Steve Bull's Blog, page 88

November 30, 2023

Confetti Dollar End of Ponzi Scheme – Bill Holter

Precious metals expert and financial writer Bill Holter says the recent underreported announcement by the UBS CEO Sergio Ermotti in Switzerland that his bank might need a “rescue” is yet another sign on the short road to the end of the global Ponzi scheme backed by the US dollar reserve currency. Holter points out, “You’ve got a sick bank (Credit Suisse) that is being bailed out by another bank (UBS) that may turn out to be sick. My question is who is going to bail out these central banks? You have got the Fed with a $9 trillion balance sheet. The last time, the Fed went from $900 billion to $9 trillion. Can the Fed now go from $9 trillion to $90 trillion? Who is going to bail out the Fed? Who is going to bail out the US Treasury? Who is going to bail out the Bank of England, the ECB or the Bank of Japan? These central banks have completely blown up their balance sheet and have no ability to save anything. My question is who is going to save them?”

Precious metals expert and financial writer Bill Holter says the recent underreported announcement by the UBS CEO Sergio Ermotti in Switzerland that his bank might need a “rescue” is yet another sign on the short road to the end of the global Ponzi scheme backed by the US dollar reserve currency. Holter points out, “You’ve got a sick bank (Credit Suisse) that is being bailed out by another bank (UBS) that may turn out to be sick. My question is who is going to bail out these central banks? You have got the Fed with a $9 trillion balance sheet. The last time, the Fed went from $900 billion to $9 trillion. Can the Fed now go from $9 trillion to $90 trillion? Who is going to bail out the Fed? Who is going to bail out the US Treasury? Who is going to bail out the Bank of England, the ECB or the Bank of Japan? These central banks have completely blown up their balance sheet and have no ability to save anything. My question is who is going to save them?”

Can’t they cut interest rates again like they did in 2009? Holter says, “If they cut interest rates from here, you would see the dollar absolutely crash. The only reason the dollar has not crashed is interest rates have basically gone from 0% to 5%. They have done that in a year and a half which is the fastest increase in interest rates in all of history.”

So, rate cuts will devalue the dollar. Can you pay trillions of dollars borrowed in Treasury Bond back in confetti dollars? Holter says, “Yes, you absolutely can pay back your debt in confetti. It’s been done many, many times before as currencies get lost…

…click on the above link to read the rest…

November 29, 2023

Deutsche Bank Economists Say the Fed Will Create More Inflation in 2024

Deutsche Bank economists say the Federal Reserve will create more inflation in 2024.

OK, that’s not exactly what they said. But that is the implication of their latest forecast.

The Deutsche Bank analyst forecast that the Fed will cut rates by 175 basis points in 2024 in response to a “mild” recession. That would drive the Federal Reserve funds rate down to between 3.5% and 3.75%.

This loosening monetary policy, by definition, would create more inflation.

The Fed currently has interest rates set at between 5.25% and 5.5%.

Most mainstream analysts now think the central bank will cut rates next year, but not as steeply as Deutsche Bank economists.

The dominant narrative today is that the Fed has successfully beaten down price inflation. A cooler-than-expected CPI report for October reinforced this notion. With inflation on the run, mainstream analysts think that the Fed has initiated its last hike and will pivot to rate cuts next year to guide the economy to a “soft landing.” Even before the CPI data release markets were pricing in 75 basis points of rate decreases in 2024.

Many mainstream analysts and financial news network pundits have taken a recession completely off the table. But Deutsche Bank senior US economist Brett Ryan told Reuters he expects the US economy to hit a “soft patch” that will lead to a “more aggressive cutting profile.”

Ryan said he expects this economic weakness to further ease inflationary pressure.

The Problems With the Forecast

There are several problems with the Deutsche Bank projections, and the entire mainstream narrative more generally.

In the first place, the death of inflation is greatly exaggerated. No matter how you slice and dice the data, none of the numbers come close to the Fed’s 2% target. Core CPI is still double that number.

