Jonathan Clements's Blog, page 257

October 31, 2021

Taking the Slow Road

A FEW WEEKS BACK, I talked about the��good-is-better-than-perfect��principle. A close corollary: Approach financial decisions incrementally. What do I mean by that? An example is dollar-cost averaging, where you invest a sum of money in regular increments, rather than all at once.

Does dollar-cost averaging guarantee a better outcome? No. But it takes what would be one big decision and breaks it into several smaller ones. The benefit: Each of those smaller decisions ends up carrying lower stakes. Just as important, when a decision is broken down like this, there���s more room for flexibility, so you can iterate and adjust to new information.

Here are eight other situations where you might consider making decisions incrementally:

1. Asset allocation.��Suppose you���ve decided to change your asset allocation. You could do it all at once. Sometimes, that���s advisable. But in many cases, it makes sense to move incrementally, for this reason: It���s often hard to know how you���ll like something until you���ve tried it.

Think about it like adjusting the heat in your home. You might start by turning the thermostat to 70. But when it gets there, you might decide it���s still a little cool. Then you'd bump it up another few degrees. It���s the same with your investments. It���s very hard to know how a particular portfolio will feel, especially from a risk perspective, until you���ve tried it and lived with it for a while. To be sure, you don���t want to make adjustments every day. But if you���re considering a big move, it might make sense to take it one step at a time.

2. Rebalancing.��Last year, as I���m sure you recall, the stock market dropped sharply in the early days of the pandemic. It was a great opportunity to rebalance and buy stocks at a discount. But it wasn���t easy. After hitting a peak on Feb. 19, the market declined 8% over the following week. That might have looked like a good buying opportunity, especially because the market staged a little bit of a recovery over the subsequent week.

But a week after that, it was down 19%. And a week after that, 29%. Ultimately, on March 23, it hit bottom 34% below its prior peak. With the benefit of hindsight, that would have been the perfect date on which to rebalance. But no one could have known that while we were in the middle of it. That���s why I think rebalancing is best done incrementally. You���ll never get it perfectly right, but you might get it more right than if you tried to pick one date and do it all at once.

3. 529 contributions.��How much should you contribute to a 529 account for your children or grandchildren? The answer: It depends. Think of all the unknowns: where they���ll go to school, whether they���ll go to graduate school, the rate of tuition increases at those schools, whether they���ll earn scholarships and, of course, how fast your investments grow.

For all these reasons, unless the market is really depressed, I generally don���t recommend taking advantage of the five-year frontloading provision allowed by the 529 rules. Instead, I think it���s best to take it year by year. That gives you the opportunity to adjust your contributions over time, as each of the unknowns comes into better focus.

4. New investments.��For better or worse, financial markets always deliver something new to worry about. This year, it���s��inflation. A few years ago, it was rising��interest rates. A few years before that, it was the dollar���s��appreciation.

In response to each new worry, the mutual fund industry happily devises new products and strategies. The problem, though, is that nothing is permanent. Sometimes, these worries fade. Sometimes, they even reverse. You don���t want to reformulate your portfolio in response to every piece of news. At the same time, the world does change, so you can���t ignore every new development. That���s why I���d take an incremental approach when making big portfolio changes.

5. Roth conversions.��This��can be a terrific strategy. While it makes sense to map out a multi-year plan for conversions, the reality is that you���ll still need to take it year by year. Why���s that? The key to successful Roth conversions is to keep your taxable income below a targeted tax bracket. As a result, you���ll want to revisit the calculation each year���usually around this time of year, when you have a good sense of your other income. Another reason to take it incrementally: As we���re witnessing in real time, Congress can change the tax brackets at any time, upending previous calculations.

6. Concentrated positions.��If you have a big position in a single stock, you may be wondering what the right strategy is. You could hold on to it, but that carries risk if the company runs into trouble. On the other hand, you could sell it, but that could carry tax consequences. It could also lead to regret, should the stock continue to rise. You could, of course, donate it. But that only makes sense if you don���t need the money.

My solution: Make a long-term sale plan���like a dollar-cost averaging program, but in reverse. Suppose you have 10,000 shares of something. You could sell 1,000 shares every year for 10 years. Will this be the optimal approach? Of course not. But I see it as a reasonable way to balance all the risks.

7. Gifting.��If your portfolio has seen big gains in recent years, you might be thinking about gifting to the next generation. But at the same time, you might worry about the impact. It can be a problem if children receive too big a windfall too quickly. That���s why I recommend an incremental approach. If you start with small gifts, any mistakes children make with these funds will carry low stakes, plus it gives them an opportunity to learn before you increase the amounts.

8. Debt.��If you���re in a position to pay off a significant loan, such as a mortgage or student loan, should you? The way I look at it, paying off a loan involves a tradeoff: Pay it off, and you���ll lower your monthly cash needs. But you���ll also reduce your cash reserves. On the other hand, if you keep the loan, your cash reserves will be higher, but so will your monthly cash needs. If you had perfect information about your future income and expenses, this might be an easy decision. In the absence of that, this is another area where you might take it one step at a time.

Adam M. Grossman��is the founder of Mayport, a fixed-fee wealth management firm. Sign up for Adam's Daily Ideas email, follow him on Twitter @AdamMGrossman��and check out his earlier articles.

Adam M. Grossman��is the founder of Mayport, a fixed-fee wealth management firm. Sign up for Adam's Daily Ideas email, follow him on Twitter @AdamMGrossman��and check out his earlier articles.

Does dollar-cost averaging guarantee a better outcome? No. But it takes what would be one big decision and breaks it into several smaller ones. The benefit: Each of those smaller decisions ends up carrying lower stakes. Just as important, when a decision is broken down like this, there���s more room for flexibility, so you can iterate and adjust to new information.

Here are eight other situations where you might consider making decisions incrementally:

1. Asset allocation.��Suppose you���ve decided to change your asset allocation. You could do it all at once. Sometimes, that���s advisable. But in many cases, it makes sense to move incrementally, for this reason: It���s often hard to know how you���ll like something until you���ve tried it.

Think about it like adjusting the heat in your home. You might start by turning the thermostat to 70. But when it gets there, you might decide it���s still a little cool. Then you'd bump it up another few degrees. It���s the same with your investments. It���s very hard to know how a particular portfolio will feel, especially from a risk perspective, until you���ve tried it and lived with it for a while. To be sure, you don���t want to make adjustments every day. But if you���re considering a big move, it might make sense to take it one step at a time.

2. Rebalancing.��Last year, as I���m sure you recall, the stock market dropped sharply in the early days of the pandemic. It was a great opportunity to rebalance and buy stocks at a discount. But it wasn���t easy. After hitting a peak on Feb. 19, the market declined 8% over the following week. That might have looked like a good buying opportunity, especially because the market staged a little bit of a recovery over the subsequent week.

