Steve Bull's Blog, page 86

December 5, 2023

All Four “Pillars Of Civilization” Are Under Attack By An “Anti-Human Death-Cult”; Shellenberger, Carlson Unload On Global Elites

As world leaders gathered over the weekend for the COP28 climate summit in Dubai, they faced an uncomfortable reality check from the conference president Sultan Al Jaber, who stated, “there is no science out there, or no scenario out there, that says that the phase-out of fossil fuel is what’s going to achieve 1.5C,” warning that their fossil-fuel policies would “take the world back into caves.”

Nevertheless, no lesser mind than Vice President Kamala Harris pledged another $3 billion to the Green Climate Fund at the summit, seeking to help developing countries adapt to the “climate crisis” as well as decreasing fossil fuel production, according to CNN.

The cult-like worship of (and escalation of) these policies is what led to tonight’s discussion between Tucker Carlson and Michael Shellenberger, author of the must-read “Apocalypse Never”, highlighting the increasingly obvious disconnect between global elites and the general public – most specifically in the context of environmental policies.

“We know that the pillars of civilization are cheap energy, meritocracy, Law and Order, and free speech and all four of those pillars are currently under attack,” warns Shellenberger in his typically erudite and fact-based manner.

The hypocrisy is simply Orwellian.

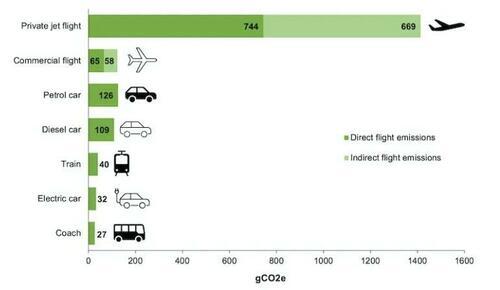

As Shellenberger recently wrote on his Public substack, flying on private jets to a climate conference to announce plans to make energy even more expensive for working people is bread-and-circuses, except there’s no bread, and the circus consists of rich people celebrating their wealth, morality, and superiority.

Carlson begins by pointing out that the drastic climate change policies are “fundamentally nonsense,” asking Shellenberger just how long this “posturing” of environmentalism can go on:

“We’re watching people push an Orthodoxy at increasing volume with increasing hysteria and with increasingly severe penalties for disagreeing…what is that?”

…click on the above link to read the rest…

Hope Dies, Gold Rises

The primary stages of grief include: Denial, anger, bargaining, depression and finally, acceptance.

When it comes to grieving over the slow demise of the American economy, sovereign IOU/USD and the absolute failure of our “re-election-only-focused” policy makers, these stages of grief are easy to see yet easier to ignore.

But false hope won’t help us.

Denying a Recession

With the vast majority of sectors that make up the U.S. economy evidencing three months of negative GDP growth while a laundry list of leading homebuilder indicators (housing starts and prospective buyers) drops into recessionary red, I keep wondering when the recession debate will finally end.

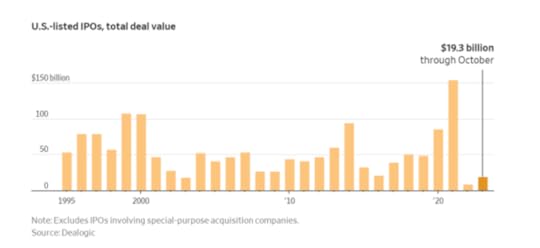

Walmart is worrying, Jamie Dimon is worrying, commercial real estate delinquencies are rising and IPO markets are all but dead on arrival.

But that’s just the latest hard data.

One can cite everything from the Conference Board of Leading Indicators, negative M2 growth, yield curve movements and a drying repo market to make it empirically clear that the US is not heading for recession but has already been in one for nearly a year.

