Jerome R. Corsi's Blog, page 352

May 29, 2013

Historian: Obama helping resurrect Ottoman Empire?

NEW YORK – Is Obama helping advance a grand plan by Turkey, with the support of Germany, to restore the Ottoman Empire, the Islamic caliphate that controlled much of southeast Europe, Western Asia and North Africa for more than six centuries?

That is a question posed by historian Robert E. Kaplan in an article titled “The U.S. Helps Reconstruct the Ottoman Empire,” published this week by the international policy council and think tank Gatestone Institute.

Kaplan, a historian with a doctorate from Cornell University, specializing in modern Europe, says history suggests a possible partnership between Turkey and Germany, which has seen influence over Turkey as a means of influencing Muslims worldwide for its own interests.

He asks why the U.S. government “would actively promote German aims,” including the destruction of Yugoslavia in the 1990s and the re-creation of the Ottoman Empire through the “Arab Spring.”

Kaplan points to Obama’s support of the Muslim Brotherhood, the ultimate victor in the “Arab Spring”; the U.S. backing of radical Islamic “rebel” groups in Libya with ties to al-Qaida; and current support for similarly constituted radical Islamic “rebel” groups in Syria aligned with al-Qaida.

Each of these U.S. military interventions occurred in areas that were under the Ottoman Empire.

Bring back the Ottoman Empire?

Kaplan sees a similarity between the Clinton-era attacks against the Serbs and the Obama administration hostility to well-established regimes in Libya and Syria.

He writes:

Since the mid-1990s the United States has intervened militarily in several internal armed conflicts in Europe and the Middle East: bombing Serbs and Serbia in support of Izetbegovic’s Moslem Regime in Bosnia in 1995, bombing Serbs and Serbia in support of KLA Moslems of Kosovo in 1999, bombing Libya’s Gaddafi regime in support of rebels in 2010. Each intervention was justified to Americans as motivated by humanitarian concerns: to protect Bosnian Moslems from genocidal Serbs, to protect Kosovo Moslems from genocidal Serbs, and to protect Libyans from their murderous dictator Muammar Gaddafi.

Kaplan observes that neither President Clinton nor President Obama ever mentioned the reconstitution of the Ottoman Empire as a justification for U.S. military intervention.

The U.S. offered other reasons for intervening in Serbia, including a desire to gain a strategic foothold in the Balkans, to defeat communism in Yugoslavia, to demonstrate to the world’s Muslims that the U.S. is not anti-Muslim, and to redefine the role of NATO in the post-Cold War era.

Recurring pattern

At its height in the 15th and 16th centuries, the Ottoman Empire stretched from its capital in Turkey, through the Muslim-populated areas of North Africa, Iraq, the costal regions of the Arabian Peninsula and parts of the Balkans.

Kaplan points out that since the 1990s, “each European and Middle Eastern country that experienced American military intervention in an internal military conflict or an ‘Arab Spring’ has ended up with a government dominated by Islamists of the Moslem Brotherhood or al-Qaida variety fits nicely with the idea that these events represent a return to Ottoman rule.”

In these conflicts, Kaplan sees recurring patterns employed by Clinton and Obama to justify U.S. military intervention:

Each U. S. military action in Europe and the Middle East since 1990, however, with the exception of Iraq, has followed an overt pattern: First there is an armed conflict within the country where the intervention will take place. American news media heavily report this conflict. The “good guys” in the story are the rebels. The “bad guys,” to be attacked by American military force, are brutally anti-democratic, and committers of war crimes, crimes against humanity, and genocide. Prestigious public figures, NGOs, judicial and quasi-judicial bodies and international organizations call for supporting the rebels and attacking the regime. Next, the American president orders American logistical support and arms supplies for the rebels. Finally the American president orders military attack under the auspices of NATO in support of the rebels. The attack usually consists of aerial bombing, today’s equivalent of the nineteenth and twentieth centuries’ gunboat which could attack coastal cities of militarily weak countries without fear of retaliation. The ultimate outcome of each American intervention is the replacement of a secular government with an Islamist regime in an area that had been part of the Ottoman Empire.

Kaplan cites a recent report published by John Rosenthal in the online Asian Times that discloses reports prepared by the German foreign intelligence service, the BND, attributing the massacre in the Syrian town of Houla on May 25, 2012, to the Syrian government.

Rosenthal linked the conclusions of the BND regarding the Houla massacre to the policy of the German government to support the Syrian rebellion and its political arm, the Syrian National Council.

Recalling that Germany invaded Serbia in both World Wars I and II and actively sought the destruction of Yugoslavia in the Cold War era, Kaplan wonders if the administration’s joining with Germany in the bombing of Libya, and possibly Syria as well, is an effort to help Germany fill its foreign policy objective of restoring the Ottoman Empire.

Kaplan notes that the Obama administration’s foreign policy requires it to downplay the Muslim Brotherhood and al-Qaida terrorist threat to U.S. national security.

Al-Qaida defeated, or embraced?

In the 2012 presidential campaign, Obama spoke at a campaign event in Las Vegas one day after the Sept. 11 Benghazi attack, proclaiming, “A day after 9/11, we are reminded that a new tower rises above the New York skyline, but al-Qaeida is on the path to defeat and bin Laden is dead.”

On Nov. 1, 2012, CNSNews.com reported that Obama had described al-Qaida as having been “decimated,” “on the path to defeat,” or some other variation at least 32 times since the attack on the U.S. consulate in Benghazi. It was a theme Obama repeated last week in his counter-terrorism policy speech at the National Defense University at Fort McNair in Washington, D.C.

Obama also has advanced a narrative expressing U.S. acceptance of Islam.

In his foreign policy speech delivered at Cairo University June 4, 2009, Obama explained he had known Islam “on three continents before coming to the region where it was first revealed.”

In a joint press availability with Turkey’s President Gul at Cankaya Palace in Ankara, Turkey, on April 6, 2009, Obama repudiated U.S. history since George Washington, declaring the U.S. is not a Christian country: “And I’ve said before that one of the great strengths of the United States is – although as I mentioned, we have a very large Christian population, we do not consider ourselves a Christian nation or a Jewish nation or a Muslim nation; we consider ourselves a nation of citizens who are bound by ideals and a set of values.”

Yet, despite Obama’s attempt to establish a narrative in which Islamic terrorism is not a threat to U.S. national security, evidence abounds that the radical Islamic rebels responsible for opposing Gadhafi in Libya and Assad in Syria have extensive ties to al-Qaida.

In September 2012, WND also broke the story that the slain U.S. ambassador, Christopher Stevens, played a central role in recruiting jihadists to fight the Syria regime, according to Egyptian security forces.

In December 2012, WND reported top level al-Qaida operatives are functioning with impunity in Libya under a NATO-established provisional government.

In February 2013, WND reported that the U.S. special mission in Benghazi was used to coordinate Arab arms shipments and other aid to rebels in Libya who are known to be saturated by al-Qaida and other Islamic terrorist groups.

On May 14, 2013, WND reported the attack that killed Stevens and three other Americans was an al-Qaida revenge killing that took place one day after al-Qaida chief Ayman al-Zawahiri called for retaliation for a U.S. drone strike that killed a top Libyan al-Qaida leader.

Formed by Osama bin Laden, al-Qaida is a Sunni Islamic organization, whereas the Assad regime in Syria has been arguably a client state of Iran, the only nation in the Middle East in which a majority of the Muslims are Shiites.

The conflict between Sunni and Shiite Muslims dates back to the founding of Islam when a split took place over who should succeed Muhammad, when he died in AD 632. Sunnis comprise about 75 to 90 percent of the world’s Muslims.

The Muslim Brotherhood that has come to power in the African Islamic states following the “Arab Spring” is a Sunni Islam-dominated organization that opposes the Shiites in Iran on religious grounds.

On Jan. 3, 2013, WND reported that the Muslim Brotherhood has penetrated the Obama White House, with several American Muslim leaders who work with the Obama administration identified as Muslim Brotherhood operatives who have significant influence on U.S. policy.

