Helen H. Moore's Blog, page 882

January 26, 2016

Noam Chomsky’s right about Hillary Clinton – but he’s wrong that Bernie can’t win

“It’s well beyond the Oscars”: Variety takes a stand on Hollywood’s diversity problem — that will only change “when the bottom line is affected”

In 2015, America’s age-old struggle over civil rights centered on police violence. Gunshots too often killed unarmed black citizens — and the African-American population exploded with indignation, no longer willing to abide the status quo. This year, the nation’s battle over identity and inclusion has found a new focus: Hollywood. The tipping point arrived with the Jan. 14 unveiling of Oscar nominees, a list as white as the Social Register, circa 1950. The announcement by the Academy of Motion Picture Arts & Sciences — revealing that every one of the 20 acting nominees was white, incredibly, for the second consecutive year — has filled the Twitterverse and cable talk shows with outrage, plunging the Academy into crisis. The lack of diversity has dominated the conversation, from the executive suites at Disney to the hallways of CAA.The story interviews studio heads and activists, and traces the issue back to an imbalance in the 1970s and a protest led by Jesse Jackson in 1996. Salon spoke to Variety reporter James Rainey about the story and the larger problem of race in Hollywood. The interview has been lightly edited for clarity. The debate over this has been whether the problem is with the academy in particular or with Hollywood in general. Which is it? I think the problem is with all of us – not just the industry and Hollywood, but there is a long way to go for a lot of minority groups, underrepresented groups, to have their place in the American economy. And in this case, in Hollywood. So it’s well beyond the Oscars. You can get into certain categories, certain performances, and see that work that should have been recognized with nominations. But I think the more important debate, as Spike Lee said at the outset, is with who’s making the decisions in Hollywood, and whether they are trying to make TV and films that look like America. I think it’s pretty clear for a lot of groups that they aren’t accomplishing that. Does the problem seem to be with all films? With prestige films? How does it differ by genre? I guess it’s with the prestige films and the big studio films. There are independents that have a wider array of ethnicities and races represented. But it’s everywhere in Hollywood. It’s at the talent agencies, in the studio hierarchies, it’s true here – as I pointed out in the story – here at Variety. We’re a mostly white newsroom here. It’s throughout the industry. If you don’t keep after this goal, inertia is a powerful thing, and it will win the day if you don’t make a conscious effort to change things. Your piece started by referencing the violence against unarmed black men that led to the BlackLivesMatter movement. Do you see a connection between this and the outrage over the Oscars? I think maybe so because there was clearly, with all those shootings and all those protests, most pronounced in Ferguson, Missouri, people reached that breaking point: People were not going to do it anymore. It was just too much. And this being the second year in a row with the Oscar acting nominees being all white there was a kind of... “Really? In each of the last two years there have been 20 nominees, and then 20 more, so a total of 40 nominations, and not a single actor who’s not white who deserves nomination for recognition?” It’s pretty easy to see the indignation over that. As we say in the story, African-Americans have done better in the Oscars, in terms of nominations and victories than any other ethnic group. They’ve done better than Asian-Americans, they’ve done better than Latinos. And there are whole other categories of people … I can think of a few films in which disability was at the center of the film, like “My Left Foot,” but [the disabled] is a group that you don’t routinely see… It’s interesting that while there’s been an outpouring on this from a lot of quarters, you haven’t seen – that I know of – a prominent director, actor, cinematographer from the Latino community speak out. They’re a substantially bigger proportion of the population, growing faster than other groups. Kind of interesting that as a group they’ve been less outspoken. I think the same is true of Asian-Americans. Spike Lee gets the ball rolling. As our story points out, it’s a discussion that’s ripe to be had. But it goes way beyond African-Americans. Academy president Cheryl Boone Isaacs has said the academy can lead on the issue – is it able to do that? They’ve proposed some new rules, for instance, about membership. I think maybe they can. Even Spike Lee and some of the people who’ve been the most outspoken have been careful to credit Isaacs with meaningful steps in that direction. It’s fairly dramatic what they did – this move to say that academy members who haven’t worked in 10 years will go into non-voting status. I know some people pretty well, including a family member, who’ve been in the academy and maybe have had a gap like that, and think they’ve put in decades of hard work to be in the academy. There’s going to be some blowback on that. At the same time, what do you want your organization to be? Do you want an organization of elders – mostly white elders – or do you want a more contemporary organization of people who are active at the moment? By that change in the bylaws, it will over time become more of the latter. That may serve the academy well, not just in terms of ethnically and racially. But it may bring in more diverse kinds of films. For instance, this year it might have gotten “Star Wars” a best-picture nomination if you’d had a younger voting group. It’s going to take time, because it’s not like those people will be culled immediately. It’ll be interesting to see the impact of that over time. There are more chances of changes in the academy than changes in the upper echelon of the studios or of the talent agencies – the two other big institutions that I think are more in need of more, as Spike Lee would say, “flava.” More color in the top ranks. There’s a new profile of Samantha Bee in New York magazine in which she talks about a blind process of staffing her writing room. Have you heard of any talk about people in Hollywood doing that to fill in the behind-the-scenes positions? I think ultimately, what has to be shown to this industry, just like any other, is that this isn’t just a case of affirmative action – it’s a business decision. You can look at the shows and films that have performed really well – a show like “Empire” that’s leading in the ratings – it’s going to take some lessons like that. On the other hand, I’ve spoken to people in Hollywood who – every time a show like “Empire” succeeds – say, “Oh, that’s a one-off, that’s an anomaly, we can’t do that all the time.” You’re starting to see that more in TV than you are in film – people who see that there is a market there and that people will come and look at films with people of different stripes and colors. That’s what ultimately is going to move this in that direction. The profit motivation is always going to be the greatest. We’re still in a capitalist society, and the dollar is going to push everything. If there’s going to be change, that’s where it’s going to come from. The protests and outspokenness are important and can start the push. But ultimately it’s when the bottom line is affected that you’re going to see real change.The movement for diversity in the Oscars just received a push from deep inside Hollywood: the new Variety cover with the phrase “Shame on Us” spread across an image of an Oscar statue. Inside, the expansive, well-reported story begins this way:

In 2015, America’s age-old struggle over civil rights centered on police violence. Gunshots too often killed unarmed black citizens — and the African-American population exploded with indignation, no longer willing to abide the status quo. This year, the nation’s battle over identity and inclusion has found a new focus: Hollywood. The tipping point arrived with the Jan. 14 unveiling of Oscar nominees, a list as white as the Social Register, circa 1950. The announcement by the Academy of Motion Picture Arts & Sciences — revealing that every one of the 20 acting nominees was white, incredibly, for the second consecutive year — has filled the Twitterverse and cable talk shows with outrage, plunging the Academy into crisis. The lack of diversity has dominated the conversation, from the executive suites at Disney to the hallways of CAA.The story interviews studio heads and activists, and traces the issue back to an imbalance in the 1970s and a protest led by Jesse Jackson in 1996. Salon spoke to Variety reporter James Rainey about the story and the larger problem of race in Hollywood. The interview has been lightly edited for clarity. The debate over this has been whether the problem is with the academy in particular or with Hollywood in general. Which is it? I think the problem is with all of us – not just the industry and Hollywood, but there is a long way to go for a lot of minority groups, underrepresented groups, to have their place in the American economy. And in this case, in Hollywood. So it’s well beyond the Oscars. You can get into certain categories, certain performances, and see that work that should have been recognized with nominations. But I think the more important debate, as Spike Lee said at the outset, is with who’s making the decisions in Hollywood, and whether they are trying to make TV and films that look like America. I think it’s pretty clear for a lot of groups that they aren’t accomplishing that. Does the problem seem to be with all films? With prestige films? How does it differ by genre? I guess it’s with the prestige films and the big studio films. There are independents that have a wider array of ethnicities and races represented. But it’s everywhere in Hollywood. It’s at the talent agencies, in the studio hierarchies, it’s true here – as I pointed out in the story – here at Variety. We’re a mostly white newsroom here. It’s throughout the industry. If you don’t keep after this goal, inertia is a powerful thing, and it will win the day if you don’t make a conscious effort to change things. Your piece started by referencing the violence against unarmed black men that led to the BlackLivesMatter movement. Do you see a connection between this and the outrage over the Oscars? I think maybe so because there was clearly, with all those shootings and all those protests, most pronounced in Ferguson, Missouri, people reached that breaking point: People were not going to do it anymore. It was just too much. And this being the second year in a row with the Oscar acting nominees being all white there was a kind of... “Really? In each of the last two years there have been 20 nominees, and then 20 more, so a total of 40 nominations, and not a single actor who’s not white who deserves nomination for recognition?” It’s pretty easy to see the indignation over that. As we say in the story, African-Americans have done better in the Oscars, in terms of nominations and victories than any other ethnic group. They’ve done better than Asian-Americans, they’ve done better than Latinos. And there are whole other categories of people … I can think of a few films in which disability was at the center of the film, like “My Left Foot,” but [the disabled] is a group that you don’t routinely see… It’s interesting that while there’s been an outpouring on this from a lot of quarters, you haven’t seen – that I know of – a prominent director, actor, cinematographer from the Latino community speak out. They’re a substantially bigger proportion of the population, growing faster than other groups. Kind of interesting that as a group they’ve been less outspoken. I think the same is true of Asian-Americans. Spike Lee gets the ball rolling. As our story points out, it’s a discussion that’s ripe to be had. But it goes way beyond African-Americans. Academy president Cheryl Boone Isaacs has said the academy can lead on the issue – is it able to do that? They’ve proposed some new rules, for instance, about membership. I think maybe they can. Even Spike Lee and some of the people who’ve been the most outspoken have been careful to credit Isaacs with meaningful steps in that direction. It’s fairly dramatic what they did – this move to say that academy members who haven’t worked in 10 years will go into non-voting status. I know some people pretty well, including a family member, who’ve been in the academy and maybe have had a gap like that, and think they’ve put in decades of hard work to be in the academy. There’s going to be some blowback on that. At the same time, what do you want your organization to be? Do you want an organization of elders – mostly white elders – or do you want a more contemporary organization of people who are active at the moment? By that change in the bylaws, it will over time become more of the latter. That may serve the academy well, not just in terms of ethnically and racially. But it may bring in more diverse kinds of films. For instance, this year it might have gotten “Star Wars” a best-picture nomination if you’d had a younger voting group. It’s going to take time, because it’s not like those people will be culled immediately. It’ll be interesting to see the impact of that over time. There are more chances of changes in the academy than changes in the upper echelon of the studios or of the talent agencies – the two other big institutions that I think are more in need of more, as Spike Lee would say, “flava.” More color in the top ranks. There’s a new profile of Samantha Bee in New York magazine in which she talks about a blind process of staffing her writing room. Have you heard of any talk about people in Hollywood doing that to fill in the behind-the-scenes positions? I think ultimately, what has to be shown to this industry, just like any other, is that this isn’t just a case of affirmative action – it’s a business decision. You can look at the shows and films that have performed really well – a show like “Empire” that’s leading in the ratings – it’s going to take some lessons like that. On the other hand, I’ve spoken to people in Hollywood who – every time a show like “Empire” succeeds – say, “Oh, that’s a one-off, that’s an anomaly, we can’t do that all the time.” You’re starting to see that more in TV than you are in film – people who see that there is a market there and that people will come and look at films with people of different stripes and colors. That’s what ultimately is going to move this in that direction. The profit motivation is always going to be the greatest. We’re still in a capitalist society, and the dollar is going to push everything. If there’s going to be change, that’s where it’s going to come from. The protests and outspokenness are important and can start the push. But ultimately it’s when the bottom line is affected that you’re going to see real change.

