Kenneth Boyd's Blog, page 25

October 7, 2021

What Is the Significance of Accounting in Your Business?

Accounting has been an aspect of every business since the earliest times. It is a crucial business function, since it helps you to examine your company’s revenue and expenditure. The significance of accounting, however, differs from one business to another. Accounting is often overlooked by small business owners, putting everything at risk.

Lack of records eventually results in extra tax payments, making tax adjustments, deals falling through, incorrect audits, and other problems. When your financial records fail to speak for you, your business will collapse. Hence, if your account management is poor, it’s high time you start taking appropriate measures. Learn more about why accounting is crucial in the sections that follow.

Consult with a CPA regarding all tax and accounting issues.

Seasonal Preparations

When you are doing the everyday operation of your business, perspective might be difficult to acquire. It might be challenging to see the company’s big picture when you are busy with sales or working late to meet a deadline. This is where accounting plays its part. It allows you to assess whether your company is moving on the right track, depending on the trends or not.

Join Conference Room: An accounting and personal finance community. Video, blog posts, live chats.

For example, there are seasonal businesses that make profits only during seasons, such as HVAC. Companies dealing in HVAC make a profit during summer by selling air conditioners and make a profit during winter by selling heaters. While rest of the year, their business slows down. Similarly, if someone took the lawn-maintenance franchise opportunity, they are likely to profit during the fall and spring for fertilization and cleaning reasons.

When there’s such fluctuation in sales and profits in the same year, it becomes difficult to track the finance. It’s when accounting helps them to take measures and prepare ahead of the sluggish business. It offers an accurate picture of the revenue in the coming months through which managing cash flows become feasible.

Keeping Your Business Organized

Several groups are interested in an organization’s financial records, including investors, lenders, and employees. Specific organizations- such as non-profits- benefit from being as open about their finances as possible. Moreover, if the records are disorganized, stakeholders find it difficult to trust the company, and business reputation may be harmed. An accounting system organizes every complicated financial document, making it easier to access and distribute to appropriate parties.

Staying Within the Law

Having sound accounting systems and practices in place might help your company stay lawful. The accountants’ primary role is to follow up with the company’s legal procedures, taxation, and financial affairs. Hence, good accounting practice helps your business avoid specific penalties and tax payments.

Consult with an attorney on all legal issues.

Decision-making

Accounting gives information regarding the business’s financial position, such as liabilities and assets, profits and losses, cost and earning, etc. Competent financial data helps make decisions such as recruiting new staff, making charitable donations, purchases, etc.

Preparing You for Tax

Businesses have to file their taxes at the end of the tax year, no matter how inconvenient. With an accounting system, you will have the financial information ready for the tax season. It will be helpful if HMRC requests a financial statement from your company for tax purposes. You will be able to predict the conclusion more precisely if you keep detailed balance sheets over time.

Avoiding Audits

An audit is something no company wants to go through. Poor management invites the kinds of errors that draw the attention of the authorities. These mistakes include disorganization of a tax return, claiming too many costs, reporting too many charitable gifts, etc. A sound accounting system helps you avoid errors and reduces the chances of an audit, which can significantly help small business owners.

Budgeting

Budgeting in a business is essential for the company to grow. Business owners need accountants who can assist them in the preparation of the overall plan. This includes evaluating the cost of services and the types of company operations earning the most profits. Hence, budgeting helps in creating a company’s financial roadmap.

Ensuring No Overdue or Late Payments

An efficient accounting system makes the job of the business owner easier. It helps in keeping track of costs, invoicing, payroll, and the total budget. There are also numerous apps and software available that help to streamline the process for busy firms. Such applications and websites ensure that no errors are made while saving you a significant amount of time.

With a simple click, they may even send payment reminders or late notices to clients. A good accounting process in action hence makes the owner’s life easier. It allows for easy financial tracking and access besides avoiding any penalties. It also helps ensure there’s no outstanding payment or receipt. This, in turn, significantly increases business profits as no invoices are lost or missed.

Go to Accounting Accidentally for 500+ blog posts and 450+ You Tube videos on accounting and finance.

Good luck!

Ken Boyd

The post What Is the Significance of Accounting in Your Business? appeared first on Accounting Accidentally.

Diversifying Your Business: The Ultimate Guide

Diversifying your business is not always an easy thing to do. First, you need to make sure that you’re diversifying in the right way, and when you are ready to move forward with the process, you must have a plan in place. This guide will help you decide if diversification is for your business or not, what type of company needs it most, how to go about testing whether it’s worth it for your firm, and much more.

What Is Diversification?Diversification refers to the process of adding new products or services to a company’s portfolio. In other words, it is the expansion into different areas or industries for a business to create more opportunities and become less dependent on its original product(s).

Join the accounting, personal finance, and entrepreneurship community on Conference Room.

You can do this by creating a new product or service, acquiring another company in an unrelated field, entering a unique market/geography with the same business model.

What Does a Business Need To Diversify?A business needs to diversify to avoid stagnation and losing touch with customers. It is where the company needs to shift what they are offering within their market to keep growing and not become stagnant.

Some of the things that a business can diversify are:

Products or Services offeredMarket Segments targetedBusiness Model usedGeography targetedShould You Diversify Your Business?The answer to this question will depend on your industry, business model, or consumers. For some businesses diversifying can be an absolute must for them to stay afloat, while others may not need to do it if they still see profitable growth from their current products offered.

A professional should always analyze this question because there’s no “one size fits all” way of doing things when it comes down to running a successful business. It means you have to make sure whatever decision you make aligns with what ideals your company stands behind and its overall mission statement in the future.

