Steve Bull's Blog, page 139

January 17, 2023

The Fed Is a Purely Political Institution, and It’s Definitely Not a Bank.

Those who know Wall Street lore sometimes recall that Fed chairman William Miller—Paul Volcker’s immediate predecessor—joked that most Americans believed the Federal Reserve was either an Indian reservation, a wildlife preserve, or a brand of whiskey. The Fed, of course, is none of those things, but there’s also one other thing the Federal Reserve is not: an actual bank. It is simply a government agency that does bank-like things.

It’s easy to see why many people might think it is a bank. “Bank” is right there in the name of the twelve regional banks that make up the system: for example, the Federal Reserve Bank of Kansas City. The Fed also enjoys many titles that make it sound like a bank. It’s sometimes called the “lender of last resort.” Or it is sometimes called “a banker’s bank.” Moreover, many people often call the Fed “the central bank.” That phrase is useful enough, but not quite true.

Moreover, even critics of the bank often repeat the myth that the Federal Reserve is “a private bank,” as if that were the main problem with the Federal Reserve. And then there are the economists who like to spread fairy tales about how the Fed is “independent” from the political system and makes decisions based primarily on economic theory as interpreted by wise economists.

The de facto reality of the Federal Reserve is that it is a government agency, run by government technocrats, that enjoys the benefits of being subject to very little oversight from Congress. It is no more “private” than the Environmental Protection Agency, and it is no more a “bank” than the US Department of the Treasury.

It’s a Purely Political Institution…click on the above link to read the rest…

Why the Cornucopia of False Solutions to Climate Change?

Painting: Cornelis van Haarlem – The Hesperides Filling the Cornucopia – oil on canvas, 1622

Painting: Cornelis van Haarlem – The Hesperides Filling the Cornucopia – oil on canvas, 1622For some decades now, a steady stream of marvelous solutions to climate change have paraded past, to great fanfare…most of them false. Some of them have come by twice, like the glorious Hydrogen Economy, which now comes in several colors, and CCS—Carbon Capture and Sequestration. CCS wore the shiny black dress of “Clean Coal” last time and is now calling itself CCUS, with the U standing for Usage. Mostly this means using captured carbon dioxide to push more oil out of old depleted wells. Even if the CO2 stays in the old well, the oil it pushes out will release more emissions than are sequestered—yet there are fat subsidies for doing this, in the name of climate action.

Then there’s nuclear power—that one has popped up again just lately, now in the guise of Small Modular Reactors. Being small and modular won’t change the many reasons nuclear power is a very bad idea, from the lack of safe ways to dispose of the waste—still, after half a century of piling it up—to its vulnerability to terrorism and accidents, to its being the most expensive of all energy sources.

There are various flavors of schemes to burn biomass to produce power, from wood-fired electricity to generating liquid fuels from corn or other crops. So far none of these looks to be sustainable or effective (effective at reducing emissions, that is—they may be very effective at garnering subsidies). As deforestation is a leading cause of climate change, burning wood to make electricity is senseless. Burning agricultural waste removes needed organic matter from soils. An occasional small biomass project may make sense, but this is not a significant way of replacing fossil fuels.

…click on the above link to read the rest…

Peter Schiff: Inflation Is Going to Win the War

The CPI data for December buoyed markets and raised hopes that the Federal Reserve is winning its war against inflation. But in his podcast, Peter explained that the Fed isn’t winning the war. It is losing and will ultimately surrender to inflation.

Markets rallied after the CPI data appeared to show further cooling in price inflation. Most people assume that means the central bank can be less aggressive and ease up on rate hikes in the coming year. And if there is enough progress, many people think the Fed will reverse course and start cutting interest rates later in 2023.

Peter said he agrees that there is a good chance the Fed will cut rates this year. And he thinks there is an even better chance the central bank returns to quantitative easing, whether it cuts rates or not. But this pivot won’t be because of a victory in the war against inflation.

No. They’re going to surrender. Inflation is going to win that war. The Fed is going to run to fight another battle — at least it’s going to try to fight because it’s going to lose that battle too. That battle is going to be recession, maybe financial crisis, maybe a battle to try to prop up the US government whose insolvency is becoming a bigger problem with rising interest rates.”

