Steve Bull's Blog, page 142

January 10, 2023

Top Marine General In Japan Bluntly Describes US Is “Setting The Theatre” For Future War With China

The top Marine Corps General for Japan this week issued some very revealing statements in an interview focused on countering China in the Financial Times. Despite Chinese leadership insisting that the Taiwan and Ukraine situations are not comparable, this is precisely how Lieutenant General James Bierman presented the situation, even going so far as to admit the Pentagon is preparing a counter-China “theatre” by cultivating military ties with southeast Asian allies.

“The US and Japanese armed forces are rapidly integrating their command structure and scaling up combined operations as Washington and its Asian allies prepare for a possible conflict with China such as a war over Taiwan, according to the top Marine Corps general in Japan,” the FT report begins.

Now Lieutenant General James Bierman Jr. pictured in June 2018. Commanding general of 3rd Marine Expeditionary Force and Marine Forces Japan. Image: US Marine Corps/Stripes.

Now Lieutenant General James Bierman Jr. pictured in June 2018. Commanding general of 3rd Marine Expeditionary Force and Marine Forces Japan. Image: US Marine Corps/Stripes.While it’s no secret that Tokyo has been more and more openly siding with the US stance on arming Taiwan over the past year, also abandoning its historic post-WWII neutrality by drastically ramping up defense spending, Gen. Bierman confirmed “exponential increases” over the past year in joint US-Japan operations.

The interview itself is explosive enough to provoke the ire of Beijing officials, given how explicit the theme of the ‘Ukraine-ification of Taiwan’ is throughout Bierman’s statements, especially given it’s coming from the commanding general of Third Marine Expeditionary Force (III MEF) and of Marine Forces Japan.

Speaking in an unusually open and detailed manner regarding ongoing preparations to defend Taiwan, the US general said the following:

…click on the above link to read the rest…

More War Means More Inflation

Apu Gomes/AFP via Getty ImagesMore War Means More Inflation

Apu Gomes/AFP via Getty ImagesMore War Means More InflationAdvanced economies and emerging markets are increasingly engaged in necessary “wars” – some real, some metaphorical – that will lead to even larger fiscal deficits, more debt monetization, and higher inflation on a persistent basis. The future will be stagflationary, and the only question is how bad it will be.

NEW YORK – Inflation rose sharply throughout 2022 across both advanced economies and emerging markets. Structural trends suggest that the problem will be secular, rather than transitory. Specifically, many countries are now engaged in various “wars” – some real, some metaphorical – that will lead to even larger fiscal deficits, more debt monetization, and higher inflation in the future.

The world is going through a form of “geopolitical depression” topped by the escalating rivalry between the West and aligned (if not allied) revisionist powers such as China, Russia, Iran, North Korea, and Pakistan. Cold and hot wars are on the rise. Russia’s brutal invasion of Ukraine could still expand and involve NATO. Israel – and thus the United States – is on a collision course with Iran, which is on the threshold of becoming a nuclear-armed state. The broader Middle East is a powder keg. And the US and China are facing off over the questions of who will dominate Asia and whether Taiwan will be forcibly reunited with the mainland.

Accordingly, the US, Europe, and NATO are re-arming, as is pretty much everyone in the Middle East and Asia, including Japan, which has embarked on its biggest military build-up in many decades. Higher levels of spending on conventional and unconventional weapons (including nuclear, cyber, bio, and chemical) are all but assured, and these expenditures will weigh on the public purse.

…click on the above link to read the rest…

2023: Expect a financial crash followed by major energy-related changes

Why is the economy headed for a financial crash? It appears to me that the world economy hit Limits to Growth about 2018 because of a combination of diminishing returns in resource extraction together with rising population. The Covid-19 pandemic and the accompanying financial manipulations hid these problems for a few years, but now, as the world economy tries to reopen, the problems are back with a vengeance.

Figure 1. World primary energy consumption per capita based on BP’s 2022 Statistical Review of World Energy. Same chart shown in post,

Today’s Energy Crisis Is Very Different from the Energy Crisis of 2005

.

