Steve Bull's Blog, page 1280

October 20, 2017

There’s only one way to avoid climate catastrophe: ‘de-growing’ our economy

Jason Hickel: You can almost feel the planet writhing. This summer brought some of the biggest, most destructive storms in recorded history: Harvey laid waste to huge swathes of Texas; Irma left Barbuda virtually uninhabitable; Maria ravaged Dominica and plunged Puerto Rico into darkness. The images we see in the media are almost too violent to comprehend. And these are the storms that made the news; many others did not. Monsoon flooding in India, Bangladesh and Nepal killed 1,200 people and left millions homeless, but Western media paid little attention: it’s too much suffering to take in at once.

What’s most disturbing about this litany of pain is that it’s only going to get worse. A recent paper in the journal Nature estimates that our chances of keeping global warming below the danger threshold of 2 degrees is now vanishingly small: only about 5 per cent. It’s more likely that we’re headed for around 3.2 degrees of warming, and possibly as much as 4.9 degrees. If scientists are clear about anything, it’s that this level of climate change will be nothing short of catastrophic. Indeed, there’s a good chance that it would render large-scale civilization impossible.

If scientists are clear about anything, it’s that this level of climate change will be nothing short of catastrophic

Why are our prospects so bleak? According to the paper’s authors, it’s because the cuts we’re making to greenhouse gas emissions are being more than cancelled out by economic growth. In the coming decades, we’ll be able to reduce the carbon intensity (CO2 per unit of GDP) of the global economy by about 1.9 per cent per year, they say, if we make heavy investments in clean energy and efficient technology. That’s a lot. But as long as the economy keeps growing by more than that, total emissions are still going to rise.

…click on the above link to read the rest of the article…

Manure: An Overview of This Shi…ning Addition to the Garden

MANURE: AN OVERVIEW OF THIS SHI…NING ADDITION TO THE GARDEN

Organic gardens really benefit from manure, and that is no mystery. However, it’s important to be aware of what kind of manure is at your disposal because they are not all equally desirable. Some manures, dare we say, are choice garden additions, while others take a lot of coaxing, a slow and patient cook, from composting gurus. Chicken manure is vastly different from cow manure, which is largely different dog manure.

Understanding some of the subtleties of manure, even in the most basic of ways, can make a huge difference to how, when, and for what you are using a particular pile. For those of us who aren’t connoisseurs of manures, it’s important to get a grasp of which ones we’d most like to get our hands on (or in) and which ones aren’t necessarily best suited for growing our food but could be useful elsewhere. So, with no further puns, let us dive head first into the wonderful world of animal excrement.

MANURE IS MAGNIFICENT

Firstly, it seems useful to know why it is that manure is such a valuable commodity. In the garden, it does two things very well: amends the soil and fertilizes the plants. Dry, well-rotted manure is great for retaining water and very useful in sandy soils, whereas the same thing goes along way in lightening up dense clay soils. In either case, fast-draining or compacted soils, manure helps reduce runoff and nutrient leaching. As far as fertilizing, manure carries a good punch of nitrogen (The type of manure changes the levels) and other nutrients, both of which release it slowly (Again, the speed changes via type) to the plants. It’s also full of microbes, which up the amount of soil life, thus fertility, in the garden.

…click on the above link to read the rest of the article…

Get Ready To Party Like It’s 2008

Apparently Treasury Secretary, ex-Goldman Sachs banker Steven Mnuchin, has threatened Congress with stock crash if Congress doesn’t pass a tax reform Bill. His reason is that the stock market surge since the election was based on the hopes of a big tax cut. This reminds me of 2008, when then-Treasury Secretary, ex-Goldman Sachs CEO, Henry Paulson, and Fed Chairman, Ben Bernanke, paraded in front of Congress and threatened a complete systemic collapse if Congress didn’t authorize an $800 billion bailout of the biggest banks.

