Kenneth Boyd's Blog, page 27

July 16, 2021

What Las Vegas Conventions Teach Us About Relevant Costs and Special Orders

It’s July of 2021, and The Wall Street Journal reports that big Las Vegas Mega-Conventions are making a comeback. Many industries host conventions in Sin City, and these events can lead to large orders and new business relationships.

But here’s the real question: Is the new business gained at a convention profitable? Specifically, what price should you charge on a special order to generate a reasonable profit? Special orders are priced differently, because some of the firm’s costs no longer apply.

Have a question about personal finance or entrepreneurship? Join the Ask Me Anything live chats on Conference Room.

Pricing a special order

Let’s assume that your business manufactures outdoor sporting goods and clothing. You’re sweating it out at a Las Vegas Trade show for retailers, and a potential customer wants to buy a large order of Tundra Tough Hiking Shorts. Here are the details:

Tundra Tough Shorts: 2021 Price and Cost Per Unit Budget

Sale Price: $100

Direct Material

StretchAll Cotton $50

Metal, plastic inserts $10

Direct Labor

Cutting, sewing $20

Total Direct Costs $80

Indirect Costs $5

(Overhead)

Total Costs $85

Profit per unit $15 (15%)

Direct costs (material and labor) are costs that can be directly traced to each pair of shorts. Overhead, or indirect costs, cannot be traced to a product. Instead, overhead costs are allocated, based on a level of activity. Direct labor hours worked or machine hours are often used to allocate overhead.

Why a lower price can still be profitableIf you receive an order at the end of the month, many of your indirect costs are already covered. Assume that you’re at the trade show on July 27th (man, it’s hot in Vegas in July). You’ve already paid the July lease on the factory, July utility costs, and repair and maintenance on machinery. You prior July production paid these costs.

The result?

You don’t have to allocate indirect costs for the special order- they’re already paid for in July. All you need to charge are the relevant costs of production.

What, exactly, is a relevant cost?

Understanding relevant costs

A relevant cost changes, based on a decision you make in your business.

I’ve always used the example of a commercial flight that is leaving in 15 minutes. The airline’s costs are nearly all sunk costs- costs that cannot be changed. That includes fuel, labor costs for the crew, gate fees- even the cost of drinks on the flight.

If a passenger buys a ticket at the last minute, none of the sunk costs are relevant when deciding a price for the ticket. The only relevant costs are labor costs needed to store luggage, and that Diet Coke during the flight. Everything else has already been paid.

When you accept a special order (or last minute order), only consider the relevant costs to fill the order. You can take on more business, charge less, and still generate a profit.

Go to Accounting Accidentally for 500+ blog posts and 450+ You Tube videos on accounting and personal finance:

Good luck!

Ken Boyd

Author: Cost Accounting for Dummies, Accounting All-In-One for Dummies, The CPA Exam for Dummies and 1,001 Accounting Questions for Dummies

(email) ken@stltest.net

(website and blog) http://www.accountingaccidentally.com/

The post What Las Vegas Conventions Teach Us About Relevant Costs and Special Orders appeared first on Accounting Accidentally.

July 14, 2021

Financing Your Home Renovations: Where to Start

When we buy a home, we tend to spend a whole lot of time browsing the housing market, actively searching for something that meets all of our needs. We ensure it has enough rooms and all the different features we’re looking for in a property. But as time goes on, many of us find that we outgrow our homes or begin to look for different features in our living spaces.

Have a question about personal finance or entrepreneurship? Join the Ask Me Anything live chats on Conference Room.

This is understandable and pretty common. But you don’t necessarily have to sell up and move on in this situation. Moving is stressful, disruptive and expensive. That’s before we even begin to mention how time consuming the entire process is. Instead, you can renovate your property, taking it and turning it into something that better suits our needs.

Now, there are countless renovations that you might want to consider, from loft conversions to garage conversions, the creation of en suites and more. But this is a pricey process and you need to make sure that you finance these changes in the best way possible. Here are some suggestions that can help you to make the most of your money when it comes to renovating your property!

