Steve Bull's Blog, page 1278

October 22, 2017

One River CIO “We’re Willing Participants In Our Own Demise”

With the world’s focus falling on Beijing this week, where president Xi Jinping give a glowing account of China’s future during the 19th Party Congress, boasting that “the banner of scientific socialism with Chinese characteristics is now flying high and proud for all to see,” not all are impressed by China’s vision of the world in which China sees itself as increasingly taking over from the US as the world’s superpower. And it’s not just stories about China’s neverending behind the scenes bailouts of anything that may telegraph a hard landing for the economy (as decribed in “China’s Government Is Expected To Buy 24% Of All Residential Real Estate For Sale In 2017“); it’s the country’s entire financial system, which Kyle Bass has been shorting for nearly two years now but which he has failed to recognize now holds the entire world hostage: if it goes, so does the global financial system, unleashing a worldwide depression the likes of which have not been seen.

Here is Eric Peters, CIO of One River Asset Mgmt, explaining why everyone is wrong about the $35 trillion Chinese financial system, and yet how Beijing has figured out a way to become a parasite on the global financial system, resulting in an outcome in which “we’re willing participants in our own demise.”

Excerpted from One River’s latest Weekend Notes:

“China’s financial system is a hermetically sealed snow globe,” he said. “They’ve built a system to resemble ours on the surface, but scratch it and you discover something altogether foreign.”

China has banks. They lend money. But pierce the patina and you find a vast subsidy machine, with no cold-blooded allocation of capital. There are no defaults to speak of; just bailouts, no reckonings.

…click on the above link to read the rest of the article…

An ecological view of Trump’s trade war

Whether you regard President Donald Trump’s rejection of America’s trade agreements as a good thing or a bad thing, few people understand what canceling them would mean. From an ecological point of view, abruptly pulling out of trade agreements, agreements which have resulted in innumerable long-term investments and commitments, is the ecological equivalent of a reduction in scope.

A reduction of scope means that occupational niches which arise specifically to facilitate trade in shipping by land, sea and air, manufacturing for export, warehousing, finance, insurance, government employment (such as customs officials and coast guard forces) and other trade-related occupations, all are endangered when the scope of their activities is reduced as a result of new trade restrictions.

To understand what this means, we need to understand the flipside of scope reduction, scope enlargement. From an ecological perspective the increase in world trade over the last few centuries has in a manner of speaking allowed local populations to escape the tyranny of Liebig’s Law of the Minimum. In the mid-19th century, Justus von Liebig observed that plant growth was strictly governed by the least available of a plant’s necessary nutrients. Adding other essential nutrients simply wouldn’t overcome the limitation imposed by the least available one.

In the absence of trade, Liebig’s Law acts like a brake on a local community, preventing it from expanding beyond the carrying capacity afforded by its least available essential resources. In dry areas, it might be water. In others it might be arable land. In yet others farmland might be plentiful, but a lack of metal mines might prevent the widespread use of metal tools that could enhance agricultural and manufacturing productivity.

…click on the above link to read the rest of the article…

Health Alert: Fatal Airborne Transmission of Pneumonic Plague Spreading at Alarming Rate. These Lifesaving Antibiotics are Your Best Defense

[Editor’s Note: Have you noticed how deadly outbreaks have been occurring more frequently? Remember the Ebola scare? Or the avian flu epidemic? While many of these spread in third world countries, they are escalating in severity. Mother Nature may be telling us something.

Presently, the pneumonic plague or as many of us know as The Black Death has resurfaced and it’s airborne. Thus far, 684 plague cases and 57 deaths have occurred from an airborne transmission of the plague in Madagascar and Seychelles. One fact is certain, this outbreak is spreading at an alarming rate and many in the affected area are scrambling for face masks, supplies and most importantly, antibiotics.

Only time will tell if this outbreak moves to other parts of the world, but it is important to keep a vigilant eye on this health crisis and know how to protect yourself to mitigate the effects.]

There has been an outbreak of plague, the pneumonic form that can be transmitted directly through airborne transmission, involving direct contact with someone who has been infected. Although this is taking place far away on the islands of Madagascar and Seychelles off the coast of East Africa, the Ebola outbreak a few years ago showed that such outbreaks cannot always be completely confined.