But a week after that, it was down 19%. And a week after that, 29%. Ultimately, on March 23, it hit bottom 34% below its prior peak. With the benefit of hindsight, that would have been the perfect date on which to rebalance. But no one could have known that while we were in the middle of it. That���s why I think rebalancing is best done incrementally. You���ll never get it perfectly right, but you might get it more right than if you tried to pick one date and do it all at once.

3. 529 contributions.��How much should you contribute to a 529 account for your children or grandchildren? The answer: It depends. Think of all the unknowns: where they���ll go to school, whether they���ll go to graduate school, the rate of tuition increases at those schools, whether they���ll earn scholarships and, of course, how fast your investments grow.

For all these reasons, unless the market is really depressed, I generally don���t recommend taking advantage of the five-year frontloading provision allowed by the 529 rules. Instead, I think it���s best to take it year by year. That gives you the opportunity to adjust your contributions over time, as each of the unknowns comes into better focus.

4. New investments.��For better or worse, financial markets always deliver something new to worry about. This year, it���s��inflation. A few years ago, it was rising��interest rates. A few years before that, it was the dollar���s��appreciation.

In response to each new worry, the mutual fund industry happily devises new products and strategies. The problem, though, is that nothing is permanent. Sometimes, these worries fade. Sometimes, they even reverse. You don���t want to reformulate your portfolio in response to every piece of news. At the same time, the world does change, so you can���t ignore every new development. That���s why I���d take an incremental approach when making big portfolio changes.

5. Roth conversions.��This��can be a terrific strategy. While it makes sense to map out a multi-year plan for conversions, the reality is that you���ll still need to take it year by year. Why���s that? The key to successful Roth conversions is to keep your taxable income below a targeted tax bracket. As a result, you���ll want to revisit the calculation each year���usually around this time of year, when you have a good sense of your other income. Another reason to take it incrementally: As we���re witnessing in real time, Congress can change the tax brackets at any time, upending previous calculations.

6. Concentrated positions.��If you have a big position in a single stock, you may be wondering what the right strategy is. You could hold on to it, but that carries risk if the company runs into trouble. On the other hand, you could sell it, but that could carry tax consequences. It could also lead to regret, should the stock continue to rise. You could, of course, donate it. But that only makes sense if you don���t need the money.

My solution: Make a long-term sale plan���like a dollar-cost averaging program, but in reverse. Suppose you have 10,000 shares of something. You could sell 1,000 shares every year for 10 years. Will this be the optimal approach? Of course not. But I see it as a reasonable way to balance all the risks.

7. Gifting.��If your portfolio has seen big gains in recent years, you might be thinking about gifting to the next generation. But at the same time, you might worry about the impact. It can be a problem if children receive too big a windfall too quickly. That���s why I recommend an incremental approach. If you start with small gifts, any mistakes children make with these funds will carry low stakes, plus it gives them an opportunity to learn before you increase the amounts.

8. Debt.��If you���re in a position to pay off a significant loan, such as a mortgage or student loan, should you? The way I look at it, paying off a loan involves a tradeoff: Pay it off, and you���ll lower your monthly cash needs. But you���ll also reduce your cash reserves. On the other hand, if you keep the loan, your cash reserves will be higher, but so will your monthly cash needs. If you had perfect information about your future income and expenses, this might be an easy decision. In the absence of that, this is another area where you might take it one step at a time.

Adam M. Grossman��is the founder of Mayport, a fixed-fee wealth management firm. Sign up for Adam's Daily Ideas email, follow him on Twitter @AdamMGrossman��and check out his earlier articles.

Adam M. Grossman��is the founder of Mayport, a fixed-fee wealth management firm. Sign up for Adam's Daily Ideas email, follow him on Twitter @AdamMGrossman��and check out his earlier articles.The post Taking the Slow Road appeared first on HumbleDollar.

Published on October 31, 2021 00:00

October 30, 2021

Meeting Demand

OUR HIGH SCHOOL principal returned from a teacher recruitment fair and announced to the school board, ���Tell your children or grandchildren: Do not get a degree in elementary education.��� He went to the recruitment fair looking to hire some very specific specialty teachers for the high school. He mostly met new grads with credentials to teach elementary school���who were looking for jobs that simply don���t exist in our region.

Our superintendent explained that our region had several large, well-known schools of education that turned out far more teachers than were needed locally. But he also noted that this was not a national issue. Ample signing bonuses were available for elementary school teachers in high-growth southern and western states.

New college grads are living in Mom and Dad���s basement because the degrees they earned didn���t translate into jobs. Career planning, preferably conducted in high school, should include an understanding of in-demand jobs. There are certain jobs where the openings greatly exceed the supply and where future growth is expected. In many cases, these in-demand jobs don���t require a college degree���and yet they���re more lucrative than many jobs that do. In our heavy-manufacturing area, employers are begging for welders and machinists. Skilled trades are another in-demand route.

As the elementary school teacher issue shows, ���in demand��� can vary geographically. As young people think about their career, they need to honestly assess where they���re willing to live. If they���re truly willing to move, it opens up more opportunities. For instance, there might be a huge need for aerospace engineers, but there are just a few specific areas of the country where those jobs will be plentiful.

In Ohio, where I live, the state jobs agency, Ohio Means Jobs, points students and adults to in-demand jobs in our state. Web searches can yield similar information for other states, including Michigan, North Carolina and Colorado. The Bureau of Labor Statistics identifies high-growth occupations from a national perspective. There���s also national data aimed specifically at women in the workforce.

These resources can be a good starting point. Students then need to consider how the data meshes with their skills and aptitude���and whether the location of these jobs matches up with their desires.

Our superintendent explained that our region had several large, well-known schools of education that turned out far more teachers than were needed locally. But he also noted that this was not a national issue. Ample signing bonuses were available for elementary school teachers in high-growth southern and western states.

New college grads are living in Mom and Dad���s basement because the degrees they earned didn���t translate into jobs. Career planning, preferably conducted in high school, should include an understanding of in-demand jobs. There are certain jobs where the openings greatly exceed the supply and where future growth is expected. In many cases, these in-demand jobs don���t require a college degree���and yet they���re more lucrative than many jobs that do. In our heavy-manufacturing area, employers are begging for welders and machinists. Skilled trades are another in-demand route.

As the elementary school teacher issue shows, ���in demand��� can vary geographically. As young people think about their career, they need to honestly assess where they���re willing to live. If they���re truly willing to move, it opens up more opportunities. For instance, there might be a huge need for aerospace engineers, but there are just a few specific areas of the country where those jobs will be plentiful.

In Ohio, where I live, the state jobs agency, Ohio Means Jobs, points students and adults to in-demand jobs in our state. Web searches can yield similar information for other states, including Michigan, North Carolina and Colorado. The Bureau of Labor Statistics identifies high-growth occupations from a national perspective. There���s also national data aimed specifically at women in the workforce.

These resources can be a good starting point. Students then need to consider how the data meshes with their skills and aptitude���and whether the location of these jobs matches up with their desires.