Set a Budget

The first step you need to take when financing your home renovations is to set yourself a budget. A budget is essential to determine what you can genuinely afford. It prevents you from falling into debt and risking your home for the sake of improving it. To create a budget, look at your usual budget that you live by.

This should take your income after tax and other essential contributions, take away essential costs (such as bills) and leave you with your disposable income. Take a look at your disposable income and determine how much of this you’re willing to contribute to your home improvements. This will let you know how much you have available to spend.

Look Into Loans

The most common means of paying for home renovations is through a loan of sorts. When you take out a loan to have home renovations carried out, you can borrow the money you need and pay it back in smaller sums as time goes on.

The key to making a loan work for you is to ensure that you can definitely afford the monthly payments and that you pay them on time, as agreed with the lender (missed payments can cause financial hardship and impact your credit score and credit file). A good place to start looking is www.gemhomeloans.com.

Create a system to save money

Alternatively, you can save. If you can only find loans with interest attached, saving the money for your renovation outright will allow you to have it for the lowest price possible. Just bear in mind that this option takes patience.

While you can have the work done now and pay it back later with a loan, saving means waiting. It is possible though and is definitely viable for the more financially savvy amongst us.

As you can see, there really is a lot to think about from a financial perspective when it comes to carrying out home improvements. Hopefully, one of these methods will work for you and will help get your venture started out on the right foot!

Consult with a financial advisor on these issues- good luck!

Go to Accounting Accidentally for 500+ blog posts and 450+ You Tube videos on accounting and personal finance:

Ken Boyd

Author: Cost Accounting for Dummies, Accounting All-In-One for Dummies, The CPA Exam for Dummies and 1,001 Accounting Questions for Dummies

(email) ken@stltest.net

(website and blog) http://www.accountingaccidentally.com/

The post Financing Your Home Renovations: Where to Start appeared first on Accounting Accidentally.

July 12, 2021

The First Steps to Financial Freedom

Financial freedom has become a catch-all term for anything from becoming a millionaire to being able to balance your budget with ease every month. Being financially free means that you can make the decisions about your finances without a great deal of stress. Freedom also means that the stress around your finances is removed.

Is it a buzz term? Absolutely, but that doesn’t make it any less desirable or achievable. Here are some of the first steps that you can take to find your own financial freedom.

What does financial freedom mean to you?

Financial freedom means something different to everyone, so what does it mean to you? Is it having savings instead of debt? Or maybe you just want to have some left over money at the end of the month. A lot of people think that financial freedom has to be about being filthy rich, but it doesn’t have to be. Work out what your goals are as the starting point for your journey.

Have a question about personal finance or entrepreneurship? Join the Ask Me Anything live chats on Conference Room.

Learn about your own financesWhat do you know about your own finances? A lot of people don ‘t like to look at them and have no idea what they have or what is available to them. Take the plunge and discover all that you can about your money, educate yourself about the world of banking.

We aren’t saying you should go and get a Masters in Finance (although you can if you want to). It just helps to know the difference between Multifamily Loans and what an annuity plan is. One of the best things you can do is look at your current budget and see if it is working. And if you don’t have a budget, it’s time to make one.

Managing savings and debt

Having savings and debt can be a tricky thing to balance in your mind. Yes, you might have savings, but how much is your credit card costing you in interest? If possible, start paying off your debt with your savings.

Let’s face, nobody wants to pay their credit card company more than they have to. Of course, you can keep some savings for a rainy day, and keep your credit card open with a zero balance (also for rainy days). Some debt can’t be paid off quickly, such as a mortgage, but long term debt like this is seen as a good debt to have.

Learn to negotiate

It doesn’t matter if it is your savings, your loans, your mortgage; if it has to do with your money, negotiate.

Many people decide to accept the current rates that they have, even if they are terrible! Don’t be afraid to shop around and come back to your financial institution with offers from other companies. Most of the time, they will not want to lose your business and may match the rate, or get as close as they can to it.

In those cases when they won’t meet you in the middle, it might be time to pack up and walk away for a better deal.

Consult with a financial advisor on these issues- good luck!