Fight Trump fatigue with “Lazer Team,” a delicious ’80s-style alien-invasion spoof

The truth about “smart drugs”: They probably won’t make you smart unless you already are

In the 2011 movie Limitless, our loser-turned-hero Bradley Cooper takes a pill, writes a novel in a few days, becomes an investment tycoon, and performs other tricks of mental derring-do. And of course at the end of the movie (spoiler alert!), he gets the girl. If only such a pill really existed. Well, it may. Sort of. Welcome to the world of nootropics, or smart drugs. Nootropics (derived from Greek words that mean to bend the mind) are categories of drugs, supplements and other additives and stimulants that enhance memory, cognitive function and even intelligence. For thousands of years, humankind has sought ways to improve the mind, and many believe that modern science is on the cusp of achieving that goal, albeit with many caveats. The brain, as you might expect, is a complicated and metabolically ravenous organ. There’s a lot going on up there, and when all processes are clicking as they should, the body and mind are generally alert and optimally functioning. When the brain metabolism is off, though, both mind and body suffer. That’s where smart drugs come in. The goal behind them is to tweak the brain metabolism and keep the neurons firing in a focused way. For instance, there is a neurotransmitter in the brain called acetylcholine, which is the main agent in memory formation. Nootropic proponents theorize that if we enhance the acetycholine, we can enhance memory function. The abilities to reason, to plan, to focus and to avoid acting on impulse are some of the higher functions of the brain that nootropics target. It’s a mistake to think of smart drugs as steroids for the brain. The drugs don’t create more brain matter, like steroids create muscle. Instead, their goal is to focus the brain and make it work more efficiently. As Amy Arnsten, a professor of neurobiology at Yale medical School put it to the BBC, “You’re not taking Homer Simpson and making him into Einstein.” In other words, smart drugs don’t make you smart unless you already are smart. Steven Rose, emeritus professor of life sciences at the Open University observed, “What most of these are actually doing is enabling the person who’s taking them to focus.” Most prescription smart drugs, like the stimulant modafinil, a popular smart drug among students, were developed for specific medical disorders (in the case of modafinil, narcolepsy, ADHD, and other similar cognitive conditions) and are used off-label for cognitive enhancement. Modafinil users reported increased wakefulness, focus, motivation and concentration. While these drugs have been shown to balance the function of a cognitively impaired brain, until recently, there was no scientific proof that they improved cognitive function in a healthy brain. In fact, the limited studies showed just the opposite, impaired functioning. However, a recent study conducted by Harvard Medical School and the University of Oxford seemed to indicate that modafinil did indeed improve cognitive skills that involved complex tasks (but not memory function or other cognitive skills). Psycho-stimulants like Adderall and Ritalin, two other widely used "smart drugs," were developed for individuals with diagnosed attention deficit disorder, and have been used instead by students for enhanced focus. There have been no significant studies proving their effectiveness for this use, although there is much anecdotal hype. Side effects from both drugs can be significant, including sleeplessness, nausea, dependency, and even heart problems. Not all nootropics are prescription drugs, and a number of nutritional supplements are purported to have cognition-enhancing abilities. Entrepreneurs are taking notice. Dave Asprey, founder of Bulletproof Nutrition, has been a prominent promoter of nootropics as a way