The post Meeting Demand appeared first on HumbleDollar.

Published on October 30, 2021 09:44

October 29, 2021

Three Questions

HOW DO WE KNOW��we're ready to retire? When I posted a link to Mike Drak���s recent article on HumbleDollar���s Facebook page, one commenter offered three questions that those approaching retirement should ask themselves:

1. Do I have enough? This, of course, is the question that gets asked most often. Do we have the financial wherewithal to carry us through a long and comfortable retirement?

2. Have I had enough? This may be easy to answer for folks who are lukewarm about their work, but much tougher if we enjoy our job, including not just what we do each workday, but also the folks we interact with and the sense of identity that our job offers. An added issue: If we quit and discover we���ve given up something we love, it���s unlikely we can get our old job back.

3. Will I have enough to do? Even in retirement, we need a reason to get out of bed each morning. What will give us a sense of purpose once we quit the workforce? My hunch: If we struggle with question no. 2, it���s especially important to have a good answer to no. 3���because we���ll need to replace the satisfaction we got from our job with retirement activities that we find equally fulfilling.

1. Do I have enough? This, of course, is the question that gets asked most often. Do we have the financial wherewithal to carry us through a long and comfortable retirement?

2. Have I had enough? This may be easy to answer for folks who are lukewarm about their work, but much tougher if we enjoy our job, including not just what we do each workday, but also the folks we interact with and the sense of identity that our job offers. An added issue: If we quit and discover we���ve given up something we love, it���s unlikely we can get our old job back.

3. Will I have enough to do? Even in retirement, we need a reason to get out of bed each morning. What will give us a sense of purpose once we quit the workforce? My hunch: If we struggle with question no. 2, it���s especially important to have a good answer to no. 3���because we���ll need to replace the satisfaction we got from our job with retirement activities that we find equally fulfilling.

The post Three Questions appeared first on HumbleDollar.

Published on October 29, 2021 23:36

No Bonds for Me

BEFORE THE FIRST World War, serious investors invested serious money in bonds, real estate and railroad shares. Other stocks were deemed ���speculative��� and ���not investment quality.��� Then came Edgar Lawrence Smith and his extensive 1924 study, Common Stocks as Long Term Investments, in which he documented the higher returns to be had by investing in stocks.

Soon, the focus of institutional and individual investors was centered on stocks, but bonds were still considered important for every investor���s portfolio. Life insurance companies and public pension funds typically continued to hold more than 90% in bonds. But private pension funds and personal trusts became more evenly balanced, often with a 60-40 or 40-60 mix of stocks and bonds. Even so, for long-term investors, the opportunity cost of holding significant investments in bonds has been large���and it���s likely to continue to be so.

With record-low interest rates, investors would be wise to recall the words from Lincoln���s 1862 message to Congress: ���As our case is new, so must we think anew, and act anew.���

Nominal yields on 10-year Treasury notes are near record lows. The Federal Reserve has been striving to fulfill its responsibility for guiding the economy toward full employment by buying bonds in bulk and driving down interest rates. While admiring the Fed for doing its duty so skillfully, investors would be wise to take a fresh look at the conventional thinking about bonds as important long-term investments.

When the Fed decides at a future date to let interest rates move to their natural level, we all know that those rates will be higher. Getting to those higher rates will mean a reduction in bond prices from current levels. Not only are bond holders already losing money because���net of inflation���yields are negative, but also holding bonds today means knowingly accepting future capital losses when rates are allowed to rise, which will drive down the price of existing bonds.

Why do bond investors, then, continue to own bonds? Habit is one ���reason��� but hardly sufficient to justify a major commitment of real money. Another reason investors do so: to reduce exposure to stock prices that are also mighty high and that fluctuate more than many investors can comfortably tolerate.

But we must also face that being irrational, including focusing excessively on short-term results, is endemic to us all. That���s why it���s important to study behavioral economics, and why Daniel Kahneman���s book Thinking, Fast and Slow is so richly entertaining and educational.

But back to Lincoln and thinking anew.

Does owning bonds make sense? Yes, it does for funds we know we���ll spend in the near term, say the next five years or less. This can be for buying a new home, or paying college tuition, or covering a gap between current earned income and current expenses. Calculating our near-term need for bonds in this mathematical fashion helps offset our probably irrational feelings about today���s unusual market environment.

One way to uncover our true feelings about the market is to challenge ourselves with a series of questions. How would we feel if the stock market dropped next week by 10%, 20% or 30%? What would we then do? What would we most wish we���d done differently? Then ask: If we could do something differently, what would we do and when would we have done it?

Pretty soon, we���re back to the hard reality that market timing is so very difficult. Most of the time, most of us aren���t successful at both getting out and getting back into the stock market. We might want to be realistic about the limits of our forecasting abilities, and about the costs that come with being long-term owners of bonds.

Just as our fingerprints and the irises of our eyes make us unique and identifiable, so each investor is also unique. When we sort people by age and life expectancy, by income, wealth, ability to save, attitudes toward risk, experience with investing and so on, we find that no two of us are alike.

Since each of us is unique, our best-for-me investing program will also be unique. This applies directly to our best-for-me decisions about bonds. To illustrate, take the conventional canard: Invest your age in bonds.

First, a confession: I am 84 and own no bonds today���and certainly not 84% in bonds. I have never owned bonds and never expect to. Why not?

All my adult life, I���ve earned enough to cover all of our family���s expenses. Still do. Over the long term, my investments���largely in low-cost stock index funds and Berkshire Hathaway���have been wonderfully rewarding. Even now, in my mid-80s, most of my investments will be converted into spending not by me, but by family members, particularly my grandchildren, whose average age is 12. My investments will be spent many long years from now.

One of the great joys of my very lucky life has been the benefits of learning about investing. If you���re considering incurring the heavy opportunity costs of investing a lot in bonds instead of stocks, you might decide to commit a few weeks to reading the best books ever written on investing, including Warren Buffett���s Essays , Burton Malkiel���s A Random Walk Down Wall Street and David Swensen���s Unconventional Success . To immerse yourself in a once-in-a-lifetime study would be one of the most rewarding���and interesting ways���to help yourself.

Latest Posts

HERE ARE THE SIX other articles published by HumbleDollar this week:

Picking health insurance for 2022? Rick Connor's advice: The best deal may be the low-premium plan with a high out-of-pocket maximum���especially if it lets you fund a health savings account.

"The odds of a recession are rising," argues John Lim. "At a minimum, investors need to be mentally prepared for a rough stretch in the economy and the financial markets."

How'd you like to realize $1,000 in capital gains���and pay more than $1,000 in taxes? Thanks to Medicare premium surcharges, that's what those age 63 and over are looking at, calculates James McGlynn.

���To monitor overall performance is humbling,��� writes Bill Ehart. ���If you���re like me, you eventually realize how much your cockamamie market-beating schemes have lagged the market.���

What books have had the biggest impact on your thinking? Mike Drak names his two favorites.