…click on the above link to read the rest…

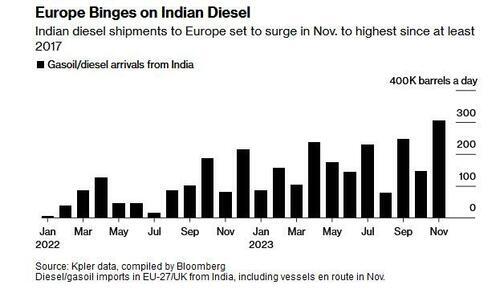

The Dieseleuro: Europe Is Guzzling Russian Oil In The Form Of Indian Diesel Imports

As western politicians ever so theatrically pretend to sanction Russian oil imports (just so they can signal to their voters just how virtuous they are), especially now that the war in Ukraine is almost over with the US and Germany “pressing Kyiv to end the nearly two-year old conflict”, and have gone so far as to ‘demand’ Greek tankers no longer transport Russian oil (something which most of the Greek dark fleet is and will continue to do), the true comedy is just how hard everyone is working behind the scenes to keep the status quo in place. For a glaring example of western hypocrisy look no further than the Russia-India-Europe petrodollar or rather dieseleuro triangle, where one year after banning most oil shipments from Russia, Europe is now binging on Indian diesel… that was made from Russian crude.

Europe’s imports of diesel from India, one of the biggest buyers of Russian crude, are on course to soar to 305,000 barrels a day, the most since at least January 2017, the latest data market-intelligence firm Kpler show.

While it’s not possible to say with certainty that the molecules originated in Russia as India also processes oil from elsewhere – although a blockchain lifecycle tracing would be most useful in this regard – Moscow’s soaring (and cheap) oil exports to India have given Indian refineries an ability to produce abundant diesel and boost both profits and exports.

According to Bloomberg, arrivals into Europe in November include a rare shipment from Mumbai-based Nayara Energy, which imported almost 60% of its crude from Russia this year, according to Kpler. Reliance Industries, Europe’s top supplier of Indian diesel, draws more than third of its crude from Russia, the figures show.

…click on the above link to read the rest…

November 28, 2023

The Life and Public Assassination of President John F. Kennedy by the CIA

What is the truth, and where did it go?

Ask Oswald and Ruby, they oughta know

“Shut your mouth,” said the wise old owl

Business is business, and it’s a murder most foul

Don’t worry, Mr. President

Help’s on the way

Your brothers are coming, there’ll be hell to pay

Brothers? What brothers? What’s this about hell?

Tell them, “We’re waiting, keep coming”

We’ll get them as well

Bob Dylan, Murder Most Foul

Why President Kennedy was publicly murdered by the CIA sixty years ago has never been more important. All pseudo-debates to the contrary – including the numerous and growing claims that it was not the U.S. national security state but the Israelis that assassinated the president, which exonerates the CIA – the truth about the assassination has long been evident. There is nothing to debate unless one is some sort of intelligence operative, has an obsession, or is out to make a name or a buck. I suggest that all those annual JFK conferences in Dallas should finally end, but my guess is that they will be rolling along for many more decades. To make an industry out of a tragedy is wrong. And these conferences are so often devoted to examining and debating minutiae that are a distraction from the essential truth.

As for the corporate mainstream media, they will never admit the truth but will continue as long as necessary to titillate the public with lies, limited hangouts, and sensational non-sequiturs. To do otherwise would require admitting that they have long been complicit in falsely reporting the crime and the endless coverup. That they are arms of the CIA and NSA.

…click on the above link to read the rest…

The West Is Inching Closer to More Insanity in the Baltic Sea

The Newnew Polar Bear

Over the weekend of October 8th there was an unusual drop in pressure in the Finnish-Estonian Balticconnector gas pipeline. By the morning of October 10th, an investigation had found that the pipeline had ruptured. Telecom cables linking Finland, Estonia and Sweden had also been damaged, as had a Russian telecom cable in the Gulf of Finland.

