Jonathan Clements's Blog, page 105

December 25, 2023

A New Life

DECEMBER IS A BUSY month for everyone. But it seems especially busy for clergy and those who work with money.

If you work with money, there are important tasks to complete, such as planning for taxes, ensuring your investment allocations are where they should be, making charitable contributions, and getting ready for the new financial year.

Meanwhile, when I was serving a congregation as a minister, December was full of gatherings and services to celebrate the traditions and holidays that come this time of year. I’d lead classes and services on the wisdom of the world’s religions, and talk about things such as holiday depression, generosity and self-care.

There were sweets to prepare and eat, carols to sing and candles to light, culminating in the Christmas Eve services, when we’d gather to tell ancient stories, rejoice in community, and remember the hope and peace possible in our hearts and our world.

I’ve been reminded in the past few weeks of my favorite Christmas Eve service. That year, a couple decided to have their baby dedicated on Christmas Eve. A child dedication in my religious tradition is when we celebrate the child. The parents, family, friends and congregation publicly vow to love, cherish and teach each child as he or she grows. Prayers would be recited, blessings would be shared, and the magic and hope that come with each new life would be remembered.

Many celebrate Christmas because, in the Christian tradition, it’s a time to honor and remember the birth of Jesus. But most historians agree that late December is not Jesus’ birthday. The birth of Jesus, the lighting of a menorah and welcoming the winter solstice are three of the many traditions we celebrate to prepare for the darkness that comes this time of year.

The birth of a baby is a time to rejoice and remember hope every day of the year. I was reminded of that on Nov. 24, when our first grandchild, Cassandra Marie, was born. It’s been a long time since I had the joy of rocking a new baby in my arms, and cooing love and prayers into little ears.

It’s a feeling that money can’t buy and something that all of us need to experience. My wife and I had long ago set aside our dreams of grandchildren because our boys didn’t seem to share those dreams. But our oldest son fell in love, and Cassie is now in our lives.

What does all this have to do with money? A lot and a little. Having a new grandchild changes the dynamics of our financial plans. Do we want to move back to California to be closer to family? How much should we allocate to her future education needs and how should we do that? What about estate planning? How generous do we want to be to our family, and maybe also to others who have new babies but may not have the support system and resources Cassie has been born into?

Time and counsel will help answer those questions. But more important than those answers is what a new baby reminds us of, and why we need to celebrate during these days of literal and metaphorical darkness in the world. Sophia Lyon Fahs wrote a poem titled Each Night a Child Is Born Is a Holy Night, which I would read almost every Christmas Eve. The poem ends with the words:

Each night a child is born is a holy night—

A time for singing,

A time for wondering,

A time for worshipping.

And, I would add, a time for hoping and remembering. Hoping that each new life brings with it more peace and joy. And remembering that each of us can love a little more and share more generously—every day.

Don Southworth is a semi-retired minister, and financial and leadership consultant, living in Chapel Hill, North Carolina. Don is passionate about the intersection between spirituality and money, and he encourages people to follow their callings wherever they lead. Follow Don on X (Twitter) @Calltrepreneur and check out his earlier articles.

Don Southworth is a semi-retired minister, and financial and leadership consultant, living in Chapel Hill, North Carolina. Don is passionate about the intersection between spirituality and money, and he encourages people to follow their callings wherever they lead. Follow Don on X (Twitter) @Calltrepreneur and check out his earlier articles.

The post A New Life appeared first on HumbleDollar.

December 24, 2023

Twelve Days Long

AS AN EPISCOPAL priest, I’ve lived for more than 40 years with two calendars for every December.

The first calendar is widely recognized. It begins on Thanksgiving Day, with the arrival of Santa Claus in the Macy’s parade, and runs through Christmas Day, with all the celebration that’s entailed.

These few weeks are a huge feature of modern life in America. Businesses depend on a good season. Extra work and part-time jobs are available.

A vast amount of charitable giving is invited and people are hugely generous, which is good because grief, loss, poverty, illness and homelessness don't observe the holiday. Conflict and disaster take no time off, either. Americans are often said to be the most generous of people. This world needs all we can give and more.

Meanwhile, the arts and cultural resources dedicated to seasonal themes and much beloved stories are a well-spring of joy and encouragement as the daylight hours shorten and winter sets in (at least in the northern hemisphere).

Although we don't often think about it, not everyone regards this time of year the same way. Jewish people, and many others, have other celebrations—some religious, some not—during this time. Depending on how you count them, there are at least two dozen other observances, even as much of society counts down to Christmas. It really is true that the most polite and generous salutation at this time of year is, “Happy Holidays.”

I live in the midst of all of this, as we all do, and there’s much for me to enjoy and participate in. Who doesn’t love Messiah sing-a-longs and holiday cookies? Who isn’t pleased to be more generous than usual, and delighted to see others be so as well? With grandchildren to think about, I join the online crowd and the throngs in shops, and look for presents and stocking stuffers, just as I did for my children long ago.

All of the Christmas preparation ends with the great celebration on Christmas Day, with lots of food, football and piles of discarded wrapping paper. The morning after brings the “after holiday” sales, gift exchanges and returns, and post-holiday clean up. The Hallmark Channel stops its 24/7 Christmas and Hanukah movie marathon, and the local Christmas music station goes back to regular programming.

But I and others have a second calendar at this time of year. It’s for the season of Advent, which usually begins in the last few days of November and runs until Dec. 24.

