Kenneth Boyd's Blog, page 30

April 22, 2021

Learn What It Takes to Be Your Own Boss

Bouncing back after losing your job can be challenging. Aside from the emotional and mental toll it brings, picking up the pieces, especially in the middle of a pandemic, can be extremely overwhelming. Rejoining the workforce may take some time, but that should not stop you from exploring other avenues. With these helpful tips, the small business you have been dreaming of will finally come to life.

Identify Your Market

One of the most compelling questions to ask yourself when building the foundation of your business is: “Who are my potential customers?” Finding a market can be overwhelming at first. However, there is always a way to narrow down your choices.

Have a question about personal finance or entrepreneurship? Join the Ask Me Anything live chats on Conference Room.

In the beginning, most of your customers will be people you already know, including your family, friends, and acquaintances. You can easily perform market research these days because of how open people are on social media. It would not hurt to look at some of the profiles of those within your network to determine whether you are predominantly connected to parents, teenagers, people in the workforce, or the elderly.

Other factors that will affect your decisions when identifying your market are

AgeCivil statusIncomeLocationLifestyle preferencesHobbiesInterests

Know Your Competitors

Small businesses have been popping up almost everywhere since the pandemic started. When the competition is stiff, effectively identifying your competition can make or break your business.

Just because what you are about to offer already exists in your target area does not mean you have to change your business plan completely. It is possible to have the same product or services as your competitors and still stand out. This is where your creativity comes in. You can start with a unique brand name, better pricing, reliable availability, and an adaptable marketing strategy.

Start with One Type of Product

Once you have determined your target market, the next thing to do is to ask yourself another question: “What products or services are they willing to pay for?” Know that these are hard times, and money is tight for a lot of people. You may want to consider offering necessities, including

FoodMedicineHygiene productsHouse or shelter repair products or servicesDelivery or logistics servicesClothing

No matter how tempting it is to be a “one-stop shop,” it is easier to start with one primary product. New entrepreneurs often have several offerings in the beginning. However, focusing on one product or service can help you build and strengthen your brand.

Market Your Product

Word of mouth spreads like wildfire. Hence, use it to your advantage by creating a strong online presence. Promote your business through various types of online advertising, such as

High-quality-content vlogsBlogsShort videosPhotosShareable pages

Social media giants, namely, Facebook, Instagram, YouTube, and Twitter, are some of the best places where you can start advertising your brand. On the internet, the possibilities are endless. You can market your business on your own, or you can collaborate with famous social media influencers. Other internet platforms that you can use are:

TikTokWhatsAppAmazoneBayGmail, Yahoo, or Microsoft EmailLinkedInQuoraGoogle AdWordsBlogs

Educate Yourself

You also need to manage the other aspects of your business, such as your staff, advertising, and logistics. Upgrading your skill set is crucial as you develop your business. The more knowledge you have, the more capable you will be in keeping your venture up and running.

You can always find courses on the internet. Classes usually include topics like:

Search Engine Optimization – to increase your online presenceManagement – to create a business strategyMarketing – to advertise your product not just online but also through traditional channelsSales – to close a sale successfullyCustomer Service – to improve the quality of your business and addressing customer complaintsFinancial Management – to source start-up money and manage itPeople Management – to hire employees and strengthen your staffOperations Management – to find suitable and long-term suppliersTax Tips – to manage your taxes correctlyCampaign Management – to create effective campaigns to promote your businessWebsite Optimization – to build a website that would boost your online presence

There are also some aspects of business that you can only learn through formal classes. Fortunately, undergraduate and graduate studies are more accessible these days. Even becoming a doctor of business administration online is possible!

They say the first step is always the hardest because, in reality, it is challenging to start from scratch. However, establishing a business can also be a fun and fulfilling experience. With enough knowledge and sheer hard work, there is nowhere else to go but upward and onward.

Go to Accounting Accidentally for 400+ blog posts and 450+ You Tube videos on accounting and personal finance:

Good luck!