By October 20th, Finland and Estonia were pointing the finger at the Newnew Polar Bear – a Chinese vessel. The Finnish National Bureau of Investigation produced a large anchor found near the damaged pipeline, which it believes belonged to the 169-meter-long ship and likely broke off as it was dragged across the sea floor. Investigators have not explained a theory for how exactly the anchor damaged telecom cables on opposite sides of the pipeline and broke off at the Balticconector.

[image error]

I haven’t been able to track down an exact distance between the Balticconnector and the telecom cables, but Finnish telecom operator Elisa told Reuters that the distance between the two was “significant.”

Nonetheless, speculation is that damaging the pipeline and cables would have been hard to do without knowing. According to Insurance Marine News:

It seemed unlikely-to-impossible that the crew could have been unaware of this incident, as the event would have slowed the ship dramatically and involuntarily…

…click on the above link to read the rest…

The Financial System Has Reached the End

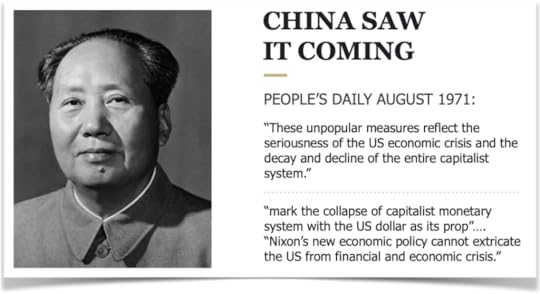

The world is now witnessing the end of a currency and financial system which the Chinese already forecast in 1971 after Nixon closed the gold window.

Again, remember von Mises words: “There is no means of avoiding the final collapse of a boom brought about by credit expansion.”

History tells us that we have now reached the point of no return.

So denying history at this point will not just be very costly but will lead to a total destruction of investors’ wealth.

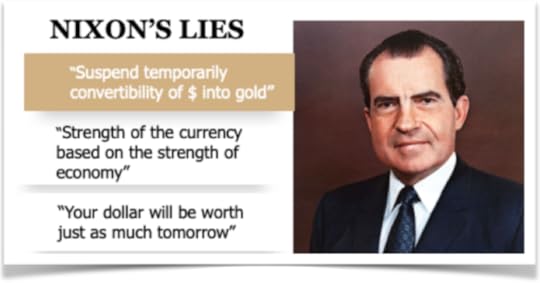

POLITICIANS LIE WITHOUT FAILHistory never lies but politicians do without fail. In a fake system based on false values, lying is considered to be an essential part of political survival.

Let’s just look at Nixon’s ignorant and irresponsible statements of August 15, 1971 when he took away the gold backing of the dollar and thus all currencies.

Later on we will show how clearsighted the Chinese leaders were about the destiny of the US and its economy.

So there we have tricky Dick’s lies.

The suspension of the convertibility of the dollar in 1971 is still in effect 52 years later.As the dollar has declined by almost 99% since 1971, the “strength of the economy” is also declining fast although using fiat money as the measure hides the truth.And now to the last lie: “Your dollar will be worth as much tomorrow”. Yes, you are almost right Dick! It is still worth today a whole 1% of the value when you closed the gold window.The political system is clearly a farce. You have to lie to be elected and you have to lie to stay in power. That is what the gullible voters expect. The sad result is that they will always be cheated.

CHINA FORECAST THE CONSEQUENCES ALREADY IN 1971

So in 1971 after Nixon closed the gold window, China in its official news media the People’s Daily made the statements below:

…click on the above link to read the rest…

November 27, 2023

The Great Simplification Ahead

“Until debt tear us apart”

Photo by Alice Pasqual on Unsplash

Photo by Alice Pasqual on UnsplashThere is no denying that a major economic downturn is now in the books, and that lacking an energy miracle, the world economy is about to go through a major shift. After discussing the faulty nature of prevailing economic metrics (GDP) in last week’s essay, and understanding how economic growth has turned into stagnation 18 years ago already, let’s turn our eyes towards the future. What might the world economy look like after the onset of the coming crisis? How would world leaders react? Could gold or bitcoin save the day? Let’s dive in.

