Steve Bull's Blog, page 1182

February 23, 2018

Iran Threatens To Abandon Nuclear Deal If Western Banks Don’t Start Doing Business

Iran says it will withdraw from the 2015 nuclear deal if big banks continue to avoid doing business with the Islamic republic, deputy foreign minister Abbas Araghchi said on Thursday, speaking from London.

The Islamic Republic agreed to restrict its nuclear program in exchange for the removal of crippling sanctions by the United States, Britain, China, France, Germany and Russia.

Following the deal, however, major banks have continued to avoid doing business with Iran for fear of violating remaining U.S. sanctions – which Iran says has hampered their efforts to rebuild foreign trade and attract investment.

Most of it is because of this atmosphere of uncertainty which President Trump has created around JCPOA, which prevents all big companies and banks to work with Iran, it’s a fact, and it’s a violation lead by the United States. –Abbas Araghchi

Compounding Iran’s woes are comments from President Trump, who told Europeans on January 12 that they must “fix the terrible flaws of the Iran nuclear deal” or he would re-impose the sanctions lifted by the Obama administration as part of the pact. Trump set a May 12 deadline to review fresh “waivers” on U.S. sanctions.

The May 12 deadline represents an opportunity for Trump to pull the U.S. out of another international deal. He has already abandoned the Paris climate accord and the Trans-Pacific Partnership, a 12-nation trade deal. He wants to renegotiate the North American Free Trade Agreement, a 24-year-old trade pact with Canada and Mexico. –USA Today

Trump sees three major defects in the deal; its failure to address Iran’s ballistic missile program, the terms by which inspectors are allowed to visit suspected Iranian nuclear enrichment sites, and “sunset” clauses on Iran’s nuclear program which expire after 10 years.

Araghchi contends that Trump’s interpretation of the sunset clause is incorrect, and that Trump’s continued trash-talking is in violation of the deal itself;

…click on the above link to read the rest of the article…

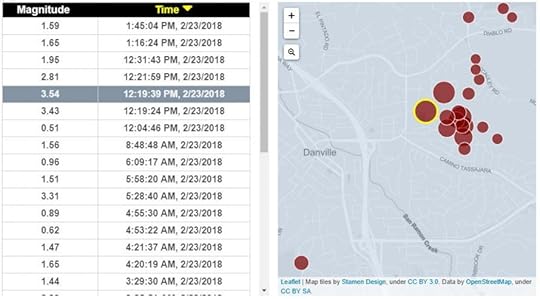

“What Just Hit Us?” – Bay Area Rattled By Unusual Quake Swarm, Trains Delayed

Following “strained” magma chamber concerns at Yellowstone, Bay Area residents have grown increasingly concerned this week as a swarm of well over 50 earthquakes has struck in recent days…

Culminating in at least 32 quakes in the last 24 hours as large as magnitude 3.6 which struck the East Bay town of Danville around 3pmET today.

“It’s been nuts. It wakes us up every night. We have a little dog, sleeps on the bed with us, and he freaks out all the time,” said Danville resident Christian Sommer.

Bay Area Rapid Transit (BART) trains were impacted by the quakes with trains delayed.

“Looking in that general region, I’m counting 55 quakes just in the last week,” said Amy Vaughan, a geophysicist with the Geological Survey.

8 fault lines run through the bay.

Several more significant temblors then shook up Diablo area businesses at midday – the strongest being a 3.6.

“I was sitting at my desk when the first one hit,” said Danville resident Brenda Hammer. “And I thought something hit the building was my initial reaction. What just hit us?”

There was another swarm of quakes just three days ago on Tuesday.Some in the East Bay are busy retrofitting for a bigger quake.

This swarm comes just a few weeks after a 4.4 quake jolted much of Bay Area awake in January.

