Jonathan Clements's Blog, page 20

September 6, 2025

An Idea Every Week

I sold and delivered beer from a side-load truck for 30 years. A stack of beer weighed up to twice what I did. That was a physically brutal job, and although I hung up my hand-truck at age 50, I still pay a price for that career choice via osteoarthritis that won’t ever go away.

Next up was 20 years of preparing tax returns. Physically simple compared to my first occupation, though stressfully intense during the 3 month busy season. Working morning, noon, and night 6 days a week, with some Sundays thrown in to keep caught up.

There must have been an easier way to get paid….

Duh Dan….. I could have been a personal finance writer, doing one stinkin’ article per week! How hard could that have been?

Then I became rather involved with HumbleDollar. How do guys like Clements and Grossman come up with interesting topics week after week? I struggle to think of something that I hope will be found worthwhile once a month.

I’ve stooped so low as to submit an article about the circuitous route my vinyl record order took from the online retailer to my front door.

The serious content on HD has enabled me to make some worthwhile tweaks to my investing, and helped me to streamline/simplify and organize for the benefit of my heirs.

So I tip my hat to Jonathan, Adam, and all of the creative HD contributors that keep me coming back for more.

As I used to end tax newsletters to my clients,

Many happy returns,

Dan

The post An Idea Every Week appeared first on HumbleDollar.

Healthcare spending and premiums during a post age-65 retirement- facts and ideas.

Do seniors (65+) pay as much as perceived for health care?

Seniors pay a lot for health care, but it is not that simple. Many, perhaps most, seniors pay no more, even less, out of pocket, than many younger families.

The bulk of spending by seniors is premiums, not the actual cost of care. That includes Medicare Part B and D premiums, plus for many, Medigap supplemental insurance. These premiums can total about $400 +- per month for an individual with variations by plan and location.

Of course, for 7-8% of beneficiaries there are the dreaded income based IRMAA premiums which can be considerably higher. Our combined total cost for all coverages now exceeds $2,000 per month.

On the other hand, premium expenses are well known, reasonably predictable and should be planned for. For seniors without Medigap it may be quite a different story - more like younger Americans who pay all their deductibles and co-insurance out-of-pocket.

The combination of Medicare/Medigap coverage can virtually eliminate out-of-pocket costs for medical care. Connie and I have incurred well over $500,000 in health care expenses since going on Medicare in 2010. Connie’s eye injury alone resulted - so far - in over $200,000, but our out-of-pocket costs are limited to the annual Part B deductible - currently $257.

One exception is if enrolled in Medigap Plans K and L with lower coverage levels and annual out-of-pocket limits of $3610 or $7220.

Here is a link explaining all the Medigap options (there are some variations by state as well)

Medicare Advantage plans may have low or occasionally no premiums, but often rely on deductibles, co-payments and coinsurance - the exact structure varies by plan. There is more risk for out-of-pocket spending than with original Medicare. Medicare Advantage plans must have an annual out-of-pocket limit (around $8,000). Once you hit the cap, the plan pays 100% of covered services for the rest of the year. Those seniors with Medigap don’t worry about annual out-of-pocket limits.

A Kaiser Family Foundation study found that the typical Medicare beneficiary spends about $6,500 per year out of pocket (mostly in premiums). Within the senior population, costs keep climbing: people over 85 often have 2–3× higher spending than those in their late 60s.

Compare Medicare with the average annual deductible of $1,787 for younger workers in 2024. Data varies, but a Kaiser Family Foundation survey indicates an average family deductible of approximately $3,000–$4,000 in 2024.

The average annual employee only premium was $1,401 in 2024 and the family premium was $6,296 (not counting any employer share).

Prescription drugs are a separate matter. Part D premiums are generally reasonable, but out-of-pocket costs vary significantly based on the Part D plan selected. Seniors may face copays, coinsurance, and deductibles (the maximum permitted deductible is $590). Even with coverage, certain brand-name or specialty drugs can be expensive, really expensive. Talking to your doctor about the medication prescribed and possible lower cost alternatives may be necessary. Your doctor probably does not know how your plan handles a specific Rx based on its formulary.

