Kenneth Boyd's Blog, page 46

July 28, 2019

Effective Interest Method: Accounting for Bond Premiums and Discounts (3 Video Links)

If you’ve taking an intermediate accounting class, or studying for the CPA exam, you may struggle with the effective interest method for bond accounting.

You’re not alone.

I’ve always thought that this topic was difficult for many instructors to teach. I started my career as a financial advisor, and my entire client base purchased bonds. So, I had to explain bond premiums and discounts to investors each day.

The experience helps.

Premiums and discounts

A bond’s par value or face value is the dollar amount started on the bond certificate. Let’s assume that you purchase a $1,000 par value bond.

Premium bond: Investor pays more than the par amount, or more than $1,000. Buying the bond for $1,050 would mean purchasing at a premium.

Discount bond: Investor pays less than par amount, or less than $1,000. A bond purchased at $980 would be at a discount.

How do you account for the difference between the par (face) amount and the purchase price?

Effective interest method: Discount bonds

This video and this second video explain purchasing a bond at a discount. In this example, a $500,000 face amount bond is purchased at $377,107:

The far right column shows a beginning carrying value of $377,107. Over the bond’s remaining 10-year life until maturity, the carrying value is increased each year to $500,000 (with rounding).

On the far left, you see that the investor earns annual interest of ($500,000 X 6%), or $30,000. That amount is fixed.

You’ll also note that phrase “purchased to yield 10%”. That phrase refers to the investor’s total return (yield to maturity) over 10 years. The investor earns 6% annual interest plus the difference between the purchase price and the face amount. That amount is the unamortized discount when the bond is purchase, or $122,892 in this case.

In year 1, the spreadsheet multiplies the carrying amount ($377,107) by the 10% yield percentage, which equals $37,710.70. The difference between that amount and the $30,000 in interest ($7,710.70) is added to the carrying value for the start of year 2.

$7,710.70 is also reclassified from the unamortized discount account into bond income. Over 10 years, the entire $122,892 unamortized discount account is moved into bond income.

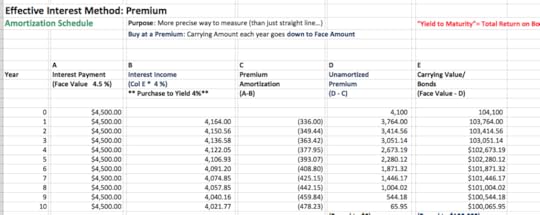

Effective interest method: Premium bonds

This video explains purchasing a bond at a premium. In this case, a $100,000 face amount bond is bought for $104,100:

The far right column shows a beginning carrying value of $104,100. Over the bond’s remaining 10-year life until maturity, the carrying value is decreased each year to $100,000 (with rounding).

On the far left, you see that the investor earns annual interest of ($100,000 X 4.5%), or $4,500. That amount is fixed.

You’ll also note that phrase “purchased to yield 4%”. That phrase refers to the investor’s total return (yield to maturity) over 10 years. The investor earns 4.5% annual interest less the difference between the purchase price and the face amount. That amount is the unamortized premium when the bond is purchase, or $4,100 in this case.

In year 1, the spreadsheet multiplies the carrying amount ($104,100) by the 4% yield percentage, which equals $4,164. The difference between that amount and the $4,500 in interest ($336) is subtracted from the carrying value for the start of year 2.

$336 is also reclassified from the unamortized premium account into bond expense. Over 10 years, the entire $4,100 unamortized premium account is moved into bond expense.

For live CPA exam prep and accounting classes, join Conference Room for free. Members will be notified of course dates, times, costs, and how to attend these courses.

Get your questions answered to pass the CPA exam, and to learn accounting concepts.

Go to Accounting Accidentally for 300+ blog posts and 450+ You Tube videos on accounting and finance:

Good luck!

Ken Boyd

Author: Cost Accounting for Dummies, Accounting All-In-One for Dummies, The CPA Exam for Dummies and 1,001 Accounting Questions for Dummies

(email) ken@stltest.net

(website and blog) http://www.accountingaccidentally.com/

The post Effective Interest Method: Accounting for Bond Premiums and Discounts (3 Video Links) appeared first on Accounting Accidentally.

