, who uses a plastic fork anyways?

3. Shop at farmers markets

Flickr/Shinya Suzuki

There are farmers markets all over the city run at all different days of the week. GrowNYC runs markets all over the city at all different days of the week, so no matter your schedule you’re bound to be able to find one that works for you. Some even have their own app that you can download to see if your favorite vendors are going to be there. You’ll pay better prices and get better stuff, usually from local vendors (so it didn’t need to be trucked in). Better for the environment, tastier for you.

4. Start a garden

You can always plant some small herbs in a window planter, grow a lemon tree on your fire escape, or use your rooftop for a larger vege patch. For the more ambitious, look into community gardens where you can use a plot or try your hand at rooftop beekeeping.

Flickr/Mohan Nellore

5. Switch to bamboo

Bamboo grows at an outrageous rate which makes it the ideal timber to use for things like counter tops, cutting boards, and hardwood floors.

Flickr/Nate Swart

6. Fix that old leaky tap

A leaky tap wastes 48 gallons of water a week. Get a wrench and finally fix that dripping tap.

7. Upgrade your kitchen

One of the easiest (and most fun) ways you can make your home more eco-friendly is to upgrade your kitchen appliances. Fridges, freezers, ovens, and dishwashers have become much more energy efficient over the years, but lots of homes are still using antiquated white goods. Upgrading them to models with high energy efficiency ratings can save you some cash and are less of a strain on the environment.

Being eco-friendly doesn’t have to involve living in a yurt. In fact, greening your lifestyle just a little will probably save you money in the long run as well as help the environment. Even a few small changes can make a big difference.

The post How to Live Eco-friendly in New York City appeared first on .

October 8, 2016

East Village vs. West Village

It’s a long-told New York tale: the battle of East versus West. The two halves of Manhattan are constantly compared and it’s a never-ending battle to see which comes out on top. The part that most people overlook, however, is that each of Manhattan’s hemispheres—though very different—has its own perks.

The East and West Village are two of the city’s most sought-after neighborhoods, and for good reason. With outstanding amenities, beautiful housing opportunities and rich history, these two areas embody classic New York charm.

West Village

by taigatrommelchen on Flickr

The West Village is arguably New York’s most desired neighborhood over the past few years. The average sales price per square foot lands at $2,393 SF with a median price of $3.23 million and average monthly rental cost at $3,810, pricing reflective of the demand for real estate in this neighborhood. New high-end condominium developments and stunning, classic brownstones are both sought-after options in the area, with co-ops and apartments available as well. With charming architecture, picturesque streets and a quiet, residential feeling, the West Village will surely feel like a home.

Situated conveniently along the Hudson River running trail and near many upscale boutiques, high-end restaurants and lavish bars, the West Village sits squarely among many of New York’s trendy hotspots like delightful Buvette and Sant Ambroeus. Though there is limited subway access from the 1/2/3 and L trains, a commute to New Jersey is swift and easy with access to the PATH train at several locations.

East Village

The East Village, on the other hand, has a much more eclectic vibe that the West. Traditionally thought of as an artist’s haven, the East Village’s historical grunge and diverse history shines through, making the neighborhood hip and in-demand. Here, the sales price per square foot comes in at $1,577 SF with the median price falling at $1.93 million and an average rental cost of $2,725 per month, making it a more affordable alternative to the West Village.

In the East Village, unlike the West, rentals are in much higher demand than purchases with high-end condominiums, traditional pre-war walk-ups and tenement buildings making up the majority of housing. In addition to new development, there are also the well-known, large-scale developments Stuyvesant Town and Peter Cooper Village that are situated on the northern edge of the East Village between 14th and 20th street.

Scattered throughout the East Village is a plethora of small parks including Tompkins Square Park and Stuyvesant Square where residents can enjoy time outdoors and go for a leisurely stroll. The streets—especially on St. Marks and in Alphabet City—are lined with restaurants carrying various cuisine, dives and upscale establishments alike. Though the West Village has a nightlife scene, one thrives in the East Village making it a weekend destination for young people across the greater New York area.