Go to Accounting Accidentally for 500+ blog posts and 450+ You Tube videos on accounting and personal finance:

Ken Boyd

Author: Cost Accounting for Dummies, Accounting All-In-One for Dummies, The CPA Exam for Dummies and 1,001 Accounting Questions for Dummies

(email) ken@stltest.net

(website and blog) http://www.accountingaccidentally.com/

The post The First Steps to Financial Freedom appeared first on Accounting Accidentally.

July 6, 2021

Signs You’re Bad At Saving Money

It doesn’t matter what you earn, saving money is something that everybody should try to do for their own financial future. Saving money isn’t a skill you should be born with. You can learn all the skills you need to build your wealth. The first step is to acknowledge that you aren’t great at saving.

Here are some warnings signs that you’re bad at saving money and could be at risk of bankruptcy. If you are worried, it could help to talk to a bankruptcy chapter 7 lawyer. Consult an experienced attorney when dealing with any legal issue.

You Don’t Know How Much You Spend

Do you know how much you spend? If you’re good at saving, you probably do. If you don’t know how much you spend, you won’t be able to tell if you’re saving as much as you should be.

Have a question about personal finance or entrepreneurship? Join the Ask Me Anything live chats on Conference Room.

It doesn’t need to difficult to track your spending. Use a budget or saving app, or track it manually on your phone or in a notebook. It doesn’t matter how you do it, as long as you do.

You’ll Tell Yourself You’ll Save More When You Earn More

Everyone thinks they’ll save more if they earn more, but this often doesn’t go as planned. For example, studies have shown that lottery winners lose their money as fast as they earned it, because they haven’t learned how to save.

The sooner you can start saving, the better. You can learn good habits for putting money into savings or investments. Even just saving loose change will help you to develop the skills for being good with money. When you do earn more, your savings will grow as you’ll know how to save.

Your Vices Eat Away At Your Savings

Are your habits costing your money? Perhaps you like to have a glass of wine in the evening, or perhaps you’re a smoker? The issue with vices like these is that they can have a negative impact on your health, and on your wallet.

Many households spend a large portion of their money on things like alcohol, without realizing it. Smoking is already an expensive habit, but it could become an even more expensive habit in the future, as some regulatory bodies consider raising taxes on cigarettes and alcohol in order to discourage citizens from doing these things.

Obviously, the easiest way to not let vices like these eat away at your savings is not to take part in them at all. However, if you really can’t give it up, and do want to enjoy the occasional glass of wine or cigarette, you should make sure you know exactly how much it’s costing you.

For example, imagine you have two drinks three evenings a week, costing an average of $10 a drink. This adds up to mean you’re spending $60 a week, which ends up being $3,120 spent on alcohol a year. This ends up being a lot! If you cut back to only drinking twice a week, you would save a massive $1,040 a year, which you could put straight into your savings.

Use these tips to increase your rate of savings, and gain peace of mind.

Go to Accounting Accidentally for 500+ blog posts and 450+ You Tube videos on accounting and personal finance.

Good luck!

Ken Boyd

Author: Cost Accounting for Dummies, Accounting All-In-One for Dummies, The CPA Exam for Dummies and 1,001 Accounting Questions for Dummies

(email) ken@stltest.net

(website and blog) http://www.accountingaccidentally.com/

The post Signs You’re Bad At Saving Money appeared first on Accounting Accidentally.

July 1, 2021

What the Warby Parker Stores Teach Us About Capital Budgeting

Warby Parker, the eyewear company, is “aggressively expanding its bricks-and-mortar footprint and says it is on track to open 35 new stores this year”, according to the Wall Street Journal.

Now, that may seem strange after the pandemic, but the business has noticed a consumer trend. Many shoppers want a hybrid buying experience. Customers look at frames online, and prefer to try on glasses at a physical store location.

Have a question about personal finance or entrepreneurship? Join the Ask Me Anything live chats on Conference Room.

The timing of Warby Parker’s expansion is good, because landlords are offering attractive terms to get tenants after the pandemic.

Evaluating a capital investment

Opening new stores requires a large investment, and the company must assess how long it takes the firm to generate enough incoming cash to recover the cost of the investment. This is a capital budgeting decision, and the business must consider the cash inflows and outflows related to each store location.

