Rickey Gard Diamond's Blog, page 2

April 15, 2020

Want to Understand the Fed? Ask Pam or Ellen, Not Janet or Jay

The Federal Reserve building, Washington D.C. (Rafael Saldaña)

Lately the Fed’s innovations have been in the news, expected to generate the six trillions we’re told we need to face off the coronavirus pandemic. The CARES Act promises $2.2 trillion in crisis relief, mostly for corporations. But the Fed is also making $4 trillion newly available through a host of new programs.

If you’re like most Americans, you’re wondering—um, who’s the Fed again? What changes exactly? And do I have the bandwidth to care right now?

You’re not alone if you’re confused or overwhelmed. Even Janet Yellen, who is the only woman ever to have chaired The Fed for a brief four years, appeared on CNBC last week to share her worst COVID-19 fears—and also, alas, a “learned ignorance.”

That’s a term coined by Erasmus to describe educated book-learning’s blind spots. Thorstein Veblen called it “trained incapacity,” for the way elite educations can smooth over any threatening questions about causes of bad results. Any ignorance you have is also learned, but more likely due to the Fed’s growing obfuscation and deception.

Since its establishment in 1913, the Fed has created our dollars. Called Federal, it is actually a network of privately-owned banks, dominated by Wall Street’s biggest banks. Like the Bank of England and other central banks, The Federal Reserve System has no vaults of gold or your savings in a locked safe to back its loans; the Fed System literally creates money out of thin air and debt. At its simplest, you could say its Reserve is actually our US Treasury bonds, or American debt, which the Fed’s primary dealers—those biggest banks again—auction off to the highest bidders world-wide.

To her credit, Janet Yellen at least worried out loud about Main Street people that Alan Greenspan, her predecessor who chaired the Fed for 19 years, never noticed even in the midst of the 2008 crash. She cited matters that Jerome “Jay” Powell, her Trump-appointed successor, ignores with his latest Fed “innovations” that serve Wall Street. Yellen told CNBC that regular people like you and me will also affect economic recovery post-COVID-19, saying:

“…if households have run down their savings and had to dip into retirement savings, or are behind on their bills, and have higher debt and lower wealth, their spending patterns are not likely to go back to what they were….”

She predicted coming bankruptcies.

But here’s the learned ignorance that astonishes, called out by financial investigative reporter Pam Martens. Beginning on September 17, 2019, four months before any US coronavirus cases, the Fed started pumping billions of dollars to Wall Street’s biggest trading houses, owned by New York’s biggest banks and hedge funds, all busy eliminating 68,000 jobs. By now this Fed backup begins to look like a new kind of bailout that author Ellen Brown likened to a trillion-dollars-a-day credit machine. So, it was surprising to hear Yellen repeat what Pam calls, “the official delusional mantra.”

“We have a strong, well capitalized banking system,” Yellen declared on CNBC: “We’re seeing the benefits of that.” But as Pam pointed out: What benefits?

Even those Americans without money in the market can see the difference between the Feds’ trillions and a lousy $1200 check they’ll possibly get. We all see the Dow reports on the market’s scary ups and downs. Finance pages report plummeting bank share prices and something called the repo market, a freakily growing number of short-term mostly private overnight loans that feel panicked.

Basically, the Fed’s so-called innovations do the same old same old, providing cheap loans for Wall Street’s biggest players while somersaulting linguistic gymnastics. On March 23, more than ten Special Program Vehicles (SPVs) were launched, each with its own tortured name and acronym. One of them, the Primary Market Corporate Credit Facility (PMCCF), allows the New York Fed to buy BBB-rated investment bonds before they turn into corporate junk-bonds on the books of the biggest banks, which would downgrade the banks themselves.

They’ve also resuscitated an SPV from 2008’s bailout, the Primary Dealer Credit Facility (PDCF), loaning to Wall Street’s trading houses at one-quarter of one percent interest, while accepting as collateral those trader’s stocks and toxic waste known as Collateralized Debt Obligations (CDOs) and Collateralized Loan Obligations (CLOs).

Got that?