There is a yawning gap between real economic productivity and debt in the world economy. Despite the fact that GDP seems to be growing, real economic output (best measured by energy consumption) has been stagnating for almost two decades now. As a result Western nations have lost their dominance in the world economy, and now face a steep decline due to an ever worsening energy balance and their colossal import dependence.

You see, this is not a matter of money or the lack thereof. Governments all around the world had the chance to print all the money they wanted in the past two decades. There were two thing they could not conjure up, however: cheap raw materials and energy. Contrary to common wisdom, the green energy transition is not a miracle waiting to happen, only an expensive and utterly unsustainable addition to the existing fossil fuel energy infrastructure. Shale oil, the much heralded “solution” to peak oil, has also run its course and now is close to reaching its all time high… Only to embark on a steep decline afterwards. None of this is a monetary question, only a matter of geology and economics: resource depletion and the resulting cost increase. Printing money does not solve any of these issues, only creates more inflation.

…click on the above link to read the rest…

When The Lights Go Out

Dreaming of a power outage that lasts forever

Each winter, storms knock out the electricity to my home. I live in the country, over hills and past muddy pastures and brown meadows. Snow and ice grip the trees, pulling them past the breaking point, and the lights flicker and die.

The first thing I notice is the quiet. The hum of the refrigerator, the ticking of the hot water heater, the barely perceptible vibration of the electrical system itself. The sounds drop away. That is how I awoke this February morning; to silence, just the murmur of a million wet snowflakes settling onto the trees, the grass, the cabin roof.

As a child, I craved power outages. School canceled, all obligations swept aside — an excuse to bypass the siren song of television, jobs, routine, and to instead place candles on the table and sit together around the flickering light. All this, of course, after the obligatory snowball fight.

Luck and privilege underlie my experience; the luck of living in a temperate climate, where a small fire and sweatshirt keep us warm inside; the privilege of a family with just enough money to relax and enjoy power outages despite not being able to work.

Power outages are still magical times for me. Now, grown, I live far enough away from the city that outages can last many days. We sit around the wood stove after a day of chores, cooking dinner slowly on the stovetop, snow melting in a pot for tea. Nothing is fast. There is no rush, and nowhere to go, and nothing to be done beyond: talk, read, cook, wash dishes in a tub with fire-warmed water. It is a balm to a soul chafed by the demands of modernity — speed, productivity, constant connectivity.

…click on the above link to read the rest…

It Will Happen Suddenly

As the Great Unravelling progresses, we shall be seeing many negative developments, some of them unprecedented.

Only a year ago, the average person was still hanging on to the belief that the world is in a state of recovery, that, however tentative, the economy was on the mend.

And this is understandable. After all, the media have been doing a bang-up job of explaining the situation in a way that treats recovery as a general assumption. The only point of discussion is the method applied to achieve the recovery, but the recovery itself is treated as a given.

However, as thorough a distraction as the media (and the governments of the world) have provided, the average person has begun to recognise that something is fundamentally wrong. He now has a gut feeling that, even if he is not well-versed enough to describe in economic terms what is incorrect in the endless chatter he sees on his television, he now senses that the situation will not end well.

I tend to liken his situation to someone who suddenly finds all the lights off in his house. He stumbles around in the dark, trying to feel his way. Although he can picture in his mind what the layout of his house is, he is having trouble navigating, often bumping into things. This is similar to the attempt to see through the media and government smokescreens during normal times.

But soon, as his government undergoes collapse, he will be getting some bigger surprises. He will find that the furniture has inexplicably been moved around. Objects are not where they are supposed to be, and it is no longer possible to reason his way through the problem of navigating in the dark.

…click on the above link to read the rest…

Today’s Contemplation: Collapse Cometh CLXVI–Societal Collapse: The Past is Prologue

Athens, Greece (1984). Photo by author.