July 25, 2019

Important Small Business Management Tips

Running a business is no easy thing to do.

You start by having everything piled on your shoulders. You work tirelessly and hard to get your business off the ground and thriving. Often just working from a computer and your phone.

But in time that business grows, and it turns out that you get your own business premises, and you end up having employees that you are now responsible for. However, it isn’t as easy as that, and there is a lot that many employers need to think about, that they can sometimes forget to consider. With that in mind, here are some of the things that every employer needs to remember.

If you’ve had a financial setback, this article can help.

Safe Work Environment

It’s all well and good having a place to work from, but if you expect other people to work there, you will find that there are other, smaller factors to consider.

However, they are important to ensuring the wellbeing of the staff you are now responsible for, including how the environment is in the office such as warm enough or cool enough. Here are some other factors to consider.

Safety Measures

You also need to ensure that you have the right safety measures in place.

Things like smoke detectors and fire alarms are vital in this day and age. But it is all well and good having them, but if you don’t have them tested, you may find that come the time you need them, they no longer work. That is why it’s worth investing in smoke alarm testing services. This can also provide peace of mind to you and the staff you have working for you. Ensuring that their safety is a high priority.

Security

Of course, the last thing you might want to consider with the workplace is to ensure that it is safe and secure when you are not there.

You may have stored stock in there, and you no doubt will have computers and technology such as phones or smart devices. This is exactly what opportunities are looking for. You may want to consider adding surveillance cameras and a burglar alarm system. Many of these built in devices have direct liaison with the police to ensure that you are fully secured when you are not there.

Staff Goals and Guidelines

Having staff means that they are accountable for the success of your business.

After all, in some circumstances, that will be why you are employing them. You are hoping they bring in business to the company, or indeed, help to keep things running smoothly.

While it’s a good idea to set targets and goals for your staff to ensure they know where they are up to, you might want to ensure they are realistic. This helps to keep staff members motivated and on course to what you want them to achieve.

If you’ve having trouble managing payroll, this article is a good resource.

A top tip would be to have regular meetings with your staff to help and offer advice in any way you can. This will also help you to keep tabs on performance and highlight any training issues you may have that need to be addressed. This is in your interest as well as theirs.

What About Taxes?

As an employer you are responsible for things such as tax and ensuring that you follow the right guidelines.

But staff and employees can cost a lot to a business, so sometimes business owners and entrepreneurs look for a way to make a saving. This might be in terms of tax avoidance or paying employees in cash.

However, don’t fall into this trap.

Websites like mahanyertl.com shares how tax whistleblowers can share your dealings and tax avoidance scenarios with the authorities and it can lead to big trouble. Always ensure that the accounting side of things when it comes to your staff is up to scratch.

Are you Approachable?

Finally, how you are as an employer is very important.

You need to be approachable and understanding while at the same time still keep the demeanor of the company owner. Employees need to feel comfortable working for you, but they also want to be motivated by you, inspired even.

Some people have great management and leadership skills naturally, while others really need to consider how they come across. Thankfully, there are plenty of articles online to help you keep tabs on how you should be within the workplace. Providing the tools to lead and manage a successful team while running a thriving business.

Let’s hope this helps you to understand exactly what every employer needs to remember. Good luck!

Ken Boyd

Author: Cost Accounting for Dummies, Accounting All-In-One for Dummies, The CPA Exam for Dummies and 1,001 Accounting Questions for Dummies

(email) ken@stltest.net

(website and blog) http://www.accountingaccidentally.com/

The post Important Small Business Management Tips appeared first on Accounting Accidentally.

July 11, 2019

Keeping Your Life Afloat When Your Income Stops

When you’re income stops, it’s a shock to the system.

A lot of our worries derive from money (usually the lack of it) and so, with one less income, or no income coming into your home at all, you’re probably frantic about what you can do.

If you’ve been injury and can’t afford to wait to see if the case put forward by your Personal Injury Lawyers will succeed, if you’ve lost your job, or the business you worked for has gone into liquidation the outcome for you is the same – To figure out your situation as quickly as possible.

If you’ve had a financial setback, this article is helpful.

Give it your all and start by reading this guide and putting into practice the below mentioned in a bid to keep your life afloat.

