Steve Bull's Blog, page 141

January 14, 2023

Nixon Threatened To Reveal CIA’s Involvement In Kennedy Assassination, Roger Stone Claims

A stunning, long-overlooked Nixon Watergate-era tape shows Richard Nixon warning CIA Director Richard Helms that he knows of CIA involvement in the murder of John F. Kennedy- “I know who shot John.”

This shocking new tape depicts Nixon increasingly besieged by Watergate but unaware that at least four of the Watergate burglars were still on the CIA payroll at the time of the break-in, and that the CIA had thus infiltrated the burglary team. Recently declassified documents reveal that Watergate Special Prosecutor Nick Akerman was aware of both the CIA’s advance knowledge and involvement in the break-in — but said and did nothing.

Senator Howard Baker, the Republican Leader on the Senate Watergate Committee and his counsel Fred Thompson himself, a future U.S. Senator from Tennessee, like Baker, stumbled on the CIA’s deep advanced knowledge and direct involvement in the Watergate break-in. Baker and Thompson both knew that at least four of the Watergate burglars were on the CIA payroll at the time of the break-in and that through CREEP Security Director James McCord, had infiltrated the burglary team. Senate Watergate Committee Chairman Sam Ervin stoutly refused to allow Baker and the Committee Republicans including Edward J. Gurney of Florida the right to publish a Minority Report which noted this stunning information regarding the CIA.

Nixon deeply distrusted the CIA because he knew that President Eisenhower had ordered the agency to give top secret briefings to both Nixon and Kennedy after both were the certain nominees of their parties. Nixon was sore that Kennedy utilized the information in their debates, attacking Nixon for being “soft” on communist Cuba, knowing full well that Nixon had chaired a working group as Vice President overseeing preparations for the “Bay of Pigs” invasion. Nixon, of course, could not reveal this upcoming attempt to topple Castro in the details.

…click on the above link to read the rest…

January 13, 2023

Europe Is Being Deindustrialized With a Purpose

Photo by Felix Mittermeier on Unsplash

Photo by Felix Mittermeier on UnsplashThe sun is shining, birds are singing and natural gas demand destruction goes on unabated in the EU. One might ask here: why have TTF gas prices fallen below 70 Eur/MWh (1) actually to even lower levels than in Asia? Mainstream media tries to spin the story that this is largely due to mild weather, energy saving and a rise in US LNG deliveries — and this is where thinking usually stops. According to Irina Slav writing for oilprice.com though:

The first red flags appeared last year: much of the gas consumption decline in Germany that was praised by politicians actually came from demand destruction among industrial users because of prohibitive prices. In other words, gas demand in much of Europe last year fell because it was destroyed and not so much because everyone suddenly became conscientious with their gas use. But demand destruction is not good for the economy. It means shutdowns of factories and layoffs.

In other words: Europe is deindustrializing as expected, and simply shed 20% of it’s gas consumption as a result. Mission accomplished.

Low demand begets low prices. Should the price of Natural Gas fall further still though, it would quickly deter LNG ships to pursue more lucrative business opportunities — i.e.: deliver their gas to Asia instead, where they can sell it for a higher price. That would (will?) leave the EU with even less gas supply. Norwegians alone will surly not able to fill in the gap, especially so that their ‘production’ is actually on a high plateau and about to peak soon (then decline).

…click on the above link to read the rest…

Two Different Perspectives – Same Conclusion: Modern Lifestyles Will End Soon

Dr. Berndt Warm’s Perspective

Thanks to Marromai for finding this new paper by physicist Dr. Berndt Warm.

Dr. Warm uses 5 different methods, 4 relying on economics, and 1 on thermodynamics, to predict when the end of oil production and motor vehicle production will occur. All 5 methods roughly converge on 2030 as the year when modern lifestyles end.

The essay was written in German and translated to English which explains any awkward phrasing.

Warm’s conclusion agrees with my 15 years of study of many different sources which converge on oil production being down by about 50% in 2030. Because our current system requires growth not to collapse, it is plausible that predicting a 50% decline is the same as predicting a 100% decline.

Our world is of course far too complex to make precise predictions, and unexpected events like a pandemic or nuclear war can dramatically change the outcome, however for planning purposes it seems reasonable to assume we have about 5 years left to prepare for a new way of life.