On Feb. 10, 2013, WND reported President Obama’s nominee to head the CIA, John Brennan, converted to Islam years ago in Saudi Arabia.

Arguably, the Obama administration’s policy of siding with the rebels in Libya and Syria may reflect the aim of isolating Shiite-dominated Iran from the rest of the Islamic world.

The logical expectation would be that a recreated Ottoman Empire headquartered in Turkey would be a Sunni organization, reflecting the Sunni-dominance in Turkey.

The Gatestone Institute website describes the organization as a non-partisan, not-for-profit international policy council and think tank dedicated “to educating the public about what the mainstream media fails to report.”

As the organization’s website explains, “Gatestone Institute conducts national and international conferences, briefings and events for its members and others, with world leaders, journalists and experts – analyzing, strategizing, and keeping them informed on current issues, and where possible recommending solutions.”

Lawsuit: IRS, OSHA, ATF, FBI probed tea party group

NEW YORK – The scandal involving IRS discrimination against conservative groups is about to reach a new level of intensity.

A top Washington-based lawyer with expertise in IRS tax-exempt organizations has filed the first of several anticipated federal lawsuits against the IRS that will force the agency to hand over documents and answer questions under oath.

“We are going to require documents and testimony from all the IRS higher-ups and agents involved that we know were involved with reviewing the True the Vote application,” attorney Cleta Mitchell explained to WND in an interview.

“We are going to find out through the process of discovery in this lawsuit exactly what the IRS was doing, who was doing it, why they were doing it,” she said.

Catherine Engelbrecht, founder of True the Vote, agrees.

“Cleta Mitchell’s strategy to press for discovery against the IRS, to my mind right now, is the best opportunity to pull back the layers of the IRS scandal and understand who knew what, when,” Engelbrecht told WND.

Engelbrecht said she intends to work very closely with Mitchell in the federal lawsuit filed against the IRS.

She said her non-partisan organization, which filed for tax-exempt status three years ago, has been “singled out, and I want to know who pointed those agencies at us.”

During that time, her family business and the personal finances of her and her husband have been audited for two years, she said.

Her business was subjected to Occupational Safety and Health Administration audits that found only minor problems but resulted in fines totaling $25,000.

The Bureau of Alcohol, Tobacco, Firearms and Explosives subjected her business to an unannounced audit, and the FBI began plying the Engelbrechts with questions that seemed more like a fishing expedition than a serious inquiry.

Mitchell, a partner in the Washington law firm Foley & Lardner LLP, is widely known in the nation’s capital as a legal powerhouse who commands wide respect among GOP conservatives for her ability to cause grief to Democrats playing fast and loose with the law in pursuit of a liberal agenda.

With more than 40 years experience in law, politics and public policy, Mitchell has extensive expertise representing conservatives seeking to form and operate IRS tax-exempt 501(c)3 and 501(c)4 groups.

“I believe through the process of discovery, we are going to discover an ongoing, systematic and pervasive IRS pattern of using the tax code to discriminate against and harass conservative activists and tax-exempt foundations seeking tax-exempt status to promote conservative causes,” Mitchell said.

On May 21, the ActRight Legal Foundation, a 501(c)3 public interest law firm, in conjunction with Mitchell, sued the IRS in federal district court on behalf of their client, True the Vote, a Houston, Texas-based non-profit voters’ rights organization. The group is asking the court to grant its three-year pending application with the IRS for tax-exempt status and seeks damages for unlawful actions by the federal agency.

Mitchell, acting as legal counsel to True the Vote and of counsel to ActRight Legal Foundation, explained to WND that a major benefit of filing the federal lawsuit involves discovery, a process through which True the Vote as plaintiff can to petition the Court to subpoena IRS records, including internal emails and memoranda relative to the case, as well as compel testimony from IRS employees, as part of the plaintiff’s pre-trial preparation leading to a federal district court civil trial.

“Through the process of discovery, we should be able to get any and all communications within the IRS regarding the True the Vote application, including emails and internal IRS communications, to find out exactly what the IRS was doing in relation to the True the Vote application.”

WND asked Engelbrecht if she suspected the OSHA and ATF examinations resulted from information the IRS leaked to the agencies with the intent to harass her.

“That much remains to be seen,” she responded. “But it doesn’t take too far a stretch to realize that some of the questions we were being asked by the IRS didn’t have much to do with a non-profit application.”

Mitchell told WND the True the Vote case was only the first of several lawsuits she plans to file in conjunction with the ActRight Legal Foundation against the IRS tax-exempt division.

The next case likely will be brought by the National Organization for Marriage, alleging the IRS illegally released to the press the group’s 2008 Form 990 Schedule B tax information in direct contravention of federal law.

“The tax code in the United States was never supposed to allow government employees to make up the law as they go along, behind closed doors, so they can selectively target certain citizens or organizations for treatment that is inconsistent with how everybody else is treated,” Mitchell stressed.

Engelbrecht told WND she and her husband have filed multiple Freedom of Information Act requests in an attempt to get to the bottom of what caused the IRS, OSHA, ATF and FBI inquiries.

“The only result of the FOIA requests so far is that we got from OSHA late last week a letter saying copying the more than 320 pages in our file would cost somewhere over $100 and we agreed to pay,” she noted. “That seemed a little much to me, but I’m curious to see what the contents of our OSHA file will reveal.”

ActRight Legal Foundation has set up an IRS litigation fund seeking public contributions to help defray the costs of legal representation in the True the Vote federal lawsuit against the IRS.

May 28, 2013

Obama half-brother uses IRS status to fund polygamy?

NEW YORK – Funds contributed in the United States to a 501(c)3 foundation run by President Obama’s older half-brother, Abongo “Roy” Malik Obama, have been diverted to support Malik’s multiple wives in Kenya, an expert on Islamic extremism has charged.

Walid Shoebat, an Arabic-speaking former Muslim Brotherhood member, has detailed his allegations in a 22-page investigative report titled “New IRS Scandal: Islamic Extremism and Sex Slaves: Report Reveals Obama’s Relatives Run Charities of Deceit,” published on his website

After a thorough examination of available evidence, Shoebat explained to WND his allegations against the Obama family tax-exempt foundations:

“When Malik Obama and Sarah Obama raised money in the United States as the respective heads of foundations claiming to be charities, not only did the Internal Revenue Service illegally grant one of them tax-deductible status retroactively, but these foundations have supported – to varying degrees – illegal operations that acquire funding for personal gain, philandering, polygamy and the promotion of Wahhabism, the brand of Islam practiced by Al-Qaeda.”

For the past two years, long before the current IRS scandals became public, WND has been reporting irregularities in two IRS-approved 501(c)3 organizations operated in the U.S. by Obama’s half-brother and step-grandmother in Kenya:

WND reported in September 2011 the Barack H. Obama Foundation apparently received IRS approval one month after an application was submitted in May 2011. The IRS determination letter June 11, 2011, granted a highly irregular retroactive tax-exempt approval only after the group came under fire for operating as a 501(c)3 foundation since 2008 without ever having applied to the IRS.

In October 2012, WND reported a separate foundation, the Mama Sarah Obama Foundation, created on behalf of Obama’s step-grandmother in Kenya, has transferred funds, 90 percent of which are raised from U.S. individuals and corporations, to send Kenyan students to the top three most radical Wahhabist madrassas in Saudi Arabia.

Since its founding in 2008, the Barack H. Obama Foundation, operating out of a commercial mail drop in Arlington, Va., has solicited tax-deductible contributions on the Internet, listing addresses and telephone numbers both in the U.S. and Kenya, without disclosing the group lacked an IRS determination letter.

In September 2011, the IRS confirmed to WND that the Barack H. Obama Foundation had received a determination letter in June 2011, awarding the group tax-exempt 501(c)3 status retro-actively to 2008

Tax-exempt polygamy?

On March 3, 2013, Andrew Malone, reporting for the London Daily Mail, documented that Malik’s youngest wife in Kenya, Sheila Anyano, 35 years his junior, had spent the past two years living with three of Malik’s other wives at the “Barack H Obama Foundation rest and relaxation center,” a restaurant complex that profits from visitors drawn by the family’s connection to the American president.