I won’t blame you if your eyes cross at all this verbiage. That’s why it’s complicated, in hopes you’ll give up. But when CNBC asked Janet Yellen if the Fed should be buying stocks, her answer’s “trained incapacity” was shocking. The Fed is not legally allowed to buy stocks, she said, restricted to buying government debt and agency debt with government backing—when clearly the PDCF allows exactly that, and not for the first time. As Nomi Prins made clear in It Takes a Pillage, its CDOs were a big part of the 2008 crisis.

We wouldn’t discover how big until US Sen. Bernie Sanders demanded an audit of the Fed, their first audit in nearly a hundred years. That’s how we found out that the Fed, in secret, had loaned another sixteen trillion dollars to EconoMan, the mostly white rich guys on Wall Street whose toxic assets had just caused the 2008 crash. The Fed hasn’t had an audit since.

If you want clearer more sensible explanations of the Fed’s hall of mirrors, check out Yves Smith at Naked Capitalism, Pam Marten and her husband Russ at Wall Street on Parade, and also Ellen Brown’s three books, Web of Debt, The Public Banking Solution, and Banking on the People, all available at The Public Banking Institute, a real source of some good news for a change. A financial system funded by the public for the public good, could create money as a utility for all of us on Main Street, instead of what we have now—a profit center for the richest few on Wall Street.

You can find all of Rickey’s columns at Ms. Magazine series tab or more directly here: Women Unscrewing Screwnomics . Read some good news for a change!

April 7, 2020

RBG Says It: A Demand for Pandemic Polls is Wrong!

Wisconsin Republicans have come out from under their rock to assert a truth: it’s to their party’s advantage when voting is suppressed, however you do it. Their latest methods are new and frightening.

Wisconsin’s governor, a Democrat, sought to move primaries to a safer summer deadline.; the vote would include a seat on the Wisconsin Supreme Court, as conservative as the R-dominated statehouse, Republicans wanted to keep it that way. They took the Governor to a state district court, which upheld the Governor’s move, but then SCOTUS took up the case, and narrowly (along party lines) upheld the Republican move to vote at in-person polls today and to shorten the deadline for absentee voting.

They vote for judges in Wisconsin. So if you are a Wisconsin citizen who wants to replace a conservative judge with someone you prefer, all you have to do is risk your life. Oh, and put the old ladies at the polling desk at risk. And first find the place where you’re supposed to vote. In the interest of polling “safety,” numbers of sites for voting have been reduced. There are now four for the city of Milwaukee!

Meanwhile, requests for absentee ballots go unacknowledged and unsent, according to many. Not surprising. There’s a pandemic going on.

Is this a preview of Republican plans for November???

The great SCOTUS Justice Ruth Bader Ginsberg wrote the dissenting opinion: “The majority of this Court declares that this case presents a ‘narrow, technical question, That is wrong. The question here is whether tens of thousands of Wisconsin citizens can vote safely in the midst of a pandemic. Under the District Court’s order, they would be able to do so. Even if they receive their absentee ballot in the days immediately following election day, they could return it. With the majority’s stay in place, that will not be possible. Either they will have to brave the polls, endangering their own and others’ safety. Or they will lose their right to vote, though no fault of their own. That is a matter of utmost importance— to the constitutional rights of Wisconsin’s citizens, the integrity of the State’s election process, and in this most extraordinary time, the health of the Nation.”

Thanks to Alternet and Cody Fenwick for covering this story. And thanks to NPR for its reports of voters turning out in masks, and polls having plastic shields and more. Let’s see what happens! Tell your legislators you want paper votes and absentee votes for November.

March 20, 2020

A Viral Refocus of Work Norms

In Her Words editors at The New York Times wrote this week about the new world many are experiencing, housebound now, while working. Are you feeling like the BBC Dad whose interrupted interview went viral? Remember how he stiff-armed his daughter, and pretended not to see the baby, while poor mom panicked behind him, clearing his office?! Then he apologized. You can see it at the link above.

Who created a business world free of children’s laughter, curiosity, and hungers? Not women!

Imagine if children and home were always an expected part of their parents' work life! Shouldn’t they be welcomed? Wouldn’t that be more normal? Here’s how to handle it! Laugh when you can!