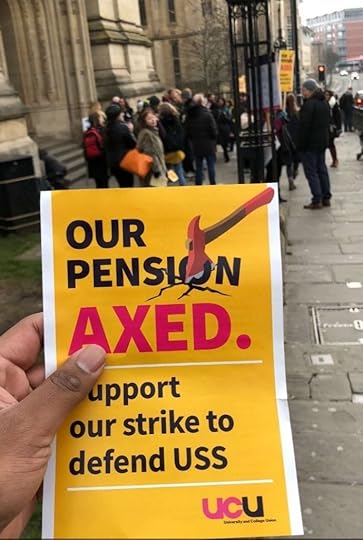

Collapse of Socialism – End of Pensions

I have been warning that we are in the midst of (1) collapse in democracy as the bureaucracy attempts to ensure they get their’s, (2) the collapse of socialism, which is the implosion of social programs, and (3) the collapse of pensions set in motion by the artificially low-interest rates for the past 10 years.

I have been warning that we are in the midst of (1) collapse in democracy as the bureaucracy attempts to ensure they get their’s, (2) the collapse of socialism, which is the implosion of social programs, and (3) the collapse of pensions set in motion by the artificially low-interest rates for the past 10 years.

Once we entered this Private Wave in 1985, we have begun the Crisis in Democracy where career politicians are the hallmark of how empires, nations, and city-states come to a dramatic end.

With each passing day, we read about another pension crisis in some municipal government or system. Now across the UK teacher/lectures began a month of student disruptions over the proposed changes in their pensions plans. The strikes have even produced refund claims by students over missing tuition time. This is the collapse not of Capitalism, but Socialism as all the promised benefits cannot be provided.

The pension system has a £6bn deficit and thus there is no choice but to cut. Some 61 universities are being affected with many teachers/lecturers simply walking-out leaving the students with no education. The teachers/lecturers voted to strike and now it has gone on for some two weeks. The assumed they would strike and the money would fall from heaven. That has not been the case.

Individually, universities pay into a pool called the Universities Superannuation Scheme. That fund is then managed by a professional Fund Management team that produces a return annually. The investment returns, future contributions, and management costs should then be calculated and projections given at every management meeting between the two (Fund Managers and the administrators of the USS).

…click on the above link to read the rest of the article…

“Cash Must Not Be Made the Scapegoat”

In the War on Cash, a rare defense of physical money by an ECB Board Member.

The proposed EU-wide cash restrictions could come into effect as early as this year. But defenders of physical cash have an unexpected ally in their struggle: Yves Mersch, a member of the European Central Bank’s executive board. In a speech hosted by the Bundesbank last week, the Luxembourgian central banker exalted cash’s value as legal tender and heaped scorn on the oft-heard argument that its anonymity only helps criminals.

“Protection of privacy matters to all of us. Privacy protects people from the risk of a surveillance state and thought police,” he told his audience. “No particular link can be established statistically between cash and criminal activities. The focus must be on the fight against crime. Cash must not be made the scapegoat.”

One of the world’s biggest issuers of notes and coins, the Bundesbank was a fitting location for a speech on the virtues of physical money. In total, €592 billion of the €1.1 trillion of banknotes in circulation at the end of 2016 were issued by the Bundesbank.

Judging by recent statements, the Bundesbank wants to preserve this arrangement. Bundesbank president Jens Weidmann, who is hotly tipped to replace Mario Draghi as ECB president in 2019, has warned that it would be “disastrous” if people started to believe cash would be abolished — an oblique reference to the risk of negative interest rates and the escalating war on cash triggering a run on cash.

That didn’t stop five national governments — Cyprus, Bulgaria, Belgium, Portugal and Denmark — from approaching the ECB last year to consult on measures to limit the use of cash, according to Mersch. Meanwhile, Sweden is widely regarded as the most cashless society on the planet.

…click on the above link to read the rest of the article…

Food by Local Farmers. Distribution System by Ants.

Looking for a way to help a sustainable food system grow, Cullen Naumoff turned to nature.