According to the Daily Mail, members of his extended family in Kenya have accused Malik, a practitioner of Islam and a polygamist, of being a wife-beater and philanderer. Malik is accused of seducing Sheila, the newest of his estimated 12 wives while she was a 17-year-old schoolgirl – a crime in Kenya where the legal age of consent is 18.

Malone tracked down Sheila’s mother, Mary, who explained to the reporter that Malik Obama had “secret trysts” with the girl after spotting her attending prayers at the mosque he has built in Kogelo, the family’s ancestral.

Sheila, now age 20, told Ambrose that marrying Malik, now age 55, was the “worst decision” of her life and confirmed that she and Malik kept their marriage “a secret” since she was 17.

“At first he was good, after he started speaking to me at the mosque,” Sheila told the Daily Mail. “But he has changed. Marrying him has been the biggest mistake of my life. He beats me, but mostly he’s just nasty and quarrelsome.”

Several sources report the “center” where Malik Obama houses his multiple wives is a “hotel” with a restaurant.

The Egyptian independent daily newspaper Al-Masry Al Youm, on Nov. 6, 2012, reported a meeting conducted in the only hotel in Kogelo, calling it the “Barack H. Obama Recreation and Rest Center.”

A Smithsonian Magazine article published in May 2011 distinguished the Barack H. Obama Recreation and Rest Center from then open and operating Kogelo Village Resort, a 40-bed hotel and conference center owned by Nicholas Rajula. The article noted Malik Obama, “the president’s half-brother and the oldest son of Barack Obama Sr., who had eight children with four wives,” had “invested a large sum in the soon-to-open Barack H. Obama Recreation Center and Rest Area in Nyag’oma Kugelo.”

On Jan. 18, 2013, the Christian Science Monitor noted Malik Obama was running for political office in Kenya. He lost running on a campaign slogan that played on his half-brother’s electoral success in the United States.

“Just as it is in the United States, I want it here,” he Malik told the Monitor.

The paper said he was speaking in his office in a recreation center he set up with the Barack H. Obama Foundation, described as “a charitable organization he founded to build houses for women and orphans.”

Shoebot charged that Malik Obama is abusing non-profit funds.

“There is no evidence to suggest that Malik is building any houses in Kogelo for widows and orphans as claimed,” Shoebat said.

Neither is there evidence that the Mama Sarah Foundation has built any homes for widows, orphans and HIV/AIDS victims.

“The only evidence where monies were spent involves the Barack H. Obama Recreation and Rest Center in Kenya, which housed Malik’s 12 wives in a facility that includes a restaurant and a mosque with a madrassa,” he said.

“While building mosques is legally considered charity, evidence shows the entire funding came directly from entities and individuals from Saudi Arabia, Qatar and Bahrain,” Shoebat said. “There is nothing of charitable nature to show for all the funds Malik raises from the United States. To date, there is no evidence for any accomplishments toward building homes for orphans, widows and AIDS victims in Kogelo or anywhere else in Kenya.”

Limited financial reporting

An IRS Form 990-EZ required for tax-exempt organizations was filed on May 23, 2011, only days before the IRS determination letter was sent.

Barack H. Obama Foundation, Form 990-EZ, filed May 23, 2011, page 1

The Form 990-EZ appears to have been hand-written by Abongo Malik Obama himself, complete with an unorthodox page of calculations evidently included to back up the amounts entered into the form.

The Form 990 reported the foundation had received $24,250 total gross income for 2010, derived from contributions, gifts and grants.

“We were not very successful this year because of limited contributions,” Malik reported on the Form 990. “The Foundation sponsored a Youth Tournement (sic) and embarked on construction of community bridges.”

The Form 990 listed Samuel Andika Obiero of Arlington, Va., and Andrew Mboya of Hackensack, N.J., as directors, in addition to Abongo Malik Obama.

GuideStar.org, the private website that posts IRS documents of non-profit organizations, indicated that no audited financial statements were available for the Barack H. Obama Foundation.

GuideStar listing for Barack H. Obama Foundation, May 28, 2013

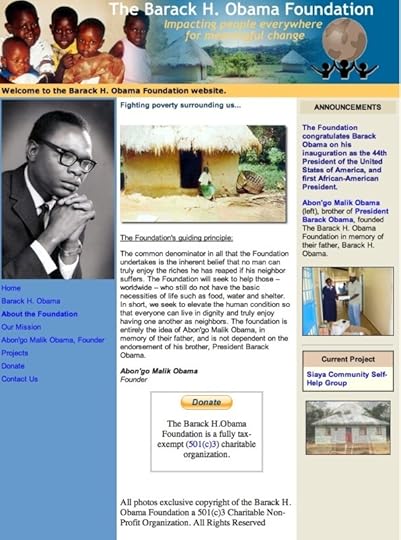

The website homepage of the Barack H. Obama Foundation prominently features a photograph of Barack H. Obama Sr. and a statement that the foundation is “a fully tax-exempt (501(c)(3) charitable organization.”

Homepage of the Barack H. Obama Foundation http://www.barackhobamafoundation.org/

Born in Kenya to Kezia

Born in Kenya, on March 15, 1958, Abongo Malik “Roy” Obama was the first child born to Barack Obama Sr.

The son of Kezia, Obama Sr.’s first wife, Malik was only 18 months old when Barack Obama Sr. arrived in New York Aug. 8, 1959, on a BOAC flight in transit from Kenya to begin his undergraduate studies at the University of Hawaii in Honolulu.

Having abandoned Kezia in Kenya, Obama Sr. subsequently married Stanley Ann Dunham, Barack Obama Jr.’s mother, while in Honolulu.

In September 1962, Obama Sr. headed to Cambridge, Mass., without Ann Dunham and Barack Obama Jr. to begin graduate studies in economics at Harvard University.

Malik Obama, best man at the wedding of Barack H. Obama, Oct. 3, 1992

As WND previously reported, Barack Obama Sr., on Aug. 17, 1962, in an Immigration and Naturalization form to extend his time of temporary stay in the United States, listed Roy Obama as his only child, neglecting to list Dunham as his wife or Barack Obama Jr. as his son.

Convert to Islam

Malik is a major character in President Obama’s autobiography, “Dreams from My Father.”’

A key passage in the book concerns Obama’s reactions when Malik joins Barack to be the best man at his wedding to Michelle.

Noting that Malik had converted from Christianity to Islam, Obama wrote on page 441 that Malik had “sworn off pork and tobacco and alcohol.”

Obama continued: “Abongo’s new lifestyle has left him lean and clear-eyed, and at the wedding, he looked so dignified in his black African gown with white trim and matching cap that some of our guests mistook him for my father.”

Pointedly, Obama observed that Malik was “prone to make lengthy pronouncements on the need for the black man to liberate himself from the poisoning influences of European culture.”

Malik was featured in a family portrait taken in one of Obama’s earlier trips to Kenya, as U.S. senator, in 2006.

Obama family portrait taken in Kenya. Abongo “Roy” Malik Obama stands to Barack Obama Jr.’s immediate left

Malik surfaced during the 2008 presidential campaign, dressed in African garb and holding a photograph of Barack Obama in African garb.

Abongo “Roy” Malik Obama displays a 1980s-era photograph of Barack Obama in Kenya

WND has determined that he has a valid Social Security number, issued in Washington, D.C., between 1985 and 1987, and associated with both the names “Roy Obama” and “Abongo Malik Obama,” names that he appears to use interchangeably in the U.S.

A private investigative report commissioned by WND shows Malik Obama has been identified since 1988 with 22 different rental addresses in the Washington, D.C., area, including in Prince Georges County and Montgomery County, Maryland.

According to a recent report in the Los Angeles Times, Malik Obama, a frequent traveler between the U.S. and Kenya, has declared himself to be the “president” of Nyangoma-Kogelo, the family’s ancestral village in Kenya.

WND was not able to determine the legal status of Roy Obama to live and work in the U.S.