There has been an outbreak of plague, the pneumonic form that can be transmitted directly through airborne transmission, involving direct contact with someone who has been infected. Although this is taking place far away on the islands of Madagascar and Seychelles off the coast of East Africa, the Ebola outbreak a few years ago showed that such outbreaks cannot always be completely confined.

Dave Hodges released an excellent piece recently, entitled “Something Very Big and Very Evil is About to Happen” that is worth reading, especially concerning the special warehouse facilities where government medicine and supplies are being stockpiled throughout the nation. Another very relevant article is entitled “An alarming development as the Bubonic Plague is now confirmed in the Seychelles while hundreds of new cases suspected in Madagascar“. The reason this plague is so bad is that it is readily transmissible, it is a pneumonic plague (which is more severe), and fatalities are occurring within 24 hours.

…click on the above link to read the rest of the article…

The Importance of Guilds and Nitrogen Fixers

THE IMPORTANCE OF GUILDS AND NITROGEN FIXERS

How is it that the natural world provides excessive abundance while not relying on any external sources of nutrients? Nature produces her own fertility needs, firstly through accumulating organic matter on the soil surface which protects the soil, adds to the layer of humus, and stimulates the biological activity of the soil. The natural world, however, also takes advantage of the abundance of nitrogen in the air to supply plants with one of the most important nutrients they need. Our air is made up of almost 70% nitrogen, and almost all plants need major amounts of nitrogen for healthy growth. Nature, then, was left with the question of how to take the nitrogen from the air and deposit it in the soil where plants could use it.

Nitrogen fixing plants have the ability to absorb the nitrogen in the air through their leaves and “fix” the nitrogen in the soil through nodules that grow on their roots. Leguminous plants such as beans and peas do this as well as many other different types of trees, bushes, and shrubs. If you have ever pulled up a bean plant by accident when weeding your garden, you may have noticed many small white nodules sticking to the roots of that plant. Those nodules are pure nitrogen and are contributing to the growth of the plant and to the overall soil health. When that bean plant dies, the nitrogen in the nodules stays in the soil. With nitrogen-fixing trees and bushes, pruning the branches causes the tree to “shed” some of its root systems. The nitrogen nodules “fixed” onto those roots are then released into the surrounding soil for other plants to take advantage of.

…click on the above link to read the rest of the article…

October 21, 2017

Unprecedented Housing Bailout Revealed, As China Property Sales Drop For First Time In 30 Months

Back in March, we explained why the “fate of the world economy is in the hands of China’s housing bubble.” The answer was simple: for the Chinese population, and growing middle class, to keep spending vibrant and borrowing elevated, it had to feel comfortable and confident that its wealth will keep rising. However, unlike the US where the stock market is the ultimate barometer of the confidence boosting “wealth effect”, in China it has always been about housing: three quarters of Chinese household assets are parked in real estate, compared to only 28% in the US with the remainder invested financial assets.

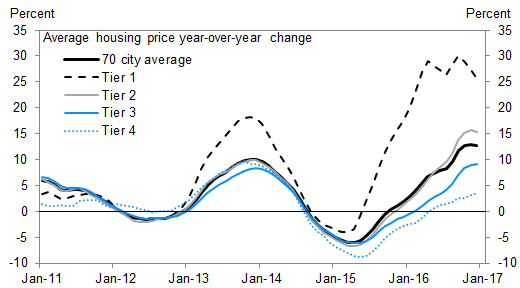

Beijing knows this, of course, which is why China periodically and consistently reflates its housing bubble, hoping that the popping of the bubble, which happened in late 2011 and again in 2014, will be a controlled, “smooth landing” process.

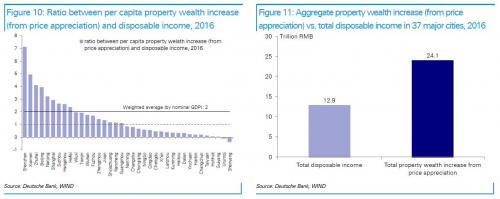

The other reason why China is so eager to keep its housing sector inflated – and risk bursting bubbles – is that as shown in the chart below, in 2016 the rise of property prices boosted household wealth in 37 tier 1 and tier 2 cities by RMB24 trillion, almost twice the total local disposable income of RMB12.9 trillion. For any Fed readers out there, that’s how you create a wealth effect, fake as it may be.