Categorize Your Expenses

If you haven’t already, make a budget of everything that leaves your account(s) and divide all of these into three different categories; necessities, wants, and savings.

Necessities

The necessities are what you need to pay to survive. These include your mortgage/rent, gas, electric, water, food budget, and travel to get your kids to school and your partner to work. After figuring out the cost to live, there is room here to bring down your spending on necessities or swap them for cheaper alternatives.

You may try switching energy providers, reducing your food budget, being more proactive with using less electricity and gas and- if needed- downsizing your home.

Wants

Sports club memberships, designer clothes are not things you need to survive.

These are luxuries, and so in terms of your spending, you can effectively cut this budget down as much as you need too. As an alternative, you could consider swapping expensive dinners out for affordable takeout food or cancelling your routine hair salon appointment for a box of DIY hair dye from the drug store.

Savings

Anything you would usually save in your kids’ accounts, emergency fund etc., may need to take a back seat, as this income may need to support your basic needs until you can get back on your feet financially.

Cutting back your budget will allow you to see if you need to make up the difference while your income is reduced. If you need to urgently find ways to bridge the gap in your finances, here are a few solutions:

You could ask your spouse/partner if they could boost their hours at work or look for a full-time job to fill the gap.

This article can help you become a freelancer, and earn more income.

You might want to consider stretching your skillset. For instance, if you worked as a builder but are now unable to do the job due to an injury, you could consider jobs that are not physically demanding, such as an office job.

Depending on the state you live in and your circumstances you may be entitled to state benefits. It’s worth checking the government website to see whether the government could help you overcome your setback.

By taking time to sit down and work out your outgoings, you can cut down your outgoings significantly and then plan going forward what you or your family need to do to help tie things over until you’re back on your feet.

You can do it!

Ken Boyd

Author: Cost Accounting for Dummies, Accounting All-In-One for Dummies, The CPA Exam for Dummies and 1,001 Accounting Questions for Dummies

(website and blog) http://www.accountingaccidentally.com/

The post Keeping Your Life Afloat When Your Income Stops appeared first on Accounting Accidentally.

12 Ways To Save Money As A Small Business

Being savvy about your business spending is an important part of keeping your business afloat, and profitable. This is especially important when your business is new or small, when every small amount of money counts.

If you’ve had a financial setback, this article is helpful.

Use these 12 tips to save money in your business:

Learn the difference between cost avoidance and cost savings. Both are useful tools when used correctly. Cost avoidance means taking actions to avoid making a financial outlay at all, such as taking steps to improve employee satisfaction to avoid the cost of hiring. Cost saving, on the other hand, is finding ways to reduce the cost of products and services, by finding discounts and negotiating deals. Find out more here.

Try non-traditional advertising ideas. Instead of spending big dollars on traditional marketing, spread the word about your business with PR instead. Social media and press coverage are much cheaper and can be just as effective.

Outsource where you can. In-house employees cost more than just their salary. Retirement plans, benefits packages, holiday and sick pay, and of course the cost of maintaining an office all add up. In the early days, if you don’t need a full-time employee, outsource to freelancers or agencies to get work like copywriting, design, or PR done by an expert.

Use the cloud. Save the costs of expensive software and use cloud-based solutions where you can. You can run almost anything, from your accounts to document storage, with cloud-based software. I recommend using QuickBooks software to process your accounting transactions on the web. Read this article to find out more about QuickBooks.

Remote work. Remote work or telecommuting is easier than ever, thanks to the technology available. Having staff based from home saves the cost of running an office.

Consider using interns. Taking on junior staff members from local colleges to do tasks like tweet, post to Facebook, or to write blog posts. This strategy can save you a fortune, while offering important work experience to local young people.

Review your expenses. Make sure you regularly take a look at your spending, and see if there’s anywhere you can make savings, even small ones. This could mean switching to a new supplier, or cutting back on how much stationery you use. While you’re doing this, make you sure also cancel any subscriptions you no longer need.

Buy in bulk. Lots of office supplies, like printer ink or paper, are cheaper when bought in bulk. The initial outlay saves you money in the long run. Cut out the middleman, and save cash by buying supplies from bulk warehouses yourself.

