Steve Bull's Blog, page 1179

February 27, 2018

Endgame Russia: NATO Sprawl Invades Eastern Europe, No More Illusions

Endgame Russia: NATO Sprawl Invades Eastern Europe, No More Illusions

In the past, the North Atlantic Treaty Organization (NATO) justified its militarization of large swaths of Eastern Europe by pointing to the omnipresent threat of terrorism, or some ‘rogue’ foreign state, inherently understood to be Iran. Today the mask has slipped and it is no longer denied that NATO’s primary target is Russia.

But first, a trip down nightmare lane. The road to ruin – at least as far as US-Russia relations were concerned – began immediately following the 9/11 terror attacks. Three months after that fateful day, in December 2001, George W. Bush informed Vladimir Putin that the US was withdrawing from the Anti-Ballistic Missile Treaty, a strange move considering that the treaty had kept the peace between the nuclear superpowers since 1972. This geopolitical “mistake,” as Putin rightly defined it, allowed the US to begin the process of deploying a missile defense system, smack on the border with Russia, allegedly to shield the continent against an attack by Iran. Never mind the fact that Tehran had absolutely no reason, not to mention the wherewithal, to carry out such a suicidal mission. But Washington has never been one to let facts get in the way of a forced move on the global chess board.

Thus, the Bush administration advocated on behalf of a land-based missile defense system with interceptors based in Poland and a radar station in the Czech Republic. However, due to serious objections from Russia, not to mention the apprehensive citizens of the host countries, the plan had reached an impasse in 2008 – just as Obama was replacing Bush in the White House. Some would call that impeccable timing. What happened next can only be described as a devious sleight of hand on the part of Washington.

…click on the above link to read the rest of the article…

February 26, 2018

Cornucopian Renewable-Energy Claims Leave Poor Nations in the Dark

Stanford professor Mark Jacobson and his colleagues have written yet another paperpurporting to show that 100 percent of energy demand can be fulfilled by wind, solar, and hydroelectric generation. This latest study, which comes in the form of a manuscript accepted but not yet published by the journal Renewable Energy, seeks to show how that goal can be met in 139 nations.

Jacobson’s previous “100 percent renewable” papers have prompted other researchers to publish their own studies pointing out faulty technical assumptions and analyses that cast a shadow over his claims. I expect that we will see technical critiques of Jacobson’s latest study as well published in coming weeks or months (if, that is, there are experts out there who are willing to risk being sued by Jacobson for questioning his results. He’s got one such sketchy lawsuit in the courts already.)

But even if we disregard the technical weaknesses of claims that all future demand can be satisfied with renewable energy sources—even if we assume for the sake of argument that such rosy scenarios really are achievable—there will remain the problem of energy poverty. As I have noted,

Billions of people around the world need more energy than they can afford, while billions of others can buy far more energy than is required to meet their needs. Global 100-percent renewable scenarios are based on these distortions; as a result, they typically aim to satisfy a worldwide per capita energy consumption that’s about one-eighth of what Americans consume. . . the 100-percent scenarios would leave in place huge gaps in consumption between affluent and poor communities, both among and within countries.

…click on the above link to read the rest of the article…

The Myth of Sound Fundamentals

Cem Ozdel/Anadolu Agency/Getty Images

Cem Ozdel/Anadolu Agency/Getty ImagesThe Myth of Sound Fundamentals

The recent correction in the US stock market is now being characterized as a fleeting aberration – a volatility shock – in what is still deemed to be a very accommodating investment climate. In fact, for a US economy that has a razor-thin cushion of saving, dependence on rising asset prices has never been more obvious.

NEW HAVEN – The spin is all too predictable. With the US stock market clawing its way back from the sharp correction of early February, the mindless mantra of the great bull market has returned. The recent correction is now being characterized as a fleeting aberration – a volatility shock – in what is still deemed to be a very accommodating investment climate. After all, the argument goes, economic fundamentals – not just in the United States, but worldwide – haven’t been this good in a long, long time.

But are the fundamentals really that sound? For a US economy that has a razor-thin cushion of saving, nothing could be further from the truth. America’s net national saving rate – the sum of saving by businesses, households, and the government sector – stood at just 2.1% of national income in the third quarter of 2017. That is only one-third the 6.3% average that prevailed in the final three decades of the twentieth century.

