Kenneth Boyd's Blog, page 47

June 14, 2019

Managing A Loved One’s Finances After They’ve Passed Away

Losing a loved one is difficult.

The last thing you want to do when you’re grieving is to look after everything that your loved one has left behind. However, it’s important that someone does take ownership so that everything can be sorted within a timely manner with as few issues as possible.

Here are some tips for looking after a loved one’s finances when they’ve passed away.

If you’ve had a financial setback, this article may help.

Don’t Rush

Emotions will be running high, and it’s expected. However, when it comes to dealing with this aspect of death, it’s important not to rush into things. Don’t let your emotions cloud your judgment.

When you’re emotionally stressed, your feelings can lead to making decisions that could have a negative impact. It could be a property you need to consider selling or certain valuables that need distributing around family and other close friends.

Don’t make these decisions until you’re emotionally stable to do so.

Get Help

No one is taught how to handle death, particularly when it comes to handling a person’s finances after they’re gone.

There are also situations where you may need a wrongful death attorney in cases where the individual died from someone else’s carelessness.

If your relative had a financial advisor or someone who looked after their finances, then this is your first port of call, because you may want to work with them going forward. The advisor can help you track down bank accounts and investment balances. These experts also work with estate agents and attorneys to address the sale of properties.

Make Calls To Bill Providers

When someone passes away, bill providers won’t realize anything has happened until someone informs them.

To avoid any bills from continuing, it’s a good idea to go through previous mail that your relative had and call up any bill providers or companies where money was being taken out of the account on a regular basis. A lot of them will hopefully be very understanding, and some may overlook any payments that were due after the individual passed away.

However, do this as soon as you can. It may be another thing for the financial advisor to do as they’re dealing with the accounts.

Locate The Will

Lastly, locating the original will and any updated versions of the document is the most important task of all.

Hopefully, they will have made one and fingers crossed they informed you or a family member of where they could retrieve it when needed. These documents will be needed when it comes to making decisions on the finances and to identify beneficiaries.

The same goes for any valuables or sentimental items that would be mentioned in the will. If you are made executor of the estate/trust, then it’s important to keep hold of any expenses or receipts that may need to be presented if you have to do a tax return for the relative.

It’s a tough time in your life, but you will get through that grief and will be able to enjoy reminiscing about all the good times in their life and all the memories you have with them.

Ken Boyd

Author: Cost Accounting for Dummies, Accounting All-In-One for Dummies, The CPA Exam for Dummies and 1,001 Accounting Questions for Dummies

(email) ken@stltest.net

(website and blog) http://www.accountingaccidentally.com/

Image: Andrew Neele

The post Managing A Loved One’s Finances After They’ve Passed Away appeared first on Accounting Accidentally.

June 1, 2019

What Do Mortgage Lenders Really Look For?

Before offering you’re a home loan, mortgage lenders want to be certain that you will pay them back. This often involves looking at your finances and then assessing whether they can trust you.

But what exactly is it that mortgage lenders look for? Here are some of the main factors that lenders like to look for before approving a home loan.

A good credit score

Much of the decision as to whether to give you a mortgage will be based on your credit score. This score is largely based off your ability to pay creditors on time. If payments regularly bounce and you have to pay late payment charges, you can expect this to damage your credit score.

Fortunately, if you’ve got into bad habits of not paying bills on time, you can rebuild your credit score using a credit builder loan. You should also check that all your accounts address details match up as this can affect your credit score too.

If you’ve had a financial setback, this article can help.

Proof of steady income

Mortgage lenders like to see that you’ve got a steady income coming in that is enough to pay off your mortgage repayments.

If you’ve been job-hopping a lot recently, you may find that this works against you – being in a steady job for a minimum of a year will look better. If you’re self-employed or work a job in which your paychecks vary from month to month, you may have to provide two years of bank statement to ensure that there aren’t too many long periods of low income.

Minimal debts

Having lots of other debts could show that you’re living beyond your means.

Some mortgage lenders may not care if you can show that you’re able to pay off all these debt repayments on time. Just to be safe, you may want to work on trying to pay off some of these debts before applying for a mortgage so that it doesn’t look so concerning.

Minimal unexplained credit

If unexplained large sums of money keep entering your account, this could also raise red flags for lenders.

This could be a sign of money laundering and lenders won’t want to associate themselves with you. Make sure that you have an answer for any unexplained deposit (lenders are likely to look at earnings in the last few months).

A suitable property

Mortgage lenders may also send someone out to appraise the property.

In the case of premium real estate, they’ll want to know that the property really is worth the amount you say it is. You should also be careful of property that is in poor condition – if it need restoring, lenders will want to know how much you plan to spend on this restoration process.

When it comes to premium property and fixer-uppers, you may be better off looking into specialist lenders. This is similarly the case when buying property to rent or buying property to do up and sell.

A suitable age

Your age is also a factor that lenders may consider.

Youth has its advantage when applying for a mortgage – lenders may allow you to pay the loan off over a longer period, resulting in smaller monthly repayments. If you’re over 50, mortgage lenders may only offer short-term mortgages that require you to pay more each month. If you’re over 65, you may even struggle to find a lender willing to take you on (although there are lenders out there that take people on past this age).

Use these tips to get approved for a home mortgage.