Go green. Making your business more eco-friendly can also save you money. Being smart about electricity use cuts down on the bills, as can running a paperless office.

Buy second hand. Lots of office equipment, from desks to printers, can be bought second hand. Try using eBay or local selling sites to outfit your first office.

Take advantage of discounts. Some vendors offer discounts for paying early, so take advantage to save money on services. Look out for discounts or offers for small businesses that you can make use of, too.

Encourage word of mouth. It’s free marketing! Ask customers to leave reviews or testimonials, or offer a reward scheme for customers who recommend you to a friend.

Good luck!

Ken Boyd

Author: Cost Accounting for Dummies, Accounting All-In-One for Dummies, The CPA Exam for Dummies and 1,001 Accounting Questions for Dummies

(website and blog) http://www.accountingaccidentally.com/

The post 12 Ways To Save Money As A Small Business appeared first on Accounting Accidentally.

July 7, 2019

4 Tips to Understand Consolidation Accounting (Video Link)

Whether you’re studying for the CPA exam, or taking an Advanced Accounting course, you may have trouble with accounting for consolidations.

Use these tips- and the video link- to understand the accounting process.

#1- What’s a Consolidation?

A consolidation means that two companies present their financials as if they are one company. Now, keep in mind that both firms continue to operate separately, and produce separate financial statements.

When a parent company buys all (or part) of a subsidiary, the consolidated financial statements reveal how the combined firms are performing financially. Did it make financial sense for the parent to buy the sub? The answer is in the consolidated financial statements.

#2- How is a Value Placed on the Subsidiary?

The value of the subsidiary (sub) is based on the purchase price paid by the parent, and the percentage of the total sub purchased.

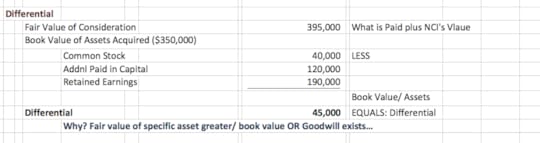

In this example, the parent pays $316,000 for 80% of the sub. The sub’s total value is ($316,000 / 80%), or $395,000. Another party, referred to as the non-controlling interest (NCI) owns the other 20%, or $79,000.

Note the screen shot below:

#3- Why Book Value is Important

When a parent buys a sub, the parent is buying the book value (assets less liabilities) of the sub. That’s the true value of the sub that is purchased.

The difference between the fair value of the consideration paid ($395,000) and the book value ($350,000 in this case) is the differential.

Check out this screenshot:

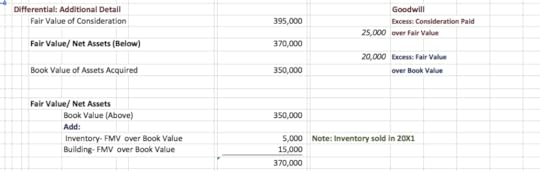

#4- How to Account for the Differential

It’s not unusual to pay more for an asset you really want. In fact, you might pay more than the fair market value of an asset, if you thought the purchase would pay off for you down the road.

People pay more than fair value (market value) for houses, cars, and other assets.

The same is true with business purchases. So how does the accounting work?

This example assume that two assets have a fair market value greater than book value, and fair market value of the subs net assets (assets less liabilities) is $370,000.

The difference between book value and fair value ($20,000) is accounted for by increasing the value of the assets to fair market value in consolidation. In other words, the assets you see in a consolidated balance sheet are presented at fair market value.

What about the excess paid above fair market value?

In this example, that excess is $395,000 (consideration paid) less $370,000 (fair value) the $25,000 is allocated to a new asset account, goodwill. The goodwill balance is amortized (expensed) over a period of years.

Here’s the video that explains these concepts:

For live CPA exam prep and accounting classes, join Conference Room for free. Members will be notified of course dates, times, costs, and how to attend these courses.

Get your questions answered to pass the CPA exam, and to learn accounting concepts.

Go to Accounting Accidentally for 300+ blog posts and 450+ You Tube videos on accounting and finance.