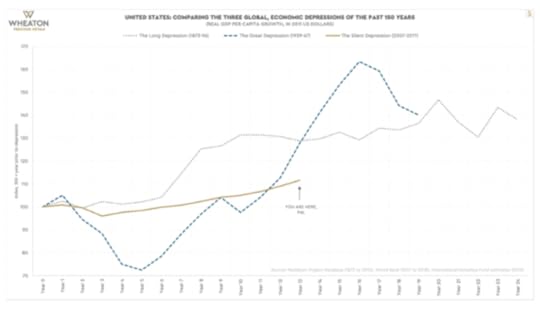

In fact, if we were to define a Depression by growth rates of inflation-adjusted GDP per capita, then factually speaking, we have also been in a quantifiable depression for the last 16 years.

Such data, of course, is depressing, but are we all still hoping for kinder facts or a political and monetary Santa Claus to cure our denial?

I for one favor preparation over denial.

Then Comes the Anger

Citizens storming the Capital, or grabbing guitars and singing “I’m taxed to no end and my dollar aint $#!T” are just the first signs of the anger stage.

…click on the above link to read the rest…

December 4, 2023

Today’s Contemplation: CLXVIII–Avoiding ‘Collapse’ Awareness

Pompeii, Italy (1984). Photo by author.

Pompeii, Italy (1984). Photo by author.Avoiding ‘Collapse’ Awareness

The following is my comment on Alan Urban’s most recent post (see here) discussing his thoughts on why more people are not ‘collapse aware’.

The reasons you cite for most not being ‘collapse aware’ are part and parcel of a variety of explanations for this state of affairs. In my contemplations on the situation I’ve come to the conclusion that a lot of this is due to human psychology and the mechanisms that help us to avoid anxiety-provoking thoughts.

First, we highly-cognitive apes deplore uncertainty and the idea of ‘collapse’ is all about an uncertain future and one in which we have little to no control over events. In response, we tend to grab a hold of stories that portray certainty, especially if they paint a more positive future (thanks optimism bias) — regardless of evidence to the contrary (see my posts that discuss this here and here).

In addition, we humans tend to defer to authority, get caught up in groupthink, strive to reduce our cognitive dissonance, and seek to justify our perceptions of the world (see my series of posts on these, beginning here). These aspects of human cognition make us most susceptible to certain forms of narrative management (aka propaganda), particularly stories that portray a comforting and certain future.

Then there’s what seems our complete and utter blindness to the underpinnings of our complex societies — energy — and the limits of our ability to sustain the quantities required to maintain our living standards (see my post series beginning here on this aspect). That we have been drawing down our primary source — hydrocarbons — at ever-increasing rates as we encounter the headwinds due to diminishing returns is increasingly rationalised away as simply a bump in the road since our ingenuity and technological prowess can address any impediments to our wishes/wants — physics be damned.

Add to the above the idea that perhaps the most important cognitive evolutionary shift for our species may have been where we became aware of our own mortality and then developed ways to deny this reality (see Ajit Varki and Danny Brower’s thesis here). Denying reality has become an entrenched means of reducing our anxiety, and it gets used often; and perhaps increasingly as the world goes sideways and provokes greater instances of uncertainty.

Combine the above with the hierarchical aspects of our social species and complex societies, and our story-telling means of communicating, and we have the perfect mix for why we rationalise away evidence for the impending ‘collapse’ of our current living arrangements and all the conveniences and comforts they afford us — especially in the so-called ‘advanced’ economies that have depended upon the lion’s share of what has been to this point in our history a growing supply of surplus energy.

We ignore the hard biogeophysical limits, we rationalise away the ecological systems destruction wrought by our demands, and we weave comforting narratives to avoid anxiety-provoking thoughts. We live in a world of what appears widely-held false beliefs where challenging them gets you ignored and/or ostracised by those clinging to mainstream notions. It’s often better to raise marginally-related topics and concerns to nudge others along a path of ‘sustainability’ and ‘resilience’ as you suggest rather than confront the hard reality of limits and what overshooting them means to our future…

December 3, 2023

Pentagon Confirms US Warship, Commercial Ships Under Attack In Red Sea

Update (1409ET):

A reporter from the Israeli public broadcasting corporation shared on X that a spokesperson for the Israel Defense Forces reported a UK commercial ship was targeted in the Houthi attack.