Figure 1. World primary energy consumption per capita based on BP’s 2022 Statistical Review of World Energy. Same chart shown in post,

Today’s Energy Crisis Is Very Different from the Energy Crisis of 2005

.In the period between 1981 and 2022, the economy was lubricated by a combination of ever-rising debt, falling interest rates, and the growing use of Quantitative Easing. These financial manipulations helped to hide the rising cost of fossil fuel extraction after 1970. Even more money supply was added in 2020. Now central bankers are trying to squeeze the excesses out of the system using a combination of higher interest rates and Quantitative Tightening.

After central bankers brought about recessions in the past, the world economy was able to recover by adding more energy supply. However, this time we are dealing with a situation of true depletion; there is no good way to recover by adding more energy supplies to the system. Instead, the only way the world economy can recover, at least partially, is by squeezing some non-essential energy uses out of the system. Hopefully, this can be done in such a way that a substantial part of the world economy can continue to operate in a manner close to that in the past.

One approach to making the economy more efficient in its energy use is by greater regionalization. If countries can start trading almost entirely with nearby neighbors, this will reduce the world’s energy consumption…

…click on the above link to read the rest…

Washington Has Trouble Refilling The SPR After 220 Million Barrel Draw

After drawing over 221 million barrels of oil from the Strategic Petroleum Reserve (SPR) in 2022, Washington is having a tough time refilling it in the New Year, with the Department of Energy (DoE) rejecting the first offers on the grounds that they failed to benefit taxpayers.

The DoE has by now received several offers for February purchases to refill the SPR, according to both Bloomberg and Reuters. However, those offers have been rejected as too expensive or failing to meet other requirements.

For February, the plan was to purchase 3 million barrels, ideally when oil dropped to around $70 per barrel. This 3-million-barrel pilot program would have given sellers a fixed price for future deliveries and is in contrast to the DoE’s normal operating procedure, which had seen it purchase oil for faster delivery without fixed-price contracts.

Right now, WTI is trading around $75/$76 per barrel, and new data from the Energy Information Administration (EIA) released on Monday shows another 0.8 million barrel draw from the SPR.

According to Bloomberg, citing unnamed sources “familiar with the matter”, the DoE will now postpone its originally planned February purchases and embark on a new approach for fixed-price offers.

“DOE will only select bids that meet the required crude specifications and that are at a price that is a good deal for taxpayers,” the DoE said in a Friday statement carried by news agencies. “Following review of the initial submission, DOE will not be making any award selections for the February delivery window.”

…click on the above link to read the rest…

Ozone Layer Recovers, Limiting Global Warming: UN Report

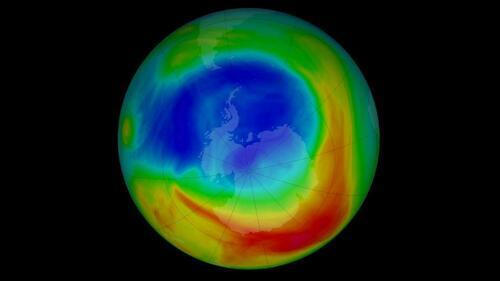

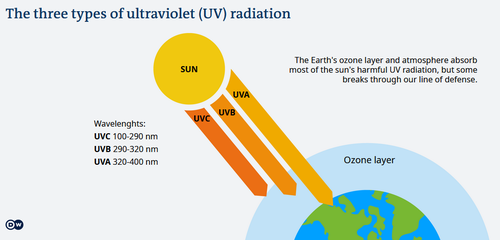

A UN-backed scientific panel tasked with assessing the effects of the 1989 Montreal Protocol – an international agreement to phase out Ozone Depleting Substances – has found that the ozone layer continues to strengthen, and as a result, the earth will avoid 0.3 – 0.5°C of global warming by 2100.

Under the 1989 agreement, 99% of ozone-killing chemicals, including chlorofluorocarbons (CFCs) that once kept fridges cool, were banned due to a thinning of the ozone – also known as an ozone hole – above Antarctica.

In around four decades, the thinning of the Antarctic hole will be completely reversed, according to the report. The much smaller hole above the Arctic is expected to repair much sooner, DW reports.

By 2066, the Antarctic ozone hole is expected to reduce to its size in 1980, while the Arctic hole will do the same around 2045. Thinning around other areas of the globe should recover around 2040.

Beyond CFCs, ozone-eating chemicals including halons, methyl chloroform, carbon tetrachloride, hydrochlorofluorocarbons (HCFCs) and methyl bromide were once abundant in refrigerators, air conditioners, aerosols, solvents and pesticides.

