Steve Bull's Blog, page 1180

February 26, 2018

Growing Risk of U.S.-Iran Hostilities Based on False Pretexts, Intel Vets Warn

As President Donald Trump prepares to host Israeli Prime Minister Benjamin Netanyahu next week, a group of U.S. intelligence veterans offers corrections to a number of false accusations that have been levelled against Iran.

February 26, 2018

MEMORANDUM FOR: The President

FROM: Veteran Intelligence Professionals for Sanity (VIPS)

SUBJECT: War With Iran

INTRODUCTION

In our December 21st Memorandum to you, we cautioned that the claim that Iran is currently the world’s top sponsor of terrorism is unsupported by hard evidence. Meanwhile, other false accusations against Iran have intensified. Thus, we feel obliged to alert you to the virtually inevitable consequences of war with Iran, just as we warned President George W. Bush six weeks before the U.S. attack on Iraq 15 years ago.

President Donald Trump and Prime Minister Benjamin Netanyahu shake hands after giving final remarks at the Israel Museum in Jerusalem, May 23, 2017. (Yonatan Sindel/Flash90)

In our first Memorandum in this genre we told then-President Bush that we saw “no compelling reason” to attack Iraq, and warned “the unintended consequences are likely to be catastrophic.” The consequences will be far worse, should the U.S. become drawn into war with Iran. We fear that you are not getting the straight story on this from your intelligence and national security officials.

After choosing “War With Iran” for the subject-line of this Memo, we were reminded that we had used it before, namely, for a Memorandum to President Obama on August 3, 2010 in similar circumstances. You may wish to ask your staff to give you that one to read and ponder. It included a startling quote from then-Chairman of President Bush Jr.’s Intelligence Advisory Board (and former national security adviser to Bush Sr.) Gen. Brent Scowcroft, who told the Financial Times on October 14, 2004 that Israeli Prime Minister Ariel Sharon had George W. Bush “mesmerized;” that “Sharon just has him wrapped around his little finger.”

…click on the above link to read the rest of the article…

How We’re Fighting to Save Democracy From Bribery and Gerrymandering, One State at a Time

In Pennsylvania, the democratic system isn’t broken. It’s dead.

Adam Eichen, Rabbi Michael Pollack, Emmie DiCicco speaking at a March on Harrisburg barnstorming event at the UU Fellowship of Erie, PA. February 19, 2018

Photo Credit: Rhys Baker

Political alienation plagues our nation, and most of us are correct in feeling that we have little to no impact on the decisions that govern our lives. Research shows that the average American has “near-zero” influence on public policy, while those with wealth have “significant influence.” Unfortunately, this conclusion is based on data from the 1980s and 1990s, and things have only gotten worse since then.

This problem is of increasing concern in the commonwealth of Pennsylvania, in which campaign finance limits are non-existent and political district lines would be more fairly drawn by an energetic puppy with a sharpie taped to its tail. The state also has no limits on the value of gifts to state legislators. If you are feeling particularly generous—or self-interested—you can take a legislator to the Super Bowl or pay off the student debt of his or her child.

In Pennsylvania, the democratic system isn’t broken. It’s dead. And regardless of political affiliation, Pennsylvanians are correct in having lost faith in our government.

But here’s the deal: Recognizing this sober truth, as depressing and upsetting as it may be, does not preclude reason to hope that things can get better.

Anger and aimlessness lead to helplessness and apathy. But when solutions are coupled with a plan to achieve them, our emotions are transformed into positive, constructive political action. This plan of action is what Pennsylvanians need now.

…click on the above link to read the rest of the article…

February 24, 2018

Here’s How Regulators Are Inadvertently Laying The Groundwork For The Next Housing Crisis

Only a few weeks ago, we pointed out a remarkable development in the US mortgage market that has significant implications not only for mortgage borrowers, but perhaps the broader economy as a whole: Wells Fargo, formerly America’s foremost mortgage lender, had seen its share of the market eclipsed by Quicken Loans – the Detroit-based, nonbank lending behemoth that pioneered applying for mortgages on the Internet with its now-famous Rocket Mortgage (readers will remember RM’s celebrity-packed SuperBowl spot).

Many factors (aside from Wells’ own criminality, which recently drew a strong, but ultimately meaningless, rebuke from the Fed) have contributed to this shift, as Bloomberg points out.

But as it turns out, the rising dominance of nonbank lenders like Quicken could portend a massive, bad-debt fueled binge reminiscent of the circumstances that led up to the housing crisis. That is to say, a wave of bad debt could create a cascading wave of defaults with repercussions far beyond the housing market.

Considering all the restrictions that Dodd-Frank and other post-crisis regulations slapped on mortgage lenders, one might wonder how this might be possible.