"Know your definition of 'winning'," advises Adam Grossman. "Is there some number that you define as enough? Or are you trying to grow your investments to as large a number as possible?"

Also be sure to check out the past week's��blog posts, including Sanjib Saha on simplicity, Dennis Friedman on Medicare, Mike Zaccardi on stagflation, Howard Rohleder on Medicare Advantage, Greg Spears on taxing the rich and Dick Quinn on universal health coverage.

Charles D. Ellis is the author of 18 books, including Winning the Loser���s Game,��which is now in its 8th edition, with 600,000 copies sold. Charley has taught investing courses at both Yale and Harvard business schools, and he served for 17 years on Yale���s investment committee. Check out his earlier articles.

Charles D. Ellis is the author of 18 books, including Winning the Loser���s Game,��which is now in its 8th edition, with 600,000 copies sold. Charley has taught investing courses at both Yale and Harvard business schools, and he served for 17 years on Yale���s investment committee. Check out his earlier articles.

Soon, the focus of institutional and individual investors was centered on stocks, but bonds were still considered important for every investor���s portfolio. Life insurance companies and public pension funds typically continued to hold more than 90% in bonds. But private pension funds and personal trusts became more evenly balanced, often with a 60-40 or 40-60 mix of stocks and bonds. Even so, for long-term investors, the opportunity cost of holding significant investments in bonds has been large���and it���s likely to continue to be so.

With record-low interest rates, investors would be wise to recall the words from Lincoln���s 1862 message to Congress: ���As our case is new, so must we think anew, and act anew.���

Nominal yields on 10-year Treasury notes are near record lows. The Federal Reserve has been striving to fulfill its responsibility for guiding the economy toward full employment by buying bonds in bulk and driving down interest rates. While admiring the Fed for doing its duty so skillfully, investors would be wise to take a fresh look at the conventional thinking about bonds as important long-term investments.

When the Fed decides at a future date to let interest rates move to their natural level, we all know that those rates will be higher. Getting to those higher rates will mean a reduction in bond prices from current levels. Not only are bond holders already losing money because���net of inflation���yields are negative, but also holding bonds today means knowingly accepting future capital losses when rates are allowed to rise, which will drive down the price of existing bonds.

Why do bond investors, then, continue to own bonds? Habit is one ���reason��� but hardly sufficient to justify a major commitment of real money. Another reason investors do so: to reduce exposure to stock prices that are also mighty high and that fluctuate more than many investors can comfortably tolerate.

But we must also face that being irrational, including focusing excessively on short-term results, is endemic to us all. That���s why it���s important to study behavioral economics, and why Daniel Kahneman���s book Thinking, Fast and Slow is so richly entertaining and educational.

But back to Lincoln and thinking anew.

Does owning bonds make sense? Yes, it does for funds we know we���ll spend in the near term, say the next five years or less. This can be for buying a new home, or paying college tuition, or covering a gap between current earned income and current expenses. Calculating our near-term need for bonds in this mathematical fashion helps offset our probably irrational feelings about today���s unusual market environment.

One way to uncover our true feelings about the market is to challenge ourselves with a series of questions. How would we feel if the stock market dropped next week by 10%, 20% or 30%? What would we then do? What would we most wish we���d done differently? Then ask: If we could do something differently, what would we do and when would we have done it?

Pretty soon, we���re back to the hard reality that market timing is so very difficult. Most of the time, most of us aren���t successful at both getting out and getting back into the stock market. We might want to be realistic about the limits of our forecasting abilities, and about the costs that come with being long-term owners of bonds.

Just as our fingerprints and the irises of our eyes make us unique and identifiable, so each investor is also unique. When we sort people by age and life expectancy, by income, wealth, ability to save, attitudes toward risk, experience with investing and so on, we find that no two of us are alike.

Since each of us is unique, our best-for-me investing program will also be unique. This applies directly to our best-for-me decisions about bonds. To illustrate, take the conventional canard: Invest your age in bonds.

First, a confession: I am 84 and own no bonds today���and certainly not 84% in bonds. I have never owned bonds and never expect to. Why not?

All my adult life, I���ve earned enough to cover all of our family���s expenses. Still do. Over the long term, my investments���largely in low-cost stock index funds and Berkshire Hathaway���have been wonderfully rewarding. Even now, in my mid-80s, most of my investments will be converted into spending not by me, but by family members, particularly my grandchildren, whose average age is 12. My investments will be spent many long years from now.

One of the great joys of my very lucky life has been the benefits of learning about investing. If you���re considering incurring the heavy opportunity costs of investing a lot in bonds instead of stocks, you might decide to commit a few weeks to reading the best books ever written on investing, including Warren Buffett���s Essays , Burton Malkiel���s A Random Walk Down Wall Street and David Swensen���s Unconventional Success . To immerse yourself in a once-in-a-lifetime study would be one of the most rewarding���and interesting ways���to help yourself.

Latest Posts

HERE ARE THE SIX other articles published by HumbleDollar this week:

Picking health insurance for 2022? Rick Connor's advice: The best deal may be the low-premium plan with a high out-of-pocket maximum���especially if it lets you fund a health savings account.

"The odds of a recession are rising," argues John Lim. "At a minimum, investors need to be mentally prepared for a rough stretch in the economy and the financial markets."

How'd you like to realize $1,000 in capital gains���and pay more than $1,000 in taxes? Thanks to Medicare premium surcharges, that's what those age 63 and over are looking at, calculates James McGlynn.

���To monitor overall performance is humbling,��� writes Bill Ehart. ���If you���re like me, you eventually realize how much your cockamamie market-beating schemes have lagged the market.���

What books have had the biggest impact on your thinking? Mike Drak names his two favorites.

"Know your definition of 'winning'," advises Adam Grossman. "Is there some number that you define as enough? Or are you trying to grow your investments to as large a number as possible?"

Also be sure to check out the past week's��blog posts, including Sanjib Saha on simplicity, Dennis Friedman on Medicare, Mike Zaccardi on stagflation, Howard Rohleder on Medicare Advantage, Greg Spears on taxing the rich and Dick Quinn on universal health coverage.

Charles D. Ellis is the author of 18 books, including Winning the Loser���s Game,��which is now in its 8th edition, with 600,000 copies sold. Charley has taught investing courses at both Yale and Harvard business schools, and he served for 17 years on Yale���s investment committee. Check out his earlier articles.

Charles D. Ellis is the author of 18 books, including Winning the Loser���s Game,��which is now in its 8th edition, with 600,000 copies sold. Charley has taught investing courses at both Yale and Harvard business schools, and he served for 17 years on Yale���s investment committee. Check out his earlier articles.The post No Bonds for Me appeared first on HumbleDollar.

