Kenneth Boyd's Blog, page 45

November 5, 2019

What the Under Armour Accounting Scandal Teaches Us About Liquidity Ratios (Video Link)

Under Armour’s CEO is stepping down, and the stock price declined by over 18% on Mon, 11/4.

What happened?

The company’s third quarter earnings report was negative, but the bigger story is this:

“Department of Justice is conducting a criminal inquiry into whether Under Armour shifted sales from quarter to quarter to make the company appear healthier.”

This is a classic example of “robbing Peter to pay Paul”, and the strategy isn’t sustainable.

Why Shifting Revenue Catches Up With You

Let’s assume that Under Armour projected $50 million in revenue for the third quarter. There are two weeks left in the quarter, and the firm projects $48 million in revenue.

One way to make the revenue number is to bend the rules on revenue recognition.

Now, that’s a problem for accountants, because of the principal of consistency. Once Under Armour decides on a method to recognize revenue, they need to stick with it. If not, the financial results aren’t comparable from one period to the next.

Assume that Under Armour posts revenue when goods are shipped to the client. Late in the third quarter, they decide to bend the rules. To earn an additional $2 million, the company recognizes revenue when $2 million in orders are placed.

Placing an order is not the same as shipping an order, and there’s a higher probability that the customer may cancel the order. But it gets the third quarter revenue to $50 million.

But the firm is taking $2 million in revenue away from the fourth quarter- can they make up the $2 million and hit the 4th quarter number?

Or will they have to bend the rules again?

It catches up with you- and can make the financial results much worse in later quarters.

This is a great example to explain liquidity ratios.

If you’ve taking an intermediate accounting class, or studying for the CPA exam, you may struggle with calculating liquidity ratios.

You’re not alone.

This discussion explains these concepts using a screenshot from spreadsheets. Here’s a video link that explains the topic.

When you think of liquidity ratios, think of your checkbook.

Liquidity Ratios

Liquidity asks the question: Can you generate enough current assets to pay all of your current liabilities? Check out the spreadsheet below:

Current assets and current liabilities

Current assets include cash, and other assets that will be converted into cash within 12 months, including accounts receivable and inventory.

Current liabilities include the accounts payable balance, and other liabilities that will be paid within 12 months. That includes the current portion (principal and interest) owed on long-term debt over the next year.

If Under Armour posts an additional $2 million in third quarter revenue, the firm will also increase accounts receivable by the same amount.

Remember: the firm is recognizing income earlier than normal. It’s unlikely that any cash has been paid, so accounts receivable is increased. Higher accounts receivable increases current assets.

Working capital, current ratio, and acid test ratio

Working capital: Current assets less current liabilities. The goal is to have a positive working capital balance, which means you have more than enough current assets to pay current liabilities.

Current ratio: This presents the working capital information as a ratio (current assets / current liabilities). Your goal is to have a ratio of 1.0 or higher.

Acid test ratio: The formula subtracts inventory from current assets in the current ratio formula. The rationale is that inventory is the current asset that takes the longest time to convert into cash. So, let’s remove that balance and look at the ratio.

Posting an additional $2 million accounts receivable will make all three of these ratios look better.

Manipulating revenue has a massive impact on reported financial results

My next book, 25 Intermediate Accounting Spreadsheets (and How to Use Them) will be out in 2020. The format will include a written discussion of a spreadsheet, with spreadsheet images, and a related video.

To learn more and get sample chapters of the book, watch this video.

For live CPA exam prep and accounting classes, join Conference Room for free. Members will be notified of course dates, times, costs, and how to attend these courses.

Get your questions answered to pass the CPA exam, and to learn accounting concepts.

Go to Accounting Accidentally for 300+ blog posts and 450+ You Tube videos on accounting and finance:

Good luck!

Ken Boyd

Author: Cost Accounting for Dummies, Accounting All-In-One for Dummies, The CPA Exam for Dummies and 1,001 Accounting Questions for Dummies

(email) ken@stltest.net

(website and blog) http://www.accountingaccidentally.com/

The post What the Under Armour Accounting Scandal Teaches Us About Liquidity Ratios (Video Link) appeared first on Accounting Accidentally.

October 7, 2019

Save Money, Save Planet

If you have ever been in the financial hole, you know how hard it is to make ends meet.

It requires some creative juggling and being extremely tight on where you spend and how much. Every expense is weighed, every option is reviewed, and creativity is flowing to stitch everything together.

At these times, you might wish you were a little more frugal when times were good.

And you know what they say: “make hay while the sun shines,” which also applies to your financial management. The goal should be to never get in a situation where you have to scramble for money. Instead, you will have looked at every angle and cost-saving option beforehand.

If you’ve had a financial setback, this article may help you.

Here are some important tips that apply to both your personal and business environment, which have a positive impact on the world as a bonus.

Change Is Hard

The reason that people don’t diet, don’t exercise, and don’t resolve bad personal relationships is that change is hard. As a result, we don’t really, truly change and grow unless we’re in real pain. When we’re at that point, the pain of change is less severe than that pain of not changing.

Discipline and time

With discipline and time, I think most people can accumulate far more wealth than they think is possible. But growing wealth requires change- which is precisely why most people don’t make the effort. The changes I’m suggesting involve an old friend:

Delayed gratification

Some decisions are relatively small:

Dropping a subscription music service and just listening to the free version (Pandora, for example).

Making coffee at home two days a week, which means that you stop by Starbucksless often.

Buying afew more generic products when you go to the grocery store and Target. (I’m not going generic on salad dressing, however).

Since these are smaller decisions, the amount of gratification you’re delaying is small. You don’t mind listening the commercials on Pandora (I certainly don’t- I just turned down the sound), and the coffee at home isn’t bad.

Other decisions are much bigger. StudySoup wrote this great article on the average amount of money a college student saves by having a roommate. The average savings over four years is over $15,000. Now, having a roommate is a big sacrifice, because you lose a fair amount of privacy. If privacy is really important to you, it’s a true delay of gratification (until you graduate, get a job and can afford to live alone).