Athens, Greece (1984). Photo by author.Societal ‘Collapse: The Past is Prologue

Today’s Contemplation has been once again prompted by the latest musings of The Honest Sorcerer. I believe their posts motivate me more than most others I read because we very often focus upon the same subject matter and appear, for the most part, to come at the issue(s) from a similar standpoint. In fact, I have had more than one person accuse me of being The Honest Sorcerer and simply using a different name/platform — which I will take as a compliment given how much I enjoy their articles.

Here is my posted comment on their Substack publication:

I’ve found it most enlightening (and I’m sure it’s my personal bias in having some background in the subject) to consider past experiments in complex societies and the societal responses/reactions to the cyclical phenomenon of ‘collapse/simplification’ to guide our discussion on how things may unfold. Archaeology demonstrates that despite human ingenuity and having the best ‘technology’ of the time, similar patterns emerge across both time and space as a complex society ‘dissolves’.

As the saying goes, ‘It’s difficult to make predictions, especially if they’re about the future’; however, there’s also the Shakespearean phrase ‘What’s past is prologue’ suggesting that we can learn from pre/history and its apparent oft-repeated processes as we have hints as to what may befall us as our societal ‘decline’ proceeds providing an educated guess on the future (the best we might hope for in an uncertain and complex world full of nonlinear feedback loops and emergent phenomena, to say little about Black Swan events).

I’ve written a number of posts about this, most recently just a couple of months ago entitled What Do Previous Experiments in Societal Complexity Suggest About ‘Managing’ Our Future (https://stevebull-4168.medium.com/todays-contemplation-collapse-cometh-cxlviii-fb2491bb08fe). Some of its points are quite similar to those you make.

In this piece of writing I focused on the aims of the ‘degrowth’ movement and why our ‘collapse’ will not likely be ‘managed’ in the way many degrowthers hope. I make the argument, based upon my understanding of archaeologist Joseph Tainter’s thesis in The Collapse of Complex Societies, that:

1) “…society’s power-brokers place the burden of ‘contraction’ upon the masses via currency devaluation, increased taxes, forever wars, increased totalitarianism, narrative management, etc..”

2) “Once surpluses are exhausted, everyday operating ‘costs’ begin to suffer and living standards for the majority begin to wane. A gradual decline in complexity ensues.”

3) “As societal investments encounter the Law of Marginal Utility due to ever-increasing costs of problem solving and its associated complexity, society experiences declining living standards. Eventually, participants opt out of the arrangement (i.e., social ‘contract’) — usually by migrating — resulting in a withdrawal of the support/labour necessary to maintain the various complex systems.”

4) “…to offset our increasing experience with diminishing returns, especially as it pertains to energy, we have employed significant debt-/credit-based fiat currency expansion to increase our drawdown of important resources among other perceived ‘needs’…”

5) “…to sustain a society’s complexity as it bumps up against limits to expanding its problem-solving ability (particularly its finite resource requirements), surpluses are drawn upon…The drawdown of these surpluses puts society at greater risk of being incapable of reacting to a sudden stress surge that may expedite the ‘collapse’ of complexity.”

6) “…once diminishing returns sets in for a society, collapse requires merely the passage of time. New energy sources, however, do little to address the issues that arise from expanded technology use–particularly the finiteness of the materials required and the overloading of planetary sinks that occur from their extraction and processing…”

7) “…pre/historic evidence also demonstrates a peer polity competition trap where competing ‘states’ drive the pursuit of complexity (regardless of environmental and/or human costs) for fear of absorption by a competing state. In such situations, ever-increasing costs create ever-decreasing marginal returns that end in domination by one state, or collapse of all competing polities. Where no or an insufficient energy subsidy exists, collapse of the competing states occurs at about the same time.”

We should be able to learn from these past trials in large, complex societies. And I recall putting this prospect to Jared Diamond about a decade ago when I heard him speak at the Royal Ontario Museum in Toronto, Canada. His response (and I’m paraphrasing) was that just because we have this capability does not in any way mean we will use it.

Do I believe humanity will heed the lessons of the past?