Ken Boyd

Author: Cost Accounting for Dummies, Accounting All-In-One for Dummies, The CPA Exam for Dummies and 1,001 Accounting Questions for Dummies

(email) ken@stltest.net

(website and blog) http://www.accountingaccidentally.com/

The post Learn What It Takes to Be Your Own Boss appeared first on Accounting Accidentally.

Essentials to Consider When Trying to Sell Your Home Smoothly

Selling your home is something that plays a massive part in improving your life and allowing you to secure the property you want. Being able to take things to the next level is certainly one of the key ways of making sure your home sale goes smoothly, and there are a lot of great ways of being able to achieve this.

Make sure you think about some of the best ideas that will help you to sell your home in the most stress free way imaginable.

There are so many things you need to think about when you are trying to sell your home, and the current housing market is one of the most unpredictable. So it is vital for you to come up with ideas that are going to help you when you are looking to sell your home as much as you can.

Work on doing your best to try to sell your home in the smoothest way possible, and this is definitely something that you should be looking to make the most of when it comes to improving this process.

Have a question about personal finance or entrepreneurship? Join the Ask Me Anything live chats on Conference Room.

Hire the Right Realtors

One of the best ways of going about selling your home as effectively as possible is to make sure you come up with the best ways of selling your home right now. There are a lot of ideas that you should consider when it comes to hiring and bringing in the best possible realtors to help assess your property sale as much as possible.

There are a lot of things that you need to keep in mind, and there are a lot of ideas you need to think about when assessing the best way to sell your home comfortably. Hiring the right realtors can play a massive part in this, and there is a lot to think about when you are considering the right ways of achieving this. Try to choose attentive realtors who are focused on getting the best possible sale for you and your family.

Get a Quick Sale

Make sure you consider some of the best ways of being able to sell your home as fast as possible. You’ve got to think about the right ways of getting a quick sale as much as possible, and this is something you need to consider.

Now, one of the key things you need to consider is looking at companies that buy houses for cash, as this is a great way of securing a fast sale as much as possible. You need to think about the best ways of being able to achieve this moving forward, and it is definitely one of the key ways of reducing a lot of the stress and anxiety surrounding your house sale as much as possible.

Choose the Right Time to Sell

When you are looking to improve the essentials relating to this, it is important to make sure you choose the perfect time to sell. This is actually more important than you might think, and there are so many ideas that can help you here.

You need to try to study the market and look at what the best time might be to sell your property. This is something that you are going to need to think about when it comes to improving the way you sell your home as quickly and carefully as you can. Choosing the right time to sell your home can make all the difference to the way your property secures interest, and this allows you to sell the property as smoothly as possible.

There are a lot of factors that you need to focus on when it comes to trying to sell your home in the best way you possibly can. There are plenty of ideas that are going to allow you to do this in a smooth and stress-free fashion, and this is definitely something that you are going to need to work on moving forward as much as possible.

Consult with an experienced real estate agent- good luck!

Go to Accounting Accidentally for 400+ blog posts and 450+ You Tube videos on accounting and personal finance:

Ken Boyd

Author: Cost Accounting for Dummies, Accounting All-In-One for Dummies, The CPA Exam for Dummies and 1,001 Accounting Questions for Dummies

(email) ken@stltest.net

(website and blog) http://www.accountingaccidentally.com/

The post Essentials to Consider When Trying to Sell Your Home Smoothly appeared first on Accounting Accidentally.

April 20, 2021

CPA Exam Changes July 2021 (Blog Post, 4 Infographics)

Passing the CPA exam is one of the most valuable credentials that you can earn in business. It’s a great tool that will serve you throughout your career.

However, everybody tends to freak out whenever the CPA exam makes changes to the content.

“Should I even start studying or wait?”

Yes, you should start studying. The reality is, the CPA exam is very hard no matter when changes are made, and the changes likely will be eased in over time. The exam does not overhaul overnight.