March 13, 2020

Undesigning Old Redlining is a Women's Issue

Thanks to WILPF’s Mary Hanson Harrison in Des Moine, Iowa, for sharing this event at the city’s Franklin Jr High School, supported by the Chrysalis Foundation for Women and Girls. Next, do City Hall and CitiBank!

In the "COLOR OF LAW: A Forgotten History of how our government segregated America", Richard Rothstein sends the reader on a BIG city tours of prejudice and disenfranchisement from Boston to San Francisco. In contrast, the Redline tour illustrates the essence of why understanding small town, rural communities needs to be highlighted in any history lesson of discrimination and the ravishing of often-overlooked cities and towns. It's just too easy to look at the BIG cities and not identify with them, but here, we see once thriving black communities torn apart by highways and racial zoning. It's a small story with a powerful exclamation point!

It’s a story recognizable across the country. You’ll see Benton Harbor, Michigan, transformed in Screwnomics. We can also recommend Linda Gartz’s recent book, Redlined: A Memoir of Race, Change, and Fractured Community in 1960s Chicago, for a more personal woman’s point of view on this economic issue so ready for big change.

February 29, 2020

Emotional Courage Counts Too

Imagine a world where men could dance together and be seen as stronger than ever! We women would love it! They could even dance with us and not be embarrassed for feeling joy in their bodies just for moving to music, for daring to know themselves fully!

February 15, 2020

Solutions Come Naturally

We LOVE this video, full of hope, not despair—and action is simpler than you think. Share this, talk about it, because everything counts, what YOU do counts!

February 13, 2020

Yowl About Trump's New CAT Policy

U.S. CAT Policy won’t regulate the surprising number of kitty videos we so love on YouTube and Facebook—nor will it urge you to get your pet spayed.

But you should worry.

(Helgi Halldórsson / Creative Commons)

CAT is the “affectionate name” for the Conventional Arms Transfer Policy that national security think tanks and lobbyists have embroidered for Congress since Jimmy Carter. His 1976 campaign, post-Vietnam, called for a more public process as a check on arms sales exports. Congress agreed transparency about deadly weapons sales and government-to-government transfers was important. Supporting human rights helped define our real national security.

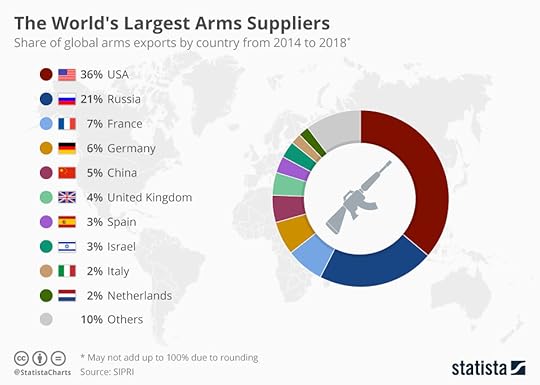

CAT Policy answers the common question of why US presidents and our State Department sometimes appear to be acting as an overseas sales force for armament corporations. They’ve helped make Lockheed Martin, Boeing, Northrup Grumman, Raytheon and General Dynamics the five biggest weapons suppliers in the world, reported the independent Stockholm International Peace Research Institute in December 2019. Total arms sales of US companies amounted to $246 billion, fully 59 percent of all world arms sales, and up 7.2 percent over 2017.

via Statista

Weapons sales numbers also help shed light on the US Dept. of Defense (DoD) cost of maintaining 800 US military bases—not here in the US, but in 70 foreign countries. Base Operations Support alone cost $250 billion in 2016. Last year’s DoD appropriation was for $617 billion, plus $69 billion for 2019’s war budget, totaling $689 billion, a $160 billion increase.

And holy cats! The cost of human injury, suicide and death appeared few places until Columbia economist Joseph Stiglitz joined Brown University professor Neta Crawford to report that the post 9/11 wars of Afghanistan and Iraq had actually cost taxpayers $5.6 trillion. We’re still counting.

You’ll remember President Donald J. Trump’s first foreign trip was to Saudi Arabia in May 2017, resulting in a $110 billion weapons sale. That these were the latest and deadliest killing machines devastating Yemen hardly affected Trump’s transactional braggadocio. So ruthless were the Saudi attacks on Yemen civilians that a divided Congress found something to agree on, a resolution blocking $8.1 billion in Saudi weapons sales. Trump vetoed this in 2019, and sent the weapons anyway. His administration had helped loosen sales with its new CAT Policy.

