Mohit Tater's Blog, page 564

June 28, 2019

Guide on Opening an Offshore Company

An offshore

company is a corporation incorporated in a foreign country where none of the

founders is a resident. Offshore business processes are facilitated in a number

of locations around the world and, when investors open an International

Business Company, a common business form for this purpose, they will not be

allowed to trade locally in that jurisdiction.

This short guide on opening an offshore company aims to offer a number

of clarifications on the process of opening a legal entity in another location.

1. Choose the

jurisdiction

Offshore

companies offer a number of advantages, from easy incorporation to low taxation

regimes and the ease of doing business internationally. Of course, these

characteristics will vary according to the chosen jurisdiction. Therefore,

selecting where the company will be based is very important.

Investors who set up a company in Singapore will enjoy a number of advantages, even though the city-state is not perceived as an offshore jurisdiction in the traditional sense of the word. Low taxes and an easy set up process are available here, with none of the disadvantages of the jurisdiction being included on any blacklist.

Investors who open a company in the Isle of Man will also benefit from tax advantages (with a 0% tax rate for selected types of activities) and a fast incorporation process. Moreover, this is the preferred jurisdiction for those who wish to enjoy the zero tax advantages in a location that is close to Europe.

Popular

offshore jurisdictions also include the British Virgin Islands, where the

International Business Company can be incorporated, the Cayman Islands,

Seychelles or Labuan, among others.

2. Begin the

incorporation of the company

Company

formation in many of the offshore jurisdictions is simple and has low

requirements. A minimum of one shareholder and one director will be required

and the minimum share capital is low. Nevertheless, the company will need to

have a registered address and in some cases, a registered agent is also

mandatory. In some locations, the presence of a local company secretary is also

required.

Entrepreneurs

will be required to provide all of the needed details for incorporation and

they can also select nominee director and nominee shareholder services during

the initial incorporation stages if they wish to protect their identities.

Opening an offshore company has a number of benefits and it is a simple process that can be easily handled by foreign investors regardless of their country of origin.

The post Guide on Opening an Offshore Company appeared first on Entrepreneurship Life.

June 27, 2019

Establishing a Merchant Account

When you’re setting up your own business, the odds are that you’ve

created a business plan to ensure you’ve considered every alternative, from

labor costs to advertising. You’ve likely compared multiple vendors to secure the

most favorable rates and fastidiously researched your targeted customer base,

as well as ascertained whether the market would be receptive to your goods and

services or not. However, did you put an equal amount of effort into opening

your business account?

Most business owners simply default to their current banking institution. Arguably, continuing to work with a bank you already have a relationship with offers a distinct advantage. You may be able to bypass several hoops that new customers have to jump through, and you’ll already be familiar with local branches and the website. Just because you’ve had a positive experience with your bank concerning your personal finances, that may not necessarily be an indication it’s the ideal option for your business account.

Merchant accounts vary widely, so you’ll need to invest some time to

understand the different fees and benefits banks offer to small businesses.

Electing to stay with your bank for the sake of convenience could cost you over

the long term, and you could potentially miss out on opportunities for reward

programs or lower rates. Some banks may not offer all the services that

merchants require, so you’ll need to work with other companies for help with

point of sale capabilities and payment processing.

Some healthy competition in the merchant banking business can

definitely work to your advantage. While you ultimately want to end up with the

solution that makes the business transactions seamless for your customers, it’s

essential for you to engage with a bank that treats you like a valued customer

as well. Not only should your bank partner be with you to help you succeed by

offering perks like favorable payment processing rates and credit cards with no

annual fees, but they should also have programs and tools to help you manage

your money.

Even after you’ve put in the effort to find a bank that caters to

small businesses and looks to be a promising fit, the nature of your business

could be a deciding factor in the end. Despite having the potential to build a

financially stable and thriving business, some banking institutions may shy

away from certain applicants because of the industry they represent.

More specifically, businesses that are affiliated with adult

entertainment tend to run into roadblocks when they attempt to establish

relationships with more conventional banks. Although these are still legitimate

businesses, working with companies in this field runs counter to the Code of

Conduct and policies of many mainstream banks. Rather than running the risk of

jeopardizing their hard-fought brand image, most banks will refuse to allow

these businesses to set up merchant accounts.

If your business falls into this category, there are financial institutions that will work with you to set up adult merchant accounts. Like your preliminary research with banks, you’ll need to shop around to ensure these organizations can accommodate your needs with reasonable terms. If you’re struggling to find a good fit, don’t give up and settle for just any payment processing company. You’ve put your heart and soul into your business, and likely made a substantial financial investment as well. You want to be sure you don’t fall victim to predatory rates or lackluster service.

The post Establishing a Merchant Account appeared first on Entrepreneurship Life.