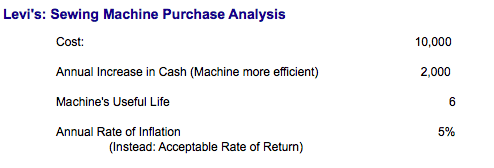

Here’s a simple example: assume that Levi’s, the jean manufacturer, has to buy a new sewing machine for jean production:

Levi’s spends $10,000, and expects the machine to increase productivity. The company will earn $2,000 more per year, due to the increased efficiency in production. Useful life for the machine is six years, and Levi’s assumes 5% as an acceptable rate of return on the investment.

Using new present valueA business wants any investment to generate a positive net present value. This means that present value of the cash inflows and outflows is a positive number. Here is the sewing machine analysis:

This analysis states that $10,000 is paid in year zero, and that the six years of $2,000 annual cash inflows are discounted at 5%- the acceptable rate of return. The net present value (NPV) is $152, which means that the investment makes financial sense.

Note, however, that the NPV is a negative $1,340 after five years. It’s year six that moves the NPV into positive territory.

This type of analysis should be used to review each capital investment.

Go to Accounting Accidentally for 500+ blog posts and 450+ You Tube videos on accounting and finance:

https://www.accountingaccidentally.com/

Good luck!

Ken Boyd

Author: Cost Accounting for Dummies, Accounting All-In-One for Dummies, The CPA Exam for Dummies and 1,001 Accounting Questions for Dummies

The post What the Warby Parker Stores Teach Us About Capital Budgeting appeared first on Accounting Accidentally.

How Online Learning Helps Students Move Forward in the Pandemic

The way people do things has changed drastically during the pandemic. There are a lot of things you may be familiar with that have become different right now. From work to school, people have been forced to adapt and adjust to how things have moved from outside the home to within their homes.

Online learning, to be fair, has been a concept that has turned to reality even before the pandemic. Some people are working that have turned to online schooling to continue their studies. Aspiring students could enroll for online classes in accounting in the same way other courses could be taken through online schooling. The pandemic only reinforced how online learning could eventually become the main schooling people know.

Have a question about personal finance or entrepreneurship? Join the Ask Me Anything live chats on Conference Room.

There are a lot of benefits in taking courses or schooling online beyond the obvious. Take a look at some of these and see for yourself if it’ll work.

You won’t have to travel long distances

Doing online classes helps you save on a lot of things. It also helps you create more time for the things you want to do. It makes you think whether the pandemic lockdown is the stress-reliever you’ve been waiting for all along; you really need to lookout, of course, but the free time is well-deserved.

Following the protocols issued by the authorities, you shouldn’t even leave home, anyway. If you’re already working, with the remote work situation in place, you’ll be able to continue your studies while you finish work at home. You can pursue your graduate education even while you’re staying safe.

In some cases, you can bring your schooling with you. Going to vacation destinations and different places still isn’t allowed, but once it is and you’re still on an online learning arrangement, you’ll be able to visit places.

School-life balance is much easier

Visiting places and having all the free time in the world is a privilege only for those who have a lot of time. The flexible schedule of online learning systems will help you get what you want- the freedom to go anywhere and all the time in the world, even while you’re in school.

You do have to maintain your schedule. However, the freedom to be in so many places at one time doesn’t mean you’ll be skimping on school. While on vacation, or despite the many activities you can do, you also need to complete school work and attend lectures when they occur.

The benefit is that you get more control of your schedule. You only need to create space for whatever you need to do at the moment, and you get to enjoy more flexibility.

You can develop healthy habits

Online learning also helps students devote more time to having a better school-life balance. This means that you can focus on things that promote a healthier lifestyle, or just a generally healthier balance between your school activities and your life events.

Under normal circumstances, you can consider yourself lucky if you have time to squeeze in a workout session before working or going to school. There is simply a lot of time to do that when you’re working from home or learning from home.

You can learn at your own pace

Online learning can also help you catch up if you’re having trouble following your lessons. You also benefit from the Internet providing you with extra resources even while a “classroom” lesson is happening. For example, imagine seeing a way to understand a particularly puzzling theory while class is ongoing- something you can’t do while you’re in a conventional classroom.