Ken Boyd

Author: Cost Accounting for Dummies, Accounting All-In-One for Dummies, The CPA Exam for Dummies and 1,001 Accounting Questions for Dummies

(email) ken@stltest.net

(website and blog) http://www.accountingaccidentally.com/

The post What Do Mortgage Lenders Really Look For? appeared first on Accounting Accidentally.

May 13, 2019

How To Market a Product or Service Overseas

Starting a business, or managing an existing business, is a challenge.

Business management is more complex, if you choose to operate globally. You’ll have to deal with more risks, but the potential rewards are also higher.

Technology has changed the way we work and reach others, and operating a successful global business is within reach for more companies. Here’s how to bring global success for a business.

If you manage a business and want to increase your productivity, I highly recommend QuickBooks accounting software. Read this article to decide if you need the desktop or online version of the software.

Research The Market And Find A Unmet Need

This is the step many entrepreneurs skip.

You’re excited about your idea, and you move straight into creating your product or service for the masses.

But that’s a mistake.

First, you need to validate your business idea, which I list here in 4 steps. If you don’t seriously consider these 4 components, run away from your product idea screaming…

a) What problem does my product or service solve?

b) Do customers feel that solving this problem is urgent?

c) How much will they pay for a solution to the problem?

d) Are there enough of these people to justify creating and marketing the solution?

The idea here is get your product or service in the hands of a relatively small group of people, ask them to use it, and then get their feedback.

If your product solves a problem, and you can sell it profitably to a large enough group of people, you may have a valid business idea.

When opening your business up to a global market, the same product validation rules apply.

Do research to determine if your product is needed if it fills an urgent need. If there are five other popular products that are similar to yours, then it’s much harder to make an impact that’s financially feasible.

Use online accounting software to dramatically increase your company productivity. Find out more here: QuickBooks Online Edition – Free Trial

Utilize The Power Of Social Media

Social media is one tool that many businesses use to expand globally.

From advertising to connecting with new clients or customers, social media can make a huge difference for businesses that are trying to get brand some exposure in a foreign country.

If you’re not social media savvy, start looking into what different platforms are available and which one will work best for the company. Instagram and Pinterest are two platforms that would suit visual content, and Twitter and Facebook for more informative content.

Make an investment in social media, and connect your social media links to your website, marketing, and advertising campaigns.

QuickBooks Online Edition – Free Trial

Understand New Cultures

When working in a new country, you need to be prepared to deal with new cultures and new ways of working.

The attitude or working style of your organization may not be the same as someone’s in the Middle East, for example. Understand and respect for how others work, and find a mutual common ground that works for both parties.

Consider collaborating with local professionals who can give the guidance and advice needed during this time. It’s worth getting hands on some reports and literature on customs and how the industry works over there.

Getting up to speed with the culture and customs will make it easier to operate and market a product overseas.

Build Partnerships

Having partnerships is a great way to network with professionals who may be able to introduce you to a global network.

Your partnership might be to earn from the foreign exchange market, offer sponsorships for events, or to partner with another firm on a new product or service.

Global success can happen for any business, it’s just a willingness to be open to collaboration and have an understanding of how other companies work in different countries. Once you’ve got this understanding, it’s likely that success will eventually follow. So start networking and building relationships now!

Ken Boyd

Author: Cost Accounting for Dummies, Accounting All-In-One for Dummies, The CPA Exam for Dummies and 1,001 Accounting Questions for Dummies

(cell) (314) 913-6529

(email) ken@stltest.net

(website and blog) http://www.accountingaccidentally.com/

The post How To Market a Product or Service Overseas appeared first on Accounting Accidentally.

May 9, 2019

The Minimalist’s Guide to Managing Rental Property

Anyone who invests in a rental property does so to make money, and when done right, renting produce a reliable side income.

Sadly, many landlords find that their rental efforts backfire.

In these cases, rather than supplementing incomes, landlords land in debt. In extreme cases, that debt is so substantial that they have to sell that property and forget their plans. That’s bad news, considering the effort that goes into buying a house, and it’s something you must work to avoid.

The trouble is that most rental articles out there focus on how to make money. Few resources focus on the funds you could end up losing. That’s why we’re going against the grain today, by talking you through some landlord mistakes that could land your finances in the red.

If you’ve had a financial setback, this article can help.

Create a Monthly Financial Budget

The starting point for your improving your personal finances is to create a personal monthly budget, and it applies to rental property owners.

Action Steps To Consider

Create a budget, even if that budget is simply on notebook paper.

Separate your expenses between fixed and variable, and take a hard look at your variable spending.

Take steps to cut your variable expenses each month and put the amount you save into a separate savings account.

Consider using a budgeting app to monitor your spending

Save 5% of your monthly gross income

Create your budget and stick to it.

Use this site to apply for a loan Find My Rate at Social Finance Pay off credit cards or invest in a major purchase

Analyze Your Pricing

Charging the wrong price for your rental property can hurt your ability to generate income.

That applies no matter which side of the rental divide you land on. If you charge more than the market price- in an attempt to increase your rental income– you’re going to struggle to fill your property, and that could leave you having to pay a mortgage on an empty space.

Even if you bought the property outright, a lack of tenants means that you won’t earn income.

At the same time, charging too little for a property can cause issues. While it does mean you’ll find tenants, you could soon struggle to cover property costs.

To avoid this, you need to spend plenty of time checking out local rental prices. Subscribe to estate agent newsletters, and watch the market for a while to make sure you get your rental price right from the off.