5 Tips to Make Your Next Small Business Event a Success [2019]

No matter if you want to launch a new product, strengthen relationships with your customers or attract new investors, hosting an event is something you just can’t go wrong with. Although we live in the age of social media and video calls, nothing beats a well-organized small business event. Still, you can’t just send out invitations and hope everyone has a good time.

Instead, it’s up to you to plan the entire thing and ensure everyone who shows up creates a memorable experience they relate to your business. But how exactly do you make your small business event a success? Here are five tips to have in mind.

Define your goals

You can’t host a small business event without knowing what you want to achieve through it. Well, you can but it’ll just be a waste of money and that’s something most small businesses aren’t able to afford. Therefore, one of the first things you need to do when organizing your event is to outline your purpose. Maybe you want to use it to encourage your current customers to come back or maybe you want potential investors to see where you see the company in a few years.

Once you know what you want to achieve, deciding on the means for doing so will be a lot easier. For instance, freebies can turn just any customer into a loyal follower of your brand while a carefully-designed presentation can draw investors to your business.

Think about money

Ask any Australian business owner who recently hosted a small business event and they’ll tell you how expensive it can all get. Still, this doesn’t mean you should decide not to do it. Instead, you need to do your homeowner and use your money as wisely as possible. This will prevent you from overspending once you start organizing the event and ensure there’s enough of it left for the details that are yet to be dealt with.

In order to be able to do this, it’s recommended that you break down your budget and determine a smaller budget for every aspect of the event. It’s also a good idea to set some money aside since unexpected costs always arise when hosting this type of events.

Order food and drink

Food and drink have to be present at every event your small business hosts. After all, you can expect people to spend hours at your event without something to bite on. When it comes to food, don’t forget that people nowadays maintain different diets and ordering different options for your employees is recommended. When it comes to drinks, it’s a good idea to come up with your alcohol policy and let everyone know about it before the event takes place.

That should help them decide on the means of transportation they use to get to your venue. Also, if you plan to serve alcohol, you need a local company that can provide you with it. For instance, if you need a professional alcohol delivery service in Sydney, there are local companies you can turn to.

Delegate responsibilities

Hosting an event is a complex process and as much as you’d like to do everything yourself, you need help from your employees. You may believe that organizing everything on your own is a good idea but delegation allows you and your team members to focus on even the tiniest details which can be of huge importance. For example, if there’s a graphic designer in your team, have them prepare visuals for you to use when giving a presentation.

Or if someone in the office is really into music, having them choose the band or make a playlist for the entire evening is a great idea. You can also use this opportunity to see who in your team is capable of taking a more important role in the company.

Don’t forget about marketing

If you want people to show up at your event, you have to promote it. Luckily, in this day and age, there are so many ways you can make sure everyone find out about your event. For example, if you want potential investors to attend your event, send them an email with a well-designed signature that’ll help them remember your business.

Tweeting about your event is another great idea since most influential people are on this platform. Twitter and email can still be used when attracting customers to your event but nothing seems to beat creating a Facebook event page for it. For local businesses, promoting your event on the radio can also work.

Final thoughts

Hosting a small business event isn’t easy no matter what your goals are. This is why it’s important to start preparing on time and have every little detail planned. Have the five tips covered earlier in this post in mind and there should be nothing stopping you from making your next small business event a real success.

The post 5 Tips to Make Your Next Small Business Event a Success [2019] appeared first on Entrepreneurship Life.

June 26, 2019

6 Challenges All Great Business Leaders Face

Let’s face it: smooth sailing is not the status quo. Even the

most successful entrepreneurs on the planet have to deal with big problems on a

daily basis. And being a great business leader entails taking on significant

challenges on a regular basis. But just what are those challenges? How can

ambitious young pros prepare themselves for the trials and tribulations of a

management role or leadership position? Today we’re going to tackle that exact

topic. Here are the six biggest obstacles all business leaders must face and

overcome on their path to success:

Internal Strife

Passionate, dedicated professionals aren’t always going to see eye-to-eye. It’s up to business leaders to ensure that their team members can effectively collaborate with each other. Coworkers don’t have to be best friends, but managers do need to understand how to resolve conflict and bring arguing factions together.

Self-Accountability

There’s a big difference between answering to a boss and

answering only to yourself. In fact, self-accountability is one of the most

difficult traits to develop. Business leaders have to be disciplined and they

have to hold themselves to high standards. Remember, employees take cues from

their bosses; if you work hard, they’ll work hard too.

Lack of Knowledge

Contrary to popular belief, the most progressive business leaders don’t have the answer to every problem they encounter. Instead, what separates great professionals from the rest is their willingness to go the extra mile and educate themselves. Effective leaders never pass up the opportunity to explore a custom elearning course or attend a beneficial seminar, for instance.