For those who keep this season, our Christmas Day preparations are deliberately left at the door of our places of worship and our homes, and there we take a break from the seasonal hubbub. Advent provides an oasis of peace, quiet and reflection on the themes of the season: hope, joy, peace, love. The four weeks end on the night of Dec. 24 with what we call the Feast of the Nativity. While Dec. 25 is a celebration indeed, for me Christmas Day is just the beginning of the happy times, because the season is 12 days long.

There are some advantages to keeping two calendars at once. As people get busier and more stressed, I’m much less so. Many people have a hard time emotionally, psychologically and spiritually at this time of year. I’m available to listen and sympathize, and offer help because I don't have to have all card and gifts gotten, wrapped, sent and so on in time for the big day, because Christmas is 12 days long. I don't have that huge pressure of a Dec. 25 morning deadline, because Christmas is 12 days long. People don’t have to get and give things to me by that time, either, because Christmas is 12 days long. So, Dec. 25 is a celebration indeed. But for me, Christmas Day is just the beginning of the happy times. The season is 12 days long.

For the world outside my door, Christmas Day is the culmination of long labor brought to fruition. It’s the happy pinnacle of the holidays, and its rather sudden endpoint. But for me and others, we're just getting started.

Tom Scott is a retired Episcopal priest. He and his wife live in Evanston, Illinois. They love retirement because they get to see more of their children and grandchildren, and they can spend more time at concerts, the opera and the Chicago Botanic Garden. Check out Tom's earlier articles.

Tom Scott is a retired Episcopal priest. He and his wife live in Evanston, Illinois. They love retirement because they get to see more of their children and grandchildren, and they can spend more time at concerts, the opera and the Chicago Botanic Garden. Check out Tom's earlier articles.

The post Twelve Days Long appeared first on HumbleDollar.

Strings Attached

WITH NO DISRESPECT TO our representatives in Congress, a new rule taking effect in January reminds me of a scene from The Jerk, an old Steve Martin movie. Playing the role of a carnival huckster, Martin shows off a wall of attractive prizes, but then narrows the choices to an impossibly small set of options.

Congress did something similar when it instituted a new rule governing 529 education savings accounts. The rule in question opens up greater flexibility in how surplus 529 funds can be used. On the surface, it looks appealing. But to avoid potential abuse, Congress attached so many strings that the benefit ends up being awfully narrow. Still, it’s better than nothing and thus worth understanding.

The issue Congress wanted to address is one that many parents struggle with: On the one hand, 529 accounts can be a terrific savings vehicle. As long as the funds are used for education expenses, 529 balances can be withdrawn tax-free. This makes 529s an attractive choice.

But 529s can also be a source of anxiety because it’s difficult to know exactly how much to contribute. Tuition costs vary widely among colleges, and it’s also difficult to know how much an account will grow. Parents can end up in a tough spot if a 529 ends up overfunded. That’s because withdrawals that aren’t used for qualified education expenses are subject to income taxes and a 10% penalty. Judging the precise right amount to contribute to a 529 is like making a hole-in-one from a mile away.

In the past, there have been only a small number of options to avoid the penalty. The most common: If a student earns a scholarship, his or her parents would be permitted to take a penalty-free 529 withdrawal, though income taxes would still be owed on the earnings portion of the withdrawal. But aside from that and a few other, rare exceptions, 529 rules were fairly inflexible.

But beginning in 2024, parents will have an alternative for surplus 529 funds: They can now transfer part of that surplus to a Roth IRA for the beneficiary. Those dollars will then be able to continue to grow tax-free but without the education-related restriction of a 529. This change sounds great—but there are key details to keep in mind:

There’s a lifetime limit of $35,000 per beneficiary that can be transferred from a 529 to a Roth.

The amount that can be transferred each year is limited to the amount that could otherwise be contributed directly to an IRA. In 2024, that will be $7,000, meaning that it would take five years to move the entire $35,000.

In years when funds are moved from a 529 to a Roth, those funds will count toward the beneficiary’s IRA contribution limit. Suppose that parents transfer $4,000 from a 529 account to their child’s Roth IRA. Since the child’s overall IRA contributions are capped at $7,000, he or she could only contribute an additional $3,000 directly to an IRA that year.

The beneficiary would need to have earned income that’s at least equal to the 529-to-Roth transfer amount, just like the requirement for a regular IRA contribution. The child doesn’t have any earned income? No transfer is allowed.

The usual income caps for direct Roth IRA contributions don’t apply. That’s a nice benefit of this new rule, allowing a high-income beneficiary to complete a 529-to-Roth transfer.

To be sure parents use the new provision in the way it was intended—that is, truly for surplus funds—there are two additional restrictions. First, the 529 account must be at least 15 years old. Second, any funds contributed to the 529 within the most recent five years aren’t eligible to be transferred. Neither of these restrictions is a permanent obstacle, but they can slow transfers.

On the other side of the scale, the $35,000 cap may be more generous than it seems because it’s a per-beneficiary limit. For example, if you have two children, each with $35,000 in their respective 529 accounts, you could move each child’s $35,000 balance to a Roth, for a family total of $70,000. The $35,000 cap will likely increase over time.

What if the leftover balance in a 529 still exceeds the lifetime cap? The simplest solution: Leave the funds in the 529 account for other family members, including future grandchildren. That would give the account additional time to grow tax-free. As the account owner, you’re permitted to change the beneficiary as many times as you wish. For instance, if your children finish school with a surplus, you could allow them to use leftover funds for their own children.

This, by the way, is a nice way to ensure equity among your children. Suppose you contributed an equal amount to each child’s 529 account, but one child chose a less expensive college and thus graduated with more of a 529 surplus. That child would then have more to use for his or her own children.

