Kenneth Boyd's Blog, page 26

September 4, 2021

IRS Offer in Compromise: Using a Doubt as to Liability Filing Approach 2021 (Blog post with graphics)

An IRS Offer in Compromise (OIC) is heavily marketed strategy to reduce a tax liability. While many companies promote their expertise, you need a enrolled agent or CPA to guide you through this complex process.

This post explains an overview of the OIC process, why offer are rejected, the three approaches used to justify the offer, and how to use the doubt as to liability approach.

If you’re a tax professional who provides tax resolution services, Lambers provides a 10-course Tax Resolution Series to help professionals sharpen their skills, and find new business. Find out more here.

Just how large is the tax delinquency problem?

An overview of the tax delinquency issues

At the end of fiscal year 2018, there were over 14 million individual tax returns (Form 1040s) with a balance due, totaling $128 billion in tax liabilities (per IRS Delinquent Collection activities reports). During the same period, 2.3 million tax delinquency investigations were conducted.

59,000 Offers in Compromise (OICs) were submitted, with 24,000 accepted (about 40%), collecting over $261 million. Less than 50% of OIC agreements are accepted, and there are several reasons why.

If you’re an enrolled agent, Lambers offers quality continuing education courses, with great customer service and affordable prices. Find out more here.

Reasons why offers are rejectedThe reasons for rejection are driven by the taxpayer’s lack of proper preparation and follow up:

Incomplete applications: If data is incomplete, the IRS may return the data, or set it aside and work on complete applications.Taxpayer not in compliance: Lack of compliance due to tax returns that have not been filed. Note : A current year tax return with a valid extension is considered to be in compliance.Reasons for the OIC programThe OIC program allows the IRS to collect more money in less time, and using fewer staff hours:

IRS can collect some funds from taxpayers who would otherwise never pay (Some taxpayers simply go off the grid)Receive payment from funds that otherwise could not be tapped (family loans, for example)Collect more money than trying to seize and sell taxpayer property, which is time consuming for IRS staffCompliance: Once the OIC is in place, the taxpayer must stay in compliance,The IRS has a limited staff, and is looking to speed up the collection process to collect as much as possible.

Understanding two important tax forms

Many former IRS Revenue Officers work as enrolled agents and assist taxpayers with the OIC process. To start the process, it’s important to distinguish between two forms:

Form 656: This form lists amount of the offer and the terms

Form 433 (OIC) is a form called Collection Information Statement for Wage Earners and Self-Employed Individuals

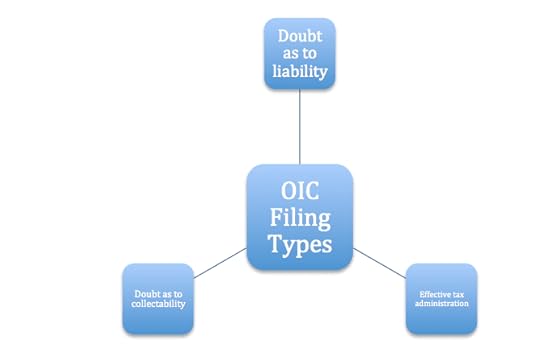

The time intensive part of completing an OIC is providing the financial data in Form 433. The three types of OIC filings are: Doubt as to liability, effective tax administration, and doubt as to collectability.

This post explains doubt as to liability, and the two other OIC filings are explained in other posts.

Doubt as to liability

The IRS Form 656-L is used if taxpayer disputes the amount of the debt. In this scenario, the taxpayer doesn’t believe that they owe the balance due, or that a much smaller balance is owed. Here are the common reasons why:

Audit: Poor representation by a third party who didn’t file proper documentation, or missed deadlines for reconsideration (or both). The taxpayer must prove why original tax assessment was wrong.Innocent or injured spouse: Late or incorrect filingsIdentity theft: It’s not the taxpayer’s tax return. The taxpayer didn’t received refunds generated by a fraudulent return, which used the taxpayer’s Social Security number.Forged return (Typically a spouse): If this occurs, the spouse must file a new return using married filing separately status.

Other requirements

Genuine dispute as to the amount of correct tax debt owed under lawNo final court decision or judgment existsOnly accepted for tax periods in question

Documents that must be included:

Form 2848 Power of Attorney: Giving enrolled agent POA. If two spouses, each needs separate POA signed.Form 656L: Spouses can fill out the form jointly, and the form can be used for personal and business tax returns. Make sure to name the specific tax years in the document.Documentation: Explain in writing why you doubt the amount owed, with supporting documentation

Completing the form

Keep these points in mind as you complete the form:

Offer to pay: State the amount you propose to pay on Form 656LIf payments have been levied: File Form 656L immediately to avoid missing a deadline for attempting to recover payments.Deadline for IRS: IRS must make a decision within 24 months, or offer is accepted automatically. Send the OIC with proof of delivery.Explanation of circumstances: Explain why the IRS amount is not accurate.Third parties: Notify third parties, provide contact info, and give permission allowing IRS to contact third parties to support your position. A common example: A 1099 dollar amount contains an error, and the payor can explain to IRS.