Berndt Warm – Calculations on the Lifespan of Vehicle Production and Petroleum Production – 11-Sep-2022DOWNLOAD

Abstract

Evaluation of five data sets concerning car production, oil prices converted in energy values gives lifespan approximations for the car industry and the oil industry. The result is that the car industry will last only until 2027 and the oil industry some years more.

Here are a few excerpts from the paper:

The author interprets the line of maxima as the oil price that the industrialized countries can afford to the maximum while maintaining their lifestyle. He interprets the line of minima as the price of oil that the producing countries need to keep their economies running. In mid-2019, the author noticed this crossroads and expected a crisis in 2020, although he was completely unclear what kind of crisis it would be. He didn’t expect Corona.

…click on the above link to read the rest…

“Catastrophic Outcomes”: Davos Elite Worried About Global Volatility, Cost-Of-Living Crisis

What happens when plebs can’t afford bread, and the circuses aren’t that entertaining?

Nothing good. Which is why the cost-of-living crisis is the #1 problem, according to the World Economic Forum’s Global Risks Report – an annual poll of 1,200 government, business and civil society professionals.

According to the poll, there will be little respite from “energy inflation, food and security crises” in the coming years (or months?).

In the near term, nearly 70% of those polled say volatile economies and various ‘shocks’ are in the cards, while 20% or so of those polled say they fear “catastrophic outcomes” within the next 10 years, according to Bloomberg.

“Very few leaders in today’s generation have been through these kind of traditional risks around food and energy, while at the same time battling what’s coming up in terms of debt, what’s coming up in terms of climate,” said Saadia Zahidi, WEF managing director, who warned that the world may be entering a “vicious cycle.”

“We’re going to need a sort of new type of leadership that is much more agile,” she told Bloomberg Television.

Next week will mark the annual WEF conference in Davos, Switzerland, where the global elite will sit around and discuss how best to run our lives.

The gathering begins at a time when inflation is at a four-decade-high across many advanced economies, with interest rates far more elevated than anyone was predicting 12 months ago.

The report calls for global cooperation, and warns that if governments mishandle the current crisis they “risk creating societal distress at an unprecedented level, as investments in health, education and economic development disappear, further eroding social cohesion.”

Increases in military expenditure could reduce support for vulnerable households, leaving some countries in a “perpetual state of crisis” and set back the urgent need to tackle climate change and biodiversity loss. -Bloomberg

…click on the above link to read the rest…

China’s Oil Demand Is Set To Hit A Record High In 2023

China’s oil consumption is expected to jump by 800,000 barrels per day (bpd) this year to a record 16 million bpd, after Beijing abandoned the strict ‘zero Covid’ policy and re-opened its borders, a median estimate of 11 China-focused consultants polled by Bloomberg News showed.

Following the initial exit Covid wave after the strictest curbs were lifted, Chinese oil demand is set to rebound from the second quarter onwards, also raising global oil demand for this year, many analysts say.

Despite the fact that China’s crude oil imports in 2022 were slightly lower than the previous year, for a second consecutive year, crude imports in December rose by 4% annually for the third highest monthly purchases in 2022, data showed on Friday.

Despite the current Covid wave, China is preparing for the re-opening with the issuance of a huge batch of oil import quotas for its private refiners.

“Higher quotas support the view of recovering Chinese demand this year and the quicker-than-expected change in Covid policy means that the demand recovery could be more robust than initially expected,” ING strategists Warren Patterson and Ewa Manthey said this week.

Global oil demand in 2023 is expected to grow by around 1.7 million bpd, of which 50% will be driven by China, according to ING, which says “There could be some upside risk to this” forecast.

…click on the above link to read the rest…

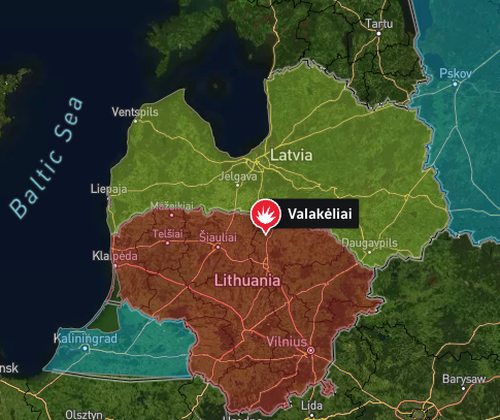

Explosion Rocks Natural Gas Pipeline Connecting Lithuania, Latvia; Village Evacuated

Lithuania natural gas transmission operator Amber Grid told Reuters its pipeline that connects Lithuania to Latvia was rocked by an explosion on Friday.