With that said, it’s important to remain cognizant of the changes that are coming in July of ’21. Universal CPA Review, the leader in visual learning for CPA review, has outlined and provided visuals for the key exam changes that you can expect this July:

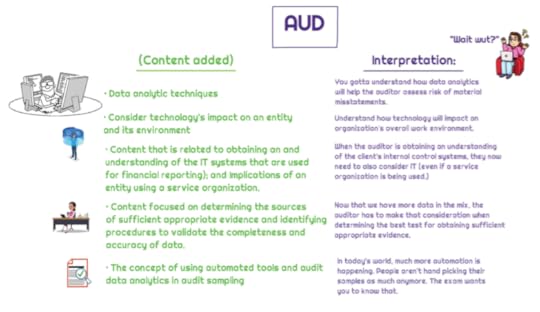

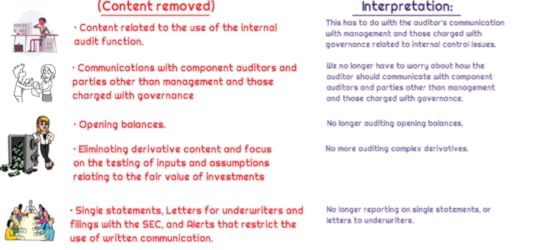

Audit (AUD):

Content will be added regarding the consideration of data analytics and information technology within management’s system of internal controls. Additional content areas will be removed, such as content related to communication with management during integrated audits, substantive procedures related to derivative investments, single statement audits, and comfort letters.

If you are a CPA exam candidate, use discount code: KENBOYD for 25% off any Universal CPA Review purchase.

Business Environment Concepts (BEC):

Like audit, BEC will add content related to data analytics and information technology, only on the managerial side. Additional content will be removed related to regulatory frameworks related to corporate governance (other than Sarbanes-Oxley).

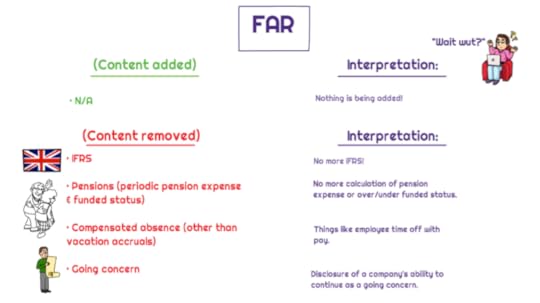

Financial Accounting and Reporting (FAR):

No content is being added to the FAR exam. However, IFRS, elements of post retirement pension plans will be removed, as will compensated absence content (other than vacation accruals), and going concern requirements.

Regulation (REG):

No content is being added to the REG exam. However, the examiners will no longer test candidates on the alternative minimum tax, tax-exempt organizations, and federal securities regulation.

If you are a CPA exam candidate, use discount code: KENBOYD for 25% off any Universal CPA Review purchase.

Best of luck on the CPA exam!

Go to Accounting Accidentally for 400+ blog posts and 450+ You Tube videos on accounting and personal finance:

Ken Boyd

Author: Cost Accounting for Dummies, Accounting All-In-One for Dummies, The CPA Exam for Dummies and 1,001 Accounting Questions for Dummies

(email) ken@stltest.net

(website and blog) http://www.accountingaccidentally.com/

The post CPA Exam Changes July 2021 (Blog Post, 4 Infographics) appeared first on Accounting Accidentally.

Protecting Yourself In The Event Of An Audit

It’s the event that most business owners want to avoid the most when it comes to their accounts. Even in the event that no wrongdoing is found, audits can be terribly stress inducing, not to mention time wasting. However, if you’re getting audited, you can do more than simply sit and wait. You can make sure that you’re safeguarding yourself as best as possible.

Locate and organize files

As soon as you are notified of an audit, gather your records and review them with a CPA in detail. Keeping detailed records of your finances is an essential part of managing your money properly, and now it’s more important to be able to provide those records more than ever.