The main reason for an OIC rejection: documentation is missing, or not supplied in a timely manner. So, where do you go from here?

Consult with a tax professional (CPA or enrolled agent) on all tax-related issues. Best of luck.

Ken Boyd

Author: Cost Accounting for Dummies, Accounting All-In-One for Dummies, The CPA Exam for Dummies and 1,001 Accounting Questions for Dummies

(email) ken@stltest.net

(website and blog) http://www.accountingaccidentally.com/

The post IRS Offer in Compromise: Using a Doubt as to Liability Filing Approach 2021 (Blog post with graphics) appeared first on Accounting Accidentally.

August 30, 2021

How to Stay on Top of Your Health Throughout your Life

Many people neglect their health as they grow older and fail to take care of themselves. This is a mistake. You are only one injury away from becoming disabled, which will lead to all sorts of financial problems down the line.

To avoid this fate, focus on improving your health throughout your life. To help you do that, this blog post lists five ways that you can stay on top of your health so that it doesn’t slip through the cracks!

Consider health insuranceHiring health insurance is an excellent way to be financially prepared for your medical needs. If you’re working, the company will likely provide free or subsidized coverage. However, suppose you’re self-employed or unemployed without any financial support. In that case, this could be one of your most significant expenses in life and can potentially cost thousands each year.

Have a question about personal finance or entrepreneurship? Join the Ask Me Anything live chats on Conference Room.

If you don’t have much money at the moment but want to protect yourself from future costs – look into government programs such as Medicaid (for low-income earners) and Medicare (for senior citizens). They may not cover all types of services, though, so make sure to read up on their limitations before signing anything. For instance, Medigap Plan F benefits and coverage is a great place to invest in.

There are many types of health insurance, but perhaps the most significant is private health insurance. It’s worth investing in to ensure you have all your bases covered if something does go wrong with your body (and it will).

Be on the lookout for health warning signs

When it comes to your health, early diagnosis is essential. If you aren’t aware of the symptoms an issue that could affect your long-term well-being – and seek help if they appear – then there’s a chance that you might miss them when they become more severe. And while this isn’t always possible with things like cancer or HIV, for example, most other issues can be dealt with before they get out of control. It all starts by knowing what sort of warning signs to look out for in yourself or those around you:

Physical warning signs can include unexplained weight loss, mysterious rashes or skin discolorations, changes in the color of your urine or stools. You should also be aware of any throat infections that don’t seem to clear up with treatment, swollen glands without an explanation for them (for example, following flu), and persistent headaches.

If you’re suffering from chronic pain at parts like around the neck area, lower back, or near joints, this could indicate arthritis early on. Still, it’s essential not to neglect these sorts of symptoms as they might suggest something else, too.

It is worth remembering that cancer often presents itself through physical complaints that may initially appear benign, such as lumps and unusual swellings anywhere on the body. So if you’re worried about something like this, then it’s best to get checked out by your Internist.

Mental health warning signs are also essential to spot in yourself or others, because many conditions can present themselves through changes of mood, behavior, and thoughts, which we might not associate with being related to our mental well-being.

For example, loss of interest in things that used to be enjoyable (such as hobbies), feeling down for no reason, sleeping too much or too little, having difficulty concentrating, making unusual decisions without thinking them through properly.

Keep in touch with various health specialistsIt is essential to establish a relationship with your primary care physician, dentist, eye doctor, and any other specialists that may be relevant to your specific needs. For example, if you are pregnant or have young children, it would make sense to see more than one pediatrician, so you can feel confident in their recommendations about vaccinations, feeding schedules, and the like.

If there’s something else going on, then talk to both of Doctors, because they could potentially collaborate or work closely with each other when referring patients back-and-forth. You don’t want all of these appointments falling through the cracks just because nobody knows what’s going on! Stay connected by having multiple referrals or a ‘transfer of care’ form that you can fill out to ensure all doctors are kept up-to-date on the patient’s health history.

Buy smart health gadgets.You might have heard already about the new smart appliances that can help you stay healthy. But, you might be asking yourself what they are and how do they work? Well, let me tell you!

Some of these gadgets include an activity tracker, a sleep monitor, or even a personal assistant. By using one of those simple devices throughout your life, the chances are high that you will live longer than ordinary people, and also feel better on top of it all due to their health benefits.

For example, with the activity trackers, you get to know which exercise is suitable for your specific age group because they measure accurately whether or not the practices provide good results in terms of heart rate intensity; well-known brands such as Fitbit would be a great choice to go with.

The sleep monitor is one of those devices that are pretty new on the market and can tell you a lot about your sleeping habits. Knowing how much time you spend in bed every night plus what quality you get from your rest, chances are high that this will help improve them over time. If, in any case, there is something wrong with either your activity tracker or sleep monitor (it would be best if different companies made them), then getting them both at once might not be such a bad idea after all!