* * *

Update (1305ET):

CNN’s Pentagon reporter Haley Britzky reports that the US Arleigh Burke-class destroyer Carney shot down two drones belonging to Yemen’s Iran-supported Houthi rebels.

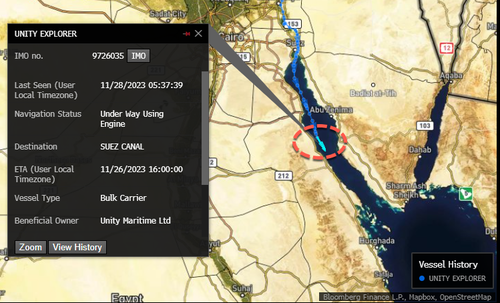

The destroy then received a “distress call from the civilian commercial vessel M/V Unity Explorer, after the Carney saw at least one ballistic missile fired at the Unity Explorer & land in its vicinity.”

According to Bloomberg data, Unity Explorer is a bulk carrier and recently transited the Suez Canal. The ship’s last known position was last Tuesday, in the middle part of the Red Sea.

Houthi rebels have claimed responsibility for the attack.

* * *

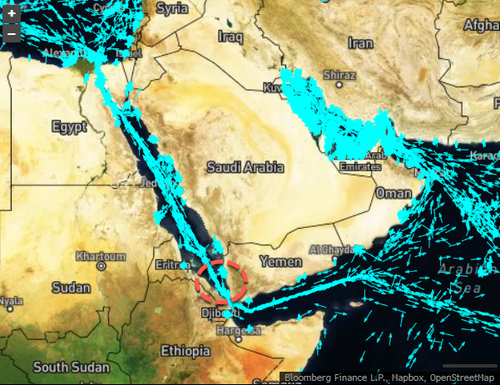

In a significant development, AP News has reported that a US Arleigh Burke-class destroyer and two commercial vessels were targeted in the Red Sea. This incident is part of a growing trend of maritime attacks in the waters of the Middle East, which have been linked to the ongoing conflict between Israel and Hamas.

“We’re aware of reports regarding attacks on the USS Carney and commercial vessels in the Red Sea and will provide information as it becomes available,” the Pentagon said.

Speaking on condition of anonymity, a US official told AP that the attack was around Sanaa, Yemen, and said Carney, an Arleigh Burke-class destroyer, repelled at least one drone during the attack.

Despite no confirmation from the Pentagon on who exactly were the attackers, one might suspect Yemen’s Iran-supported Houthi rebels, who have frequently attacked ships in the Red Sea, could be responsible. The terror group has also launched drones and missiles at Israel.

Let’s remember the Red Sea is one of the world’s most heavily traveled commercial shipping lanes.

…click on the above link to read the rest…

Beware the Snake Oil Salesmen: Climate Change and Elite Confabs

I penned this more than two years ago as members of the world’s ruling caste gathered for COP26. It’s just as relevant today as these so-called ‘leaders’ gather once again in Dubai, United Arab Emirates for COP28…

_____

Today’s Contemplation: Collapse Cometh XXXI–

Beware the Snake Oil Salesmen: Climate Change and Elite Confabs

“If we are not discussing significant degrowth, however (and we’re not because there’s no money to be made from it and the primary motivation of the ruling class, who control the mainstream narratives, is the control/expansion of the wealth-generating systems that provide their revenue streams), then it would seem we are just creating stories to sell more stuff and people tend to accept them readily because they reduce cognitive dissonance — we recognise we live on a finite planet and infinite growth is not possible (except through extreme magical, Cargo Cult-like thinking) but want to also believe that we can continue to live in our energy- and resource-intensive lifestyles uninterrupted and without significant sacrifice”