Both areas feature stunning architecture, a variety of amenities and are popular neighborhood for young professionals, families and couples alike – there is no wrong choice. No matter if you end up in the East or West Village, you will have access to all of the best New York City has to offer.

The post East Village vs. West Village appeared first on .

October 7, 2016

13 Reasons on Whether You Should Buy vs Rent a NYC Apartment

Buying or Renting your New York City apartment should be dependent on a number of factors. Consider your particular lifestyle, your finances and any other additional features you might want in your home.

Enjoying privacy and comfort in your home

The decision to purchase New York City real estate requires a long term financial commitment so it is essential that it is done while considering numerous things. Some choose to move to New York for reasons related to their employment, others because of family and there are a many other reasons for moving which may require a change in lifestyle. Purchasing property is more time consuming affair than the practice of renting.

Someone who has purchased their home, will usually be eager to settle down in their new new abode. The primary concern for the homeowner has to deal with their privacy and comfort. The new homeowner will also want to think of ways that they can personalize their new home and this might mean some renovation or modifications to the existing floor plan. However most people usually stick with upgrading kitchen appliances and bathroom remodeling.

Equity Creation

Owning a New York City apartment isn’t simply about having a place to call home; it also comes with a number of major financial advantages. Buying property means that the property owner isn’t wasting money on rent and even if they do decide to move homes, the property can always be rented and become a source of income. The many benefits of property ownership are why it is an important option. People who bought five figure homes in the 70’s were delighted to sell the same homes for seven figures and more in the later part of the 90’s. This huge rate of growth isn’t always guaranteed but it does not make owning New York City apartments any less rewarding.

Tax Benefits

Tax benefits in terms of owning a NYC apartment, come from the ability to deduct mortgage interest and property taxes from your income statements. People who choose to rent do not have such benefits. A substantial amount of money can be saved and reinvested from such gains and can also lead to a sizeable reduction in terms of expenses incurred monthly.

Despite all this, it is essential to note that those who choose to rent are not tying down their capital like those who purchase property that earns them no income. The fact that it is possible to yield a large Capital Gain from the resale of a property makes the decision to buy a smart one.

If you require additional information about tax benefits that accrue from purchasing property, contact an accountant or other relevant professional.

Well Equipped and Maintained property

People who demand a higher living standard should note that condominiums and co-operative buildings tend to come built with higher standards compared to rental buildings. They typically feature larger living spaces, better finishes, high end appliances and greater overall amenities. In addition those that own a condominium or co-operative can choose to be actively involved in management of the building.

Substantial Capital Commitment

The main reason people choose not to buy a home is the large amount of money required for the down payment. A one bedroom apartment costs seven hundred thousand dollars on average in New York City and at least 20% is required as a down payment to buy it.

Expensive closing costs are an additional expense as well as insurance costs and attorney’s fees. A detailed explanation is provided in our First-Time Buyer’s guide. Anyone who wants to purchase a New York City apartment should have no less than $100,000 in their bank accounts as well as a cash reserve of up to six months for mortgage payments and common expenses.

There will also be requirements you need to fulfill prior to the purchase, such as a credit check, rental and owner history and approval by a condominium association or a co-operative board.

Long Term Involvement

Another reason while people may not be so eager to purchase a New York City apartment, is the long-term commitment required. Buying real estate is a large financial obligation that can impact on a buyer’s lifestyle with the loan financed having to be repaid over an extended period of time. Buyers’ will be legally responsible for every aspect that comes with home ownership.

Dealing with Condominium Associations and Co-operative boards

People who wish to move into a condo or a co-op apartment will first require approval from the management overseeing the building. In the case of condo boards, the rules are not as strict as co-ops and most people don’t experience too many difficulties. People applying for co-ops may find that things tend to get more complicated. When it comes to approval requirements for co-operative buildings, New York City co-ops have the most stringent requirements.

Stress-Free Process

If you have neither the money nor time to buy a home, renting one can be a quicker and cheaper way of living in New York City. The legal and financial commitments are less complicated than buying a property and it is a much quicker process. Many people who come to New York City choose to rent whether they come to work, to search for work or just to experience residing in the Big Apple.

Renting offers the opportunity to live in the city, understand it better and prepare thoroughly to make the right decision when purchasing a home.