Published on October 29, 2021 22:00

Rare Feat

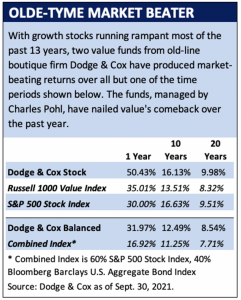

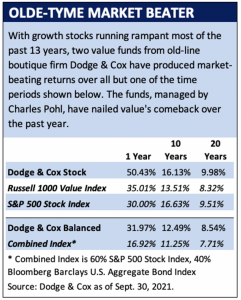

AFTER A 13-YEAR drought, value stocks surged over the past year, and arguably no fund rode the wave better than the venerable Dodge & Cox Stock Fund (symbol: DODGX), which was launched in 1965. Long one of the largest and most respected mutual funds, it’s run by a nine-member investment committee, though the fund is perhaps most associated with Charles Pohl, who has been a manager for 30 years and is set to retire in 2022. Turns out he’s beaten the market the entire time.

In an era when we’re used to eye-popping gains, the fund’s 53% return in the year ended Oct. 22 ought to grab attention. That 53% is well ahead of the Vanguard 500 Index Fund (+33%), as well as the huge winners from the past five years, like Invesco QQQ Trust (+32%) and the ARK Innovation ETF (+21%). It’s also ahead of fellow giant value funds Vanguard Windsor (+46%) and Windsor II (+42%).

According to a fund report by Morningstar, Pohl and his colleagues stuck with hard-hit energy and financial names through the pandemic bear market and added on weakness, scoring with top holdings like Capital One Financial.

Returns cited on Dodge & Cox’s site go back 20 years. The fund beat both the S&P 500 Index and the Russell 1000 Value Index during that time. One publication, citing data from Morningstar Direct that I don’t have access to, says the fund has handily beaten both benchmarks from the time Pohl took over in early 1992 through 2020. Pohl also has managed the equity portion of the Dodge & Cox Balanced Fund during that time.

Returns cited on Dodge & Cox’s site go back 20 years. The fund beat both the S&P 500 Index and the Russell 1000 Value Index during that time. One publication, citing data from Morningstar Direct that I don’t have access to, says the fund has handily beaten both benchmarks from the time Pohl took over in early 1992 through 2020. Pohl also has managed the equity portion of the Dodge & Cox Balanced Fund during that time.

Even the late Jack Bogle, Vanguard Group’s founder and a big proponent of the notion that trying to beat the indexes was futile, said the stock-picking team at Dodge & Cox was among the few he would recommend. I only recall two other managers garnering such praise, but their days have long past: Peter Lynch, former manager of the growth-oriented Fidelity Magellan Fund, and the late John Neff, who ran Vanguard Windsor Fund.

Dodge & Cox stumbled during the Great Financial Crisis, causing changes in the investment process, but has since roared back, as you can see in the accompanying table. Indeed, even though value was out of favor from 2007 through late 2020, Dodge & Cox Stock Fund beat the S&P 500 over the past 20 years.

While Pohl will retire next June, Morningstar says it has confidence in the fund’s succession plan. During Pohl’s tenure, index funds came to dominate. The pursuit of “top fund managers,” which sustained many a financial magazine back in the day, seems so 20th century.

Will Dodge & Cox continue to perform well? Nobody knows. Still, it offers two attributes much loved by index-fund investors. First, the fund’s expense ratio is just 0.52%, modest for an actively managed fund. Second, its portfolio turnover rate over the past five years has averaged a glacial 17%, meaning the fund typically holds stocks for almost six years. Such attention to costs doesn’t guarantee the fund will continue to beat the market. But it should ensure that shareholders collect a decent chunk of whatever the fund does earn.

In an era when we’re used to eye-popping gains, the fund’s 53% return in the year ended Oct. 22 ought to grab attention. That 53% is well ahead of the Vanguard 500 Index Fund (+33%), as well as the huge winners from the past five years, like Invesco QQQ Trust (+32%) and the ARK Innovation ETF (+21%). It’s also ahead of fellow giant value funds Vanguard Windsor (+46%) and Windsor II (+42%).

According to a fund report by Morningstar, Pohl and his colleagues stuck with hard-hit energy and financial names through the pandemic bear market and added on weakness, scoring with top holdings like Capital One Financial.

Returns cited on Dodge & Cox’s site go back 20 years. The fund beat both the S&P 500 Index and the Russell 1000 Value Index during that time. One publication, citing data from Morningstar Direct that I don’t have access to, says the fund has handily beaten both benchmarks from the time Pohl took over in early 1992 through 2020. Pohl also has managed the equity portion of the Dodge & Cox Balanced Fund during that time.

Returns cited on Dodge & Cox’s site go back 20 years. The fund beat both the S&P 500 Index and the Russell 1000 Value Index during that time. One publication, citing data from Morningstar Direct that I don’t have access to, says the fund has handily beaten both benchmarks from the time Pohl took over in early 1992 through 2020. Pohl also has managed the equity portion of the Dodge & Cox Balanced Fund during that time.Even the late Jack Bogle, Vanguard Group’s founder and a big proponent of the notion that trying to beat the indexes was futile, said the stock-picking team at Dodge & Cox was among the few he would recommend. I only recall two other managers garnering such praise, but their days have long past: Peter Lynch, former manager of the growth-oriented Fidelity Magellan Fund, and the late John Neff, who ran Vanguard Windsor Fund.

Dodge & Cox stumbled during the Great Financial Crisis, causing changes in the investment process, but has since roared back, as you can see in the accompanying table. Indeed, even though value was out of favor from 2007 through late 2020, Dodge & Cox Stock Fund beat the S&P 500 over the past 20 years.

While Pohl will retire next June, Morningstar says it has confidence in the fund’s succession plan. During Pohl’s tenure, index funds came to dominate. The pursuit of “top fund managers,” which sustained many a financial magazine back in the day, seems so 20th century.

Will Dodge & Cox continue to perform well? Nobody knows. Still, it offers two attributes much loved by index-fund investors. First, the fund’s expense ratio is just 0.52%, modest for an actively managed fund. Second, its portfolio turnover rate over the past five years has averaged a glacial 17%, meaning the fund typically holds stocks for almost six years. Such attention to costs doesn’t guarantee the fund will continue to beat the market. But it should ensure that shareholders collect a decent chunk of whatever the fund does earn.

The post Rare Feat appeared first on HumbleDollar.

Published on October 29, 2021 01:08

Books to Live By

I READ A LOT—and every now and then I come across an “aha” book that ends up changing the course of my life. Here are two of the most important:

How to Retire Happy, Wild, and Free by Ernie Zelinski

In my mid-50s, I wasn’t happy in my banking job. The stress was starting to get to me. Don’t get me wrong: I was good at my job and it paid well. But it no longer gave me what I needed. The thrill was gone. I had no personal goals, no real purpose. Just hanging on ‘til the finish line isn’t a very good way to go through life.

I read somewhere that, to de-stress, it was helpful to go for a walk. At lunchtime, I’d go out for a stroll. I would usually walk to the local pharmacy to test my blood pressure. More often than not, it would be red-lining.