It is important to think about saving in “net” terms, which excludes the depreciation of obsolete or worn-out capacity in order to assess how much the economy is putting aside to fund the expansion of productive capacity. Net saving represents today’s investment in the future, and the bottom line for America is that it is saving next to nothing.

…click on the above link to read the rest of the article…

Britain Officially Prepares Now for War Against Russia

Britain Officially Prepares Now for War Against Russia

On Wednesday, February 21st, the UK’s Minister of Defence, Conservative Gavin Williamson, announced that the United Kingdom is changing its fundamental defence strategy from one that’s targeted against non-state terrorists (Al Qaeda, etc.), to one that’s targeted instead against three countries: Russia, China, and North Korea. He acknowledged that a massive increase in military spending will be needed for this, and that “savings” will have to be found in other areas of Government-spending, such as the health services, and in military spending against terrorism.

The headline in the London Times on February 22nd was “Russia ‘is a bigger threat to our security than terrorists’”. Their Defence Editor, Deborah Haynes. reported:

The threat to Britain from states such as Russia and North Korea is greater than that posed by terrorism, the defence secretary said yesterday, marking a significant shift in security policy.

Gavin Williamson suggested to MPs that more money and a change in the structure of the armed forces would be needed as part of a defence review to meet the challenge of a state-on-state conflict, something that Britain has not had to consider for a generation. …

It is a departure from the national security strategy published in 2015, which listed international terrorism first, and chimes with a decision by the United States last month to declare “strategic competition” from countries such as China and Russia as its top focus instead of counterterrorism. …

He described the Kremlin’s “increased assertiveness”, such as a ten-fold increase in submarine activity in the North Atlantic, a growing Russian presence in the Mediterranean region and their involvement in the war in Syria. “But then you are seeing new nations that are starting to play a greater role in the world, such as China. …

…click on the above link to read the rest of the article…

The Cost of 100% renewables: The Jacobson et al. 2018 Study

Proponents of a global transition to 100% renewable energy point to a number of studies which claim to show that such a transition is feasible, and arguably the most influential of these is the study of Jacobson et al. 2017, an updated 2018 version of which is now available. Jacobson’s methodology is far too complex to be reviewed here, and besides Clack et al. 2017 have already reviewed it. This post therefore summarizes what the Jacobson study says will be needed in the way of new generation, energy storage etc. to convert the world’s energy sector – electricity, transportation, industry, agriculture, the lot – to 100% wind, water and sunlight power (WWS) by 2050. Among other things it calls for a thirty-fold expansion in total world WWS capacity, including a seventy-fold increase in wind + solar capacity, and up to 16,000 terawatt-hours of energy storage. And the cost? Well, a few trillion here, a few trillion there, and pretty soon we‘re talking real money.

Proponents of a global transition to 100% renewable energy point to a number of studies which claim to show that such a transition is feasible, and arguably the most influential of these is the study of Jacobson et al. 2017, an updated 2018 version of which is now available. Jacobson’s methodology is far too complex to be reviewed here, and besides Clack et al. 2017 have already reviewed it. This post therefore summarizes what the Jacobson study says will be needed in the way of new generation, energy storage etc. to convert the world’s energy sector – electricity, transportation, industry, agriculture, the lot – to 100% wind, water and sunlight power (WWS) by 2050. Among other things it calls for a thirty-fold expansion in total world WWS capacity, including a seventy-fold increase in wind + solar capacity, and up to 16,000 terawatt-hours of energy storage. And the cost? Well, a few trillion here, a few trillion there, and pretty soon we‘re talking real money.

The updated Jacobson et al. 2018 study (hereafter J2018) is available in preprint form here. A hat-tip to correspondent “Zigak” for providing this unpaywalled link.

J2018 is more than just another renewable energy study. It’s a blueprint for transitioning the entire global economy to 100% renewables by 2050. The complexities involved in achieving such a conversion are of course enormous, and the way j2018 handles them is far beyond my capacity to summarize here. Clack et al. 2017 have nevertheless reviewed them, and their criticisms of Jacobson’s methodology are provided here for anyone who may be interested in a more detailed analysis of specifics.

But what has not so far come through – and this applies whether J2018’s plan works or not – is the sheer scale of J2018’s proposals. What might be required in the way of new capacity, new generation, new energy storage etc.?