Exercise, eat well, and drink enough waterAs mentioned earlier, exercise is a crucial part of staying healthy throughout your life. You don’t have to be the next Olympic athlete to stay fit and live healthily – just aim for 30 minutes a day (or more!) by taking regular walks or doing some other form of physical activity that you enjoy.

If you can’t start with 30 minutes straight away because your body isn’t used to being active, that’s fine – try starting with 20-minute sessions instead and work up from there as time goes on! As long as you’re at least moving around every day, even if only slightly, like going out for short strolls or walking upstairs rather than using an elevator when available, then this will be a step in the right direction.

When it comes to your diet, there are many ways that you can ensure that you’re eating healthy and getting all of the nutrients that your body needs to stay strong (and keep yourself from feeling hungry).

Of course, some changes will be easier than others for different people – so if one idea doesn’t work for you, don’t give up on being healthy altogether! You should take into consideration what foods make you feel best and which ones do not. Although at the same time, everyone’s bodies may react differently (for example, someone might have issues with gluten but not lactose), certain commonalities tend to emerge when observing multiple dietary needs.

Take action nowIn conclusion, staying healthy can be a challenge, especially as you age. Many lifestyle changes need to occur for someone to keep on top of their health and wellness. These include eating right, exercising regularly, and maintaining good hygiene habits. Consult with a Doctor regarding questions or concerns arise concerning your health throughout the aging process.

Go to Accounting Accidentally for 500+ blog posts and 450+ You Tube videos on accounting and personal finance:

Good luck!

Ken Boyd

Author: Cost Accounting for Dummies, Accounting All-In-One for Dummies, The CPA Exam for Dummies and 1,001 Accounting Questions for Dummies

(email) ken@stltest.net

(website and blog) http://www.accountingaccidentally.com/

The post How to Stay on Top of Your Health Throughout your Life appeared first on Accounting Accidentally.

August 24, 2021

Understanding Health Care Jargon – HIPAA

When choosing the right Healthcare insurance understanding the jargon that goes along with the paperwork can be very confusing. A lot of the policies use standardized legal wording that can be difficult for anyone not trained in law to understand.

However, some of these words are vitally important in ensuring we receive the right care and dignity when we are being cared for by healthcare professionals.

What is HIPAA?

HIPAA stands for Health Insurance Portability and Accountability Act. This act protects how companies deal with your personal health information and how they store that information. Any treatment centers, insurance companies and operators working within the Healthcare sector have to comply with these rules. Anybody who deals with you surrounding your Healthcare in a Healthcare setting has to comply with this set of rules.

Have a question about personal finance or entrepreneurship? Join the Ask Me Anything live chats on Conference Room.

Where am I covered by this law?

To be covered by HIPAA laws, you must be within the United States. The laws were created by the Department of Health and Human Services and the Office for Civil Rights. By creating this law, the government has protected your human rights with your protection in mind.

What do HIPAA rules do?

The HIPAA rules require all healthcare settings to have compliant HIPAA policies that are easily accessible for all users to see how their information is stored, shared and protected from fraud. They were developed to streamline and modernize the use of healthcare information and to enable continuity of communication between healthcare settings and insurance companies.

The rules are there to protect your sensitive information from being disclosed and discussed without your consent.

Are there exceptions to the rules?

Like most laws yes there are, but it’s only in extreme cases where safety is at risk that these rules can be breached. These include; cases of domestic violence or assault, any judicial proceedings, cadaveric tissue donation and certain types of compensations.

What are the key points of this law?

Ensuring all electronically stored health information is accounted for and kept confidentially. The law requires companies or businesses that store this type of information to detect and safeguard any threats made to the information. All businesses that have access to this type of information are compliant with these regulatory laws.

Why does my information need so much protection?

HIPAA protects any of your Protected Health Information (PHI) from being shared. You may not mind your health status being shared, however, your PHI is linked to data such as your address, any personal demographic information that can be used to identify you personally.

It may also include phone numbers, your Social Security number, financial information and photographs of you and your illnesses. Your personal information is personal to you, and sharing any of this may lead you to be open to fraud, which is a very scary experience. You can share anything you wish, however companies are not. That is why this legislation is in place.

Are there any risks involved with storing information online?

Unfortunately, there are. With the increase in storing information online comes the increased risk of security and data breaches by third parties.

Consult with an attorney and your Doctor regarding these important issues.

Go to Accounting Accidentally for 500+ blog posts and 450+ You Tube videos on accounting and personal finance.

Good luck!

Ken Boyd

Author: Cost Accounting for Dummies, Accounting All-In-One for Dummies, The CPA Exam for Dummies and 1,001 Accounting Questions for Dummies

(email) ken@stltest.net

(website and blog) http://www.accountingaccidentally.com/

The post Understanding Health Care Jargon – HIPAA appeared first on Accounting Accidentally.

August 23, 2021

Creating Positivity in the Workplace

When the coronavirus pandemic began, business leaders woke up to a whole new world. They had to move their team from physical offices to work from home in a matter of hours. This situation led to questions about workplace culture. It also brought questions about employees’ mental health.