Tests of Diversification ValueThis is a great question to ask because there are many ways you can go about doing this. For example, you could start by first looking at your company’s current growth rate and then analyze how much potential revenue or profits the business will be able to gain from diversifying its products/services offered.

In turn, it may lead to helping save money, increase efficiency, and create new competitive advantages down the road.

The best way is to go back over records and find out exactly why customers stopped buying anything after seeing specific items become available within your lineup of products/services. This will help you save money by being able to avoid unproductive production and operations.

One test is when sales numbers decrease significantly after you introduce a new product or service. It’s probably best not to continue down this path with them unless there are some particular reasons why profits have gone down, which you can’t address otherwise.

Another test of diversification value is to check how much revenue will come in from a new product/service and compare it with the costs associated with producing something brand new. If this number isn’t very high, you should probably stick with what works best for your company instead of branching out into different areas. It may not pay off at all once you finally introduce it due to a lack of interest from consumers worldwide.

Drawbacks of Diversifying Your BusinessThe drawbacks of diversifying your business strategy can be frustrating for some to deal with, but it’s a necessary evil to succeed in moving forward.

One drawback is that you could be wasting time and resources investing in the product/service that may fail to succeed. In addition, it can sometimes lead to having your employees working very hard just for nothing in return from consumers once they finally start using it.

This test of diversification value should include how much revenue would come in from different products/services and who specifically within their target audience these items will appeal to more than anything else before deciding on moving forward with them at all.

In addition, it means you’ll need to do research and studies on how customers reacted when you introduced this new item years ago because it could mean there isn’t anyone interested present until you make changes to the item.

Another drawback is that it’s easy for your business to lose its identity, which means consumers could start thinking of them as just another company selling too many different things all at once instead of something unique and one of a kind.

Finally, you risk letting competitors take advantage of any available opportunities or resources within your industry by focusing on diversifying even though they may have already established themselves years ago with one item within each category.

It means, if they were the first ones to introduce this type of product/service, then you could potentially lose money due to them having more experience with it than your company does. It is why every business owner needs to stay up to date on current trends and what consumers want most to beat out their competition without a problem whenever possible.

Have a Plan for DiversificationThere must be an obvious goal and a plan for diversification to have any chance of success within your business. It means you need to know the purpose and how this will benefit them moving forward before taking action.

Businesses can set a specific goal with regards to achieving their overall aim by utilizing a SWOT analysis that involves gathering research from inside and outside sources about everything related to your business, so it’s easier for everyone involved when figuring out where they want things headed next.

It also helps establish an understanding between co-workers since employees may think one thing should happen while others believe something else entirely instead. But if everyone shares the same vision behind what you need or don’t need to do, it’ll lead to a better chance of achieving goals instead.

Secure FundingYou should secure funding for diversification even though it may take some time to get approved. You’ll need to investigate every opportunity that is available before making any decision whatsoever.

It can include borrowing money from family members or friends or connecting with money ASAP to get a loan, just in case there isn’t enough cash within your business account. Be sure to work on your funding early enough to avoid halting operations midway through your project.

Learn About the Market and CompetitorsOne of the best ways to understand what is and isn’t going to work correctly when diversifying your business involves learning about the market and all possible competition that you may have.

Focus on the New ProductsOnce you’ve learned about the market and any competition lurking around, it’s time to focus on bringing new products or services into your business which should automatically lead towards diversification since this needs to happen for everything else to fall into place. In addition, if certain things aren’t working, they need to either improve until they do work properly or eliminate them, so there isn’t any wasted money.

Get Diversification AdviceAnother thing that you may want to consider before beginning is getting advice from individuals who have experience with diversification within their businesses. If there are people who can help give pointers whenever they’re needed, then go out of your way to make sure these things happen immediately since it’ll lead towards a better chance of achieving success when everyone involved knows what they need to do.

Monitor ProgressThe last step involves closely monitoring every aspect of diversity throughout all levels of your company. It’s great to set up a system that makes sense for everyone involved to avoid any mishaps along the way.

Innovate and AdaptYou’ll need to keep an eye out for new opportunities and put extra effort into improving upon everything else. These things could lead towards uncovering even more prospects. You must be willing to innovate and adapt to get ahead of everyone else involved.

Rely on the InternetAnother thing about innovation is that people from all walks of life now prefer turning towards technology due to how fast it moves. So companies need to sit up and take notice whenever something new comes into play because chances are, they’re going after your market share whether you like it or not.

It consists of internet business which means, if you’re not already in the loop, then it’s time to hop on board and put your personal touch into the mix because chances are, someone out there will be doing something similar. However, you can still be ahead by offering a personalized view of what’s available when everything else looks like.

Food for ThoughtIn short, diversification isn’t just about taking over another market. But more so about looking out for all avenues while remaining open during every step along the way while trying something completely different from before, perhaps even if only by a little bit at first until bigger things can come later on down the line.

Go to Accounting Accidentally for 500+ blog posts and 450+ You Tube videos on accounting and personal finance:

Good luck!

Ken Boyd

Author: Cost Accounting for Dummies, Accounting All-In-One for Dummies, The CPA Exam for Dummies and 1,001 Accounting Questions for Dummies

(email) ken@stltest.net

(website and blog) http://www.accountingaccidentally.com/

The post Diversifying Your Business: The Ultimate Guide appeared first on Accounting Accidentally.

October 6, 2021

Honing Your Employees’ Abilities: Increasing Workplace Productivity

Employees are the backbone of any business. Without employees, many companies have a hard time meeting deadlines and producing quality results. This has a significant impact on the company’s revenue margins. This is one of the main reasons many organizations emphasize skilled labor as a requirement for many positions.