Negativity &

Failure

Sometimes, despite their best efforts, business leaders fall

short of their goals. Dealing with failure is never easy. After all, it’s

demoralizing to lose a vital account or to miss out on new business. The key is

to dust yourself off and continue to remain positive in the face of adversity.

Financial Issues

Every business owner will have their fair share of financial

worries over the years. Balancing your company’s books can be a daunting task,

but the reality is that funding and cash flow are essential to a business’s

viability.

Delegation

While most business leaders possess a great deal of self-confidence, they nevertheless need to recognize their own boundaries. Delegating a task to a team member with more experience or a more developed skill-set than your own isn’t a sign of weakness. Rather, it sends a message to the rest of your staff that you believe in them and trust them. Great leaders elevate the performance of those around them –– not just their own.

The post 6 Challenges All Great Business Leaders Face appeared first on Entrepreneurship Life.

Why People Love What Neil Patel Publishes Across 5 Content Formats

If you’re unfamiliar with who Neil Patel is and

the value that he brings to the online marketing ecosystem, it’s high time you

got caught up.

Patel is among the founders of HelloBar, Kissmetrics, Crazy Egg and QuickSprout, some of the biggest names in contemporary marketing. Today, most of his online activity takes place via his own website, while the Neil Patel Digital agency offers consulting services to big-name corporate clients like Intuit, Expedia and GM.

In a nutshell, Patel’s public-facing persona is

that of a teacher who offers highly useful and thought-inspiring ways to get

you and your brand recognized online – most of which is freely published for

all to see.

Whether it’s through the entrepreneur’s articles,

videos, podcasts, free SEO tools or even courses, Neil Patel utilizes a simple,

easy-to-understand and comprehensive

approach to share lessons from his years of success in the digital space.

Here we’ll take a look at some of the most

popular media formats that Neil Patel offers his multi-million online

following.

Blog posts

The core value of what Neil Patel brings to the online SEO community can be found via the articles on his blog.

Whether it’s advice on how to rank on Google,

guidance on writing content, or finding a profitable niche for your new

website, it is all but certain that you’ll find it through one of Neil Patel’s

blog posts.

Not only are his articles highly comprehensive,

but they are suitable for online marketers of all shapes and sizes. Regardless

of whether you are a newbie looking to start your first online business or a

seasoned digital marketeer, the blog content that Neil Patel offers is of the

utmost value.

Video clips

On top of offering valuable advice through his

online blog, Neil Patel also has a strong presence via his video explainers.

This is ideal for those who prefer to learn in video format, as opposed to

reading somewhat lengthy blog articles.

While Neil Patel attracts more than 370,000 subscribers to his YouTube channel, the marketing guru still gets the bulk of his audience via his official website.

Much like in the case of his online blogs, Patel

offers simple hacks to help get your online business noticed. Once again, his

video content is always explained in layman’s terms, meaning that those with

little exposure to the online marketing space can absorb Patel’s knowledge with

ease.

Courses

While the vast majority of Neil Patel’s online content

comes at no cost, the guru also offers premium, expert-level educational

courses for those who want to take things to the next level.

One such example of this is the year-long

Advanced Marketing Program, which focuses on metrics such as performing in-depth

research on prospective clients, and engaging in competitive intelligence

research through a variety of tools.

Customer reviews of this Neil Patel course are well received by students. Joy Bender, a San Diego luxury real estate agent, says she’s grossed over $2 million, largely thanks to what she’s learned on the Advanced Marketing Program. “There is significant eye opening information, shared resources and tools, and exercises to complete for maximum potential,” she writes.

Free SEO Tools

When it comes to out-ranking your competitors on Google, engaging in keyword research is fundamental. Recognizing that this is a crucial stage of the marketing process, Neil Patel purchased popular keyword tool Ubersuggest in 2017. The entrepreneur says he paid $120,000 for the tool, which is now hosted on his site. And he hasn’t looked back, rolling out new functionalities every few months.

Prior to this initiative, users would need to pay premium subscription fees to software providers like SEMrush or Ahrefs for the data insights he offers. However, Neil Patel being the man he is, it’s all now free to use. Patel explains that his motivating reason to buying Ubersuggest was to see whether it was possible to grow his audience without engaging in content marketing.

Neil’s latest release: a free SEO analyzer

This once again highlights why Neil Patel is so

well-regarded by his global following, offering his users free, alternative

tools for drawing top-level insights.

Podcasts

Whether it’s through platforms such as Spotify,

iTunes, Google Play or SoundCloud, the popularity of podcasts is growing at an

amazing rate. With this in mind, Neil Patel launched his very own podcast in

2016, which is suitably branded as Marketing School.

