Steve Bull's Blog, page 1276

October 24, 2017

Liquidity Provider Signals Collapse In Global ETF Trading

Trading in low cost, passive investment products might be more vulnerable than some thought. Global ETF trading collapsed by 14% in Q3 2017 versus Q2 2017 – and was described as “unusually slow”. Global ETF trading in September 2017 was 24% lower than the same month a year ago.

For those unfamiliar, Flow Traders NV is a global electronic liquidity provider specializing in exchange-traded products (ETPs). The Company continuously quotes bid and ask prices for ETPs listed across the globe, both on and off exchange, in all asset classes. Flow Traders is a proprietary trading firm with offices in the Netherlands, Singapore, the USA, and Romania.

Today’s results from specialized ETF trader, Flow Traders NV (Euronext: FLOW), fell well short of consensus, with trading volume both for the company and the ETF market significantly lower in Q3 2017 versus the previous quarter. The share price rose 1.98%. This from Bloomberg:

[24 October 2017 at 13:54:31 UTC+1] Zero Hedge: Flow Traders Misses on Weak Volumes, Margins]

Flow Traders 3Q Ebitda was 14% below consensus and driven by weaker volumes and margins in Europe, says Morgan Stanley (equal weight).

Net was 2% below consensus due to one-off tax rebates

U.S. revenue was down 53% Y/y, hurt by weaker volumes and low market volatility

3Q net trading income EU31.7 million

Flow Traders expects “declining trend in cost growth to continue in 4Q17 towards the lower end of the guided 15-20% cost growth target range for full year 2017”

Flow Traders intends to increase the pay-out ratio to at least 75% of its net earnings over 2017

The results summary below taken from Flow Traders’ quarterly earnings release shows a quarter-on-quarter decline in the company’s ETP trading (Exchange Traded Products – basically ETFs) of 14% and 9% in Europe and the Americas, respectively. More significantly, the bottom three lines show that the total value of ETF trading fell by 14% and 15% in the Europe and Americas, respectively, and by 14% on a global basis.

…click on the above link to read the rest of the article…

California Wildfires Inflict More Devastation

Among recent natural disasters striking the U.S. are devastating wildfires that torched California’s wine country, destroyed thousands of homes and killed more than 40 people, report Dennis J Bernstein and Miguel Gavilan Molina.

The Tubbs neighborhood in Santa Rosa, Sonoma County, one of the hardest hit by the recent fires in Northern California, looked like some of the worst bombed-out and scorched neighborhoods in Syria with little left standing other than a few red brick chimneys and the burnt-out shells of cars and heavy metal appliances.

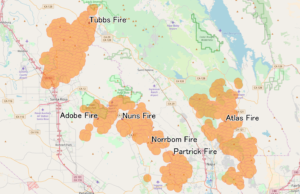

A map of the 2017 Northern California wildfires from October 5 to October 12. (Wikipedia)

According to CalFire, the three largest fires in California’s Wine Country — the Tubbs, Atlas and Nuns — have burned more than 182,000 acres in Sonoma and Napa counties. The total number of houses and businesses destroyed is estimated at more than 5,700 buildings with a death count of more than 40 people. In the Tubbs Fire alone, 17 people died, making it among the deadliest fires in the state’s history.

Pacifica’s Flashpoints program broadcast live from the Arlene Francis Center in Santa Rosa with interviews with Santa Rosa City Council Member Julie Combs and Sonoma County Supervisor James Gore.

Dennis Bernstein: Let me first begin with you, Councilwoman Julie Combs. … Let’s start on a personal note. We were talking before we went on air and I was thinking it must be horrifying to have a tree fall on your house. But then you said….

Julie Combs: I’d rather have a tree than a fire. I was very lucky. I am okay but my heart is with my whole city and my whole city is still recovering.

Dennis Bernstein: Tell us some of the stories you have heard.

…click on the above link to read the rest of the article…

Is Europe Repeating the 1930s?

Europe is now replicating the 1930s and the mistakes it made with austerity back then as well outside of Germany. Of course, Merkel has imposed the German view of austerity based on their experience but has ignored the opposite experience of the rest of Europe that led to the 1931 Sovereign Debt Crisis and mass defaults.

It was the year of 1925 when then chancellor of the Exchequer, Winston Churchill, returned Britain to the gold standard. Britain was trying desperately to reestablish itself as the financial capital of the world as if nothing had taken place. Returning to the gold standard resulted in wages being forced down to compete with America.John Maynard Keynes at the time pleaded that this was madness. The pound was overvalued against the dollar by 10% trying to reestablish confidence in Britain but the net result crippled exports and unemployment began to rise and workers engaged in strikes for having wages reduced even though the pound was worth more officially.