Read this article, and improve your credit score.

So, what do I get?

OK- so what do I get out of all this delayed gratification?

You build wealth- which can give you peace of mind.

Here’s a practical example: By making changes to your spending and building a savings account, you create a $1,000 emergency fund. If your car brakes down, you can pay for the repair.

Cut Down on Overhead

An excellent place to look for wastage is, well, in the waste bin. Look at all the food waste you might be generating, or perhaps the amount of paper that gets printed to end up in the bin anyway. The waste bin is the perfect indicator of things that can be saved on.

In terms of food waste, the solution is to portion appropriately. In general, food waste is a global problem, so why not start with yourself? It might require some discipline, but with time and dedication, you can cut back appropriately so you can reduce not only wastage but also save money.

In terms of printer usage, you will find a lot of people still needing to print documents to review them. Granted, reading documents on the screen is not everyone’s cup of tea, but printing them will cost energy, ink, and paper. Setting a policy to ask people to reconsider before printing might help create an attitude that saves not only money but also the planet.

Solar Panels

A good way many people are saving money (and saving the planet) is to install solar panels.

If your home or business is well isolated, fitted out with energy-saving light bulbs, properly set up sleep timers, and “A” energy class devices, you can decrease your energy usage tremendously. Add to that solar panels, and if they are well placed, and the sun has been out in force, you can nullify most of your electric bills.

Some households can even run a surplus, generating more electricity than usage, which means you are contributing to a sustainable world. In some cases, you can get a federal solar tax credit towards your initial investment.

Smart Technology

It might seem quite gadget-ty, but smart technology can be a cost savings and better for the environment over the long term.

Take smart thermostats, for example, which can maintain the room temperature at a much more sensible and efficient manner than we humans can. Smart technology can help us do things much better while saving money along the way.

Reduce waste, don’t print when not needed, install solar panels, and start relying on smart technology; these are the things you can look at when the sun is shining. You’ll be happy that you did if you feel another tough time coming on.

Use these tips to save money- and to help save the planet.

Ken Boyd

Author: Cost Accounting for Dummies, Accounting All-In-One for Dummies, The CPA Exam for Dummies and 1,001 Accounting Questions for Dummies

(email) ken@stltest.net

(website and blog) http://www.accountingaccidentally.com/

(you tube channel) https://www.youtube.com/user/kenboydstl

The post Save Money, Save Planet appeared first on Accounting Accidentally.

September 23, 2019

Empty Coffers: Why You Can’t Save Money

In a perfect world, we would all have money tucked away for an emergency.

Of course, in reality, many of us lurch from one paycheck to another, crossing our fingers and praying that we have enough to cover what we owe. Sadly, this often leaves very little or nothing for savings.

But you can make changes.

If you’ve had a financial setback, this article can help.

Avoid Overspending

Avoid spending more than you can afford to.

Spending involves a number of factors, including how much you earn, how much you pay out on monthly costs, and how much you spend as you go along.

However, the issue of overspending is usually caused by a lack of care with budget making and tracking. Something that allows you to believe you still have more money available for non-essential items than you actually do.

This article can help you improve your credit rating.

Change is hard

The reason that people don’t diet, don’t exercise, and don’t resolve bad personal relationships is that change is hard.

As a result, we don’t really, truly change and grow unless we’re in real pain. When we’re at that point, the pain of change is less severe than that pain of not changing.

Discipline and time

With discipline and time, I think most people can accumulate far more wealth than they think is possible. But growing wealth requires change- which is precisely why most people don’t make the effort. The changes I’m suggesting involve an old friend:

Delayed gratification

Some decisions are relatively small:

Dropping a subscription music service and just listening to the free version (Pandora, for example).

Making coffee at home two days a week, which means that you stop by Starbucksless often.

Buying afew more generic products when you go to the grocery store and Target. (I’m not going generic on salad dressing, however).

Since these are smaller decisions, the amount of gratification you’re delaying is small. You don’t mind listening the commercials on Pandora (I certainly don’t- I just turned down the sound), and the coffee at home isn’t bad.

Other decisions are much bigger. StudySoup wrote this great article on the average amount of money a college student saves by having a roommate. The average savings over four years is over $15,000. Now, having a roommate is a big sacrifice, because you lose a fair amount of privacy. If privacy is really important to you, it’s a true delay of gratification (until you graduate, get a job and can afford to live alone).

So, what do I get?

OK- so what do I get out of all this delayed gratification?

You build wealth- which can give you peace of mind.

Take an honest look at your spending habits, and adjust them accordingly.

Medical debts

Another major issue that prevents many people from saving money is that they have sustained medial debts to pay off.

Of course, this type of debt is different from all others in two ways. Firstly, it can run in the tens of thousands very easily, and secondly, it is usually necessary debts. That is you can go around with a broken arm or ruptured appendix in ordinary life.

Sadly, when you have significant medical debt, it often means that any money you do have is diverted straight to paying that off. A situation that rarely leaves anything left for the savings pot.

Although there is a possible way around such an issue. In fact, if the injury you sustained was not your own fault, you can claim compensation to cover your medical bills. Something that it can be surprisingly easy to do.

In fact, you only need to search for terms like ‘best personal injury attorney near me‘, and lawyers that can handle the case for you will show up. Then you can leave the hard work to them, and if they succeed, you will no longer have such a strain on your finances. Something that should enable you to divert more to your savings coffers.

Overcharged for Financial Products

Make sure that you understand how you are charged by your bank, credit card companies, and for investments.

When it comes to paying back loans with interest, be sure to negotiate the lowest APR before you sign on the dotted line. Otherwise, you could end up paying for it out of your saving later on!

Take Action Now

With self-discipline and effort, you can improve your financial situation and fill those empty coffers. You can do it!

Ken Boyd

Author: Cost Accounting for Dummies, Accounting All-In-One for Dummies, The CPA Exam for Dummies and 1,001 Accounting Questions for Dummies

(email) ken@stltest.net

(website and blog) http://www.accountingaccidentally.com/

(you tube channel) https://www.youtube.com/user/kenboydstl

The post Empty Coffers: Why You Can’t Save Money appeared first on Accounting Accidentally.