However, honing the skills of employees is easier said than done. There are many factors that trainers and managers need to consider. For instance, an employee doing payroll requires specialized training for workers working in other departments, such as marketing. That said, honing the skills of your workforce takes some time and energy.

Join Conference Room: An accounting, personal finance, and entrepreneur community. Video, blog posts, live chat.

So what are some essential strategies that can help hone your workforce’s skills? What can you do to help get your business up to speed with a highly motivated and skilled workforce? Here are some tried and tested means of honing your workforce’s skills.

Steering in the Right Direction

Steering your business in the right direction is key to team cohesion and streamlining business operations. Although organizations are comprised of individuals who have their way of doing tasks, a company should have a direction that they are striving for. If everyone has their approach, this can waste both time and energy.

So what’s one way of ensuring that your organization is geared towards a single long-term vision in mind? Training employees to become leaders and supervisors steers the organization in the right direction. Fortunately, you won’t have to look far since training programs for leadership skills can help aspiring employees catapult their way to becoming leaders and achieving success.

Letting People Do Their Job

Another way to ensure that workers can hone their abilities is by building a sense of trust. Many managers and supervisors have a hard time trusting their team, since they want to have complete control over business operations. In reality, this can inadvertently lead to more problems than produce quality results.

Trust and communication between workers and supervisors should be two-way. That said, it’s best to leave individuals within the organization to learn by taking the initiative and doing their part.

Although there are times that managers need to step up to train employees, it’s still vital to remember that the best way of developing skills is to give employees some wiggle room to build their abilities. Empowering employees to make critical decisions while taking responsibility for their actions is also vital to becoming high performers.

Communicating with the Team

Concerning the first section discussed, communication is one of the most integral parts of honing skills. The last thing that most new employees and workers want is being in the dark regarding their skills and trying to adjust to their current roles. This is one of the main reasons why honest feedback is critical in making progress. Communication is essential to ensuring that everyone in the team is on track. Moreover, communication is one of the best ways to keep everyone engaged.

Each employee in the organization has his or her own pace in learning. That said, you have to customize and personalize your approaches for the best results. Some supervisors don’t want to give constructive feedback since they think that this might offend employees. In reality, employees want to know what they should improve on. Constructive criticism is the only way of honing their skills and pushing them to do more.

Focusing on Growth and Scaling

Lastly, one of the most critical parts of getting your workers up to speed is focusing on the opportunity for growth. Let’s face it: no employee wants to stay in a job role that doesn’t give them a boost and a chance to improve their career in a specific industry. Many managers want to delegate tasks to employees that are “just enough” for their position. Why? Many supervisors are scared of disrupting the usual flow of work. If employees know that they are destined for something better, they might leave or get promoted.

But an organization that doesn’t shy away from genuinely developing its workforce can help retain employees while also helping the business scale well in the long term. That said, promising personal and career growth can help motivate employees to improve their skills and abilities.

As you can see, various ways can be utilized to hone your workforce’s skills and abilities. Although there are many direct approaches to educating and helping your employees improve their skills, it’s still important to consider that effectively managing your business and streamlining daily operations are effective ways to increase your revenue.

Having an employee-centric business is key to stirring your organization in the right direction. Remember, focusing on growth, development, and scaling are integral parts of business success.

Go to Accounting Accidentally for 500+ blog posts and 450+ You Tube videos on accounting and finance:

Best of luck!

Ken Boyd

The post Honing Your Employees’ Abilities: Increasing Workplace Productivity appeared first on Accounting Accidentally.

October 2, 2021

Why Financial Management Is Very Important for Businesses

Financial management is a crucial part of any business. Whether you are the owner or an employee, financial management is key to ensuring that a business runs smoothly and grows. As a business owner, financial management will help you avoid financial hardships, such as bankruptcy, and keep your company running in tip-top shape. Managing finances well leads to smoother business operations and clear career paths for those who want them.

Many entrepreneurs have considered paying for the services of a bookkeeper to help them with financial management. However, there are other ways that entrepreneurs can guarantee that proper financial management strategies are implemented properly.

Join Conference Room: An accounting, personal finance, and entrepreneur community. Video, blog posts, live chats.

Financial management decisions

Businesses will not be able to succeed without proper financial management. After all, financial management deals with cash flow and financial decisions. Not only is financial management important for businesses, but it also affects the business’ customers as well.

Without financial planning, a company’s employees might not be paid on time or at all, which would lead to poor morale among staff members. Customers will lose out, because they cannot rely on businesses that do not manage their finances properly.

Financial planning is a wise idea for entrepreneurs to consider, since it will ensure that their business operations are well-planned and organized. This way, companies can set aside funds without going into debt or incurring expenses that they cannot afford to pay back later on in the future.

Here are more reasons why financial management is important for businesses:

Smart debt management

Entrepreneurs should do everything they can to avoid debts. However, there are times when financial planning fails and financial management is not done properly. As a result, entrepreneurs have no other choice but to take out loans to keep their businesses in operation.

For example, a company might receive funds from financial institutions, but not utilize the money effectively due to poor financial planning. Because of this, entrepreneurs will face a lot of debts that could lead to the failure of a business down the line. Therefore, entrepreneurs should plan their finances carefully and find ways on how to avoid debts altogether.

Avoid bankruptcy through management

Bankruptcy is something that every business should avoid. This is because bankruptcy can lead to financial disasters and other problems that could affect a company’s reputation.