The U.S. financial system is experiencing an asset “bubble” that is unprecedented in history. This is a bubble that has been fueled by an unprecedented amount of Central Bank money printing and credit creation. As you are well aware, the Fed printed more than $4 trillion dollars of currency that was used to buy Treasury bonds and mortgage securities. But it has also enabled an unprecedented amount of credit creation. This credit availability has further fueled the rampant inflation in asset prices – specifically stocks, bonds and housing, the price of which now exceeds the levels seen in 2008 right before the great financial crisis.

However, you might not be aware that Central Banks outside of the U.S. continue printing money that is being used to buy stocks and risky bonds. The Bank of Japan now owns more than 75% of that nation’s stock ETFs. The Swiss National Bank holds over $80 billion worth of U.S. stocks, $17 billion of which were purchased in 2017. The European Central Bank, in addition to buying member country sovereign-issued debt is now buying corporate bonds, some of which are non-investment grade.

…click on the above link to read the rest of the article…

A New Oil Crisis Is Developing In The Middle East

After over 40 years in the energy business, more than two decades of that with a parallel career in intelligence, I regularly witness the impact of global developments on the energy markets.

So it’s hardly surprising that I often address geopolitical events here.

Currently, situations in Latin America (Venezuela), Asia (the South China Sea crisis), and Africa (ongoing civil conflict in Libya and Nigeria) show how widespread the geopolitical impact is on energy prices and availability.

Each one either is, or could easily, spike oil price volatility.

But the instability in a different region remains the biggest single factor in how the two sectors interact…

The Middle East.

There, two significant events unfolded over the past week. Each is certain to have an impact on how crude oil trades in the near-term.

The curious de-certification of JCPOA (the Joint Comprehensive Plan of Action, more popularly known as the “Iranian nuclear accord”), by President Trump, was followed in short order by the ominous hostilities between Iraq and Kurdistan over the status of the city and region of Kirkuk.

Both impact the northern Persian Gulf, already a region with a short fuse.

The toppling of Raqqa, the self-styled ISIS capital, may be underway in Syria, but the ongoing cross-border disagreements have already spread elsewhere.

And they could set the whole region on fire…

Sanctions Don’t Work Very Well

First, take the Iranian nuclear deal. Decertifying it was a curious choice by the White House, as it actually accomplishes very little.

The move kicks the can back to Congress, where the legislative branch has 60 days to decide whether the U.S. remains in the accord.

What it does do, of course, is increase volatility.

…click on the above link to read the rest of the article…

Australia’s east coast gas crisis will be permanent

Australia comes up with yet another grand energy policy in which gas is supposed to deliver dispatchable (peak) power. From the Prime Minister’s website:

NATIONAL ENERGY GUARANTEE TO DELIVER AFFORDABLE, RELIABLE ELECTRICITY

17/10/2017

“….delivering more gas for Australians before it’s shipped offshore”

Fig 1: Turnbull’s game changer and level playing field. Convincing?

https://www.pm.gov.au/media/2017-10-17/national-energy-guarantee-deliver-affordable-reliable-electricity

Let’s see how this miracle was achieved. The year 2017 didn’t start well. In February NSW had load shedding of 300 MW for a couple of peak hrs during which an aluminium smelter had to be partially turned off.

14 Feb 2017 NSW’s privatized giveaway coal plant causes load shedding in extreme weather

http://crudeoilpeak.info/nsws-privatized-giveaway-coal-plant-causes-load-shedding-in-extreme-weather

Turnbull’s gas walks to Canossa

Historical context: Prime Minister Turnbull, as Environment Minister under Howard, approved massive LNG export projects from Western Australia without a national domgas policy in place including imposing on the gas industry a condition to build a pipeline to the east, where conventional gas reserves were already known to be limited, as described in this excerpt from Howard’s energy white paper 2004:

…click on the above link to read the rest of the article…

Censorship in the Digital Age

The grand experiment with western democracy, badly listing thanks to broadsides from profiteering oligarchs, may finally run ashore on the rocks of thought crime. In the uneven Steven Spielberg project Minority Report, starring excitable scientologist Tom Cruise, Cruise plays a futuristic policeman who investigates pre-crimes and stops them before they happen. The police owe their ability to see the criminal plots developing to characters called pre-cognitives, or pre-cogs, kind of autistic prophets who see the future and lie sleeping in sterile pools of water inside the police department. Of course, it turns out that precogs can pre-visualize different futures, a hastily hidden flaw that threatens to jeopardize the profits of the pre-crime project. Here is the crux of the story: thought control is driven by a profit motive at bottom. As it turns out, just like real life.

