Tyler Cowen's Blog, page 516

May 2, 2012

Does the term structure of debt limit monetary policy?

Here is a superb piece from Jim Hamilton, hard to excerpt so read the whole thing. Here are comments from Brad DeLong.

Question of the day

Employers [under ACA] save $422 billion if they dump health coverage. Will they?

From Sarah Kliff, here is an argument that the answer will be no. I am less convinced. I believe national effects will be larger than single-state effects (Massachusetts), and that employers will offer their employees some compensation for taking their chances on the subsidized exchanges. I suppose we will see, or then again maybe not.

Bucharest bleg

After Milan, I will be in Bucharest for a few days. Your recommendations are most welcome and I thank you in advance.

Why is unemployment so high in South Africa?

Ryan Cooper writes to me:

Hey Tyler, possible blog post topic: I’m wondering how you would explain the situation in South Africa (or other similar countries) with stupendous persistent unemployment–SA has been above 20% since 2000: http://www.tradingeconomics.com/south-africa/unemployment-rate

A few factors I imagine are important:

1) The education system is totally broken in a lot of places. As in, 12th graders can neither read nor write in any language nor figure out 3×3 in their heads.

2) Unions are crazy strong, and have been driving up wages like gangbusters, particularly in the public sector.

3) Minimum wage laws are stringent and have actually led to worker protests: http://www.nytimes.com/2010/09/27/world/africa/27safrica.html?pagewanted=all

4) Inflation hasn’t been TOO bad recently (~6%), but has seen spikes to almost 14 percent not long ago: http://www.tradingeconomics.com/south-africa/inflation-cpi

5) There’s a highly developed sector. On average, whites are far richer than blacks.

6) Crime and inequality are incredibly bad.

7) The ANC has won every election in a landslide and is strongly allied with the unions.

So how does it tie together? Lots of poorly-educated ZMP layabouts? Wages too high to start sweatshop-style development? Razor wire + electric fence + security guard costs deterring investment? The results of generations of systematic oppression and denial of education? All of the above, plus some?

Just trying to iron out a coherent story. I was a Peace Corps volunteer for two years there and I’m slowly building up my economics knowledge; this question has always fascinated me.

Here is one additional account. Here is an IMF analysis. Here are some World Bank powerpoints. I told him I would try to answer the question, but after a bit of research I don’t find myself getting much further than his suggestions.

May 1, 2012

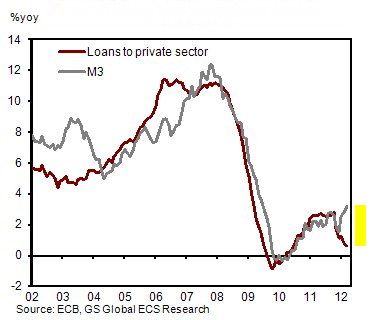

Divergence of credit and money stock in the Eurozone

Uh-oh:

Eurozone M3 vs loans to the private sector (source: GS)

Eurozone M3 vs loans to the private sector (source: GS)

From SoberLook, here is more. One possible lesson is that the real enemy of monetary policy is collapsing credit markets, not zero short-term rates per se.

*The Substance of Style*

That is one of Virginia Postrel’s best books, you can now buy it on Kindle for $2.99. Mine is the second Amazon review, Jerry Brito’s is first.

April 29, 2012

The cultures that is Europe

Many of the Spaniards say the work environment in Germany takes getting used to, with Germans far more direct than Spanish people and much quieter. No one makes personal calls during business hours, for instance. But the work day is much shorter.

They were surprised that they were expected to greet co-workers each morning with formal handshakes and to call colleagues “Herr” and “Frau” (Mr. and Ms.). Impromptu hallway conversations over work issues were cut off by Germans suggesting it would be more appropriate to schedule a formal meeting.

The German fondness for order, often joked about, has proved true, said Carlos Baixeras, 30, an engineer who started working near Frankfurt 18 months ago. “There are rules for everything,” he said. “There’s a trash police.”

There is also this demographic point:

Last year, though, even while deaths once again exceeded births, the German population grew for the first time since 2002, thanks to a net immigration of 240,000 people, nearly double the 128,000 net gain in 2010. Countries like Poland and Romania sent the most, but German government statistics showed thousands more coming from the crisis-stricken southern nations.

The full story is here.

Note that highly productive economic activity seems to be concentrating itself in the United States, in a smaller number of locations. Perhaps the same is happening in Europe too. That’s hardly Spain’s biggest problem right now, and migration can in some ways be a blessing for an economy with high unemployment. Still, when the debt overhang is so high, this is troubling news too.

From the comments, on downturns, fiscal policy, and multiple equilibria

We were less wealthy than we thought we were.

Call me an AD-denier, but I still think the basic issue here is that you can’t consume more than you produce. Production exists to satisfy demand, but at the same time demand is limited by production. We had a long boom built on the notion we could boost demand and thus supply and thus demand again in a virtuous cycle, and now we are seeing the cycle work in reverse as demand/supply seek their natural levels.

One way to justify this model is in terms of multiple equilibria, and that we have been walking (bouncing our heads?) back down the escalator. Arguably for the United States this downward bouncing is over. Along the way we are sending signals about the quality of our institutions and thus shaping the course of the future.

In this model there is still a useful role for fiscal policy. For one thing, fiscal policy can smooth that ride down the escalator, by spreading the losses out over time, at the cost of future debt of course. This may be needed if only to make the political economy of decline less bitter; see Spain and Greece. Nonetheless fiscal policy cannot make up for the output losses at will. We are not standing in an IS-LM diagram where the difference between “what we have” and “what we could have” is thwarted only by some supposed Austerians who won’t shift the proper curve and yet somehow have taken over some of the biggest spending social democratic, insider-leaning governments in world history. The IS-LM approach fits in nicely with the view that policy improvement is all about yakking about the obstructionists. Instead, policy is also about rebuilding trust, not just maintaining ngdp on a decent keel.

There is another possible role for fiscal policy, as there usually is in models of multiple equilibria. If you ran some super-duper fiscal policy, and invented the flying car, a cure for cancer, and other marvels, the market might suddenly latch its expectations on to a much more positive scenario. There could be a significant upward bounce to a much higher equilibrium of output and employment. In any case, the quality of fiscal policy matters, and Keynesian ditch digging probably doesn’t do much for inferences about institutional quality and for the selection of multiple equilibria. “Spend the money, anywhere” is in my view a deeply pernicious attitude, somewhat akin to thinking you can create a good NBA team, with a strong ethic for quality and work, by tanking for better draft picks at the end of every season. But no, the internal ethic matters and cannot be first destroyed and then recreated at will. Good teams don’t usually work that way, and neither do good fiscal policies.

Right now we Americans are building back up to better equilibria, slowly, by showing that our economic institutions are not totally crummy. This process can take a good while, but in fact our recovery is going better than many people believe. The eurozone is far — very far — from being on that kind of rebuilding track.

There is plenty of talk about various commentators don’t understand the lessons of Econ 101. There is a reason why we teach classes beyond 101, and why we spend so much time studying institutions and the theory and empirics of public choice.

Assorted links

1. Scott Sumner on his economic method (with a passing mention of ngdp).

3. How much does deleveraging matter?: a U.S.-UK comparison. And is the UK price behavior just due to the VAT?

4. Man’s best friend? Maybe Argentina can export these dogs to Spain soon, and what’s all this about the Michael Jensen/Werner Erhard connection?

5. Is the health care cost curve finally bending?

Tyler Cowen's Blog

- Tyler Cowen's profile

- 844 followers