For example, a company might not have enough funds to cover its operating expenses and meet other financial obligations. However, this does not mean that entrepreneurs need to give up on their dreams of running successful businesses. To avoid financial problems that could result in bankruptcy, entrepreneurs should invest in good financial management strategies.

Using financial resources

With proper financial planning, entrepreneurs will be able to maximize every financial resource they have at hand. This includes using funds from loans efficiently and making sure that finances are allocated properly for various financial obligations.

However, financial management is not just about spending the right amount of money following financial plans; it’s also allocating funds to different financial goals and ensuring there are enough resources for emergencies or unexpected events later on.

Reducing costs

Maintaining good financial management can help businesses reduce costs by staying within budget limits and ensuring financial stability. Plenty of businesses cut costs by eliminating human resources, but this can cost the company more money in the long run, since they will then have to hire new employees and train them on how things work at their business.

By cutting financial corners, businesses also risk losing customers who prefer doing business with financially sound companies. This financial instability can also prevent businesses from expanding their operations to new locations.

Managing risks

Entrepreneurs should do everything that they can to avoid risks as much as possible. This is because financial risks can cause businesses to lose a lot of money and fail to achieve financial instability. This financial instability could also force them to close their doors for good.

Investing in Financial Management

Financial management is very important for businesses because it helps them save money, maintain financial stability, stay within budget limits, and avoid financial risks. Financially successful businesses have a stable source of income, which provides the company with enough cash flow to meet all expenses. For businesses to achieve financial stability, entrepreneurs must invest in good financial management strategies.

Go to Accounting Accidentally for 500+ blog posts and 450+ You Tube videos on accounting and finance:

https://www.accountingaccidentally.com/

Good luck!

Ken Boyd

The post Why Financial Management Is Very Important for Businesses appeared first on Accounting Accidentally.

September 29, 2021

The Unexpected Risks Of Operating A Rental Property

Property has almost always been considered a relatively sound investment for individuals, and the yield from short-term rentals has been increasing considerably as of late. There is an opportunity to take advantage of, but there is also a risk that you have to be willing to deal with, as well. Some of these risks can see you making less than you should, but some might even have some legal consequences.

Consult with an investment advisor, CPA, and an attorney regarding these issues.

Here, we’re going to look at some of the risks that you might not anticipate when you start running a short-term rental property, as well as some of the steps that you can take to ensure that you’re managing them effectively.

Have a question about accounting, personal finance, or entrepreneurship? Join the online community on Conference Room.

The high vacancy rateThis is a risk that can affect properties of all types and in any location. Even vacation rental hotspots will have periods of dealing with higher vacancy rates. One of the best ways to make sure that you’re able to combat it is to understand your high-demand seasons and to adjust your pricing when demand starts to dip. Otherwise, working with property management professionals may be able to help you get the support in advertising and outreach that can allow you to reach more potential guests and bring in more business.

Considering your neighbors

The more considerate individual is not likely to be happy with the idea of affecting their neighbors’ quality of life too much. Vetting your tenants can help you stop them from being too much trouble for either your property or for your guests. There are additional steps you can take such as to avoid AirBnB noise complaints with noise-blocking technology that makes your tenants a little easier to manage. Get an idea of not just laws you need to abide but any community or housing association policies that you might have to follow depending on where your property is.

Steep competition

Choosing a good location isn’t just about choosing rentals in a location that people like to spend their time. You also need to consider how much room there is in the market there. With the advent of things like AirBnB, rentals are opening at a much faster rate in cities across the globe.

If it’s too late for you to choose a different property, you need to consider other ways to get good word of mouth and guest ratings, such as gift baskets, bathroom luxuries, and high-quality materials for anything that is designed for guests use in the home.

Losing track of cash flow

Even if your property remains profitable for the entire year, there are likely to be periods of that year where you are spending more than you are making. As such, you can easily end up finding that you get into a negative cash flow overall because you haven’t accounted for and prepared for those higher costs.

To that end, make sure that you are using tools like rental accounting software to get more accurate calculations of the expenses of your rental property throughout the year and take cash from your high-profit periods to keep for when you need that cash flow injection.

Cancellations galore

Depending on where you can rent, you might be always open to the risk of a booking being closed. Some of the rental apps out there allow for guests to cancel their booking at very short notice and with no additional discussion, so long as they can claim extenuating circumstances.

As such, if you’re planning to set up a rental, you have to make sure that you know the cancellations policies of the platforms that you are renting through. There’s a good chance that you might have to eat the occasional cancellation if you want access to a larger base of potential customers.

Getting back out

If you’re planning on using a vacation rental as an eventual retirement home, then you might not need to worry about this too much. However, property is not a liquid asset, meaning it can be difficult to get out and to get your money back.

If you are thinking of selling, you need to get the wheels rolling in advance with the help of an agent. Otherwise, if you need the cash from a sale quick, your options may be limited to companies that buy properties for cash, but at a reduced price.

Any investment you take is always going to have some degree of risk that comes with it. However, with the tips above, you can be aware of those risks and be making your effort to prevent them from getting in the way of running a successful rental property.

Go to Accounting Accidentally for 500+ blog posts and 450+ You Tube videos on accounting and personal finance:

Good luck!

Ken Boyd

Author: Cost Accounting for Dummies, Accounting All-In-One for Dummies, The CPA Exam for Dummies and 1,001 Accounting Questions for Dummies

(email) ken@stltest.net

(website and blog) http://www.accountingaccidentally.com/

The post The Unexpected Risks Of Operating A Rental Property appeared first on Accounting Accidentally.