September 20, 2019

How Businesses Are Changing The World

The world is changing.

Starting a business has become, and the market is becoming so crowded with people who are desperate to make it to the top.

And there are some really powerful businesses at the top of the food chain, that can make a massive difference to the way that this world is heading. So, if you run a business yourself, or if you know someone who does, we’re going to show you how they are succeeding.

If you’ve had a financial setback, this article can help.

Putting Their Profits To Better Use

Business is about making profits.

Many businesses, however, give back to the community.

AssuranceAmerica is one company who is using their profits to tackle issues in their community, such as homeslessness. Homelessness is on the rise all around the world. The economy and certain life situations is forcing people to the streets, and the streets are no place for someone to be.

Use a portion of your profits to help your community.

Tackling Climate Change

Climate change is by far one of the most pressing issues that we’re facing at the moment.

Businesses are largely at fault for climate change, because everything they create we’re relying heavily on. But the things we’re relying heavily on, are polluting the air quicker than they ever have before.

So, to tackle climate change, businesses are aiming to become greener than they ever have before. From car manufacturers experimenting with hybrid technology, to electricity providers turning to wind farms. But for the most part, businesses are largely changing the world for the worse when it comes to climate change, and a lot more is going to have to be done if we want to reverse the effects that are happening right now!

Read this article, if you work as a freelancer.

Being Innovative

Businesses are now being forced to be more innovative, simply because the race to stay at the top is requiring them to be.

Innovation is the key- if you want to please customers- and the demand that we’re showing as customers seem to be growing. We want bigger and better, and that’s leading businesses to produce things we would only have been able to dream of a decade ago. From virtual reality headsets, to driverless cars, the world is changing quicker than it ever has due to the innovation of businesses!

The more that the population grows, and the more that the new generation is being raised on technology, the more pressure there is going to be to become bigger and better!

Raising Funds to Operate

“To improve is to change; to be perfect is to change often” – Winston Churchill

To raise funds for your business, you may need to change.

In 2017, Trinidad and Tobago (a country of slightly less than 1.4 million people) just beat the US Men’s Soccer Team (325 million people) to eliminate the US from the next World Cup soccer tournament. Every few years, we Americans get all jacked up about a new coach, new team members- and we don’t seem to make much progress in Men’s soccer.

Sounds like someone needs to make some serious changes.

(The US Women’s Team, on the other hand, are the current world champions (as of 2017)- which is more proof that the US can figure out international soccer).

Change is hard

The reason that people don’t diet, don’t exercise, and don’t resolve bad personal relationships is that change is hard. As a result, we don’t really, truly change and grow unless we’re in real pain. When we’re at that point, the pain of change is less severe than that pain of not changing.

Discipline, time, and delayed gratification

Discipline and time

With discipline and time, I think most people can accumulate far more wealth than they think is possible. But growing wealth requires change- which is precisely why most people don’t make the effort. The changes I’m suggesting involve an old friend:

Delayed gratification

Some decisions are relatively small:

Dropping a subscription music service and just listening to the free version (Pandora, for example).

Making coffee at home two days a week, which means that you stop by Starbucksless often.

Buying afew more generic products when you go to the grocery store and Target. (I’m not going generic on salad dressing, however).

Since these are smaller decisions, the amount of gratification you’re delaying is small. You don’t mind listening the commercials on Pandora (I certainly don’t- I just turned down the sound), and the coffee at home isn’t bad.

Other decisions are much bigger. StudySoup wrote this great article on the average amount of money a college student saves by having a roommate. The average savings over four years is over $15,000. Now, having a roommate is a big sacrifice, because you lose a fair amount of privacy. If privacy is really important to you, it’s a true delay of gratification (until you graduate, get a job and can afford to live alone).

So, what do I get?

OK- so what do I get out of all this delayed gratification?

You can grow your investment assets- and use those assets to fund your business.

Good luck!

Ken Boyd

St. Louis Test Preparation

(email) ken@stltest.net

(website and blog) http://www.accountingaccidentally.com/

(you tube channel) https://www.youtube.com/user/kenboydstl

The post How Businesses Are Changing The World appeared first on Accounting Accidentally.

September 8, 2019

Computing Weighted Average Shares Outstanding (2 Video Links)

If you’ve taking an intermediate accounting class, or studying for the CPA exam, you may struggle with calculating weighted average shares of stock outstanding.

You’re not alone.

This discussion explains these concepts using screenshots from spreadsheets. Links to the You Tube videos that explain the topics are here and here.

It all starts with earnings per share.

Earnings Per Share Formula

Earnings per share (EPS) reports the dollar amount of earnings generated for each share of common stock outstanding. EPS is a frequently used metric to determine the value of a company’s stock.

Now, there are a number of variations on the formula, but we’ll stick with the most basic version:

(Earnings available to common stock shareholders) / (weighted average shares outstanding)

Some earnings may not be available to common shareholders. If your firm has preferred stock outstanding, you may have to pay dividends to preferred shareholders before earnings are available to common stock owners.

Say, for example, that total earnings are $1.2 million, and that $200,000 must be allocated to preferred stock dividends. The weighted average common shares outstanding total 100,000 shares.

EPS for common stock is ($1 million earnings) / (100,000 shares), or $10 per share.

Several types of securities can be converted into common stock, which impacts the EPS formula.

Dilutive Securities

Financial analysts often use dilutive earnings per share to assess company value.

Dilutive EPS assume that any security that can be converted into common stock is converted. Here are securities that are dilutive:

Stock options

Rights and warrants

Convertible bonds

Convertible preferred stock

Now that you know about EPS, let’s calculate weighted average shares of stock outstanding.

Setting Up the Calculation

When you calculate weighted average shares, use the format in this spreadsheet:

This format helps you solve the problem in a document that deals with each variable.

