Steve Bull's Blog, page 83

December 23, 2023

The Great Taking: The Latest “Anti-Mainstream” Conspiracy

A new book has exploded on the alternative / conspiracy / fringe landscape over the past few weeks – I don’t mean that in a derogatory sense. Zerohedge, Bombthrower Media, et al, we all occupy this space. Let’s call it, “anti-mainstream”.

The book is called “The Great Taking” and there is now a YouTube video documentary of it here. You can’t actually find it on Amazon (deliberate choice by author, I presume); I bought my copy via Lulu, but you can download the PDF for free here.

At the risk of oversimplifying it: The Great Taking puts forth a warning that a virtually unknown entity called “The Depository Trust & Clearing Corporation” (DTCC) is effectively the “owner” of all the publicly traded companies in the world, and in fact all debt-based assets of any kind:

“It is about the taking of collateral (all of it), the end game of the current globally synchronous debt accumulation super cycle. This scheme is being executed by long-planned, intelligent design, the audacity and scope of which is difficult for the mind to encompass.

Included are all financial assets and bank deposits, all stocks and bonds; and hence, all underlying property of all public corporations, including all inventories, plant and equipment; land, mineral deposits, inventions and intellectual property. Privately owned personal and real property financed with any amount of debt will likewise be taken, as will the assets of privately owned businesses which have been financed with debt.”

Over the course of the book, the author describes a 50-year process by which ownership of shares in public companies, and all debt collateral has been “dematerialized”.

In the olden days, you invested in a company – they gave you physical share certificates – and you were now part owner of the company. This is still how many value investors including me think of stock ownership.

…click on the above link to read the rest…

No One Has Really Grokked How Big The Suez/Houthi Gambit Is

We’ve had a lot of foreshadowing of the Suez Canal being a major hotspot for conflict over the past couple of years. Think back to the Evergreen beaching itself in the canal in 2021. Everyone is just now waking up to the idea that global shipping is at risk here.

This Twitter thread (by a self-professed moron who, IMO, seems to have a good grasp on things) is representative of the level of analysis being put forth by people still in love with the US Navy’s ability to force project around the world. He’s just waking up to the importance of this situation but he hasn’t picked up on the nuance of it from the other side of the battlefield.

In order to set the stage properly I’m going to have to go back in time. So, let’s start with October 7th and the attack on Israel by Hamas. In the October issue of the Gold Goats ‘n Guns Newsletter I laid out why I thought everyone had an incentive to allow and/or instigate that event.

The October Setup

So, here’s the backdrop for Davos and the US/UK:

Now, if you are a cornered old money globalist oligarch with your finger on the pulse of these events…

Then, you are seeing:

The project in Ukraine hanging by a thread as European and American support wanes at every level just below the unelected leadership.The ECB failing to hold the line on rising bond yields to stave off a banking crisis.US Yield Curve blowing out on the long end, giving Yellen no good options for funding the current budget deficit or for rolling over existing debt, much of which is due in 2024.

…click on the above link to read the rest…

December 21, 2023

Americans Understand Inflation

Americans Understand Inflation

Americans Understand InflationEveryday Americans understand inflation perfectly. But the egghead economists and policymakers who govern their lives don’t.

That may be because inflation is one of the biggest concerns of those who live in the real world, and it may lead to a political earthquake next November in the presidential and congressional elections.

Here’s the reality and here’s the political narrative: Reality is that prices have been going up at the fastest rate in 40 years and they are still going up.

Inflation (on an annualized basis) was 9.1% in June 2022, 4.9% in April 2023, 3.7% in September 2023 and 3.1% in November 2023 (the most recent data available).

It’s true that the rate of inflation is coming down, but prices are still going up. They’re going up at a slower rate but they’re still going up.

Not only that, but past price increases are locked in so new price increases are applied to a higher base. This is killing American consumers.

The average price of a pound of ground beef in the U.S. was $5.11 in September 2023. In October 2023 the price of a pound of ground beef was $5.23. That’s a 2.3% increase on a month-over-month basis, which annualizes to over 25%.

That’s the kind of inflation that real Americans confront every day.

The economists prefer measures of inflation that exclude energy and food prices, what they call “core” inflation. Some eggheads use measures that exclude food, energy and housing costs. They call that “super-core” inflation.

Those measures are academic constructs and bear no relationship to the real world. Try living without gas in your car, food on the table or a place to live.