September 27, 2021

If You Feel Like You Need To Do Everything In Your Business, Read This

Many business owners get into the habit of believing that they need to do everything in their firms. They take on more and more tasks as the company expands until they hit burnout. Then it’s just a matter of time before the whole darn thing collapses.

The reality, though, is that trying to do everything is not what business is about. In fact, the very word “company” comes from a company of people – a group of individuals with the necessary skills to create a product.

Have a question about accounting, personal finance, or entrepreneurship? Join the online community on Conference Room.

The word “group” here is absolutely essential. Unless you’re a solo entrepreneur, you should always have other people you can rely on.

It sounds like a statement of the obvious, but the reason you hire people is because they add value to your processes. The whole point of employing a marketing professional is so that they can do it instead of you.

If you find yourself rushed off your feet, you might want to take an honest look at the hires you’ve made so far. Are these people competent to take responsibility for their assigned roles? Or is your anxiety getting in the way?

In this post, we take a look at some of the ways you can avoid being so busy while also getting more done. Check them out below.

Map Out Your Projects

Instead of just going through the motions, performing task after task, try mapping out your projects to really see what you need to do. Doing this is a great way for you to figure out what your milestones are. You can see how your projects are likely to progress over time, giving you a more realistic picture of what you can get done.

Schedule Your Day

The next pro tip is to schedule your day comes from https://www.forbes.com. Write down what you’re going to do hour by hour and try, if possible, to stick rigidly to your schedule.

While sticking to a schedule can sometimes feel artificial, it lets you dedicate quality time to each task. Overall, you’ll find that you get much more done this way, instead of constantly allowing distractions to side track you.

Outsource or Hire for Repetitive Tasks

Doing repetitive, technical or procedural tasks yourself is generally a bad idea. That’s because there is almost always a specialist out there who can do it far cheaper and better than you can.

Take payroll, for instance. Doing it yourself is extremely time-consuming. But as https://employeradvantage.com/payroll-services/ explains, getting professionals to do it for you is just like any other business cost.

Once you start automating these time-consuming tasks, you’ll find that you have much more space in your day for the things that matter. Always outsource as much as you can afford.

Give Your Team Responsibility

Most importantly, you need to give your team more responsibility. If you don’t allow them to do their jobs, you’ll always feel like you have to do everything yourself. And that is ultimately going to make both you and your business less successful. Responsible delegation is the key to success.

Go to Accounting Accidentally for 500+ blog posts and 450+ You Tube videos on accounting and personal finance:

Good luck!

Ken Boyd

Author: Cost Accounting for Dummies, Accounting All-In-One for Dummies, The CPA Exam for Dummies and 1,001 Accounting Questions for Dummies

(email) ken@stltest.net

(website and blog) http://www.accountingaccidentally.com/

The post If You Feel Like You Need To Do Everything In Your Business, Read This appeared first on Accounting Accidentally.

3 Brave Ways To Condemn Workplace Fraud as a Business Owner

If you’ve ever caught someone at your company stealing, you may feel like it’s not worth the hassle of confronting them. But if you want to condemn workplace fraud as a business owner, some brave steps can help make sure this never happens again. Here are three ways that will help deter fraudulent activity in your company, while keeping employee relationships in mind.

Encourage WhistleblowingWhistleblowing refers to the reporting of a crime or misconduct committed within an organization to the relevant authorities. For example, organizations may have policies requiring employees to report malfeasance, either directly or through officially designated persons (internal whistleblowing). In addition, external companies like https://whistleblowerinfocenter.com/resources/blog/what-is-whistleblowing/ might offer protection against reprisals for doing so (external whistleblowing).

Have a question about accounting, personal finance, or entrepreneurship? Join the online community on Conference Room.

For example, suppose you suspect that one of your employees is defrauding the company. In that case, it’s essential to create an environment in which people feel safe enough to speak up without fear of retribution. Encouraging this in the workplace will help protect your company from fraud.

Conduct Surprise AuditsAudits refer to the examination of accounts, records, and other information regularly.

Conducting audits randomly may help you find any wrongdoing before it becomes excessive and costly for your business. In addition, surprise audits will ensure that no employee knows when one might occur, so there’s more transparency throughout the process from beginning to end. Everyone involved knows there are no exceptions to the rules.

Conducting audits properly will help reduce fraud within your company and protect you from potential risks down the road. The main advantage of conducting surprise audits is that it will help you prevent fraud from occurring in the first place.

Small business owners need to regularly conduct random internal and external audits throughout their company as part of an overall strategy to reduce exposure risk, limit potential losses, and to promote responsible use of assets everywhere within their organization.

Implement Segregation of DutiesYou segregate duties when you assign employees to specific tasks and activities. It limits the opportunity for fraud, because it is more difficult for a single individual to commit a fraudulent act if their efforts are limited to one task or activity.

Segregating duties also makes identifying those involved in committing fraud easier because it focuses on those employees whose job responsibilities impact the area of fraud that occurred.

Think about this scenario: an owner suspects that someone is stealing and cashing incoming customer payments. To investigate, the owner would review the work performed by staff members who prepare and send invoice, and workers who receive incoming payments.

This segregation reduces the risk of mistakes leading to non-payment of goods or services provided to the business.

Take Action NowIn conclusion, there are several things business owners can do to discourage fraud and misconduct within the workplace. First, employees who notice irregularities or fraudulent activity should be able to report the activity using anonymous channels, such as hotlines or compliance websites. These tools encourage whistleblowing.

Second, conduct surprise audits regularly, without warning employees in advance of the audit. And lastly, segregate duties among those with access to financial information and assets.

These steps it more difficult for any individual to perpetrate fraud, because they will not have unrestricted access across multiple departments and functions of its operations.