Change in Shares column: Lists the increase or decrease in shares, based on a specific event.

Shares outstanding: Total shares held by the public, as of a specific date.

Fraction of a year: Here’s the tough part: Each shares outstanding total is held for a portion of the year. This data is needed, in order to adjust the share total to compute the weighted average.

Let’s look at the share changes in detail:

On January 1st, the company starts with 20,000 shares. On February 1st, the firm issues 10,000 more shares, and the share outstanding total is increased to 30,000.

On March 1st, the business issues a 10% stock dividend. For every 100 shares previously outstanding, there are now 110 shares.

The 30,000 shares are multiplied by 110%, and the new total of shares is 33,000. Note also in the “10% Stock Dividend” column that prior period share totals are also multiplied by 110%.

Keep working your way down the spreadsheet:

On May 1st, the company buys 5,000 shares of stock from the public, and posts them to the Treasury stock account. Shares outstanding decline to 28,000.

The firm issues a 3 for 1 (or 3:1) stock split on June 1st. Every 100 shares now becomes 300. The 28,000 shares outstanding is adjusted to 84,000 on June 1st. The “3 for 1 Split” column adjusts shares in the earlier periods for the stock split.

Calculating Weighted Average Shares

To compute the weighted average shares, multiply across for each period.

The 20,000 shares are outstanding from Jan 1st to Feb 1st, or 1/12th of the year. The formula for weighted average shares is:

(20,000 shares) X (1/12th of year) X (1.1 stock dividend) X (3 stock split) = 5,500 shares

On October 1st, the company takes 4,000 out of treasury stock and reissues them to the public. The new share total is 88,000, and the shares are outstanding from 10/1 to 12/31 (3 months).

The formula for weighted average shares is:

(88,000 shares) X (3/12ths of year) = 22,000

In this case, the shares are already adjusted for the 10% stock dividend and the 3:1 stock split earlier in the year.

How Total Shares Are Used

The weighted average shares of stock outstanding total 87,250. This total is used to calculate earnings per share.

My next book, 25 Intermediate Accounting Spreadsheets (and How to Use Them) will be out in January of 2020. The format will include a written discussion of a spreadsheet, with spreadsheet images, and a related video.

To learn more and get sample chapters of the book, watch this video.

For live CPA exam prep and accounting classes, join Conference Room for free. Members will be notified of course dates, times, costs, and how to attend these courses.

Get your questions answered to pass the CPA exam, and to learn accounting concepts.

Go to Accounting Accidentally for 300+ blog posts and 450+ You Tube videos on accounting and finance:

Good luck!

Ken Boyd

Author: Cost Accounting for Dummies, Accounting All-In-One for Dummies, The CPA Exam for Dummies and 1,001 Accounting Questions for Dummies

(email) ken@stltest.net

(website and blog) http://www.accountingaccidentally.com/

The post Computing Weighted Average Shares Outstanding (2 Video Links) appeared first on Accounting Accidentally.

August 31, 2019

Difficult Jobs: Actions Steps to Take

Many people love their jobs.

For most of us, there will be at least one job you just have to get through until you get another opportunity and can run for the door.

There are lots of reasons jobs don’t work out. Perhaps you don’t get along with your colleagues, maybe you are simply bored with what you’re doing or it might be that the business itself is poorly managed.

But whatever the reason, it’s imperative that you don’t give up. You can deal with most things with a good manager or even legal support from a company like McCarthy Law PLC so please keep pursuing your goals.

Figuring out a way to resolve problems at work isn’t easy, and sometimes it’s difficult to put your finger on exactly what’s wrong. So, before you stress yourself out, let’s work through the issues rationally and calmly.

If you’ve had a financial setback, this article can help.

List the Problems You Have

Listing your problems won’t be a fun-filled activity but it should give you a bit more clarity about why you hate your job. The list will also serve as a basis for formulating a plan to make things better – but we’ll come to that in a moment.

When you list your problems, try to be specific. For example, if you don’t get on well with your colleagues, don’t just write that they are useless and you hate them. Be specific and outline the actual issue.

It might be that they often leave work late and that affects your deadlines, or maybe they have been making some underhand comments and making you feel marginalized. When you list their actions rather than your feelings, it should become a little clearer how you can best tackle the issue.

Listing your problems might also help to give you a sense of perspective.

Sometimes, you might be feeling badly about your job, because you are overly anxious about your performance or you are taking criticism too personally. When you are young and new to the working environment, this is a really common issue.

Developing a thicker skin might just help you to brush away comments that would otherwise bruise. Equally, building your self-confidence will have a huge impact on the way you work and you might find that when you present yourself more confidently, others respond positively and everything gets better.

It’s easier to tackle a problem when it’s laid out impersonally and you might find that an attitude change is all you need.

If you’re feeling tired, take a holiday; if you’re bored, maybe you could step up your social life; if you’re insecure, maybe you should discuss your feelings with a therapist. The point is, once your problems are written down, you have the means to tackle them one by one.

For live CPA exam prep and accounting classes, join Conference Room, an online community for accountants.

Can You Solve Any Problems Now?

Working out how to solve problems is critical, so try to approach your list as if you are a 3rd party.

Giving yourself a bit of distance can be hard though, so enlist the help of a friend or family member for some advice if you need it!

Some smaller problems might have simple solutions you can enact on your own. For example, if you are frustrated that your desk has become a dumping ground for your team’s stuff, find a place for it to go or redistribute to your colleagues! On the other hand, you might need your manager’s support to deal with more serious problems like workplace bullying or concerns that your job isn’t working for you.

Telling your manager you’re not happy at work is a difficult thing to do – it’s hard to admit something isn’t working and you are obviously going to feel quite emotional as you speak. However, there are a few things you can do to make it easier. For one thing, you should arrange a time to talk together privately so that you don’t just bombard them with problems all of a sudden.

Taking a list in with you is also a really good idea.

You might like to edit your personal list down to a few key points you want to handle and make sure that your language is as impersonal as possible. Remember, it’s easier for your manager to deal with a concrete issue that it is an insult so instead of saying that your colleague is useless, say that you need your colleague to meet deadlines or listen to instructions.