No Long-Term Commitment

Clearly renting an apartment is the least expensive option for short term purposes, with no large down payments, mortgage, attorneys, insurance or closing costs. There is also no monthly maintenance, repair fees or property-related taxes when renting. The only commitment is utilities and in some instances a brokerage fee equal up to 15% of the annual rent.

Renting does not build Equity

The major disadvantage when renting is that regardless of how long you have lived in any apartment, you do not own property or equity when you move out and the money spent on rent is also not tax deductible. All these are substantial benefits you would enjoy when owning your own apartment. Building equity

Buildings and Apartments not as well equipped and maintained as condominiums and co-ops

Rental buildings are rarely the same quality as cooperatives or condominiums. There are a few exceptions however most co-ops and condos tend to be built according to higher standards.

Lack of Control over Living Conditions

Renters are always obligated to accept different living conditions when it comes to various buildings. Some major problems may include the lack of an elevator, old staircases, leaking roofs, problems with kitchens and bathrooms, electrical faults etc. Landlords might allow renters to customize their apartments but sometimes the costs are so prohibitive that renters stick with whatever is available.

Landlords

This is the most important aspect in any renters’ position. A great landlord can make your stay an enjoyable one and a terrible landlord can make you regret ever signing the lease. The best thing to do is have a meeting with the landlord first and assess the person’s demeanor and understand what they desire from their tenants and what they can provide in return.

The post 13 Reasons on Whether You Should Buy vs Rent a NYC Apartment appeared first on .

October 6, 2016

What you need to know about NYC Condops

Condops, although less common than condos and co-ops, are another housing alternative in New York City. Started in the 1960s, condops are mixed-use condominiums that contain a unit or units owned by a cooperative corporation. In a nutshell, a condop is a co-op within a condo.

Because a co-op cannot legally earn more than 20 percent of its income from the building’s commercial tenants, owners and developers divided buildings to reap the tax benefits. If the co-op did earn an income greater than 20 percent, the co-op’s shareholders weren’t permitted the standard tax deductions.

Within a condop building, commercial spaces were categorized as one condo unit and residential spaces were categorized as a separate unit. Those residential spaces were then broken into cooperative shares, hence the co-op within a condo, or “condop.” In a condop, residential units are most often in the tower section or high-rise, and commercial spaces are located on the lower floors.

By Nicole Beauchamp on Flickr

Land leases

In New York, since a condo building is not permitted to sit on leased land, but rather must own the land on which it’s situated, often those buildings with a land lease have been converted to condops. The land is usually owned by a third party, and the condop pays rent to the owner of the land. In this case, you’ll find that the condop typically adopts the legal structure of a co-op, but follows the bylaws of a condo.

Land lease properties often sell for less than those not on leased land, which means you could possibly purchase a larger apartment at a lower price. Bear in mind, however, the lot’s rent is split among the apartment owners and included in the monthly maintenance fee, making that maintenance higher than it would be in a similar building with owned land. The portion that goes toward the maintenance is not tax deductible, either, so that’s something else to consider. The more years left on a land lease, the better. Most leases are renewed with no issue, but there is the rare occurrence when a lease is not renewed. In this case, the owner of the land would evict the condop.

Another consideration is financing an apartment in a building with a land lease. Securing a mortgage on an apartment within a land-lease building could prove more challenging than securing one for a unit in a building that owns its land.

The boards

You’ll find three boards in most condops. The first is a condo board, which represents the commercial spaces as well as the co-op portion of the building.

The second is strictly a commercial board and handles any issues directly related to the commercial spaces. And the third is elected by the shareholders to preside over the residential units, making decisions regarding common areas such as the laundry room, storage, hallways, etc.

Operation

It’s a myth that all condops have less stringent rules than co-ops. It’s likely that those operating as co-ops will enforce the same rules, e.g. – the two-year maximum to sublet, and specifics of dog ownership. Similar to co-ops, condops operating as co-ops require board interviews.

Many condops function as condos, however, and have liberal policies, such as no board interviews and less restrictive rules regarding pets and sublet policies.