Many freelancers and business owners may have times when cash flow is a problem. Use this site to apply for a loan Find My Rate at Social Finance in order to cash flow your business until you can collect receivables from customers.

Manage Your Rental Income

Often, landlords see rental income as expendable. But, spending all your money here could spell trouble.

That’s because, as a landlord, you have a responsibility of care. If tenants call about problems, you need to repair things fast. If the boiler breaks, that could mean needing a few thousand to hand if you want to avoid losing your tenants.

Equally, you need the cash to repair any broken appliances or floors right away. Failure to act fast enough could see you facing even larger costs, and if tenants have injuries as a result of your negligence, you may have to deal with personal injury attorneys. In an ideal world, you should keep a relatively large amount of rental income to one side in case of problems.

Check Tenant References

This last point seems obvious, but it’s surprising how many landlords neglect to check tenant references.

The problem here is that you may find tenants stop paying their rent, or even do damage which they don’t pay you for. That would leave you with an empty property, and extreme repairs costs. Make sure it doesn’t happen by always asking for tenant references. Make sure, too, that you do adequate ID checks to protect your property and your finances.

Be Disciplined

Most important, you must be disciplined enough to apply these steps month after month. Your consistency will help you improve your finances and successfully rent your property.

Ken Boyd

Author: Cost Accounting for Dummies, Accounting All-In-One for Dummies, The CPA Exam for Dummies and 1,001 Accounting Questions for Dummies

(amazon author page) amazon.com/author/kenboyd

(email) ken@stltest.net

(website and blog) http://www.accountingaccidentally.com/

The post The Minimalist’s Guide to Managing Rental Property appeared first on Accounting Accidentally.

May 8, 2019

How to Take Charge of a Contract Dispute

Whether your starting a business or managing a profitable firm, contracts are a very important part of business, and every company uses them in some form.

You may have contracts suppliers and manufacturers, so there is a clear standard set in terms of what services you expect from them and how they expect to be paid. If you don’t have a contract in place, the other party may not deliver the product or service you expect, and this can have a damaging effect on your business.

If you have contracts in place, you protect your own interests and ensure that the relationship that you have with any suppliers is a good one. However, contract disputes can arise if both parties disagree about the terms of the agreement. If you don’t handle these contract disputes effectively, they can turn into a lengthy court battle that costs both parties a lot of money. If you find yourself in the middle of a contract dispute, here’s how to deal with it.

If you manage a business and want to increase your productivity, I highly recommend QuickBooks accounting software. Read this article to decide if you need the desktop or online version of the software.

Seek Legal Advice

Seek legal advice as soon as you determine that you have a problem with a contract.

It’s important that you proceed carefully and try to come up with a solution that works best for both parties. As soon as a dispute arises, you should speak with an attorney and ask them what your best options are.

If you don’t act rationally in the beginning, there is always a danger of escalating things and making them a lot worse. If, instead, you seek legal advice, an attorney can help you come to a solution without having to go to court.

When you’re trying to come up with a solution, there are a few important things that you need to consider. First and foremost, you need a quick solution that isn’t going to cost you lots of money in legal fees. You also need to come up with a solution that doesn’t cost the business a lot of money and doesn’t damage your relationship with the other party, if possible.

Use online accounting software to dramatically increase your company productivity. Find out more here: QuickBooks Online Edition – Free Trial

Request Services

Often, a contract dispute occurs because one party has not provided goods or services that were agreed to in the contract. If that’s the case, the first step is to request that the breaching party fulfill the contract and provide the goods and services that are agreed upon, and ask them for a response.

In some cases, that might be enough to settle the dispute. However, the other party may instead come back and say that they have a different understanding of the contract and the services that they are obliged to provide.

QuickBooks Online Edition – Free Trial

Rewrite Contracts

If there is disagreement about the terms of the contract, you will need to make some changes.

In a lot of cases, there are certain parts of the contract that aren’t clear, which is easily solved by rewriting smaller sections and changing some terminology. However, if there is disagreement about large parts of the contract, it’s sometimes best to get rid of the old contract and renegotiate a new one so both parties are satisfied.

You should always take these steps to try to solve a contract dispute out of court, but it doesn’t always work out that way. You may need to enter into a legal battle.

Fix the Problem. Maintain the Relationship

Make every attempt to fix a contractual problem, so that you can maintain the relationship with the supplier or vendor. Ask an attorney to help you, so that you can address the problem and move forward in your business.

Ken Boyd

Author: Cost Accounting for Dummies, Accounting All-In-One for Dummies, The CPA Exam for Dummies and 1,001 Accounting Questions for Dummies

(amazon author page) amazon.com/author/kenboyd

(email) ken@stltest.net

(website and blog) http://www.accountingaccidentally.com/

The post How to Take Charge of a Contract Dispute appeared first on Accounting Accidentally.

May 7, 2019

5 Useful Tips for Effective Financial Planning

Putting your family onto a sound financial footing isn’t just smart financial planning, it’s essential.

Whether you’re starting a business, or working as an employee, financial planning is a critical issue.

It’s not just about the children that you care for until they move out, it’s your own future, too. One day, you won’t be heading to work on a commute, and you could still have thirty or so years ahead of you in which you need to support yourself. You have to be ready for that financially, which is why creating a financial plan now is so important.