When you’re learning at your own pace, that also includes the completion of materials and courses. You don’t have to wait for a long time to finish these-you can choose to finish them at your own pace, either quickly or you can also wait for your classmates.

You can save on school costs

Learning from home is like remote working. You don’t have to go to your school, and you don’t have to spend money to do so. These savings can be used for anything else, but the main thing is you have substantial savings from not commuting.

One thing you can spend your savings on is your school bills. This lessens your chances of having to rely on student loans to learn. The tuition you pay may also be less, depending on which further deductions you have since you’re learning from home.

You save on many things with learning from home, but the main thing is that you keep yourself safe. So get what you can from remote learning and use it to work on the best version of yourself.

Go to Accounting Accidentally for 500+ blog posts and 450+ You Tube videos on accounting and personal finance:

Good luck!

Ken Boyd

Author: Cost Accounting for Dummies, Accounting All-In-One for Dummies, The CPA Exam for Dummies and 1,001 Accounting Questions for Dummies

(email) ken@stltest.net

(website and blog) http://www.accountingaccidentally.com/

The post How Online Learning Helps Students Move Forward in the Pandemic appeared first on Accounting Accidentally.

5 Everyday Practices That Will Help You Better Manage Your Finances

One lesson to learn from the Coronavirus pandemic is the importance of having an emergency fund. The onset of this pandemic saw many people enter into a panic mode after losing their jobs and sources of income.

The cases of depression and hopelessness have since heightened ,as people work towards re-establishing themselves. The truth is those highly affected are people who did not have an emergency fund. It takes great sacrifice and discipline to set aside some money for unknown emergencies.

Have a question about personal finance or entrepreneurship? Join the Ask Me Anything live chats on Conference Room.

Though a bitter pill to swallow, the fruits of financial discipline are peace of mind when you have an emergency. Implementing these five everyday practices can help you stay on top of your finances with ease.

Be a MinimalistAs you can already tell, the challenging economic times going on in the world today are having a significant toll on people’s mental health. Consequently, it’s not yet clear when or if things will ever normalize, so take good care of the finances you can control.

One of the surest ways to do this is to embrace a minimalist lifestyle that entails a careful examination of situations and opting for the least expensive option. A minimalist will, for example, opt for bail bonds instead of wasting their finances paying for cash bonds. Consult with an attorney regarding all legal issues.

A minimalist derives in simplicity, and top priority needs to cut unnecessary costs. This is a must-have trait for anyone wishing to have a healthy financial life.

Get Out of DebtImpossible, you think? The truth is it’s possible to survive without debt, but overcoming a debt situation takes hard work and self-discipline. The first step to staying away from debt entails coming up with a budget and sticking to it. Next, you need to have a clear outline of your income and connect your earnings with your spending.

Establish a plan to guide you on repaying your current debt. Chances are you may wish to postpone this, but kindly resist this urge for your peace of mind. Sleeping on debt is a gateway to poverty and untold sufferings. Besides the interest rates that increase daily, it affects your credit score, making it hard for you to get funding.

Do everything within your power to repay your current debt and avoid new ones.

Have a Long Term Financial GoalSaving for a long term financial goal such as purchasing a house or car will prevent you from misusing your money. These goals will motivate you to work hard and achieve the impossible. Although a viable idea, it’s not always easy to set and follow a long-term financial plan.

Most people are always trying to push this idea to a later date, claiming that the current financial needs do not accommodate it. If you are among this group, change your mindset- there is never a perfect time to start saving for your future.

The lame excuses will only waste your time, leaving you with nothing to show at the end of the day. It would help if you started with the little you have, instead of wasting it on unproductive activities.

Be Careful With Your Credit CardsThough an essential credit builder, your credit card could see you sink into more debt as they tempt you to borrow more than you can afford to pay. Moreover, they increase your chances of missing a payment, affecting your credit score and accrue late fees.

You, therefore, need to practice ultimate care when using your credit cards and always ensure to automate your payments or set monthly reminders to avoid missing out on deadlines. Also, avoid applying for too many credit cards as each application results in a hard inquiry, which negatively affects your credit score.