Repairs

With regards to repairs, how does one classify capital improvements as the co-op’s responsibility, the condo’s responsibility, or a commercial responsibility? It’s not unheard of for the three boards to be at odds regarding certain building issues, such as refurbishing elevators. For this reason, it’s best to speak with the managing agent to find out the political stance of the building before adding a condop to your shortlist, or making an offer on a unit in a condop building.

Costs

As far as cost, condops should run in the same range as condos. Financing a condop apartment will likely be easier than financing a co-op. It’s not uncommon for the required percentage down to be lower (many co-ops require 25 percent or higher.) Most lenders will treat a condop like a co-op. Some lenders, however, may not be familiar with the workings of a condop, and may need an explanation. As long as a condop meets Fanny Mae guidelines, there shouldn’t be issues during the underwriting process.

Resale

Today, you’ll find fewer than 300 condop buildings in New York City as compared to more than 6,700 co-ops and well over 2,000 condos. Since there are fewer NYC condops than there are co-ops and condos, often buyers will need to be educated about their specifics. These details include how a condop works, as well as the advantages and disadvantages of buying one.

The post What you need to know about NYC Condops appeared first on .

October 4, 2016

Buying a New York City Apartment – 12 Point Checklist

Think you’re ready to become a homeowner? By this point, you’ve doubtlessly made some significant changes in your life and taken a long, hard look at your finances. To help you in this journey, consult this helpful home buyer’s checklist.

1.❏ Locate an Agent: If possible, you should try to vet at least three real estate agents before making a decision. Keep in mind that there are different types of real estate companies: some work on the behalf of only sellers or only buyers, others that work either for buyers and sellers, and still others that attempt to work for both simultaneously. Companies like Elika that work only for buyers are called Exclusive Buyer Agent (EBA) companies, and you should at least speak with one before making your final decision.

2.❏ Work out a Pre-approval: Assuming a mortgage is in your future, you’ll want to set up a pre-approval. This will allow you to establish a certain level of comfort with your mortgage payments, and to plan your budget in advance. If you’ve found a good agent, they should be able to refer you to some fair lenders. Just make sure there’s no conflict of interest between the real estate company and the lender–they shouldn’t be associated.

by John Fraissinet on Flickr

3.❏ Begin Looking at Prospective Homes: With a well-prepared agent and depending on desirable available inventory, you likely will be able to visit roughly 3 to 15 different apartments per day. Beware of concentrating only on open houses, though; typically, the number of available apartments will be much larger in any area you target.

4.❏ Start Narrowing Your Choices Down: Once you’ve had a good look at your options, you should begin to focus on only two or three apartments. Plan a follow-up visit to do a more detailed viewing of each home. With any luck, you’ll find at least one suitable alternative if your front-runner falls through.

5.❏ Learn about Purchase Contracts: Many first-time homebuyers make the mistake of failing to closely review their contract before signing. Sit down with your attorney to review processes, documents, negotiation strategies, and any other relevant considerations while you’re still searching. The added confidence when it comes time to sign will be well worth your time.

6.❏ Get an Attorney: It’s customary in New York City for home buyers to have an attorney represent them during the buying process. Real estate transactions in the city are complex, and sellers often will have their own lawyer on hand as well.

7.❏ Review Comparable Sales Data: Begin reviewing comparable sales data, so you know the fair market value for the apartment you’re considering. Be sure you’re watching market values—if they aren’t stable (i.e. are frozen or dropping), you should check out the market inventory and rate of absorption. An experienced buyers agent will guide you through this process with additional industry data and resources.

8.❏ Submit an Offer and Begin Negotiations: Having chosen a particular home, you’ll want to make a written offer right away. In the case you reach an accepted offer keep in mind that should another buyer come along and place a higher offer on the property before you and the seller have signed the contracts there is a chance the seller may decide to go with the higher offer. A deal is not done until both the buyer and seller have signed the contract of sale.

by Jurgen Leckle on Flickr

9.❏ Put it in Writing and Move Forward: If the negotiations have reached a point where a fair price has been accepted, then now is time to get ink on paper with the seller. If your negotiations have stalled or turn against your favor, though, you’ll want to move on to the next home and try again elsewhere.