Photo Courtesy of Oberlin Food Hub

Photo Courtesy of Oberlin Food HubDriving down U.S. 20 toward Cleveland, Cullen Naumoff knew something had to change.

Naumoff, director of sustainable enterprise for the Oberlin Project in Oberlin, Ohio, had recently launched a food hub with colleague Heather Adelman. Food hubs bring together what small farmers produce into quantities needed by big buyers like schools, restaurants and supermarkets. The problem? The Oberlin Food Hub was so successful that demand was outstripping the ability of participating farmers to meet it. Naumoff turned to other regional food hubs — and soon found herself driving all around the region to pick up and deliver lone bushels of produce — encumbering the expenses of big food companies without benefiting from the economies of scale they enjoy.

“All we had done with the food hub was shrink their model,” she says, “so local produce would never be able to compete.”

Then Naumoff met Ohio State University entomologist Casey Hoy at a food conference. She told Hoy of her frustration trying to incorporate a higher level of complexity into her food hub enterprise.

Stylized versions of three ant foraging patterns offer insights into strategies for boosting efficiency of a growing sustainable food system. Illustration by Sean Quinn

“Insects are so diverse they have probably already solved it,” Hoy responded. He then shared what he had learned from ants about efficient transportation.

Ant colony optimization is an approach to applying ant behavior to solving engineering and operations problems. Different ant species, Hoy said, use different kinds of networks of nests and paths in between them to optimize food transportation. In the process, they create a library of strategies humans can tap to solve our own food transportation challenges.

…click on the above link to read the rest of the article…

Is Volatility in Oil Price on the Way, Again ?

Experts say that you shouldn’t look at your pension investments too often as you might make unwise decisions. I don’t follow this advice. The reason that I’m drawn to tending my pension spreadsheet weekly, if not daily, is two-fold. First, I’m told by professionals who read the tea leaves on this sort of thing that I have Asperger’s syndrome. It turns out that pawing over columns of numbers in Excel is nirvana to certain of us oddball hues on the autism spectrum. Second, for ten years I have had a fascination, bordering on dread, for the incremental drama of two charts in my spreadsheet, both of which are shown below.

Figure 1 – Stock market volatility follows clusters of spikes in oil price volatility

Paradoxically, neither chart directly relates to my investments. However, they have guided the timing of when I move money around in my accounts – shifting between riskier stock indexes to safer bond funds. So far, my strategy has worked. For example, my pension fund suffered little during the 2008 financial crisis, and from lesser bouts of turbulence in 2011 and 2015.

So how does my investment approach work? It’s quite simple. The top graph in red shows a rolling 3-day standard deviation (SD) of daily oil price – specifically calculated from the Brent crude oil index. The chart below it in blue is a rolling 3-day SD calculated from the Dow Jones Industrial Average. Whenever, the red chart (i.e., that of oil) develops a cluster of large spikes that is sustained for a few months or more, I’ve noticed that a similar cluster turns up a few months later in the stock market. More importantly, I’ve learned that you don’t want your money in stocks when this is happening, so when the warning signs occur in oil, I march my money off to the relative safety of the bond market.

…click on the above link to read the rest of the article…

China Is Erasing The Gas Glut

China and other countries in Southeast Asia are helping erase the LNG glut, which was thought to last well into the next decade.

China is in the midst of a radical overhaul of how many of its citizens heat their homes. The government has made an aggressive push to scrap coal burning, particularly in smoggy cities, replacing home coal furnaces with natural gas. The effort has been so successful, arguably too successful, that there has been natural gas shortages this winter.

At the global level, China is helping to eliminate the glut of LNG, which many analysts predicted would stretch into the 2020s after a series of high-profile LNG export terminals came online in recent years.

Several of them, including Chevron’s Gorgon LNG facility in Australia, saw tens of billions of dollars’ worth of investment, massive bets on the future of LNG demand in Asia.