Of course, as Bloomberg explains, instead of making the market safer, regulators are inadvertently enabling the rise of lenders like Quicken who aren’t bound by many of the rules that restrict banks’ mortgage-lending practices. As a result, Quicken Loans is effectively free from many of the regulations that have forced some of the biggest mortgage lenders into a period of retrenchment…

Make no mistake, regulators have done plenty to rein in the mortgage business since the 2000s. New rules require that lenders carefully assess borrowers’ ability to pay, and that mortgage servicers — which process payments and manage other relations with borrowers — give troubled customers plenty of opportunity to renegotiate their debts before resorting to foreclosure.

…click on the above link to read the rest of the article…

Riots Breakout Across Italy Ahead Of General Election (And Markets Are Getting Anxious)

Heading into the weekend, the Italian government massively stepped up security across the country in anticipation of demonstrations by anti-fascist and far-right groups, ahead of the general election on March 04. Italians will go to the polls next Sunday, in an election that could rebalance the political environment or send shockwaves through the European Union.

According to CNBC, here are the three leading candidates dominating the race:

Silvio Berlusconi, former prime minister and head of Forza Italia.

Matteo Renzi, the embattled leader of the center-left Democratic Party (PD) and former prime minister who quit the post in 2016 after a referendum on constitutional reform failed.

Luigi Di Maio, the anti-establishment 5 Star Movement’s (M5S) leader.

Last night in Pisa, Italy, anti-fascist protestors formed a counter-demonstration against Lega leader Matteo Salvini, who was speaking at the center of town. Anti-fascist groups threw glass bottles and rocks and attacked police officers as they tried to silence Salvini, a leading anti-EU political figure, before next week’s elections.

Professor Cuz@ProfessorCuz

Professor Cuz@ProfessorCuzItaly, #Pisa#antifa protest against the visit of Lega far-right leader Salving LIVE

11:02 AM – Feb 23, 2018

Local Team @localteamtv

DIRETTA VIDEO Salvini a Pisa, contro-corteo dei centri sociali in corso

pscp.tv

Insane video of Anti-fascist activists fighting with police last night in Pisa

Voice of Europe @V_of_Europe

FollowFollow @V_of_Europe

More

Soros puppets meet Italian police..

130K views

2:29 PM – 23 Feb 2018

In the early hours of Saturday morning, riots have erupted on the streets as police and protesters have clashed in Pisa and Milan with massive marches expected in Rome later in the day, said the Daily Express.

…click on the above link to read the rest of the article…

“CalPERS Is Near Insolvency; It Needs A Bailout Soon” – Former Board Member Makes Stunning Admission

Two weeks ago, in the aftermath of the February 5 volocaust, we quoted David Hunt, CEO of $1.2 trillion asset manager PGIM, who said ignore the volatility spike, the real financial timebomb was and remains public pensions: “if you were going to look for what’s the possible real crack in the financial architecture for the next crisis, rather than looking in the rearview mirror, pension funds would be on our list.”

In a brief discussion wondering what municipalities and states will do when local tax revenues decline and unemployment worsens, Hunt said “we’re worried about those pension obligations.”

He is hardly alone: having reported over and over and over (and over, and over) again that public pensions are in deep trouble, two days ago none other than Steve Westly, former California controller and Calpers board member – manager of the largest public pension fund in the US, made a stunning admission, confirming everything:

“The pension crisis is inching closer by the day. CalPERS just voted to increase the amount cities must pay to the agency. Cities point to possible insolvency if payments keep rising but CalPERS is near insolvency itself. It may be reform or bailout soon.”

Steve Westly

Steve Westly @SteveWestly

@SteveWestlyThe pension crisis is inching closer by the day. @CalPERS just voted to increase the amount cities must pay to the agency. Cities point topossible insolvency if payments keep rising but CalPERS is near insolvency itself. It may be reform or bailout soon.http://ow.ly/CQGw30iyLko

3:40 PM – Feb 22, 2018

[image error]

Commentary: California’s public pension crisis in a nutshell | CALmatters

The essence of California’s pension crisis was on display last week when the California Public Employees Retirement System made a relatively small change in its amortization policy. The CalPERS board…

calmatters.org

…click on the above link to read the rest of the article…

Bank Run Feared After ECB Unexpectedly Pulls Plug On Latvia Largest Private Bank

Last week we reported that as part of a rapidly deteriorating banking crisis in Latvia, which culminated with the detention of central bank head Ilmars Rimsevics on suspicion of accepting a bribe of more than €100,000 (which prompted both the prime minister and president to demand his resignation, something he has so far refused to do), the European Central Bank froze all payments by Latvia’s largest private bank, ABLV, following U.S. accusations the bank laundered billions in illicit funds, including for companies connected to North Korea’s banned ballistic-missile program.