Go to Accounting Accidentally for 500+ blog posts and 450+ You Tube videos on accounting and personal finance:

Good luck!

Ken Boyd

Author: Cost Accounting for Dummies, Accounting All-In-One for Dummies, The CPA Exam for Dummies and 1,001 Accounting Questions for Dummies

(email) ken@stltest.net

(website and blog) http://www.accountingaccidentally.com/

The post 3 Brave Ways To Condemn Workplace Fraud as a Business Owner appeared first on Accounting Accidentally.

September 22, 2021

Keeping Your Home Safe by Maintaining Structural Integrity

Everyone wants to live in a secure home that’s built on a solid foundation. For homeowners to have a reliable and sturdy household, they need first to consider that various factors come into play during the planning and construction process.

Naturally, our home is explicitly designed to be durable and versatile against natural elements. But even though many homes are made up of suitable building materials that can withstand the test of time and nature, that doesn’t mean that they are entirely immune to damage. Many homeowners overlook their home’s support structure, since they are confident that this can hold on their own.

Consistent maintenance and monitoring are still critical parts of keeping your home safe. Not only does constant maintenance help with keeping your home in good condition, this strategy can also identify structural issues right before they can become a problem.

So what are some ways of maintaining optimal structural integrity for your home? What are some key ways of ensuring that your home remains safe, even after being subjected to harsh weather conditions? Here are some vital strategies that you need to consider.

Join the Conference Room community for great content on accounting, personal finance, and entrepreneurship.

Using Quality Materials

One of the most effective ways of ensuring that your home remains in a sturdy condition is by using high-quality construction materials. When you’re still in the process of planning out your home’s structure, the materials that you use are essential to how it fares against different harsh weather conditions.

But before choosing your building materials and essential components that make up your home, it’s crucial to keep in mind that certain types of construction materials work better for certain types of environments and weather conditions. For instance, most homes situated in areas with storms and strong winds have steel roofing since this can adequately protect the property.

If you’re planning on investing in high-quality materials, many experts in the construction industry would suggest placing time in your home’s foundations. Let’s face it: nobody wants to live in a house that’s built on shaky foundations. Aside from being a potential safety hazard for the inhabitants, your home’s foundation plays an integral part in your home’s structural integrity.

However, it’s challenging to make necessary changes to your home’s foundations when everything is now literally set in stone. While you’re still planning ahead of time, having versatile construction materials is the best choice in this matter. Fortunately, you won’t have to look far, since suppliers of quality stainless steel pipes can provide piping systems with multiple purposes. This is one of the best choices when maximizing your home’s structural integrity and support.

Looking Out for Telltale Signs of Damage

Another important thing you have to consider when maximizing your home’s structural integrity is by taking some time to look for tell-tale signs of damage. Contrary to what most people believe, not all types of damage to your home can be easily remedied with repairs. There are situations where injuries are permanent. This is why most homeowners try to root out water damage as soon as they see signs of wear. Water damage can cause relatively expensive repairs since most damages are long-lasting.

That said, preventive maintenance and taking a proactive approach instead of a reactive one is the best way of rooting out damage right before it happens. Damages to your home’s supporting infrastructure can have a significant effect on your home’s lifespan.

Consistent Maintenance and Inspection Are Key to Success

Last but not least, one of the essential parts of maintaining your home’s structural integrity is by placing time and effort in the maintenance process. Although you might be confident that your home won’t need any maintenance or inspection at the present moment, you should still place some resources in maintaining your home at least twice a year. Having a systematic plan in place when you’re inspecting your home is an excellent way of keeping your home in mint condition.

As you can see, you can maintain your home’s structural integrity in various ways. When you’re ensuring that your home is in good condition, you need to focus on preventive maintenance. You don’t necessarily have to spend a luxury on your home’s components.

Instead, setting a bit of sweat equity when you’re still planning out your property’s structure is one of the best ways of retaining much of its durability and preserving its lifespan in the years to come. Remember: it’s easier to spend a few hundred dollars on improvements, renovations, and preventive maintenance rather than having to spend thousands of dollars on major repairs and replacements.

Go to Accounting Accidentally for 500+ blog posts and 450+ You Tube videos on accounting and personal finance:

Good luck!

Ken Boyd

Author: Cost Accounting for Dummies, Accounting All-In-One for Dummies, The CPA Exam for Dummies and 1,001 Accounting Questions for Dummies

(email) ken@stltest.net

(website and blog) http://www.accountingaccidentally.com/

The post Keeping Your Home Safe by Maintaining Structural Integrity appeared first on Accounting Accidentally.

September 16, 2021

IRS Offer in Compromise: Using an Effective Tax Administration Filing Approach 2021 (Blog post with graphics)

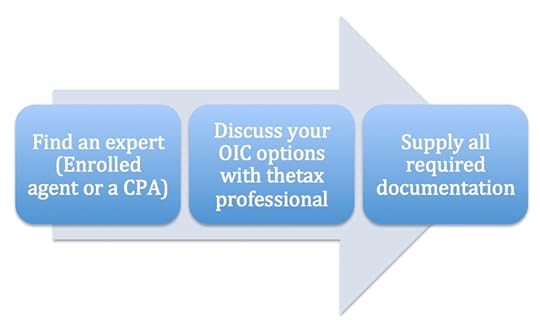

An IRS Offer in Compromise (OIC) is heavily marketed strategy to reduce a tax liability. While many companies promote their expertise, you need an enrolled agent or CPA to guide you through this complex process.