The latter example is actionable – your manager can go to your colleague, explain the issue and then ask them to be more careful about meeting deadlines. Asking someone to be less useless is a non-starter!

Allowing yourself to be vulnerable is always uncomfortable and it’s natural to want to protect yourself by projecting all the problems onto your colleagues. Remember though, this meeting is about what you need to be happier at work – it might be that there are things you can do to make the situation better as well.

For example, if you are bored at your job, you might be able to take on further responsibilities, or shadow someone in the office to see if something else might suit you better.

It’s rare that a problem has a single solution.

Most of the time, we all need to make small adjustments to ease the relationships we have. Be prepared to compromise and listen to alternative solutions as well. It’s easy to dig your heels in and assert that x, y and z need to happen but if you are open to other ideas – including the likelihood that you are part of the problem – you will find it much easier to resolve things for the better.

What if the Job Really Isn’t for You?

If you have made a genuine effort to resolve the problems you have but you still hate your job, it’s probably time to move on.

There are some problems that simply aren’t solvable – such as a failing business or difficult work culture – and the best idea is to jump ship. But given that you are so dejected, how can you move on quickly and effectively without landing on another sinking ship?

The first thing you should do when contemplating a new job is dust off your CV.

Your resume (CV) should be as polished as possible when you come to apply for a new opportunity, so make sure that you include any new skills you have gained and any particular highlights of your time in your current job. Thinking positively about your job and capabilities will hopefully give you a bit of a boost and help you to see what you are qualified to do next. Again, thinking objectively is the key here.

If you still like the industry and the job, it’s just the company that isn’t working for you, becoming a freelancer is a good idea. Freelancing allows you to take control of the work you do and the people you work with. It’s also a good way to get to know a range of other businesses and could easily lead to a more suitable and stable job later on.

For people who find that their dream job is actually a nightmare, moving on can be really daunting. Sure, your resume is great but what should you apply for now? You thought you had it all sorted out so how on earth can you figure out what to do next? First of all, please don’t panic.

Falling out with a dream job happens to lots of people, because we change and grow over time and so does the job market.

Instead of focusing on why your dream job has been such a disaster, think about what the good points have been and what you would like to aim for now. You don’t need a concrete idea just yet, but knowing that you liked the office vibe but want more flexibility or you would like a chance to be more creative is a good start.

Once you’ve started planning your exit, please remember to stay civil with your colleagues. Don’t allow your work to fall in standard or risk disciplinary action because you’ve got one foot out of the door. While you are applying for other jobs, maintain your high standards and keep working as a team player, after all, your manager may still be required to write a reference for you.

Make a Positive Change

Working through a job you hate is hard but it is possible.

Understanding your problems, finding potential solutions and working on a new strategy is a skillset we could all use in various areas of our lives. Staying positive and facing the challenges ahead is what sets the very best employees out from the crowd. And, you never know, your determination to make things better could have a great impact on everyone in your team and build the confidence of others to make the workplace a better place.

Good luck!

Ken Boyd

Author: Cost Accounting for Dummies, Accounting All-In-One for Dummies, The CPA Exam for Dummies and 1,001 Accounting Questions for Dummies

(email) ken@stltest.net

(website and blog) http://www.accountingaccidentally.com/

(you tube channel) kenboydstl

The post Difficult Jobs: Actions Steps to Take appeared first on Accounting Accidentally.

August 30, 2019

Accounting for Statement of Cash Flows (2 Video Links)

If you’ve taking an intermediate accounting class, or studying for the CPA exam, you may struggle with the statement of cash flows.

You’re not alone.

This discussion explains these concepts using screenshots from spreadsheets. Links to the You Tube videos that explain the topics are here and here.

Where did you cash go?

Cash does not equal profit.

Image that you start a business in January, and contribute $40,000 in cash into the firm. You’re profitable each month, but you notice that your cash balance is only $28,000 on June 1st.

How can you have less cash than where you started?

The answer is in the statement of cash flows, which separates cash transactions into three sections.

Three categories

If you review all of your cash inflows and outflows, the transactions can be separated into three categories:

Cash flows from operations: These are cash flows related to the day-to-day activities of running your business. Paying suppliers, processing payroll, and depositing customer payments are posted to operations. In fact, most of your business activity will end up here.

Cash flows from investing: You need assets to operate your business. Investing refers to buying and selling company assets. Buying a machine is a cash outflow, and selling a piece of equipment is a cash inflow.

Cash flows from financing: This category includes raising money to run your business and paying it back. Issuing a bond is a cash inflow, while paying a dividend to shareholders is a cash outflow.

Here’s the formula for the ending balance in cash:

Beginning balance in cash, plus

Net effect of the inflows and outflows, equals

Ending cash balance.

The ending balance in cash should agree to the cash balance in the balance sheet.

Figuring out cash flows for financing and investing is straightforward. The more difficult concept is using the indirect method to compute cash flows from operations.

Indirect method, cash flows from operations

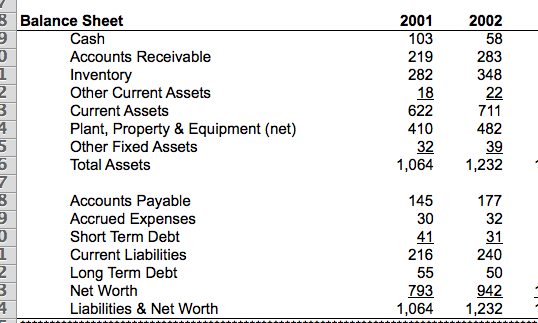

The indirect method requires you to reconcile from company net income to cash flow from operations. Here’s a screenshot from my video that illustrates the process:

The 2002 indirect method starts with $167 in net income and reconciles down to cash flow from operations of $57.

Now, here’s the tough part.

You see that adjustments are made to current assets and current liabilities.

An increase in current assets is subtracted in the reconciliation. In 2002, a $64 increase in accounts receivable is subtracted.