The ignorance of politicians gets worse when we see Joe Biden come out and say, “Prices are going down,” and retailers should lower their prices and avoid “price gouging.”

Biden is purposely confusing lower rates of inflation (which are still price increases) with lower prices (which are not happening).

…click on the above link to read the rest…

“This Is Off The Charts”: Economist Claims 2024 Will Bring ‘Biggest Crash Of Our Lifetime’ In US

An economist who focuses on consumer spending has issued a dire warning about the U.S. economy in the coming year.

“Since 2009, this has been 100 percent artificial, unprecedented money printing and deficits: $27 trillion over 15 years, to be exact,” economist Harry Dent told Fox Business on Dec. 19. “This is off the charts, 100 percent artificial, which means we’re in a dangerous state.

“I think 2024 is going to be the biggest single crash year we’ll see in our lifetime.

“We need to get back down to normal, and we need to send a message to central banks,” he said. “This should be a lesson I don’t think we’ll ever revisit. I don’t think we’ll ever see a bubble for any of our lifetimes again.”

A trader looks over his cellphone outside the New York Stock Exchange in New York on Sept. 14, 2022. (Mary Altaffer/AP Photo)

A trader looks over his cellphone outside the New York Stock Exchange in New York on Sept. 14, 2022. (Mary Altaffer/AP Photo)As Jack Phillips reports at The Epoch Times, Mr. Dent, who owns the HS Dent Investment Management firm, told the outlet that U.S. markets are currently in a bubble that started in late 2021 amid the COVID-19 pandemic.

“Things are not going to come back to normal in a few years. We may never see these levels again. And this crash is not going to be a correction,” he said.

“It’s going to be more in the ’29 to ’32 level. And anybody who sat through that would have shot their stockbroker,” Mr. Dent said, making references to the stock market crash in 1929 that led to the Great Depression throughout the 1930s.

“If I’m right, it is going to be the biggest crash of our lifetime, most of it happening in 2024. You’re going to see it start and be more obvious by May.

…click on the above link to read the rest…

Today’s Contemplation CLXXI–A ‘Solution’ to Our Predicaments: More Mass-Produced, Industrial Technologies.

Chichen Itza, Mexico (1986). Photo by author.

Chichen Itza, Mexico (1986). Photo by author.A ‘Solution’ to Our Predicaments: More Mass-Produced, Industrial Technologies.

Got into one of those social media discussions with someone yesterday morning. The post I was commenting upon is, unfortunately, no longer available and I failed to take a screenshot of it when I originally commented. However, it was from the Globe Content Studio, a content marketing group of the Canadian newspaper The Globe and Mail. It was advertising content on the importance of new technologies to address climate change and global carbon emissions.

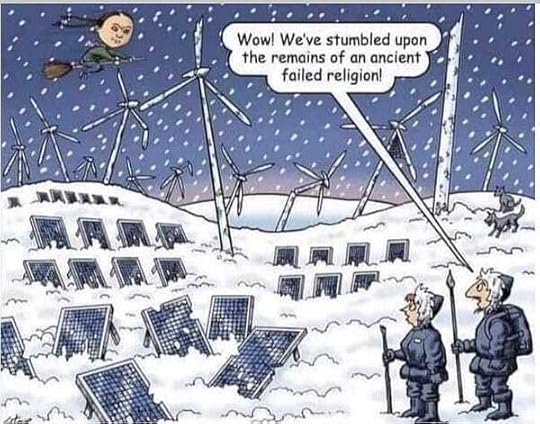

These two images, I believe, are relevant to the conversation that evolved after my original comment:

I have to admit that I’m not sure what this other person thought I was advocating besides wanting to curtail our pursuit of industrial technologies to address atmospheric overloading (and other symptom predicaments of ecological overshoot) but perhaps some readers can discern something I am unable to see.

Keep in mind that I share this dialogue as I have previously to provide a glimpse into the variety of opinions, perceptions, and stories that are being circulated over social media and elsewhere regarding our predicaments and how they might, or might not, be addressed.

Without further ado, here is the conversation and please note that I have copied verbatim and not corrected typos/grammar/etc.).

Me: Complex, industrial technology is what has helped to create our ecological overshoot predicament. More of it only exacerbates the dilemma. Stop marketing the illusion that it can ‘solve’ anything.

WS: Steve Bull the world is not out to “solve”. That is why the Global Energy Transition is called…a transition. What part of that is so difficult yet to grasp. Are you interested in the problem or just dismissing it?