Trump’s reframed CAT adds “economic benefits” as a new criterion. He seeks more transfers and quicker reviews of human rights by Congress and the State Department with an added reviewer, the US Chamber of Commerce. To help weigh and define sales “benefits,” the Chamber has newly spawned its own Defense and Aerospace Export Council. Their strategic plan is to “host initial discussions and conduct a survey of industry executives on the global challenges they face competing with foreign exporters.” The CEOs of Lockheed Martin, Boeing and others apparently couldn’t afford this without government help.

One informative panel discussion of CAT changes took place at the Center for Strategic and International Studies, where well-funded meetings regularly churn bureaucratic “word soup,” as one panelist described it. He expressed concerns that CAT was not about a simple trade commodity, but dangerous killing machines often misused by abusers of human rights. The US had gotten it wrong in the past (like weaponizing Saddam Hussain and Osama bin Laden). He had hopes that lately Congress was taking its review powers more seriously, sometimes blocking these.

The new DAEC rep sat on the Center’s panel, too. He described Trump’s expanded CAT Policy as: “a unique opportunity capitalizing on…influencing the government—both US government and foreign governments—and working with our industrial sector to advance opportunities for industries globally.” It’s hardly comforting that armament CEOs will now more directly determine how many guns, missiles, and killer jets must protect democracy around the world—you know, like the democracy in Saudi Arabia.

American jobs creation by the arms industry is Trump’s underlying premise—and about as bogus as the yield from clean coal jobs vs. double-the-number of solar and wind jobs. Fortunately, Tom Dispatch writers Cassandra Stimpson, Nia Harris and Ben Freeman, have helped expose the lie, drawing on the work of some watchful women academics.

Catherine Lutz, Neta Crawford, and Andrea Mazzarino first founded the Costs of War Project at Brown University in 2011, now housed at the University’s Watson Center. (Crawford later also worked with economist Stiglitz.) Tom Dispatch cited the Project to find that “$1 billion in military spending creates approximately 11,200 jobs, compared with 26,700 in education, 16,800 in clean energy, and 17,200 in health care.” So why, you might ask, do we spend more on DoD than all these others combined? Just eleven percent of DoD could fund clean energy for every home, says National Priorities.

Heidi Garrett-Peltier’s report at UMass-Amherst’s Political Economy Research Institute underlined the comparatively poor choice military spending is for job creation, finding that each $1,000,000 of DoD spending creates 6.9 jobs, counting not just defense industries but their supply chain subcontractors. Spending the same $1,000,000 on wind or solar energy corresponds to 8.4 wind energy jobs or 9.5 jobs for solar. A million bucks produces 19.2 jobs in elementary-high school education and 11.2 jobs in higher ed.

Jobs in education and green energy include the added benefit of hardly ever killing or disabling people, while carrying the hope of making Americans smarter. Smarts are required when dealing with our tricky military-industrial CAT Policy and arms exporters. Tom Dispatch checked with the US Securities and Exchange Commission (SEC) to discover whether the five top Pentagon defense contractors had in fact created promised jobs from 2012 to 2018. Despite increases in government funding, three of the five had slashed jobs and sent others overseas. Jobs added mostly came from buying out competing companies. CEO pay and stock returns went up, however.

Now you know how Trump’s CAT Policy chases the government budget up a tree and way out on a limb. Military Times asked presidential Dems about DoD’s budget, and of the top five in Iowa, only Warren and Sanders planned cuts, though Klobuchar promised a review of inefficiencies and maybe cuts. Whatever your party politics, remember, Congress still can check overzealous arms transactions. So yowl meow!

Check out Ms. Magazine’s must-read news and other Unscrewing columns by Rickey Gard Diamond here: msmagazine.com/tag/women-unscrewing-s...

January 10, 2020

Daddy Warbucks Is Not Coming to Save Us—But Women Economists Will

from Rickey Gard Diamond’s column in Ms. Magazine. See them all at msmagazine.com/tag/women-unscrewing-screwnomics-series/

You may have dreamed of a white Christmas—but events becoming whiter and more exclusively male in 2020 show signs of turning nightmarish.