An increase in current liabilities is added in the reconciliation. For 2002, a $32 increase in account payable is added.

These changes come from the balance sheets for ’02 and ’03, which are also in the spreadsheet:

Accounts receivable increased from 219 to 283 ($64), and accounts payable increased from $145 to $177 ($32).

The best way to learn this concept is to link two balance sheets to the cash flow statement, which is what the spreadsheet (and the videos) present.

Investing and financing cash flow are easier to understand.

Working with Investing and Financing

Take a look at the rest of the cash flow statement:

In the investing category, the property, plant and equipment account increased by $72. The company bought assets, so cash decreased.

If you look at the financing section, note that the firm paid back $5 in debt, which is also a cash use.

Again, let’s go back to the balance sheet detail:

Property, plant and equipment increased by $410 to $482 (a $72 increase). Long-term debt, on the other hand, decreased from $55 to $50.

One more thing.

The net change in cash is $45. If you check the cash balances in the balance sheet, you’ll see that cash declined from $103 to $58, a $45 decrease.

My next book, 25 Intermediate Accounting Spreadsheets (and How to Use Them) will be out in January of 2020. The format will include a written discussion of a spreadsheet, with spreadsheet images, and a related video.

To learn more and get sample chapters of the book, watch this video.

For live CPA exam prep and accounting classes, join Conference Room for free. Members will be notified of course dates, times, costs, and how to attend these courses.

Get your questions answered to pass the CPA exam, and to learn accounting concepts.

Go to Accounting Accidentally for 300+ blog posts and 450+ You Tube videos on accounting and finance:

Good luck!

Ken Boyd

Author: Cost Accounting for Dummies, Accounting All-In-One for Dummies, The CPA Exam for Dummies and 1,001 Accounting Questions for Dummies

(email) ken@stltest.net

(website and blog) http://www.accountingaccidentally.com/

The post Accounting for Statement of Cash Flows (2 Video Links) appeared first on Accounting Accidentally.

August 23, 2019

Essential Money Steps For Cohabiting

It’s a huge step in any relationship.

Moving in together is a big commitment to each other and to develop a life together. It’s often framed purely in romantic terms, as a natural development of two people falling in love. But actually, starting to cohabit is a very practical step and it should always be approached with a level head.

Living together is an upwardly mobile trend which shows no signs of slowing down, due to factors such as the rising cost of living, scarcity of accommodation in urban centres, and loosening of social standards.

A few decades ago, living together without being married was deemed unacceptable by many, nowadays most people would find it unacceptable not to live together before being married – and many do not have any desire for marriage anyway.

In the last Census, over 18 million unmarried couples were living together – a figure that continues to increase. That represented a 29% increase from 9 years earlier, and the trend is increasing all the time. Most of these couples are under the age of 35.

Forty percent of unmarried cohabiting couples have children, which can potentially make for an even more complicated financial scenario in the event of any relationship difficulties.

If you’ve had a financial setback, this article can help.

Be Practical

Although moving in with a partner can be a heady and intense time, it’s hugely important to also be practical – be honest – and take care of your monetary interests.

It may not especially pleasant to think of at a time of intense hopefulness, but the reality is that relationships can and do end for a variety of reasons, and you could find yourself in a very bad position if you haven’t taken some simple financial steps at the outset.

Moving in together means really knowing a person in a way that you can’t while living apart – and it may not all be rosy. Sure waking up together in the morning and spending cosy evenings in front of Netflix with no-one having to make the trek home is great – but you may uncover a few domestic bad habits or a questionable taste in decor along the way.

Those things you can probably learn to live with, but when it comes to your money health and your financial position, there can easily be a few dealbreakers in there. You need to make sure that you’re on the same page before you sign that lease together.

Common Goals

Money in and of itself is not inherently good or bad.

It’s a tool, and it’s all about how you use it to get to where you want to be in life. Money is not so much about an amount as the value you that you can derive, and how it can enable you to achieve what you want in life.

This could be a huge range of things – from saving up to go backpacking around the world for a year, to purchasing and doing up your first house, to starting a family and paying for children’s education, or even setting up your own business.

If you work as a freelancer, use the tips listed in this article.

You will have a dream of what money can help you to do in life, and you need to be on the same page as your partner. As important as having compatible personalities or a physical attraction, is having a set of shared goals and aspirations.

Money is cited as the number one cause of fights and stress in a relationship – some are naturally financial risk-takers or like to spend, while others are cautious and prioritise saving. Have an open conversation about your longer-term life aims, as these will map across to the aims you have for your money.

When you both work together towards something, that’s when it feels like a true partnership.

Check Your Credit Scores

It’s human nature to shy away from financial details and difficult conversations about money in the early stages of a relationship, but by the time you come to move in together, you need to be able to talk openly and honestly about the financial facts.

Do you make these credit scoring mistakes?

It’s amazing how many cohabiting partners are in the dark about each other’s salaries, savings, credit scores and debts. This is information that needs to be out in the open now that your lives and your credit histories are about to become linked in a concrete way.

For renting together or if you decide to purchase a home, your financial backgrounds have a huge impact, so you must get the initial awkwardness out of the way and address it. Far better to have a clear discussion than to have awkward secrets emerge at a crucial moment – that way, if there are any problems, you can tackle them together.

You are supposed to be a team now! Assess the factors behind any problems that you find. Are they just random poor decisions, or the result of poor financial education? Or is this somehow who is willfully and consistently making bad money decisions?

If so, approach with caution and gauge whether they are mending their ways or not. It may make more sense to delay big joint financial decisions until they have managed to get their credit score in shape and pay down some debt than jumping into living with someone who has an irresponsible approach, major debts and no savings in case of an emergency.

Decide How to Manage Joint Finances

The gap between our expectations of how finances should operate jointly, and those that our partner may have can be considerable, so create a plan for how you are going to manage the household expenses together.

Will you both open a joint account and merge everything?