to “hack” human biology. He claims to have spent 15 years and over a quarter of a million dollars using himself as a guinea pig for his nutritional beliefs. His goal has been to find the right combination, or “stack,” of nutritional supplements to help his body, and more importantly, his brain, reach its full potential. He boasts to have increased his IQ by 20 points, and told CNN, "It feels almost seamless, like I just got upgraded....That's a gift." Maybe the most popular non-prescription nootropic is piracetam. Developed in Belgium in the 1960s, the supplement has a relatively long history, and as such, is considered safe, non-toxic and non-addictive. Piracetam is thought to improve the function of acetylcholine in the brain, the neurotransmitter involved in memory formation. Its popularity can be attributed to its apparent safety and relative low cost, as well as its purported mild but noticeable cognitive enhancement. Its side effects, if experienced at all, are minimal, including possible mild headache and stomach upset. Adrafinil is another popular non-prescription smart drug. When taken, the liver converts adrafinil into modafinil. Because it has to be taken in larger doses, and can cause an elevation in liver enzymes, adrafinil cannot be taken on a continual basis. Users have reported a sharper, more alert mind and increased motivation. Recently, creatine has been eyed as a potent smart drug. A popular supplement for body builders (often mistaken as a steroid, which it is not), creatine is a naturally occurring product in the body formed from two amino acids, glycine and arginine. Normally used to help athletes build muscle, some small-scale studies have shown creatine may be helpful in improving memory, cognitive processing, and even enhancing IQ. Theanine (or L-theanine) is another amino acid that has shown nootropic potential. Studies have indicated that theanine affects the level of neurotransmitters, is helpful to young boys with ADHD, and in combination with caffeine, has improved focus and alertness (presumably more than caffeine alone). The amino acid is prevalent in green tea, and has been recognized by the FDA as safe. Choline is a precursor molecule to the memory neurotransmitter acetylcholine. Users of choline as a nootropic report improved memory and focus. Not all forms of choline are actually able to penetrate through the blood-brain barrier, however. Alpha-GPC and citicholine are two forms of the nutrient that are more bio-available. Noopept is a chemical that was originally discovered by Russian researchers. Up to 1000 times more powerful than piracetam, Noopept can be taken in very small doses. Users reported Noopept increased their focus and memory, cognition, as well as their logical thinking. It is important to note that most of the positive effects that have been reported by nootropic enthusiasts has been anecdotal. That is, strict scientific protocols have not firmly established their effectiveness. In 2014, the National Institutes for Health noted, “It is clear from the current lack of research in the field that much work needs to be done in order to determine the safety of cognitive enhancers, particularly among adolescents, the population most likely to take advantage of these drugs should they become available. " Many of the positive effects may be nothing more than placebos. Additionally, much of the scientific studies have been done on animals like rats, and making the leap from rat to human is a large leap indeed. As more and more smart drugs crop up, more side effects have been noted. And there are, for the most part, no studies to establish that the drugs are safe over long periods of time. Always do your research, and consult your doctor before deciding to add any of these medicines or supplements to your daily regimen. Larry Schwartz is a Brooklyn-based freelance writer with a focus on health, science and American history.