Me: WS, Perhaps you don’t understand the difference between a predicament and a problem. Ecological overshoot is an example of the former — there is no ‘solution’ apart from a correction via Mother Nature.

WS: Steve Bull unless we slow the rate of acceleration by reducing and restricting burning. Exactly what the world has agreed to do. The run away acceleration of warming of the planet and the oceans is a PROBLEM no matter how articulate you try to spin it. So spare me your Bull.

Me: WS, Please peer behind the greenwashed curtains of said energy ‘transition’ being pushed by the mainstream media and politicians. Look at the work of Dr Bill Rees, Dr Simon Michaux, Derrick Jensen, Alice Friedemann, Dr Nate Hagens, Max Wilbert, Erik Michaels, and many others. Attempts to scale up non-renewable, renewable energy-harvesting technologies and their associated products will exacerbate the symptoms of overshoot including atmospheric sink overloading through hydrocarbon use (all of such technologies rely heavily upon them, and they have simply been additive to human energy use over the decades — they have not reduced hydrocarbon use in the least). To say little about the continued destruction of ecological systems through their production, maintenance, and end-of-life reclamation/disposal. There is nothing green, clean, or sustainable about them.

WS: Steve Bull Good grief. More deflective nonsense. So what do you suggest is to be done. Think I will stick with the 250+ scientists from 60+ countries and their collective 3 year study that aligns with NASA and the WHO and MIT reports on the troposphere where 75% of ghg gases reside elevating the ceiling and trapping earth radiated and human induced heat in the lowest level of the atmosphere causing escalation in record heat events…record fires and fire seasons that are full month longer than 100 years ago. Record advancing drought and record hurricanes in frequency and intensity to the extent of “rapid intensification” one day intensity increases. Record hottest years ever recorded and record warming of the oceans. Plain English talk about about the escalation of extreme weather records which 2010–2019 saw the most records broken of any decade in recorded history which was also the hottest decade ever re order and likely both the records and the heat will be broken this decade and the next. Over 580 months without a single below average month for the planet for global mega surface temperatures. All is easily verifiable. I will check the work of the names you mentioned if their names are not on my list of debunked contrarians. Your opinion is very well articulated but still reads as just opinion. You value it..I don’t. I prefer facts.

Me: WS, I don’t disagree with the predicament created by hydrocarbon burning and subsequent atmospheric sink overloading. But I return to my general thesis: it is our technology (that has been supercharged by the leveraging of hydrocarbons) that has led us to our overshoot predicament. Yes, reduce hydrocarbon use but this necessarily includes almost all modern, mass industrial processes including all those required to produce non-renewable, renewable energy-harvesting technologies and their associated products. More technology (that requires industrial processes) is no ‘solution’.

WS: Steve Bull As it is not solvable stating something is not a solution is redundant al…”I don’t disagree but” is just more selection no matter how articulate. Reduction and restriction of emissions across all modes of transportation and burning for energy is the only practical direction which is the agree upon global direction. The rest of you commentary is just dismissive deflection and I believe you know that. You can baffle people with BS but it is little more than a veiled vested interest in the status quo. Necessity fuels innovation and the debate is really over so I will take your point but don’t really see the point of it other than dismissive deflection.

Me: WS, We will have to agree to disagree then. The laws of thermodynamics (especially pertaining to entropy) and the biological principles of ecological overshoot trump what us naked, story-telling apes wish or hope for, especially as it pertains to supposed human ingenuity and our technological prowess. Here’s a recent paper by Dr Bill Rees that might help inform you on these issues: https://www.researchgate.net/publication/353488669_Through_the_Eye_of_a_Needle_An_Eco-Heterodox_Perspective_on_the_Renewable_Energy_Transition

WS: Steve Bull I do t need to be informed so don’t be condescending . Theory is irrelevant in terms of the facts the drive the global direction that is necessary to attempt to slow down the rate of accelerating warming or planet and oceans leading to exponential decadal increase in disaster costs and economic loss and the potential tipping point collapses of multiple feedback loops. You ever been in a disaster Steve? Theory is rather irrelevant

Me: WS, So, you’re interested in just the facts but refuse to read more widely the researchers who have a different story to tell than those who support your perspective? You accuse me of supporting more of a status quo path when I am suggesting a significant reduction in technology but you are arguing for replacing that technology with other industrial technology — which is much more a status quo path. And all the while you are saying that I am deflecting…sounds more like you’re projecting your behaviour onto me. Again, we must agree to disagree on this. Enjoy the remainder of your day, I have better things to do than continue to engage in what is increasingly a pointless debate.