May 26, 2013

Obama's 2-ocean globalist plan

WASHINGTON, D.C. – Quietly, the Obama administration is systematically putting into place a two-ocean globalist plan that will dwarf all prior trade agreements, including NAFTA, with the goal of establishing the global sovereignty envisioned by New World Order enthusiasts.

The two agreements are the Trans-Pacific Partnership, or TPP, and the Transatlantic Trade and Investment Partnership, or TIPP.

WND has learned the Obama administration plans to jam the TPP through Congress no later than Dec. 31.

Plans to implement the Trans-Atlantic agreement have now begun in tandem with the implementation the Trans-Pacific agreement that has been in place for almost two years.

The Obama administration calculates that passage of the TIPP will be reduced to a rubber-stamp decision once Congress has already passed the TPP.

Largely unreported by establishment media, the 17th round of Trans-Pacific or TPP negotiations is taking place in Lima, Peru, May 15-24, as revealed on the official government website of the U.S. Trade Representative, a division of the Executive Office of the President.

The website of the U.S. Trade Representative also announces Obama’s decision to launch the Transatlantic or TIPP negotiations, derived from a detailed exploratory process that began at the November 2011 U.S.-EU Summit, a development that also took place with little noticed by establishment media.

Since 2007, as WND has reported, globalists controlling free-trade policy within the U.S. government have been planning to achieve European Union and United States political integration, beginning with the TIPP free-trade agreement.

As WND reported in 2007, President George W. Bush, at a summit meeting with German Chancellor Angela Merkel and President of the EU Commission Manuel Barroso, signed an agreement in Washington creating “a permanent body” that committed the U.S. to “deeper transatlantic economic integration.”

The “Transatlantic Economic Integration” agreement put in place the Transatlantic Economic Council to be chaired in the U.S. by a Cabinet-level officer in the White House and on the EU side by a member of the European Commission.

A brave new world of trade

As WND previously reported, Obama announced in his 2013 State of the Union address the addition of the trans-Atlantic free-trade agreement to the agenda already in place to create the counterpart trans-Atlantic free-trade agreement:

To boost American exports, support American jobs and level the playing field in the growing markets of Asia, we intend to complete negotiations on a Trans-Pacific Partnership. And tonight, I’m announcing that we will launch talks on a comprehensive Transatlantic Trade and Investment Partnership with the European Union – because trade that is fair and free across the Atlantic supports millions of good-paying American jobs. (Applause.)

The promise of creating new jobs drew congressional applause despite legitimate concerns that previous trade agreements, including NAFTA and U.S. participation in the World Trade Organization, have resulted in the loss of millions of high-salary U.S. jobs overseas to nations with less expensive markets.

The globalists advising the Obama administration appear to have learned from the adverse public reaction to the Security and Prosperity Partnership of North America, or SPP, to avoid leader summit meetings so that the international “working group” coordination needed to create these international free-trade agreements is kept away from a critical alternative news media.

The Obama administration has shut down the Security and Prosperity Partnership website, SPP.gov. The last joint statement issued by the newly formed North American Leaders Summit, operating as the rebranded SPP, was issued April 2, 2012, at the conclusion of the last tri-lateral head-of-state meeting between the U.S., Mexico and Canada, held in Washington, D.C.

It was the sixth North American leaders summit. The previous meetings were: Waco, Texas (2005), where the SPP was first announced; Cancun (2006); Montebello, Canada (2007); New Orleans (2008); and Guadalajara (2009).

WND has previously reported the North American integration planned first under the SPP and now under the rubric of the North American Leaders Summit follows a plan initially developed by the Council on Foreign Relations, openly expressed in the May 2005 CFR report “Building a North American Community.”

Fast track

WND has previously reported the Obama administration plans to jam the Trans-Pacific Partnership through Congress by pursuing “fast track authority” that would restrict congressional prerogatives to an up-or-down vote, with the intention of pushing TPP through Congress by the end of this year.

Fast-track authority, a provision under the Trade Promotion Authority, requires Congress to review an FTA under limited debate, in an accelerated time frame subject to a yes-or-no vote.

Under fast-track authority, there is no provision for Congress to modify the agreement by submitting amendments. Fast-track authority also treats the FTA as if it were trade legislation being negotiated by the executive branch. The purpose is to assure foreign partners that the FTA, once signed, will not be changed during the legislative process.

A report released Jan. 24 by the Congressional Research Service, titled “The Trans-Pacific Partnership Negotiations and Issues for Congress,” makes clear the Obama administration does not have fast-track authority to negotiate the TPP, even though the office of the U.S. Trade Representative is acting as if fact-track authority is in effect.

The present negotiations are not being conducted under the auspices of formal trade promotion authority, or TPA, according to the CRS report. The latest TPA expired July 1, 2007. The administration, however, is informally following the procedures of the former TPA. If TPP implementing legislation is brought to Congress, TPA may need to be considered if the legislation is not to be subject to potentially debilitating amendments or rejection, the report says.

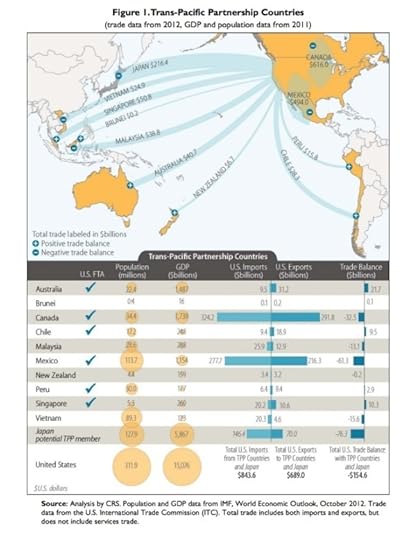

A graphic of the reach of the Trans-Pacific agreement presented in the CRS report on the first page shows the reach of the agreement across the Pacific Ocean, including Peru and Chile in South America; Australia and New Zealand; Malaysia, as well as Vietnam in Southeast Asia; Singapore; and Japan.

The North American detail of the graphic, right, shows trade from Canada is shown extending down into roughly Oklahoma in the U.S. and trade from Canada extending north into the U.S., roughly to Colorado.

According to the CRS report, Obama formally notified Congress of his administration’s decision to enter into negotiations with the TPP countries on Dec. 14, 2009. The notification set off a 90-day timeline under the now-expired 2002 trade promotion authority legislation for congressional consultations prior to the beginning of negotiations.

There is nothing on the public record to indicate Congress objected in any way to the Obama administration proceeding with the Bush administration plan to finalize TPP negotiations.

May 25, 2013

'Youth rioting' in Sweden? It's the Muslims, stupid

The nightly rioting in Stockholm that establishment media ascribes merely to “youths,” is being carried out by Muslim immigrants.

Muslim immigrants in Sweden now total slightly more than 6 percent of the population, providing additional support for the maxim that a Muslim population of 5 percent is a tipping point for political turmoil. In other countries, Muslim immigrants at that point have begun to seek concessions, including, typically, the right to govern themselves by Shariah, or Islamic law.

In Sweden, the Muslim population has doubled in the last 14 years, with Muslims now accounting for over 41 percent of Sweden’s total population growth. The growth reflects not only increasing Islamic immigration but also a disproportionately high birth rate in a nation in which the native birth rate is trending toward zero-growth.

According to European Union statistics, an estimated 574,000 Muslims lived in Sweden in 2012, making up 6.05 percent of the population, compared to 1998, when there were 284,000 Muslims, or 3.21 percent of the total population.

The EU currently estimates that at current rates of growth, the Muslim population will reach 40 percent of the total population in Sweden by 2030.

While Sweden does not keep welfare statistics specifically for Muslims, experts estimate from available government welfare statistics on the foreign-born that somewhere between 70 and 80 percent of Sweden’s welfare payments go to Muslims, with the percentage on the rise.

In Stockholm, the rioting in recent days has centered on Husby, a low-income suburb of Stockholm with some 12,000 residents. Approximately 80 percent are first- or second-generation Muslim immigrants from Turkey, the Middle East and Somalia.