Many employees find it hard to keep a work-life balance while working remotely. They added that they continue working even after working hours have ended. This circumstance led to extreme burnt-out and depression.

As a manager, you can help prevent mental exhaustion for you and your team. Here are some tips to remain emotionally healthy while working at home:

Create a separate workplace area

Managers encourage their teams to establish a separate workplace at home. This arrangement helps people focus on their job. It also allows them to mentally transition from work to home mode.

Have a question about personal finance or entrepreneurship? Join the Ask Me Anything live chats on Conference Room.

This idea also brought about the concept of creating a Zen Garden in your office. In the past, you may have asked a commercial landscaping contractor to construct one for you. It allows your team members to calm down.

Having a separate workplace at home will allow you to step out of work. But if you live in a one-bedroom apartment, you can still establish a dedicated workstation. You have to mentally create one.

Plan for offline breaks

We mentioned creating a mental workstation. To do this, you have to promise to yourself to step away from your laptop. If possible, you should stay away from any gadget.

Instead, you can do yoga. The government has released a report stating the different effects of yoga. Some poses will only take 5 minutes. It is a great way to relieve your stress during your break. Here are some of them:

Child’s Pose – This yoga position allows you to calm down. It eliminates those kinks on your neck and your back as you stretch. But you should avoid this if you have ankle problems or have been diagnosed with high blood pressure. Experts also discourage pregnant women from doing this.Bridge Pose – If you have tried yoga before, you can do advanced yoga techniques such as the bridge pose. Other than improving your spinal flexibility, it relieves stress, insomnia, and anxiety.Downward-Facing Dog – If you are looking for a way to tone your arms and legs, you should try the downward-facing dog pose. It can also relieve back pain. But you are discouraged from doing this if you have carpal tunnel syndrome. You should also avoid this if you are in the late stages of your pregnancy or have high blood pressure.Four-Limbed Staff Pose – This pose is a push-up alternative. It can be a good default position for more advanced poses. It strengthens your arms and tones your abdomen. But you should avoid this if you are pregnant or have a shoulder injury.

Yoga is an excellent alternative to logging into your social media account. It does not only incorporate physical activity into your life. But it can also calm you. Check with a trained yoga instruction before you start doing poses.

Additional Physical Activity

It would be best if you stepped outside of your home unless there is a government-mandated lockdown. If you can do so, you can take a quick stroll around your neighborhood. Doing this will help ease the transition to your personal life. You can even bike.

If you went overtime and have to run straight to the grocer for tonight’s dinner, you can take a 5-minute break. Allow yourself to mentally rest before jumping to your chores. Doing this will calm you. In this 5-minute break, you can stretch or do some yoga poses.

Stick to a Schedule

Can you still remember what it was like before the pandemic hit? You may have missed the ability to log off on time. You can bring that habit to your current work-from-home situation. It would be best if you had the discipline to implement it.

It would be best if you established a schedule. Set yourself to prepare dinner at 5:05 PM sharp. The 5-minute difference gives you a chance to do some stretching and yoga. The short transition period will help you detach yourself from work-related anxiety.

Covid-19 brought the world to its knees. The WHO reported that at least four million people have died because of the disease. But it also pointed out that roughly the same number of vaccine doses have been administered.

The last number should give us hope. We should bring such positive news to our workplace. We should see how lucky we are to be alive. That positive outlook will help us go on and fight another day.

Go to Accounting Accidentally for 400+ blog posts and 450+ You Tube videos on accounting and personal finance:

Good luck!

Ken Boyd

Author: Cost Accounting for Dummies, Accounting All-In-One for Dummies, The CPA Exam for Dummies and 1,001 Accounting Questions for Dummies

(email) ken@stltest.net

(website and blog) http://www.accountingaccidentally.com/

The post Creating Positivity in the Workplace appeared first on Accounting Accidentally.

August 19, 2021

Take These Steps To Instantly Make More In Your Business Model

As a business owner, you are always going to have numerous goals. It’s important to make sure that you are approaching these the right way. You need to make sure that you understand how to earn more money in your business model. These are the key suggestions that we recommend.

Use The Right Equipment

First, you should think about investing in the right equipment in your company. The best equipment will mean that you will have no issues in achieving a high level of productivity and efficiency. This is going to be more important in certain business models compared to others. For instance, if you are growing plants for commercial purposes then you should be using equipment like nextlight. This will ensure that your plants always have the right, equal amount of light that they need.

Have a question about personal finance or entrepreneurship? Join the Ask Me Anything live chats on Conference Room.

Employ The Key Team Members

Next, you should think about hiring the right team members. The best team members will guarantee that you are making more money, because they will ensure that your business is more productive overall.

The best employees will achieve a higher level of efficiency and be able to handle more roles without the need to be micromanaged. In essence, they will offer the ideal support for your company. Finding the right team members will involve numerous steps. For instance, you need to make sure that you send out the right ad for your business. That’s step one. The next step will be thinking about exploring social media for the best candidates. You might want to hire a social media manager to complete this process for you.