In December 2019, there was reason for hope: Nancy Pelosi and the U.S. House impeached the president. The Democratic debates, although they grew whiter, still included two women. And the first ever female president of the Economic Policy Institute (EPI), Thea Lee, appeared on Samantha Bee’s Full Frontal—proving economists can be fully human and funny, and encouraging a whole flank of female economists, notably rare in this still whitest, mostly male and unfunniest realm.

Economists at EPI, a nonpartisan nonprofit focused on policies affecting middle- and low-income families, are more diverse than those at most economic think tanks in Washington, D.C. In late October 2019, Lee hosted a distinguished panel to discuss how the economic conversation changes when women enter the picture that included Janet Yellen, the first and only woman former head of the Federal Reserve, and Bucknell University professor Nina Banks, who described committee work seeking curriculum change at the National Economic Association. The youngest panelist, Harvard Research Scholar Kayla Jones described a new community of black women economists, named for Dr. Sadie Tanner Mosel Alexander, the first of her race to earn a Ph.D. in economics in 1921. (The Sadie Collective will hold its second national conference in Washington, D.C., Feb. 20-22, 2020.)

The life experiences of more diverse economists, Lee told Ms., promises a wider variety of perspectives and research into unique problems and solutions.

Lee’s own heritage is Jewish-Chinese. She started as a trade economist at EPI in the 1990s, and went on to work with the AFL-CIO, the largest labor organization in the country. Late in 2019, she told reporter Carly Stern at Ozy.com that men dominated the top ranks of both economics and labor during most of her career. “That’s made me feisty,” admitted the five-foot-two woman whose nickname at the AFL-CIO was “Big Labor.”

In December, she was appointed to the Congressional U.S.-China Economic and Security Review Commission—created in 2000 to help oversee trade war details, another hopeful development. She already served on the board of the nonprofit Congressional Progressive Caucus Center, helping to nail down the details of Alexandria Ocasio-Cortez’s Green New Deal on the horizon.

Then, just as 2019 came to a close, The New York Times revealed the backside of Trump’s 2017 tax cut, a more skyrocketing federal deficit than had first been predicted.

Two tax reform measures, publicly proclaimed as a way to get corporations to bring their money back from overseas tax havens and invest in jobs here, had acronym names: BEAT and GILTI—yes, you read that last one right—stands for Base Erosion and Anti-abuse Tax and Global Intangible Low-Taxed Income. Clear as mud.

These two changes, we’d been told with a straight face, would save the day and our jobs. But rewired by lobbyists with devilishly detailed new rules-making, these two measures became a booster rocket attached to our federal budget. Newly reinforced tax exclusions for the wealthiest sent our government’s revenues into an outer space void.

Our government begins to look as bankrupt as Trump’s Atlantic City casino. In 2018, the U.S. had the biggest budget deficit of any of the 36 developed nations that are members of the Organization for Economic Cooperation and Development; our drop in national revenue in 2018 was also the biggest.

Daddy Warbucks didn’t come to our rescue. Instead, we cut food stamps for our poorest families, a tiny drop in our federal deficit bucket. Middle East war-making has already cost us $6.9 trillion, according to a Brown University study cited by CNBC. Now thanks to a suspiciously timed “imminent threat,” an impeached president tweet-threats Iran with the Pentagon’s “brand new beautiful equipment.”

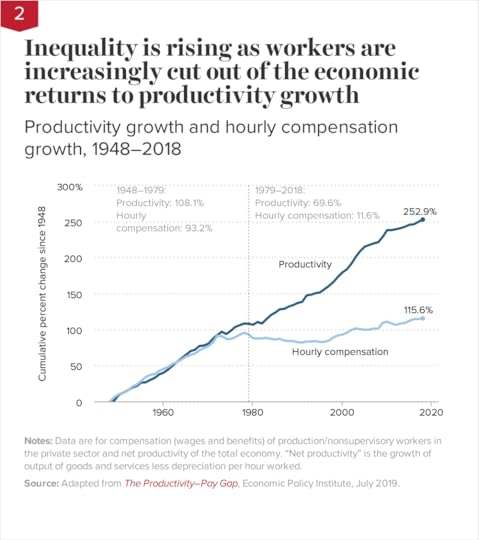

More privately held profits for those who own financial tools and transnational corporations means more freedom to exploit labor around the world. This privatized white male solidarity among the one percent keeps our U.S. wages stuck in the 1970s. Some of EPI’s most important research, Lee told Ms., is its analysis of the ratio, or relationship, between U.S. productivity and U.S. wages over the long haul.