Swedish police estimated that about 200 Muslim youths were responsible for the violence last week that set hundreds of cars and several buildings on fire with Molotov cocktails, including a parking garage fire that forced the evacuation of residents of an adjacent apartment block.

After setting cars on fire, masked Muslim youths waited to pelt with rocks any police responding to calls.

Husby residents claimed the violence was in retaliation for the police shooting death May 13 of a 69-year-old man. The police claim they were acting in self-defense, shooting the man after he attacked police with a machete when they broke down the door to an apartment where the man had locked himself up with the woman.

Several YouTube videos by amateurs show graphically the violence in Husby beginning May 19.

Reports indicate Megafonen, a “youth activist group” funded by the city, planned the Husby riots. Police in riot gear scuffled with Muslim gangs roaming freely in Husby. Some 200 organized Muslim youth rioters armed with rocks and Molotov cocktails stood near the burning cars awaiting to pelt with rocks and Molotov cocktails police and fire departments responding.

The Muslim riots in the suburbs outside Stockholm bear a strong resemblance to the Muslim riots that began Oct. 27, 2005, in suburbs outside Paris.

Several common elements between the rioting in France in 2005, and again in 2012, with the rioting currently occurring in Stockholm:

Unemployed Muslim youth immigrants from welfare families relocated from Africa to Europe begin the riot in early evening by tossing Molotov cocktails to set parked cars on fire;

The violence is intensified and spread by mobs of Muslim gangs running wild through the suburb streets, spreading to the area in which cars and buildings are torched;

When police and fire department units respond, the Muslim rioters lie in wait to pelt them with rocks, sticks and Molotov cocktails.

In February, the Economist reported that in Sweden, only 51 percent of non-Europeans have a job, compared with over 84 percent of native Swedes.

“The Nordic countries need to persuade their citizens that they are getting a good return on their taxes,” the Economist noted, “but mass immigration is creating a class of people who are permanently dependent upon the state.”

In Sweden, 26 percent of all prisoners and 50 percent of prisoners serving more than five years are foreigners, the Economist detailed.

Nor is the conflict limited to social-demographic characteristics and economics; it also extends to cultural differences.

“Nordics fervently believe in liberal values, especially sexual equality and freedom of speech, but many of the immigrants come from countries where men and women are segregated and criticizing the prophet Muhammad is a serious offense,” the Economist concluded.

'Hating Breitbart' a must-see documentary

Andrew Marcus, the writer and producer of the full-length documentary film “Hating Breitbart,” first met Andrew Breitbart when he was covering the tea party movement in 2010.

“Filming tea party events, I came across Andrew Breitbart and was captivated by his energy and his commitment,” Marcus told WND in an interview. “We approached Breitbart with the idea (of making a film) and Andrew loved it.”

Marcus explained Breitbart had to agree to be followed around for what turned out to be the larger part of two years, without having editorial control over the film.

“Andrew didn’t see the film until we were just about done,” Marcus explained. “He saw the final rough-cut, when we were in the last stages of post-production.”

How did Breitbart react to seeing the film the first time?

“He loved it,” Marcus said, “so much so that he came up with a brilliant idea of how to promote the film.”

‘Occupy Breitbart’

Marcus explained Breitbart’s promotional concept.

“In a flash of intuition, Breitbart came up with the idea of funding the Occupy movement to create and film an ‘Occupy Breitbart’ movement,” Marcus explained.

“The idea was to fund the Occupy movement with an anonymous grant, requiring only that the Occupy movement film every step of their ‘Occupy Breitbart’ production.”

Then, just as “Hating Breitbart” was about to be released, Breitbart planned to hold a press conference at the National Press Club in Washington, D.C.

“Breitbart would then come out on the stage at the National Press Club and announce that he was the ‘anonymous’ who had funded ‘Occupy Breitbart,’” Marcus continued, pointing out the idea was a lot like guerrilla warfare.

“It was a brilliant idea,” Marcus said. “Breitbart wanted to demonstrate the Occupy movement was nothing more than a ‘for-hire’ protest of anarchists with no real message. Breitbart believed that exposing ‘Occupy Breitbart’ as a fraud was the perfect launching pad for what he wanted to say in our ‘Hating Breitbart’ documentary.”

Marcus said what motivated Breitbart was a desire to expose the political left as a “hate machine.”

“Breitbart’s message was that if you don’t go along with the politically correct message of the radical left, then the leftist activists and media turn on you and try to destroy you,” Marcus said.

“Breitbart very much wanted to confront and expose that tactic for what it is – intolerant and hateful. His point was the radical left hates anyone who doesn’t agree with them. ‘Hating Breitbart’ was not only the title of the documentary, it was what Breitbart wanted to explain the radical left was all about.”

Capturing Breitbart

In his tracking of Breitbart for two years, Marcus captured undercover-video activist James O’Keefe strategizing with Breitbart on the release of O’Keefe’s famous “pimp and prostitute” exposure of ACORN.

Marcus documented the political left’s claim that O’Keefe’s and Breitbart’s goal was “not journalism,” but conservative activism.

The charge was about the best the radical left could do to defend itself against Breitbart’s relentless attacks exposing leftist hypocrisy.

Marcus creatively interweaves clips from Breitbart speeches and from television interviews, ranging from Keith Olbermann at MSNBC to Sean Hannity at Fox News, demonstrating Breitbart’s creative political debate skills in a variety of venues.

“If you keep portraying the tea party as homophobic and racist, instead of what they are – American patriots concerned about fiscal responsibility,” Breitbart challenged the media in one clip from a speech in New York City, “then I’m going to organize a tea party protest in downtown Manhattan, and these media liars won’t be able to get out to the Hamptons that weekend.”

Marcus also shows Breitbart’s sensitivity in clips with actor Orson Bean, Breitbart’s father-in-law. In one, Bean explains that when Breitbart first started dating his daughter, Breitbart was surprised to find out Bean was a conservative.

“He was surprised I had a book by Rush Limbaugh,” Bean explained, “but after he read the book, he called me up and said, ‘That’s really interesting.’ Andrew had been to college, and in those years he was a big lefty.”

‘I dodged a bullet’

Breitbart, a 1991 graduate of Tulane University, explains in scenes showing him returning to his college campus that it was probably better he did not take his college days too seriously.

“Had I been going to college at 8 a.m. in a shiny, happy way with a cup of coffee and filled my notes up, I guarantee you I wouldn’t be fighting the left the way that I am,” Breitbart confesses on a New Orleans street outside the Tulane campus. “I probably would have embraced that mindset. So I kind of realize I dodged a bullet.”

One of the best sequences in the documentary shows Breitbart confronting blogger Max Blumenthal, the former senior writer of the Daily Beast, over whether or not Blumenthal called Breitbart a “racist” in print.

Breitbart fearlessly gets in Blumenthal’s face and challenges him to retract what he wrote.

“I have two modes,” Breitbart explains to an audience from the podium. “Mode One is jocularity and Mode Two is righteous indignation.”

Marcus explained to WND he wanted to show the audience that Breitbart lived to confront the radical left with its lies.

From the podium, Breitbart proves Marcus’ point.

“I love confrontation, and by the way, and so should you,” Breitbart tells the audience. “It’s the only way we’re going to win. We have to confront these people. We have to videotape them. We have to put it on the Internet. We have to shove it in the mainstream media’s face saying, ‘No, they’re the racists, they’re the intimidators, they’re ones who are caught on tape being violent.”

Marcus began the documentary with a Breitbart soliloquy that Breitbart ends by carefully articulating a single word with emphasis and meaning. “War!” Breitbart says, summing up much of his journalistic career.

“We have an obligation to confront them,” Breitbart concluded his speech to appreciative applause. “This is a once-in-a-lifetime obligation to take on the institutional left. Please join the fight.”

Controversial even in death

Marcus told WND he had no reason to disbelieve the family’s story that what killed Breitbart was a heart ailment that he did not fully realize he had until a year before his death.

“You have to understand that Breitbart never slept,” Marcus explained. “He would give a speech and then spend hours afterwards with his fans and supporters, only to realize it was morning and he had to rush off to catch an airplane for the next event.”