Footage of the explosion emerged on Twitter in the last 30 minutes.

The location of the blast is in northern Lithuania. Amber Grid said an investigation is underway into the source of the explosion.

Baltic news agency BNS said police evacuated the entire town of Pasvalys, located in northern Lithuania, due to the situation.

“The gas transmission system in the area consists of two parallel pipelines, and initial data indicates that the explosion occurred in one of them,” SKY News said.

Amber Grid’s pipeline flows show where Natgas supplies have been halted.

The grid is an interconnected NatGas transmission system of four countries – Latvia, Belarus, Poland, Russia’s Kaliningrad region, the Klaipėda LNG terminal, and the systems of Lithuania’s gas distribution operators.

A statement from the grid operator read:

On Friday at around 5pm an explosion occurred in the Amber Grid gas pipeline in Pasvalys district. According to initial data, no people were injured. The explosion took place away from residential buildings. The fire is being extinguished by the fire brigades that immediately arrived on the scene.

The gas transmission system in this area consists of two parallel pipelines, and initial data indicate that the explosion occurred in one of them. The other pipeline was not damaged. The gas supply through the damaged pipeline was immediately interrupted, but the Pasvalys district consumers are already being supplied with gas through the adjacent pipeline.

Nemunas Biknius, CEO of the gas transmission system operator Amber Grid, said: “We regret this incident in the gas pipeline system. We immediately started to investigate the circumstances of the incident and ensure gas supply to consumers…

…click on the above link to read the rest…

January 12, 2023

Colder Weather Might Return To Northwest Europe Next Week

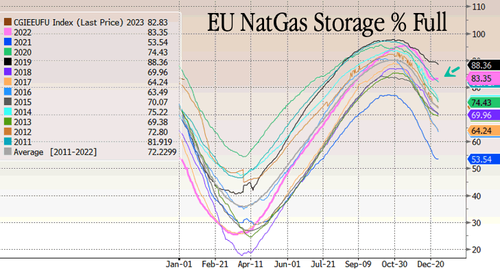

European natural gas prices have plunged to pre-Ukraine invasion levels on mild winter. Heating demand across the EU has declined, allowing fuel storage tanks to continue injections and remain above seasonal levels. This bodes well for the energy-stricken continent, but new weather forecasts suggest a late-month return to winter.

The benchmark Dutch TTF futures contract for February was down to 65.80 euros a megawatt-hour or more than 6% on the session. On the eve of Russia’s invasion last February, the contract sold for about 88 euros.

Several factors have allowed the EU to skirt around an energy crisis, including alternatives to Russian NatGas, such as increased imports of US LNG, widespread conservation efforts for residential and business customers, and a very mild winter.

NatGas stockpiles across the continent are well above a 12-year mean for this time of the year. The percentage of NatGas full has yet to fall from around 83% since Christmas.

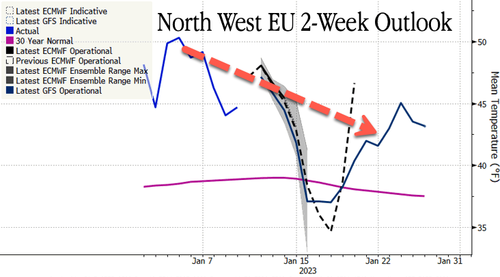

Meanwhile, new weather models are pointing to a possible flip back to colder temperatures next week for parts of Europe. Natgas traders will be focused on the severity of the cold and the impacts on heating demand.

The return of wintry conditions follows a record-warm start to the year, which provided relief from an energy crunch that has hammered Europe for months. The mild weather curbed demand for heating, allowing some countries to top up natural gas stockpiles at a time when they’d usually be tapping supplies.

Most of Britain will see below-average temperatures by the end of next week, with snow possible in northern areas, according to the country’s Met Office. –Bloomberg

A few models show the possible cold snap for parts of the EU next week.

Colder temperatures could be arriving in North West EU in days.

…click on the above link to read the rest…

Zoltan Pozsar, the Four Prices of Money, and the Coming Gold Bull Market

Over the past 100 years there has been a correlation between major equity bear markets, adjustments in one of the four “prices of money,” and gold bull markets. If we let history be our guide, the current equity bear market is signaling a new gold bull market, supported by changes in the price of money.