The good news is that an annual out-of-pocket limit of $2,000 for Medicare Part D was added by the Inflation Reduction Act of 2022 effect in 2025 - but that benefit contributes to higher premiums.

Seniors can now enroll to pay their prescription drug bills on a monthly basis rather then at the pharmacy as used. That smooths out the expense, but doesn’t lower it.

So, planning for health care in post 65 retirement boils down to mostly premiums and possibly $2,000 in Rx costs, but that’s highly variable. Individuals with chronic conditions are most exposed to ongoing expenses. Selecting MA means a possible trade off between premiums and higher out-of-pocket spending.

There are two important steps seniors should take. First assure that premiums plus at least a 6% annual inflation factor are part of the retirement spending plan and second, enter retirement with a dedicated pool of funds for out-of-pocket health care costs-including services not generally covered by insurance- dental and routine vision care (like annual exams and refractions). Ideally, these dedicated funds are accumulating on a tax advantaged basis, such as a health savings account.

Dental, routine vision (refractions/glasses), hearing, and non-rehabilitative long-term care are not covered by traditional Medicare. Seniors pay out of pocket unless they have supplemental coverage. Routine dental, vision and hearing care expenses are generally manageable, but perhaps not if one needs a hearing aid or dental implants. Treatment for diseases of the eye are covered by Medicare.

Purchasing dental insurance is generally not worth the premium for most people because internal fee limits on the services covered and the often sporadic use of the coverage, limit the value when compared with the ongoing monthly premium. We had dental insurance, but after comparing premiums and actual benefits received, I cancelled it. Perhaps save what you would pay in premiums to be used for routine OOP expenses.

According to a BLS report on employee benefits from March 2024 only 43% of private industry workers had access to dental benefits.

Long-term care is a scary outlier. Nursing homes, assisted living, and in-home care are very costly and not covered by Medicare or any health insurance. Medicaid may help, but only after seniors spend down most of their assets.

Some estimates suggest that nearly half (45-56%) of people turning 65 will need some form of paid LTC in their lifetime. However, over 70% of LTC is provided in the home and research says less than 10% of that is paid care. The median daily cost for a home health aide in NJ for example is reported to be $232 - $84,680 a year. The need for LTC is mostly related to those with disabilities or chronic conditions.

Our premiums today are $111 and $152 a month for LTC insurance, but we purchased it in our 40s through a group plan. Several years ago we received a 40% premium increase and the insurer tried to encourage us to drop the coverage. Since then it has been pretty stable. Our insurance will cover about half the cost of in-patient care for up to five years. At age 55 today you could easily pay triple our premium.

It all sounds pretty confusing, but is not really. My view is stick with a Medigap supplement plan (be sure it covers international care if that’s important to you). Medicare doesn’t work outside the US.

If you use many or expensive drugs, consider the monthly payment plan. Be sure your retirement budget includes all expected premiums and potential OOP costs - did I say “budget?”

The post Healthcare spending and premiums during a post age-65 retirement- facts and ideas. appeared first on HumbleDollar.

How Much to Save to Retire?

I came across the following Kiplinger article recently:

https://www.kiplinger.com/retirement/...

It postulates that you would need to save a minimum of 1.6 M to retire comfortably in California, the third most expensive state in which to retire. There are a lot of unknowns in how they calculate this, but alarmingly the median savings of people 65-74 in $200,000 the average is $609,230. On social media sites, people ask if they can retire on social security alone. I know this is preaching to the choir, but what do people do if they fall short? Do you feel prepared to retire?

The post How Much to Save to Retire? appeared first on HumbleDollar.

September 5, 2025

Inventing Problems

According to a recent analysis by Bloomberg, the fund industry rolled out more than 640 new exchange-traded funds (ETFs) in the first half of this year—an average of more than three a day. There are now more ETFs in the U.S. than there are stocks (4,300 vs. 4,200). On top of that, private funds continue to launch at a fast clip.

How should investors respond to all of this innovation? I’d steer clear. While some of these new funds may be worthwhile, many are, in my view, witch’s brews that are unlikely to be useful.