The US government continues to run massive budget deficits even as its interest costs rise. Interest payments on the debt rose 41% in 2022. According to the Peterson Foundation, the jump in interest expense was larger than the biggest increase in interest costs in any single fiscal year, dating back to 1962.

If interest rates remain elevated or continue rising, interest expenses could climb rapidly into the top three federal expenses. (You can read a more in-depth analysis of the national debt HERE.)

…click on the above link to read the rest…

The Energy Transition Will Run Through the Copper Gauntlet

And it may not survive

Image by Dijana from Pixabay

Image by Dijana from PixabaySince the 2018 IPCC climate report laid out the calamitous consequences of our unbridled carbon emissions, every pathway published by academics and think tanks that claim to save us from ourselves involves the expansion of solar and wind farms as well as net-zero and carbon capture dreams of unbridled optimism.

Net-Zero, the idea that we can keep emitting greenhouse gasses only if we somehow capture or offset those emissions by some yet-to-be-determined means was a dubious proposition at best. It relies on untested-at-scale projects such as carbon capture and sequester (CCS) as well as accounting fantasies that pretend a young sapling that takes 50 years to grow offsets the carbon released from the burning of a mature tree today after being shipped overseas.

Net-Zero plans also assume a rapid and universal deployment of renewable energy-capturing machines a.k.a. solar panels and wind generators. Unfortunately, contrary to their portrayal in mainstream media, solar panels and windmills do not produce renewable energy. These are machines designed to capture and transform energy (electromagnetic or kinetic) available to them and they are manufactured, installed, maintained, and replaced using fossil fuels.

It’s astonishing how the continual absence of any credible carbon removal technology seems to never affect net-zero policies. Whatever is thrown at it, net zero carries on without a dent in the fender.

Senior Lecturer in Global Systems, University of Exeter

Many other metals and rare earth elements have received a great deal of attention due to their exotic-sounding names, relative scarcity, and utilization in cutting-edge technologies, but one of the most critical minerals to the energy transition that is essential to curtailing the most serious effect of climate change is also one that the human race has learned to work earliest — copper.

…click on the above link to read the rest…

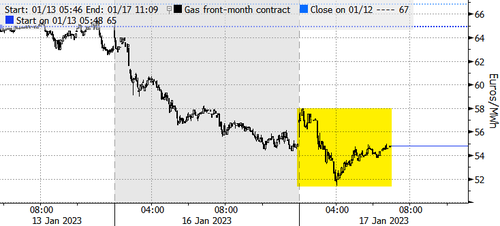

French And German Power Prices Soar As Cold Sweeps Europe

After a mild start to the year, cold weather sweeping across western Germany, France, and the UK led to a surge in electricity prices on Tuesday.

French day-ahead power prices jumped to 135 euros a megawatt-hour, a 42% increase versus the rolling two-week average. The cause of the price spike is a surge in heating demand and delays in restarting nuclear plants.

Day-ahead prices in Germany, Europe’s largest economy, increased as much as 16% Tuesday.

“Cold is expected to grip areas from the mid-continent to west, including in western Germany, France and the UK where average departures from normal range anywhere between 2-6 degrees Celsius below normal,” Matthew Dross, a meteorologist at Maxar Technologies, told Bloomberg.

Dross said the cold spell “will increase heating demand for those regions to above normal levels.”

Despite colder weather and increasing heating demand, Dutch front-month natural gas futures, Europe’s benchmark, slid as much as 7.3% after rising 4.6%. Prices have clawed back some losses after tagging 16-month lows.

Mild temperatures are expected to return next week, denting demand once more. Morgan Stanley recently wrote that Europe’s NatGas consumption in the year to October could be as low as 16% below the five-year average.

“Even if it makes gas-fired power plants increasingly competitive with coal-fired power plants, it does not lead to an increase in gas demand for power generation because” other cheaper power generation sources will be used first, Engie SA’s EnergyScan wrote in a note.

* * *

Record warmth spread across Europe in the first half of January. Temperatures in the energy-stricken continent felt more like spring as several metropolitan areas recorded the warmest temperatures on record. Now a pattern shift is underway as parts of northwest Europe brace for a cold snap starting Monday.