With equities in a bear market, and the Fed adjusting the price of money, we can expect a gold bull market in the coming years.

With equities in a bear market, and the Fed adjusting the price of money, we can expect a gold bull market in the coming years.One of the more intriguing financial analysts of our times is Zoltan Pozsar, Managing Director and Global Head of Short-Term Interest Rate Strategy at Credit Suisse. In his writings of the past months, one of the things that caught my attention was his framework for multiple prices of money. Remarkably, when I looked up big historical changes in the price of the US dollar, they usually succeeded equity bear markets and introduced gold bull markets. Because equities are in a bear market as we speak, we can expect a gold bull market in the years ahead, enabled by the Federal Reserve changing the price of money.

First, let’s see how changes in the price of the dollar have caused gold bull markets in the past 100 years. Then we will add the stock market.

The Four Prices of Money and Previous Gold Bull Markets

Pozsar’s money framework, which he got from his intellectual mentor Perry Mehrling, states money has four prices:

1) Par, which is the price of different types of the same money. Cash, bank deposits, and money fund shares should always trade at a one-to-one ratio.

2) Interest rates, which is the price of future money.

…click on the above link to read the rest…

Visualizing $65 Trillion In Hidden Dollar Debt

The scale of hidden dollar debt around the world is huge.

As Visual Capitalist’s Dorothy Neufeld details below, no less than $65 trillion in unrecorded dollar debt circulates across the global financial system in non-U.S. banks and shadow banks. To put in perspective, global GDP sits at $104 trillion.

This dollar debt is in the form of foreign-exchange swaps, which have exploded over the last decade due to years of monetary easing and ultra-low interest rates, as investors searched for higher yields. Today, unrecorded debt from these foreign-exchange swaps is worth more than double the dollar debt officially recorded on balance sheets across these institutions.

Based on analysis from the Bank of International Settlements (BIS), the above infographic charts the rise in hidden dollar debt across non-U.S. financial institutions and examines the wider implications of its growth.

Dollar Debt: A Beginners Guide

To start, we will briefly look at the role of foreign-exchange (forex) swaps in the global economy. The forex market is the largest in the world by a long stretch, with trillions traded daily.

Some of the key players that use foreign-exchange swaps are:

CorporationsFinancial institutionsCentral banksTo understand forex swaps is to look at the role of currency risk. As we have seen in 2022, the U.S. dollar has been on a tear. When this happens, it hurts company earnings that generate revenue across borders. That’s because they earn revenue in foreign currencies (which have likely declined in value against the dollar) but end up converting earnings to U.S. dollars.

In order to reduce currency risk, market participants will buy forex swaps. Here, two parties agree to exchange one currency for another. In short, this helps protect the company from unfavorable foreign exchange rates.

What’s more, due to accounting rules, forex swaps are often unrecorded on balance sheets, and as a result are quite opaque.

…click on the above link to read the rest…

January 11, 2023

Ominous Military & Financial Nuclear Threats Could Erupt in 2023

The world is today confronted with two nuclear threats of a proportion never previously seen in history. These threats are facing us at a time when the world economy is about to turn and decline precipitously not just for years but probably decades.

The obvious nuclear threat is the war between the US and Russia which currently is playing out in Ukraine.

The other nuclear threat is the financial weapons of mass destruction in the form of debt and derivatives amounting to probably US$ 2.5 quadrillion.

If we are lucky, the geopolitical event can be avoided but I doubt that the explosion/implosion of the Western financial timebomb can be stopped.

More about these risks later in the article.

There is also a summary of my market views for 2023 and onwards at the end of the article.

CURIOSITY AND RISK

With a business life of over 52 years in banking, commerce and investments, I am fortunate to still learn every day and learning is really the joy of life. But the more you learn, the more you realise how little you really know.

Being a constant and curious learner means that life is never dull.

As Einstein said:

“The important thing is not to stop questioning.

Curiosity has its own reason for existing.”

There has been another important constancy in my life which is understanding and protecting RISK.

I learnt early on in my commercial life that it is critical to identify risk and endeavour to protect the downside. If you can achieve that, the upside normally takes care of itself.

Sometimes the risk is so clear that you want to stand on the barricades and shout. But sadly most investors are driven by greed and seldom see when markets become high risk.

…click on the above link to read the rest…