Make sure you’re providing specifically what is being asked for, as any delays can work against your favor. You need to make sure you’re preparing the right documents and that you’re ready to submit them on time.

Have a question about personal finance or entrepreneurship? Join the Ask Me Anything live chats on Conference Room.

Hire an expert to prepare tax returns

You should ensure that your taxes and tax returns are both being prepared by someone that you are able to rely on. To put it simply, you should have a chartered accountant take a look over your records to see where deductions and credits are being used.

An inexperienced tax preparer without the right training may take large-scale deductions where they shouldn’t, which is what can lead to an audit. An accountant can be with you during an in-person audit as well.

Consult with a tax attorney

In addition to a qualified tax preparer, you need to consult with a tax attorney. With the highest quality legal services, you can get advice from tax attorneys on how to handle the audit before any such accusations come. Should you be accused of an improper act, you then have the right help by your side to help you mount a defense as swiftly as possible.

Don’t speculate on tax issues

You might not be able to remember every detail about your books. However, you should be careful not to speculate where you don’t have the facts. Saying things that are not consistent with the records on hand can harm your case.

This is a good reason to make sure that your accountant speaks for you during your in-person audit.

How the audit goes will depend, in part, on whether or not the auditors can find anything wrong with your finances. But it can also depend on whether you’re able to defend yourself against charges well, too. Consult with a CPA and a tax attorney on these important issues.

Go to Accounting Accidentally for 400+ blog posts and 450+ You Tube videos on accounting and personal finance:

Good luck!

Ken Boyd

Author: Cost Accounting for Dummies, Accounting All-In-One for Dummies, The CPA Exam for Dummies and 1,001 Accounting Questions for Dummies

(email) ken@stltest.net

(website and blog) http://www.accountingaccidentally.com/

The post Protecting Yourself In The Event Of An Audit appeared first on Accounting Accidentally.

April 16, 2021

Building Team Spirit Should Be Fun

It doesn’t matter what sort of business you run, whether you have a large nationwide corporation or you have a small team, the importance of having a strong sense of team cannot be overlooked.

Everyone needs to be working together to help you achieve your business goals and objectives. However, this can be a lot easier said than done.

Teamwork needs to be worked on. After all, you have different personalities within a team, and so it is impossible that everyone is going to gel perfectly all of the time. This is why you need to focus on team-building activities for your workforce. With that being said, let’s explore this and why it is imperative to make team-building fun.

What is Team Building?

Team-building activities can be critical when you are working on a difficult project, or you’re embarking on a new area of business. They can also enhance the results of a group project.

Have a question about personal finance or entrepreneurship? Join the Ask Me Anything live chats on Conference Room.

The key is choosing team-building activities with care. After all, the purpose is to bring your team closer together, not further apart. This is why we should always add fun into the mix.

There are many different ways you can do this as well, from adventure trips to escape rooms. With activities like this, team work is at the heart of everything. It is imperative to ensure a successful outcome. However, you still enable your employees to have fun in the process. After all, teams always work better together when they are enjoying themselves, and this feeling can be brought into the workplace as well.

Knowledge-Based Team Building

In addition to this, you may want to consider looking at team-building opportunities that can help employees to advance their knowledge or learn something new.

For example, you may decide to give your workforce the chance to do stock market courses together. This means that your employees are going to be learning new skills and working together, especially on the group elements of the course. However, they are also going to be learning something that can help them to earn income in other areas of their life or to develop their skills within the workplace.

This makes a massive difference in terms of employee retention levels, as people will not feel like they are in a dead-end job when they are working for your business. Word soon gets out about things like this and then it can boost your brand image, while also helping you in terms of attracting the best talent at your business.

So there you have it: an insight into different team-building activities and why they should be fun. The importance of bringing everyone together as a team really cannot be underestimated irrespective of the type of company you run today. However, when there starts to be friction, it can be hard to pull things back and get everyone on the same page again. The good news is that by embracing team-building activities that center on fun, you have a good solution to the issue.