Ken Boyd

Author: Cost Accounting for Dummies, Accounting All-In-One for Dummies, The CPA Exam for Dummies and 1,001 Accounting Questions for Dummies

(email) ken@stltest.net

(website and blog) http://www.accountingaccidentally.com/

The post 4 Tips to Understand Consolidation Accounting (Video Link) appeared first on Accounting Accidentally.

July 4, 2019

Big Ways You Could Cut Your Household Budget Today

When it comes to your day-to-day spending, you need to understand your habits.

Things like cutting down cigarettes and alcohol, using a thermos instead of buying coffee, and resisting impulse spending are all good advice. However, they are a way of chipping away at your costs little by little, when sometimes you need a big, and immediate change.

Here, we’re going to look at what you can do when you need to take drastic action and make big cuts.

If you’re had a financial setback, this article may help.

Plan your shopping

One of the worst habits that generates too much spending is poorly planned shopping.

If you don’t plan out your meals and what you buy in advance, it’s easy to come home with a bunch of extras that you might not necessarily need to buy. It also means you can forget certain household goods, which might necessitate another trip to the store. That extra trip may result in another impulse buy.

Besides keeping a grocery list for what you need to restock, consider using meal planning apps to know exactly what food and how much you need to buy. Buying fewer ingredients for more meals also reduces the costs of eating healthily.

Invest in energy savings

The most frequently encountered household bill is the energy bill and, for the vast majority of us, there is a lot we could do to cut down on it.

This includes using AC only when necessary, making sure to turn off the power supply for appliances we’re not using, and generally being more mindful of electricity use.

You can make some of your savings automatic by making a few investments now. Besides long-term cost saving appliances like LED bulbs, you should check out sites like appbodia.com to find smart programmable thermostats. These can help you save by ensuring that your heating and AC only turn on when they’re necessary- and turn them off automatically to ensure you’re not burning through cash.

Click unsubscribe

If you want to immediately cut down your monthly budget, then you should look at not only how you spend money from day to day, but those automatic charges that are oh-so-easy to miss.

One that has been growing more and more consistently an issue is the digital subscription services we’re relying on more frequently. Netflix, Audible, Spotify, Xbox Live, it’s easy to lose track of your subscriptions.

Take the time to look over your monthly bank returns and identify what subscriptions you have. If you haven’t used them in a month or longer, then it’s a good sign that you’re spending money where you shouldn’t be. Any time you decide to opt in for a new subscription, make sure that you make a note of it in your budget, too.

Review your insurance

You don’t necessarily need to cut down on your insurance to find some savings.

Yes, you may have more cover than you realistically need, and, in that case, it might be time to switch up your policy. You may be able to get the same coverage at a lower cost by switching to another provider. Check out sites like insurdinary.ca, to find out more.

Some insurance companies don’t reward loyalty, and between contract renewals, your policy may get more expensive. For that reason, know when your insurance contracts run out, and compare the market to see if there are better offers around.

Get in touch with your service providers

Your internet and cell providers are two other costs that need a closer look.

Not only could you get a better deal by switching providers when it’s right, but you could save money simply by getting in touch with them. Broadbandnow.com shows a few effective tips for negotiating with your current providers and lines of reasoning you could use to haggle down your monthly bills.

Sometimes, simply mentioning that you want to switch to another provider can be cause enough for them to lower your costs or offer some freebies that make a deal more valuable. Again, loyalty rarely pays with service providers, or at least, it doesn’t pay as much as negotiating or switching.

Consider how you manage your debt

Many of us have some level of debt, which eats into our budget.

For some people, it’s a simple credit card that we use to better manage our finances. However, if you have multiple debtors with interest rates that are too high, there may potentially be a better way.

Debt consolidation is not always the best answer, especially for low interest loans. However, for those with high interest payments eating away at their finances, it can help you freeze or reduce them. Furthermore, it can be a lot less stressful to pay one debtor rather than to have to manage several at the same time.

This steps can also help you improve your credit score, and I write about credit score mistakes here.

Pay yourself first

This isn’t really a tip on how to save money, but rather to make sure that it’s going the right place.

One of the reasons we spend money more than we should is that it’s available. We’re more likely to overspend and eat into our funds that should go towards our financial resolutions if it’s accessible. As such, you should make it unavailable by paying yourself first.