Use An Accounting Solution

You might also want to consider using the right accounting solution. The best accounting service will help you find money that you didn’t know was available. This usually comes in the form of saving in key areas of your company. For instance, a skilled accountant might discover that you are paying more than you should in taxes.

Or, it’s possible that you are struggling to keep your marketing budget under control. You should spend about 20% of your budget on marketing. Anything over this is always going to put a significant strain on your finances.

Think About Going Green

Finally, you might want to consider going green in your business. Going green is a great way to save a lot of money in your business model and this is going to instantly help increase your company profits. There are lots of ways that you can go green.

Since we mentioned equipment, you might want to think about investing in eco-friendly equipment for your company. This works whether you are running an industrial business or an office. There are plenty of laptops and computers that use far less energy compared to others.

We hope this helps you understand everything that you need to know to ensure that you are making more money in your business model. If you take the right steps, then you will quickly reach the higher level of profitability that you hoped for.

Go to Accounting Accidentally for 500+ blog posts and 450+ You Tube videos on accounting and personal finance:

Good luck!

Ken Boyd

Author: Cost Accounting for Dummies, Accounting All-In-One for Dummies, The CPA Exam for Dummies and 1,001 Accounting Questions for Dummies

(email) ken@stltest.net

(website and blog) http://www.accountingaccidentally.com/

The post Take These Steps To Instantly Make More In Your Business Model appeared first on Accounting Accidentally.

July 31, 2021

Online Education Programs for Kids in Elementary: Why It’s a Good Thing

The pandemic of 2020 was, suffice to say, one of the most destructive natural calamities the world has faced in some time. Almost overnight, entire countries were shuttered, millions sheltered at home, and entire industries went bankrupt. The economic impact is devastating, but it doesn’t hold a candle to its harsh impact on people.

And yet, life goes on: as vaccine rollouts across the world start improving, the world is starting to breathe a sigh of relief (albeit with a face mask on!). Yes, some parts of our life are going back to pre-pandemic notions of normal, but there are some aspects of our culture that have been so drastically changed that there is no “going back.”

Have a question about personal finance or entrepreneurship? Join the Ask Me Anything live chats on Conference Room.

During the height of the pandemic, a vast majority of industries, from entertainment and food to tech and, yes, education, moved their operations online. The education sector specifically had to adjust, because while businesses may come and go, education needs to stay constant.

With the worst of the pandemic finally behind us, many schools are sticking to their online structure a little while longer, with some schools around the world offering full time online schooling for kids. But is it really that much better than the “traditional” system?

Online elementary education programs in the Philippines, arguably one of the most advanced in Asia in terms of online capabilities, are a good case study for the efficacy of online schooling.

Here’s what experts have found:

Self-pacing is Beneficial for Most Kids

Self-pacing is an educational concept wherein students are encouraged to learn lessons at their own pace. Yes, homework and deadlines and exams are still part of self-pacing, but students are just given more freedom to learn the lesson in a way that is most effective for them. In online education programs, students are allowed to self-pace because of the nature of their schooling.

In a traditional set-up, wherein students are in school from 8am to around 3pm, students have to follow a rigid schedule of back-to-back classes, with only 2-3 breaks in between. Extra-curriculars also have to be planned out to account for schoolwork and for the commute home.

With online classes, however, student schedules become more fluid, allowing children a lot of freedom to decide what their schedule is going to be like. In essence, online education programs encourage children to learn proper time management, an essential tool they’ll be using throughout their lives.

By teaching proper time management, online education programs also teach children how to be responsible and confident. Time management requires identifying which tasks require immediate attention and prioritizing them above everything else. By allowing elementary children to decide their schedules, online education program also teaches them how to be confident about their decision-making skills.

Online Courses Encourage Kids to Slow Down

As mentioned, traditional school schedules will usually have elementary school children start at 8am, with classes going all the way to around 3pm, with a morning break, a lunch break, and an optional afternoon break before their last class. After classes are done, students are also encouraged to participate in extra-curricular activities like sports, hobby clubs, student government, or artistic endeavors.

It’s no surprise, then, that many elementary school children are already feeling undue pressure from their school schedules. In between the pressure to succeed in their academics, children are also pressured to excel in their extra-curriculars. By the end of the day, many elementary school children are so exhausted that they have barely have any time for themselves. In fact, the average elementary school child spends a minimum of seven and a half hours per week to accomplish homework.

Online education programs, however, allows elementary children to slow down, manage their schedules better, and give themselves time to accomplish all of their necessary tasks while giving themselves ample time for self-growth. Because many of these children are staying at home, they’ve had to get creative with their extra-curriculars, further strengthening their curiosity, their time management skills, and building up their confidence.

Easing Expectations but Maintaining Standards

At the end of the day, online education programs work just as well as traditional schooling, if not better in some cases. In fact, because teachers are now more sensitive to the mental health of their students because of pandemic fatigue, elementary school children are now under less pressure because their workloads are distributed more evenly, and because they are taught to be better with their time management skills.

Online education programs, especially for elementary school children, is a positive step towards a safer, more modern educational system that encourages personal growth in our kids.