The IRS actually provides quite a bit of latitude in how 529 balances can be redirected. It’s not just children and grandchildren. You could transfer a balance—or part of a balance—to virtually any family member. This could include a niece or nephew, a cousin, or a son- or daughter-in-law.

What else can you do with a 529 surplus that exceeds the cap? As I noted, the key source of anxiety around 529 surpluses is the 10% penalty that the government imposes if you withdraw an unused balance for non-education purposes. While it seems distasteful to ever incur a penalty, in certain circumstances, it may not be the worst thing.

Many retirees experience a window of time when they’re in very low tax brackets—typically in their late 60s, after they retire but before Social Security and required minimum distributions begin. If you find yourself with 529 surpluses that exceed the cap and no one else needs the funds, you could simply hold onto those balances until a future, low-tax year, and then take a withdrawal. In this case, you’d still incur the 10% penalty, but at least the underlying tax would be lower. And remember that the penalty applies only to the gains in your account, not to the entire balance.

Suppose you meet all the requirements for a 529-to-Roth transfer. What’s next? The new rule became law a year ago, as part of the package known as SECURE 2.0. Congress delayed implementation for a year because 529 providers needed time to develop new infrastructure for these transfers. Those changes should be coming online shortly.

In the meantime, the IRS is also expected to provide guidance on some of the more nuanced transfers scenarios. For example, if you’ve changed the beneficiary of a 529 account, does that start the 15-year clock over? There’s a helpful Q&A on Utah’s 529 plan website that discusses this and other open questions.

Adam M. Grossman is the founder of Mayport, a fixed-fee wealth management firm. Sign up for Adam's Daily Ideas email, follow him on X (Twitter) @AdamMGrossman and check out his earlier articles.

Adam M. Grossman is the founder of Mayport, a fixed-fee wealth management firm. Sign up for Adam's Daily Ideas email, follow him on X (Twitter) @AdamMGrossman and check out his earlier articles.The post Strings Attached appeared first on HumbleDollar.

December 23, 2023

Be the Good Scrooge

IT'S THE HOLIDAY season, which means I get to enjoy one of my favorite movies, A Christmas Carol. I’ve watched it every Christmas for as long as I can remember. I guess you could say it’s cast a spell over me, but in a good way.

To be honest, I don’t watch it in its entirety anymore. Instead, I usually just tune in for when Scrooge wakes up on Christmas Day as a changed man, happy to be alive, and asks a little boy to buy the prize turkey for him that’s hanging in the butcher shop.

I love the last lines in the movie and book: “Scrooge was better than his word. He did it all, and infinitely more; and to Tiny Tim, who did not die, he was a second father. He became as good a friend, as good a master, and as good a man, as the good old city knew, or any other good old city, town, or borough, in the good old world.” The narrator continues: “And it was always said of him, that he knew how to keep Christmas well.”

A few years ago, while watching the movie for the umpteenth time, I had an aha moment. I realized that when we retire—similar to Scrooge—we’re given a second chance at life. We have an opportunity to redeem ourselves and change our life’s trajectory. Since this realization, I’ve been focused on becoming more like Scrooge—the good version.

I’ve made it a habit to look for ways to perform acts of kindness that’ll put smiles on others’ faces and, when I manage to do that, it ends up putting a smile on my face as well—a true win-win if ever there was one.

Sometimes, I pay for the car behind me in the drive-through at Tim Hortons, the Canadian equivalent of Dunkin’. The first time I tried it, the cashier asked if I really wanted to do it because the next car’s order was for $36.79. I laughed it off and paid, all the time thinking about what Scrooge would do if he were in my shoes.

What I’ve learned from doing good deeds is that you don’t have to do big things to make people feel good. The simple act of holding a door open, or letting someone go ahead of you in the grocery store checkout line, works just as well.

Believe me, there’s no better feeling than seeing someone light up because of your kindness. An added bonus: When you’re kind to others, others will be kind to you. The more kindness you show, the happier you’ll be. Helping others gives my life meaning and purpose.

My goal now is to help as many retirees as I can, so I can feel like Scrooge on Christmas Day. With that objective in mind, this past year, my coauthors and I released our free retirement guide, Longevity Lifestyle by Design.

For the year ahead, I’ve decided to give back in a different way. I’m offering to do free retirement webinars in Canada and the U.S. for libraries, church groups, teachers, health care workers and more. If you’d be interested in having me present to your group, email me at Michael.Drak@Yahoo.ca.

The post Be the Good Scrooge appeared first on HumbleDollar.

December 22, 2023

Lean Against the Wind

AT THE RISK OF CAUSING readers to think too much on a Saturday morning, let me start by offering a pair of seemingly contradictory statements:

The financial markets are efficient, but occasionally go stark, raving mad.

Nobody knows what stocks are worth, but they have fundamental value.

My contention: There’s a payoff to be had from grappling with these two apparent contradictions—a payoff that takes the form of greater calm in the face of market turmoil and improved long-run portfolio performance.

Measuring up. Many HumbleDollar readers, and perhaps most, are fans of indexing, and with good reason. We all know how difficult it is to pick winning stocks and to forecast the financial markets’ short-term direction. Statistics tell us that even professional money managers struggle to outwit the markets, especially once their investment costs are factored in.

Beating the market, of course, would be far easier if we could figure out what stocks were truly worth. But as I’ve come to realize after almost four decades of writing about investing, valuation metrics like price-earnings ratios, book value and dividend yield give only a rough idea of what stocks are truly worth, and they certainly aren’t a reliable guide to short-term performance.