WS: Steve Bull at least I am debating facts and not theory and perspective. We definitely disagree as the debate is really over and actions have been agreed upon. I don’t have a perspective Steve. I have only a decade of research and following of weather records and climate altering extreme weather events. While you ponder your perspective your children if you have them and their children will have to live through devastating life threatening extreme events the likes that have never been seen other than cataclysmic events. You break an ice cube into smaller pieces and the melting pendulum cannot be stopped. So either it continues to get to hot to live in some places with wet bulb temperature potentials …or…the unstoppable melting slows or stops the currents that regulate climate. We simply waited too long debating the warnings and now action is needed to try and slow it down..not stop it or reverse it. Theory and perspective are at this point completely irrelevant. So drop out of this pointless debate in your opinion. I am happy to have the last word.

Me: WS, In reading through our discussion I believe that we may be speaking past one another. I am and believe that I stated that I agree with the predicament of atmospheric sink overloading, which seems to be your position. Correct me if I am wrong. My initial comment was a challenge of the approach being pushed to address this predicament: more mass-produced, industrial technology. It was not to deny nor deflect a concern for emissions. In fact, my point is that to reduce this consequence of human impacts upon our planet as well as the other planetary boundaries we have broached (such as biodiversity loss, land system changes, biogeochemical flows, etc.), we need to be reducing our industrial technologies, significantly — especially because they all require the continued use of hydrocarbons (and exponentially increasing use if we attempt to replace much or most of our current technologies). This perspective is not theoretical in nature as you suggest. It is factual. Modern, industrial processes cannot continue or expand without hydrocarbons, except perhaps on the margins in very limited ways. Want to mitigate atmospheric sink overloading (and the other boundaries)? We cannot do it via massive expansion of technologies as is being marketed (by those who stand to profit from this, not surprisingly), we need to reduce human population, consumption, and complex technologies.

WS: Steve Bull well we seem to have been cut of for some reason as I cannot load the post of see your comments where you suggested I did know the difference between predicament and problem. Predicament is soften terminology to what is a problem and life threatening one at that. You still are theorizing and discussing philosophy of perspective. I think that is deflection even if it is a predicament. It is not practical to stop technology or production at this point in time as action to drastically reduce burning is a practical action for the situation. Truthfully do you how a way to reduce population in any kilns of significant manner and do you know anyone that will voluntarily sacrifice their lifestyle. Humanity is addicted to comfort and convenience and your they is not applicable for a large enough scale. So talking about is not changing what needs to change now to even slow down the rate of extreme weather. Or just for lost lives and homes and entire towns but for the unsustainable quadrupling of extreme weather related disaster costs and economic loss. Politicians have to protect employment levels and that requires feeding the machine. We just have to do so without burning. Period. So you keep theorizing and I will debate facts and current events. I have been doing this for a very long time and have seen the extent of regurgitated deflection sponsored by organized and funded misinformation campaigns with what about isms and cherry picked data and you tube contrarians. While you may be 100% right of what is needed it still is deflection of the action necessary right now. It simply is not practical to stop the prosecution. Only innovate that so it better and and in the meantime we must agree to reduce and restrict emissions whenever and however possible. You are clearly more educated than me but education does not always equate to acquired knowledge. Happy holidays. I don’t know whether I May internet is sketchy or once again I have been sensores which has happens many times as my views that may be considered wrong by many are disliked but many as well. Especially if I bring up what the militaries are doin got prepare for the inevitable while the debate is allowed to be perpetuated. Which is what your entire dialog feels like to me.

December 20, 2023

The Fed’s Empire of Speculation and the Echoes of 1929

Speculation has its own expiration dynamics, and they don’t depend on us recognizing speculative excess for what it is. They will unravel the excesses regardless of what we think, hope or deny.

The Federal Reserve has so completely normalized speculative excess that these extremes are no longer even recognized as extremes. Rather, they are simply “the way the world works.” This Empire of Speculation is complex and plays out on multiple levels.

The primary mechanism is obvious to all: whenever the equity market falters, the Fed unleashes a flood tide of liquidity, i.e. fresh currency, that rushes into the market at the top–corporations, banks and financiers–because the Fed distributes the fresh liquidity solely into the top tier of market players.