Financial planning includes anything from hiring estate lawyers for probate to retirement planning, but both of those things have your financial security in mind more than anything else. When you are caring for a young family, time can drift away from you so quickly. It’s up to you to ensure that you aren’t allowing it to drift so far that there’s no clawing back your financial future.

If you’ve had a financial setback, this article may help.

So, let’s look at five ways you can ensure your family remains secure throughout your life.

#1 Create a Monthly Financial Budget

The starting point for your improving your personal finances is to create a personal monthly budget:

Action Steps To Consider

Create a budget, even if that budget is simply on notebook paper.

Separate your expenses between fixed and variable, and take a hard look at your variable spending.

Take steps to cut your variable expenses each month and put the amount you save into a separate savings account.

Consider using a budgeting app to monitor your spending

Save 5% of your monthly gross income

Create your budget and stick to it.

Use this site to apply for a loan Find My Rate at Social Finance Pay off credit cards or invest in a major purchase.

#2 Insurance

It’s easy to overlook life insurance, but if you insure your car, your health, and even your dog, why would you miss out on yourself?

You need the security of knowing that if you died, your children and your spouse would be cared for long afterward, that they would be able to pay the mortgage and maintain school fees. Check with your employer as to whether they offer any company-paid life insurance coverage. If not, meet with an insurance agent who can explain your options.

#3 Find a Retirement Plan

Whether you have a pension fund with your workplace or not, you still need a retirement fund in place to support you for the years that you are not working.

A retirement fund should be started as young as possible, so that you can accumulate enough money to support your home and lifestyle long after you’ve stopped working. You don’t want to spend your life paying off a mortgage, only to have to sell the house to pay for your life after work.

Many freelancers and business owners may have times when cash flow is a problem. Use this site to apply for a loan Find My Rate at Social Finance in order to cash flow your business until you can collect receivables from customers.

#4- Write A Will

You will need to have a will written up to ensure that your assets are distributed based on your wishes after death.

If you can get your will written early, you can choose your own executor to look after your estate and make decisions that match your wishes. This way of financially planning benefits your family.

#5- Plan a Possible Illness

Always carry health insurance, and understand your coverage in the event of a critical illness.

If you must pay a large portion of insurance expenses for a critical illness, you’ll need to use other assets- such as retirement funds- to cover the cost of a major illness.

Plan Now

Getting your future finances in place is so important – it can mean the difference between financial freedom and financial woe. Don’t allow woe to chase you down; you can do this now and make life simpler all around.

Ken Boyd

Author: Cost Accounting for Dummies, Accounting All-In-One for Dummies, The CPA Exam for Dummies and 1,001 Accounting Questions for Dummies

(amazon author page) amazon.com/author/kenboyd

(email) ken@stltest.net

(website and blog) http://www.accountingaccidentally.com/

The post 5 Useful Tips for Effective Financial Planning appeared first on Accounting Accidentally.

May 5, 2019

Sage vs. QuickBooks Online Accounting Software: Comparison & Review

To grow your business, you have to become more productive.

If you’re thinking about how to start a business, or you’ve got a business up and running, you need to consider tools that allow you to work productively.

If, for example, sales growth requires you to process 300 invoices a month vs. 50 in the prior month, you need tools that create more invoices in less time.

That’s where technology can be a difference-maker.

This article reviews QuickBooks Online vs. Sage accounting software (full disclosure: I write for QuickBooks), and I’ve previously reviewed QuickBooks Online vs. Desktop software. I’m a huge fan of using accounting software to process more business transactions in less time, and I think it’s critically important that you move to a software-based accounting system as soon as possible.

Sage vs Quickbooks Online Dashboard Comparison

These two software companies market themselves differently, and the difference will impact your choice of software. Sage does a nice job of marketing their products, but the accounting software webpage doesn’t offer links to as much detail as you can access through QuickBooks.

I was looking for tutorial videos on the Sage accounting page, which I think are most helpful for someone who wants to see the accounting software in action. Sage lists what the software can do, but doesn’t show you using video.

QuickBooks Online Edition – Free Trial

QuickBooks Online’s homepage, on the other hand, presents a changing set of screenshots in the top right portion of the screen. You’re able to how the dashboard, invoices, payroll and other screenshot examples on both a computer screen and on a mobile device:

At the bottom of the homescreen, you can watch a “QuickBooks in Action” video, which show you the most valuable tools QuickBooks offers an accountant.

User Experience & Software Ease of Use

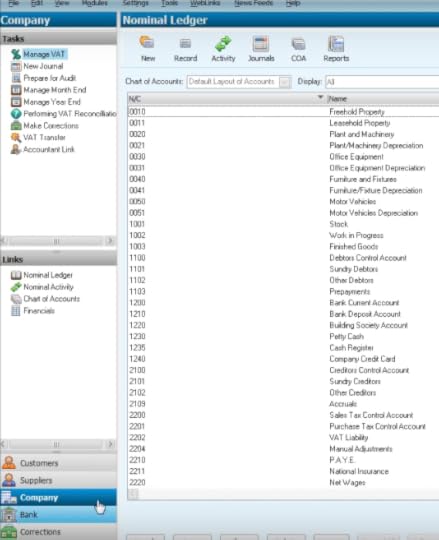

I was able to find a good You Tube channel that walks the viewer through Sage software. The Sage homepage layout is similar to QuickBooks. In the left side of the screen, you’ll see a category for Tasks (posting a journal entry, etc.), and a section for Links (chart of accounts, others).