In the 2011 movie Limitless, our loser-turned-hero Bradley Cooper takes a pill, writes a novel in a few days, becomes an investment tycoon, and performs other tricks of mental derring-do. And of course at the end of the movie (spoiler alert!), he gets the girl. If only such a pill really existed. Well, it may. Sort of. Welcome to the world of nootropics, or smart drugs. Nootropics (derived from Greek words that mean to bend the mind) are categories of drugs, supplements and other additives and stimulants that enhance memory, cognitive function and even intelligence. For thousands of years, humankind has sought ways to improve the mind, and many believe that modern science is on the cusp of achieving that goal, albeit with many caveats. The brain, as you might expect, is a complicated and metabolically ravenous organ. There’s a lot going on up there, and when all processes are clicking as they should, the body and mind are generally alert and optimally functioning. When the brain metabolism is off, though, both mind and body suffer. That’s where smart drugs come in. The goal behind them is to tweak the brain metabolism and keep the neurons firing in a focused way. For instance, there is a neurotransmitter in the brain called acetylcholine, which is the main agent in memory formation. Nootropic proponents theorize that if we enhance the acetycholine, we can enhance memory function. The abilities to reason, to plan, to focus and to avoid acting on impulse are some of the higher functions of the brain that nootropics target. It’s a mistake to think of smart drugs as steroids for the brain. The drugs don’t create more brain matter, like steroids create muscle. Instead, their goal is to focus the brain and make it work more efficiently. As Amy Arnsten, a professor of neurobiology at Yale medical School put it to the BBC, “You’re not taking Homer Simpson and making him into Einstein.” In other words, smart drugs don’t make you smart unless you already are smart. Steven Rose, emeritus professor of life sciences at the Open University observed, “What most of these are actually doing is enabling the person who’s taking them to focus.” Most prescription smart drugs, like the stimulant modafinil, a popular smart drug among students, were developed for specific medical disorders (in the case of modafinil, narcolepsy, ADHD, and other similar cognitive conditions) and are used off-label for cognitive enhancement. Modafinil users reported increased wakefulness, focus, motivation and concentration. While these drugs have been shown to balance the function of a cognitively impaired brain, until recently, there was no scientific proof that they improved cognitive function in a healthy brain. In fact, the limited studies showed just the opposite, impaired functioning. However, a recent study conducted by Harvard Medical School and the University of Oxford seemed to indicate that modafinil did indeed improve cognitive skills that involved complex tasks (but not memory function or other cognitive skills). Psycho-stimulants like Adderall and Ritalin, two other widely used "smart drugs," were developed for individuals with diagnosed attention deficit disorder, and have been used instead by students for enhanced focus. There have been no significant studies proving their effectiveness for this use, although there is much anecdotal hype. Side effects from both drugs can be significant, including sleeplessness, nausea, dependency, and even heart problems. Not all nootropics are prescription drugs, and a number of nutritional supplements are purported to have cognition-enhancing abilities. Entrepreneurs are taking notice. Dave Asprey, founder of Bulletproof Nutrition, has been a prominent promoter of nootropics as a way to “hack” human biology. He claims to have spent 15 years and over a quarter of a million dollars using himself as a guinea pig for his nutritional beliefs. His goal has been to find the right combination, or “stack,” of nutritional supplements to help his body, and more importantly, his brain, reach its full potential. He boasts to have increased his IQ by 20 points, and told CNN, "It feels almost seamless, like I just got upgraded....That's a gift." Maybe the most popular non-prescription nootropic is piracetam. Developed in Belgium in the 1960s, the supplement has a relatively long history, and as such, is considered safe, non-toxic and non-addictive. Piracetam is thought to improve the function of acetylcholine in the brain, the neurotransmitter involved in memory formation. Its popularity can be attributed to its apparent safety and relative low cost, as well as its purported mild but noticeable cognitive enhancement. Its side effects, if experienced at all, are minimal, including possible mild headache and stomach upset. Adrafinil is another popular non-prescription smart drug. When taken, the liver converts adrafinil into modafinil. Because it has to be taken in larger doses, and can cause an elevation in liver enzymes, adrafinil cannot be taken on a continual basis. Users have reported a sharper, more alert mind and increased motivation. Recently, creatine has been eyed as a potent smart drug. A popular supplement for body builders (often mistaken as a steroid, which it is not), creatine is a naturally occurring product in the body formed from two amino acids, glycine and arginine. Normally used to help athletes build muscle, some small-scale studies have shown creatine may be helpful in improving memory, cognitive processing, and even enhancing IQ. Theanine (or L-theanine) is another amino acid that has shown nootropic potential. Studies have indicated that theanine affects the level of neurotransmitters, is helpful to young boys with ADHD, and in combination with caffeine, has improved focus and alertness (presumably more than caffeine alone). The amino acid is prevalent in green tea, and has been recognized by the FDA as safe. Choline is a precursor molecule to the memory neurotransmitter acetylcholine. Users of choline as a nootropic report improved memory and focus. Not all forms of choline are actually able to penetrate through the blood-brain barrier, however. Alpha-GPC and citicholine are two forms of the nutrient that are more bio-available. Noopept is a chemical that was originally discovered by Russian researchers. Up to 1000 times more powerful than piracetam, Noopept can be taken in very small doses. Users reported Noopept increased their focus and memory, cognition, as well as their logical thinking. It is important to note that most of the positive effects that have been reported by nootropic enthusiasts has been anecdotal. That is, strict scientific protocols have not firmly established their effectiveness. In 2014, the National Institutes for Health noted, “It is clear from the current lack of research in the field that much work needs to be done in order to determine the safety of cognitive enhancers, particularly among adolescents, the population most likely to take advantage of these drugs should they become available. " Many of the positive effects may be nothing more than placebos. Additionally, much of the scientific studies have been done on animals like rats, and making the leap from rat to human is a large leap indeed. As more and more smart drugs crop up, more side effects have been noted. And there are, for the most part, no studies to establish that the drugs are safe over long periods of time. Always do your research, and consult your doctor before deciding to add any of these medicines or supplements to your daily regimen. Larry Schwartz is a Brooklyn-based freelance writer with a focus on health, science and American history.