The Fed’s ability to conjure up liquidity in a variety of ways appears limitless: expand its balance sheet (QE), use the reverse repo market and bank reserves, launch new lending mechanisms, and so on.

The Fed has long relied on useful fictions to mask its agenda. One useful fiction is that the Fed is independent and apolitical. Despite being risibly shopworn, this mirth-inducing fiction is still dutifully trotted out by every Fed chairperson.

Another useful fiction is that the Fed’s mandate focuses on promoting stable expansion of the economy, not the equity market. This masks the reality everyone knows and acts on, which is the market isn’t a reflection of the economy, it is the economy.

This is why the Fed will pursue ever greater policy extremes to rescue the market from any decline and keep equity markets lofting higher: should the market falter, the economy will quickly follow, as the animal spirits of the market are now the primary engine of expansion.

…click on the above link to read the rest…

100 Container Ships Diverted, Insurance Surges As Red Sea Chaos Worsens

Global transport and logistics company Kuehne + Nagel International AG reports more than 100 container ships have been rerouted from the Red Sea around Africa to avoid Iran-backed Houthi militants in Yemen who attack commercial vessels with missiles and drones.

Bloomberg released two headlines early Wednesday detailing Kuehne + Nagel’s update on the Red Sea. The logistics firm said 103 container ships have detoured around the Cape of Good Hope, lengthening travel time by 1 to 2 weeks. It expects the number of detours to rise in the coming days.

For commercial vessels still transiting the vital waterway that connects to the Suez Canal, Bloomberg noted in a separate report that the cost of insuring jumped this week from about .1% to .2% of the hull value to .5%. A $100 million vessel must pay about $500,000 per voyage.

Increased insurance costs plus more extended travel around the Cape of Good Hope only suggest snarled supply chains and increased prices of goods.

“Both options of increased premiums and rerouting around Africa will see a knock-on effect on the price of goods,” said Toby Vallance, Executive Committee Member of the London Forum of Insurance Lawyers.

Euronav NV Chief Executive Officer Alexander Saverys told Bloomberg TV that the disruption in the Red Sea “will slow down the trade because we will have to wait for a convoy to pass through.” The petroleum tanker giant halted shipments through the Red Sea early this week and won’t transit the region unless there are military escorts. Several other major shipping firms stopped traveling through the area this week (read: here).

Called “Operation Prosperity Guardian,” the Pentagon hasn’t released exact details on how it plans to escort commercial vessels through the conflict region. Vincent Clerc, the chief executive of container shipping giant A.P. Moller-Maersk A/S, said it could take several weeks for the task force to become operational.

…click on the above link to read the rest…

The World Is Sitting on a Powder Keg of Debt

The Federal Reserve recently surrendered in its inflation fight. But price inflation is nowhere near the 2% target. Why did the Fed raise the white flag prematurely?

One of the major reasons is debt.

The world is buried under record debt levels and the global economy can’t function in a high interest rate environment.

Fed officials know that and it is certainly one of the reasons they don’t want to raise rates any higher and hope to bring them down as soon as possible.

Over a decade of easy money policies incentivized borrowing to “stimulate” the economy. As a result, governments, individuals, and corporations all borrowed to the hilt. That was all well and good when interest rates were hovering around zero, but when central banks had to hike rates to battle the inevitable price inflation, it pulled the rug out from under the borrow-and-spend economy.

Governments around the world are feeling the squeeze as they try to deal with trillions in debt in a rising interest rate environment.

According to projections by the International Monetary Fund (IMF) global government debt will hit $97.1 trillion in 2023. That represents a 40% increase since 2019.

By 2028, the IMF projects that global public debt will exceed 100% of global GDP. The only other time global debt-to-GDP was that high was at the height of the pandemic lockdowns.

Americans like to brag about being number one. Well, when it comes to debt, they’re right.

The US national debt makes up 32.4% of the total global government debt.

According to the IMF, America’s debt-to-GDP ratio stands at 123.3%.

This chart by Visual Capitalist captures the extent of the problem.

THE DEBT SPIRAL

Unless governments dramatically cut spending and/or raise taxes, this debt spiral will only get worse, especially if interest rates remain elevated.

…click on the above link to read the rest…

December 19, 2023

UK Navy Alerted To Incident Near Djibouti As Houthis Paralyze Red Sea Shipping

International shipping in the Red Sea and vital Bab al-Mandab Strait is grinding to a halt with tankers, container ships, and other types of commercial vessels rerouting around the Cape of Good Hope to avoid missile and drone attacks from Yemen’s Iran-backed Houthis.