At the bottom left, you’ll see categories for customers, suppliers, bank- all important accounting issues that you can quickly access:

Sage also has a Report browser that is easy to navigate:

QuickBooks Online, in my view, has a more visually appealing format. They use colors, and an uncluttered screen that make using the software easier.

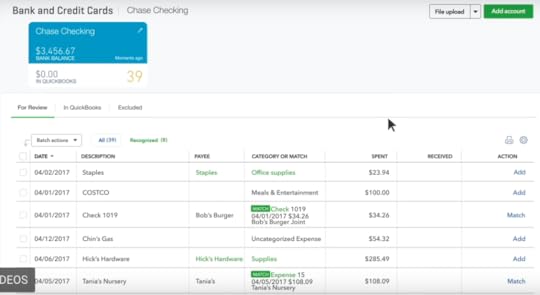

The use of better color and different fonts also makes it easier to scan a page with a large amount of data. Here’s a Banking screenshot from QuickBooks:

QuickBooks Online Edition – Free Trial

Quickbooks Online vs Sage Pricing

Sage has a focus on project management, while QuickBooks Online is a more complete accounting system. Sage One, for example, offers expense tracking and invoicing capability, but it does not provide all of the other functionality needed by an accountant.

Both Sage and QuickBooks Online offer cloud computing, mobile access, and each system can link to your bank and credit card account activity.

QuickBooks offers a more complete suite of add-ons, including inventory management, payroll and other tools that allow you to stay with the software as your firm becomes more complex.

Both systems offer a monthly subscription model, and the differences in pricing are not a meaningful amount. In other words, pricing should not be a factor in your software purchase decision.

More QuickBooks Online Features

If you need a complete accounting software package, I recommend QuickBooks Online rather than Sage. Here are some other QuickBooks features:

Data Processing

You need tools to increase productivity so that you can grow your business, and QuickBooks is a great tool to work efficiently.

QuickBooks Online Edition – Free Trial

Consider these data processing features:

Statement downloads: The online software can download your bank and credit card statements automatically. After you set up expense and revenue categories, the software can assign each transaction to the desired accounts. This automated process saves time, and makes your bank reconciliation process much easier.

Complex journal entries: The online version lets you post journal entries with multiple accounts payable or accounts receivable line items. Rather than separate a transaction into multiple journal entries, the online software lets you post one large entry, which saves time.

Use the online version to work productively from anywhere.

Management

As your business grows, you may have multiple people in your company who need access to QuickBooks and use the app to input data, or to generate reports. Here are some features that allow you to manage your QuickBooks users:

Activity log: The online version provides an activity log, which lists transactions posted by user, and other reports. The software will also report when users log in and out of the system.

End notes: QuickBooks online allows a user to add end notes to a particular report, which can be used to remind or educate users about data in the report.

Professional report pack: Every business owner has a particular set of reports that may be the most useful for management. A retailer, for example, may be most concerned about inventory levels, and keeping sufficient inventory on hand for customers. The online software allows you to create a set of reports that you can generate easily.

QuickBooks can help you become a better and more efficient manager.

Remote and Mobile Use

Using the online option can increase your productivity, because you can access on work on QuickBooks from anywhere, including from your mobile device. If you’re waiting for a client meeting, for example, you can use the time to invoice a customer, or work on your bank reconciliation.

The online software gives you the freedom to plan your work, regardless of location. Here are some examples:

Scan receipts: If you have a receipt that you need to file as support for an accounting transaction, you can take a photo with your mobile device, and attach the receipt photo to a transaction using the mobile app.

Invoicing: QuickBooks online lets you automatically schedule and send invoices. This app saves you time, and allows you to get invoices out faster- and speed up cash collections.

Easier monitoring / follow up: If you need to find information or take action, you don’t have to wait until you get to your desk. If, for example, you need to email a client regarding an outstanding invoice, you can do it from your laptop or mobile device.

Working with an accountant: You can set up the online software, so that your accountant can access your books remotely. This is particularly useful, because the accountant can make corrections and ask questions quickly, which speeds up the accounting process.

Linking to apps: The online software allows you to link to over 300 cloud-based apps.

Perhaps most important, QuickBooks Online resides on the cloud, so you don’t have to download software to your PC or Mac. Your data can be backed up automatically on the cloud, so that you reduce the risk of losing data.

My Recommendation

I recommend QuickBooks Online to accountants.

Ken Boyd

St. Louis Test Preparation

Author: Cost Accounting for Dummies, Accounting All-In-One for Dummies, The CPA Exam for Dummies and 1,001 Accounting Questions for Dummies

(amazon author page) amazon.com/author/kenboyd

(email) ken@stltest.net

(website and blog) http://www.accountingaccidentally.com/

The post Sage vs. QuickBooks Online Accounting Software: Comparison & Review appeared first on Accounting Accidentally.

QuickBooks Online vs. Sage Accounting Software: Review

To grow your business, you have to become more productive.

If you’re thinking about how to start a business, or you’ve got a business up and running, you need to consider tools that allow you to work productively.

If, for example, sales growth requires you to process 300 invoices a month vs. 50 in the prior month, you need tools that create more invoices in less time.

That’s where technology can be a difference-maker.

This article reviews QuickBooks Online vs. Sage accounting software (full disclosure: I write for QuickBooks), and I’ve previously reviewed QuickBooks Online vs. Desktop software. I’m a huge fan of using accounting software to process more business transactions in less time, and I think it’s critically important that you move to a software-based accounting system as soon as possible.