This post explains an overview of the OIC process, why offer are rejected, the three approaches used to justify the offer, and how to use the effective tax administration (ETA) approach.

If you’re a tax professional who provides tax resolution services, Lambers provides a 10-course Tax Resolution Series to help professionals sharpen their skills, and find new business. Find out more here.

Just how large is the tax delinquency problem?

An overview of the tax delinquency issues

At the end of fiscal year 2018, there were over 14 million individual tax returns (Form 1040s) with a balance due, totaling $128 billion in tax liabilities (per IRS Delinquent Collection activities reports). During the same period, 2.3 million tax delinquency investigations were conducted.

59,000 Offers in Compromise (OICs) were submitted, with 24,000 accepted (about 40%), collecting over $261 million.

As you can see, less than 50% of OIC agreements are accepted, and there are several reasons why.

If you’re an enrolled agent, Lambers offers quality continuing education courses, with great customer service and affordable prices. Find out more here.

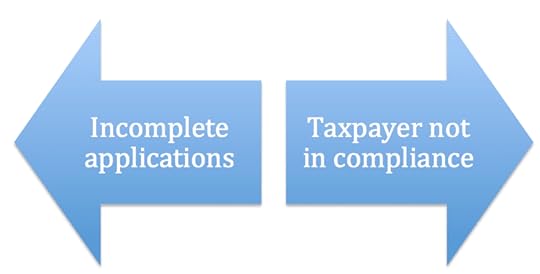

Reasons why offers are rejectedThe reasons for rejection are driven by the taxpayer’s lack of proper preparation and follow up:

Incomplete applications: If data is incomplete, the IRS may return the data, or set it aside and work on complete applications.Taxpayer not in compliance: Lack of compliance due to unfiled tax returns. Note : A current year tax return with a valid extension is considered to be in compliance.Reasons for the OIC programThe OIC program allows the IRS to collect more money in less time, and uses less IRS staff time:

IRS can collect some funds from taxpayers who would otherwise never pay (Some taxpayers simply go off of the grid)Receive payment from funds that otherwise could not be tapped (family loans, for example)Collect more money than trying to seize and sell taxpayer property, which is time consuming for IRS staffCompliance: Once the OIC is in place, the taxpayer must stay in complianceThe IRS has a limited staff, and is looking to speed up the collection process to collect as much as possible.

Understanding two important tax forms

Many former IRS Revenue Officers work as Enrolled Agents and assist taxpayers with the OIC process. To start the process, it’s important to distinguish between two forms:

Form 656: This form lists amount of the offer and the terms

Form 433 (OIC) is a form called Collection Information Statement for Wage Earners and Self-Employed Individuals

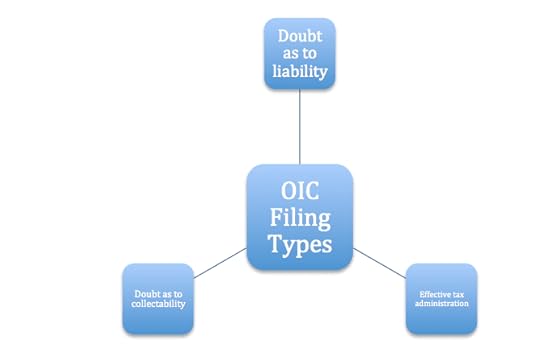

The time intensive part of completing an OIC is providing the financial data in Form 433. The three types of OIC filings are:

Doubt as to liability (find out more in this blog post)Effective tax administrationDoubt as to collectability

This post explains effective tax administration, and the two other OIC filings are explained in other blog posts.

Effective tax administration

Effective tax administration (ETA) filings are rarely approved. With this filing, there is not doubt that the tax liability exists, and you must also file Form 433. Effective tax administration includes the following components:

Demonstrates compelling public policy: Because of the nature of the individual’s situationDeals with overall fairness and equityTaxpayer must demonstrate facts that justify exceptional circumstanceThe taxpayer must have equity and/or reasonable collection potential to pay the full liability

To start the process, complete Form 656, Section 3- Reason for Offer, check the ETA box, and explain the circumstances. You’ll see other instructions below

An ETA may be appropriate for a taxpayer who is old, ill, or frail. Here’s an example:

A physically disabled person owns a home, and needs the customized home to accommodate for the disability. Selling the home would make it difficult to care for the disabled taxpayer. Finally, the taxpayer has no ability to earn income and make payments on another home or apartment.

IRS Manual vs. the IRS code

The IRS manual (guidance for IRS employees) requires you to be in compliance to quality for an ETA offer. Compliance requires the taxpayer to file all required tax returns, for example. However the IRS Code does not have this provision.

As a result, the Tax Court has overturned some ETA filings that have been rejected. In one case, the taxpayer had several years of unfiled tax returns. In another, the taxpayer had not paid the current year tax liability. Both taxpayers were otherwise in compliance for an ETA.

Documents that must be included

Form 2848 Power of Attorney: Giving enrolled agent POA. If two spouses, each needs separate POA signed.Form 656: The ETA box is checked in Section 3, and an explanation is included that explains why an ETA is justifiedForm 433: Collection Information Statement for Wage Earners and Self-Employed IndividualsApplication fee

Here are some guidelines that apply to all OIC filings.

Key provisions for all offers

When an offer is made: Remains open until IRS accepts, rejects, counters, or returns in writing. The taxpayer can also revoke an offer. It’s critically important to track all of the dates related to a filing.Filing accepted: If IRS accepts an OIC, you cannot contest itLiens: IRS will most likely file a lien (or leave a lien in place) until full payment of the offer is satisfiedClient default: In the event of a default, the IRS will attempt to collect the full balance, plus penalties and interest

Note, also, that the IRS may speak with third parties, including the taxpayer’s bank, employer, or insurance companies.