Why aren’t these market yardsticks more helpful? There’s a host of reasons. Stocks’ fair value rises when interest rates fall, and it falls when rates climb. Investors’ appetite for risk has grown over time, and that means typical stock valuations have also trended higher. Valuing corporations based on the assets they own has become trickier as companies focus on building intangible assets like brand names and intellectual property. Meanwhile, valuation measures that look at earnings have drifted upward as the market has come to be dominated by fast-growing technology firms.

Because it’s so difficult to figure out whether stocks are cheap or pricey, outperforming the market averages is mighty tough and few manage it over the long haul. Indeed, the most sensible assumption is that the financial markets are efficient, meaning they accurately reflect all publicly available information, and that the best strategy is to settle on a prudent stock-bond mix and then build our desired portfolio using low-cost broad market index funds.

Going nuts. Investors tend to anthropomorphize the stock market, ascribing human qualities to its unpredictable behavior. For instance, if the market rockets higher and then lower, we might call it crazy. If it moves against us, we might depict the market as punishing us. Even the great Benjamin Graham anthropomorphized the market, with his famous analogy of Mr. Market, whose erratic behavior might allow us to make money at his expense.

But in truth, the market’s action reflects not the behavior of a single, unhinged individual, but rather the decisions of millions of investors, all buying and selling based on their best judgment of what stocks are worth. While some of these folks may be acting foolishly, most investors are reasonably rational and hence stocks tend to be reasonably valued. The financial markets are indeed efficient—most of the time.

That said, it seems that, every so often, a significant number of investors go collectively nuts, causing stocks to become unmoored from their intrinsic value. I don’t want to suggest this is a common occurrence and that stocks are often wildly mispriced. Still, it’s clear that it does indeed happen.

Think back to the 2021 craziness over special purpose acquisition companies, cryptocurrencies, net fungible tokens, and meme stocks like AMC and GameStop. Or think about the pricing of dot-com companies in 1999 and early 2000. Markets may be efficient when individuals make judgments in isolation. But when large numbers of investors act as a herd, with folks egging each other on, market efficiency can break down and share prices can lose touch with reality.

Behaving yourself. What does this mean for more sensible investors? Even if you think particular stocks are at unsustainable prices, I would caution against betting that they’ll fall back to earth. Shorting stocks is a dangerous game—because the potential losses are unlimited.

So, what should sensible investors do? At a minimum, I think it’s helpful to be aware of this herd behavior, so you aren’t tempted to join in. Eventually, fundamental value will win out, dragging foolishly priced investments back to earth, and you don’t want to get caught up in the carnage.

Instead, if there’s any opportunity for sensible investors, I think it comes during broad market declines. When the news is relentlessly bad, your neighbors are talking about cashing out their 401(k) and the TV talking heads are certain the market decline has further to go, there’s a chance we’re seeing herd behavior—and this is the moment when you want to rebalance your portfolio, buying stocks so you get your holdings back up to your target portfolio percentage. At such moments of collective madness—think early 2009 or early 2020—you might even consider overweighting stocks, something I’ve done during market declines.

But even if you aren’t inclined to buy, I’d encourage you to lean against the wind, at least emotionally. We may not know the precise fundamental value for stocks. But we know they do have fundamental value, and that value changes far more slowly than share prices. When financial markets seem nuts, we should keep this fundamental value in mind—and know there’s more to stocks’ value than just the latest price quote.

Think about the past year, with all the fretting over inflation, recession, a government debt default and the dollar losing its reserve currency status. If you paid too much attention to the handwringing, it would be easy to lose your nerve and make panicky decisions. And even if you stood your ground, there’s a good chance you found yourself worrying needlessly.

My advice: Get into the habit of telling yourself it isn’t as bad as the headlines suggest and that this too shall pass. Indeed, even if we fear “it’s different this time,” it’s rational to bet otherwise. How so? An imploding world hurts everybody, no matter how they’re invested, but a recovering world only rewards those brave enough to stay the course.

Jonathan Clements is the founder and editor of HumbleDollar. Follow him on X (Twitter) @ClementsMoney and on Facebook, and check out his earlier articles.

Jonathan Clements is the founder and editor of HumbleDollar. Follow him on X (Twitter) @ClementsMoney and on Facebook, and check out his earlier articles.The post Lean Against the Wind appeared first on HumbleDollar.

Alberta’s Money

I PAY FOR MY OWN partial retirement with a university pension, income from rental properties, income from the remnants of my private psychology practice and, of course, Social Security. I long ago emptied my retirement accounts to pay for our son Ryan’s college education and to help launch his career.

What about my wife Alberta? She has income from her fulltime psychology practice, her share of our rental income and Social Security. But unlike me, Alberta is also awash with traditional retirement accounts, where all withdrawals are taxable as ordinary income. She has a Roth in name only because, as we say in Yiddish, it’s “bupkes,” or hardly anything at all.

Too many decades ago, we opted to forgo funding Alberta’s Roth in favor of investing in rental real estate. Property owners, like stock investors, have enjoyed a bountiful if bumpy long bull run. But our zeal to redirect excess cash to real estate rather than stocks was overdone.

Now, more than three-quarters of our combined wealth sits in relatively illiquid rental properties. After 40 years of uninterrupted appreciation, selling would mean big tax bills—or, at least, it will until my passing means a step-up in basis on the properties and hence relief from the tax burden.