Ken Boyd

Author: Cost Accounting for Dummies, Accounting All-In-One for Dummies, The CPA Exam for Dummies and 1,001 Accounting Questions for Dummies

(amazon author page) amazon.com/author/kenboyd

(email) ken@stltest.net

(website and blog) http://www.accountingaccidentally.com/

The post Online Education Programs for Kids in Elementary: Why It’s a Good Thing appeared first on Accounting Accidentally.

July 29, 2021

Managing Your Business Finances Is Likely Harder Than You Think

When it comes to your business finances, managing them is likely a lot harder than you think. When you first start out, there are very few things that need to be done at any given time by you alone, which is why you have time to go through the business finances.

However, as your business grows, this is going to get tricker and tricker, eventually coming to a point where you don’t know what’s going on and half the time things are slipping through the cracks. This is the last thing that you want, which is why we have written this article. Read on to find out more.

Have a question about personal finance or entrepreneurship? Join the Ask Me Anything live chats on Conference Room.

All The Different Elements

One of the reasons that managing your business finances is so difficult is because of all the different elements. You need to be able to keep up with everything that is going on, which ends up being a lot of numbers.

Even if you’re good with numbers, if you don’t have the right kind of training, this can still get extremely complicated for you. Try to keep in mind that business finances are not the only thing you are doing, so it’s really easy to get stressed and just rush through something that shouldn’t be rushed, simply because you have other things to do.

If you find yourself struggling to manage all of the different elements, you are not alone. Just do your best until you can bring someone onto the team to help with this.

Consistently Updating The Budget

You are also going to need to be updating your budget constantly. Setting a business budget can be a long process to begin with, but consistently having to review it and amend it to fit the current financial situation of your business can be a hefty task.

You could be there for hours reviewing the budget, then amending it, and doing this every couple of weeks is going to be a killer for you. And yet, it has to be done in order to keep your business on the right track.

If you don’t update your budget for your business, you are going to be working with the wrong numbers, which could end up putting you into debt if you are not careful.

If In Doubt, Outsource

Finally, if you are ever in doubt about your ability to do this task, then outsource it to someone who can. Hiring a company that has experience to take care of all of this seems like the best option. They will be able to work out everything for you, from whether you are overspending on insurance policies such as general liability business insurance or if there are areas of your business that are suffering due to lack of funding.

We hope that you have found this article helpful, and now see some of the things that you are going to find out when trying to manage your business finances.

It’s not an easy thing to do, and most people don’t do it themselves for this exact reason. They have got enough on their plate without adding this to it! It’s entirely up to you how you want to manage your business finances, but you need to always do what is best for the business. We wish you luck, and hope that this has helped.

Go to Accounting Accidentally for 500+ blog posts and 450+ You Tube videos on accounting and personal finance:

Good luck!

Ken Boyd

Author: Cost Accounting for Dummies, Accounting All-In-One for Dummies, The CPA Exam for Dummies and 1,001 Accounting Questions for Dummies

(email) ken@stltest.net

(website and blog) http://www.accountingaccidentally.com/

The post Managing Your Business Finances Is Likely Harder Than You Think appeared first on Accounting Accidentally.

Struggling To Stay Within Your Business Budget? Use These Tips To Save Money

Setting a business budget is essential if you want to make as much profit as possible. If you allow yourself to spend aimlessly, then you will likely not maximize your potential profit. A budget helps you stay within your means and make better financial decisions.

If you are struggling to stick to your business budget and find yourself making poor financial decisions, here are some tip improve your results.

Have a question about personal finance or entrepreneurship? Join the Ask Me Anything live chats on Conference Room.

Set up online transactions

You can send money to the UK or any country of choice with online transactions for free. Instead of spending extra on transactions by sending checks in the mail or through fax, you can set up fast and free transactions online. This will speed up your business processes and help you save money.

Track your spending

Tracking your spending every day is a good practice that will help you better manage your finances. It will help you see where you are spending too much money and help you make better financial decisions.

Tracking every day might seem like hard work. But, it will make financial management much easier over time. You won’t suddenly get to the end of the month and have to trawl through your transactions. Instead, you can make a note of your inflows and outflows each day and never have to worry about building up your finances. You will be able to closely monitor your money and not forget about small purchases that could be hindering your profits.

Set up a strict budget

To keep on top of your business expenses and make better decisions, it is important to set a strict budget. Being strict will be challenging, yet beneficial, for the profit of your business.

If you find yourself going over budget each month, then reduce your budget even further. This will help you realize how much money you can save and stop making unnecessary purchases.

Reduce costs of the business

You will likely spend the majority of your budget on bills. You need to pay to rent a space, pay for energy bills, and pay your employees.

If possible, you should reduce the cost of your business expenses. You could negotiate prices with the landlord and energy providers. If you offer them a long-term deal, then they will likely offer you a discount.