Will you keep separate bank accounts but set one up together and pay in a set amount to cover shared expenses like the rent, groceries and utility bills?

Will you pay 50/50 or if one person earns more will you split proportionally, or will one person cover specific extra expenses?

If you don’t have equal incomes, things can quickly become complicated and unspoken assumptions can lead to hurt feelings and resentment. You want to avoid whoever earns less feeling stretched beyond what they can afford, or the higher earner feeling like they can’t treat themselves without feeling guilty.

Try to think about the situation holistically – relationships are about give and take, but this doesn’t always have to mean money. People contribute in different ways, but if one person’s expectations aren’t being met, that is where the trouble begins. Both people have to feel happy and confident in whatever solution you both agree.

Sign A Cohabitation Agreement

Couples who aren’t married still have far less legal rights when it comes to joint assets and finances than those who are married, so consider protecting yourself with a cohabitation agreement. Check with an attorney for more info.

Some people react strongly to the idea because it doesn’t seem romantic, but finances shouldn’t be subject to feelings which can change over time. Think of it as protection for yourself and your partner.

A cohabitation agreement is a living document which can change over time, but that provides a written plan for how financial responsibilities will be managed without a couple. You can plan to revisit it every so often to make sure that the terms still suit your circumstances and arrangements.

Start by noting down all the household expenses – bills and other payments – their due dates and who is responsible for paying what.

Make a note of your approach – whether each individual is responsible for certain payments, if they come out of a shared account or if one person reimburses the other.

This agreement becomes especially important if there are children involved, which generally means a period of low or no pay for one partner.

This can represent a fundamental change in financial arrangements which will need to be agreed by both partners. It’s not the most pleasant thing, but you can gain a lot from formalising in the agreement what happens in the event of a break-up. This could be the agreed division of shared assets such as property, furniture or vehicles, childcare costs and any joint accounts or debts such as a shared credit card. You may also include a log of big-ticket purchases that have been made jointly or by one or the other partner.

Keep The Discussion Going

The financial conversation isn’t something which just happens once – talking about money needs to be an ongoing process between a couple who live together. Talking about personal budgets and credit balance will never be sexy, but then neither is having huge fights about money.

So schedule time to sit down and have a regular review of money matters with your other half. It can be easy to skip this when both of you are busy, so create a shared Google calendar and pop in some time to talk about the household finances each month. These discussions don’t have to be long and onerous – it’s more about making them feel familiar and natural, so that talking about money isn’t some big taboo that feels unreasonable.

Having money conversations little and often can make the bigger discussions much easier to have. Optimise your finances together – get into the habit of shopping around for the best deals from utilities providers or using a portal like Morison Personal Insurance to make sure you get the best coverage for the lowest cost.

Think About A Way Out

They say begin with the end in sight, and this should also be true when it comes to your personal relationships.

Yes, perhaps you will be together for the rest of your lives. But admitting that may not happen doesn’t stop you aiming for that fairy tale, happy-ever-after finish. It just gives you some protection in case the outcome is different from what you hoped for.

In life these days, very few people stay in one relationship for the duration of their adult lives – not planning for this eventuality doesn’t mean you aren’t aiming for that, but it is an acknowledgement of reality. It is extremely important to retain some degree of financial independence to enable to you get out of any bad situation – that means having a separate amount of savings in a personal account, and perhaps having a credit card in your name only as well.

Not having any separate financial identity at all is asking for trouble should anything unforeseen go wrong – especially as the idea of having ‘common law’ rights is essentially a myth, and there is no required division of shared assets if you aren’t legally married.

You may want to consider keeping crucial accounts in your name only initially, to make it easier to cut ties if you find things aren’t working out after moving in together.

You are the only person who is best qualified to look out for and make decisions about your own money, no matter how much your partner loves you. Financial independence is a gift which many aren’t lucky enough to have, so hold it close and don’t ever consider giving it up or sleepwalking into arrangements which might take away your freedom of choice.

Best of luck!

Ken Boyd

Author: Cost Accounting for Dummies, Accounting All-In-One for Dummies, The CPA Exam for Dummies and 1,001 Accounting Questions for Dummies

(website and blog) http://www.accountingaccidentally.com/

(you tube channel) https://www.youtube.com/user/kenboydstl

The post Essential Money Steps For Cohabiting appeared first on Accounting Accidentally.

August 18, 2019

Accounting for Deferred Taxes (2 Video Links)

If you’ve taking an intermediate accounting class, or studying for the CPA exam, you may struggle with accounting for deferred tax assets and liabilities.

You’re not alone.

This discussion explains these concepts using screenshots from spreadsheets. Links to the You Tube videos that explain the topics are here and here.

Book income vs. taxable income

Deferred tax entries must be posted, because of the difference between income for book (accounting) purposes and income posted on the tax return.

The differences may be permanent or temporary, and temporary differences for depreciation expense are the most frequently tested.

Temporary differences: Depreciation expense

This example assumes that pretax accounting income does not include depreciation expense, which is why it’s subtracted as “Depreciation for tax” on line 2 below.

The rest of the chart should make logical sense. Let’s use the year 2009 as an example. Depreciation is subtracted to arrive at taxable income ($20,400), and income is tax at a 30% rate. The tax payable is $6,120. You’ll see taxes payable for 2009 and 2012 in a journal entry at the bottom of the article.

Now, you’ll see that the tax depreciation is higher in the early years ($39,600 in ’09), and lower in the later years ($9,600 in ’12). This is an accelerated method of depreciation for tax purposes.

Book depreciation expense is different.

Differences in depreciation expense

This chart explains the differences between book and tax depreciation expense:

For starters, it’s important to realize that total depreciation expense is the same for both book and tax. Both methods recognize $120,000 in total depreciation expense, the difference is in the timing of the expense.

Book income uses the straight-line method, which generates $30,000 in depreciation a year for 4 years. The company uses an accelerated method for taxes.

Check out 2009:

Tax depreciation is $9,600 greater than book depreciation expense. This temporary difference creates a deferred tax liability.

Why?