Go to Accounting Accidentally for 400+ blog posts and 450+ You Tube videos on accounting and personal finance:

Good luck!

Ken Boyd

Author: Cost Accounting for Dummies, Accounting All-In-One for Dummies, The CPA Exam for Dummies and 1,001 Accounting Questions for Dummies

(email) ken@stltest.net

(website and blog) http://www.accountingaccidentally.com/

The post Building Team Spirit Should Be Fun appeared first on Accounting Accidentally.

March 26, 2021

One Small-But-Powerful Tactic Small Businesses Can Use To Connect With Consumers

Launching a business is tough. In many ways, it’s never been easier because the tools and resources are more accessible than ever. Still, the stats prove that fewer SMEs are successful, with the vast majority of them failing within five to ten years. Ouch.

As an entrepreneur, the goal isn’t only to survive – it’s to thrive. With the odds stacked against you, it’s imperative to create an unbreakable bond with your customer base. If you can encourage them to remain loyal, you’ll have a strong foundation on which to build on in the future.

Have a question about personal finance or entrepreneurship? Join the Ask Me Anything live chats on Conference Room.

There are many ways to do it, yet putting the environment first is rapidly becoming a go-to option for several savvy companies. By highlighting how you care about the planet, you automatically transform into a trustworthy brand because you share the same principles.

The even better news is that simply avoiding certain features can be enough to boost your credentials. Bitcoin, for example, is a fund that lots of businesses invest in to increase their wealth. However, when you understand the ecological impact it has on the planet, you realise that the way you handle your budget affects the people around you. By opting for eco-friendly projects instead, consumers will love the fact that you are willing to put the environment before profits.

These are complex and risky issues- consult with a financial advisor.

For those who don’t know about the eco consequences cryptocurrencies have on the planet, you should read the infographic underneath. In it, you’ll find out why Bitcoin isn’t everything that it appears on the surface.

designed by arbtech consultants

Go to Accounting Accidentally for 400+ blog posts and 450+ You Tube videos on accounting and personal finance:

Good luck!

Ken Boyd

The post One Small-But-Powerful Tactic Small Businesses Can Use To Connect With Consumers appeared first on Accounting Accidentally.

March 22, 2021

The Small Business Way of Managing Your Finances

The first few years of any new small business are important to its long-term success, with many lessons to be learned and challenges to overcome. Mismanaged finances and cash flow problems are the primary culprits behind business failures in the early years. Some businesses don’t keep track of their costs, fail to plan or keep a close eye on their cash flow.

Whether you offer piano lessons for students in Las Vegas or run a small bakery in NYC, taking practical steps can help you control your spending and grow your business, no matter its location, without the financial risks.

The Importance of Managing Your Business’s Finances

By understanding the basic skills needed to run a small business – like drafting financial statements, applying for a loan or doing accounting tasks – business owners can create a stable financial future without worrying about big failures. Apart from education, the organization of finances is a major component of stable money management.

Have a question about personal finance or entrepreneurship? Join the Ask Me Anything live chats on Conference Room.

There’s nothing more costly, risky or downright terrifying than showing up at your accountant’s office at the end of the year with endless bills and receipts. Managing your business finances creates a stable financial future that secures your small business’s growth and success.

Tips for Managing Your Small Business Finances

Keep the following things in mind so you can stay on top of your finances:

Pay Yourself

If you are running a small business, putting everything into daily operations may seem easy. After all, the additional capital goes a long way in helping your business thrive. But you shouldn’t overlook your role in the business; always compensate your company accordingly. Don’t be part of the group of small business owners who neglect to pay themselves.

Although it’s important to get the business running and pay everyone else, you need to pay yourself. You’re part of the business. You need to pay yourself as much as you pay the others.