Teaming up with fellow thought leader Eric Siu, the podcast provides its audience with 10 minutes worth of marketing advice each and every day. This is arguably just as valuable as Neil Patel’s other online channels, not least because it offers fresh, quick and up-to-date content on a daily basis.

Source: https://marketingschool.io/

Source: https://marketingschool.io/ Marketing School is perfect for those who don’t have the time to sit through lengthy videos or blogs, and instead prefer quick and easy access to valuable advice. Reviews of the podcast are highly positive, with listeners explaining that they love the “hit and run format” and that the podcast plays a large “part of the morning routine.”

The Verdict

Whether it’s through the entrepreneur’s free articles, videos, podcasts or SEO tools, Neil Patel is regarded as a legend in the online marketing space. Patel recognizes that his content needs to be produced in such a manner that it offers value to marketers of all shapes and sizes, which is why he has such a diverse audience.

The post Why People Love What Neil Patel Publishes Across 5 Content Formats appeared first on Entrepreneurship Life.

June 25, 2019

How to Properly Choose A Good Pest Control Service

Pest problems are the plague of many a home and business. Living with bugs

is unsanitary and unhealthy. Luckily, a good pest control service can allow you

to live pest free. Unfortunately, not every service is built the same and to

find the best pest control company to meet your needs requires a little

homework. Here are the most important things you should look for when

considering a pest control service.

Look at Their Reputation and Ratings

The first place to stop when looking for good pest control is the Internet. A good online search can provide you with ratings and reviews. These are essential to get a good feel for a company’s reputation. If vetting a service like Moxie Pest Control, take a look at what the internet has to say before you even contact them. A rule of thumb to follow is to go with the crowd. Go where all the other consumers say to go. If a service has a wide range of positive reviews, then it does a good job. If it bears high ratings, then it is overly professional. If it has high customer satisfaction, then you be sure that you will be satisfied as well. Reputation says everything about a company and you want your pest control company to have the best one out there.

Check Their Range

A fundamentally important aspect of choosing a pest control service is

making sure they can actually handle your pest problem. Pest control services

often specialize in the pests they target. Different pests require different

chemicals, equipment, and methods. Services that specialize also have years of

experience dealing with a specific type of pest. Check to see if they utilize new

forms of pest control. A service that specializes in termites will be more

adept at ridding your home of termites than one that is proficient in mice.

When taking the next step, find a service that meets your specific need.

Check Their Credentials

Only deal with services that have the specific licenses and certification for your area. You do not want to be held liable for damage to your home or harm done to others. Using a company without proper certification can leave you holding the ball. They can also scam you for a job not done properly. A company bearing the right certification and licensing is reliable and trustworthy. They will also carry the necessary insurance to protect you should the worst happen. Last thing you need is to face lawsuits for the use of harmful chemicals. Remember, such services will have no problem showing their credentials on their webpage or providing them if asked. A warning sign is any company that makes finding this documentation difficult.

Look at Additional Services

Most pest control services provide maintenance as well as eradication. This

means they will regularly spray your home or business once every three months.

Such services not only get rid of infestation but ensure that the problem does

not return. Oftentimes, such services are bundled with the cost of an

eradication. A good way to vet a service is how they offer this additional maintenance.

Regular maintenance is important to keep unwanted guests away but oftentimes

companies may try to upsell you services you do not need. Remember, outside

spraying is not needed in the winter months and you only need a spray every

three months. So if a company offers an additional service that over sprays

your area, that is worth consideration. What else are they overcharging you

for?

Do Not Only Consider Price

A big mistake to make is letting the overall cost of the job control the

company you choose. A cheap price is always wanted, but cheap does not

necessarily mean good. Always consider everything else about the company first

and look at the price last. If the company has a good reputation, then a higher

price means the job will be done right. If they have a lower price but their

reputation is iffy, you may be paying for a service that does not fix your

problem. Always look at why they charge the price they do and what exactly

comes with it. A more expensive quote may end up being cheaper in the long run

depending on what it covers. Also, be wary of any company that tries to

pressure you into choosing them. Make the decision you want to make from a

position of comfort.

The post How to Properly Choose A Good Pest Control Service appeared first on Entrepreneurship Life.

Why Working in a Coworking Space Is Ideal for a New Startup

Many startups choose to work in

coworking spaces these days. The trend is gaining momentum each year, and more

and more startups elect to work for longer periods in shared working spaces

before moving to a dedicated office. The following are some of the most

important reasons for this new trend.