10.❏ Start Shopping for a Mortgage Deal: Once you have a contract in the bag, you’ll want to shop for a good deal on your mortgage. Start with the lender which has pre-approved you in addition to one other, and then perform cost comparisons to narrow down your choice. Keep these things in mind as you shop:

❏ Type of loan (and your credit profile)

❏ Amount of your loan

❏ The loan’s lock period (your closing date determines this)

❏ The quote’s date and time (rates often fluctuate throughout any given day)

11.❏ Get an Inspection for the Home: Be sure to confirm the home passes all the major inspection criteria—structural integrity, plumbing, electrical work, lead, radon, termites, and all applicable…

12.❏ Square Away Your Insurance: here are the basic things you’ll need on which you’ll need to provide information:

❏ Address and county, construction year, and type of dwelling

❏ Number of total apartments in the building/complex

❏ Roof type

❏ Heating type (also any other types of heating, like fireplaces or wood-burning stoves)

❏ Proximity to fire hydrants and the nearest fire department

❏ Information about the locks (deadbolts, chain locks, etc.)

❏ Electrical service info

❏ Square footage of your intended home

13.❏ Submit your Purchase application to Receive Condo approval or Set Up an Interview with a Coop Board: To get approval for your co-op, you’ll need to get approval from the board . Bring a copy of your board application with you, or at the very least, have the information below handy for the meeting:

❏ Copies of your tax returns for the required period

❏ REBNY Financial Statement highlighting your assets and liabilities

❏ Paycheck stubs, bank statements, and statements for any 401(k), mutual funds, and stocks you may own

❏ Letters of recommendation

❏ Documents/references to verify your current employment and your history of employment.

The post Buying a New York City Apartment – 12 Point Checklist appeared first on .

Buying a New York City Apartment Checklist

Think you’re ready to become a homeowner? By this point, you’ve doubtlessly made some significant changes in your life and taken a long, hard look at your finances. To help you in this journey, consult this helpful home buyer’s checklist.

❏ Locate an Agent: If possible, you should try to vet at least three real estate agents before making a decision. Keep in mind that there are different types of real estate companies: some work on the behalf of only sellers or only buyers, others that work either for buyers and sellers, and still others that attempt to work for both simultaneously. Companies like Elika that work only for buyers are called Exclusive Buyer Agent (EBA) companies, and you should at least speak with one before making your final decision.

❏ Work out a Pre-approval: Assuming a mortgage is in your future, you’ll want to set up a pre-approval. This will allow you to establish a certain level of comfort with your mortgage payments, and to plan your budget in advance. If you’ve found a good agent, they should be able to refer you to some fair lenders. Just make sure there’s no conflict of interest between the real estate company and the lender–they shouldn’t be associated.

by John Fraissinet on Flickr

❏ Begin Looking at Prospective Homes: With a well-prepared agent and depending on desirable available inventory, you likely will be able to visit roughly 3 to 15 different apartments per day. Beware of concentrating only on open houses, though; typically, the number of available apartments will be much larger in any area you target.

❏ Start Narrowing Your Choices Down: Once you’ve had a good look at your options, you should begin to focus on only two or three apartments. Plan a follow-up visit to do a more detailed viewing of each home. With any luck, you’ll find at least one suitable alternative if your front-runner falls through.

❏ Learn about Purchase Contracts: Many first-time homebuyers make the mistake of failing to closely review their contract before signing. Sit down with your attorney to review processes, documents, negotiation strategies, and any other relevant considerations while you’re still searching. The added confidence when it comes time to sign will be well worth your time.

❏ Get an Attorney: It’s customary in New York City for home buyers to have an attorney represent them during the buying process. Real estate transactions in the city are complex, and sellers often will have their own lawyer on hand as well.

❏ Review Comparable Sales Data: Begin reviewing comparable sales data, so you know the fair market value for the apartment you’re considering. Be sure you’re watching market values—if they aren’t stable (i.e. are frozen or dropping), you should check out the market inventory and rate of absorption. An experienced buyers agent will guide you through this process with additional industry data and resources.