Use Financial Planning and Forecasting

Develop a financial framework or plan to keep track of the money coming into and out of the business. For instance, one financial model your business may follow can be:

20 percent of the revenue on the future, for developing new services and products.30 percent of the revenue set aside for building the business. This includes recruiting costs or expansion of equipment.50 percent of revenue on expenses. This includes supplies or payroll.

Different business plans work for different small businesses. Talk to your accountant to determine the best business model for you.

But circumstances can also change. When they do, your plan must change with it. Forecast your business’s possible financial run for the half of the year. Be realistic in estimating the amount your business will gain or spend. Input these numbers in your financial plan and see if the model still works for your business. If not, change your plan.

Invest in Growth

Set aside a portion of your profits and look for business opportunities. This allows you to move toward a healthier financial direction. As a small business owner, you should always keep an eye on the future.

Small businesses that want to grow, attract the best clients and employees and innovate should demonstrate their willingness to invest in the future. Clients will appreciate the continuous improvement of products and services. Employees will appreciate your investment in their growth. And ultimately, you will create more value for your business than spending all of your profits on personal gains.

Chart Your Cash Flow

Quality accounting software creates charts of outflows (accounts payable) and inflows (sales of services or goods) for your business. It can also change the period and other variables so you can understand your current financial situation. If you look at these charts regularly, you’ll get a better idea of the amount of money that goes into and out of your business.

As a rule of thumb, your inflows must be greater than the outflows to make a profit. The size difference between the two, however, matters more. This gap will vary over time since few businesses make profits consistently. Some weeks or months will be good; others, not so much. Looking at these charts can help you follow the patterns of your financial values.

The Bottom Line: Put Financial Management at the Heart of Your Business

Managing your cash flow and finances should never be an afterthought. Instead, consider it a fundamental aspect of your business strategy. Even if you’re a small business owner, you must understand the numbers that drive business growth.

Remember: only you and good accounting can steer your business in the right direction.

Thanks!

Ken Boyd

Go to Accounting Accidentally for 300+ blog posts and 450+ You Tube videos on accounting and finance:

https://www.accountingaccidentally.com/

The post The Small Business Way of Managing Your Finances appeared first on Accounting Accidentally.

March 19, 2021

Financial Considerations When Starting Up A New Business

Starting up a business is a very exciting time. It can be easy to get swept up with the making the ideas, generating a website and social media presence, creating logos and branding as well as finalizing your product or service.

Although, along with those elements it is also important to consider your financial needs, along with considering as and when to appoint an accountant to help you with your businesses financial needs.

Have a question about personal finance or entrepreneurship? Join the Ask Me Anything live chats on Conference Room.

Managing Investments

Depending on the business you are setting up, you may need initial financial support to allow you to get this business off the ground. It is really important that if you are realistic with the expected expenditure you will have and that you have a well considered business plan in place to demonstrate your business offers a good investment concept.

Understanding How You Will Financial Support Yourself

Starting any business costs money. It is vital that you have considered how this will be funded. Also, it takes a while for a business to take off and profits to show. Again, it is important that while you’re in the initial stages that you’ve considered how you will live and continue to support yourself and the business.

As noted above, you may look at getting investments. You may have savings or alternatively you may continue to work elsewhere while setting this business venture up on the side until enough profit is being made to support you financially.

It is really important that you consider the financial aspect if you want your business to work. You need to be realistic with your outgoings and how long you have the financial capacity to support this, along with realistic timescales as to when you expect to see profits.

Keeping Personal And Business Finances Separate

Although it may not seem too important in comparison to other tasks you have to complete when starting up, it is worth setting up a separate account for your business.

By doing that, you will be able to manage separate business expenditures and when it comes to completing your taxes you’ll know what can be deducted from your gross profit. If you have personal and business banking merged it can make this task a lot harder to know which bill links to either work or pleasure.

Tax And Legal Issues

You want to make sure that you are registering your business correctly and that then you are completing your taxes correctly each year. It is worth making sure this is set up properly as once done, it will free up more time for you in the long run to focus on your business. Ask an accountant and an attorney for help with these issues.