Fierce Competition

Any new startup will find the

competition to be extremely fierce and even hostile. New businesses need to do

their market research very carefully to ensure that there is a viable place for

them in the community. There is also the issue of startup capital to cover the

overhead of the business until such time that it to stand on its own two feet

financially. Statistics show the harsh reality: 50% of all startup businesses

will fail in the first two years. Therefore, any action that can be taken by

the owner to reduce the operating costs can help the business have cash on hand

for more important things. That is exactly why sharing a coworking space can be

of tremendous benefit, especially during that time when a business is still

struggling to stand on its own two feet.

The Case for Coworking

In many industries, coworking

situations are frequently encountered, especially among startups. In most

cases, a businessperson will pay for a membership, the cost depending on a wide

range of options. You may require a certain number of seats to run your

business successfully, or you may require one or more dedicated desks to do

what you need to do. In such a coworking space, there

are often things such as printing services or a variety of beverages for the

convenience of people working there. There will also be telephone services that

are then debited to the various businesses using the service.

Such a coworking space provides a new

business with many benefits. There is no need to rent expensive offices or

purchase office furniture and other important resources that normally needed to

run a conventional business. The cost of those expenses is saved by using a

coworking space, which is often the saving grace of a new startup. In fact,

coworking spaces can make the difference between success and failure in a very

competitive environment. There is also no need to commit to long-term leases as

far as office space is concerned.

Looking at the Situation Objectively

Obviously, the most important reason

why startups should consider a coworking space is that it provides a more

cost-effective way of doing business. If the startup owners don’t find an

effective way to curb excessive spending, they may very quickly find themselves

in a situation where the startup’s capital is exhausted, and refinancing may

not be a viable or cost-effective option because the potential of the business

may not be sufficient to seriously consider additional finances.

It is important to approach the issue

of coworking space with the necessary care, and several things have to be taken

into consideration, such as the expected monthly costs. Furthermore, business

owners should look at the value that can be derived from that coworking space,

such as how much space is available and how many people can fit into that

available space.

Basic

Business Necessities

To run your business successfully, you may need meeting rooms and other office equipment. Another very important consideration is the future growth of that startup; therefore, the shared office space should be sufficient to allow the business to operate efficiently. In some cases, the target market of the startup might change, especially when market research has not been done properly, resulting in a location choice that later turns out to be less than perfect for that business. This situation may require the business to relocate to another part of the city where it will be closer to its target market. Such relocations can be very expensive, and once again, the option of shared office space could enable the startup to continue normally, something that would not be possible if conventional offices are leased. The problem is that there may be so many uncertainties when starting a new business and so many things for which there might not be a definite answer.

Many Things

to Consider

Even though shared office space can be

a wonderful solution, it is important that they provide all the things the

startup requires. There needs to be scanning and printing options, an internet

connection, and appliances for making coffee and other beverages so that things

are civilized and comfortable. When it comes to conventional office spaces,

business owners may have to run around and search for all the things needed to

run that business successfully. Finding all those things can be time-consuming

and expensive, but all of this can be avoided by finding adequate coworking

space from which to run your business.

The post Why Working in a Coworking Space Is Ideal for a New Startup appeared first on Entrepreneurship Life.

The Dentist’s Guide to Dental Equipment Maintenance

Maintaining your equipment is an unsung but

essential part of running a dental practice. Simply put, if your equipment

isn’t working, you can’t work on patients. The expense of replacing equipment

can run into the hundreds and thousands of dollars, making it sound financial

management to prioritize equipment maintenance. The cost of losing a customer

because your equipment wasn’t working when you needed it can be even higher

than the cost of replacing equipment. Fortunately, it’s easy to maintain your

equipment if you follow a few best practices. Following a maintenance schedule,

keeping a maintenance kit on hand and using automated tools to implement your

schedule will help ensure that you keep your equipment in top working condition.

Create a Maintenance

Schedule Checklist

With hundreds of different pieces of equipment in your dental clinic, the only way to make sure everything gets taken care of is to use a maintenance checklist. Your checklist should cover everything that needs periodic review, repair or replacement. The most efficient way to organize your checklist is to group it into items that need daily, weekly, monthly and annual attention. Daily items can include:

Flushing water through syringesFlushing water through

handpieces, sterilizing them and lubricating themFlushing handpiece waterlines

after each patient uses themLubricating prophy and contra

angles and nose cones after useDisinfecting operatory equipment

after useUsing suction cleaner on high

volume evacuators and saliva ejector tubingsCleaning traps on delivery unitsDraining and cleaning ultrasonic

cleanersChecking and disposing of

containers for hazardous waste, infectious waste and needles and other sharp

objects

Weekly items can include:

Checking handpiece gaskets and replacing any that need itChecking o-rings on handpiece couplers and replacing any that need itTesting sterilizers for biological sporesChanging delivery unit trapsInspecting for safety hazards in the workplace, such as obstructed paths, spills or loose rugs