Now, the British government has decided to prosecute pre-crime but has done away with the clunky plot device of the pre-cogs, opting rather to rely on a hazy sense of higher probability to justify surveilling, nabbing, convicting, and imprisoning British citizens. The crime? Looking at radical content on the Internet. What is considered radical will naturally be defined by the state police who will doubtless be personally incentivized by pre-crime quotas, and institutionally shaped to criminalize trains of thought that threaten to destabilize a criminal status quo. You know, the unregulated monopoly capitalist regime that cuts wages, costs, and all other forms of overhead with psychopathic glee. Even a Grenfell Towers disaster is regarded more as a question of how to remove the story from public consciousness than rectify its wrongs.

The Triple Evils

Martin Luther King, Jr. famously, or infamously, depending on whether you are a penthouse mandarin or garden-variety prole, linked the triple evils of poverty, racism, and militarism.

…click on the above link to read the rest of the article…

What Should Be the Criteria for Model Selection?

In order to make the data “talk,” economists utilize a range of statistical methods that vary from highly complex models to a simple display of historical data. It is generally held that by means of statistical correlations one can organize historical data into a useful body of information, which in turn can serve as the basis for assessments of the state of the economy. It is held that through the application of statistical methods on historical data, one can extract the facts of reality regarding the state of the economy.

Unfortunately, things are not as straightforward as they seem to be. For instance, it has been observed that declines in the unemployment rate are associated with a general rise in the prices of goods and services. Should we then conclude that declines in unemployment are a major trigger of price inflation? To confuse the issue further, it has also been observed that price inflation is well correlated with changes in money supply. Also, it has been established that changes in wages display a very high correlation with price inflation.

So what are we to make out of all this? We are confronted here not with one, but with three competing “theories” of inflation. How are we to decide which is the right theory? According to the popular way of thinking, the criterion for the selection of a theory should be its predictive power.

On this Milton Friedman wrote,

The ultimate goal of a positive science is the development of a theory or hypothesis that yields valid and meaningful (i.e., not truistic) predictions about phenomena not yet observed.

So long as the model (theory) “works,” it is regarded as a valid framework as far as the assessment of an economy is concerned. Once the model (theory) breaks down, we look for a new model (theory).

…click on the above link to read the rest of the article…

Canada’s Hunt For Taxes Turns on Minimum Wage Earners

The hunt for taxes has turned to employees of companies. Any benefit you give an employee is considered “soft-income” and is to be taxed. In the USA, the maximum value of a gift I can hand an employee is $25. I can’t even give them a decent bottle of champagne for New Years.

In Canada, this same idea of taxing any employee benefit has gone all the way to hunting the minimum wage earners. The politicians have classified any discount an employee gets as tax-avoidance and they want their nickel and dime. A minimum wage store employee who gets a 20% discount on anything the store sells or if a waitress gets a free meal while working is to be taxed. The Income Tax Act of the Canada Revenue Agency is now targeting not the “rich” but minimum wage earners since the rich are leaving. When an employee receives any sort of a discount on merchandise or a free meal because of their employment, the value of the discount is to be included in the employee’s income and taxed.

The hunt for taxes is just going to get worse until the people rise up, as they have always done, and probably start yelling the same words: No Taxation Without Representation!” Politicians are doing the same thing that sparked the French Revolution with their arrogance when taxes reduced the standard of living and people could no longer survive. The response of the government was “let them eat cake” and that did not sit very well even if those words were not really spoken – it was the rumor attached to Marie Antoinette.