As soon as you get paid, transfer however much you have planned for your savings out of your current account and get it out of reach. This, at the very least, makes sure that you’re not able to overspend to the point of harming your long-term financial goals, which is crucial for keeping your resolutions.

Most important of all is that, if you haven’t done so already, you track your spending. See where your money is coming in and going out is the best way to identify overspending, allowing you to tackle the biggest problems first and foremost.

You got this!

Ken Boyd

Author: Cost Accounting for Dummies, Accounting All-In-One for Dummies, The CPA Exam for Dummies and 1,001 Accounting Questions for Dummies

(email) ken@stltest.net

(website and blog) http://www.accountingaccidentally.com/

The post Big Ways You Could Cut Your Household Budget Today appeared first on Accounting Accidentally.

June 26, 2019

Credit Scare: Why Your Credit Rating Might Not Be As Good As You’re Expecting

So, the exciting time has come; you’re about to apply for a loan, perhaps to buy that dream car, or get a mortgage. Either way, you’re buzzing when you walk into your application meeting. Then, the credit check happens.

This is where many applications fall down and, sometimes, refusal here can come as a shock. This is especially true for those who haven’t needed to check their credit reports before.

Perhaps this is a mortgage for your first home, or an attempt to get your first credit card. It could even be that you’ve been accepted for credit in the past, but something unexpected has changed since then.

If you’ve had a financial setback, this article can help.

No matter the reason, refusal can leave you at a loss as to what could have caused the decline. In reality, there are a few reasons why your credit rating could fail to win approval without your realizing the problem. And, getting to the bottom of those is the best way to get accepted next time around.

No credit

If this is your first time applying, you might assume your score is perfect.

You’d be wrong.

For large loans, in particular, no credit rating is as much a red flag as a bad one. That’s because lenders want to know they can trust you. A lack of credit score doesn’t provide that guarantee.

The good news is that overcoming this is as simple as taking out options like credit cards and meeting all payments in full. Eventually, this will build your credit score up to make you a more appealing prospect in future.

Mistakes were made

There are also cases where credit refusal can be due to mistakes.

These could be human errors in your application. More often, though, they come down to mistakes on your report. If you think this is the case, it’s vital to seek a credit check yourself. That way, you can identify mistakes yourself.

It may be, for instance, that a payment you met on time was logged as missed. Or, it may be that inaccurate information about missed payments are posted to your credit history.

In that instance, you should challenge unjust bills with the company and credit bureau. If this issue is something like an undeserved parking fine, companies like GetDismissed could clear it for you. While it isn’t ideal, acting fast could still see you getting the loan you need.

Credit crunch

Even if you’ve been approved for credit before you may find that your credit rating isn’t so good this time.

Often, this can come down to your first source of credit. Even those who pay off their credit card every month can still damage their rating if they are flagged for a high utilization rate.

This effectively means the percentage of credit payments to your limit. In this instance, you should seek to reduce the amount you spend on your credit card. Over time, that will get you back in the green and accepted for the credit of your choice.

Use these tips to improve your credit score, get access to credit, and to lower your interest rate on debt.

Ken Boyd

Author: Cost Accounting for Dummies, Accounting All-In-One for Dummies, The CPA Exam for Dummies and 1,001 Accounting Questions for Dummies

(email) ken@stltest.net

(website and blog) http://www.accountingaccidentally.com/

The post Credit Scare: Why Your Credit Rating Might Not Be As Good As You’re Expecting appeared first on Accounting Accidentally.

June 23, 2019

5 Tips to Understand Pension Accounting (2 Video Links)

What, exactly, is a pension, and how does the accounting work?

Both CPA exam candidates and undergraduate accounting students struggle with this concept, so I thought I’d explain the basic concepts here.

Pension- Defined

A corporate pension is a written agreement that requires a business to pay a former employee a series of payments at retirement. Everyone is familiar with pensions, either through your own job, or the pension offered by a friend or relative’s company.

The tricky part is who is liable to pay the pension, and how the liability is calculated.