Also see: Today’s Contemplation: Collapse Cometh XXXII–

Greenwashing, Fiat Currency, Narrative Management: More On Climate Change and Elite Confabs

Insanity: Celebrating Rate Cuts At A Shiller PE Of 31x

Last week ended the way all weeks have been ending: with the stock market raging higher based on future expectations of rate cuts that (1) have not happened yet (2) probably won’t happen until next year, unless a market crash happens first and (3) won’t make their way through the economy for another 18 to 24 months.

But nonetheless, the S&P is looking to finish the year nearing astronomical 20% gains, something that I would have thought to have been impossible with rates raging higher over the last 2 years. But, then again, remember as I wrote in September — rate cuts are usually the signal for the market to crash — not rate hikes: Fed Rate Cuts Should Scare The Shit Out Of You

Is that something I wish I had understood better heading into the last few years? Absolutely. Have I taken an ass whooping betting on volatility and being mostly net short? Absolutely. Does that mean I’m going to be deadass wrong again in 2024?

Not necessarily.

After all, look at gold. As I’ve noted, gold is one of the very few names I’d consider ever being “all in”. And, as I have written about extensively, I find the setup for the precious metal heading into 2024 to be outstanding. I’ve been harping on this since the inception of this blog and it took until this week for gold to hit new all time highs: The Fed Can’t, And Won’t, Nail The Dismount

So let’s just hope it isn’t my analysis that’s wrong, but rather, just my timing.

Anyway I took the time this week to offer up my updated thoughts on Elon Musk and Tesla, after both Musk’s outburst at the DealBook conference and Tesla’s Cybertruck reveal. I explain my thoughts and continued stance on Tesla here: Elon Musk And Dark Forces

…click on the above link to read the rest…

December 2, 2023

Today’s Contemplation: Collapse Cometh XXXIV–Energy-Averaging Systems and Complexity: A Recipe For Collapse

November 28, 2021

Athens, Greece (1984) Photo by author

Athens, Greece (1984) Photo by authorEnergy-Averaging Systems and Complexity: A Recipe For Collapse

Supply chain disruptions and the product shortages that result have become a growing concern over the past couple of years and the reasons for these are as varied as the people providing the ‘analysis’. Production delays. Covid-19 pandemic. Pent-up consumer demand. Central bank monetary policy. Government economic stimulus. Consumer hoarding. Supply versus demand basics. Labour woes. Vaccination mandates. Union strikes. The number and variety of competing narratives is almost endless.

I have been once again reminded of the vagaries of our supply chains, the disruptions that can result, and our increasing dependence upon them with the unprecedented torrential rain and flood damage across many parts of British Columbia, Canada; and, of course, similar disruptions have occurred across the planet.

Instead of a recognition that perhaps a rethinking is needed of the complexities of our current systems and the dependencies that result from them, particularly in light of this increasingly problematic supply situation, we have politicians (and many in the media) doubling-down on the very systems that have helped to put us in the various predicaments we are encountering.

Our growing reliance on intensive-energy and other resource systems is not viewed as any type of dependency that places us in the crosshairs of ecological overshoot and unforeseen circumstances, but as a supply and demand conundrum that can be best addressed via our ingenuity and technology. Once again the primacy of a political and/or economic worldview, as opposed to an ecological one, shines through in our interpretation of world events; and of course the subsequent ‘solutions’ proposed.

Our dependence upon complex and thus fragile long-distance supply chains (over which we may have little control whatsoever) is not perceived as a consequence of resource constraints manifesting themselves on a finite planet with a growing population and concomitant resource requirements but as a result of ‘organisational’ weaknesses that can be overcome with the right political and/or economic ‘solutions’. Greater centralisation. More money ‘printing’. Increased taxes. Significant investment in ‘green’ energy. Massive wealth ‘redistribution’. Expansive infrastructure construction. Higher wages. Rationing. Forced vaccinations. The proposed ‘solutions’ are almost endless in nature and scope.