In those early days of my journey down the rabbit hole of societal ‘collapse’ that began with my exploration of the concept of Peak Oil and its implications for our world (I thank the rental from our local Blockbuster in late 2010 of the documentary Collapse with the late Michael Ruppert for this), I thought we could avoid the pending decline of society. I thought that human ingenuity and intelligence could and would come to understand our plight and take remedial steps to set things right.

I no longer believe this; in fact, I chuckle somewhat at my naivete in those early days as I struggled to move through Kubler-Ross’s stages of grieving. I experienced an awful lot of denial and bargaining.

Pre/history appears to show that every complex society has reacted to their decline in somewhat parallel ways. Not exactly the same, but pretty damn similar despite the vast differences between them in terms of time, geographic location, and sociocultural practices.

Despite all of this evidence, most of us involved in the current iteration (at least those that have the ‘privilege’ to contemplate such things; many in our world of course don’t) have a tendency to believe that this time is different — especially because of our ingenuity and technology leading to our perpetual ability to ‘solve’ any issue that arises — and the narratives we craft in light of this belief system. But our responses appear to be unfolding in ways not unlike those that previous societies have experienced.

In fact, there’s a good argument to be made that our ‘modern’ responses are even more broadly and significantly detrimental to our future prospects because of the ever-present and widely disseminated propaganda that aims to keep the masses ignorant of the various revenue-generation/-extraction rackets siphoning resources towards the top of our power/wealth structures, and that appear to be expanding and speeding up as the surplus energy that has sustained our growth moves towards zero and then goes negative.

And as I conclude in the piece referenced above,

Little to none of the above takes into consideration our current overarching predicament: ecological overshoot (and all of its symptom predicaments such as biodiversity loss, resource depletion, sink overloading, etc.).

Having significantly surpassed the natural environmental carrying capacity of our planet, we have strapped booster rockets to the issue of complex society ‘collapse’.

We have chosen to employ a debt-/credit-based economic system to more quickly extricate finite resources from the ground in order to meet current demands rather than significantly reduce stealing them from the future. We have created belief systems that human ingenuity and finite resource-based technologies are god-like in their abilities to alter the Laws of Thermodynamics (especially in regard to entropy) and biological principles such as overshoot…

Given we cannot control complex systems, we also cannot predict them well (if at all) and thus we cannot forecast the future with any certainty. But there exist physical laws and limits, biological/evolutionary principles, and pre/historical examples/experiments that all point towards a future quite different from the optimistic ones painted by those who believe we have control over such things.

I expect one last ginormous pulse of energetic ‘consumption’ in a most wasteful binge (and likely mostly towards geopolitical strife over the table scraps of finite resources) and a significant amount of narrative management by society’s wealth-extracting forces before ‘the great simplification’ and Nature’s corrective responses to our overshoot take hold — showing Homo sapiens who is really in charge…and it’s not us.

Also see these:

Cognition and Belief Systems: Part Six — Sociopolitical ‘Collapse’ and Ecological Overshoot (https://stevebull-4168.medium.com/todays-contemplation-collapse-cometh-lvi-1f3de97ef6e9)

Infinite growth. Finite planet. What could possibly go wrong? Part One (https://stevebull-4168.medium.com/todays-contemplation-collapse-cometh-lix-800413db180a)

Energy Future, Part 3: Authoritarianism and Sociobehavioural Control (https://stevebull-4168.medium.com/todays-contemplation-collapse-cometh-xciii-78f4f61f8a1d)

Energy Future, Part 4: Economic Manipulation (https://stevebull-4168.medium.com/todays-contemplation-collapse-cometh-xcix-1eaf7ac0c5c6)

Collapse Now to Avoid the Rush: The Long Emergency (https://stevebull-4168.medium.com/todays-contemplation-collapse-cometh-cxxxv-5b9d26816e33)

Declining Returns, Societal Surpluses, and Collapse (https://stevebull-4168.medium.com/todays-contemplation-collapse-cometh-cxli-c3a58b371496)

Ruling Caste Responses to Societal Breakdown/Decline (https://stevebull-4168.medium.com/todays-contemplation-collapse-cometh-cxliii-a063a8dee7ff)