Working with Credit

Along with the considerations for start up, it is also worth considering and having a plan in place for your businesses future. With that in mind it is worth considering monetizing bank instruments and what lines of credit will be available to you and your business in the future if required.

Go to Accounting Accidentally for 400+ blog posts and 450+ You Tube videos on accounting and personal finance:

Good luck!

Ken Boyd

Author: Cost Accounting for Dummies, Accounting All-In-One for Dummies, The CPA Exam for Dummies and 1,001 Accounting Questions for Dummies

(email) ken@stltest.net

(website and blog) http://www.accountingaccidentally.com/

The post Financial Considerations When Starting Up A New Business appeared first on Accounting Accidentally.

March 18, 2021

5 Things to Do if You Have a Negative Credit Card Balance

Did you log into your online banking account to find that you have a negative balance on your credit card? Your heart might have dropped for a moment — how could you have accrued this much debt? What does having a negative credit card balance even mean?

You can relax: having a negative credit card balance is not a bad thing. It does not mean that you owe the bank lots of money — the opposite, in fact.

That said, if you searched the internet for answers thinking that having a negative credit card balance is the same thing as having a negative bank account balance, we’ll discuss both situations and provide you with five pieces of advice to get out of debt.

Why is My Balance Negative?If you have a legitimate negative credit card balance, that means your credit issuer owes you money. If you had a $100 balance on your statement but received a refund for $300, then your balance would read -$200. You didn’t do anything wrong, and you don’t have to pay up.

Refunds are a common reason why people’s credit card balances become negative (if they’ve paid off their previous statement balances, of course), but it may also happen due to canceled fees, removing fraudulent charges, or another reason. Your balance will return to zero if you contact your issuer and ask for your money back or choose to think of it as a kind of credit card prepayment. Remember, it’s not extra money; it was yours to begin with.

Negative credit card balances don’t affect your credit score. You aren’t earning money, either, but neither will your creditworthiness take a hit.

What if I Owe Money Instead?If you’ve confused “negative credit card balance” with owing money, here are a few ways to get your bank account positive again:

Use a Financial AppDo you have trouble budgeting, or is your financial situation a bit of a mystery? Use a financial app like Mint, PocketGuard, or Peak to create a budget, stick to it, and achieve your financial goals. Some apps allow you to view all of your accounts from one place and keep track of your expenses and spending habits.

If you are good at budgeting, but delays in payroll make you short on cash anyway, you can use Earnin to improve your overall financial health. With Earnin, you can take advantage of the “Tip Yourself” feature, so you remember to save, and you can access up to $500 per pay period before payday (you pay the app back when your paycheck comes in), so you can pay your expenses on time without over-relying on credit.

Apply for a Balance TransferConsider applying for a balance transfer card with a 0% introductory rate. This measure allows you to transition your debt from one line of credit to another card with a different issuer (though there may be transfer fees, so do the math to make sure your current interest rate isn’t actually less expensive).

Negotiate with Credit IssuersIt never hurts to pick up the phone and just ask. Ask your credit issuer if they are willing to lower your interest rate, or if they are willing to let you switch cards. You might have a chance if you have a history of making your payments on time.

Do this for your bills, too. Many kinds of debt are more negotiable than you think, so call your healthcare provider to reduce medical bills, your insurance company, your internet service, your landlord, and other people if you want to pay less. It never hurts to try because the worst thing they can do is say no.

Pay More than the Minimum PaymentYes, the minimum payment is all you are legally obligated to pay each month — but that doesn’t mean you shouldn’t pay more. Paying the minimum only ensures that you are stuck with your debt longer and thus owe more money over time thanks to interest. Pay whatever you have the budget for so that you can climb out of debt faster.