Unfortunately for China, whose record credit creation in 2017, and certainly in the months leading up to the 19th Chinese Communist Party Congress which started last week, has been the primary catalyst for the “global coordinated growth”, the good times are now again over, and according to the latest real estate data released last week, property sales in China dropped for the first time since March 2015, or more than two-and-half years, in September and housing starts slowed sharply reinforcing concerns that robust growth in the world’s second-largest economy is starting to cool.

…click on the above link to read the rest of the article…

Political Economics

Who President Trump ultimately picks as the next Federal Reserve Chairman doesn’t really matter. Unless he goes really far afield to someone totally unexpected, whoever that person will be will be largely more of the same. It won’t be a categorical change, a different philosophical direction that is badly needed.

Still, politically, it does matter to some significant degree. It’s just that the political division isn’t the usual R vs. D, left vs. right. That’s how many are making it out to be, and in doing so exposing what’s really going on.

As usual, the perfect example for these divisions is provided by Paul Krugman. The Nobel Prize Winner ceased being an economist a long time ago, and has become largely a partisan carnival barker. He opines about economic issues, but framed always from that perspective.

To the very idea of a next Fed Chair beyond Yellen, he wrote a few weeks ago, “we’re living in the age of Trump, which means that we should actually expect the worst.” Dr. Krugman wants more of the same, and Candidate Trump campaigned directly against that. As such, there is the non-trivial chance that President Trump lives up to that promise.

Again, it sounds like a left vs. right issue, but it isn’t. The political winds are changing, and the parties themselves are being realigned in different directions (which is not something new; there have been several re-alignments throughout American history even though the two major parties have been entrenched since the 1850’s when Republicans first appeared). Who the next Fed Chair is could tell us something about how far along we are in this evolution.

What Krugman wants, meaning, it is safe to assume, what all those like him want, is simple: success. He believes that the central bank has given us exactly that, therefore it is stupid to upset what works.

…click on the above link to read the rest of the article…

Volatility and the Alchemy of Risk

Reflexivity in the Shadows of Black Monday 1987

The Ouroboros, a Greek word meaning ‘tail devourer’, is the ancient symbol of a snake consuming its own body in perfect symmetry. The imagery of the Ouroboros evokes the infinite nature of creation from destruction. The sign appears across cultures and is an important icon in the esoteric tradition of Alchemy. Egyptian mystics first derived the symbol from a real phenomenon in nature. In extreme heat a snake, unable to self-regulate its body temperature, will experience an out-of- control spike in its metabolism. In a state of mania, the snake is unable to differentiate its own tail from its prey, and will attack itself, self-cannibalizing until it perishes. In nature and markets, when randomness self-organizes into too perfect symmetry, order becomes the source of chaos (1).

The Ouroboros is a metaphor for the financial alchemy driving the modern Bear Market in Fear. Volatility across asset classes is at multi-generational lows. A dangerous feedback loop now exists between ultra-low interest rates, debt expansion, asset volatility, and financial engineering that allocates risk based on that volatility. In this self-reflexive loop volatility can reinforce itself both lower and higher. In a market where stocks and bonds are both overvalued, financial alchemy is the only way to feed our global hunger for yield, until it kills the very system it is nourishing.

The Global Short Volatility trade now represents an estimated $2+ trillion in financial engineering strategies that simultaneously exert influence over, and are influenced by, stock market volatility(2). We broadly define the short volatility trade as any financial strategy that relies on the assumption of market stability to generate returns, while using volatility itself as an input for risk taking. Many popular institutional investment strategies, even if they are not explicitly shorting derivatives, generate excess returns from the same implicit risk factors as a portfolio of short optionality, and contain hidden fragility.

…click on the above link to read the rest of the article…

Fact: Your Chances of Surviving a Post-Collapse Urban Environment are Slim

ReadyNutrition Readers, Simply put, urban survival will be quite a bit different from survival in a remote wilderness area or even a sparsely-populated suburban area. Let’s game some options, remembering that these options are general. These actions aren’t specific to the type of breakdown of society (external by an attack from a foreign nation, or internal from economic collapse, for examples).

ReadyNutrition Readers, Simply put, urban survival will be quite a bit different from survival in a remote wilderness area or even a sparsely-populated suburban area. Let’s game some options, remembering that these options are general. These actions aren’t specific to the type of breakdown of society (external by an attack from a foreign nation, or internal from economic collapse, for examples).