I knew I had to do something before something bad happened. But it’s hard to leave a good-paying job late in your career. I can’t tell you how many hours I wasted looking at pension projections to calculate how much I’d lose by leaving early.

I began visiting the library to read books on retirement. One day, I got my hands on Zelinski’s book. After reading it, I knew exactly what I had to do. His book helped me avoid spending another seven years at the bank, dying a little bit each day.

What to Do When It’s Your Turn by Seth Godin

When I was suffering from the shock of retirement, my son took me to a seminar. Godin was the keynote speaker, and he gave everyone a free copy of his book. The title—What to Do When It’s Your Turn—haunted me for a long time. Reading it resulted in one of my biggest “aha” moments, when everything started to make sense.

I suddenly knew exactly what I needed to do from that day forward. It felt like Godin was personally challenging me to take action, so I could achieve the lasting happiness I was after. He was telling me that it was now up to me to gain control of my future, and achieve the life that I’d always wanted.

I had paid my dues. I’d met my responsibilities to my family and achieved financial independence. Because of that, I’d earned the chance to do whatever I wanted with my newfound freedom. Reading that book helped me escape from retirement hell. It set me on a path to figure out who I really was—and what I wanted to become.

It made me realize that retirement wasn’t the end goal I’d been striving for, but rather a new beginning. I had a chance to live the rest of my life on my own terms. I’d learned there’s a big difference between being retired and having a great life.

I owe a big debt of gratitude to Zelinski and Godin. Reading their books saved me, and put me on track to change my life for the better.

What books have you read that had a similar impact on you?

Mike Drak is a 38-year veteran of the financial services industry. He’s the author of

Retirement Heaven or Hell

, which was published in 2021, as well as an earlier book,

Victory Lap Retirement

. Mike works with his wife, an investment advisor, to help clients design a fulfilling retirement. For more on Mike, head to

BoomingEncore.com

. Check out his earlier articles.

Mike Drak is a 38-year veteran of the financial services industry. He’s the author of

Retirement Heaven or Hell

, which was published in 2021, as well as an earlier book,

Victory Lap Retirement

. Mike works with his wife, an investment advisor, to help clients design a fulfilling retirement. For more on Mike, head to

BoomingEncore.com

. Check out his earlier articles.

How to Retire Happy, Wild, and Free by Ernie Zelinski

In my mid-50s, I wasn’t happy in my banking job. The stress was starting to get to me. Don’t get me wrong: I was good at my job and it paid well. But it no longer gave me what I needed. The thrill was gone. I had no personal goals, no real purpose. Just hanging on ‘til the finish line isn’t a very good way to go through life.

I read somewhere that, to de-stress, it was helpful to go for a walk. At lunchtime, I’d go out for a stroll. I would usually walk to the local pharmacy to test my blood pressure. More often than not, it would be red-lining.

I knew I had to do something before something bad happened. But it’s hard to leave a good-paying job late in your career. I can’t tell you how many hours I wasted looking at pension projections to calculate how much I’d lose by leaving early.

I began visiting the library to read books on retirement. One day, I got my hands on Zelinski’s book. After reading it, I knew exactly what I had to do. His book helped me avoid spending another seven years at the bank, dying a little bit each day.

What to Do When It’s Your Turn by Seth Godin

When I was suffering from the shock of retirement, my son took me to a seminar. Godin was the keynote speaker, and he gave everyone a free copy of his book. The title—What to Do When It’s Your Turn—haunted me for a long time. Reading it resulted in one of my biggest “aha” moments, when everything started to make sense.

I suddenly knew exactly what I needed to do from that day forward. It felt like Godin was personally challenging me to take action, so I could achieve the lasting happiness I was after. He was telling me that it was now up to me to gain control of my future, and achieve the life that I’d always wanted.

I had paid my dues. I’d met my responsibilities to my family and achieved financial independence. Because of that, I’d earned the chance to do whatever I wanted with my newfound freedom. Reading that book helped me escape from retirement hell. It set me on a path to figure out who I really was—and what I wanted to become.

It made me realize that retirement wasn’t the end goal I’d been striving for, but rather a new beginning. I had a chance to live the rest of my life on my own terms. I’d learned there’s a big difference between being retired and having a great life.

I owe a big debt of gratitude to Zelinski and Godin. Reading their books saved me, and put me on track to change my life for the better.

What books have you read that had a similar impact on you?

Mike Drak is a 38-year veteran of the financial services industry. He’s the author of

Retirement Heaven or Hell

, which was published in 2021, as well as an earlier book,

Victory Lap Retirement

. Mike works with his wife, an investment advisor, to help clients design a fulfilling retirement. For more on Mike, head to

BoomingEncore.com

. Check out his earlier articles.

Mike Drak is a 38-year veteran of the financial services industry. He’s the author of

Retirement Heaven or Hell

, which was published in 2021, as well as an earlier book,

Victory Lap Retirement

. Mike works with his wife, an investment advisor, to help clients design a fulfilling retirement. For more on Mike, head to

BoomingEncore.com

. Check out his earlier articles.The post Books to Live By appeared first on HumbleDollar.

Published on October 29, 2021 00:00

October 28, 2021

Free to Work

FOR THE RECORD, I’m a card-carrying member of the FIRE—financial independence/retire early—movement. Except I don’t believe in the RE part.

All the folks I know who advocate FIRE, and who have achieved financial independence, are still working in some capacity. Many of them have websites, put out podcasts or write books on how to retire early—which is funny because they’re still working and making money.

For some reason, they feel the need to deny that they’re still working. But why deny the truth? There’s no shame in admitting that you enjoy working.

The pandemic taught us how important it is to have a sense of purpose. Some people woke up to the fact that having a job—any job—was better than just puttering around the house killing time or taking the dog out for yet another walk around the block.

The lesson: Even when you become financially independent and get your freedom back, you still need to find interesting, rewarding things to fill your day. Working at something you enjoy is one of the best ways of doing that. FIRE is still a good concept, one that I’m teaching my kids. We just need to redefine the RE part.

All the folks I know who advocate FIRE, and who have achieved financial independence, are still working in some capacity. Many of them have websites, put out podcasts or write books on how to retire early—which is funny because they’re still working and making money.

For some reason, they feel the need to deny that they’re still working. But why deny the truth? There’s no shame in admitting that you enjoy working.

The pandemic taught us how important it is to have a sense of purpose. Some people woke up to the fact that having a job—any job—was better than just puttering around the house killing time or taking the dog out for yet another walk around the block.

The lesson: Even when you become financially independent and get your freedom back, you still need to find interesting, rewarding things to fill your day. Working at something you enjoy is one of the best ways of doing that. FIRE is still a good concept, one that I’m teaching my kids. We just need to redefine the RE part.

The post Free to Work appeared first on HumbleDollar.