Navigating Websites, Available Information

These two software companies market themselves differently, and the difference will impact your choice of software. Sage does a nice job of marketing their products, but the accounting software webpage doesn’t offer links to as much detail as you can access through QuickBooks.

I was looking for tutorial videos on the Sage accounting page, which I think are most helpful for someone who wants to see the accounting software in action. Sage lists what the software can do, but doesn’t show you using video.

QuickBooks Online Edition – Free Trial

QuickBooks Online’s homepage, on the other hand, presents a changing set of screenshots in the top right portion of the screen. You’re able to how the dashboard, invoices, payroll and other screenshot examples on both a computer screen and on a mobile device:

At the bottom of the homescreen, you can watch a “QuickBooks in Action” video, which show you the most valuable tools QuickBooks offers an accountant.

Reviewing the Software in Use

I was able to find a good You Tube channel that walks the viewer through Sage software. The Sage homepage layout is similar to QuickBooks. In the left side of the screen, you’ll see a category for Tasks (posting a journal entry, etc.), and a section for Links (chart of accounts, others).

At the bottom left, you’ll see categories for customers, suppliers, bank- all important accounting issues that you can quickly access:

Sage also has a Report browser that is easy to navigate:

QuickBooks Online, in my view, has a more visually appealing format. They use colors, and an uncluttered screen that make using the software easier.

The use of better color and different fonts also makes it easier to scan a page with a large amount of data. Here’s a Banking screenshot from QuickBooks:

QuickBooks Online Edition – Free Trial

Understanding the Functionality, Pricing

Sage has a focus on project management, while QuickBooks Online is a more complete accounting system. Sage One, for example, offers expense tracking and invoicing capability, but it does not provide all of the other functionality needed by an accountant.

Both Sage and QuickBooks Online offer cloud computing, mobile access, and each system can link to your bank and credit card account activity.

QuickBooks offers a more complete suite of add-ons, including inventory management, payroll and other tools that allow you to stay with the software as your firm becomes more complex.

Both systems offer a monthly subscription model, and the differences in pricing are not a meaningful amount. In other words, pricing should not be a factor in your software purchase decision.

More QuickBooks Online Features

If you need a complete accounting software package, I recommend QuickBooks Online rather than Sage. Here are some other QuickBooks features:

Data Processing

You need tools to increase productivity so that you can grow your business, and QuickBooks is a great tool to work efficiently.

QuickBooks Online Edition – Free Trial

Consider these data processing features:

Statement downloads: The online software can download your bank and credit card statements automatically. After you set up expense and revenue categories, the software can assign each transaction to the desired accounts. This automated process saves time, and makes your bank reconciliation process much easier.

Complex journal entries: The online version lets you post journal entries with multiple accounts payable or accounts receivable line items. Rather than separate a transaction into multiple journal entries, the online software lets you post one large entry, which saves time.

Use the online version to work productively from anywhere.

Management

As your business grows, you may have multiple people in your company who need access to QuickBooks and use the app to input data, or to generate reports. Here are some features that allow you to manage your QuickBooks users:

Activity log: The online version provides an activity log, which lists transactions posted by user, and other reports. The software will also report when users log in and out of the system.

End notes: QuickBooks online allows a user to add end notes to a particular report, which can be used to remind or educate users about data in the report.

Professional report pack: Every business owner has a particular set of reports that may be the most useful for management. A retailer, for example, may be most concerned about inventory levels, and keeping sufficient inventory on hand for customers. The online software allows you to create a set of reports that you can generate easily.

QuickBooks can help you become a better and more efficient manager.

Remote and Mobile Use

Using the online option can increase your productivity, because you can access on work on QuickBooks from anywhere, including from your mobile device. If you’re waiting for a client meeting, for example, you can use the time to invoice a customer, or work on your bank reconciliation.

The online software gives you the freedom to plan your work, regardless of location. Here are some examples:

Scan receipts: If you have a receipt that you need to file as support for an accounting transaction, you can take a photo with your mobile device, and attach the receipt photo to a transaction using the mobile app.

Invoicing: QuickBooks online lets you automatically schedule and send invoices. This app saves you time, and allows you to get invoices out faster- and speed up cash collections.

Easier monitoring / follow up: If you need to find information or take action, you don’t have to wait until you get to your desk. If, for example, you need to email a client regarding an outstanding invoice, you can do it from your laptop or mobile device.

Working with an accountant: You can set up the online software, so that your accountant can access your books remotely. This is particularly useful, because the accountant can make corrections and ask questions quickly, which speeds up the accounting process.

Linking to apps: The online software allows you to link to over 300 cloud-based apps.

Perhaps most important, QuickBooks Online resides on the cloud, so you don’t have to download software to your PC or Mac. Your data can be backed up automatically on the cloud, so that you reduce the risk of losing data.

I recommend QuickBooks Online to accountants.

Ken Boyd

St. Louis Test Preparation

Author: Cost Accounting for Dummies, Accounting All-In-One for Dummies, The CPA Exam for Dummies and 1,001 Accounting Questions for Dummies

(amazon author page) amazon.com/author/kenboyd

(email) ken@stltest.net

(website and blog) http://www.accountingaccidentally.com/

The post QuickBooks Online vs. Sage Accounting Software: Review appeared first on Accounting Accidentally.