❏ Submit an Offer and Begin Negotiations: Having chosen a particular home, you’ll want to make a written offer right away. In the case you reach an accepted offer keep in mind that should another buyer come along and place a higher offer on the property before you and the seller have signed the contracts there is a chance the seller may decide to go with the higher offer. A deal is not done until both the buyer and seller have signed the contract of sale.

by Jurgen Leckle on Flickr

❏ Put it in Writing and Move Forward: If the negotiations have reached a point where a fair price has been accepted, then now is time to get ink on paper with the seller. If your negotiations have stalled or turn against your favor, though, you’ll want to move on to the next home and try again elsewhere.

❏ Start Shopping for a Mortgage Deal: Once you have a contract in the bag, you’ll want to shop for a good deal on your mortgage. Start with the lender which has pre-approved you in addition to one other, and then perform cost comparisons to narrow down your choice. Keep these things in mind as you shop:

❏ Type of loan (and your credit profile)

❏ Amount of your loan

❏ The loan’s lock period (your closing date determines this)

❏ The quote’s date and time (rates often fluctuate throughout any given day)

❏ Get an Inspection for the Home: Be sure to confirm the home passes all the major inspection criteria—structural integrity, plumbing, electrical work, lead, radon, termites, and all applicable…

❏ Square Away Your Insurance: Although we cover this more extensively in Chapter 8 (see the checklist at the end of the chapter), here are the basic things you’ll need on which you’ll need to provide information:

❏ Address and county, construction year, and type of dwelling

❏ Number of total apartments in the building/complex

❏ Roof type

❏ Heating type (also any other types of heating, like fireplaces or wood-burning stoves)

❏ Proximity to fire hydrants and the nearest fire department

❏ Information about the locks (deadbolts, chain locks, etc.)

❏ Electrical service info

❏ Square footage of your intended home

❏ Submit your Purchase application to Receive Condo approval or Set Up an Interview with a Coop Board: To get approval for your co-op, you’ll need to get approval from the board . Bring a copy of your board application with you, or at the very least, have the information below handy for the meeting:

❏ Copies of your tax returns for the required period

❏ REBNY Financial Statement highlighting your assets and liabilities

❏ Paycheck stubs, bank statements, and statements for any 401(k), mutual funds, and stocks you may own

❏ Letters of recommendation

❏ Documents/references to verify your current employment and your history of employment.

The post Buying a New York City Apartment Checklist appeared first on .

October 3, 2016

What Happens at a New York City Real Estate Closing?

After months of searching and days of negotiating, it’s finally time to close on your New York City apartment. At this point, you’ve found your ideal home, assembled a board package (if purchasing a resale condo or co-op), passed the board’s interview in case of coop, and you feel good about your investment. Although you might think that the closing just consists of wrapping up a few details, there actually are still a few hurdles to overcome.

You should also have completed the essential walkthrough with your agent; if you haven’t done so yet, then don’t move forward with closing the sale until you’ve done so. It’s important that your agent confirms that everything is as it should be, and that your new apartment doesn’t have any huge problems that have heretofore gone unnoticed.

During the closing, you as the buyer will (of course) be giving the agreed-upon amount of money to the seller. In return, you either receive a deed (for a condo) or a proprietary lease (for a co-op). In reality, two closings may be happening at this stage—a closing for the sale, and possibly a closing of your loan on the mortgage.

By Spencer Means on Flickr

The location of this closing could be at one of a few different places: the managing agent’s office, an attorney’s office, a broker’s office, or possibly even another place where the sale is officially recorded. You (the buyer) and the seller both will obviously be in attendance along with both sets of attorneys. Additionally, a closing agent, your real estate agents, and maybe a mortgage company representative will be there as well. Some insurance deals also might have to happen at this stage—just be sure you’ve gone over all these things with your attorney beforehand.

As the buyer, you’ll need to come with whatever monies have been prescribed by your purchase application and the sales contract. If you’re moving into a condo or co-op, you’ll have to pay for these things:

● move-in fee

● attorney fees

● filing fees

● flip tax (in some cases when purchasing a co-op)

● maintenance adjustment and appraisal (depending on the specific circumstances)

Assuming you’re financing, you’ll also need to have a recognition agreement, and you’ll have to pay a loan origination fee and a UCC-1 filing fee. You may also need to pay out for pre-paid mortgage interest.