…click on the above link to read the rest…

January 16, 2023

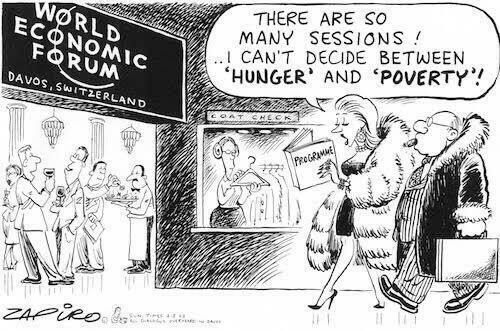

“Distasteful Masterclass In Hypocrisy”: Elites Swarm Davos In Private Jets To Discuss Climate Crisis

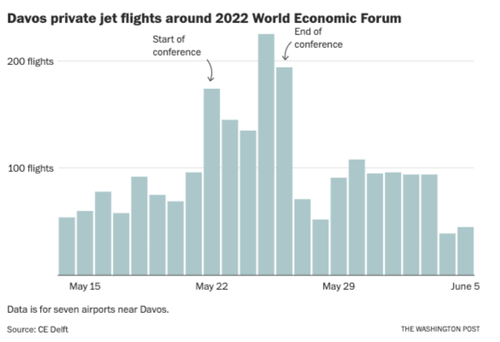

The annual conference of the World Economic Forum begins today in Davos, Switzerland. Global elites landed in luxurious private jets over the last few days in airports around Davos to discuss important global challenges, such as climate change, behind closed doors.

“The rich and powerful are swarming to Davos to discuss climate and inequality behind closed doors using the most unequal and polluting form of transport: private jets,” Klara Maria Schenk, transport campaigner for Greenpeace’s European mobility campaign, told news website Politics.co.uk.

Greenpeace International published a new report that showed 1,040 private jets flew in and out of airports around Davos for last year’s meeting, causing CO2 emissions from private jets to increase four times more versus a weekly average.

“Given that 80% of the world’s population has never even flown, but suffers from the consequences of climate-damaging aviation emissions, and that the WEF claims to be committed to the 1.5°C Paris Climate Target, this annual private jet bonanza is a distasteful masterclass in hypocrisy. Private jets must be consigned to history if we are to have a green, just and safe future for all. So-called world leaders must lead by example and ban private jets and useless short-haul flights,” added Schenk.

WEF hopes to tackle what they believe is a climate crisis plaguing the world despite most attendees arriving by private jets, which are the most polluting mode of transport per passenger

And motorcades of WEF attendees were spotted in gas-guzzling SUVs and high-end sedans.

Meanwhile, climate protesters spent Monday morning blocking at least one airport used by the super-rich.

…click on the above link to read the rest…

Claims Of A Lower CPI Cannot Inflate Away Reality

Yes, we have a problem, and claims of a lower CPI cannot inflate away the reality that inflation hurts consumers. To start with consider the argument inflation is much higher than the government reports. That said, Jay Powell is most likely very serious about ending the Fed put which has been a huge contributor to the wealth effect and inequality. This has also been a big driver of financial and economic growth.

If Powell accomplishes his goal it is expected to result in a more “responsible” and less speculative financial system. As things stand, most Americans are watching their wages falling behind the price of goods. As people are forced to buy less economic growth slows. This would of course extend down to falling prices as the wealth effect slams into reverse. All this brings with it risk and probably a lot of pain. This issue is intensified because the ability to simply roll over debt and refinance has been greatly diminished. Both liquidity and rates reduce this possibility. Trends are not friendly to growth anywhere in the world.

Lower CPI Does Not Signal Growth Ahead

Lower CPI Does Not Signal Growth AheadEven if inflation drops like a stone, that does not mean it will not return with a vengeance or signal growth will pick up. Feeding into this is that many people today do not want to work. The five-day service sector office work week became a thing of the past when people were told to stay home during the pandemic. Mediocre production on the part of workers coupled with the potential that Geo-political issues may soon create a slew of new commodity shortages. Supply chain problems and disruptions tend to limit the supply side of growth.…click on the above link to read the rest…

“A New System” – Inside the Davos Summit 2023WEF conference looks set to focus on what the globalist elite can learn from the failures of their “pandemic” narrative.

WEF conference looks set to focus on what the globalist elite can learn from the failures of their “pandemic” narrative.

The World Economic Forum’s annual meet-up kicks off tomorrow. Politicians, corporate giants, “philanthropists” and all manner of elite monstrosities gather for a weekend of telling each other how smart they are and making the world generally worse.