Why? The standard reasons are well known. For starters, a large number of these new funds are actively-managed and, on average, actively-managed funds are more expensive than their index-based peers. As the late Jack Bogle used to say, when it comes to investments, “you get what you don’t pay for.” As a result, actively-managed funds, on average, have consistently underperformed their index-based peers. Active funds also tend to be more tax-inefficient than index funds.

There’s also Lindy’s law, which tells us that we should approach new investments cautiously—not because there’s an inherent virtue in moving slowly, but because, when it comes to investments, it’s important to see how they perform through multiple market cycles.

But those aren’t the only reasons I suggest avoiding these new funds. Below are additional considerations.

Complicated investments are often hard to categorize, and that makes them less-than-ideal from a risk perspective. Consider this pitch for a new fund: “The strategy actively rotates between equities, Treasuries, and cash depending on market volatility and trend signals. It’s fully rules-based, unemotional, and adaptable in real time.”

If you wanted to establish an asset allocation for your portfolio, with specific percentages in stocks and in bonds, this fund would be of no help. That’s a problem, in my view, because research has found asset allocation to be the most important driver of portfolio risk.

Black-box funds like this also make it difficult to estimate what level of returns they might deliver. That’s hard enough with traditional funds. But overly engineered funds make it that much harder. Consider this fund description, which arrived in my inbox this summer: “[Our fund] equips advisors with tactical exit strategies and patented indicators designed to limit downside and preserve growth.”

Or consider this pitch: “Our new tactical ETF…takes a dynamic approach to asset allocation, designed to help protect on the downside and participate when markets turn.” These descriptions sound sophisticated, but they provide investors with little idea of what they can expect. Peter Lynch, the retired manager of the Fidelity Magellan Fund, once offered this advice: “Never invest in any idea you can’t illustrate with a crayon.” That was as true then as it is now.

To the extent that funds are pursuing so-called tactical strategies, that should be of particular concern. According to a study by Morningstar, tactical funds are among the most risky out there. This is how Morningstar summed up the performance of this category: “They Came. They Saw. They Incinerated Half Their Funds’ Potential Returns.”

Another unwelcome trend on Wall Street is the use of what are known as “interval” funds. They’re designed to provide a bridge of sorts between private and public funds. As the name suggests, these funds allow investors to withdraw money only at defined intervals—monthly, quarterly or sometimes semiannually. That would be inconvenient enough, but redemptions are also capped, typically at 5% or 10% of the fund’s shares outstanding, so investors may not always be able to withdraw as much as they’d like if demand is high.

A related trend: Investment marketers are creating versions of the same sorts of “alternative” funds that have been popular with college endowments. This has always been a problem because individual investors typically can’t get into the same top-tier funds as big universities. Instead, what tends to be available are pale copies of what these big institutions are able to invest in.

Worse yet, recent evidence suggests that even those top-tier funds have seen returns deteriorating. It turns out that the boom in private equity was fueled in large part by the long-term trend toward lower interest rates. But with rates now higher, buyout firms have been having a harder time generating the same types of profits as before.

In an interview, a retired member of Yale’s endowment management team explained, “Just because something has worked for a particular set of institutions over some period of time, it’s not a guarantee of future success.” This is good advice.

Because the market for alternative investment funds is so challenging, these funds fail quite frequently. According to recent data, over the past 10 years, 75% of alternative funds have closed down. That can be a problem because fund closures can generate taxable gains, and this occurs much more frequently with actively-managed funds than with simple index funds.

Fundamentally, the challenge with all of these new funds is that no one has a magic wand. Especially when there are more funds than there are stocks, there just aren’t that many new ways to combine investments into something new and better than what already exists. Despite that, Wall Street continues to roll out new offerings every day.

How should you respond? Morningstar’s Jeffrey Ptak puts it best: “The more rhapsodic the sales pitch, the more you should plug your ears."

Adam M. Grossman is the founder of Mayport, a fixed-fee wealth management firm. Sign up for Adam's Daily Ideas email, follow him on X @AdamMGrossman and check out his earlier articles.