Track Your SpendingThe secret to achieving healthy financial management is the ability to account for every single dollar. There are many ways of spending money today, increasing the risk of wasting your finances if you are not careful.

There are various ways of tracking your expenditure, such as using apps, for instance, Mint.com, recording on a piece of paper, and using different bank accounts. Whatever option you decide to go with, ensure it answers your money questions and helps locate every single coin.

The goal of tracking your expenditure is to ensure it doesn’t surpass your budget. Therefore be on the lookout and make timely adjustments when your spending gets out of control.

Stay with itYou hold the key to your financial freedom. The truth is it’s not how hard you work in to generate income, but how careful you are in spending it. Stay in control of your finances using the above five tips.

Go to Accounting Accidentally for 500+ blog posts and 450+ You Tube videos on accounting and personal finance:

Good luck!

Ken Boyd

Author: Cost Accounting for Dummies, Accounting All-In-One for Dummies, The CPA Exam for Dummies and 1,001 Accounting Questions for Dummies

(email) ken@stltest.net

(website and blog) http://www.accountingaccidentally.com/

The post 5 Everyday Practices That Will Help You Better Manage Your Finances appeared first on Accounting Accidentally.

June 29, 2021

Innovations that Can Assist Entrepreneurs in Business Finances

Financial management will always be a pivotal part of every business that wants to improve profitability and stability. But with the many duties that entrepreneurs need to attend daily, there may be instances when one would find it hard to keep track of their cash flow. Luckily, with the numerous digital solutions nowadays, handling budgets, sales, and even investments, are already becoming easier.

Makes It Easier to Track Monetary StatementsSecuring enough budget dollars is a must to get one’s operations running. Of course, it would take at least a few months before your venture manages to earn a profit. But before doing so, you should first identify all possible costs for you to have an idea of how much you need to set aside.

Have a question about personal finance or entrepreneurship? Join the Ask Me Anything live chats on Conference Room.

It does not need to be too detailed, since you are still in the early stages, but additional expenses may arise at any moment. Because prices tend to fluctuate, your predictions would not always be accurate, which may somehow affect your overall budget. This is why you may want to consider creating a list that will include fixed and variable costs, as well as one-time purchases so that you will not end up spending more than necessary.

Fortunately, with the help of technology, particularly expense tracker software, recording purchases now becomes possible to achieve in real-time. In that way, you will always be aware of which product or service is causing your company to steer away from its projected expenses.

Digital Gateways Lead to More ConnectionsUpon familiarizing yourself with such a practice, you can look for ways to fund your venture further. However, this is a challenge for most startups because they do not usually have as many connections compared to big corporations. And that in itself is already a factor that some traditional lenders heavily consider, since they would be taking a big risk once they allow you to borrow a certain amount.

But ever since the arrival of technology, it somehow became easier for one to reach out to multiple lenders. For instance, if you are in the real estate industry, you already know that purchasing or investing in properties would be difficult to do if you do not have the monetary means. But with the presence of digital gateways, you may now rely on the services of independent mortgage brokers to provide you with the help and support you need to secure a loan.

Providing More Payment OptionsWhen it comes to handling sales, it may be wise for small business owners to provide more payment options, such as cashless transactions, for their consumers. Of course, this is now a common practice around the world, especially since many individuals opt not to carry their cash whenever they are outdoors.

This will benefit not only consumers but also entrepreneurs like you. For instance, if you need to pay suppliers or employees, digital transfers are already a convenient option, regardless of the location or currency.

Protects Financial and Other Crucial DataHowever, one should not overlook that they would still need to monitor their everyday expenses because, despite the benefits of technological developments, problems can also arise along the way.

For instance, in terms of security, many individuals are becoming more capable of hacking into a company’s system. So you should learn to take steps that would help protect your data because if you are not careful enough, you may end up losing more than what you gained.

Capitalizing on Technological InnovationsLiving in today’s advanced society comes with many privileges, especially for owners in the business industry. Of course, fulfilling daily duties can somehow take a toll on one’s well-being in the long run. But with the various innovations that we now have, managing operations become easier, specifically when it comes to finances.