At the start of 2017, there was an estimated 340 million tonnes of annual LNG capacity (mtpa) around the world, up by more than a quarter since 2012. But all of the new capacity helped crash prices. At the start of 2014, for instance, spot LNG prices in Asia – the Platts JKM marker – traded at about $20/MMBtu. A year later, spot cargoes were down by two thirds.

The long lead times for LNG export terminals make it hard for the markets to respond nimbly to changes in supply and demand. Sudden large additions of export capacity leave the market drowning in supply, while demand increases at a more gradual pace.

So many new terminals have already come online, but with 114 mtpa of LNG under construction, the LNG markets are thought to be under threat from still more waves of new supply. An estimated 57 mtpa was under construction in Australia, as of last year, with a further 31 mtpa in development in the U.S.

…click on the above link to read the rest of the article…

Venezuela’s New Cryptocurrency: Just Another Form of Control Fraud

If a currency can’t be converted on demand into the underlying commodity, it’s not “backed by oil,” it’s just another form of control fraud.

The broke and broken country of Venezuela appears to be the first nation-state to issue a cryptocurrency token (the petro) as a means of escaping the financial black hole that’s consuming its economy: Maduro Launches Oil-Backed Crypto “For The Welfare Of Venezuela”.

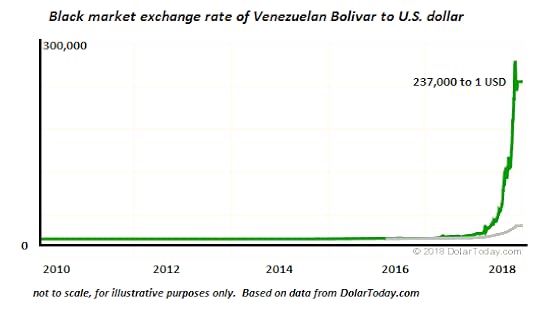

For context, here is a chart of the black market (i.e. real-world) value of the Venezuela’s fiat currency, the bolivar: a 100,000 bolivar note is worth somewhere around 40 cents USD (US dollar), i.e. near zero. (Venezuela maintains a fantasy-official USD/bolivar exchange rate that has no relation to the actual purchasing-power value of Venezuela’s fiat currency.)

The gee-whiz component of the petro is that it is supposedly “backed by oil.”In other words, unlike other cryptocurrencies/ tokens, the petro has intrinsic value because it’s backed by oil.

But what does backed by oil actually mean?

The only way any currency, fiat or crypto, is “backed” by any real-world commodity is if the currency is convertible into the commodity on demand, that is, the currency can be exchanged for the commodity at a transparent published conversion rate.

If Venezuela’s petro cannot be converted directly into deliverable-upon-demand oil contracts, it’s not backed by anything. It’s important to understand that any currency that claims to be “backed” by gold, oil, rice, bat guano, etc. must be convertible to the underlying commodity at a transparent conversion rate.

If a currency can’t be converted on demand into the underlying commodity, it’s not “backed by oil,” it’s just another form of control fraud, which I define as those holding power in centralized institutions enrich themselves at the expense of the citizenry by modifying what’s legally permissible.

…click on the above link to read the rest of the article…

Don’t Worry, It’s Only a “Pre-Bubble”

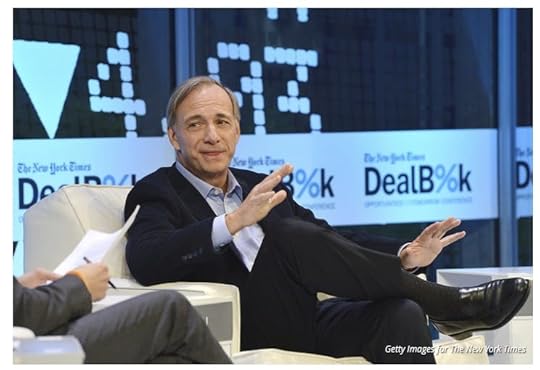

Ray Dalio, who embarrassed himself saying “You’re Going to Feel Pretty Stupid Holding Cash” offers more silliness.