Furthermore, if you can cut costs by cutting staff, then do so. Although it can be hard letting staff go, it will be the right idea for your business. You might be paying for someone to complete your financial management each month. However, after mastering these tips you might be able to do it yourself. If you can cut one member of staff, it will save you a lot of money.

Create contests for employees to save money

A great challenge for employees is setting them a task to save the most money each month. Whoever saves the most money can be rewarded for it. The reward should cost less than the money saved, otherwise, you will be defeating the purpose of the challenge.

This will instill good practice into your staff. Plus, with each member of staff fighting for first place, they will all be saving money, which will maximize your profits.

Increase the cost of your goods and services

You might have been struggling to maximize your profits due to charging too little for your goods and services. You should look around at competitors and see what they are charging. If they charge more, then you should. Firstly, you want to stay in the competition and not be taken advantage of. Secondly, you can increase your prices and attain more profit.

You won’t lose customers by increasing the cost of goods, if the price is in line with similar businesses. YTo keep your customers loyal and engaged, offer them discounts from time to time, so that the increased prices don’t feel like a hard hit.

Make adjustments when necessary

When you track your spending, you will be able to see where you should make adjustments to save money. For instance, may realize that you are overspending on your marketing strategies. You might see that you are spending double what you need to host your website. When you realize your errors, you can make the necessary adjustments.

Ensure to keep close tabs on monitoring your money so that you can make adjustments as soon as possible. This will ensure that you save money as often as possible, which will help you stay within budget and maximize profits.

Go to Accounting Accidentally for 500+ blog posts and 450+ You Tube videos on accounting and personal finance:

Good luck!

Ken Boyd

Author: Cost Accounting for Dummies, Accounting All-In-One for Dummies, The CPA Exam for Dummies and 1,001 Accounting Questions for Dummies

(email) ken@stltest.net

(website and blog) http://www.accountingaccidentally.com/

The post Struggling To Stay Within Your Business Budget? Use These Tips To Save Money appeared first on Accounting Accidentally.

July 28, 2021

What a Red-Hot Stock Market Teaches Us About Shareholder Returns

It’s the summer of 2021, and the market is on a tear. As of 7/27/21, the Standard and Poor’s 500 Index (a basket of 500 large company stocks) is near a record high- up nearly 36% in the last 12 months.

So, if you’re an investor, how much are you earning on your stock investments? After all, you’re investing to save for a house, or to plan for retirement. Is your investment earning a reasonable rate of return?

Have a question about personal finance or entrepreneurship? Join the Ask Me Anything live chats on Conference Room.

Generally speaking, there are three ways to earn a return on a stock.

Price appreciation: You profit from selling the stock for more than the costCash dividend: The company pays you a cash dividend, which is a share of company earningsStock dividend: You receive a dividend in the form of additional stock, and you can benefit from price appreciation and/or a cash dividend on the new shares

The biggest driver of a stock’s value is the earnings per share (EPS).

Understanding earnings per share (EPS)

Earnings per share is defined as (Net income available to common stock) / (average shares of common stock outstanding). In other words, how much did the company earn on each share of common stock?

Not all of company net income may be available for common shareholders. Firms that issue preferred stock may set aside net income to pay a preferred dividend before a common stock dividend (hence the term “preferred” stock).

Let’s assume that Premier Manufacturing earns $5,000,000 and that the average number of common stock shares outstanding is 2,000,000 shares. EPS is ($5,000,000 / 2,000,000 shares), or $2.50 per share.

So, is $2.50 a good, bad, or average return?

The answer is found in the earnings yield:

Earnings yield = (Earnings per share) / (Market price of common stock per share)

If Premier’s common stock price is $60 per share, the earnings yield is:

($2.50 Earnings per share) / ($60 Market price), or 4.2% (with rounding).

Here’s the challenge of investing when markets are near an all-time high: When the price you pay for a stock is higher, the earnings yield is lower. Essentially, you’re paying a higher amount of each dollar of earnings.

If there are more common stock shares outstanding, the earnings per share will be lower.

How dilutive securities impact EPS

Dilutive securities increase the number of common stock shares outstanding. Here are two common examples:

Convertible bonds: Bonds that allow the owner to convert the bond into shares of common stockStock options: A security that allows the holder to purchase shares of common stock at a specific price

If Premier has dilutive securities outstanding, investors will want to know the dilutive earnings per share. Using dilutive EPS, every share that can be converted into common stock IS converted. It’s a “worst case scenario” for EPS.

There are several ways to measure the value of a stock dividend.

Measuring the value of a stock dividend

Dividend yield reports the rate of return on a dividend, based on the current market price of the stock:

Dividend yield = (Annual dividend per share) / (Market price of common stock per share)

In this example, Premier pays a $1.25 dividend when the stock price is $60 per share. The dividend yield is ($1.25 annual dividend) / ($60 market price), or 2.1% (with rounding). Think about it this way: If an investor purchases Premier at $60 per share, they are “buying” a 2.1% dividend return.

Finally, the dividend payout ratio points out the percentage of company earnings paid as a dividend:

Dividend payout ratio = (Common stock dividend) / (Earnings available to common shareholder)

Premier’s dividend payout ratio is ($1.25 dividend) / (2.50 EPS), or 50%.