In May 2012, WND reported Los Angeles private investigator Paul Huebl interviewed Christopher Lasseter, 26, the eyewitness who was walking his dog outside the Brentwood Restaurant when he saw Breitbart leave the restaurant, cross the street and drop dead as he reached the curb.

Lasseter said he did not initially notice anything unusual about how Breitbart looked. When Breitbart reached the curb across the street, Lasseter said he observed, “Breitbart took one step up onto the curb and dropped like a sack of bricks.”

Lasseter said he knew Breitbart was dead as soon as he walked up and looked; he shook off any suggestion he suspected foul play in Breitbart’s death.

WND was never able to locate other witnesses who reportedly claimed that in the days leading up to his death, Breitbart was particularly paranoid that he was being followed.

Movie critics still hate Breitbart

Even in death, Breitbart’s critics on the left continue to hate him.

Evidence of this is the on movie website RottenTomatoes.com, where the “TomatoMeter” shows a grand total of six movie critics give the “Hating Breitbart” documentary a “zero” rating, displayed side-by-side with an audience rating in which 415 viewers rate the documentary “94″ out of a total of “100.”

“Hating Breitbart” is currently being shown in select theaters in some 15 different markets in the United States, as listed on the movie’s official website.

It is available on Amazon.com both as a DVD and for viewing as an Amazon Instant Video. Currently, “Hating Breitbart” is listed in the top 20 documentaries on Amazon.com.

The documentary is also available for viewing on Netflix.com.

May 24, 2013

IRS to be sued in federal court

The American Center for Law and Justice plans to file a lawsuit in federal court next week against the IRS on behalf of several clients, charging the IRS is continuing to target and harass conservative groups applying to create 501(c)3 and 501(c)4 tax-exempt groups, despite White House claims to the contrary.

The ACLJ represents 27 conservative organizations from 17 states that it claims the IRS targeted.

“The White House continues to pursue a narrative that doesn’t square with the facts,” Jay Sekulow, chief counsel of the ACLJ, told WND in an email.

“The assertion that this targeted abuse ended in May 2012 is simply not the case,” he said.

Sekulow said “intrusive and unlawful questioning continued after May 2012 with 18 of our clients receiving 26 questionnaires from the IRS from May 2012 through May 2013.”

“Even more troubling is the fact that the IRS sent a letter to one of our clients dated May 6, just four days before the IRS admitted to launching this targeting scheme,” he said.

On May 20, White House press secretary Jay Carney in his daily press briefing claimed IRS targeting of conservative groups had ended in May 2012.

Two days later, Carney changed his story, adding a year to the timeline.

On May 22, Carney told the press President Obama had acted immediately after the release of the inspector general audit of the IRS, taking steps to make sure the agency practice of targeting conservative groups had come to an end: “Let me say that, as you heard from the president immediately after the release of the independent inspector general’s audit, he is absolutely committed to finding out everything that happened here, finding out who’s responsible for the failures, holding them accountable and ensuring that the IRS take steps so that this will never happen again.”

The Treasury Department inspector general for tax administration released its audit in early May. On May 10, Lois Lerner, then director of the IRS Exempt Organizations Division, told reporters the targeting of conservative groups was “absolutely inappropriate,” suggesting the actions were undertaken by “front-line people” working in Cincinnati who singled out groups with “tea party,” “patriot” or “9/12”in their names.

In filing a federal lawsuit against the IRS, the ACLJ has concluded the White House is covering up continuing abuse, implying that Carney’s statement of President Obama’s orders to the IRS has no basis in fact.

“The intrusive and unconstitutional conduct continues – with the IRS demanding donor lists and even requesting lists of what reading materials that organizations used,” Sekulow charged.

“It’s our belief that the only way to stop this ongoing abuse is to take the federal government to court. We are planning to file a federal lawsuit next week in Washington, D.C., on behalf of numerous organizations. This abusive conduct by the IRS must be stopped.”

26 IRS letters

The ACLJ has documented that since May 2012, the date the White House initially said the targeting stopped, the ACLJ received 26 IRS questionnaires sent to 18 clients.

The 26 IRS letters posed further intrusive and intimidating questions, including demanding donor lists and requesting lists of what reading materials the organizations used, with the latest inquiry coming just days before the IRS revealed its targeting scheme.

None of the IRS questionnaires received by the ACLJ in the 26 IRS letters have been rescinded by the IRS, made inoperative or been revised since the release of the inspector general’s audit earlier this month – the second date the White House said Obama had order the abusive and possibly illegal practice to end.

The ACLJ rejects the IRS contention the abuse was limited to a few low-level employees in Cincinnati.

“While letters were sent from that office, our clients received letters sent from other IRS offices around the country – including two in California and from the main office in Washington D.C.,” he said. “There is no question that the IRS scheme emanated from beyond the IRS office in Cincinnati.”

To prove its point, the ACLJ linked to letters the IRS sent ACLJ clients from the IRS offices in Laguna Nigel, Calif.; El Monte, Calif.; Cincinnati; and Washington, D.C.

Acting IRS commissioner also lying?

Attorney Cleta Mitchell, a partner in the Washington-based law firm Foley & Lardner extends the ACLJ accusations to claim acting IRS Commissioner Steven T. Miller made serious misstatements and misrepresentations in his testimony before the House Ways and Means Committee earlier May 17.

Foley & Lardner has more than 40 years of experience in law, politics and public policy, including providing legal advice to non-profit and issue organizations.

Specifically, Mitchell objected to Miller’s claim that “foolish mistakes were made by people [in the IRS] who were trying to be more efficient in their workload selection.”

In a legal memo to “Interested Parties,” dated May 20, 2013, Mitchell pointed out the inconsistency of claiming IRS employees were trying to be more efficient, when the questionnaires submitted to conservative groups were typically multi-paged “dragnet” type questions probing into every aspect of the applying organizations, including the content of prayers by leaders of the groups.

“So the decision to change a system that (prior to 2010) might ask five to six short questions specifically about an application to one that consisted of dozens of questions, necessitating volumes of materials and documents to be filed with the IRS, was done in order to ‘be more efficient’?” Mitchell asked.

Mitchell noted Miller also spoke about IRS employees “taking shortcuts.”

“This was hardly a ‘shortcut’ when it lengthened the process substantially, as documented in the Treasury Inspector General Tax Audit report,” she said.

Michell also objected to Miller’s attempt to scapegoat two “rogue” employees in the Cincinnati IRS office as being responsible for “overly aggressive” handling of tea party requests for tax-exempt status over the past two years, echoing the claim made by Lerner.

“This is completely false,” Mitchell continued.

“In 2011, at least one of the Cincinnati IRS agents assigned to handle two clients’ applications advised me that the Washington, D.C., office was actively involved in the decisions and processing of my clients’ applications for exempt status. This was memorialized in a letter to the agent, Ron Bell, on November 8, 2011. When I called him in December 2011 for an update, he advised me that the applications had been transferred to a special task force in Washington, D.C., for further review.

Mitchell said the “effort by senior IRS officials to lay this scheme at the hands of a few low level’ IRS employees is despicable and must not be tolerated.”

DOJ forces employees to affirm 'gay' agenda

The Department of Justice is demanding its employees affirm homosexuality and the broader LGBT agenda.

This week, the DOJ mailed an internal two-page document, titled “LGBT Inclusion at Work: The 7 Habits of Highly Effective Manners,” to DOJ managers in advance of “Lesbian, Gay, Bisexual, and Transgender Pride Month,” LifeSiteNews.com reported.

Obama designated June as “pride” month in a presidential proclamation May 31, 2011.

The document, which was emailed to DOJ managers, was produced by DOJ Pride, an independent DOJ employee association.

WND can find no similar “sensitivity brochure” distributed by DOJ that emphasizes the First Amendment religious freedom rights of Christians employed by who object to LGBT lifestyles on the grounds of their religious beliefs.

The document poses a possible conflict of interest. The current president of DOJ Pride is an attorney employed in the DOJ office responsible for hiring and firing attorneys and adjudicating cases involving DOJ whistleblowers.