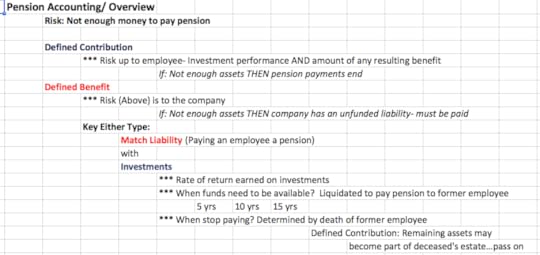

Two Types of Plans

The CPA exam, and intermediate accounting courses, will test you on the two types of pensions:

Defined benefit

This plan requires the business to pay a specific sum to a retiree each month, and the payment amount is based on several factors. Defined benefit plans consider years of service, and the worker’s salary for the last year of work (or the last few years of work).

The company is on the hook to pay a specific dollar amount- regardless of the dollars invested in the plan, and the rate of return earned on those dollars. So, if the money in the plan isn’t sufficient to make the payments, the company makes up the difference.

In the US, companies are shifting the liability for the pension payment amount to the retiree by switching to defined contribution plans.

Defined contribution

In this type of plan, the company is liable for contributing a specific dollar amount into the pension plan- but not for a specific pension payment. The investment performance of the dollars in the plan determines the pension benefit paid, which shifts the burden away from the employer.

Here’s a screenshot from my Pension part one video, which you can access here:

The Bucket Analogy

The CPA exam and intermediate accounting tests spend more time covering defined benefit plans, since the accounting is more complicated. Many of these questions ask: How is the company’s pension liability calculated?

To answer the question, think of the pension plan as a bucket. Dollars are invested into the plan, and those dollars earn a rate of return. Those transactions fill the bucket.

So, what comes out of the bucket? The costs incurred to manage the plan, and payments to retirees.

This screenshot from the Pension part two video explains more, and you can access the video here:

For live CPA exam prep and accounting classes, join Conference Room for free:

Members will be notified of course dates, times, costs, and how to attend these courses. Get your questions answered to pass the CPA exam, and to learn accounting concepts.

Go to Accounting Accidentally for 300+ blog posts and 400+ You Tube videos on accounting and finance.

Good luck!

Ken Boyd

Author: Cost Accounting for Dummies, Accounting All-In-One for Dummies, The CPA Exam for Dummies and 1,001 Accounting Questions for Dummies

(email) ken@stltest.net

(website and blog) http://www.accountingaccidentally.com/

The post 5 Tips to Understand Pension Accounting (2 Video Links) appeared first on Accounting Accidentally.

June 21, 2019

The Financial Benefits Of Safer Driving

We shouldn’t need to tell you about the benefits of safer driving.

Hopefully, you already understand the risk to both your life and the lives of others when you behave recklessly on the roads. There are financial benefits to safer driving too, and while these are probably of no surprise to you, we are here to remind you of them anyway.

If you’ve had a financial setback, this article can help.

Benefit #1: Avoiding the economic impact of a car accident

The reason for a car accident may be through no fault of your own.

Our highways and byways are littered with reckless drivers, and you might be an unfortunate victim. On the other hand, if you are guilty of speeding, driving under the influence, or not paying attention to the road, you might be the influencing factor in an accident that could cause an injury or worse.

On a financial level, you will need to deal with repair costs for your car. You might have to fork out money on medical bills. And if you are guilty of a criminal offense, despite the assistance of esteemed legal firms such as https://www.leyba-defense.com/, you will still incur some legal costs.

Oh, and as we will examine below, you will also see a price hike in your insurance premium. Drive safely then, and reduce the personal and financial costs that might follow if you don’t!

For live CPA exam prep and accounting classes, join Conference Room for free:

Members will be notified of course dates, times, costs, and how to attend these courses. Get your questions answered to pass the CPA exam, and to learn accounting concepts.

Benefit #2: Qualify for a lower insurance rate

As we discussed here at https://www.accountingaccidentally.com/, you need to be mindful of less expensive car insurance.

While you might think you have netted yourself a good deal, you might not have the coverage you need, and this could have financial repercussions for you later. However, there are ways to lower your insurance premium, and unsurprisingly, this includes driving safely.

If you have a clean driving record, one free of penalty points and other pointers to criminal negligence, you might qualify for lower rates and special discounts.