Adam M. Grossman is the founder of Mayport, a fixed-fee wealth management firm. Sign up for Adam's Daily Ideas email, follow him on X @AdamMGrossman and check out his earlier articles.The post Inventing Problems appeared first on HumbleDollar.

The Wheel Deal

It comes with a lot of rules and nuances, so I wanted to cover this topic a bit more in depth in case you are planning to acquire a vehicle soon.

So, what is “qualified passenger vehicle loan interest”?

It means any interest that was paid during the taxable year (e.g 2025) on a loan started after Dec. 31, 2024, secured by a first lien, on a passenger vehicle for personal use.

In simple terms, if you financed a passenger vehicle that was new (not used) in 2025 or after, for personal use, you likely can deduct the interest from this loan unless you meet some exceptions/limitations.

The maximum amount of interest you can deduct in a single year is $10,000. The deduction is available regardless whether you itemize or take the standard deduction, as long as the rest of qualifications are met.

There is also a limitation based on modified adjusted gross income (MAGI) of $100,000 (single) or $200,000 (married jointly). If you exceed these limits, the maximum deduction will be reduced by $200 for each $1,000 of income exceeding these thresholds.

For example, say you have $125,000 of MAGI and are single. Your maximum deduction will be:

$125,000 (income) - $100,000 (threshold) = $25,000.

$25,000 / $1,000 = 25

25 * $200 = $5,000 (phase out amount)

$10,000 deduction - $5,000 phase out = $5,000 maximum allowed deduction

Doing some simple math, this means that if you have $150,000 or more (single) or $250,000 (married), you can’t take the loan interest deduction.

There are some exceptions of vehicle loans that do not qualify for interest deduction:

Buying a commercial vehicle not used personally

Lease financing

Buying a vehicle with a salvaged title

Buying a vehicle intended for scrap or parts

There are also some specific rules regarding “passenger vehicle”, which means any vehicle that:

The original use commences with the taxpayer

Manufactured primarily for use on public streets, roads and highways

Has at least 2 wheels

Is a car, minivan, van, pickup truck or motorcycle

Which has a gross vehicle weight of less than 14,000 pounds

Lastly, the final assembly of the vehicle must be in the US.

For example, say you took a loan of $38,810 at 6% for 5 years to buy a brand new $45,000 MSRP 2025 Ford F-150 for personal use on January 1, 2025.

Because this vehicle was manufactured in the US and meets the requirements, you can deduct the interest (assuming below the income limits).

Using a calculator, we can estimate the first year interest from this loan at ~$2,141. If you are in a 22% marginal rate, that’s ~$470 of tax savings on the federal level.

Here’s an important point:

Don’t finance a brand new car just because you will qualify for the deduction.

In our example, that still means that you bought a $45,000 car and received ~$470 of tax savings/yr. Imagine if you bought that same car but slightly used for $30,000, which would outweigh any tax savings. So it’s important to understand why you are buying specifically that new vehicle, and there might be reasons outside of the tax savings.

This also makes an important point – there are offers from car companies that allow you to buy a car with 0% APR. In such a case, it likely would work better to drop the price and get a market rate, since you would qualify for the deduction, but more analysis is needed on the price drop vs interest charged and tax savings.

Final assembly must be in the US

This is a key requirement for the car deduction. Just because you buy a new car in 2025 doesn’t mean you will get the deduction. Which car you buy makes a difference.

The IRS recently clarified how the final assembly would work by saying “the location of final assembly will be listed on the vehicle information label attached to each vehicle on a dealer’s premises,” or “taxpayers may rely on the vehicle’s plant of manufacture as reported in the VIN number to determine if a car has undergone final assembly in the United States,” using the National Highway Traffic Safety Administration (NHTSA) VIN Decoder.