DOJ advances LGBT agenda

The document requires DOJ employees to express active support of alternative LGBT lifestyles in a series of “DO” and “DON’T” statements.

Among the admonitions are the following:

“DON’T remain silent. Silence will be interpreted as disapproval.”

DO use a transgender person’s chosen name and the pronoun that is consistent with that person’s self-identified gender.

DON’T use words and phrases like “gay lifestyle,” “sexual preference” or “tranny” that are considered by many as offensive.

DO deal with offensive jokes and comments forcefully and swiftly when presented with evidence that they have occurred in the workplace.

DO speak to employees, including LGBT employees, about their experiences at work, and solicit their ideas for how to make the workplace more inclusive.

DO consider coming out of the closet if you are LGBT and not out at work. The presence of visible LGBT managers communicates that your office is open and accepting.

Established in 1994, DOJ Pride is an association formally independent of the Department of Justice, with voting membership in DOJ Pride open to any DOJ employee, former employee, individual contractor or employee of a contractor “who is interested in the association’s interests and goals.”

A DOJ Pride brochure specifies, “DOJ Pride works to make the Department [of Justice] a model employer of LGBT individuals.”

The DOJ’s distribution to managers of the DOJ Pride document implies that those who fail to actively support LGBT lifestyles are in violation of DOJ employment policy, perhaps to the point of losing their jobs or promotion opportunities.

The DOJ Pride document makes no mention of God or of the possibility that DOJ managers or employees might have a personal objection to LGBT lifestyles that that is protected by the First Amendment rights to freedom of religion and expression.

In a WND commentary, Matt Barber wrote that the “lawless administration is now ordering federal employees – against their will – to affirm sexual behaviors that in every major religion, thousands of years of history and uncompromising human biology reject.”

Conflict of interest?

Computer experts have examined the metadata in the computer file for the DOJ Pride document and discovered the author was Marc Salans, the president of DOJ Pride.

Salans also serves as the assistant director in the DOJ Office of Attorney Recruitment and Management, or OARM, which is responsible for hiring all lawyers at Justice.

The DOJ website also identifies OARM as “the Department’s adjudicative office in FBI Whistleblower cases.”

This suggests Salans also is authorized to oversee the qualifications of lawyers hired by DOJ and adjudicate the cases of any whistleblower attempting to make public disclosure of alleged DOJ improprieties.

DOJ encourages LGBT hiring

On the DOJ website, a statement regarding “diversity policy” puts “gender identity” on a par with other discrimination criteria that have been identified by the Supreme Court as being applicable under the 14th Amendment.

The relevant paragraph of the DOJ diversity management policy statement reads:

We value diversity in our workforce and embrace the cultural and demographic dimensions of our country. We work diligently to attract and retain a workforce that represents the range of personal and professional backgrounds, and experiences and perspectives that arise from differences of culture and circumstances. This includes persons of varying age, ethnicity, gender, disability, race, sexual orientation, gender identity, religion, national origin, political affiliation, socioeconomic and family status, and geographic region.

DOJ further interprets Executive Order 11478 as requiring an affirmative action policy that applies to the LGBT community.

DOJ has also established Special Emphasis Programs that includes an aim to hire and support “lesbian, gay, bisexual, and transgender applicants and employees in various categories and occupations and in all organizational components through the department.” The Special Emphasis Program clearly states: “DOJ enhances diversity to Include Lesbian, Gay, Bisexual and Transgender (LGBT) individuals.”

The DOJ website also includes a page in the “photo gallery” to report on the LGBT Pride Month Program conducted by DOJ on June 6, 2012. The website also features the text of a speech Attorney General Eric Holder gave at the event.

Is now the time to pull out of stock market?

NEW YORK – All it took to trigger a global stock sell-off was a comment Federal Reserve chairman Ben Bernanke made Wednesday suggesting the Fed would take a look at backing off quantitative easing at one of its “next few meetings.”

The near-panic selling set off in global markets by a mere suggestion the Fed might quit pumping hundreds of billions of dollars of liquidity into world financial markets should be a warning sign to retirement investors with IRAs, 401(k)s or other funds invested in stocks.

Is now the time for retirement investors to pull out of stock market investments in anticipation of what increasingly appears to be a massive downward stock market adjustment should the Fed significantly ease off buying U.S. government debt?

This may be a difficult decision for many retirement investors to make, especially after the historic gains registered over the past two years in most IRA and 401(k) funds invested in stocks and bonds.

Should the Fed end or significantly reduce QE3, as is widely anticipated for no later than March 2014, interest rates can be expected to rise in the United States, with the likely consequence of setting off a round of losses not only in the U.S. stock market, but also in the U.S. bond market.

Savers and investors in or approaching their retirement years are advised to be cautious, given the limited time remaining in typical life cycle expectations in which to recover losses suffered in investment markets.

Rough waters for retirement savings

For cautious retirement investors who cannot afford to take a loss, the question is not necessarily whether the 15,000 mark is the high point of the Dow Jones Industrial Average in the current investment cycle, but whether QE 3 must come to an end, perhaps sooner rather than later.

The safest calculation of cautious retirement investors may be to examine the possibility the current stock market historic highs have been fueled predominately by the massive liquidity pumped into world markets by the Fed since 2009, as opposed to traditional bull markets in which stock market rises have been fueled by gains in economic fundamentals as reflected in strong corporate earnings derived from genuinely strong market demand.

When the Fed pulls out of QE3, panic selling will benefit only those who get out first, most likely the institutional fund managers and professional financial analysts, not typically the individual retirement funds investor.

A long-standing rule of investing is that those who stay in markets to achieve the last possible gains are the ones who may risk taking substantial losses. Individual retirement savings investors holding IRAs, 401(k) plans and other tax-favored retirement instruments, including variable annuities, may be well advised to pull money out of stock and bond investments at this time.

Market gains that individual retirement investors take at this time can be placed in bank CDs or money market funds to preserve gains and wait for a more stable investment environment in which to go back into stock and bond markets.

This is a time when individual retirement savers should seek the advice and counsel of appropriately licensed professional investment advisors with an established track record of success, even in volatile market environments.

Global stock markets plunge

Global markets took Bernanke’s seemingly innocuous comments as a signal the Fed was serious about ending its third round of buying billions of dollars monthly of U.S. government debt, including Treasury bonds and housing bonds. The program that is currently designated Quantitative Easing 3, or QE 3, indicating the current debt buying round is the third such effort the Fed has taken since the DJIA hit a new 12-year low of 6,547.05 on March 9, 2009.

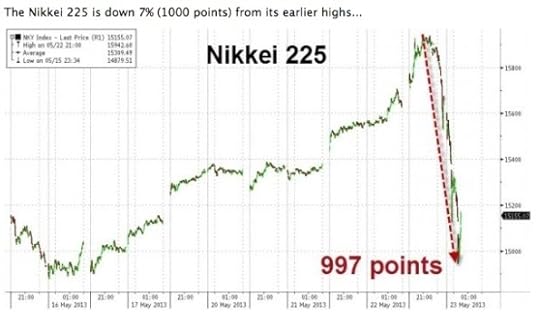

The most severe stock market decline occurred in Japan as a “flash crash” caused the Nikkei index to plunge 7.3 percent.

Japanese Stock Market Decline, May 23, 2013 (Source: ZeroHedge.com)

Overnight in the U.S., stock markets in Frankfurt, London, Paris and Milan slumped more than 2 percent.

On the market open in the U.S., the DJIA plunged 127 points, before bullish analysts, including some government officials representing the Obama administration, quietly advised institutional investors the Fed had no immediate plans of ending or significantly backing off QE3.

Obama balloons Fed’s holdings of debt

Under Barack Obama, the Federal Reserve has become the world’s largest holder of U.S. government debt.

In January 2013, the Federal Reserve revealed that its holdings of U.S. government debt had increased to an all-time record high of nearly $1.7 trillion.

By comparison, when Obama was inaugurated in 2009, the Fed owned a mere $475 billion in U.S. government debt. Since then, the Fed’s holdings of U.S. government debt have increased by 257 percent.