Here in California—a community property state—my death will eliminate the entire embedded tax bill on our jointly owned properties and not just half, which is the case in most states. Still, in retrospect, adopting my parents’ investment ideology, that owning real estate is the gold standard for retirement, wasn’t the wisest course of action.

I have concerns about Alberta’s income once she decides to stop seeing patients and if she lives well into her senior years. Perhaps greedily and unrealistically, we’re reluctant to cut back our (hardly extravagant) lifestyle at this late stage. Still, that means we’re currently a little strapped for cash unless we start withdrawing from Alberta’s traditional retirement accounts. Her upcoming required minimum distributions may, ironically, force our hand at just the right time.

As the money nerd in our relationship, I manage Alberta’s retirement accounts. I rely almost exclusively on exchange-traded funds (ETFs), largely because of their liquidity, low cost, and freedom from the cumbersome and annoying restrictions that fund families sometimes impose on mutual fund investors.

I have dual and sometimes conflicting goals, aiming both to generate income for us and to increase Alberta’s portfolio for our son Ryan’s eventual inheritance. Since both Alberta and I are in our 70s, I’ve embraced a moderate growth strategy. I aim for an overall dividend yield above 3% and a total return that’s two-thirds of the broad market’s advance or decline—similar to the goal I have for my taxable account.

To that end, I’ve invested Alberta’s retirement accounts in two core low-cost Vanguard Group ETFs: Total World Stock (symbol: VT) and International High Dividend Yield (VYMI). Together, they represent a third of Alberta’s portfolio.

I’ve bought eight other ETFs for Alberta. In the interest of diversification, only two account for more than 10% of her portfolio: Technology Select Sector SPDR (XLK), a meat-and-potatoes sector ETF, and Schwab U.S. Dividend Equity (SCHD), a dividend-and-growth ETF with enviable 10-year relative performance.

Two of the other six funds deserve special mention. Avantis U.S. Small Cap Value (AVUV) has a promising record since its inception four years ago, and it lost only half as much as its Vanguard peer (VBR) in 2022’s market bloodletting. Although an actively managed ETF, it has an uncharacteristically low 0.25% expense ratio and only 24% turnover. Meanwhile, Vanguard Real Estate ETF (VNQ) seems like a timely investment after a stretch of weak performance, plus it offers Alberta an opportunity to become comfortable with real estate investment trusts, should she ever decide to relinquish direct real estate ownership in favor of this hassle-free alternative.

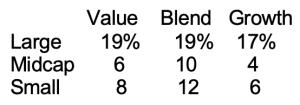

For insights into Alberta’s fund mix, I give thanks to Morningstar’s Portfolio Manager platform, especially the Portfolio X-Ray tool. To make sure I’ve achieved a desirable amount of diversification, I use Portfolio X-Ray to check what percentage of Alberta’s  overall fund mix is in each of Morningstar’s nine style boxes. You can see the result in the accompanying chart.

overall fund mix is in each of Morningstar’s nine style boxes. You can see the result in the accompanying chart.

My goal is a sensible allocation, with a slight value tilt and meaningful small and midcap exposure, and that’s what the portfolio has. Morningstar’s X-Ray also tells me that international stocks comprise an intended one-third of the portfolio. The average cost is 0.18%, which I consider very acceptable, although it may not satisfy a Bogle purist. The technology allocation is 24%, compared with the S&P 500’s 29%, a deliberate underweight dictated by my anxious temperament.

What about that Holy Grail called performance? As a benchmark, I use 70% in a total U.S. stock market index fund and 30% in a total international stock fund. Over the past year, Alberta’s portfolio earned 69% of the benchmark’s return, in line with my target of capturing two-thirds of the overall market’s movement.

Steve Abramowitz is a psychologist in Sacramento, California. Earlier in his career, Steve was a university professor, including serving as research director for the psychiatry department at the University of California, Davis. He also ran his own investment advisory firm. Check out Steve's earlier articles.

Steve Abramowitz is a psychologist in Sacramento, California. Earlier in his career, Steve was a university professor, including serving as research director for the psychiatry department at the University of California, Davis. He also ran his own investment advisory firm. Check out Steve's earlier articles.

The post Alberta’s Money appeared first on HumbleDollar.

December 21, 2023

Better Together

RETIREMENT PLANNING is about much more than money. As regular readers of HumbleDollar know, getting the social aspects right is just as important—and perhaps more so—than nailing the financial issues.

In 2019, before we retired, we took a trip to the desert southwest, a region we love. It was our first visit to Canyonlands National Park in Utah. I was captivated by the beauty of the rock formations, canyons and mesas. The most striking memory was the path of cottonwood trees, with their golden leaves, running along the Colorado River.

On that trip, we stood on the Island in the Sky mesa and looked down on the White Rim Road, a 100-mile road running through the park. Although it’s a road, it can be traversed only by foot, bicycle, motorcycle or high-clearance four-wheel-drive vehicle.

In winter 2022, I finally got serious about returning to the White Rim Road. My sons and their wives also said that they’d like to go, so we had to pick a date that worked for everyone. We were able to find two days in October that looked doable. A two-day visit meant we’d need to rent Jeeps.

The first order of business was obtaining an overnight permit to camp along the road. Only 20 such campsites are available, and October is one of the most popular times to visit.

Reservations for October camping opened at 8 a.m. on May 10. We had three of us logged into Recreation.gov trying to get a campsite. My wife was on a conference call with everybody, coordinating our activity. Fortunately, one of us scored our preferred campsite within minutes. I checked back the next day, and every campsite for every day in October had been reserved.