Your attorney will provide you with a closing statement that itemizes costs paid both by you and the seller. It will also list how much money they get after all brokers fees, attorney’s fees, flip taxes, and everything else that is paid. The closing statement will also specify the transaction’s various “debits and credits” as they pertain to the buyer and seller. All of these will need to be paid via certified checks.

The real property transfer tax (which the seller usually pays) also will be given at this stage of the transaction. If the property in question costs more than one million dollars, you’ll also have to pay a “mansion tax” that comes out to 1 percent of the property’s purchase price. Considering that this tax generated more than $259 million in the 2012-2013 fiscal year, according to the New York Post, it’s clear that this tax is becoming increasingly common in NYC.

If either side is unprepared, you may find that your closing will take a ridiculous amount of time to complete. Be sure that you carefully review the process with your attorneys to prevent this from happening. Take care that you have all the right checks lined up, and that you know what all the documents mean. Assuming you’re on the same page as the seller, though, the process should more or less be painless.

The turning point in any closing, of course, will be when you finally receive the keys to your new property. Although you’ll likely end up changing all the locks right away, the symbolic significance nonetheless will still offer closure to the process. The deed and mortgage will then be recorded in the public records by your attorneys, and the purchase of your new home will be closed officially.

UNDERSTANDING THE BUYER’S CLOSING COSTS

If financing, your lender must prepare a good faith estimate of all settlement costs before closing, but the title company or other entity calculates the exact amount you are required to bring to closing. Be sure to get a cashier’s check for your share of the costs a few days before the settlement date.

Common real estate closing costs charged to buyers include:

● Down payment

● Loan origination fees

● Appraisal fee

● Credit report

● Private mortgage insurance premium (if financing more than 90%)

● Property tax and homeowner’s insurance escrow

● Title insurance

● Survey

● Deed recording fees

● Inspection fees—building inspection, termites, etc.

● Notary fees

● Prorated costs such as utilities and property taxes*

*Since these costs are usually paid on a monthly or annual basis, you may pay for some services used by the seller before they moved. Similarly, some costs are paid in advance of services being used. Proration allows the buyer and the seller to balance these accounts so that each only pays for the services they used.

YOUR CLOSING DOCUMENTS

● The Real Estate Settlement Procedures Act (RESPA) statement, also called the HUD-1 statement, itemizes all closing costs. You’ll need this document for income tax purposes, and when you sell your property.

● The Truth in Lending Statement spells out the terms of your mortgage loan.

● The mortgage and the note, two separate documents, explain the legal terms of your mortgage obligation and agreed-upon repayment terms.

● The deed, which transfers ownership to you.

● Affidavits affirming various statements made by either party. For example, the sellers often sign an affidavit stating they have not incurred any liens on the property.

● Riders/amendments to the sales contract that affect your rights. For example, if you buy a condo, there may be a rider outlining the condo association’s rules and restrictions.

● Insurance policies to provide a record and proof of your coverage.

The post What Happens at a New York City Real Estate Closing? appeared first on .

October 2, 2016

10 Celebrities Who Live in New York City

New York City has long been recognized as a town filled with famous faces. Not only have hundreds of public figures and multi-talented people been born in the Big Apple, but many continue to live in NYC because they’re able to blend in and live side by side with other New Yorkers. From television and film stars to musical legends, countless celebrities choose to call NYC home, and these ten are some of our favorites.

Jerry Seinfeld

This hilarious comedian/actor and star of Seinfeld has been living in the city that never sleeps for years. Unsurprisingly, although the comedian’s hit sitcom was about everything New York, much of it wasn’t filmed in the city, but rather, in a studio in Los Angeles. Still, the show will go down as one of the funniest of all time, and of course, the Brooklyn native still resides in NYC with his family.

Jessica & Jerry Seinfeld By David Shankbone – Shankbone, CC BY 3.0, https://commons.wikimedia.org/w/index.php?curid=11607071

Sarah Jessica Parker

No, she’s not Carrie Bradshaw, but she does live the New York life with hubby Matthew Broderick and their three children. Parker has made it clear that she loves the city and being a New Yorker, so it’s no surprise that she has continued to hang her hat in the Village.