Published on October 28, 2021 11:17

Compare and Contrast

IT���S OPEN SEASON for many of us���time to choose our health insurance for the year ahead. It���s a topic I got seriously interested in when I took over management of 500 mathematically astute engineers. They challenged me daily to understand how the various plans stacked up against each other. I spent a lot of time looking at various ways to assess the value of the different plan choices, and came up with a framework that worked for my family.

This is also the time of year when Chicago financial researchers Morningstar publishes its annual review of health savings accounts (HSAs). These are another favorite topic of mine because of their triple tax-deductibility. My wife and I were able to accumulate a decent sum that we���re now using in retirement to help pay medical costs while we wait to reach the Medicare eligibility age of 65.

I���ve spoken with dozens of people over the years about their benefit choices, and there always seems to be a group that wants the highest-priced plan, regardless of the underlying cost structure. They see plans with high deductibles and high out-of-pocket costs as unaffordable. They often pay so much more in premiums, however, that their total cost is greater.

My advice: As a first step when comparing plans, figure out each plan���s lowest possible cost and maximum possible cost. The lowest possible cost is the sum of your premiums for the year. The maximum possible cost is that premium total plus the maximum out-of-pocket cost.

Say you have two choices. The first is a top-notch health plan with monthly premiums of $700, maximum family deductible of $2,000, a 20% copay after meeting the deductible, and a maximum family out-of-pocket cost of $6,000. The lowest possible cost is 12 months of $700 premiums, or $8,400. The maximum possible cost is that $8,400 plus the $6,000 out-of-pocket maximum, or $14,400 total.

The other choice is a high-deductible health plan (HDHP). It has monthly premiums of $200, a maximum family deductible of $6,000, a 20% copay after meeting the deductible, and an out-of-pocket maximum of $12,000. This plan���s lowest possible cost is 12 months of $200 premiums, or $2,400. The maximum possible cost is that $2,400 plus the $12,000 out-of-pocket maximum, or $14,400.

With these two plans, the lowest possible cost is significantly different, but the maximum possible cost is the same. Most of us rarely reach the maximum possible cost. You���d have to have very significant medical issues. What if your family has a very healthy year and you never use any medical services? The HDHP will save you $6,000 in premiums.

The HDHP���s other advantage: You can fund a health savings account. Instead of paying the additional $500 per month in premiums, you could save that amount in your HSA. Both medical premiums and HSA contributions are deducted pretax from your paycheck. But the money you save in an HSA is yours forever. You can use it to pay medical expenses in the current year or in future years. By contrast, premium payments are gone, regardless of whether you incur medical expenses during the year.

The above examples are simplified versions of the choices my wife���s employer offered several years ago. There are certainly factors to consider other than total cost. For instance, does the plan include your current doctors and current health care systems? It���s also important to look carefully at the plans to make sure the coverage is similar.

Some employers offer incentives to stay healthy, which may include contributions to an HSA���and HSAs are only available with a high-deductible health plan. To be sure, employers want to steer you into the plan that minimizes their costs. But in my experience, this often aligns with the employees��� interests, because they end up with adequate medical insurance at the lowest price.

Richard Connor is��a semi-retired aerospace engineer with a keen interest in finance. He��enjoys a wide variety of other interests, including chasing grandkids, space, sports, travel, winemaking and reading. Follow Rick on Twitter��@RConnor609��and check out his earlier articles.

Richard Connor is��a semi-retired aerospace engineer with a keen interest in finance. He��enjoys a wide variety of other interests, including chasing grandkids, space, sports, travel, winemaking and reading. Follow Rick on Twitter��@RConnor609��and check out his earlier articles.

This is also the time of year when Chicago financial researchers Morningstar publishes its annual review of health savings accounts (HSAs). These are another favorite topic of mine because of their triple tax-deductibility. My wife and I were able to accumulate a decent sum that we���re now using in retirement to help pay medical costs while we wait to reach the Medicare eligibility age of 65.

I���ve spoken with dozens of people over the years about their benefit choices, and there always seems to be a group that wants the highest-priced plan, regardless of the underlying cost structure. They see plans with high deductibles and high out-of-pocket costs as unaffordable. They often pay so much more in premiums, however, that their total cost is greater.

My advice: As a first step when comparing plans, figure out each plan���s lowest possible cost and maximum possible cost. The lowest possible cost is the sum of your premiums for the year. The maximum possible cost is that premium total plus the maximum out-of-pocket cost.

Say you have two choices. The first is a top-notch health plan with monthly premiums of $700, maximum family deductible of $2,000, a 20% copay after meeting the deductible, and a maximum family out-of-pocket cost of $6,000. The lowest possible cost is 12 months of $700 premiums, or $8,400. The maximum possible cost is that $8,400 plus the $6,000 out-of-pocket maximum, or $14,400 total.

The other choice is a high-deductible health plan (HDHP). It has monthly premiums of $200, a maximum family deductible of $6,000, a 20% copay after meeting the deductible, and an out-of-pocket maximum of $12,000. This plan���s lowest possible cost is 12 months of $200 premiums, or $2,400. The maximum possible cost is that $2,400 plus the $12,000 out-of-pocket maximum, or $14,400.

With these two plans, the lowest possible cost is significantly different, but the maximum possible cost is the same. Most of us rarely reach the maximum possible cost. You���d have to have very significant medical issues. What if your family has a very healthy year and you never use any medical services? The HDHP will save you $6,000 in premiums.

The HDHP���s other advantage: You can fund a health savings account. Instead of paying the additional $500 per month in premiums, you could save that amount in your HSA. Both medical premiums and HSA contributions are deducted pretax from your paycheck. But the money you save in an HSA is yours forever. You can use it to pay medical expenses in the current year or in future years. By contrast, premium payments are gone, regardless of whether you incur medical expenses during the year.

The above examples are simplified versions of the choices my wife���s employer offered several years ago. There are certainly factors to consider other than total cost. For instance, does the plan include your current doctors and current health care systems? It���s also important to look carefully at the plans to make sure the coverage is similar.

Some employers offer incentives to stay healthy, which may include contributions to an HSA���and HSAs are only available with a high-deductible health plan. To be sure, employers want to steer you into the plan that minimizes their costs. But in my experience, this often aligns with the employees��� interests, because they end up with adequate medical insurance at the lowest price.

Richard Connor is��a semi-retired aerospace engineer with a keen interest in finance. He��enjoys a wide variety of other interests, including chasing grandkids, space, sports, travel, winemaking and reading. Follow Rick on Twitter��@RConnor609��and check out his earlier articles.

Richard Connor is��a semi-retired aerospace engineer with a keen interest in finance. He��enjoys a wide variety of other interests, including chasing grandkids, space, sports, travel, winemaking and reading. Follow Rick on Twitter��@RConnor609��and check out his earlier articles.The post Compare and Contrast appeared first on HumbleDollar.

Published on October 28, 2021 00:00

October 27, 2021

Rich Pickings

THE NEWSPAPERS ARE full of reports that a new tax on billionaires may be uncorked. The Washington Post even ran an article estimating what the 10 richest Americans would pay over the next five years should it pass.