Once we knew that we could go, we had to rent Jeeps. Fortunately, Moab, Utah, has a number of Jeep-rental services. Because five of us were going, we rented two Jeeps. All of us are veteran campers. The difference this time was that, while we all preferred human-powered adventure, this would be our first time in Jeeps.

With a camping permit and Jeeps secured, we spent several months collecting the rest of our supplies. The National Park Service recommended that we carry 10 gallons of water per person and five gallons of extra gas per vehicle. We also needed a shovel to help dig out our Jeeps if they got bogged down. The rest of the gear was standard camping equipment that we all owned.

The first mile of the road is a 1,500-foot descent from the mesa to the river bottom. The road was built for trucks hauling uranium ore out of a mine, so—although it’s narrow with steep dropoffs along the sides—it’s in pretty decent shape.

The section of road we covered on the first day was rocky, and had steep ascents and descents. Our Jeeps recorded some of the roads as having a 21-degree grade. That’s sufficiently steep that, when you’re climbing, the Jeep’s hood blocks your view of the road.

It normally takes about five-and-a-half hours to travel the 45 miles to our campsite, but it took us a bit longer because we made several side trips to see other parts of the trail. While we were eating lunch beside the Colorado River, a group of canoeists stopped to use the latrine located nearby. We shared stories of our respective adventures.

Shortly after arriving at our campsite, we started cooking dinner. The meal was standard camping fare, but the view overlooking the expansive valley, surrounded by the walls of the mesa, was far better than the view offered by any Michelin-rated restaurant.

Two memories of that evening are most vivid. First is the profound silence. In this extremely arid area, life is scarce. There was no background noise of insects buzzing or wind blowing, let alone any sounds of civilization, such as cars and airplanes. The only other time I’ve experienced such silence was in a quinzhee, where the snow absorbs all sound.

The second memory was the beauty of the night sky. Canyonlands is a dark-sky preserve, so the firmament above was covered with points of light and the river that is the Milky Way. Whenever there are no lights to detract from the view, I’m always in awe of the night sky.

The second day, we drove around a buttress of the mesa, and the road changed from stony to shifting sand. At times, our speed got up to 20 mph, but we still had to crawl slowly over Hardscrabble Hill and up the Mineral Bottom switchbacks to the mesa top. It was a wonderful time spent with my sons and their spouses.

The Rational Reminder podcast ends every interview with this question: How do you define success in your life? Many interviewees talk about making contributions to society or doing groundbreaking research. But my favorite answer was from author and financial advisor William Bernstein, who replied: “Oh, that’s easy. When you get to my age and your kids still want to spend time with you, then you are a success.”

The lesson: Take the time to plan not just your retirement’s finances, but the social aspects as well.

Kenyon Sayler is a retired mechanical engineer. He and his wife Lisa are extraordinarily proud of their two adult sons. He enjoys walking his dog, traveling, reading and gardening. Kenyon's brother Larry also writes for HumbleDollar. Check our Kenyon's earlier articles.

Kenyon Sayler is a retired mechanical engineer. He and his wife Lisa are extraordinarily proud of their two adult sons. He enjoys walking his dog, traveling, reading and gardening. Kenyon's brother Larry also writes for HumbleDollar. Check our Kenyon's earlier articles.The post Better Together appeared first on HumbleDollar.

Losing the Keys

MY MOTHER AND MY future mother-in-law met at a funeral 37 years ago. They started discussing their respective families. It was during that conversation that they realized they each had an unmarried child, and they decided it would be nice if their two children got together. Thus, on that fatal day, my life was changed forever.

One of the stories I heard early on about my mother-in-law was how she lost a house to foreclosure. My father-in-law diligently handed over his paycheck to my mother-in-law every payday. My mother-in-law was the one responsible for paying the bills.

One day, when my future wife was six years old, she walked home from school to find a “for sale” sign on the front lawn. The doors were locked and no one was home. My wife freaked. She thought her mother, father, older brother and younger sister had left, and forgotten to take her. She started crying and began walking to her uncle’s house down the street. At about this time, her father was driving up the block and stopped to find out why she was crying. When he got to their house and saw the sign, it was his turn to freak out.

My in-laws were both born on 116th Street in Manhattan, just south of Harlem, to immigrant parents. My father-in-law was Italian. My mother-in-law was Chilean. They lived in separate apartment buildings. As my mother-in-law described it, “In the neighborhood, everyone was poor, but we were all equally poor, so we didn’t consider ourselves poor. We were just like everyone else."

After serving in World War II, my father-in-law—like many GIs—wanted a better life. He got a job working in the aircraft industry building airplanes. He met a girl from the neighborhood and got married. They started a family and wanted to move up in the world by buying their very own house in the suburbs of Long Island. Life was good—until it wasn’t.

My mother-in-law had a soft touch for people in need. Their next-door neighbor was struggling with financial problems, and my mother-in-law wanted to help out. Instead of paying the mortgage with the money her husband was giving her, she gave it to the neighbor. Apparently, this went on for a while until the mortgage company foreclosed.

My wife has often described her family life as exactly like the TV show All in the Family, with my father-in-law as Archie Bunker, and often yelling at my mother-in-law, who played Edith. Indeed, I often witnessed these Archie Bunker-like rants by my five-foot-tall father-in-law.

What I wanted to know: If my father-in-law would scream at his wife for every mistake she made, why didn’t he divorce her after she lost the house that he’d worked so hard to save up for?