Woody Allen

This one should be obvious. Mr. Manhattan himself has written a multitude of love letters to New York, so why wouldn’t he live there? The truth is, Allen has called the Upper East Side home for decades.

Woody Allen By Georges Biard, CC BY-SA 3.0, https://commons.wikimedia.org/w/index.php?curid=40681655

Olivia Wilde

Born and raised in NYC, Wilde recently took the leap from Manhattan over the river to live in Brooklyn. The House star shares a home with actor Jason Sudeikis and their son Otis (and soon-to-be-born baby number two) in the beautiful Clinton Hill neighborhood.

Tina Fey

The Saturday Night Live star lives on West End Avenue with her husband and children. Known most recently for creating UnBreakable Kimmy Schmidt, the Upper Darby native and sketch comedy queen continues to make us all laugh through her writing, acting, and directing.

Robert De Niro

As one of the founders of the TriBeCa Film Festival, De Niro was a driving force in Lower Manhattan’s revitalization after 9/11. We know him most for his iconic roles in films like Taxi Driver, Raging Bull, and The Godfather Part II, for which he won an Oscar. The Greenwich Village native has become synonymous with NYC, and loves the city and what it stands for, and will always be a New Yorker.

Robert De Niro By David Shankbone – Own work, CC BY 3.0, https://commons.wikimedia.org/w/index.php?curid=15006451

Madonna

You guessed it – when the material girl isn’t jet-setting around the globe, she lives in Manhattan (on East 81st Street, to be exact). According to some of her neighbors, they rarely, if ever grab a sighting of the legendary pop-star, who built a gated triple-wide townhouse on the Upper East Side.

Madonna By chrisweger – Madonna – Rebel Heart Tour 2015 – Berlin 1, CC BY-SA 2.0, https://commons.wikimedia.org/w/index.php?curid=45261311

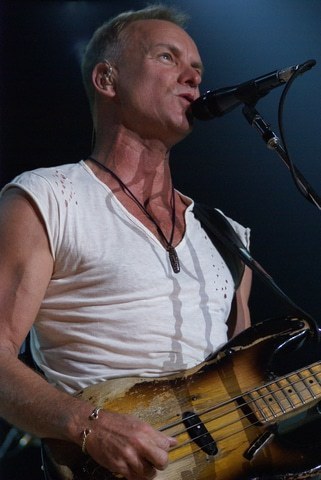

Sting

This British music man no doubt spends a fair amount of time in his homeland, but when he’s in the US, he and his wife Trudie Styler share a penthouse facing Central Park.

Sting By Lionel Urman, CC BY-SA 3.0, https://commons.wikimedia.org/w/index.php?curid=3520497

Kevin Bacon

An accomplished actor and musician, Kevin Bacon might have been born in Philly, but he is definitely a New Yorker. In fact, he’s lived on the Upper West Side since 1976. He owns a co-op with wife Kyra Sedgwick, and can occasionally be spotted out and about in the neighborhood.

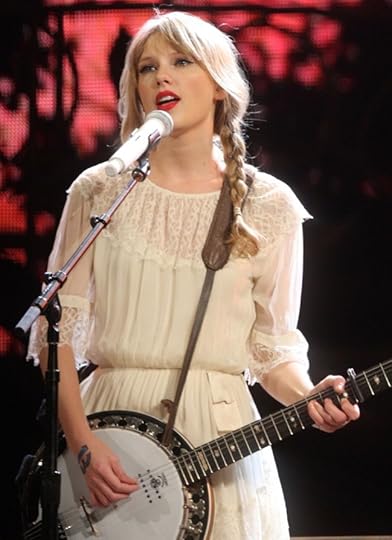

Taylor Swift

A host of celebrities have lived in Taylor Swift’s building at 155 Franklin Street in TriBeCa, so the property boasts a certain amount of star power. Now that the singing style icon owns penthouse there, her famous friends have a cool spot to chill out and shake it off.

Taylor Swift By Eva Rinaldi, CC BY-SA 2.0, https://commons.wikimedia.org/w/index.php?curid=26970782

The post 10 Celebrities Who Live in New York City appeared first on .