For starters, if you plan to secure a budget, you know that identifying possible expenses is a must for you to estimate how much your company needs. This is why you canc onsider investing in automation software, since it can allow you to track purchases that you or your employees make.

If you plan to secure more funding as you go along, then you can also turn to the Internet as a gateway to help you build more connections.

As technology continues to advance, so do the abilities of hackers to get into your system. This is why you should take preventive measures to protect your company’s data at all times as well.

Go to Accounting Accidentally for 500+ blog posts and 450+ You Tube videos on accounting and finance:

https://www.accountingaccidentally.com/

Good luck!

Ken

The post Innovations that Can Assist Entrepreneurs in Business Finances appeared first on Accounting Accidentally.

June 28, 2021

How Religious Beliefs Can Affect Your Finances

Religious beliefs may have a huge influence on important life decisions. It’s not uncommon for individuals to reject a job offer from a business that goes against their faith values. Indeed, people need a reference pattern in terms of what is right or wrong.

Emotional engagement, intuition, factual information will play a crucial role in making up your mind. But your faith also drives some choices, both in your personal and professional life.

Have a question about personal finance or entrepreneurship? Join the Ask Me Anything live chats on Conference Room.

As such, it makes sense that beliefs and money should go hand-in-hand. Ultimately, faith is a big part of your life. On the other hand, money management establishes your financial health throughout your life. Consequently, people of faith can find it challenging at times to juggle faith and money.

Yet, there are some helpful solutions to make sure your religious beliefs and your finances are working together rather than against each other.

Belief-friendly investment plans

Investment strategies are challenging at the best of times. Investment plans that respect your religious beliefs can be daunting if you don’t know where to start.

There are, thankfully, plenty of helpful solutions to get you started. For example, the Islamic religion prohibits gambling and trading, which can affect your investment strategies if you are approaching the stock exchange and foreign exchange markets.

However, dedicated broker plans can provide a manageable solution, such as this Islamic Foreign Exchange Brokerage that makes it clear that your investment relies on data and market analysis.

Similar plans are also available for different religious faiths via the National Association of Christian Financial Consultants. The association is dedicated to supporting Christian investors with biblical integrity and services that honor both your finances and your faith.

Planning for your future according to your beliefs

For many people, faith influences major life decisions. This will affect your choices regarding relationships, and also the end of life. Most people don’t realize the importance of planning for future decisions. However, as an individual of faith, planning your funeral, for instance, enables you to decide on the process.

You can ensure things will go according to your wishes, without burdening your grieving relatives with difficult choices. As you plan ahead, you also finance the whole process.

Similarly, weddings can be pre-financed by the family. Some decisions can also be pre-arranged, such as the choice of the church or other religious center, for example.

Considering faith and borrowing

According to a survey, religious individuals are more inclined to save money, as they tend to be more conservative in their financial decisions. When it comes to managing your financial strategy with faith for guidance, it becomes essential to consider the most relevant saving plans.

For Christian families, the Bible acts as a reference for everyday decisions. The Bible also contains content that prohibits the practice of aggressive high-interest rates loans. In practice, families may not be able to avoid a loan, but their religious education can prevent them from making risky decisions, such as payday loans or bad credit loans.

Can your faith provide financial guidelines? Many religious and financially savvy individuals believe that faith and finances can be a match made in heaven.

Go to Accounting Accidentally for 500+ blog posts and 450+ You Tube videos on accounting and personal finance:

Good luck!

Ken Boyd

Author: Cost Accounting for Dummies, Accounting All-In-One for Dummies, The CPA Exam for Dummies and 1,001 Accounting Questions for Dummies

(email) ken@stltest.net

(website and blog) http://www.accountingaccidentally.com/

The post How Religious Beliefs Can Affect Your Finances appeared first on Accounting Accidentally.