Monthly items can include:

Sitting in patient’s chair to

review how the office looks and see what needs cleaningCleaning plaster traps and master

trapsCleaning model trimmersCleaning radiology cassettes and

intensifying screensChecking working condition of

patient monitoring equipmentChecking working condition of

anesthesiology equipment

Annual items can include:

Changing cassette seals and

gaskets for sterilizer doorsChanging compressor oilInspecting x-ray equipmentInspecting emergency fire, smoke

and lighting systemsReviewing compliance with state,

OSHA and HIPAA regulationsRunning OSHA and emergency

procedure training sessions

Use this list as a starting point, and

include any other items that apply to your office. You can write your checklist

by hand, but for best results, use an electronic format such as a spreadsheet

or app.

Keep a Maintenance Kit on

Hand

In addition to routine maintenance tasks,

there are occasional repair needs that may arise unexpectedly, and can set your

schedule back if you don’t have a prompt solution. To prepare for this, you

should keep a maintenance kit on hand. Your kit should include items such as:

Extra o-rings and gasketsHandpiece cleaners, lubes and

replacement turbines and chucks along with bur tools for replacing themExtra light bulbs for handpieces,

operatory lights and curing lightsVacuum line cleaners, air

filters, canisters and trapsAir compressor intake valves and

oil

Having these items on hand will help you

avoid unpleasant emergencies that can throw off your whole patient schedule and

potentially cost you customers.

Automate Your Maintenance

Scheduling

Because there are so many maintenance items

to remember and schedule, it’s advisable to have a system in place to make sure

tasks get done on time. Automation can assist you in making this chore easier.

One of the simplest ways to use automation

for maintenance scheduling is to create a maintenance log in an Excel

spreadsheet. List your maintenance tasks in rows, with column headings

indicating whether the task should be done daily, weekly, monthly or annually.

When a task is completed, mark the date in the corresponding cell. Be sure to

keep copies of your logs for future reference.

Another way to use automation to help you implement your maintenance schedule is to use a reminder app that sends you automatic notifications when a task is scheduled. A more sophisticated version of this strategy is to use specialized equipment maintenance software, which can include features such as work order management and warranty tracking in addition to automated reminders.

A comprehensive checklist forms the foundation for scheduling routine maintenance tasks. Keeping a maintenance kit on hand ensures that you have the tools you need to clean, repair and replace your equipment when you need to. Using automated tools for notifications and tracking will help make sure that essential maintenance tasks get done on time, keeping your equipment ready when you need it and extending its lifespan to save you money on replacement costs.

The post The Dentist’s Guide to Dental Equipment Maintenance appeared first on Entrepreneurship Life.

Online Money Transfers: Honesty is the Best Policy, but are you Getting a Fair Deal?

Plenty of

consumers will be all too familiar with the historically laborious and costly

task of sending money abroad.

The outbound UK

retail FX transfer market is worth around £60 billion a year, according to a

survey carried out by FXCintel on behalf of the Financial Conduct Authority (FCA)

in 2018.

Where

traditionally, high street banks and traditional providers were the primary way

consumers transferred money internationally, recently, online exchange

providers have gained significant traction among consumers, by leveraging lower

infrastructure costs and new technologies.

The shift to online

platforms should in theory have increased transparency for consumers. However, with

many providers overcharging customers through hidden charges, inflated exchange

rates and even using personal customers to subsidise their business custom,

that’s simply not the case. What’s worse, it’s likely thousands of customers

are losing money on their transfers without even realising.

The Advertising Standards Authority (ASA) and the FCA have been aware of companies potentially misleading customers with false advertising or incorrect rates. This has led to a handful of well-known firms having complaints upheld against them.

In 2015 the ASA

ruled that the widespread use of website “currency converters” by online FX

providers, including many of the largest ones, was potentially misleading. This

was because the interbank rate they returned could not be achieved. The FCA

agreed, it stepped in and by 2018 they were all but gone.

However, instead of replacing the potentially misleading prices

with meaningful information, many firms have chosen not to give any upfront pricing at all. They often

advertise their services as having ‘no fees’ or even as ‘free international

currency transfers’, but potential customers are not told the actual cost of

the transaction until after they have provided contact information or, in some

cases, registered. This makes it very

difficult for potential customers to shop around and compare providers.

For a while,

neither authority had enough power to put a halt to the malpractice all

together. Until 2018, when the FCA was granted new powers by HM Treasury to try

to tackle the issue at industry level rather than firm by firm, as it had

previously done. It has now produced a recommendation paper, 19/3: General standards and communication rules

for the payment services and e-money sectors.