You can also qualify for lower insurance if you install a telemetric device in your car. Around the size of your cell phone, some insurance companies offer these boxes to drivers looking to showcase their safe driving and reduce their premiums. With evidence acquired, the driver should then be offered a discount, sometimes as much as 50%.

You can learn more about telemetric devices at https://www.thesimpledollar.com/. You might also qualify for lower insurance (and learn safer driving skills) if you take a defensive drivers course, so that’s also something to think about if you’re currently paying more than you think you should be on your insurance.

Benefit #3: Pay less for gas

Other than the cost of insurance, your other financial burden each month will be the price of fuel.

While you can shop around your local gas stations for cheaper deals, you can also reduce your gas mileage by driving safely. As discussed in this article at https://www.moneycrashers.com/, this includes keeping to the speed limit, braking gently, and driving smoothly.

The alternative is burning more gas by driving too fast, braking aggressively, and performing reckless maneuvers on the road. Of course, not only will you save money on fuel if you drive safely, but you are less likely to be hit with a costly driving fine should the police catch up with you.

Use these tips to become a safer driver and to reduce the cost of operating a vehicle.

Ken Boyd

Author: Cost Accounting for Dummies, Accounting All-In-One for Dummies, The CPA Exam for Dummies and 1,001 Accounting Questions for Dummies

(email) ken@stltest.net

(website and blog) http://www.accountingaccidentally.com/

The post The Financial Benefits Of Safer Driving appeared first on Accounting Accidentally.

June 16, 2019

3 Little-Known Facts About Inventory Valuation Methods (3 Video Links)

Inventory is often the largest account balance in the balance sheet, and accountants must get inventory valuation right.

If you’re studying for the CPA exam, taking an undergraduate accounting course- or managing a business- this concept can be difficult.

What is inventory valuation?

When you add an item to inventory, you need a method to figure out the cost of the item. The cost of each item determines the cost of good sold, and the impact on net income when the item sold.

The method you choose has a big impact on your company profit or loss.

Accountants use several methods to value inventory, and the three most popular are First-in, first out (FIFO), Last-in, first-out (LIFO) and Weighted average.

Factors that stay the same

Several factors stay the same, regardless of the method you choose. To explain, check out this screenshot from my FIFO video explanation:

The total cost ($3,925), units purchased (325), the units sold (100) and the items in ending inventory (225) are the same for any inventory method. What’s different is the value placed on each item.

FIFO assumes that the oldest (usually cheapest) units are sold first. In this case, 100 units are sold at $10 per unit.

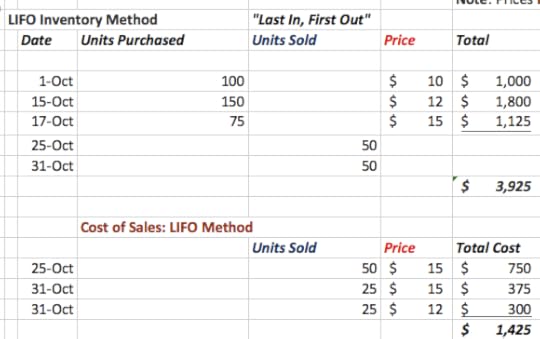

Here’s the LIFO method video screenshot:

LIFO assumes that the newest (usually more expensive) units are sold first. In this case, units at $12 and $15.

Finally, here’s the Weighted average method video screenshot:

This method computes a cost per units as: ($3,925 total cost) / (325 units) = $12.08. The same cost is assigned to all units.

Use the video links to learn more about these concepts, and to study for the CPA exam.

For live CPA exam prep classes, join Conference Room for free. Members will be notified of course dates, times, costs, and how to attend these courses.

Attend these courses and get help to pass the CPA exam, or to study for accounting topics.

Go to Accounting Accidentally for 300+ blog posts and 400+ You Tube videos on accounting and finance.

Good luck!

Ken Boyd

Author: Cost Accounting for Dummies, Accounting All-In-One for Dummies, The CPA Exam for Dummies and 1,001 Accounting Questions for Dummies

(email) ken@stltest.net

(website and blog) http://www.accountingaccidentally.com/

The post 3 Little-Known Facts About Inventory Valuation Methods (3 Video Links) appeared first on Accounting Accidentally.