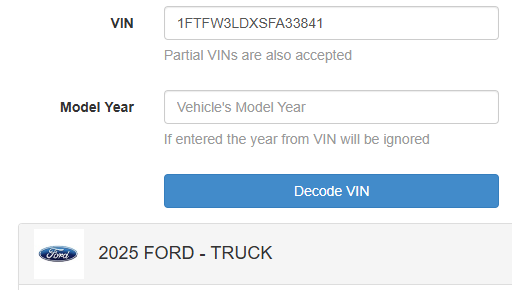

For example, I entered a random VIN (1FTFW3LDXSFA33841) for a 2025 Ford:

Once we scroll down, we can get to the section “Plant Information”:

We can see that this one is located in the United States and will likely qualify.

Refinancing

There is a lot of conflicting information online, including major finance publications, which state that if you refinance an old loan (pre-2025), this loan would qualify for the interest deduction.

But I personally disagree with that statement.

Reading the bill, it says that “Indebtedness described in subparagraph (B) shall include indebtedness that results from refinancing any indebtedness described in such subparagraph,” and the subparagraph (B) says “indebtedness incurred by the taxpayer after December 31, 2024.” Based on my interpretation, the refinancing will qualify as long as the initial loan ("indebtedness") started after Dec. 31, 2024. I would wait until the IRS clarifies the details to make any strategic moves, though.

Also, there is a limit on how much of a loan would qualify under the deduction — only the portion of the new loan up to the amount of the original loan can be treated as qualified for tax purposes.

For example, if the original qualified loan was for $20,000, and you refinance for $22,000, only $20,000 of the new loan counts toward the deduction.

Reporting

How will you know how much interest you’ve paid on a qualified car?

Well, the tax code requires lenders (like banks, credit unions, etc.) that receive $600 or more of interest in a calendar year from an individual on a specific passenger vehicle loan to file a return with:

The IRS

The borrower

Think of this similarly to the mortgage statements or interest statements you receive. This informational return will include:

> Name and address of the borrower

> Interest paid

> Outstanding principal balance

> Origination date of the loan

> Vehicle details (Year, Make, Model, VIN)

However, 2025 is a transition year.

The IRS will certainly be busy releasing the forms and instructions. They’ve announced no changes to any information return forms for 2025.

There haven’t been more details about it, but for 2025, there will likely be some sort of calculator or estimate for the interest you can claim on your taxes.

Lenders will also need to figure out for 2026 how to correctly report these numbers, as only certain vehicles qualify.

Overall, the new car loan interest deduction could save you a few dollars in taxes, but make sure you aren't overspending just to get the tax deduction.

I hope you enjoyed this post, and let me know if you have any thoughts in the comments.

Bogdan Sheremeta is a licensed CPA based in Illinois with experience at Deloitte and a Fortune 200 multinational. He shares insights on taxes and personal finance through his newsletter, helping thousands of readers to make smarter financial decisions. He has over 140,000 followers on X and 110,000 on Instagram

The post The Wheel Deal appeared first on HumbleDollar.

Pension Plan Buyout: The Exception to the Rule

I realize this is an anomaly, but my wife Suzie is in a much better financial position today because she cashed out her Defined Benefit pension for a lump sum payment.

Neither Suzie nor I understood the reasons why the offer was so generous. The financial advisor we consulted about the proposed surrender value also didn't get the logic but strongly suggested we take the deal.

I don't like little mysteries that defy normal thinking, so over the last while, I've tried to piece together a reason for the offer. My thoughts on this are speculative, but I believe they're on the right track.

At the time of the offer, Suzie hadn't worked for the bank for ten years. It was a large, globally diverse UK banking group that had a "super-funded" pension plan. This plan's assets were well above what was required to meet its future obligations. From what I can gather, the company wanted to freeze the plan and close it to any future accruals, which it has since done.

At the same time, government bond yields—specifically U.S. Treasury yields, which have a massive impact on pension values—were at an all-time low. Because of this factor, I believe the plan essentially had to offer a large lump sum to "buy back" the guaranteed income liability.

When you combine these two very favorable situations that happened to come together at the right time, I think I have a reason for the generous offer. It was a classic case of corporate financial strategy and macroeconomic conditions creating an extraordinary opportunity for a pension plan member.

While we were already in a strong financial position before the offer and can't honestly say it transformed our lives or retirement prospects, I know it certainly did for some of Suzie's former colleagues. Sometimes life is full of unexpected gifts, and we were happy this one came calling.