In a report that has become almost daily this week, Bloomberg states that the United Kingdom Maritime Trade Operations is monitoring a new potential incident involving a commercial vessel. This latest incident is said to have occurred around 80 nautical miles northeast of Djibouti.

On Monday, Houthi rebels attacked two commercial ships in the Red Sea. Full details of the attacks were not immediately known, but spurred a handful of major shipping companies to halt transit through the Red Sea.

At least seven major shipping companies, including Taiwanese container shipping line Evergreen, Belgian tanker owner Euronav, energy giant BP Plc, Maersk, Hapag-Lloyd, CMA CGM, and Mediterranean Shipping Company have paused all commercial vessel operations through the Red Sea that connects to Egypt’s Suez Canal.

Spillover risks of the Israel-Hamas war are quickly building, as the Red Sea is responsible for 10% to 12% of the world’s international trade. These mounting risks have forced London maritime insurers to demand war risk coverage for vessels that want to transit the Red Sea.

Red Sea is now largely closed to traffic. That’s 8.8 million bpd of daily oil transit, and nearly 380 million tons of daily cargo transit.

Global traffic now will be rerouted around Cape of Good Hope, adding 40% to voyage distance (and even more to cost) pic.twitter.com/Xct7x03tFI

— zerohedge (@zerohedge) December 18, 2023

On Monday, US Secretary of Defense Lloyd J. Austin said the US and allies, including the UK, Canada, France, and others, are creating a new naval task force to protect critical maritime shipping lanes.

…click on the above link to read the rest…

December 18, 2023

Today’s Contemplation: Collapse Cometh CLXX–To EV Or Not To EV? One Of Many Questions Regarding Our ‘Clean/Green’ Utopian Future, Part 1.

Pompeii, Italy (1984). Photo by author.

Pompeii, Italy (1984). Photo by author.To EV Or Not To EV? One Of Many Questions Regarding Our ‘Clean/Green’ Utopian Future, Part 1.

Today’s Contemplation has been prompted by my recent thoughts regarding the debate around the uptake of electric vehicles (EVs), their place in a world experiencing the predicament of ecological overshoot (and its various symptom predicaments but especially atmospheric sink overloading), and the competing narratives as to whether EVs can address in any way the environmental/ecological concerns and/or resource constraints/depletion that is at the forefront of discussions.

I’ve seen a recent array of arguments by proponents of EVs highlighting the increase in sales over the past few years[1], with some even using these relatively short-term trends to suggest that the end of the internal combustion engine (ICE) vehicles is nigh[2] — and, for a few, that the world is ‘saved’[3]. I have my doubts and the following are some of the reasons why.

While the eventual ‘end’ of ICE vehicles is increasingly probable, it will likely be due to the ever-increasing impact of waning liquid, hydrocarbon fuel supplies and associated cost increases, not the burgeoning transition to EVs its cheerleaders are crowing about. Even government mandates[4] will unlikely create the widespread adoption of EVs advocates are demanding/encouraging as these directives will likely be cancelled or pushed further and further into the future as increasingly economically-challenged citizens rebel against them and various headwinds arise[5]. What we may experience is a curtailing of personal ICE vehicles for many as fuel supplies dwindle and are overwhelmingly taken up by the privileged sitting atop society’s power and wealth structures who can afford/access them — particularly in nations that control hydrocarbon resources. Of course, only time will tell how this all plays out both spatially and temporally.

The first thing to consider is that uptake on the margins by those with the financial ability to be early adopters of EVs does not a long-term trend make. This is especially so with smallish numbers of new purchases having outsized impacts on percentage increases in the early stages of availability. Early trends can be quite misleading and not truly representative of long-term ones. Bubbles happen in technology adoption and the initial euphoria can quickly peter out[6]. This may be what we are seeing with EVs; again, only time will tell.

It is estimated there were 1.4 billion motor vehicles on the roads in 2019[7] (excluding heavy construction equipment and off-road vehicles). In 2022, approximately three out of every twenty new car sales were EVs[8]. And while these vehicular sales can be marketed as monumental based upon comparisons carried out over a short-term perspective, it would take many years of such growth in sales to replace even half of the more than a billion ICE vehicles on the road[9]. Should this early sales growth slow (as some have argued — see below), then replacing over a billion ICE vehicles will take decades; if it happens at all.