“Boys don’t get raped”: “American Crime” is smashing damaging myths about sexual assault

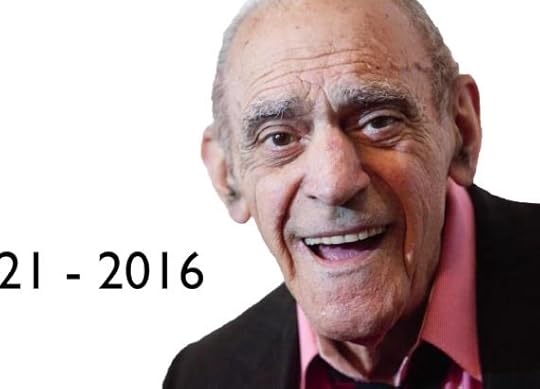

“You know I got rhymes like Abe Vigoda!!!”: Beloved “Godfather” actor’s death sparks funny, heartfelt tributes

Time to freak out: 4 reasons the global economy is completely screwed

A fresh blast of cold air swept across global financial and commodity markets on Wednesday, raising fears that the world economy could be heading toward a recession — one perhaps even bigger than the last one.

A fresh blast of cold air swept across global financial and commodity markets on Wednesday, raising fears that the world economy could be heading toward a recession — one perhaps even bigger than the last one. Further falls in crude oil prices were the catalyst for the widespread sell-off as investors from New York to London dumped stocks. The Dow Jones Industrial Average was down more than 500 points at one point, and US crude fell below $27 a barrel, its lowest level since May 2003.

The alarming combination of plunging stock markets, sinking oil prices, collapsing emerging market currencies and the slowdown in China has left many market participants wishing 2016 was over already.

The renewed panic comes as political and business leaders gather in the Swiss Alps town of Davos for the World Economic Forum, which is likely to be dominated by the turmoil in global markets.

"The situation is worse than it was in 2007. Our macroeconomic ammunition to fight downturns is essentially all used up," William White, the Swiss-based chairman of the Organization for Economic Cooperation and Development's policy review committee and former economic advisor at the Swiss-based Bank for International Settlements, told The Telegraph in Davos.