I thought you might find this case study of interest. I'm UK based and although I've used the term US treasury yields in reality it was the UK government equivalent, UK guilt yields.

The post Pension Plan Buyout: The Exception to the Rule appeared first on HumbleDollar.

September 4, 2025

Never Working a Day in My Life

I spent most of my early 20s not knowing what I wanted to do with my life – I lost track of how many times I changed my major! After graduating, I moved to Japan and spent a couple of years teaching English and exploring SE Asia. I knew I eventually wanted to go to graduate school, but I also knew that I didn’t want to continue in the field in which I’d (finally) majored. In a twist no one who knew me saw coming, I decided to get a PhD in biology. Two writers played a part in my making this decision: E.O. Wilson and Edward Abbey.

E.O. Wilson, who was a professor at Harvard, wrote a book in 1992 called The Diversity of Life, in which he celebrates the diversity of life on Earth, explains the role of healthy ecosystems in providing important services (clean air, clean water, food, nutrient cycling, etc.), and describes the ways in which human activities are threatening these ecosystems. As a person who spent much of her childhood exploring the outdoors and who loved nature, I felt called to a field where I hoped to make a difference. The stumbling block? I hadn’t taken science classes as an undergraduate and couldn’t really see myself as a scientist. Enter Edward Abbey.

My love for Edward Abbey began when I read The Monkey Wrench Gang in high school and deepened when I discovered his many collections of essays. One essay in particular, published in The Journey Home: Some Words in Defense of the American West, reassured me that there could be a place for me in the world of science. Here’s the passage that spoke to me: “The moral I labor toward is that a landscape as splendid as that of the Colorado Plateau can best be understood and given human significance by poets who have their feet planted in concrete — concrete data — and by scientists whose heads and hearts have not lost the capacity for wonder.”

So, I took the plunge. I applied to graduate programs, moved back to the States, and 5 years later earned my PhD in marine biology.

My dad, who I’m sure despaired of my ever settling on a career path, often said while I was growing up, “if you have a job you love, you’ll never work a day in your life.” I may have reflected on that when I was waking up at 3am to head to my field sites or working late into the night analyzing data or studying for my qualifying exams. I was working harder than I ever had in my life! But it was wonderful. I remember one morning in particular: I had hiked out to my field site in the dark and, just as the sun was rising, a whale surfaced so close to shore I could hear the ‘whoosh’ of its breathing. I was so delighted I laughed out loud and marveled that I was actually getting paid (not much, but enough!) to be there. My dad was so right.

Jonathan and others have written about the importance of purpose in our lives, and I’m grateful that my work has been so closely aligned with what’s important to me. I don’t know what aspects of my work life I’ll bring forward when I retire, but I suspect not many. It strikes me that contemplating what I’ll do in retirement mirrors my experience of choosing a major. There are a number of paths in front of me, equally interesting, and I’m not sure which one to choose. If history repeats itself, I can look forward to skipping from path to path for some time, and that’s just fine. After all, nonlinear journeys are often the most interesting!

The post Never Working a Day in My Life appeared first on HumbleDollar.

Tax estimation tools on Bogleheads Wiki

It was interesting to me to learn to that the AARP free tax calculator that I often use appears to be a licensed version of the current Dinkytown program referenced in the Wiki article with the Dinkytown version being updated more frequently and thus the Boglehead's recommend over the licensed versions. As of yesterday the software has not yet been updated for the 2025 OBBBA tax law changes. I have read that may be coming at the end of September. You can also use the tax estimator at the developer's website for free. Lot's of other useful free financial calculators also at Dinkytown.

For those who like excel spreadsheets there is also one to download from a different developer that has been updated for OBBBA already. I have downloaded but I have not yet dug into the program that but it appears to be comprehensive.

I hope you find this to be a useful reference.

Best, Bill

The post Tax estimation tools on Bogleheads Wiki appeared first on HumbleDollar.