All of these ‘solutions’ have one thing in common: they attempt to ‘tweak’ our current economic/political systems. They fail to recognise that perhaps the weakness or ‘problem’ is with the system itself. A system that has built-in constraints that pre/history, and population biology, would suggest result in eventual failure.

Archaeologist Joseph Tainter discusses the benefits and vulnerabilities of ‘energy averaging systems’ (i.e., trade) that contributed to the collapse of the Chacoan society in his seminal text The Collapse of Complex Societies.

He argued that the energy averaging system employed early on took advantage of the Chacoan Basin’s diversity, distributing environmental vagaries of food production in a mutually-supportive network that increased subsistence security and accommodated population growth. At the beginning, this system was improved by adding more participants and increasing diversity but as time passed duplication of resource bases increased and less productive areas were added causing the buffering effect to decline.

This fits entirely with Tainter’s basic thesis that as problem-solving organisations, complex societies gravitate towards the easiest-to-implement and most beneficial ‘solutions’ to begin with. As time passes, the ‘solutions’ become more costly to society in terms of ‘investments’ (e.g., time, energy, resources, etc.) and the beneficial returns accrued diminish. This is the law of marginal utility, or diminishing returns, in action.

As return on investment dropped for those in the Chacoan Basin that were involved in the agricultural trade system, communities began to withdraw their participation in it. The collapse of the Chacoan society was not due primarily to environmental deterioration (although that did influence behaviour) but because the population choose to disengage when the challenge of another drought raised the costs of participation to a level that was more than the benefits of remaining. In other words, the benefits amassed by participation in the system declined over time and environmental inconsistencies finally pushed regions to remove themselves from a system that no longer provided them security of supplies; participants either moved out of the area or relocalised their economies. The return to a more simplified and local dependence emerged as supply chains could no longer provide security.

Having just completed rereading William Catton Jr.’s Overshoot, I can’t help but take a slightly different perspective than the mainstream ones that are being offered through our various media; what Catton terms an ecological perspective. And one that is influenced by Tainter’s thesis: our supply chain disruptions are increasingly coming under strain from our being in overshoot and encountering diminishing returns on our investments in them (and this is particularly true for one of the most fundamental resources that underpin our global industrial societies: fossil fuels).

What should we do? It’s one of the things I’ve stressed for some years in my local community (not that it seems to be having much impact, if any): we need to use what dwindling resources remain to relocalise as much as possible but particularly food production, procurement of potable water, and supplies of shelter needs for the regional climate so that supply disruptions do not result in a massive ‘collapse’ (an additional priority should also be to ‘decommission’ some of our more ‘dangerous’ creations such as nuclear power plants and biosafety labs).

Pre/history shows that relocalisation is going to happen eventually anyways, and in order to avert a sudden loss of important supplies that would have devastating consequences (especially food, water, and shelter), we should prepare ourselves now while we have the opportunity and resources to do so.

Instead, what I’ve observed is a doubling-down as it were of the processes that have created our predicament: pursuit of perpetual growth on a finite planet, using political/economic mechanisms along with hopes of future technologies to rationalise/justify this approach. While such a path may help to reduce the stress of growing cognitive dissonance, it does nothing to help mitigate the coming ‘storms’ that will increasingly disrupt supply chains.

The inability of our ‘leaders’ to view the world through anything but a political/economic paradigm and its built-in short-term focus has blinded them to the reality that we do not stand above and outside of nature or its biological principles and systems. We are as prone to overshoot and the consequences that come with it as any other species. And because of their blindness (and most people’s uncritical acceptance of their narratives) we are rushing towards a cliff that is directly ahead. In fact, perhaps we’ve already left solid ground but just haven’t realised it yet because, after all, denial is an extremely powerful drug.