Leaving without much comment at all the resource constraints that exist regarding the energy storage components that would be needed for this stupendous feat[10] — and the strain on existing electrical power production and its infrastructure[11] — there exist a number of impediments to a continuing increase in EV adoption suggesting the claims by their cheerleaders to be hopium-laced predictive tales rather than a reflection of on-the-ground reality; especially for a world experiencing diminishing returns on its investments in complexity and well into ecological overshoot — particularly with regard to finite resource depletion and associated shortages.

Perhaps one of the largest deterrents to the mass adoption of EVs is the cost[12]. Cost is a huge factor for many (most?) individuals/families when considering the purchase of a vehicle. This is as true for the purchase of an ICE vehicle as it is for an EV but there exists a variety of cheaper, used vehicles that allow more affordable price points in the ICE realm. Even given these less expensive options, the reality is that purchasers are struggling to afford personal transportation vehicles.

As a recent Zerohedge article highlighted for American car purchasers, an Edmunds analyst told Bloomberg News that: “We’re in this situation where combined with the cost of the vehicles being so high and the interest rates being so historically high, you have a lot of people who are in bad car loans.” As a result, “…the percentage of subprime auto borrowers at least 60 days past due in September topped 6.11%, the highest percentage ever.”

This may change with time but it’s not the current reality, and for potential EV purchasers there are growing concerns over battery degradation leading to declining range ability and more rapid cost depreciation for used EVs to consider[13]. Not only can EVs be substantially more expensive at the outset[14], reports of much higher repair costs[15] are beginning to surface and inhibiting purchases. Again, this may change over time if their uptake continues to grow but it’s a significant concern for cash-strapped families/individuals.

More and more families/individuals are struggling with price inflation of basic goods and services, let alone having to replace high-cost items such as increasingly ‘encouraged/mandated’ ‘low-carbon’ home heating appliances and transportation vehicles. In addition, government economic support via various incentives for EVs is beginning to be withdrawn[16].

‘RealClear’ publications have a fairly obvious bias/bend to them, but this particular article highlights a not so ‘hidden’ aspect of the ‘electrify everything’ narrative: the substantial government subsidies/incentives that has been driving the growth in non-renewable, renewable energy-based technologies (NRREBTs). These financial supports are quite widely publicised by our virtue-signalling politicians looking for brownie points with the public giving credence to the argument that without such incentives by governments (using taxpayer funds and hidden price-inflation taxes) the growth in these products would not be anywhere close to what they have been in recent years.

Countering this point has been the assertion that the main reason NRREBTs have not been widely purchased and sought after is due to oil and gas-industry subsidies[17] (and their massive negative propaganda), a practice that must stop — except for NRREBTS, and these should be increased in one form or another[18].

Digging further into recent data and policy changes (and despite counter-narratives bestowing the incredible recent increase) it would appear that growth in the pickup of EVs is/or is expected to stall/fall as these incentives/subsidies are removed[19]. Once again, only time will tell since it’s difficult to make predictions — especially if they’re about the future.

One other aspect of supposed EV sales records is the emerging evidence of channel stuffing[20] that is occurring. This is a deceptive sales practice that sends products to retailers in quantities far beyond their ability to sell them, but count the inventory as ‘sales’ thus influencing statistics. This has occurred for some time with regard to ICE vehicles[21] and is now being seen with EVs[22].

On top of the considerations described above, there are others who are extremely skeptical of the much ballyhooed benefits of such technologies from an environmental perspective. The production of both EVs and ICE vehicles have tremendous negative impacts upon our ecological systems. Perhaps the most salient differences being discussed are the fuel sources and the impacts of these. It’s not as simple, however, as one being much less destructive than the other and therefore the obvious choice to pursue and mass produce.

I will explore this further in Part 2…

[1] See this, this, this, and/or this.

[2] See this, this, this, and/or this.

[3] See this, this, and/or this.

[4] See this, this, and/or this.

[5] See this, this, this, and/or this.

[6] See this, this, and/or this.

[8] See this.

[9] See this, this, and/or this.

[10] See this, this, and/or this.

[11] See this, this, and/or this.

[12] See this, this, and/or this.

[13] See this, this, and/or this.

[14] See this, this, and/or this.

[15] See this, this, and/or this.

[16] See this, this, this, this, and/or this.

[17] See this, this, this, and/or this.

[18] See this.

[19] See this, this, this, this, this, and/or this.

[20] See this.