What They Don’t Tell You About Retirement: Part 2 – Grandchildren Are Expensive

I know I and many others mockingly complain in a joking manner about our grandkids costing us a "fortune" when they visit—but with no malice intended, did you actually consider these costs when crafting your retirement spending plan?

I certainly never thought about this; it didn't even cross my mind. Maybe I'm being too generous, or perhaps I've had a run of bad luck. In recent months, my granddaughter dropped an iPad, requiring a replacement, and my grandson accidentally let a toy car slip from his hand while spinning around, resulting in a car-shaped hole in our TV.

Some costs we did consider beforehand: Christmas and birthday presents, for example, along with money we put into savings accounts for their future. Beyond that, I never thought through the scope of other expenses, and these, I've found, can build up over time.

My daughter works hard but struggles financially, and Suzie and I feel an obligation and need to "help out" with care costs. Recently we purchased a school uniform for our grandson and all his back-to-school essentials, plus a daycare uniform for our granddaughter. Although I don't really understand this expense, we also pay a monthly subscription for games on his Xbox.

During the summer, our grandson stayed with us at our holiday home. Eating out involved an extra hungry mouth with hollow legs attached! Requests for money to visit the harbour shop with his friends soon mount up. We both enjoy playing golf together—that's another extra cost. The thing is, we handed this out without a thought or any regrets; he's my grandson. But it's certainly not spending we detailed on any spreadsheet.

It's natural that love for our family makes us blind to these costs—after all, what good is our wealth if we don't use it to improve the lives of our nearest and dearest? But should we maybe make certain of our own financial firm footing? By doing so we can ensure our continued ability to help our family and, just as importantly, look out for our own needs.

I'm in the fortunate position that these unforeseen retirement costs are not an issue, but not everyone might have this luxury within their budget. More awareness of this emotional spending during retirement planning could help. We could then spend freely and joyfully on our grandchildren. And we could do so without the worry of compromising our own retirement security.

The post What They Don’t Tell You About Retirement: Part 2 – Grandchildren Are Expensive appeared first on HumbleDollar.

What They Don’t Tell You About Retirement: Part 1 – Everything Breaks

As I struggled out of the electrical retailer with an enormous box, a thought crossed my mind. I was grateful I had taken a pessimistic view of life in one particular area. The box contained a new flat-screen TV to replace our old one, which had recently given up the good fight. My pessimistic thoughts had led me to create a large emergency fund on my retirement spreadsheet specifically for replacing items that wear out.

I suspect, though I have no data to back me up, that some approach retirement spending with too much optimism regarding the longevity of their possessions. If life has taught me anything, it's that this lumpy spending can come fast and often. Not giving it due consideration can be unwise.

Taking my recent past as a good example, my wife Suzie and I have had to replace a tumble dryer and a cooker extractor fan. We also had storm damage on our roof repaired and replaced seven Velux skylights that had reached the end of their lives. Other things come to mind, like an iPad my granddaughter dropped, breaking the screen, and a full exterior repaint of our home.

Sudden, significant expenses force a choice: dip into your emergency fund or sell a portion of your investments. If you haven't planned for these "lumpy" costs, you might be forced to sell assets during a market downturn, locking in losses and eroding your future growth potential. This series of unplanned withdrawals can seriously derail even the most carefully crafted financial plan.

These costs can mount quickly and become substantial. This is an area where you need to be realistic, not optimistic. My personal advice is to think back over the past few years to get a feeling for costs. Also, consider the end-of-life components of your house's structure and research repair and replacement costs. While this won't give you an exact amount, it will provide a better-informed guess. Whatever figures you arrive at, double the amount and then sleep soundly at night.

Back to reality with my new TV, I was pleased with my purchase. More importantly, I was very happy that Suzie didn't come with me. But the only cloud in my immediate future is explaining why I thought a 70-inch, all-singing, all-dancing flat screen was a direct replacement for the much smaller, recently deceased one it's replacing. I'm sure the drive home will bring some inspiration. But it just shows even a sound plan can be derailed by "necessary" upgrade costs.

The post What They Don’t Tell You About Retirement: Part 1 – Everything Breaks appeared first on HumbleDollar.