So, we have our collapse. Let us “X” out a nuclear war/nuclear terrorist attack, as we can deal with all the other scenarios in variables without radiation to contend with. Let’s identify the largest challenges faced for that high-rise apartment resident in Manhattan, or the family in the brownstone on the South side of Chicago. First, let’s game the scenario:

After “The Day,” the city was almost completely without power. You and your wife and two children were not able to leave town. All mass transit was halted or discontinued. It has been three days, and your family has been listening to static on the radio for the most part, with “campy” pre-recorded disaster broadcasts that have not been helpful or informative. One of your neighbors left this morning after saying goodbye: he and his family had a boat, and they were heading out of the harbor, hoping to use one of the major rivers to make an escape.

They didn’t have room to take you or yours, but you wanted to stay put and not follow your neighbor’s idea: that there were plenty of boats whose owners were not going to use them…probably dead following the rioting and civil breakdown. You’re beginning to think you should have listened to him. Now you can hear angry voices outside, and you go to the window. A mob has gathered at the top of your street!

…click on the above link to read the rest of the article…

450,000 Take To Barcelona’s Streets, Led By Catalan Separatist President, Chanting “Time To Declare Independence”

With Spain officially pulling the trigger on Article 155, and activating the Spanish Constitutional “nuclear option” this morning, when PM Rajoy said he would seize control of the Catalan government, fire everyone and force new elections in six months, attention has shifted to the Catalan response. And as we waited for the official statement by Catalan separatist president Carles Puigdemont, expected at 9pm local time, we found him taking to the streets, where he led hundreds of thousands of independence supporters in protest around Barcelona on Saturday, shouting “freedom” and “independence” following the stunning news from Madrid earlier on Saturday.

The protest in the center of the Catalan capital had initially been called to push for the release of the leaders of two hugely influential grassroots independence organisations, accused of sedition and jailed pending further investigation. But it took on an even angrier tone after Prime Minister Mariano Rajoy announced his government would move to dismiss the region’s separatist government, take control of its ministries and call fresh elections in Catalonia.

According to municipal police, over 450,000 people rallied on Barcelona’s expansive Paseo de Gracia boulevard, spilling over on to nearby streets, many holding Catalonia’s yellow, red and blue Estelada separatist flag.

Catalan regional vice-president Oriol Junqueras and Catalan regional president

Carles Puigdemont attend a demonstration on October 21, 2017 in Barcelona

Protesters greeted Puigdemont’s arrival at the rally with shouts of

“President, President.” The rest of his executive was also there.

For at least some locals, the time to split from Spain has come: “It’s time to declare independence,” said Jordi Balta, a 28-year-old stationery shop employee quoted by AFP, adding there was no longer any room for dialogue.

Others disgree: “The Catalans are completely disconnected from Spanish institutions, and particularly anything to do with the Spanish state,” said Ramon Millol, a 45-year-old mechanic.

…click on the above link to read the rest of the article…

Kyle Bass: “Today’s Market Resembles The 1987 Debacle On Steroids”

The US stock market celebrated the 30th anniversary of Black Monday with the 2017 version of a rocky trading day: Stocks sold off early, with S&P 500 futures recording their steepest post-midnight drop of the year. But the dip was reflexively and aggressively bought, and stocks even poked back into the green seconds before the close as algos mistook a repetitive Politico headline about Jay Powell’s chances of becoming the next Fed chair for news – leaving us with yet another record close.

Of course, the historical juxtaposition of the 1987 crash with today’s unnaturally placid markets practically forced even the most bullish of traders to question how much longer the present market paradigm – where markets listlessly drift through a seemingly interminable series of record highs while trading volume and volatility remain suppressed – can possibly last.

With that question in mind, Real Vision released a video early today containing interviews with some of the biggest names in the hedge fund universe. Though the interview was shot a few weeks ago, remarks from Hayman Capital’s Kyle Bass resonated with market’s mood.

Bass discussed what he sees as the many short- and long-term risks to the US equity market, including the rise of algorithmic trading and passive investment, which have enabled investors to take risks without understanding what they’re doing, leaving the market vulnerable to an “air pocket.”

And with so many traders short vol, Bass said investors will know the correction has begun when a 4% or 5% drop in equities snowballs into a 10% to 15% decline at the drop of a hat.

…click on the above link to read the rest of the article…