The mission of

these new rules, that are due to come in on the 1st August, is to

ensure good price disclosure and more competition based on price. Its rules and

guidance are designed to require providers to ensure that their communications

are accurate, balanced and do not disguise, diminish or obscure important

information.

A company that goes by the same name as the

Greek goddess of disruption, Eris FX, has made it its mission to champion

transparency and bring about change to the industry, empowering consumers with

information to allow them to make an informed decision.

Money transfers and international payments specialists Eris FX is already leading the way; by displaying live rates online that update by the second, customers can clearly see the rate they’re getting compared to the interbank rate, their margin and the total amount they would get in their desired currency.

Eris prides itself in offering its

customers a transparent money transfer solution and are welcoming the new rules

that are looking to transform the industry with an injection of transparency,

to ensure that each and every consumer gets a fair deal up front.

The post Online Money Transfers: Honesty is the Best Policy, but are you Getting a Fair Deal? appeared first on Entrepreneurship Life.

How to Setup Your Own Accounting/Bookkeeping Business [2019]

Accounting and bookkeeping continue to be one of the most profitable industries for small businesses in the US. If you already have an in-depth knowledge of bookkeeping and/or years of experience in the industry, the idea of starting your own business can be very attractive.

But, once you set out on your own, you’re no longer just an accountant or bookkeeper. You’re an entrepreneur and a business owner.

Which means, in order to be successful, you need to handle more than just client’s books. You also need to manage every aspect of a business from marketing to invoicing and filing your own business taxes.

Here’s how to set up your own accounting or bookkeeping business for success in six simple steps.

1. Create a Business Plan

Even if you’re considering starting a bookkeeping business as a side gig, it’s important to start with a business plan. Not only is a business plan critical for requesting outside funding, such as a bank loan, but going through the creation process ensures that you’ve thought everything out.

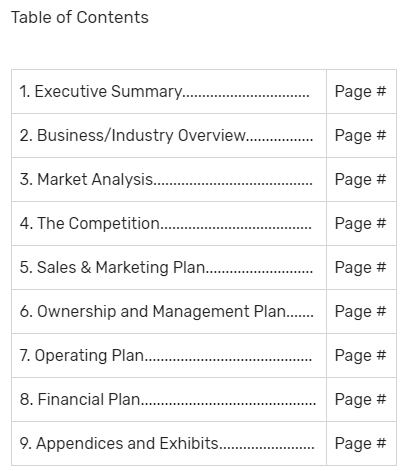

A formal business plan typically includes the following sections:

An overview of the industry. This includes the size of your industry and market pool. For instance, are you planning on offering your services locally, throughout your State, the entire US, or even globally?A market analysis. In this section, you should detail your target market. Are you aiming to serve individuals, small companies, or large businesses? Are you targeting students or seniors? Try to include as much geographic and demographic information as you can. This will help when it comes time to market your business.Competitive analysis. Who are your competitors? What advantages, strengths, and weaknesses do they each have? Where do you see opportunities? What or who are going to be the largest threats to your own business? Sales and marketing plan. This is where you need to detail your service offerings and your price points. You should also outline how you plan to advertise your business and any plans you have for drawing in new clients. Management plan. Your management plan will outline how you’re going to manage your business. If you plan to have other people working for you, will they be employees or subcontractors? What is your planned organizational structure? If you’re starting a business with a partner, this section would also outline who is responsible for what.Operating plan. This section details how and where you will operate your business from. Will your business be in-person, online, or both? Will you have a home office, or rent out space? What are your planned days and hours of operation?Financial plan. This section will outline your expected business costs, projected revenue, and any funding you believe you need in order to start up. If you’re presenting this to potential lenders, you should draft a projected balance sheet, a projected income statement, and a projected cash flow statement.

If you’re not planning on requesting funding, don’t get too hung up on the business plan. It’s more important to focus on just completing what you can, rather than getting overwhelmed and deciding to skip the whole process.

Remember, everything you write down will help create a stronger foundation for your new business. And you can always go back and add or change things later, as needed.

2. Select Your Structure

When you start up a new business, there are four common structures that you can choose to adopt:

Sole proprietorshipPartnershipLimited liability company (LLC)Corporation

Each structure has its own advantages, disadvantages, and costs associated. The structure you choose will also determine your potential personal liability if the company ends up being sued. It can also impact the amount of taxes you have to pay and your ability to raise funds for the business.

Every business and every business owner is different, so while one bookkeeping company may be a sole proprietorship, another may be a corporation.

To determine the right structure for your business, it’s important to take some time to understand your options and consider how you want to structure your business. You may also wish to consult a lawyer to help determine which type is best for you and how you can go about setting it up.

3. Get Certified

As a new business owner, you will need to work harder to establish trust and credibility. People who don’t know you may be reluctant to put their finances in the hands of a brand new company.