The hunt for taxes is just going to get worse until the people rise up, as they have always done, and probably start yelling the same words: No Taxation Without Representation!” Politicians are doing the same thing that sparked the French Revolution with their arrogance when taxes reduced the standard of living and people could no longer survive. The response of the government was “let them eat cake” and that did not sit very well even if those words were not really spoken – it was the rumor attached to Marie Antoinette.

China and Russia: Full Steam Ahead Towards a Cashless Society

We reported back in November 2016 – Cashless World: 1 out of 3 People Never Use Cash – fewer and fewer people understand the importance of using cash to protect themselves from an overarching government warlord. At the time China’s use of digitized currency was growing at about 40% per annum. This means millions of people each year freely hand over their cash and opt to use their cell phone, online currency transfers or a plastic debit/credit card to make 100% of their purchases. We see this as nothing short of happily going into the gulag of digital enslavement.

Today we learned China is taking another step toward being a cashless society. Not just any cashless society, but the largest populated nation on the planet. Please keep in mind this announcement is coming on the heels of China’s closest ally, Russia, announcing she would be issuing a crypto-ruble – Which is a digitized currency as well. Once these two nations go cashless that will be a huge blow to hard currency in circulation around the world.

Yesterday, Cointelegraph reported that local news sources in Russia had been informed by the Minister of Communications, Nikolay Nikiforov, that President Putin has approved a plan for the issue of a “CrypoRuble.” There was no detail, however, on timeline and no any subsequent confirmation that we’ve seen. Coincidentally, or not, Nikiforov is quoted as saying “I confidently declare that we run (sic) CryptoRuble for one simple reason: if we do not, then after 2 months our neighbors in the EurAsEC will.” Source

As ZeroHedge reported

In a story that seems to have gone largely unnoticed by the western press, the China Daily reported that the PBoC has successfully designed a prototype that can regulate its future supply of digital fiat currency.

…click on the above link to read the rest of the article…

October 19, 2017

These Are The Top Geopolitical Risks According To The World’s Largest Asset Manager

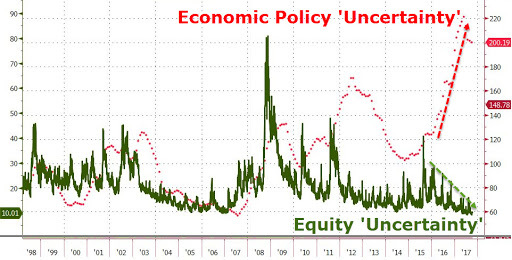

Like many others, the world‘s largest money manager with $5.9 trillion in (ETF) investments, BlackRock, is not too worried about a market which no matter what, promptly rebounds from any and every selloff, and seems to close at all time highs day after day as if by magic. To be sure, BlackRock’s employees are delighted: the less the volatility, and the higher the S&P goes, the more likely retail investors are to hand over their cash to BlackRock. So far so good. Still, not even Blackrock can state that after looking at this chart, which unveils unprecedented economic policy uncertainty at a time when equity uncertainty has never been lower…

… that everything is ok.

And it doesn’t: in a blog post by BlackRock’s Isabelle Mateos y Lago, Blackrock’s chief multi-asset strategist writes that while markets may be a sea of calm, geopolitics are anything but. As a result, the world’s biggest ETF administrator has its eyes on 10 geopolitical risks and is tracking their likelihood and potential market impact, as it wrote recently in the firm’s Global Investment Outlook Q4 2017.

The “world of risk” map below is a quick snapshot of all

Among the Top risks tracked by Blackrock are:

North American trade negotiations

Russia-NATO conflict

South China Sea conflict

US-China tensions

Escalations in Syria and Iraq

North Korea conflict

Fragmentation in Europe

Gulf conflicts

Of the risks listed above, which are the ones BlackRock is most worried about? According to Mateos y Lago, the top three right now: North American trade negotiations, a North Korea conflict and U.S.-China tensions, with the second and third particularly interrelated.

…click on the above link to read the rest of the article…