But what’s on the menu this year?

Well, here are the five main items up for discussion, according to the WEF’s website:

See if you can notice a pattern:

Addressing the Current Energy and Food Crises in the context of a New System for Energy, Climate and NatureAddressing the Current High Inflation, Low Growth, High Debt Economy in the context of a New System for Investment, Trade and InfrastructureAddressing the Current Industry Headwinds in the context of a New System for Harnessing Frontier Technologies for Private Sector Innovation and ResilienceAddressing the Current Social Vulnerabilities in the context of a New System for Work, Skills and CareAddressing the Current Geopolitical Risks in the context of a New System for Dialogue and Cooperation in a Multipolar WorldNow, none of this is news. A “new system” for energy is a “green new deal”, a “new system” for international cooperation is some type of global governance, and a “new system” for investment and trade covers a lot of topics, including digital currency.

Like I said, nothing new, but it’s always refreshing to see it in print, with no effort to hide it.

It’s also interesting that they don’t use the phrases “new normal”, “great reset” or “build back better” anywhere on the page, despite the fact it’s obviously what they’re talking about.

A little victory for the alternate media, who have clearly raised enough awareness that those phrases are now considered too tainted to use.

…click on the above link to read the rest…

January 15, 2023

The evolution of credit and debt in 2023

The evidence strongly suggests that a combined interest rate, economic and currency crisis for the US and its western alliance will continue in 2023.

This article focuses on credit, its constraints, and why quantitative easing has already crowded out private sector activity. Adjusting M2 money supply for accumulating QE indicates the degree to which this has driven the US tax base into deep recession. And the wider effects on credit in the economy should not be ignored.

After a brief partial recovery from the covid crisis in US government finances, they are likely to start deteriorating again due to a deepening recession of private sector activity. Funding these deficits depends on foreign inward investment flows, which are faltering. Rising interest rates and an ongoing bear market make funding from this source hard to envisage.

Meanwhile, from his public statements President Putin is fully aware of these difficulties, and a consequence of the western alliance increasing their support and involvement in Ukraine makes it almost certain that Putin will take the opportunity to push the dollar over the edge.

Credit is much more than bank deposits

Economics is about credit, and its balance sheet twin, debt. Debt is either productive, in which case it can extinguish credit in due course, or it is not, and credit must be extended or written off. Money almost never comes into it. Money is distinguished from credit by having no counterparty risk, which credit always has. The role of money is to stabilise the purchasing power of credit. And the only legal form of money is metallic; gold, silver, or copper usually rendered into coin for enhanced fungibility.

…click on the above link to read the rest…

How Can We Trust Institutions That Lied?

How Can We Trust Institutions That Lied?

How Can We Trust Institutions That Lied?Trust the Authorities, trust the Experts, and trust the Science, we were told. Public health messaging during the Covid-19 pandemic was only credible if it originated from government health authorities, the World Health Organization, and pharmaceutical companies, as well as scientists who parroted their lines with little critical thinking.

In the name of ‘protecting’ the public, the authorities have gone to great lengths, as described in the recently released Twitter Files (1,2,3,4,5,6,7) that document collusion between the FBI and social media platforms, to create an illusion of consensus about the appropriate response to Covid-19.

They suppressed ‘the truth,’ even when emanating from highly credible scientists, undermining scientific debate and preventing the correction of scientific errors. In fact, an entire bureaucracy of censorship has been created, ostensibly to deal with so-called MDM— misinformation (false information resulting from human error with no intention of harm); disinformation (information intended to mislead and manipulate); malinformation (accurate information intended to harm).

From fact-checkers like NewsGuard, to the European Commission’s Digital Services Act, the UK Online Safety Bill and the BBC Trusted News Initiative, as well as Big Tech and social media, all eyes are on the public to curtail their ‘mis-/dis-information.’

“Whether it’s a threat to our health or a threat to our democracy, there is a human cost to disinformation.” — Tim Davie, Director-General of the BBC

But is it possible that ‘trusted’ institutions could pose a far bigger threat to society by disseminating false information?

Although the problem of spreading false information is usually conceived of as emanating from the public, during the Covid-19 pandemic, governments, corporations, supranational organisations and even scientific journals and academic institutions have contributed to a false narrative.

…click on the above link to read the rest…