The signs were there before Wednesday's market woes. US billionaire investor George Soros has warned that global markets are facing a 2008-style crisis as China makes the difficult transition from an export-driven economy to one that is more reliant on domestic consumption.

“China has a major adjustment problem,” Soros said. “I would say it amounts to a crisis. When I look at the financial markets there is a serious challenge which reminds me of the crisis we had in 2008,” Soros told an economic forum earlier this year, Bloomberg reported.

So, is it time to start stashing your savings under the mattress?

Here are four reasons why you should be very worried about the state of the global economy.

1. Emerging market debt crisisBlame the US Federal Reserve for this one.

Since the Fed lowered interest rates to near zero during the financial crisis, the world has been flooded with cheap money. Emerging market companies, banks and governments have responded by taking out dollar-denominated loans. Now that US interest rates are rising again and the dollar is strengthening, those debts are becoming a lot more expensive to pay back.

"Emerging markets were part of the solution after the Lehman crisis. Now they are part of the problem too,” the OECD's White told The Telegraph.

2. Stock markets are plungingIf you were thinking about taking an early retirement and living off the fat of your financial market investments, think again.

Wall Street is having its worst start to a year ever, with the S&P 500 falling more than 8 percent in less than three weeks. The losses have spread like a bad flu to other regions — China and Japan have tumbled into bear markets and London’s FTSE 100 looks set to join them. (The technical definition of a bear market is a fall of 20 percent or more from a recent high). European markets are deep in negative territory, too.

With the International Monetary Fund downgrading its global economic growth forecasts for this year and next, citing the ongoing problems with China and weak commodity prices, now is not the time to be perfecting your golf putt.

3. Super-low oil pricesGlobal oil prices have plunged in the past 18 months and key benchmarks have begun trading below $30 a barrel, the lowest level in more than a decade, as a global glut and China growth fears weigh on demand. The International Energy Agency warned Tuesday the oil market could “drown in oversupply.” Sounds scary, right? It is.

Many businesses and consumers are cheering the low oil prices because it means gasoline is cheaper, which reduces their costs and gives them more money to spend. But there’s a downside. When oil is too cheap it can fuel deflation. One reason that's bad for an economy is that if consumers believe prices will fall further, they might delay making purchases, pushing down prices even more and creating a dangerous downward spiral. The domino effects can be devastating. Falling oil prices can also be a sign that economic activity is slowing.

4. China is slowing downThe latest data show China’s economy grew at its slowest pace in 25 years in 2015, confirming fears that the world’s growth engine is losing steam. It expanded by 6.9 percent last year, compared with 7.3 percent in 2014.

China’s deceleration has huge economic implications, now and in the long term. While the slowdown is partly a consequence of Beijing's efforts to wean the country off its addiction to export-driven growth, there are fears that Chinese leaders could lose their nerve and further devalue the currency to prop up the country's labor-intensive manufacturing sector. That could lead to a damaging global currency war and undermine confidence in China.

A fresh blast of cold air swept across global financial and commodity markets on Wednesday, raising fears that the world economy could be heading toward a recession — one perhaps even bigger than the last one.

A fresh blast of cold air swept across global financial and commodity markets on Wednesday, raising fears that the world economy could be heading toward a recession — one perhaps even bigger than the last one. Further falls in crude oil prices were the catalyst for the widespread sell-off as investors from New York to London dumped stocks. The Dow Jones Industrial Average was down more than 500 points at one point, and US crude fell below $27 a barrel, its lowest level since May 2003.

The alarming combination of plunging stock markets, sinking oil prices, collapsing emerging market currencies and the slowdown in China has left many market participants wishing 2016 was over already.

The renewed panic comes as political and business leaders gather in the Swiss Alps town of Davos for the World Economic Forum, which is likely to be dominated by the turmoil in global markets.

"The situation is worse than it was in 2007. Our macroeconomic ammunition to fight downturns is essentially all used up," William White, the Swiss-based chairman of the Organization for Economic Cooperation and Development's policy review committee and former economic advisor at the Swiss-based Bank for International Settlements, told The Telegraph in Davos.

The signs were there before Wednesday's market woes. US billionaire investor George Soros has warned that global markets are facing a 2008-style crisis as China makes the difficult transition from an export-driven economy to one that is more reliant on domestic consumption.

“China has a major adjustment problem,” Soros said. “I would say it amounts to a crisis. When I look at the financial markets there is a serious challenge which reminds me of the crisis we had in 2008,” Soros told an economic forum earlier this year, Bloomberg reported.