The Fed’s use of quantitative easing demonstrates it is out of monetary tools, having keep interest rates at or near zero in an attempt to stimulate economic growth for nearly three years.

Market expectations until recently have been that the Fed will attempt to stop before $2 trillion of Treasury debt has been purchased and added to the Fed’s balance sheet.

The U.S. Treasury reports that as of this month, total U.S. public debt outstanding is approximately $16.7 trillion; by comparison, total U.S. public debt outstanding at the end of the presidency of George W. Bush was approximately $10 trillion.

According to official estimates by the federal Bureau of Economic Analysis, on Sept. 11, 2012, total U.S. debt exceeded U.S. gross domestic product, or GDP, for the first time since the end of World War II, with U.S. GDP 2012 estimated at $15.6061 trillion, about $440.5 billion less than the $16.0466 in debt that the federal government had accumulated as of that day.

Coincidentally, Sept. 11, 2012, was the 11th anniversary of the 9/11 terrorist attacks on the World Trade Center and the Pentagon, as well as the day on the U.S. facility in Benghazi, Libya, was attacked by terrorists, resulting in the murder of U.S. Ambassador Christopher Stevens and three other Americans.

Novel approach

The use of quantitative easing as a tool of the Fed to stimulate the economy and reduce unemployment is a novel and untested approach to monetary policy.

QE3 was announced Sept. 13, 2012, in an 11-to-1 vote of the Federal Reserve Board. The Fed decided to launch a $40 billion per month, open-ended purchasing of U.S. Treasury debt instruments and U.S. agency-generated mortgage-backed securities.

On Dec. 12, 2012, the Fed decided to increase the open-ended purchasing of U.S. debt from $40 billion per month to the current level of $85 billion a month.

May 21, 2013

Christians claim IRS harassment in election

During the 2012 election year, the Internal Revenue Service delayed the application of a conservative Christian group in Ohio that was seeking 501(c)3 tax-exempt status to register Christians to vote and to oppose the ACLU in court in First Amendment cases.

“We have suspicion that the IRS delayed our application for nearly 13 months due to the selective targeting of Ohio conservative groups that Congress is now investigating in both the House and Senate,” stated Chris Long, president of the Ohio Christian Alliance, told WND.

Long said his group’s original application made it clear that the new organization would go into Christian congregations with a non-partisan effort to register voters in the battleground state of Ohio during the 2012 presidential election.

“The IRS knew we would be registering conservative church-goers and weighing in on the 2012 presidential election,” he said.

Long pointed out that the non-partisan Ohio Christian Alliance Educational Fund, operating as a 501(c)3 organization, would have registered both Democrats and Republicans.

The group has operated as a 501(c)4 since 2004, but only 501(c)3 groups can accept tax-deductable contributions.

The ACLU has both a 501(c)3 and a 501(c)4 organization. The 501(c)3 group pursues legal cases, and the 501(c)4 advocacy group engages in legislative efforts.

Long suspects the IRS was attempting to block the Ohio Christian Alliance, or OCA, from forming a 501(c)3 organization because it didn’t want the organization to counter the ACLU in court.

He noted that at the time of OCA’s application, the Obama administration was pushing forward the Obamacare mandate that would require even Christian organizations to pay for abortion and contraceptive services in employee health care plans.

“My suspicion is the IRS knew the Ohio Christian Alliance would appear in court to oppose the ACLU and the HHS mandate,” he said.

“It did cause us to wonder after these reports surfaced if there may have been some motive behind the additional questions to our application and the delay in its processing.”

Long said it’s now up to Congress to further investigate what the motives of the IRS officials might have been.

In a formal letter, Long and OCA have asked the House Ways and Means Committee to investigate how the IRS handled their request to form the Education Fund as a 501(c)3 organization.

The group wants the House panel to find out how the applications of other organizations with missions similar to the Education Fund were processed last year.

Sarah Swinehart, a House Ways and Means Committee staff member, was shown a copy of OCA’s letter to the committee and said she had not seen it. She promised to pass it on to appropriate staff.

The committee has established a page on its website titled “The IRS Political Discrimination Investigation: Share Your Story,” inviting organizations that alleged discrimination by the IRS for political reasons to tell their story and file a complaint with the committee.

IRS timeline

The Ohio Christian Alliance provided WND with documentation, including copies of IRS correspondence, that establishes the following timetable:

OCA filed a Form 1023 application with the IRS on Feb. 8, 2011, to create the Ohio Christian Alliance Education Fund as a 501(c)3 tax-exempt group in which contributions would be tax-deductible;

On March 17, 2011, the IRS responded to OCA, saying within 90-days it should receive a response from the IRS;

Months went by with OCA receiving no response from the IRS, despite repeated efforts by the group’s lawyers to determine the status of the application;

Then, on Dec. 12, 2011, OCA received what amounted to a two-page demand letter from the IRS, dated Dec. 8, 2011;

The IRS demand letter required OCA to file “additional information” to a detailed series of questions by no later than Dec. 30, 2011, 18 days after the receipt of the IRS demand letter, or the IRS would conclude OCA no longer wanted to pursue the application;

The IRS informed OCA that if it did not respond by the deadline, the IRS planned to treat the Ohio Christian Education Fund as a taxable entity.

“The IRS gave us only 18 days during the holiday season in December to respond to a long list of intrusive questions when the it knew it would be difficult for us to get the time required from our lawyers,” Long said.

He believes the IRS’s motivation was political.

“I believe the IRS wanted to block the Ohio Christian Alliance from being effective registering Christians to vote in the 2012 election, especially because Ohio was considered such an important battleground state,” he said.

Long’s lawyers were available in mid-December 2011, and OCA was able to expeditiously answer the IRS.

Finally, on Feb. 21, 2012, OCA received a determination letter approving 501(c)3 status for the Ohio Christian Alliance Education Fund, nearly 13 months after the original filing.

Long explained to WND that OCA lost several substantial donations from contributors who wanted to make tax-deductible contributions.

“Each month the application was delayed put the Ohio Christian Alliance Education Fund at a distinct disadvantage in fundraising capability,” he noted. “Most grant dispersements to organizations with missions similar to that of the OCA Ed Fund were distributed in November and December 2011 and January 2012. By the time we got our determination letter, that money from the large contributors had already left the barn.”

IRS questions ‘opposing anti-Christian bigotry’

The questions submitted in the IRS demand letter of Dec. 8, 2011, caused OCA to wonder about the IRS’s motivation, Long said.

“The IRS narrative suggested that somehow it was objectionable to oppose anti-Christian bigotry and defend the rights of Christians.”

The IRS letter read:

“The narrative [of the Ohio Christian Educational Fund] indicates the organization ‘ … opposes anti-Christian bigotry and defends the rights of Christians.” Please describe how the organization achieves this purpose. For example, will the organization engage in legal action against activity the organization interprets as Christian bigotry, or are the actions of the anti-Christian organization against anti-Christian bigotry more accurately classified as educational in nature.”

Long instructed his attorneys to inform the IRS that the Ohio Christian Educational Fund did intend to file legal actions in court.

“The ACLU is a 501(c)3 organization and they file legal suits in court all the live-long day,” Long countered. “We are opposed to the positions the ACLU holds, we are at the opposite end of the spectrum. But why would we not have access to the courts to defend the First Amendment rights of churches, Christians, and institutions that hold with religious beliefs?”

The IRS also asked OCA to supply a complete description of all activities planned for the Ohio Christian Alliance Education Fund for the next 12 months.

“Remember, we had already filed with the IRS a detailed and comprehensive application in which we went through the entire narrative of what the Education Fund would be about, as well as the details of how it would be organized, how it would be structured and what activities the 501(c)3 would be conducting,” he said.

Long said his organization’s lawyers found the IRS’s handling of the application very unusual, expecting the application to be accepted in five or six months, at the most.

“We had already answered all those questions in the original application,” he said. “Our lawyers have had some three decades of experience filing tax-exempt applications with the IRS, and they were surprised.”

Jerome R. Corsi's Blog

- Jerome R. Corsi's profile

- 74 followers