May 3, 2019

Money Management For Millennials

A number of millennials struggle to manage money.

This can be blamed on many things, from student loan debt to inflated living costs. However, there are steps that millennials can take to overcome these hurdles and improve their personal finances.

If you’ve had a financial setback, this article can help.

Take An Online Course

If you’re seriously at a loss when it comes to managing your money, consider taking an online course.

You can take a course in numerous subjects that could help you to get better at managing your finances, including economics, accounting and capital markets. Sites like Udemy offer courses for free or for a very low cost. You’ll likely learn things you didn’t know, and knowledge is power!

Many freelancers and business owners may have times when cash flow is a problem. Use this site to apply for a loan Find My Rate at Social Finance in order to cash flow your business until you can collect receivables from customers.

Consume Financial Content Regularly

The more content you consume based around finances and spending smart, the better you’ll likely be at managing your money.

We can control most of the content we consume by being vigilant online and our social media platforms. If you follow people on social media that make you want to spend to keep up, unfollow. Many people find themselves spending money they haven’t got to keep up with people that they don’t really like. Don’t fall into this trap! Reuse and recycle as much as you can instead.

Follow Instagram pages that give you great tips on finances, and watch YouTube videos. Just like taking an online course, you’ll learn so much more.

Use this site to apply for a loan Find My Rate at Social Finance Pay off credit cards or invest in a major purchase

Create A Monthly Budget

If you haven’t got a budget, how are you supposed to manage your money better? You must know your numbers!

Know how much you have coming in each month, and what your essential expenses are, like your bills. When you know this, you can allocate your money to different things, such as food, entertainment, and little luxuries. Of course if you’re going to manage your money properly, you should also allocate a decent amount to savings each week/month, keeping your luxury spending to a minimum. You can allow yourself a little luxury spending though, especially if you know it’ll stop you from having a huge spree at some point.

Find a Side Hustle

If you’re always swapping your time for money, then unfortunately, it’s unlikely you’ll become wealthy at any point.

Having a day job is completely valid and a must for most people, but see if there’s anything you can do to make income passively. Ideally, you’ll work as little as possible while making as much as possible. You start small, and simply keep trying things. Eventually, you should find you’re covering some bills each month, and as you continue you might even find that you’re making as much as, if not more than you would in a regular job.

Some people make helpful YouTube content and monetize their videos, some write Ebooks, some create courses online, and some rent out properties and other assets. There are lots of options, but it’s up to you to explore what’s best for you.

Get A Mentor

A mentor may be able to look at your situation objectively and help you to make changes to your lifestyle that will enable you to manage your money better.

Ideally, a mentor will be an organic relationship with somebody that you trust. It could be somebody you’re close to who you know is great at money management, or it could even be a colleague.

Track Absolutely Everything You Spend

As well as having a budget, you should track everything you spend.

Those little purchases add up, and only when you know where your money is going can you make changes. There are lots of ways you can track your spending, but there are apps that will do it for you. If you prefer, you can do it in a spreadsheet, or while you’re on the go on your smartphone. Doing it as you go is probably the easiest way, as you won’t forget and everything will be accounted for.

The great thing about tracking everything you spend is that you’ll know how much you have to spend at all times, and you won’t be tempted to overspend simply because you’re not looking at your bank balance.

Use Apps To Help You Budget And Save

We just mentioned apps, but they are worthy of having a section all their own.

There are numerous money management apps you can use, and they will help you to budget and save. They can notify you when you’re nearing your spending limit, show you pie charts of how you’ve spent your money that month, and even round up your purchases and put the rest into savings for you. Some apps are free, but others may cost you a certain amount per month/year. Although you may not want to pay for an app, they may pay for themselves eventually if they help you to budget and save effectively.

Speak To A Financial Professional

If you need more than a few tips to help you manage your finances, it might help you to speak to a professional company who can learn about your situation and advice you from there.

If you have debts that you want to pay off, for example, then you might want to learn more about DebtConsolidationUSA.com. There’s always a solution for you if you feel you’re having trouble with this kind of thing, just don’t leave it too late to speak to somebody.

Get Into The Habit of Saving

Getting into the habit of saving is one of the best favors you can do for yourself.

It can be tough to part with 10% of your earnings each month, so if you feel you might change your mind and choose to spend it instead, consider setting up a direct debit. This way, you won’t even have to think about the money leaving your account and you can just look at it as another bill. Before you know it, you’ll have a substantial amount in savings.

Live Within Your Means

Whatever your goals are when it comes to money, make sure you always live within your means. Spend less than you earn, and don’t be tempted to get into debt or use your overdraft for the sake of it. No purchase is worth getting into debt, unless it’s an emergency and you have absolutely no choice!

Save Up An Emergency Fund

Having an emergency fund behind you can stop you from getting into debt.

What would you do if your car broke down unexpectedly, or you had an issue with an appliance at home? What if you lost your job or had to take a pay cut? You just don’t know what the future holds, so saving up anywhere from 3-6 months of your living expenses can give you peace of mind and keep you going if something bad were to happen.

Set Goals- And Come Up With A Plan To Reach Them

By having some goals to work towards, you have more of an incentive to save money and take steps to get better with money. Figure out what your goals are and come up with a plan to reach them. Let’s say you want to save up 6 months of living expenses in 1 year.. How much would you have to put aside each week to make this happen? By breaking down your goals like this, you should find reaching them much easier.