Prioritize DebtsPay off your loans or debts with the highest interest rates first. Say you have two credit cards, one with 17% APR and another with 15%. Pay off the 17% debt first with as many funds as you have available and make the minimum payment on the other. The former credit card will cost you more money in the long-run due to accruing interest, so prioritize that one and keep up the pace with the second card once your other debt is gone.

Having a negative credit card balance is not bad, but a negative bank account balance definitely is. Either way, don’t panic — you don’t owe money in the first scenario, and there are ways to pay off debt in the latter.

Please note, the material collected in this blog is for informational purposes only and is not intended to be relied upon as or construed as advice regarding any specific circumstances. Nor is it an endorsement of any organization or Services.

This article originally appeared on Earnin.

Go to Accounting Accidentally for 400+ blog posts and 450+ You Tube videos on accounting and personal finance:

Good luck!

Ken Boyd

Author: Cost Accounting for Dummies, Accounting All-In-One for Dummies, The CPA Exam for Dummies and 1,001 Accounting Questions for Dummies

(email) ken@stltest.net

(website and blog) http://www.accountingaccidentally.com/

The post 5 Things to Do if You Have a Negative Credit Card Balance appeared first on Accounting Accidentally.

Creating a Bright Future For Your Business

Things might be going well for your business right now, but it’s always important to remember that ‘right now’ won’t be around for all that long. The future is coming whether you like it or not, and when it does, the business conditions and the requirements for success will be different from what they are today.

Indeed, that change will come about is the only thing that anyone involved in business can be sure of. As such, it’s important to take steps that’ll ensure a bright future for your organization. In this blog, we’re going to run through some essential steps that’ll put you on the right track.

Invest in Employees

Your employees will have a huge impact on the overall success or failure of your venture. Indeed, when you put them all together, you’ll likely find that they have a bigger influence than you! After all, it’s all good and well coming up with good ideas, but if the team you entrust to bring them to life doesn’t do a good job, then your business will suffer.

So first, bring on great employees. And two, train and empower them! This will allow your staff to do their best work, and it’ll also boost employee retention too. Once you have a great team, you’ll want to preserve it — it can be a drag to always replace leaving staff members.

Have a question about personal finance or entrepreneurship? Join the Ask Me Anything live chats on Conference Room.

Where Is The Industry Going?

Your company doesn’t exist in isolation. It forms part of a much bigger industry. And, of course, how that industry functions will impact your operations. It’s a good idea to keep up with industry news (which you can do by reading trade magazines/attending trade shows) to get an idea of where things are moving in the future. If you don’t, then you might find that it arrives and that you’ve been left behind! This is especially important if you work in a fast-changing industry, such as IT.

What’s a Risk?

If you’re in business for long enough, then something will go wrong. It’s just the way it works! The issue isn’t that things go wrong; it’s that businesses aren’t prepared to handle them when they do.

A little bit of forethought can go a long way. For example, if you work in a flood-risk area, then investing in cloud storage would protect your sensitive data if a flood happened. Sometimes, the risk is entirely clear, but even in that case, it’s best to act as if there are risks that you’re not seeing.

Investing in insurance to protect your business in case something goes wrong will make it easier to manage whatever comes your way. You’ll hope that nothing negative happens at your company, but this is far from guaranteed!

Ongoing Innovation

Finally, you can ensure that your business is always the best of the best by making a commitment to ongoing innovation and being the best company that you can be. If you always have a forward-facing mindset, then your customers will always know they’re in good hands.

Consult with a financial advisor and an insurance agent regarding these important issues.

Go to Accounting Accidentally for 400+ blog posts and 450+ You Tube videos on accounting and personal finance:

Good luck!

Ken Boyd

Author: Cost Accounting for Dummies, Accounting All-In-One for Dummies, The CPA Exam for Dummies and 1,001 Accounting Questions for Dummies

(email) ken@stltest.net

(website and blog) http://www.accountingaccidentally.com/

The post Creating a Bright Future For Your Business appeared first on Accounting Accidentally.