So, is it time to start stashing your savings under the mattress?

Here are four reasons why you should be very worried about the state of the global economy.

1. Emerging market debt crisisBlame the US Federal Reserve for this one.

Since the Fed lowered interest rates to near zero during the financial crisis, the world has been flooded with cheap money. Emerging market companies, banks and governments have responded by taking out dollar-denominated loans. Now that US interest rates are rising again and the dollar is strengthening, those debts are becoming a lot more expensive to pay back.

"Emerging markets were part of the solution after the Lehman crisis. Now they are part of the problem too,” the OECD's White told The Telegraph.

2. Stock markets are plungingIf you were thinking about taking an early retirement and living off the fat of your financial market investments, think again.

Wall Street is having its worst start to a year ever, with the S&P 500 falling more than 8 percent in less than three weeks. The losses have spread like a bad flu to other regions — China and Japan have tumbled into bear markets and London’s FTSE 100 looks set to join them. (The technical definition of a bear market is a fall of 20 percent or more from a recent high). European markets are deep in negative territory, too.

With the International Monetary Fund downgrading its global economic growth forecasts for this year and next, citing the ongoing problems with China and weak commodity prices, now is not the time to be perfecting your golf putt.

3. Super-low oil pricesGlobal oil prices have plunged in the past 18 months and key benchmarks have begun trading below $30 a barrel, the lowest level in more than a decade, as a global glut and China growth fears weigh on demand. The International Energy Agency warned Tuesday the oil market could “drown in oversupply.” Sounds scary, right? It is.

Many businesses and consumers are cheering the low oil prices because it means gasoline is cheaper, which reduces their costs and gives them more money to spend. But there’s a downside. When oil is too cheap it can fuel deflation. One reason that's bad for an economy is that if consumers believe prices will fall further, they might delay making purchases, pushing down prices even more and creating a dangerous downward spiral. The domino effects can be devastating. Falling oil prices can also be a sign that economic activity is slowing.

4. China is slowing downThe latest data show China’s economy grew at its slowest pace in 25 years in 2015, confirming fears that the world’s growth engine is losing steam. It expanded by 6.9 percent last year, compared with 7.3 percent in 2014.

China’s deceleration has huge economic implications, now and in the long term. While the slowdown is partly a consequence of Beijing's efforts to wean the country off its addiction to export-driven growth, there are fears that Chinese leaders could lose their nerve and further devalue the currency to prop up the country's labor-intensive manufacturing sector. That could lead to a damaging global currency war and undermine confidence in China.

The atrocities will continue: No matter who wins the presidency, the Middle East loses

Robert Reich: Paul Krugman just doesn’t get it

January 25, 2016

Dems grilled at CNN town hall: As Iowa caucus looms, Sanders, Clinton and O’Malley talk guns, health care, war

"On day one, I said the Keystone Pipeline was a dumb idea. Why did it take Hillary Clinton a long time before she came into opposition to the Keystone Pipeline? I didn't have to think hard about opposing the Trans Pacific Partnership. It took Hillary Clinton a long time to come on board that," he continued.

But shortly thereafter, Sanders' argument of standing as a strident liberal was challenged by the second town hall speaker, Martin O'Malley.

"My story is not the story of a Democratic conversion, but of a Democratic upbringing," O'Malley bragged, echoing a favored campaign trail line mentioning that he is the only candidate in the field who has been a Democrat his entire life.

Like Sanders, O'Malley received a round of hard-hitting audience questions, beginning with an opening zinger from a resident of Ferguson who asked the former Maryland governor to defend his record as Baltimore mayor, overseeing a rapid expansion of the police state. (Sanders' first audience question was on how he defines socialism).

In the end, the longshot candidate declined to instruct his Iowa voters on whom to support should his campaign prove unviable. "Hold strong at your caucus," O'Malley urged.

Finally, it was Clinton's turn at bat and she showed up full of energy in hour two. And like Sanders and O'Malley before her, Clinton was peppered by difficult questions from the audience, beginning with a skeptical young voter who demanded an explanation for why his friends find the former secretary of state so untrustworthy and immediately followed-up by another young voter seeking assurances that Clinton's leftward tilt in the primary will continue through the general election and into a potential Clinton administration.

https://twitter.com/CNNPolitics/statu...While most of the candidates' answers have already been heard by even the most casual observers of this election, it was the substantive town hall questions from the audience that really stood out in a debate season marred by inept moderation and non-existent policy prescriptions on the more widely watched GOP side.