One of the best ways to overcome this hesitancy is to ensure you have the appropriate business credentials. For instance, if you’re a CPA, then your potential clients are more likely to trust that you have the knowledge and experience necessary to take care of their books.

If you have experience or self-taught knowledge, but no credentials, you may want to get certified before you start seeking out new clients.

Here are two options for bookkeeping accreditation:

American Institute of Professional Bookkeepers (AIPB) – To earn certification through AIPB, you must have at least 3,000 hours of relevant work experience and successfully pass a certification exam. National Association of Certified Public Bookkeepers (NACPB) – To become NACPB-certified, you must already have an Associate or Bachelor’s degree in Accounting, and you need to pass an exam.

4. Invest in Accounting Software

As a professional bookkeeper or accountant, you’re going to need accounting software. Not only to help you manage your clients’ accounts but also to help you track and manage your own business’ accounting.

Determining which software to select can seem overwhelming, as there are so many options to choose from. However, one of the most important things to keep in mind is that you need a flexible solution that can grow with your business.

You don’t want to fork out a lot of cash for something much larger and more complex than you currently need. But, you also don’t want to have to switch solutions every year or two as your business grows.

By choosing a solution such as a Manager, you can start out with a completely free option and upgrade as your business grows. All without the hassle of switching platforms, migrating data, or having to learn a new tool.

5. Set Up Operations

Any business comes with a host of paperwork and administrative tasks. Before you’re ready to open your doors to new clients, you’ll need to take care of the following:

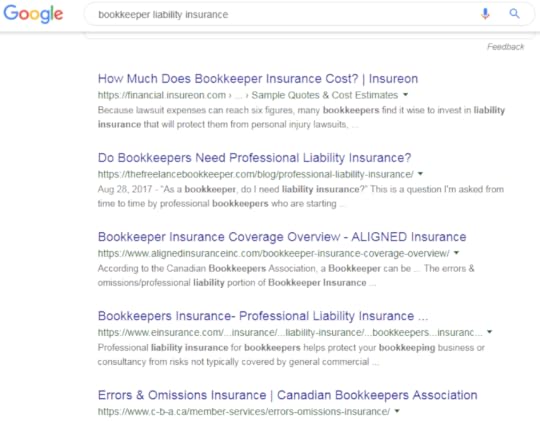

Select a business name. You’ll need to name your company before you can start advertising. If you incorporate, you’ll also need to register the company and ensure someone else hasn’t already taken that name. Set up an office. Before serving clients, you’ll need a location to work from. If your business is going to be online only, this may be a home office. Otherwise, you may need to rent or lease space somewhere that you can meet clients. Set up a separate bank account. It’s important to keep your business income and expenses separate from your personal finances. Even if you set up a sole proprietorship, having a separate account for your business makes tax time a lot easier. Set up your contact channels. Even with a home office, you may want a separate phone number for your business. You may also want to set up a PO Box to allow for business mail while keeping your home address private. Check out bookkeepers insurance. As a bookkeeper, you will need liability protection in case you ever make a mistake in one of your client’s books. Do a Google search for “bookkeeper liability insurance” and get quotes from a few companies in order to find the best rate. Get your supplies. You will likely need everything from printer ink and paper to business cards for your new business. Make sure you have all of your basic supplies stocked in advance. You don’t want to meet with a client only to realize you have no pens.

6. Setup A Website

Even if you’re only planning on bringing in local clients, you still need a website.

Fortunately, you can set up a free WordPress, Wix, or Weebly website. All three sites are relatively intuitive and easy to set up, even if you have no website building experience.

At a minimum, you should have a home page, an overview of your services, some information about yourself, and a contact page. Check out your competition and other well-known accounting and bookkeeping websites to get a good idea on what else to include on your site.

Although a website is critical, you need more than one way to draw in business, especially as you’re building up your reputation.

7. Market Your Business

Now that everything is set up and ready to go, all that’s left is to start bringing in clients.

Here are some marketing suggestions to help you find new clients:

Ask friends and family members for their business and/or a referral.Put out a local ad in the papers, on Craigslist, or posted up around town.Advertise on LinkedIn and other social channels.Attend networking events where your ideal client might be.Get referrals and testimonials from clients, or past bosses and coworkers –- anyone who can testify that you’re knowledgeable, reliable, and capable. Do a Google search for bookkeeper freelance jobs and agencies.Join a local group of bookkeepers and accountants.Cold call or email businesses in your target market.

If you’ve started your own accounting or bookkeeping business and have any tips for aspiring business owners reading this article please let them know in the comments.

The post How to Setup Your Own Accounting/Bookkeeping Business [2019] appeared first on Entrepreneurship Life.