Wait Before Purchasing An Item

We’ve all been online or in a store when we’ve felt the burning desire to purchase an item out of the blue.

If you can just stay mindful, avoid the urge and wait it out, you should find that a few days will pass and you’ll be glad you didn’t by it. If in a few weeks or a month you still find yourself thinking about the item, you can buy it knowing that it wouldn’t have lost its novelty. It’s always best to plan for purchases, though!

Always Look For Ways To Trim Your Expenses

Make sure you constantly look for ways to trim your expenses. Don’t just keep on paying your bills without looking for better deals, for example. If you have subscriptions you don’t use, cancel them. Make sure you plan to look at your budget at least once every 8 weeks to see what changes you can make.

Keep An Eye On Your Credit Score

Finally, keep an eye on your credit score. Many millennials have no idea what their credit score is. Your credit score can affect your interest rates, mortgage, and more. Make sure you keep it healthy by paying your bills on time, paying off your debts, and disputing any mistakes on your score. Don’t just ignore it and hope for the best!

Follow these tips to improve your finances.

Ken Boyd

Author: Cost Accounting for Dummies, Accounting All-In-One for Dummies, The CPA Exam for Dummies and 1,001 Accounting Questions for Dummies

(amazon author page) amazon.com/author/kenboyd

(email) ken@stltest.net

(website and blog) http://www.accountingaccidentally.com/

The post Money Management For Millennials appeared first on Accounting Accidentally.

May 1, 2019

7 Great Ways to Make Extra Income

Everyone has dreams, but not many people take action to make the dream a reality.

Your goal may be to start a business, pull money together for a down payment on a better car, or maybe to make a home repair.

It may be a bigger house, or a particular vacation spot.

If you need more money to reach your goal, you may need a side hustle, a part-time job, or another income source. Use these ideas to make extra income and to fund your goal.

If you’ve had a financial setback, this article may help you.

Most Important: Get Your Financial House in Order

Getting your personal finances in order is the first- and most important step- for finding more available dollars.

Action Steps To Consider

Create a budget, even if that budget is simply on notebook paper.

Separate your expenses between fixed and variable, and take a hard look at your variable spending.

Take steps to cut your variable expenses each month and put the amount you save into a separate savings account.

Consider using a budgeting app to monitor your spending

Save 5% of your monthly gross income

If you start implementing these strategies, you can reduce your spending, save money, and fund a special need.

Many freelancers and business owners may have times when cash flow is a problem. Use this site to apply for a loan Find My Rate at Social Finance in order to cash flow your business until you can collect receivables from customers.

#1- Become A Driver

If you have time to pick up extra work and can drive a car, then companies like Uber and Lyft offer a great opportunity to make some quick cash. You’ll need a clean driving record, a relatively new car, and the authorization to work wherever it is that you live.

Driving offers great flexibility, because you can control the number of hours you work, and when you drive. You can increase or decrease your hours (and your income), based on your personal needs.

Use this site to apply for a loan Find My Rate at Social Finance Pay off credit cards or invest in a major purchase

#2- Take Advantage of Promotions, Discounts

Spending less money is another smart way to fund your dream project, so think before you spend.

Before you shop for groceries, household items, or even spending on meals and entertainment, look for promotions and discounts that can save you money.

For example, check with your bank to see if they’re giving away cash bonuses for opening up accounts. Banks often run promotions and can mean you get a quick $50 or $100 when you need it.

#3- Do Market Research

Market research participation is relatively quick money for not a lot of work.

Businesses who are looking for consumers’ opinions on a variety of products and services will put you in a room just to get your opinion, and that’s it. It might involve answering polls or surveys, breaking off in a discussion group or writing or stating your opinion. Either way, it’s something you can rely on it from time to time. Check out Focusgroup.com for more information.

#4- Sell Sell Sell

Amazon is a great place to list and sell old books, games, and devices on its marketplace. You can make more than just a few pennies if you have pricey textbooks from a university. Just make sure that the books are in good condition as you’ll get negative reviews if you attempt to sell books that are falling apart or games that don’t work. Remember, be upfront about any defects, no matter how small they might be and no matter how few people might readily notice it.

#5- Borrow From Yourself

Can you refinance your mortgage? Release cash equity or borrow against annuity? Check with your tax accountant and a financial advisor, so that you understand both the risks and rewards of these strategies.

#6- Do Tasks

TaskRabbit lets you tap into an existing marketplace of people looking for help locally with chores; it could be anything from helping people with their ironing to home renovations or helping them to move house. Amazon is also getting in on the action with Amazon Home Services. The services listed range from minimal repairs to more extensive and more involved tasks that would take considerably more effort.

#7- Get a Small Microloan

You can get a small business loan on Fundera, or Prosper if you’re looking for a very small personal loan. While it will depend on your credit, financial and employment situations, but it is possible to secure up to a few thousand dollars from loans like this.

There are a number of platforms that offer these small microloans, but it can help you out in the short term.

You Can Do It!

Use these ideas to fund that dream project- you can do it!

Ken Boyd

Author: Cost Accounting for Dummies, Accounting All-In-One for Dummies, The CPA Exam for Dummies and 1,001 Accounting Questions for Dummies

(amazon author page) amazon.com/author/kenboyd

(email) ken@stltest.net

(website and blog) http://www.accountingaccidentally.com/

The post 7 Great Ways to Make Extra Income appeared first on Accounting Accidentally.