Then overnight the Latvian banking crisis escalated when in a statement released early Saturday, the ECB said ABLV Bank’s liquidity had deteriorated significantly, making it unlikely to pay its debts and declaring it “failing or likely to fail.” As a result, Latvia’s third largest bank will be wound up under local laws after the European Central Bank

Following the ECB’s decision, which also included the bank’s subsidiary in Luxembourg, the WSJ reported that Europe’s banking resolution authority decided the banks didn’t represent a systemic risk for their countries or the region and should be wound up by local authorities rather than be “bailed in” under EU rules.

And so, on Saturday ABLV said it would be liquidated. In four days, the bank claimed, it had raised enough capital to meet all its depositors’ demands and keep functioning, however “Due to political considerations the bank was not given a chance to do it,” it said in a statement.

As we discussed previously, ABLV’s fall follows a move by the U.S. Treasury last week to block its access to U.S. dollars, accusing it of “institutionalized money laundering.” It said most of the bank’s customers were shell companies registered outside Latvia.

…click on the above link to read the rest of the article…

“GDP Growth Driving Rates Higher!” – Is That True?

“Peter Cook is the author of the ‘Is That True?’ series of articles, which help explain the many statements and theories circulating in the mainstream financial media often presented as “truths.” The motives and psychology of market participants, which drives the difference between truth and partial-truth, are explored.”

Summing up the current conventional wisdom:

Global GDP growth has bottomed and is accelerating systematically higher,

Which will cause the inflation rate to accelerate higher.

Bond markets hate higher inflation, so interest rates have bottomed and will move even higher.

The stock market, dependent on low rates for high valuations, will fall if rates move higher,

Which is why the stock market peaked on January 26, 2018, and then declined dramatically,

Ushering in an era of systematically higher volatility

In this article, we will investigate the data behind the first three assertions related to GDP growth, inflation, and the bond market and offer explanations that differ from the conventional wisdom. Next Friday, we will continue this theme with a discussion of the following three assertions.

Global GDP Growth Is Accelerating

Unless GDP can be exported from another planet to Earth, the main drivers of global GDP growth are in four large economic zones. Here are the past 30 years of GDP growth in the U.S……

The past ten years in China……

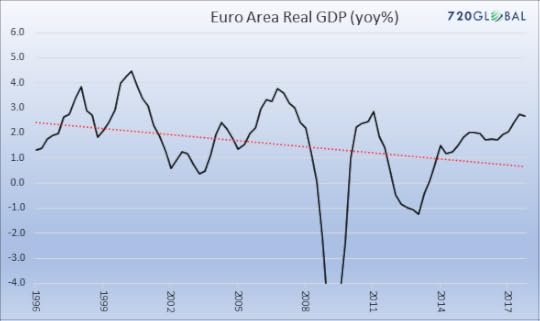

The past 20 years in Europe…..

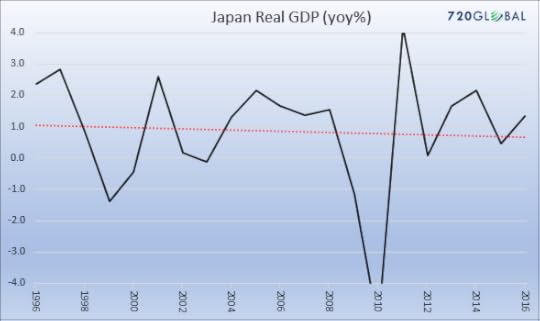

and Japan.

In summary, each of the main economic zones are growing at lower rates than they did 10-20 years ago. While they are each trending slightly higher after bouncing off recent troughs in early 2016, all are well within a range established since the Global Financial Crisis (GFC).

…click on the above link to read the rest of the article…

Haunted by Ghosts of the Old Eastern Bloc

Ridiculous Minutia

Jerome Powell, the new Chairman of the Federal Reserve, just completed his third week on the job. He’s hardly had enough time to learn how to operate the office coffee maker, let alone the all-in-one printer. He still doesn’t know what roach coach menu items induce a heinous gut bomb.

The perpetually slightly worried looking new Fed chairman Jerome Powell, here seen warily inspecting the Rose Garden at the White House. Everybody wants to know if he has a “better plan” – but there is no better plan, thus no-one has one. [PT]

Photo credit: A. Brandon / AP

Yet across the planet, folks high and low are already telling him exactly how he should do his job. What’s more, they’re passing advance judgment on things that may or may not happen. For example, the South China Morning Post recently offered the following opinion:

“President Donald Trump may have done Janet Yellen a favor by not giving her a second term as Chairwoman of the Federal Reserve. Her successor, Jerome Powell, may have inherited a poisoned chalice. The Fed will have to up the pace of U.S. rate hikes or risk accusations of being behind the curve as markets react to signs of rising inflation.”