These compounds attack ozone by releasing chlorine and bromine atoms that degrade ozone molecules in the stratosphere.

Since the substances were banned, declining concentrations of chlorine and bromine have helped to limit human exposure to harmful UV rays from the sun that can cause skin cancer, cataracts and suppress the immune system. -DW

“Thanks to a global agreement, humanity has averted a major health catastrophe due to ultraviolet radiation pouring through a massive hole in the ozone layer,” said UN Secretary-General Antonio Guterres last September 16, World Ozone Day.

Impacts on climate change?

Meanwhile, in a fringe benefit that won’t likely silence environmentalists, the panel affirmed the treaty’s positive impact on the climate.

…click on the above link to read the rest…

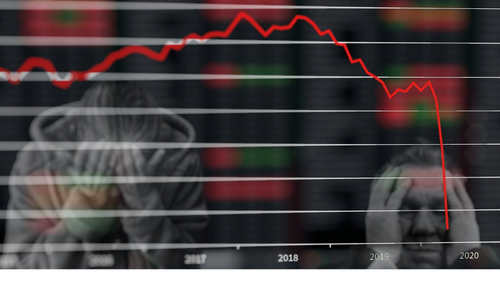

Dr Doom’s Mother-Of-All-Crises Looming

We are yet to see whether it will be a hard landing or a soft landing by the end of 2023.

Biden’s administration has shamelessly pumped thousands of billions of dollars into the state financial system for less than two years announcing even a brand new ‘New Deal’ and new financial incentives. One wonders if these measures make any sense and if they get any support from ordinary Americans? How do the money printing and continual and excessive borrowing reflect onto the U.S. economy, and does it have any effect on global inflation the way it is forecasted by Nouriel Roubini, an economics professor at NYU Stern, nicknamed “Dr. Doom” who is warning us that the mother of all crises is looming?

Time will tell whether these measures make any sense or not. They seem not to for the time being. Biden’s administration spent about 1,900 billion dollars to offset the effects of COVID pandemic and then 400 billion dollars for the unpayable student loans, them being a major financial issue in the U.S. economy. Student loans total at about 600 billion dollars and the growing trend is that there is an ever-increasing number of unpayable student loans. Meanwhile, 400 billion dollars have been invested to stimulate the climate change-related Green Agenda. Furthermore, the Biden administration has been announcing a brand-new New Deal, which would cost 4700 billion dollars but there does not seem to be any effect afterwards. Each plan is followed by a new one, which tends to be more prohibitively expensive, which in fact boils down to merely fulfilling the vacuous pre-election pledges for Biden’s voters rather than actual genuinely effective plans.

…click on the above link to read the rest…

Renewables Are Slowly Approaching Diminishing Returns

Photo by Ryan Grice on Unsplash

Photo by Ryan Grice on UnsplashOnce a source of hope for maintaining our modern lifestyle, renewables are close to hit diminishing returns (i.e.: providing less and less benefit to society with every addition of a new solar panel or wind turbine). For the record: fossil fuels have long passed the same point, where drilling another well or opening a new mine eats up exponentially more resources and energy than the previous one — not to mention kicking CO2 levels even higher. The question is: can we continue high tech civilization now based on renewables, or are we about to hit the same limitations as with every other technology we have used in the past?

Providing data to substantiate claims of hitting diminishing returns is not easy. It goes well beyond “simple” return on investment calculations — it takes a holistic approach, a real cradle to grave assessment if you like. So far I haven’t came across such study (Simon Michaux’s work comes closest), so if you are an independent researcher or student looking for a PhD topic, feel free to elaborate on the subject— just please let me know what you have found.

Until then — as usual — treat the following as thought experiment, and see if it makes sense to you. As always, use your critical thinking skills and don’t take anything I (let alone uneducated people in the mainstream media) say at face value. With that aside let’s see what may be the ominous signs of society hitting diminishing returns when it comes to deploying ‘renewables’ at scale.

…click on the above link to read the rest…

World Bank Warns Global Economy “Perilously Close To Falling Into Recession”

Six months ago, The World Bank slashed its global growth outlook for 2022 and 2023 to +2.9% and +3.0% respectively blaming “the war in Ukraine, lockdowns in China, supply-chain disruptions, and the risk of stagflation” for hammering growth.