Vancouver is now completely cut off from the rest of Canada by road

Vancouver is now completely cut off from the rest of Canada by roadThere is currently no way to drive between Vancouver and the rest of Canada. The Lower Mainland and Fraser Valley are…www.kelownanow.comWeather whiplash in Canada: extreme rains hit wildfire-devastated British Columbia ” Yale Climate…

An intense low-pressure system brought an atmospheric river of water vapor and torrential rains to southern British…yaleclimateconnections.orgProduct shortage at Okanagan grocery stores, due to highway closures – Williams Lake Tribune

It’s been a busy two days at FreshCo in Kelowna. Customers are stocking up on various products after access between the…www.wltribune.comSupply Chain Disruptions Will Continue – Daily Reckoning

Forty percent of all the cargo into the United States comes through the ports of Los Angeles and Long Beach. Offshore…dailyreckoning.comThe Cost of Waiting | The Tyee

“Push a complex system too far, and it will not come back.” – Joe Norman, founder and chief scientist at Applied…thetyee.caHow Much of the Worsening Energy Crisis is Due to Depletion?

Coal and natural gas spot prices have recently soared to record levels internationally, while oil is trading at over…www.resilience.orgOur fossil fuel energy predicament, including why the correct story is rarely told

The article explains why the energy story told by main street media is biased, to make the situation appear like a “too…ourfiniteworld.com

Today’s Contemplation: Collapse Cometh XXXIII–Overlooking Ecological Overshoot

November 25, 2021

Tulum, Mexico (1986) Photo by author

Tulum, Mexico (1986) Photo by authorOverlooking Ecological Overshoot

Today’s thought was prompted by an Andrew Nikiforuk article in The Tyee and my recent rereading of William Catton Jr.’s Overshoot.

I just finished rereading William Catton’s Overshoot. One of the things I’m coming to better appreciate is Catton’s idea that the ‘Age of Exuberance’ (a time created by human expansion in almost all its forms and mostly facilitated by our extraction of fossil fuels) has so infiltrated our thinking that we tend to view the world through almost exclusively human-created institutional lenses, especially economic and political ones. We have come to think of ourselves as completely removed from nature: we sit above and beyond our natural environment with the ability to both control and predict it; primarily due to our ‘ingenuity’ and ‘technological prowess’.

This non-ecological worldview is still very much entrenched in our thinking and comes through quite clearly in mainstream narratives regarding our various predicaments. Usually it goes like this: our ingenuity and technological prowess can ‘solve’ anything thrown our way so we can continue business-as-usual; in fact, we can continue expanding our presence and increase our standard of living to infinity and beyond (apologies to Buzz Lightyear).

What are by now increasingly looking to be insoluble problems appear to have been solved in the past by two different approaches that Catton describes: the takeover method (move into a different area via migration or military expansion) or the drawdown method (depend upon non-renewable and finite resources that have been laid down millennia ago). On a finite planet, there are limits to both of these approaches.

But because of our tendency towards cornucopian thinking, most analyses overlook the idea of resource depletion or overloaded sinks that can help to cleanse our waste products that accompany growth on a finite planet. It’s all about economics, politics, technology, etc..

Our traditional ‘solutions’, however, have probably surpassed any sustainable limits and instead of being able to rely upon our ‘savings’ we have to shift towards relying exclusively upon our ‘income’ which, unfortunately, doesn’t come close to being able to sustain so many of us. To better appreciate the increasing need to do this we also need to shift our interpretive paradigm towards one that puts us back within and an intricate part of ecological systems. Ecological considerations, especially that we’ve overshot our natural carrying capacity, are missing in action from most people’s thinking.