When Powell showed up to work on February 5, for his first day on the job, the general consensus was that the Fed would raise the federal funds rate three times this year, at 25 basis points – or 0.25 percent – per increase. But now that consumer prices are rising at an annual rate of 2.1 percent, average hourly earnings are increasing at an annual rate of 2.9 percent, and Congress has passed a massive two year budget deal, twitchy economists are questioning if three rate hikes will be enough to keep inflation in check.

…click on the above link to read the rest of the article…

The Ultimate 30-Minute Travel Workout

We should never underestimate or neglect the importance of physical training in your life. This piece is for those of you who travel frequently during the week…overnighters or for a few days, at a distance not too far. More than 15 million people do this per week.

We should never underestimate or neglect the importance of physical training in your life. This piece is for those of you who travel frequently during the week…overnighters or for a few days, at a distance not too far. More than 15 million people do this per week.

Truck drivers are self-sufficient folks; however, this article is for them, too. Businessmen and those who make commutes of about a hundred miles or so with a one to two-day layover by vehicle may benefit from this piece. What we’re talking about is toting some of your weights with you, in your vehicle. Dumbbells are what I’m referring to here, with a “short-term” workout you may find to your benefit. Traveling businesspeople and salesmen are not immune to needing physical training, so this may help them, too.

Don’t Forget to Pack Your Weights!

There are many motels and hotels that we are obliged to stay in, whether directed by our firms (and paid for) or paid out-of-pocket…budget “rest stops” to cut down on the costs. Most of the time these places do not have weight room facilities or perks: they’re just a room with a roof over your head. Take a set of dumbbells with you in the trunk of your vehicle and give yourself a workout in the morning.

Let’s suggest some exercises for you:

Biceps and Triceps Day

Alternating Curl – 3-5 Sets/8 Reps

Triceps Extensions – 3-5 Sets/8 Reps

Wrist Rolls – 3 Sets/20 Reps

Radial Curls – 3 Sets/8 Reps

Chest and Shoulders Day

Dumbbell Bench Press – 3-5 Sets/8 Reps

Dumbbell Military Press – 3 Sets/8 Reps

Shoulder Shrugs – 3 Sets/8 Reps

Lower Body

Abs (Right, Left, Center) – 3 sets of 10 reps (beginners)

Wall Squats (with or without weights in your lap) – 3 sets: 30 to 1 min for beginners

Flutter Kicks – 3 sets of 10 (8-count), with 30 to 1:00 min rest between

…click on the above link to read the rest of the article…

Resist That

Perhaps because a weary public was underwhelmed by his indictment last week of thirteen ham sandwiches with Russian dressing, Special Prosecutor Robert Mueller has returned to an old baloney sandwich with American cheese named Paul Manafort, and slathered on some extra mayonnaise to lubricate his journey to federal prison.

The additional charges specify tax evasion and money-laundering shenanigans around Manfort’s activities in Ukraine between 2006 and 2015, a period that included the USA’s active participation in the overthrow of Ukraine’s elected president, Victor Yanukovych, who had declared a desire to join the Russian Customs Union instead of being shanghaied into an expanded NATO.

Scrupulous observers may note that all this took place well in advance of the 2016 US presidential election, when Manafort was candidate Donald Trump’s campaign manager for several months before being thrown overboard for reasons still publicly unknown — but probably the awareness that Manafort’s personal financial affairs were a smoldering wreck. Meanwhile, Manafort’s business colleague, Rick Gates, has also been charged by Mueller, and this week an associate of Gates, one Alex Van Der Swaan, son-in-law of a Russian billionaire, was persuaded to plead guilty to lying to the FBI about his contacts with Gates.

All of this suggests that there were fabulous opportunities for American profiteering in the sad-sack, quasi failed state of Ukraine, and that the feckless Manafort circle will be doing Chinese fire drills in the federal courts until the cows come home, but it doesn’t say a whole lot about Russian interference in the 2016 US election. One might surmise that there is enough pressure on Manafort and company to get them to say anything now to save their asses. On the other hand, it could lead in open court to the airing of all sorts of dirty laundry about surreptitious US meddling in Ukraine, and about the corps of camp-following money-grubbing American grifters who raced in after 2014 to steal anything that wasn’t nailed down there by the homegrown kleptocrats.

…click on the above link to read the rest of the article…