As I point out in red, the business has more depreciation expense and less income on the 2009 tax return. Makes sense, because the tax depreciation expense is higher than book.

The firm posts a deferred tax liability, because the tax return will report lower deprecation expense and more income in future years.

More income, less expense means a higher tax bill down the road.

You can confirm this concept by looking at the later year.

In 2011 and 2012, book depreciation expense is higher than the tax expense. Less depreciation expense means a higher tax bill in later years.

Journal entry for tax expense

The last step in this discussion is to understand the tax journal entries. Here’s a summary:

In 2009, you see the $9,600 temporary difference as the cumulative difference. As you move across the line from left to right, you see the cumulative impact of all years.

The deferred tax liability is ($9,000 temporary difference X 30% tax rate), or $2,880 (in green).

Ok, slide down the journal entry.

The 2009 income tax expense ($9,000) has two components:

$6,120, which is the taxes payable calculation in the screenshot at the top.

$2,880 deferred tax liability

$6,120 is the check amount your write to the IRS.

Finally, let’s review the 2012 journal entry for taxes:

The 2012 income tax expense ($16,000) has two components:

$24,160, which is the 2012 taxes payable calculation in the screenshot at the top.

$8,160 deferred tax asset, which lowers the tax expense to $16,000

$24,160 is the check amount your write to the IRS. The tax expense is lower than the tax payable, because of the deferred tax asset.

My next book, 25 Intermediate Accounting Spreadsheets (and How to Use Them) will be out in January of 2020. The format will include a written discussion of a spreadsheet, with spreadsheet images, and a related video.

To learn more and get sample chapters of the book, watch this video.

For live CPA exam prep and accounting classes, join Conference Room for free. Members will be notified of course dates, times, costs, and how to attend these courses.

Get your questions answered to pass the CPA exam, and to learn accounting concepts.

Go to Accounting Accidentally for 300+ blog posts and 450+ You Tube videos on accounting and finance:

Good luck!

Ken Boyd

Author: Cost Accounting for Dummies, Accounting All-In-One for Dummies, The CPA Exam for Dummies and 1,001 Accounting Questions for Dummies

(email) ken@stltest.net

(website and blog) http://www.accountingaccidentally.com/

Image: Andrew Neele

The post Accounting for Deferred Taxes (2 Video Links) appeared first on Accounting Accidentally.

August 10, 2019

Raising Funds For Your Dream Business

Everyone has pictured owning a pretty successful business at one time or another. Only a select few will actually get there one day.

More worryingly, it’s still only a small percentage of people that will even attempt it.

They have their fantasies in the minds, but they never even bother learning how to get through the initial stages. A lot of people are put off by the business game because it’s always perceived as a confusing and overcomplicated world. While some things are a little tricky to get to grips with, the majority of the tasks aren’t that difficult.

If you’ve had a financial setback, this article can help.

The actual money side of things is something that people get a little intimidated by when thinking about creating a business. That’s a fair way to behave, in all honesty, because it can be such a sensitive topic. It’s not that difficult to understand, however. Let’s take, for example, the idea of building up some dough in order to get off the ground. How can it be done? Well, if you have a couple of minutes, let’s go through a few ways you can generate a few bucks.

Build a Savings Balance

We’ll start with the most obvious option: saving up what you’re already earning. See, this stuff is pretty easy, huh? You’ve been doing this since you were a kid, and you’ll be doing it until the day you die. If you want to build up some funds in order to start a business, then having a little self-control and throwing it into your savings account is a wise move.

Looking to become a freelancer? Read this.

But the process can be difficult.

Change is hard

The reason that people don’t diet, don’t exercise, and don’t resolve bad personal relationships is that change is hard. As a result, we don’t really, truly change and grow unless we’re in real pain. When we’re at that point, the pain of change is less severe than that pain of not changing.

Change over the long term pays off.

Discipline and time

With discipline and time, most people can accumulate far more wealth than they think is possible. But growing wealth requires change- which is precisely why most people don’t make the effort.

The changes I’m suggesting involve an old friend:

Delayed gratification

Some decisions are relatively small:

Dropping a subscription music service and just listening to the free version (Pandora, for example).

Making coffee at home two days a week, which means that you stop by Starbucksless often.

Buying afew more generic products when you go to the grocery store and Target. (I’m not going generic on salad dressing, however).

However, these small changes can lead to a big savings balance over time.

Crowdfund

Thanks to websites like Kickstarter and GoFundMe, this method has become more and more popular as the years have gone by.

Basically, you head onto social media (or a similar place) and tell the world what your goal is. If people empathize with you- or buy into what you’re trying to achieve- then they might give you a couple of bucks. If you get enough people, you can build up a serious amount.

Take Out A Loan

If you managed to get everything you have planned out, and you have all of your personal paperwork ready, then you might be able to get yourself a startup loan. Heading into a bank and pitching to them in order to convince them that you’re going to make it big is the only task you have ahead of you there.

If you’re not confident about the pitch, then you can take out a quick loan. Obviously, you need to be confident that you can pay them back. There are loads of firms that offer lots of types online, and you can head to sites like HittaSMSLån to find something suitable for your situation.

Angel Investors

There are successful people scattered around the globe that are looking for the perfect business to invest in.

Now, they usually opt for well-established companies that are already comfortable, but if you have a real gem, then they might be interested. You’ve seen the likes of Dragons’ Den and Shark Tank, right? Well, this is basically what it’s like – but without the drama and the TV cameras.

Do Two Things at Once

Keep building your business while you look for funding.

The further along you are, the more attractive your business is to investors.

Stay at both tasks, and you can succeed.

Ken Boyd

Author: Cost Accounting for Dummies, Accounting All-In-One for Dummies, The CPA Exam for Dummies and 1,001 Accounting Questions for Dummies

(amazon author page) amazon.com/author/kenboyd

(email) ken@stltest.net

(website and blog) http://www.accountingaccidentally.com/

Image: Dmitry Moraine

The post Raising Funds For Your Dream Business appeared first on Accounting Accidentally.