The main reason for an OIC rejection: Documentation is missing, or not supplied in a timely manner. So, where do you go from here?

Consult with a tax professional (CPA or enrolled agent) on all tax-related issues. Best of luck.

Ken Boyd

Author: Cost Accounting for Dummies, Accounting All-In-One for Dummies, The CPA Exam for Dummies and 1,001 Accounting Questions for Dummies

(email) ken@stltest.net

(website and blog) http://www.accountingaccidentally.com/

The post IRS Offer in Compromise: Using an Effective Tax Administration Filing Approach 2021 (Blog post with graphics) appeared first on Accounting Accidentally.

September 6, 2021

5 Timeless Ways to Protect Yourself from Money Issues (Blog post, graphics)

Are you feeling like the world is crumbling down around you? Do money problems seem like they’re too much to manage? Don’t panic. Money might never be easy to deal with, but it doesn’t mean that life should be hard or that there’s no hope for peace.

The key to surviving today’s money issues is taking care of your finances before things get out of hand. Here are five timeless ways to protect yourself from the stress and pressure of money issues.

Have a question about personal finance or entrepreneurship? Join the Ask Me Anything live chats on Conference Room.

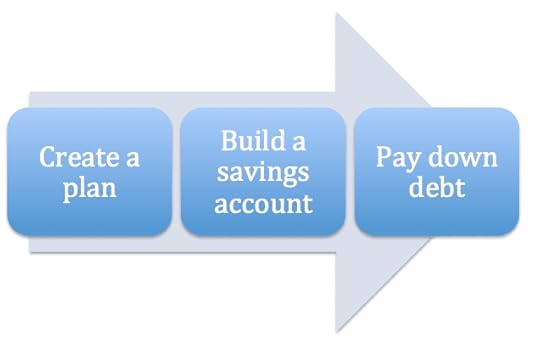

Have a Financial PlanMany young adults today fail to understand the concept of having a financial plan. Research shows that more than 50 percent of college grads have no financial plan in place for after they graduate. The best way to protect yourself from money problems is by making a plan and sticking to it.

By creating a financial plan, you’ll be able to estimate how much money you’ll need to meet your budget. You can keep track of your progress every month and use the information to adjust your plan when needed. Once you find a financial plan that is realistic and easy for you to maintain, it will be much easier for you to avoid money problems in the future.

Save for Retirement AS YOU EARNMany people don’t realize how much money they need to save for retirement. It’s never too early to start planning for retirement, and that’s why many financial experts recommend that you start saving in your mid-20s.

“But I’m still paying off debt,” you might wonder. The good news is that this is fine. Saving while you’re paying off debt will help you avoid debt, which will also protect you from money problems in the future.

“But I don’t make enough to save,” you might say. The good news here is that there are ways to earn more money without taking on more debt.

For example, switching careers to a higher-paying job can help you earn more money while still paying off debt. Or, look for side hustles to make money while you’re not working. There are tons of ways to be more productive with less time, which can help you get ahead financially.

Pay off DebtYes, paying off debt will help you avoid money problems, but it’s also a great way to become financially independent. One of the easiest mistakes to make is spending money on what’s available without considering the future.

For example, trying to buy as much as you can now instead of saving your money for retirement. You may want to get a TV streaming subscription such as peacock, but is peacock worth it?

While it’s understandable that you want what you want and when you want it, this thinking is why people end up in debt. Plus, it’s essential to think about what you can afford now versus what you think you might want in the future.

When you’re deep in debt, it can be easy to feel like things will never change. However, the sooner you get out of debt, the sooner you will solve your money problems. Paying down your debt will not only help you become financially independent; it will also help lower your stress levels and give you more energy for the rest of your life.

Keep an Emergency FundFinancial experts agree that having at least six months’ worth of living expenses is essential to prepare for any emergency. The easiest way to prepare for an emergency is by setting aside money each month to put into a separate account for emergencies.

If there are any types of unexpected expenses, or if you lose your job, you’ll have plenty of money saved to last through the tough times.

Invest Each MonthOne of the most innovative ways to grow your wealth is by investing your money. Earning money while you relax is key to financial success, and it is by investing, you can reach this goal. Once you make your savings work for you, your money will eventually pay off your debt or finance businesses that can help you earn more money. By investing, you can avoid stagnating and live a life of great financial freedom.

Next StepsMoney issues are a genuine concern for many people. They can be a sign that something is going wrong in your financial life.

If you want to protect yourself from money issues for the rest of your life, learn how to manage your money properly. Start by thinking about your long-term goals and how to reach them. Once you establish a relationship between your current finances and your goals, you will succeed in all life areas.

And remember, we all need to work on our money issues somehow, but sometimes it’s better to learn from others than from experience alone. So, make sure to take the time to pay attention and keep learning. Don’t forget that the most challenging part about learning practical ways to manage your finances is that it can feel awful at first.

Consult with a financial advisor and a CPA regarding personal finance issues.

Go to Accounting Accidentally for 500+ blog posts and 450+ You Tube videos on accounting and personal finance:

Good luck!

Ken Boyd

Author: Cost Accounting for Dummies, Accounting All-In-One for Dummies, The CPA Exam for Dummies and 1,001 Accounting Questions for Dummies

(email) ken@stltest.net

(website and blog) http://www.accountingaccidentally.com/

The post 5 Timeless Ways to Protect Yourself from Money Issues (Blog post, graphics) appeared first on Accounting Accidentally.