I take no stand on the politics of the proposal. But I have seen enough trial balloons to be skeptical that Elon Musk will soon write a 10-digit check to the U.S. Treasury. As Chuck Collins has written in The Wealth Hoarders , billionaires pay their advisers millions to hide trillions. Collins is the great-grandson of hot dog king Oscar Mayer, so he���s seen how wealth works from the inside.

The fledgling tax proposal does meet one important objective, as espoused by the late Senator Russell Long, the longtime chair of the tax-writing Senate Finance Committee. As Long once noted, many people have the same plea: ���Don���t tax you, don���t tax me, tax that fellow behind the tree.���

A proposal to tax just the ultra-wealthy does indeed aim the tax gun at somebody else. But can we count on billionaires to stand still? Collins says there are two main ways that the wealthiest deflect taxes. The first is to assign lobbyists to Washington to ward off a blow before it���s imposed. That, no doubt, is happening right now.

The second way is to deploy talented professionals with highly specialized knowledge to adeptly navigate a complex tax landscape. Several recent dumps of secret legal papers have shown that���should it get that far���assets can be moved offshore or to tax-friendly states like South Dakota.

Of course, if options A and B don���t work, there���s always the nuclear option���giving the money away. That���s the idea behind the giving pledge endorsed by Bill Gates and Warren Buffett, two of the tax proposal���s principal targets.

Signers of the pledge promise to give away the majority of their wealth to philanthropy. This is a generous impulse, but it���s also far-sighted. Since estates that contain assets of more than $23.4 million per couple are taxed at a 40% federal rate, why not give away what Uncle Sam was only going to take?

The creators of great wealth���like Rockefeller, Getty, Gates and Ford���can extend their influence beyond a single lifetime by endowing a foundation. It���s either that or blast off for Mars. There���s no tax code there���so far.

I take no stand on the politics of the proposal. But I have seen enough trial balloons to be skeptical that Elon Musk will soon write a 10-digit check to the U.S. Treasury. As Chuck Collins has written in The Wealth Hoarders , billionaires pay their advisers millions to hide trillions. Collins is the great-grandson of hot dog king Oscar Mayer, so he���s seen how wealth works from the inside.

The fledgling tax proposal does meet one important objective, as espoused by the late Senator Russell Long, the longtime chair of the tax-writing Senate Finance Committee. As Long once noted, many people have the same plea: ���Don���t tax you, don���t tax me, tax that fellow behind the tree.���

A proposal to tax just the ultra-wealthy does indeed aim the tax gun at somebody else. But can we count on billionaires to stand still? Collins says there are two main ways that the wealthiest deflect taxes. The first is to assign lobbyists to Washington to ward off a blow before it���s imposed. That, no doubt, is happening right now.

The second way is to deploy talented professionals with highly specialized knowledge to adeptly navigate a complex tax landscape. Several recent dumps of secret legal papers have shown that���should it get that far���assets can be moved offshore or to tax-friendly states like South Dakota.

Of course, if options A and B don���t work, there���s always the nuclear option���giving the money away. That���s the idea behind the giving pledge endorsed by Bill Gates and Warren Buffett, two of the tax proposal���s principal targets.

Signers of the pledge promise to give away the majority of their wealth to philanthropy. This is a generous impulse, but it���s also far-sighted. Since estates that contain assets of more than $23.4 million per couple are taxed at a 40% federal rate, why not give away what Uncle Sam was only going to take?

The creators of great wealth���like Rockefeller, Getty, Gates and Ford���can extend their influence beyond a single lifetime by endowing a foundation. It���s either that or blast off for Mars. There���s no tax code there���so far.

The post Rich Pickings appeared first on HumbleDollar.

Published on October 27, 2021 21:50

No Stagflation

WE SPEND TOO MUCH time worrying about stagflation. The term describes a period of high inflation with stagnant growth���a disastrous economic condition. It was seen at times during the worst of the mid-1970s recession, and again when inflation spiked in the early 1980s.

Do we see it today? No way.

Everyone over 60 surely recalls how difficult it was decades ago. Consumer prices were out of control. The unemployment rate jumped. Real wages were on the decline, while stock and bond prices were also dropping.

Blogger and investment expert Michael Batnick notes that the S&P 500 fell 51.8%���including dividends, but after inflation���from January 1973 to September 1974. At the same time, long-term Treasurys experienced a real bear market of their own, losing 21.1%.

Real gross domestic product (GDP) contracted 2% in 1974. The Misery Index, which adds together the unemployment and inflation rates, soared to 20 that year.��It was the worst of times, part I.

The early 1980s brought part II. The Misery Index again spiked above 20. The inflation rate peaked just shy of 15%, while the jobless rate climbed to 7% in 1982. Real GDP growth was barely above zero from 1979 through 1982.

That was stagflation. Today���s economic landscape doesn���t compare. Sure, a lot can change, as fellow HumbleDollar writer John Lim recently noted. But core inflation looks to top out early next year at around 5%, according to Bank of America analysts. Meanwhile the Federal Reserve���s GDP growth estimate eases from 5.9% in 2021 to a still-robust 3.8% in 2022. Next year, the unemployment rate might even dip under 4%, or so says the Federal Reserve.

As we head into the holiday season, let���s put away this nonsense that stagflation is gripping the U.S. economy. We could conceivably get there. But we aren���t anywhere close right now.

Do we see it today? No way.

Everyone over 60 surely recalls how difficult it was decades ago. Consumer prices were out of control. The unemployment rate jumped. Real wages were on the decline, while stock and bond prices were also dropping.

Blogger and investment expert Michael Batnick notes that the S&P 500 fell 51.8%���including dividends, but after inflation���from January 1973 to September 1974. At the same time, long-term Treasurys experienced a real bear market of their own, losing 21.1%.

Real gross domestic product (GDP) contracted 2% in 1974. The Misery Index, which adds together the unemployment and inflation rates, soared to 20 that year.��It was the worst of times, part I.

The early 1980s brought part II. The Misery Index again spiked above 20. The inflation rate peaked just shy of 15%, while the jobless rate climbed to 7% in 1982. Real GDP growth was barely above zero from 1979 through 1982.

That was stagflation. Today���s economic landscape doesn���t compare. Sure, a lot can change, as fellow HumbleDollar writer John Lim recently noted. But core inflation looks to top out early next year at around 5%, according to Bank of America analysts. Meanwhile the Federal Reserve���s GDP growth estimate eases from 5.9% in 2021 to a still-robust 3.8% in 2022. Next year, the unemployment rate might even dip under 4%, or so says the Federal Reserve.

As we head into the holiday season, let���s put away this nonsense that stagflation is gripping the U.S. economy. We could conceivably get there. But we aren���t anywhere close right now.

The post No Stagflation appeared first on HumbleDollar.

Published on October 27, 2021 10:09