Ray Galio, the head of the world’s largest hedge fund says U.S. in a ‘Pre-Bubble Phase’ with a 70% Chance of Recession.

“I think we are in a pre-bubble stage that could go into a bubble stage,” the hedge-fund manager said during a Harvard Kennedy School’s Institute of Politics on Wednesday.

Dalio’s recession comments echo remarks he has made over in a LinkedIn post, where he wrote that “the risks of a recession in the next 18-24 months are rising.”

“Stupid to Hold Cash”

Despite his recession call, Dalio is the same person who told the crowd at Davos, ‘If You’re Holding Cash, You’re Going to Feel Pretty Stupid’.

Dalio is also a believer in the sideline cash theory and that we may see a “Minor Correction“.

In a LinkedIn article following the VIX-related plunge, Dalio said We’ve Just Had a Taste of What the Tightening Will Be Like.

The headline sounds bearish, but the message sure isn’t, as the key paragraph explains.

“Still, these big declines are just minor corrections in the scope of things, there is a lot of cash on the side to buy on the break, and what comes next will be most important.”

Inundated With Cash

In the CNBC interview, Dalio also spoke of sideline cash.

“There is a lot of cash on the sidelines. I don’t mean just investor cash. I think banks have a lot of cash. Corporations have a lot of cash. So we are going to be inundated with cash.”

Sideline Cash Rebuttal

St. Louis Fed Promotes the Mathematically Impossible

Sideline Cash Nonsense From Bloomberg and Merrill Lynch

$50 Trillion Sideline Cash Conundrum?

…click on the above link to read the rest of the article…

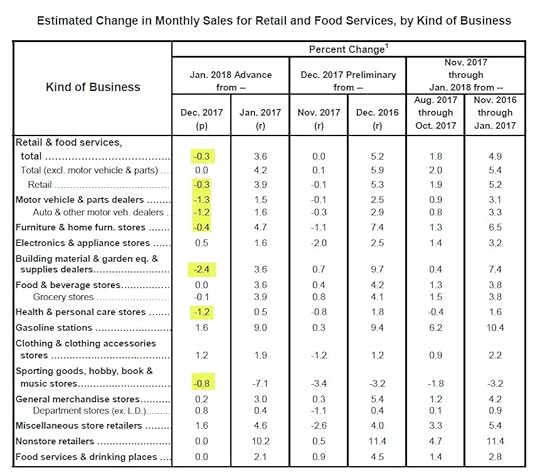

Global Growth? Retail Sales Flop in US, UK, Canada, Germany, Australia

Consumers unexpectedly threw in the towel in 5 countries but the central banks and the IMF insist everything is fine.

On February 14, I noted US Retail Sales Dive, Negative Revisions Too. This will impact both 4th quarter and first quarter GDP estimates.

On February 22, Bloomberg reported Canadian Retail Sales Drop Unexpectedly.

“Receipts fell 0.8 percent to C$49.6 billion in the last month of 2017, Statistics Canada reported Thursday. It was the biggest monthly decline since March 2016. Economists were expecting no change during the month.”

On February 16, the Financial Times reported UK retail sales figures disappoint. The results were positive but barely.

“The volume of retail sales grew by 0.1 per cent month-on-month, far below analysts’ expectations of 0.5 per cent growth in January, according to a poll from Thomson Reuters. On the year, sales were up by 1.6 per cent, from 1.4 per cent, far below expectations for a 2.6 per cent rise.”

On January 31, Reuters reported German Retail Sales Unexpectedly Fall in December.

On February 6, Business Insider reported Australian retail spending for the Christmas was far weaker than many were expecting.

Given the Fed’s outlook and increasing expectations of four rate hikes plus tapering in the US, tapering in the EU, and rate hikes in the UK, such reports must be meaningless.

Also note the IMF made a “Brighter Forecast” for the global economy in January. When has the IMF ever been wrong?