To compute the shareholder return on a stock:

(Increase in common stock price + Annual dividend per share) / (beginning common stock price).

Compare all of these calculations to historical trends, and to industry averages.

Good luck!

Ken Boyd

Author: Cost Accounting for Dummies, Accounting All-In-One for Dummies, The CPA Exam for Dummies and 1,001 Accounting Questions for Dummies

(email) ken@stltest.net

(website and blog) http://www.accountingaccidentally.com/

(you tube channel) https://www.youtube.com/user/kenboydstl

The post What a Red-Hot Stock Market Teaches Us About Shareholder Returns appeared first on Accounting Accidentally.

July 23, 2021

What Inflation Concerns Teach Us About Business Operating Cycle

It’s the summer of 2021, and prices on many goods and services are increasing. Businesses are paying more for raw materials, and qualified workers hard to find. It’s getting more expensive to produce products and services, and firms are under pressure to increase prices.

Two questions may keep business owners up at night:

Can I produce a product or service and still earn a profit at current prices?Will I generate enough cash inflows to pay the higher prices for materials and labor?

Inflation is defined as the overall increase in prices over time, and inflation has an impact on each component of the operating cycle. As the name implies, the operating cycle defines how quickly you can make a product (or purchase inventory), sell the product, and collect cash.

Let’s walk though each component of the operating cycle, so you can use this metric to make informed business decisions.

Have a question about personal finance or entrepreneurship? Join the Ask Me Anything live chats on Conference Room.

Using the turnover ratios

Collecting cash faster is the name of the game, and the turnover ratios measure how quickly you collect cash. For many businesses, the biggest uses of cash are accounts receivable and inventory:

Accounts receivable: When you sell goods on credit, you don’t recoup the cost of your product until the customers pays for the purchaseInventory: In a similar way, you don’t recoup the cost of inventory until the customer invoice is paid

Accounts Receivable Turnover Ratio = (Credit sales) / (Average gross accounts receivable)

“Average” refers to the average balance in a month or year. Let’s assume annual credit sales of $1,200,000, and average gross accounts receivable of $350,000 for the year.

($1,200,000 Credit sales) / ($350,000 Average gross accounts receivable) = 3.43

On average, the company sells the entire accounts receivable balance about 3.4 times per year. You want to increase sales and reduce accounts receivable, so that the turnover rate is higher, and you collect cash faster.

If you can’t raise prices and costs are increasing, you need to collect accounts receivable balances even faster- in order to finance operations.

Inventory turnover views cash collections from the cost of sales side of things. Here is the formula:

Inventory Turnover = (Cost of goods sold) / (Average inventory)

Assume that the turnover ratio looks like this:

($900,000 Cost of goods sold) / ($125,000 Average inventory) = 7.2

The company sells the entire inventory balance about seven times per year.

Whether these turnover ratios are good or bad depends on your industry, and you should compare your performance to industry averages.

Inflation forces up the cost of inventory, which leads to a higher cost of goods sold balance. If you can’t raise prices, you’ll make a smaller profit.

Working with the days sales ratios

It’s helpful to assess your business by measuring days. Again, getting financial results faster is better in this context.

Day sales in inventory = (365) / (Inventory turnover)

This ratio converts inventory turnover (how often do you sell your entire inventory balance in a year) into a number of days. Here’s the days sales total:

(365) / (7.2 Inventory turnover) = 50.69

It takes about 51 days to completely sell the inventory balance.

Day sales outstanding in receivables = (365) / (Accounts receivable turnover)

Ok- similar formula for account receivable. The days sales total is below:

(365) / (Accounts receivable turnover) = 106.46

To collect the average accounts receivable balance, the company needs about 106 days.

Putting it all together: the operating cycle

So how long does it take you to sell inventory and collect accounts receivable? That’s the operating cycle:

Operating cycle = (50.69 Day sales in inventory) + (106.46 Day sales outstanding in receivables) = 157.15

You need 157 days, on average, to sell all of your inventory once, and collect the accounts receivable balances once. Is that good or bad? It depends on your industry.

Inflation can reduce your profits and create a cash squeeze in your business. Use the operating cycle formulas to improve your business.

Universal CPA Review is giving away a free individual course (AUD, BEC, FAR, or REG) to one candidate. To be eligible for the giveaway, just fill out this short 5 question survey and start a free 14-day trial! If you have already started a trial, just fill out the survey to be eligible to win.

Fill out this survey by July 31st at 11:59pm (EST) to be eligible! Feel free to share the link with other candidates that may be interested.

Good luck!

Ken Boyd

Author: Cost Accounting for Dummies, Accounting All-In-One for Dummies, The CPA Exam for Dummies and 1,001 Accounting Questions for Dummies

(email) ken@stltest.net

(website and blog) http://www.accountingaccidentally.com/

(YouTube) kenboydstl

The post What Inflation Concerns Teach Us About Business Operating Cycle appeared first on Accounting Accidentally.