June 25, 2021

Business Costs Increasing? Accounting Tools to Maintain Profitability

It’s June of 2021, and business costs are increasing in a number of industries. Manufacturers are paying more for raw materials, computer chips are in short supply, and restaurants are struggling to find enough staff. There are several factors that may hurt your bottom line:

As we come out of the pandemic, consumers are spending money, and business owners want to meet customer demand.Your costs may increase before you can pass along a price increaseIf you operate in a highly competitive environment, you may not be able to increase prices and maintain your market share

But how can you maintain profitability in an environment of rising costs? Here are some accounting tools to make better decisions, and to maintain profitability.

Have a question about personal finance or entrepreneurship? Join the Ask Me Anything live chats on Conference Room.

Start with the breakeven formula

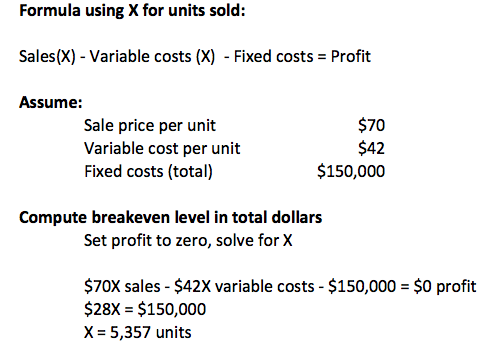

The first rule of thumb is to cover all of your costs, and the breakeven formula is the tool to assess that issue. As you see below, the formula sets profit (net income) to zero and solves for the number of units sold. Keep these points in mind:

Both sale price per unit and variable costs per unit are multiplied by the number of units sold (X)Use total fixed dollars, not fixed dollars per unit. Eventually, all fixed costs are paid for, and you don’t need to assign a per unit amount for fixed costs. Stick with total dollar amountThe formula calculates the number of units sold needed to reach breakeven

The business must sell 5,537 units to breakeven.

With if circumstances change? No problem, you can change the formula.

Changing assumptions in the breakeven formula

If your variable costs increase, you can change variable costs per unit in the formula and run the calculation again. Let’s assume that variable costs increase to $50 per unit. Here’s the new breakeven level:

$70X sales – $50X variable costs – $150,000 = $0 profit

$20X = $150,000

X = 7,500 units

An $8 increase in variable costs ($42 to $50), requires the business to sell 2,143 more units to reach breakeven.

That’s how you should think of cost increases: how many more units do I need to sell, in order to breakeven?

You can change the formula and make assumptions about profits.

Considering target net income

Let’s assume that the owner wants to generate a $50,000 profit, which is referred to as the target net income. Here’s how the formula looks with the profit included:

$70X sales – $50 X variable costs – $150,000 = $50,000 profit

$20X = $200,000

X = 10,000 units

You can perform “what-if” analysis on any factor in the formula, and run the numbers to see where you stand.

If your costs are increasing, how can you maintain profits?

Strategies to maintain profits

To keep your business profitable, you should evaluate your business from both a cost point of view, and a pricing point of view.

Minimizing costs

The rise in inflation and product shortages may lead to price increases, some of which are unavoidable. Here are some ideas to lessen the impact of higher costs:

Find more vendors: Find more reputable vendors who can sell you products. If you have multiple vendors, you may be able to negotiate lower prices.Adjust your spending: Do you really need to buy as much of a particular item as you do now? Can you substitute certain materials or components for a cheaper option?

Don’t forget to think about pricing.

Increasing prices

Over 35 years in business, I’ve noticed that successful companies are more comfortable increasing prices.

If you’re hesitant, think about this way: If your car mechanic, plumber, or grocery store raised prices, would you still buy their products and services? If the answer is yes, it’s because you believe that they offer enough value to justify the increase.

We’re all consumers, and we’re not surprised by price increases- particularly in today’s environment. If you offer value, most of your customers will accept a price increase. Those that don’t aren’t a reliable source of business.

Good luck!

Go to Accounting Accidentally for 500+ blog posts and 450+ You Tube videos on accounting and personal finance:

Ken Boyd

Author: Cost Accounting for Dummies, Accounting All-In-One for Dummies, The CPA Exam for Dummies and 1,001 Accounting Questions for Dummies

(email) ken@stltest.net

The post Business Costs Increasing? Accounting Tools to Maintain Profitability appeared first on Accounting Accidentally.