…click on the above link to read the rest of the article…

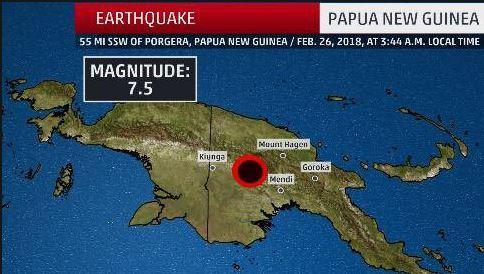

“Communications Are Down”: Massive 7.5M Quake Cripples Papua New Guinea

Several major oil and gas operators were forced to shutter operations on Monday after a powerful 7.5 magnitude earthquake rattled Papua New Guinea’s energy-rich interior, causing landslides and cutting off communications, per Reuters. The tremor hit in the rugged, heavily forested Southern Highlands about 350 miles northwest of Port Moresby at around 3:45 am local time (1545 GMT Sunday), according to the U.S. Geological Survey (USGS).

No Casualties

As of the latest report, there were no confirmed casualties, although the International Red Cross said some reports indicated there were “fears of human casualties.”

“It’s a very serious all across the Southern Highlands and also all over the western highlands. People are definitely very frightened,” Udaya Regmi, the head of the IRC in Papua New Guinea, said by telephone from Port Moresby.

The PNG government also said it had sent disaster assessment teams. At least 13 aftershocks with a magnitude of 5.0 or more rattled the area throughout the day, according to USGS data. So far, no tsunami warnings have been issued.

“The Papua New Guinea Defense Force has also been mobilized to assist with the assessment and the delivery of assistance to affected people as well as the restoration of services and infrastructure,” Isaac Lupari, the chief secretary to the government, said in a statement.

Energy Disruptions

ExxonMobil said it had shut its Hides gas conditioning plant and that it believed administration buildings, living quarters and a mess hall had been damaged. It also said it had suspended flights into the nearby Komo airfield until the runway could be surveyed.

“Due to the damage to the Hides camp quarters and continuing aftershocks, ExxonMobil PNG is putting plans in place to evacuate non-essential staff,” the company said in an emailed statement.

Gas is processed at Hides and transported via a 435-mile pipeline that feeds a liquefied natural gas plant near Port Moresby for shipping.

…click on the above link to read the rest of the article…

How Puerto Rico Could Turn Disaster into a Decentralized Paradise

How Puerto Rico Could Turn Disaster into a Decentralized Paradise

Could the massive failure of the Puerto Rican government-run energy grid be a blessing in disguise? It has the potential to set Puerto Rico on a course of self-sufficiency and individual empowerment for decades to come.

Many Puerto Ricans are still without power from the large-scale grid failure after Hurricane Maria last fall. Some are not expected to be reconnected to the grid until April or May.

Community Solutions

One of those communities took matters into its own hands and set the local school up with solar panels. Plans to set up rainwater collection and filtration are also in the works. This would make the school entirely off-grid, and a perfect community shelter in the event of other natural disasters.

The Daily Bell recently published an article called 7 Reasons to Shut Down Public Schools Immediately and Permanently. Praising an off-grid public school seems like a contradiction.

But Puerto Rico announced plans to introduce a school voucher program so that students could take a portion of a school’s funding with them and apply it towards another public or private school. Perhaps a school which is off the grid and teaches kids about solar and rainwater systems will flourish. Competition always helps to improve things.

This doesn’t come close to solving all the current problems with mainstream schooling. But the off the grid school couple with school choice can be seen as a decentralization of government, with the community more in control. And that seems like a step in the right direction.

Individual Solutions

Puerto Rican companies in the solar industry had a hard time convincing consumers of the need for solar energy and storage before Hurricane Maria. But now, everyone understands the value of being off the grid. It means you don’t sit around waiting and hoping for the government to come save you. You are in control of your own energy production and use.

…click on the above link to read the rest of the article…

Real Estate Bubbles: These 8 Global Cities Are At Risk

If you had $1 billion to spend on safe real estate assets, where would you look to buy?

For many funds, financial institutions, and wealthy individuals, the perception is that the world’s financial centers are the places to be. After all, world-class cities like New York, London, and Hong Kong will never go out of style, and their extremely robust and high-density city centers limit the supply of quality assets to buy.