Churchill acted in an effort to restore Britain but he was dead wrong. Keynes proved to be correct and this lesson has still been ignored by Europe today. The overvalued pound led to deflation and ultimately forced the economic collapse in 1931. The capital was fleeing Britain and bankers were pleading for austerity to retain bond values. The Labour government collapsed and a coalition national government was formed. They ignored the pleas of the bankers and abandoned the gold standard overnight. The pound fell from $4.85 to $3.40 against the dollar.

NEVERTHELESS, despite the dire forecasts of ultimate catastrophic consequences if Britain abandoned the gold standard, the economy held and began to recover. There was no revolution in the streets as predicted.

…click on the above link to read the rest of the article…

4 In 10 Canadians Can Not Cover Basic Expenses Without Going Deeper In Debt

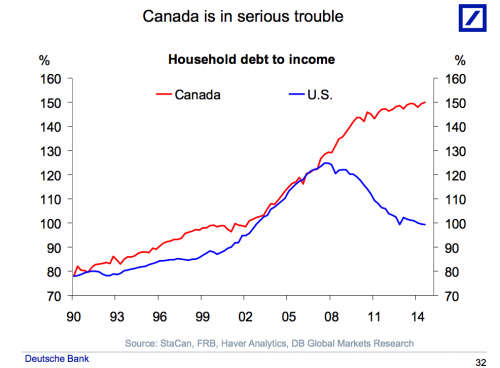

Back on July 13, when the BOC hiked rates by 25bps to 0.75% – its first rate hike in 7 years – followed by another unexpected rate hike in September, we documented some troubling trends among Canadian households, including the record household debt-to-income ratio…

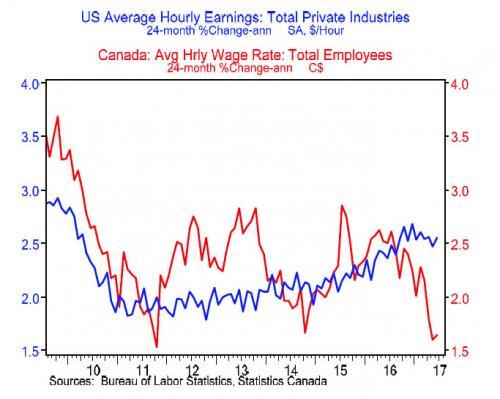

… the sliding average hourly wages…

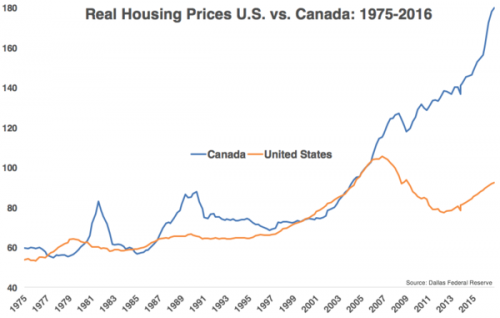

… as well as the unprecedented Canadian housing bubble which puts US home prices to shame…

… followed by a just as troubling observation that Canadian reliance on housing has never been greater in the form of loans secured by property reaching an all time high…

… we warned that the combination of rising interest rates and Canada’s record reliance on debt, would be a dangerous combination.

Our fears were confirmed three months later, when BNN reported that a survey released yesterday found that almost half of Canadian households don’t feel financially prepared for further interest rate increases.

According to the Ipsos poll, conducted on behalf of MNP, 40% of respondents said they fear ending up in financial trouble if rates go up much higher, with one-in-three already feeling the impact of higher rates.

“It’s clear that people are nowhere near prepared for a higher rate environment,” MNP President Grant Bazian said in a release. “The good news is that there seems to be at least the acknowledgement now that rates are going to climb which might make people reassess their spending habits – especially using credit.”

It gets worse: 42% of respondents said they don’t think they can cover basic expenses over the next year without going deeper into more debt. The same number said they’re within $200 of not being able to cover monthly expenses.

…click on the above link to read the rest of the article…

Yawning Debt Trap Proves the Great Recession is Still On

While David Stockman stated early this year with resolute certainty that the debt ceiling debate would blow congress up and send the nation reeling over the financial precipice, I avoided jumping on the debt-ceiling bandwagon. While I was convinced major rifts in the economy would start to show up in the summer, I was not convinced they would have anything to do with the debt ceiling debate. If there is anything you can be certain of this in endless recovery-mode economy, it is that the US will just keep pushing its bags of bonds up a hill until it can finally push no more. So, I figured another punt down the road was more likely.