The first thing one must do when found in a hole you want to extricate yourself from is to stop digging. Until and unless we can both individually and as a collective stop pursuing the infinite growth chalice, we travel further and further into the black hole that is ecological overshoot with an eventual rebalancing (i.e., collapse) that we cannot control nor mitigate. Our ingenuity can’t do it. Our technology can’t do it (in fact, there’s a good argument to be made that pursuing technological ‘solutions’ actually exacerbates our overshoot).

It is increasingly likely that a ‘solution’ at this point is completely out of our grasp. We’ve pursued business-as-usual despite repeated warnings because we’ve viewed and interpreted our predicament through the wrong paradigm and put ourselves in a corner. It is likely that one’s energies/efforts may be best focused going forward upon local community resilience and self-sufficiency. Relocalising as much as possible but especially procurement of potable water, appropriate shelter needs (for regional climate), and food should be a priority. Continuing to expand and depend upon diminishing resources that come to us via complex, fragile, and centralised supply chains is a sure recipe for mass disaster.

December 1, 2023

It’s Not About Saving the Planet, It’s the Big Daddy We Need To Look For

Don’t tell Greta, but the hits keep coming for wind projects…

Don’t tell Greta, but the hits keep coming for wind projects…

For perspective, $4 billion equals about 28 billion DKK. Orsted’s equity is 76 billion DKK, so that $4 billion hit is equivalent to some 37% of its market cap. How the hell did they get it that wrong? Perhaps we can just put it down to delusional expectations that pervaded in the wind industry and still pervade today.

Remember: your energy bills have skyrocketed in order to subsidise bird-killing wind turbines that don’t work. You may think it’s just silly and those pushing this agenda are simply delusional, but this is actually part of the Net Zero agenda to deliberately deindustrialise (and thereby impoverish) the West, while China and other countries unashamedly continue to capitalise on the huge economic prosperity afforded by the use of fossil fuels.

None of this has anything to do with saving the planet, and everything to do with demolishing our standard of living, demolishing our economic prosperity and transforming the former middle class into a neo-feudal peasant class.

From Wall Street Silver: “Net Zero was never viable. It is impossible to completely remove CO2 from our energy needs and overall economy. Politicians are just now beginning to realize that. Just about every modern technology requires oil, natural gas and/or coal in order to function. Many of the metals required need to be mined and new deposits are often remote with no access to the electric grid.”Then there’s this from The Travelling Scientist: “The Paris accord interestingly promotes “non-fossil biocarbon-based” CO2 sources as being okay and counts towards net zero… so cutting trees and burning wood is no problem to the regulators, and becoming ever more popular to meet regulations companies are even patting themselves on their backs in their quarterly reports for doing so.”…click on the above link to read the rest…

Today’s Contemplation: Collapse Cometh XXXII–Greenwashing, Fiat Currency, and Narrative Management: More On Climate Change and Elite Confabs

November 6, 2021

Tulum, Mexico (1986) Photo by author

Tulum, Mexico (1986) Photo by authorGreenwashing, Fiat Currency, and Narrative Management: More On Climate Change and Elite Confabs

Today’s missive was motivated by a former student’s (and eventual colleague) question regarding a Facebook Post I made regarding COP-26.

Here’s what I posted:

COP-26. Be aware…

These elite confabs are not about climate, except to leverage the fear factor over it to meet the primary concern of the ruling class: control/expansion of the wealth-generating systems that provide their revenue streams. It’s additionally a marketing expo for ‘green’ energy products; a mechanism for helping to steer the mainstream narratives; and a justification for further enrichment of the elite via massive expansion of fake fiat currency.

It is not about saving the planet.

And here is the comment I am responding to:

The greenwashing of society is ridiculous. People continuing to buy useless things they don’t need that will not help the environment and now feeling good about draining their own pockets. The elite lining their pockets and masterminding it all. Curious, what do you mean by fake flat currency?