His answer shocked me: “Oh, she was young and she just wanted to help the neighbor.” That’s it? I couldn’t believe Archie Bunker was saying this.

I immediately got nervous and wondered if this financial thinking was hereditary, and whether my wife had inherited this same defective gene. From that point on, I’ve handled our finances. I’m happy to report that we live debt-free.

But that isn’t the end of the story. My in-laws became ill in 2021 and were forced to sell their home in a 55-plus community in Sun City, South Carolina, and move into an assisted living apartment. My sister-in-law asked me to help her go through their financial papers to see if there were any problems.

Even after her early hiccup, my mother-in-law had continued to handle the family finances. In reviewing their credit card statements, I discovered that my mother-in-law had set up auto-pay, so the utilities and other bills were automatically charged to their credit cards. The credit cards, in turn, were automatically paid from their checking account, which was where my father-in-law’s monthly pension and their Social Security checks were deposited.

My mother-in-law was the last person I’d imagine teaching me a positive financial lesson, but she did. By reviewing what she’d done, it made me realize how simple your financial life becomes when you know your bills will be paid. It frees you up to focus on enjoying other aspects of life, which is what my in-laws had done. My mother-in-law’s rationale for this arrangement: When they were traveling, she wanted to be sure the bills were paid while they were gone.

My mother-in-law passed away in 2022. After her death, my father-in-law never got the hang of paying the bills. Instead, that responsibility has fallen to their other daughter—my sister-in-law.

David Gartland was born and raised on Long Island, New York, and has lived in central New Jersey since 1987. He earned a bachelor’s degree in math from the State University of New York at Cortland and holds various professional insurance designations. Dave’s property and casualty insurance career with different companies lasted 42 years. He’s been married 36 years, and has a son with special needs. Dave has identified three areas of interest that he focuses on to enjoy retirement: exploring, learning and accomplishing. Pursuing any one of these leads to contentment. Check out Dave's earlier articles.

David Gartland was born and raised on Long Island, New York, and has lived in central New Jersey since 1987. He earned a bachelor’s degree in math from the State University of New York at Cortland and holds various professional insurance designations. Dave’s property and casualty insurance career with different companies lasted 42 years. He’s been married 36 years, and has a son with special needs. Dave has identified three areas of interest that he focuses on to enjoy retirement: exploring, learning and accomplishing. Pursuing any one of these leads to contentment. Check out Dave's earlier articles.The post Losing the Keys appeared first on HumbleDollar.

December 20, 2023

Yielding Results

I INVEST FOR GROWTH, not income. That will likely change as I get closer to my 2028 planned retirement. For now, I diversify my portfolio mainly with cash and short-term bonds with the goal of stability, not yield. Yet this article is about the yield I receive.

Why focus on yield? Some say everyday investors overemphasize the importance of dividends, and maybe that’s true of me. But with much of the U.S. stock market richly valued—and now that I’m only five years from retirement—I feel pretty good about my portfolio’s yield, currently around 3%.

Indeed, if the stock market’s price-earnings multiple stops its upward trajectory of the past 40 years, dividends should become a greater part of total return than in the past. Likewise, with the decades-long bond bull market probably over, yield will be an even more important driver of returns for bond investors going forward.

My portfolio yield is higher than the pair of funds I benchmark against, iShares Core Growth Allocation ETF (symbol: AOR), which yields 2.3%, and iShares Core Aggressive Allocation ETF (AOA), which yields 2%. Both are global funds that track the major developed and emerging market stock indexes, as well as those of U.S. and foreign bonds.

My relatively large allocation to cash investments, including money market funds, certificates of deposit and short-term Treasurys, contributes greatly to my portfolio’s overall yield. Thanks to today’s high federal funds rate, my cash investments yield more than the 4.3% offered by the overall investment-grade bond market, as measured by iShares Core U.S. Aggregate Bond ETF (AGG).

I also own some conventional bonds through my two balanced funds, and I’m slowly building a position in high-yield “junk” bonds with my 401(k) contributions. High-yield bonds are a new asset class for me. Why bother? With the U.S. stock market so pricey, I wanted to take a bit less risk with the aggressive side of my portfolio, while still having the chance for rich returns.

My 3% yield is also partly earned from my stake in foreign value stocks. They’ve done well this year relative to the broader foreign indexes, as I wrote here. Most of my foreign exposure is through my largest position, iShares MSCI World ETF (URTH), a global developed markets index fund that includes U.S. shares. But I add a value tilt to my international stock holdings with Dimensional International Value ETF (DFIV) and Dimensional International Small Cap Value ETF (DISV).

These two funds invest only in developed countries, and yield 4% and 2.6%, respectively. Meanwhile, my emerging markets exposure comes from iShares MSCI Emerging Markets ex China ETF (EMXC), which yields 2.4%.

My value bias at home also comes with good dividends, even if U.S. value stocks’ overall returns have lagged growth shares this year. Vanguard Small-Cap Value ETF (VBR) yields 2.3%, compared with 1.5% for the S&P 500. The Income Fund of America (AMEFX) and Exxon Mobil (XOM) shares that I inherited yield 3.5% and 3.7%, respectively, while the Lockheed Martin (LMT) shares I purchased in late 2021 yield 2.7%.

The post Yielding Results appeared first on HumbleDollar.

December 19, 2023

Taxing Our Brains

I SPENT A GOOD portion of my early adult life in neighborhood taverns. Back then, I sold beer for a living. You can imagine that I saw and heard some crazy things. Remember the sitcom Cheers? I knew doppelgangers for each and every Cheers character.