While David Stockman stated early this year with resolute certainty that the debt ceiling debate would blow congress up and send the nation reeling over the financial precipice, I avoided jumping on the debt-ceiling bandwagon. While I was convinced major rifts in the economy would start to show up in the summer, I was not convinced they would have anything to do with the debt ceiling debate. If there is anything you can be certain of this in endless recovery-mode economy, it is that the US will just keep pushing its bags of bonds up a hill until it can finally push no more. So, I figured another punt down the road was more likely.The Debt Ceiling Debate that Didn’t Happen

The reason I didn’t think that debate would blow apart is that Republicans have more than once experienced the political reality that comes from taking the nation to the brink of default or of shutting down government. Each time that kind of thing has happened, it has hurt Republicans far more than it has hurt Democrats. I doubted establishment Repubs (the majority) had the stomach to take us through another credit downgrade, though I’ve noted such an event was possible.

Unsurprisingly to me, then, Congress did the only thing it seems to be capable of any more and just kicked that can a little further down the road with hardly a kerfuffle about it. Hurricane Harvey made things a lot easier for congress to kick the can again by providing a good excuse to dodge that unwanted debate on the basis of massive human suffering that truly did need tending to. Much-talked-about government shutdown put off for a better time

…click on the above link to read the rest of the article…

Inside the Doughnut

Book review:

Doughnut Economics: Seven Ways to Think Like a 21st-Century Economist

(Random House, 2017)

I doubt many people would have betted that this year’s hot new concept for a healthy economy would be that bad food staple, the doughnut. But with the publication of Kate Raworth’s book, it’s come to pass. The idea of the ‘doughnut’ is that there is (1) a lower social limit for human flourishing, beneath which welfare is limited by shortfalls in such things as food, education and housing, and (2) an outer ecological limit for human flourishing, beyond which welfare is limited by overshoot in such things as climate change, ocean acidification and nitrogen and phosphorous loading. These two limits constitute respectively the inner and outer rings of the ‘doughnut’, the sweet spot within which humanity must try to remain. I have to confess I’m not greatly moved by the metaphor, which doesn’t seem to go much beyond the truth that individually people can have too little, and collectively they can take too much. And too much of what – is there really a conceptual equivalence between taking too much water or fossil energy, and taking too much health, as Raworth’s ‘doughnut’ diagram (p.51) seems to imply? Whatever the case, she hangs a lot of sensible and lucid analysis off the concept in a genuinely thought-provoking, if for me ultimately unsatisfactory, book.

In the first part of the book Raworth dissects orthodox economic theory, showing how it frames the world in questionable but powerful and largely hidden ways that buttress right-wing, ‘free’ market politics, while silencing other modes of thinking.

…click on the above link to read the rest of the article…

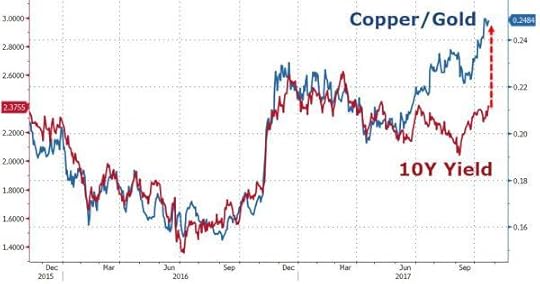

Gundlach Warns “The Order of The Financial System Is About To Be Turned Upside Down”

“I’m not a big fan of bonds right now,” may seem like an odd way for the so-called Bond King to begin, but in an audience at Vanity Fair’s Establishment Summit, DoubleLine’s Jeff Gundlach told Bethany McLean, “I haven’t been really [a fan of bonds] for the past four years, even though I manage them, and institutions have to own them for various reasons.”

Gundlach urged investors to be “light” on bonds.

As Vanity Fair’s William Cohan reports, Gundlach admitted “I’m stuck in it,” of his massive bond portfolio, adding that interest rates have bottomed out and been rising gradually for the past six years.

Gundlach said his job now, on behalf of his clients, “is to get them to the other side of the valley.”

When the bigger, seemingly inevitable hikes in interest rates come, “I’ll feel like I’ve done a service by getting people through,” he said.

“That’s why I’m still at the game. I want to see how the movie ends.”

But it can’t end well. To illustrate his point about the risk in owning bonds these days, Gundlach shared a chart that showed how investors in European “junk” bonds are willing to accept the same no-default return as they are for U.S. Treasury bonds, pointing out that this phenomenon has been caused by “manipulated behavior” by central banks.

European interest rates “should be much higher than they are today,” he said,

“…[and] once Draghi realizes this, the order of the financial system will be turned upside down and it won’t be a good thing.

It will mean the liquidity that has been pumping up the markets will be drying up in 2018…

…Things go down. We’ve been in an artificially inflated market for stocks and bonds largely around the world.”

…click on the above link to read the rest of the article…

Dear Spain, Mainstream Media: A Majority of Catalans Want Independence (Stop Saying Otherwise)

Even though 92% of voters in the Catalonia election voted for independence, mainstream media keeps repeating the lie that a majority in Catalonia were against independence. Here’s the real math.