Today, in its latest report on global economic prospects, The World Bank has slashed its growth forecast for 2023 by almost a half to just +1.7%, led by weaker growth in all the world’s top economies — the United States, Europe and China.

“Global growth has slowed to the extent that the global economy is perilously close to falling into recession,” the World Bank said.

That would mark the third-weakest pace of global growth in nearly three decades, overshadowed only by the 2009 and 2020 downturns.

The World Bank called on global central banks to remain alert to the risk that aggressively tightening monetary policy to fight inflation could spill across borders. The new report called for discussions between central bankers to “help mitigate risks associated with financial stability and avoid an excessive global economic slowdown in the pursuit of inflation objectives.”

“Weakness in growth and business investment will compound the already devastating reversals in education, health, poverty, and infrastructure and the increasing demands from climate change,” said David Malpass, president of the World Bank.

For now, those central bankers are facing their nemesis… Stagflation…

Though the United States might avoid a recession this year – the World Bank predicts the U.S. economy will eke out growth of 0.5% – global weakness will likely pose another headwind for America’s businesses and consumers, on top of high prices and more expensive borrowing rates.

The United States also remains vulnerable to further supply chain disruptions if COVID keeps surging or the war in Ukraine worsens.

…click on the above link to read the rest…

Andurand: Oil Prices Could Exceed $140 If China’s Economy Fully Reopens

Crude oil prices could exceed $140 per barrel yet this year if China’s economy fully reopens, hedge fund manager Pierre Andurand said on Friday.

Andurand sees the possibility of crude oil demand growing by more than 4 million barrels per day this year—a 4% increase over last year. This far exceeds crude demand growth set out for 2023 by other oil market forecasters.

“I think oil will go upwards of $140 a barrel once Asia fully reopens, assuming there will be no more lockdowns, Andurand said, adding that the “market is underestimating the scale of the demand boost that it will bring.”

Andurand’s forecast goes against the trend that crude oil prices set so far this year. During the first week of the year, crude oil prices tumbled by 9% in the first two trading days in what was the worst start to a year since 1991.

Last week, Andurand said in a tweet that oil demand could increase between 3 and 4 million bpd this year, aided by the switch from oil to gas.

China’s reopening has been on the oil industry’s radar ever since it employed its zero-covid policies and locked down much of its economy. China only recently made significant changes to its covid policies, abandoning its strict measures in favor of relaxed testing requirements and travel restrictions. But China’s reopening has been plagued with a new wave of Covid, spooking many oil bulls off what would be their rejoicing at what should be a significant bump in demand.

Andurand did say last week that oil demand will be limited somewhat by a growth in the EV sector, as EVs have the potential to displace 600,000 bpd of oil demand.

Torrential Rains Trigger Flash Floods Across California

Since the end of December, a ‘parade of cyclones’ has swamped California. The latest round of torrential rain has caused flooding in Los Angeles County, and still unclear in the early morning hours of Tuesday the extent of the destruction, though social media video on Monday evening shows flooded streets, overflowing streams and rivers, and mudslides in what is usually a dry, sunny place where residents have to worry about drought.

National Weather Service said 34 million people are under flood alerts across Southern and Central California through early Tuesday. In Los Angeles County, a flood warning is in effect through the evening.

Dramatic footage has surfaced on social media showing the widespread flooding.

Forecasters estimate the latest round of rain could bring upwards of 5-10 inches in some areas by the end of this week.

More stormy weather is forecasted for today. NWS said heavy precipitation is expected this morning and will begin to taper later in the day, warning a new and “energetic” low-pressure system was becoming more powerful offshore.

Officials said Los Angeles and San Diego residents faced an increased risk of flash flooding and mudslides. Tropical storm-strength winds were also forecast for San Luis Obispo County. Parts of Highway 101, which runs up and down the West Coast, were closed due to flooded-out sections of the major roadway.

Santa Barbara County told residents to shelter in place and closed public schools today. Officials told wealthy residents of Montecito, such as Prince Harry and Meghan, the Duchess of Sussex, to evacuate because of the flooding.

And it was just only six months ago ‘global warming’ alarmists and celebrities were complaining about droughts…

California Governor Gavin Newsom announced yesterday that storms had caused 14 deaths. He said that figure was higher than deaths caused by “wildfires in the past two years combined.”

…click on the above link to read the rest…