But, as Visual Capitalist’s Jeff Desjardins asks, what happens when too many people pile into a “safe” asset?

According to UBS, certain cities have seen prices rise at rates that are potentially not sustainable – and eight of these financial centers are at risk of having real estate bubbles that could eventually deflate.

Global Real Estate Bubble Index

Every year, UBS publishes the Global Real Estate Bubble Index, and the most recent edition shows several key markets in bubble territory.

The bank highlights Toronto as the biggest potential bubble risk, noting that real prices have doubled over 13 years, while real rents and real income have only increased 5% and 10% respectively.

However, the largest city in Canada was certainly not the only global financial center with real estate appreciating at rapid rates in the last year.

In Munich, Toronto, Amsterdam, Sydney and Hong Kong, prices rose more than 10% in the last year alone.

Annual increases at a 10% clip would lead to the doubling of prices every seven years, something the bank says is unsustainable.

In the last year, there were three key markets where prices did not rise: London, Milan, and Singapore.

London is particularly notable, since it holds more millionaires than any other city in the world and is rated as the #1 financial center globally.

Turkey – Default or War?

QUESTION: Mr. Armstrong, My father was ______ the banker who commissioned you to do the Turkish lira hedging project in 1983. He passed away as you know. I found this material in his files on Turkey that you apparently published back in 1985. Some articles are saying that Turkey is the epic center of debt. I do not get that sense here and I figured you were really the authority my father always quoted. Can you shed some light on this subject?

Thank you

__

ANSWER: Yes, I remember your father well. You have my sincere condolences. I remember that project for it was very challenging. I had to create a hedging model for the Turkish lira when nobody would make a market. That was one of my earliest synthetic creations.

The Turkish lira continues to move into hyperinflation and it has nothing to do with the fiscal policies of the government. Plain and simple – even its own people do not trust the government nor the currency. Hyperinflation takes place not because of the quantity of money, but because of the collapse in public confidence.

Turkey is BY NO MEANS the epic center of the debt crisis. That is really an absurd statement. Turkey has sold Dollar-denominated foreign debt like all other questionable emerging market countries. That is how they all have sold debt by taking the currency risk on to themselves.

I have been warning that as the US rates rise, this puts pressure on the $9 trillion of emerging market debt issued in dollars. The risk of a major debt crisis starting in Turkey is a very myopic view as we are facing a contagion of a Sovereign Debt Crisis among all emerging markets.

…click on the above link to read the rest of the article…

“It’s Not only Carillion that’s Built on Sand, it’s our Whole System of Corporate Accountability”

The construction & services giant collapsed even as KPMG signed off on its financial statements; now they deny any responsibility.

The Big Four accountancy firms — PricewaterhouseCoopers, Ernst & Young, KPMG, and Deloitte — reported combined annual revenues of $134 billion in 2017. In the global audit arena, they are virtually unassailable. In the US, the Big Four audit 497 of the S&P 500 companies. In the UK, they audit 99 of the FTSE 100 companies. In Spain there’s not a single firm listed on the IBEX 35 whose accounts are not audited by one of the Big Four.

But what are the Big Four firms actually good for?

Given the oligopolistic structure of the global audit industry as well as the potential conflicts of interest that can arise between the auditors’ myriad roles, this is a vital question — and one that is finally being asked by British lawmakers following the epic crash-and-burn of the services and construction giant Carillion.

In recent years, the external and internal auditors of Carillion, KPMG and Deloitte, pocketed a combined £40 million for their services. Yet they abjectly failed to discover, and warn investors of, the company’s precarious condition that caused it to collapse in spectacular fashion in January. Many other market players, including major investors, pension covenant assessors, and hedge funds shorting Carillion stocks on the markets — some with access to the accounts, others without — saw warning signs long before its demise. So, why didn’t the auditors make sure that the company discloses those problem to investors?

Carillion’s external auditor, Dutch-seated KPMG, signed off on its accounts without fail to the very bitter end, even though it was clear that Carillion had wafer-thin profit margins and was dangerously overloaded with debt, including some £2.6 billion worth of pension liabilities, and that between 2012 and 2016 it ran up debts and sold assets just to continue paying out dividends to shareholders.

…click on the above link to read the rest of the article…