For a little more than 30 years after WWII, from 1948 to 1979, and in a time when labor unions were more numerous, the two figures nearly matched. Overall productivity grew 108 percent, while hourly wages grew by 93 percent. In the nearly 40-year period from 1979 to 2018, productivity and wages parted ways. While production efficiency increased by another 69.6 percent, hourly compensation grew by only 11.6 percent.

The promise of “trickle down” was betrayed by policies favoring larger corporate profits—like Trump’s latest tax cuts—while squelching labor organizing. The result is growing inequality for a labor force more productive than ever. Thanks to additional rule-making magic by Trump’s National Labor Relations Board, EPI also reports that workers’ rights have been rolled back at an unprecedented rate, reversing an intended mission to protect them.

Only Congress can enforce workers’ rights it once established by law. It’s the same Congress that needs to run a fair impeachment trial and curb presidents who go to war without counting the cost in lives, money or shame. The stock market is already rearranging investments to cash in on higher oil prices and armaments, but the resulting costs of commutes and taxes will come out of working family pockets.

Lee at the EPI helps make sure we can see clear details and add it up for ourselves.

November 29, 2019

Cooperatives and Credit Unions Deliver Economic Justice to Black America

Economist Jessica Gordon-Nembhard’s research into black history revealed a cooperative business model that had been largely forgotten, but is now being revitalized.

Building community assets through cooperatives is essential to repair the harm done by colonization and slavery in America. Cooperatives can regenerate poor communities that still suffer worst from white supremacy, pollution, monopolies, and financial extraction. Resilient people are tapping into ancient ways of collaborating through shared ownership. By participating in coops, individuals are more effectively stewarding resources and taking responsibility for meeting the needs of the community in mutually beneficial ways.

People are engaged in utility cooperatives, food and pharmaceutical coops, community-supported agriculture, and housing cooperatives to create more vibrant local economies. These decentralized networks of citizens contribute to a solidarity economy which is especially important in times of financial hardship. Decentralized organizations are more agile, because of the agency given to each participant to offer their unique intelligence.

With increasing climate chaos and the collapse of old-fashioned hierarchical systems, we need quick and efficient processes and structures to align a community’s actions with the health and well-being of living systems. Two African American women, Jessica Gordon-Nembhard and Ebony Perkins are each engaging predominantly black communities in a solidarity economy through the use of cooperatively owned structures. These women are changing hearts and minds of people, and increasing the well-being in some of the most disadvantaged populations in America. Listen for my podcast interviews of them at Money-Wise Women in early 2020.

Jessica Gordon-Nembhard has been a political economist for over three decades and is a professor who studies worker-owned cooperatives and credit unions. Her book is Collective Courage: A History of African American Cooperative Economic Thought and Practice . Jessica’s decades of research explores cooperative economic development and worker ownership, community economic development, wealth inequality, community-based asset building, and community-based approaches to justice.

She says, “I am more interested in decreasing poverty, democratizing capital, and re-distributing wealth than simply closing the wealth gaps.”

Ebony Perkins is the investor and community relations manager at Self-Help Credit Union. Last October, she was named a recipient of the “30 Under 30 Award,” at the 2019 Socially Responsible Investing Conference. Ebony wrote this recent article, “Plan for Tomorrow by Supporting Vulnerable Communities Today,” in the “Community Impact Investing” issue of the GreenMoney Journal .

Self-Help Credit Union finances underserved populations, including people of color, women, rural residents, and low-income families.They have made loans totaling over $386 million to projects with environmental benefits, including recycling businesses, land conservation, efficient affordable housing, and solar energy.