But the things I heard in those bars didn’t come close to the things I heard later when I worked as an income-tax preparer. No doubt other tax preparers and CPAs can add to my list. Here are my top 12:

1. Years ago, I asked a friend why she hadn’t refinanced her home loan after mortgage rates dropped sharply. Her response? She said she needed the bigger tax deduction. Even after I explained that she only saved 15 cents in tax for every $1 spent on mortgage interest, she still didn’t get it.

2. A client received Form 1099-C for the cancellation of credit card debt. She couldn’t understand why it was taxable, saying, “Why do I have to pay tax? It’s not like I got anything for it.”

I asked her, “What about all the stuff you bought and never paid for?”

The tax-code rationale: If one party can take a deduction, such as the credit card company for cancelling the debt, then someone else—my client, in this case—has to claim it as income.

3. A client with a fully depreciated rental property had the notion that, by using a mortgage loan to remove his home equity from the property, he could eliminate the taxable gain. This wasn’t an easy conversation.

The good news is, the client had been able to deduct a fraction of the price paid for the property each year. The bad news is, this process had reduced his cost basis to $0, not including the cost of the lot. Upon selling the property, the IRS recaptures all of those prior depreciation deductions in the form of long-term capital gains. And, no, the IRS doesn’t care how much you owe on the house.

4. Multiple landlord clients wanted to deduct uncollected rent from deadbeat renters or vacant units, or deduct the value of their time spent working on the property. Sorry, there’s no line on the tax form for that.

5. A client pulled all his money from his retirement account in early 2009. He was shocked that the distribution pushed him into the next tax bracket and cost him the 10% early withdrawal penalty.

Asked why he took out the money, he said it was because his account was going down in value. The market turned around in 2009 and has, for the most part, been going up ever since. Did I mention that he bought a beautiful new pickup truck with the money?

6. “My friend at work gets a bigger refund than me.” I got this comment frequently. There are lots of reasons this could happen, and it often has to do with how much tax was withheld during the year.

"In your case, I don’t know why you got less because I don’t do your coworker's taxes," I'd explain. "And even if I did, the IRS has its own version of HIPAA, the rules that cover medical privacy, which would prevent me from talking about your coworker's taxes."

7. A typical question from someone with a casino-issued W-2G for gambling income: “Why do I have to put that on my tax return? They taxed me when I got it.” Yes, they withheld tax, just like your employer does from your wages. But you still have to report those earnings on your tax return.

This situation is one of my income tax pet peeves. Slot machines and lotteries are programmed to keep a percentage of the money put into them. I don’t believe that the occasional lucky soul should be taxed at all on his or her winnings. Side note: Learn how to count cards at the blackjack table or become a really good poker player. As long as you aren’t in a tournament, where they keep track of your winnings, there’s no way for the casino to know your precise good fortune and issue the dreaded W-2G. I say this tongue-in-cheek: The winnings are still taxable, even when no W-2G is issued.

8. “I turned down the overtime because it put me in a higher tax bracket.” Ever tried to explain progressive taxation to someone? There are good reasons to turn down overtime, such as wanting to spend more time with family. But please don’t turn it down because of taxes. We’ll sort out the details at tax time—but, yes, you’ll be dollars ahead.

9. “Can I deduct as a loss my investment in Iraqi dinars?” I had advised the client not to buy the dinars in the first place. In this client’s case, his income wasn’t high enough to trigger income taxes, making the capital loss worthless to him.

10. Instead of a wage increase, a company increased its contributions to the defined benefit pension, thereby decreasing its unfunded liability. An employee insisted that he should be able to take a tax deduction for the amount of wages lost.

It’s hard for a lot of people to connect the dots between the money they receive for wages and the value of fringe benefits, such as their pension and health insurance. I can only imagine the outrage if all of a sudden people had to pay tax on the cost their employer pays for their family's health insurance, which can easily be worth $30,000 a year.

11. “If I won the lottery, I’d hide the money in the basement so the government wouldn’t tax me every year.” If you have the money in a savings account, you’d make a little interest and still be ahead after taxes, plus the money would be safer from folks who know you’ve got a pile of cash in your basement. Like your tax preparer, for instance.

12. “I’m filing as head of household,” a client told me.

“You can’t be head of household,” I explained. “You don’t have any dependents.”

“Yeah, but I’m still head of my household.”

Beam me up, Scotty.

Are these comments from stupid people? No, they’re from all sorts of people, many with advanced degrees and highly technical jobs. It’s just indicative of how opaque taxes can be.

I don’t want you to get the impression that, now that I’ve retired, I’m happy to be done with these misinformed souls. I’m not. By doing their taxes, I got to know these folks. When I run into former clients now, I get a vigorous handshake or a warm hug. I miss them.

I also miss the days when, if someone asked me about E.D., they were talking about elective deferrals to their 401(k).

For 30 years, Dan Smith was a driver-salesman and local union representative, before building a successful income-tax practice in Toledo, Ohio. He retired in 2022. Dan has two beautiful daughters, two loving sons-in-law and seven grandchildren. He and Chris, the love of his life, have been together for two great decades and counting. Dan's previous article was Beer to Taxes.

For 30 years, Dan Smith was a driver-salesman and local union representative, before building a successful income-tax practice in Toledo, Ohio. He retired in 2022. Dan has two beautiful daughters, two loving sons-in-law and seven grandchildren. He and Chris, the love of his life, have been together for two great decades and counting. Dan's previous article was Beer to Taxes.

The post Taxing Our Brains appeared first on HumbleDollar.