My response to Michelle:

Thanks for the question. It has motivated me to write a rather lengthy response that I have ‘published’ with my ongoing ‘series’ on Medium. You can find it below:

Basically, the currency we use is supposed to carry with it a number of ‘qualities’: use as a medium of exchange; a measure of ‘wealth’; and, a store of ‘value’. As with virtually everything the ruling class touches, our ‘fiat’ currency has become a tool of control and wealth extraction through its creation and distribution mechanisms (just another in a long line of examples that have lead me to believe that the primary motivation of our ruling class is the control/expansion of the wealth-generating systems that provide their revenue streams; everything they do seems to serve this purpose in one way or another).

Our ‘money’ has always been problematic in the ability to be manipulated, but became even more exploitive in nature once removed from its tie to physical commodities, such as gold and silver, that served to constrain somewhat the level of abuse — thanks Richard Nixon and fellow politicians of the time. Since then, money (with the aid of the monetary policies of our central banks) has been able to be created from thin air in staggering amounts. This exponential growth in currency destroys it as a store of ‘value’ — the quality that most significantly impacts the ‘average’ user.

The term inflation actually refers to this growth in currency but has been twisted (as language often is by the-powers-that-be, think about the notion of ‘clean/green’ energy and the greenwashing that has and is occurring) to represent something ‘beneficial’ when it is for the ‘average’ person actually quite detrimental (classic Orwellian doublespeak). When the term inflation is now used it usually refers to the increase in the price of consumer products, and those running the fiat currency system market this price increase as beneficial to the economy and pursue it believing they can control it and its consequences (the belief that one can control/predict a complex system is perhaps one of humanity’s greatest shortcomings).

In reality, this currency expansion is primarily beneficial to the creators and distributors of money, and those first in line to receive this newly ‘minted’ money — usually governments and wealthy elite who can more or less avoid the impact of price inflation by getting access early, thus the lack of resistance by governments and large businesses to reign it in; to say little about the banking system that creates the currency and then charges interest on its product made from nothing. Once this flood of currency filters down to the ‘average’ person, its ‘value’ has decreased significantly because of consumer price inflation (what we witness as a loss of purchasing power — which of course is drastically underreported by the government institutions that ‘measure’ it; primarily because of the way they manipulate the statistics with the actual price increases people experience multiple times higher than the value reported and broadly regurgitated by the uncritical establishment media).

The issue is far more complex and convoluted than I could summarise in a few paragraphs, and I am sharing my ever-changing view based on relatively limited reading and experience. There are a myriad of books written about the subject.

And I haven’t even touched on the ‘narrative managers’ (academics, private economists, government bureaucrats, journalists, etc.) that steer the public perceptions of this gargantuan scam for that is what our monetary/financial systems have become (and thus our entire economic system): they have morphed into the largest Ponzi scheme ever created. In fact, we have entered a time where without constant growth (thus exponential in nature) the entire scheme collapses — the classic definition of a Ponzi scheme, one in which we are all embroiled.

For a long time, the growth needed to ‘fuel’ our economic system was provided by our exploitation of the planet and its relatively preserved and seemingly limitless resources. That changed, however, as we began encountering diminishing returns on our investments. For the past 50 years or so this growth has been predicated upon the expansion of debt/credit (i.e., fiat currency creation) and has, unfortunately, entered a very dangerous territory where debt repayments are exceeding people’s ability to even pay for their interest, let alone principal. To say little about the fact that debt/credit is in essence stealing from the future in the form of claims on future resources (especially energy) that are not only increasingly difficult to procure but in many cases don’t or won’t exist in the future because we live on a finite planet.

Our ‘prosperity/wealth/growth’, therefore, is in a sense all ‘fake’. A Potemkin village if you will. It appears solid and real on the surface but behind the façade is nothing but the ‘promises’ of our feckless ‘leaders’ — and we should, by now, know how much integrity these class of people have and how much of the ‘truth’ they spew. Zero, except perhaps some kernel of it that can be manipulated and leveraged to their advantage.