Ebony says, “If our goal is to achieve environmental and economic justice, we need to prepare for tomorrow by investing today in the communities that are most vulnerable to the shocks and stresses of climate change and most impacted by the burdens of pollution.”

More critical of the privately-owned non-cooperative banks, past Money-Wise Women guest Ellen Brown writes, “Banks are not serving the real economy. They are using public credit backed by public funds to feed their own private bottom lines. She quotes Pam and Russ Marten of “Wall Street on Parade,” who write: “‘According to its SEC filings, JPMorgan Chase is partly using federally-insured deposits made by moms and pops across the country in its more than 5,000 branches to prop up its share price with buybacks.’ Small businesses are being deprived of affordable loans because the liquidity necessary to back the loans is being used to prop up bank stock prices. Bank shares constitute a substantial portion of the pay of bank executives.”

Clearly, we need to remove our money from these predatory banks and use cooperative banking structures. My interviews with Jessica Gordon-Nembhard and Ebony Perkins will illuminate the way to circulate value locally through cooperative structures. Stay tuned!

—by Crystal Arnold, founder of Money-Morphosis, director of education at Post Growth Institute

For more: check out this video of a Truthout Laura Flanders interview with Dr. Gordon-Nembhard on the black radical tradition of economic solidarity.

November 20, 2019

He Only Cares about Big Stuff

If you’ve been too busy to watch the televised impeachment hearings, like me, you rely on news sources to highlight what’s most important, only catching pieces. As I ate breakfast yesterday, I watched while Minority Chairman Devin Nunez readied for the testimony of Jennifer Williams, a VP Senior Aide, and Lt. Col. Alexander Vindman, who had each served under presidents of both parties. Rep. Nunez’s attacks on the whistleblower came as no surprise, as I’d tuned into Fox and learned this is their theme too.

But his repeated “False!” declarations as he listed “hysterical” mainstream reports troubled me. What evidence? Reports of John Solomon, he claimed. Who’s he? No reporter; he’s a media “executive” like Steve Bannon, with a long history of reports catching fire in far-right online news. His allegations about Ukraine and Biden in The Hill were weaponized by Giuliani and Sean Hannity. Solomon’s columns were questioned by other reporters at The Hill, and now its editor has ordered his columns be fact-checked and annotated.

Fact-checking is something you’d hope they’d do BEFORE they published. So are we in some carnival hall of mirrors? Yes. Much of it is a new virtual world owned by billionaires. So how do we find our way out?

Like Dorothy in the land of Oz, all we can do is follow the yellow-brick road—the money. In the background is news about Energy Sec’y Rick Perry’s attending Zelensky’s Ukraine inauguration, after the President and VP Pence both declined the new president’s invitation. Lower down the pecking order, Perry was one of the “three amigos,” and in private he recommended to Zelensky his favorite trusted Texan energy consultants—who also just happened to be Perry donors—who just happened to win a 50-year drilling contract despite a lower bid than competing Ukrainians. Perry recently resigned. Adios, senor.

Another of the amigos on special assignment by the president, billionaire donor Gordon Sondland made ambassador, has been filmed explaining his business philosophy of quid pro quo, his words, claiming something for something is more useful than the usual government diplomacy. He doesn’t say useful for whom, but I don’t think he means you and me or the Ukrainians.

Two recent movies reveal how awful and laughable these generalissimos and their amigos are, their sociopathic egos a danger to themselves, as well as to us. Check out The Laundromat, now on Netflix, for its coloring in the gray details of offshore banking and shell companies’ money-laundering, exposed by Monseca’s Panama Papers. What’s not to like when Meryl Streep appears as an ordinary grandmother who cannot be stopped. Money scandals aren’t over until we say they are, she says.

Then watch The Brink on Hulu, filmed by a young woman descended from holocaust survivors. I don’t know how on earth Alison Klayman talked Steve Bannon into letting her film him for months—his ego? This film is darker, alarming even, lightened only by glimpses of a real life as grungy as any, and the rising resistance of women in 2018, defeating Bannon’s guy, Roy Moore. Their voices and our reanimated elections remind us that bombastic fake-men, impeachable bores and liars, are far from inevitable. The trail of “big stuff,” namely “big money,” marks our way out of a fantasy Oz.