Mainstream Media Lies

Yesterday, the Wall Street Journal repeated this frequently stated lie “A majority of Catalonia’s 7.5 million inhabitants don’t support independence, recent polls show.”

Today, ABC news repeated the stale news we have heard so many times before: “Until this crisis erupted, polls showed about 70 per cent of Catalans wanted to vote in an independence referendum. But only 41 per cent were actually in favour of cutting ties with Spain.”

These media outlets all parrot each other. Lies get repeated over and over and over. The Guardian and countless other places made the statement. No one bothers to link to or even cite the date of the “recent poll”.

I believe the allegedly “recent” poll was taken in July. Regardless, it was superseded by a more recent poll.

Most Recent Poll

The most recent poll was taken October 1. The results are as posted above. Counting ballots confiscated by Madrid, the real turnout was 57%.

Some may dispute the number of confiscated ballots. Don’t blame me, blame Madrid. If Madrid did not confiscate ballots and prevent people from voting, that reporting issue would not be in play.

It’s a certainty those confiscated ballots were overwhelmingly in favor of independence. In addition to the confiscated ballots, many who wanted to vote were forced away by Madrid police.

Its likely that yes had an outright majority from the 770,000 stolen votes alone. Add in other suppressed votes and its a certainty yes had an outright majority.

Dear mainstream media, the majority of Catalonia wanted independence. Please stop your lies.

The FBI’s Forgotten Criminal History `

Photo by Dave Newman | CC by 2.0

President Trump’s firing of FBI chief James Comey last May spurred much of the media to rally around America’s most powerful domestic federal agency. But the FBI has a long record of both deceit and incompetence. Five years ago, Americans learned that the FBI was teaching its agents that “the FBI has the ability to bend or suspend the law to impinge on the freedom of others.” This has practically been the Bureau’s motif since its creation in 1908.

The bureau was small potatoes until Woodrow Wilson dragged the United States into World War I. In one fell swoop, the number of dangerous Americans increased by perhaps twentyfold. The Espionage Act of 1917 made it easy to jail anyone who criticized the war or the government. In September 1918, the bureau, working with local police and private vigilantes, seized more than 50,000 suspected draft dodgers off the streets and out of the restaurants of New York, Newark, and Jersey City. The Justice Department was disgraced when the vast majority of young men who had been arrested turned out to be innocent.

In January 1920, J. Edgar Hoover — the 25-year-old chief of the bureau’s Radical Division — was the point man for the “Palmer Raids.” Nearly 10,000 suspected Reds and radicals were seized. The bureau carefully avoided keeping an accurate count of detainees (a similar pattern of negligence occurred with the roundups after the 9/11 attacks). Attorney General Mitchell Palmer sought to use the massive roundups to propel his presidential candidacy. The operation took a drubbing, however, after an insolent judge demanded that the Justice Department provide evidence for why people had been arrested. Federal judge George Anderson complained that the government had created a “spy system” that “destroys trust and confidence and propagates hate. A mob is a mob whether made up of government officials acting under instructions from the Department of Justice, or of criminals, loafers, and the vicious classes.”

…click on the above link to read the rest of the article…

Neo-Liberalism: From Laissez-Faire to the Interventionist State

One of the most accusatory and negative words currently in use in various politically “progressive” circles is that of “Neo-Liberalism.” To be called a “Neo-Liberal” is to stand condemned of being against “the poor,” an apologist for the “the rich” and a proponent of economic policies leading to greater income inequality.

The term is also used to condemn all those who consider the market economy to be the central institution of human society, at the expense of senses of “community” and shared caring and concern beyond supply and demand. A Neo-Liberal is one who reduces everything to market-based dollars and sense, and disregards the “humane” side of mankind, say the critics of Neo-Liberalism.

The opponents of Neo-Liberalism, so defined, claim that its proponents are rabid, “extremist” advocates of laissez-faire, that is, a market economy unrestrained and unrestricted by government regulations, controls or redistributive fiscal policies. It represents and calls for the worst features of the “bad old days” before socialism and the interventionist-welfare state, each in their respective “radical” or “moderate” ways, attempted to abolish or rein in unbridled, “anti-social” capitalism.

The Birth of Neo-Liberalism: Walter Lippmann and a Paris Conference

The historical fact is that these descriptions have little or nothing to do with the origin of Neo-Liberalism, or what it meant to those who formulated it and its policy agenda. It all dates from about eighty years ago, with the publication in 1937 of a book by the American journalist and author, Walter Lippmann (1889-1974), entitled, An Inquiry into the Principles of the Good Society, and an international conference held in Paris, France in August of 1938 organized by the French philosopher and classical liberal economist, Louis Rougier, centered around the themes in Lippmann’s book. A transcript of the conference proceedings was published later in 1938 (in French) under the title, Colloquium Walter Lippmann.

…click on the above link to read the rest of the article…