Tyler Cowen's Blog, page 518

April 27, 2012

Assorted links

April 26, 2012

UK economic data — not your standard AD story

Richard Williamson, a loyal MR reader, writes to me:

I think there has been a lot missing from the discussion of the UK in the blogosphere. We are a bit of a puzzle on a purely AD-based explanation of the recession.

1) We didn’t have deflation (on annual basis at least), and even stripping out the effect of the VAT rise in 2011 should still show persistent inflation over 3% since 2010

http://www.tradingeconomics.com/united-kingdom/inflation-cpi

2) UK inflation expectations seem to be significantly higher here (if falling away a little recently)

http://www.bondvigilantes.com/2012/03/19/markets-start-to-think-about-inflation-again/

http://uk.finance.yahoo.com/news/uk-inflation-expectations-drop-1-093038319.html

3) If you look at table EMP02 here, you can see that the public sector as share of total employment the same in the UK today as in Q1 08, and almost all the decline in *total* employment has been in the private sector (the increase in public sector employment in Q4 08 was due to bank nationalisations)

http://www.ons.gov.uk/ons/rel/lms/labour-market-statistics/april-2012/index-of-data-tables.html#tab-Employment-tables

I’m not really sure what is going on. But based on my twitter feed today, a lot of other people seem to be. If we were to just look at inflation (at expectations thereof), the country that ought to be having an AD-driven double-dip recession would appear to be the US.

Richard writes again to me:

I would also like to add that any demand issue we have would not appear to be due to ‘austerity’, but rather that we are explicitly targeting inflation in the context of some (as-yet unspecified) supply side problems…

Ps I also think there’s a weird thing about the ‘confidence fairy’ rationale for austerity, where we might expect a government that believes this to tactically *exaggerate* the amount of actual cutting they’re doing, a reversal of usual government incentives.

*The Washington Post* covers *An Economist Gets Lunch*

Cowen fears the effects of gentrification, which tends to drive up real estate rates and drive out ethnic restaurants. It can also lead to blander food. But if defense funding is cut, and the impact is felt locally, that would be a good thing for ethnic restaurants, if not for the populace in general, Cowen said.

And finally, some more helpful tips for ethnic restaurant exploration: ”It’s all about the ordering,” Cowen said. The best places have smaller menus, so they aren’t trying to please everyone, and likely do several things very well. Don’t ask the waiter what’s good, “that will only confuse them.” Instead, ask, “What dish do you have here which is special?” or “What are your regional specialties.”

That is from Tom Jackman, here is more. Also from the Post today, Tim Carman adds further discussion.

*The Great Inversion and the Future of the American City*

The author is the excellent Alan Ehrenhalt, here is one bit:

Walking the streets of the Financial District today, one can’t help but think that it is, indeed, a throwback to an earlier version of the city’s life. But not to the Wall Street of a century ago: That was an economically segregated one-use neighborhood, with offices and virtually nothing else, no residents, hardly a place to shop, only a handful of restaurants to cater to the financial workforce.

But look back farther than that, and you begin to see a resemblance. In some ways, lower Manhattan in the early twenty-first century has come to resemble lower Manhattan in the late eighteenth and early nineteenth: brokers, investors, and insurance agents who live in the neighborhood and walk to work; a social life that does not disappear at quitting time, the way it did twenty years ago; a modest but growing number of families with young children. Ron Chernow offers a picture of this early lower Manhattan in his biography of Alexander Hamilton, who lived there both as a college student and as a young lawyer.

Recommended, you can buy it here.

Assorted links

1. Travel dating.

2. Markets in everything the culture that is Japan.

3. Polygamy price discrimination.

4. What does a highly leveraged university look like?

5. ZMP chickens?

April 9, 2012

Assorted links

2. New results on sea disasters and the Titanic.

3. The development predictions of Paul Rosenstein-Rodan.

Revised TFP growth for Singapore looks much better

From Chang-Tai Hsieh, plucked out of the 2002 AER, via @dtimesd:

This paper presents dual estimates of total factor productivity growth (TFPG) for East Asian countries. While the dual estimates of TFPG for Korea and Hong Kong are similar to the primal estimates, they exceed the primal estimates by 1 percent a year for Taiwan and by more than 2 percent for Singapore. The reason for the large discrepancy for Singapore is because the return to capital has remained constant, despite the high rate of capital accumulation indicated by Singapore's national accounts. This discrepancy is not explained by financial market controls, capital income taxes, risk premium changes, and public investment subsidies.

The initial context is given here. Via Dave Backus, here is another relevant paper.

I enjoyed this post

But there's a good-versus-evil story just below my surface, pitting reasonable, constructive, iconoclastic people who agree with me against the benighted masses and their emotional, whiny, conventional intellectual apologists.

Here is more, from BC, interesting throughout. It starts with this:

I'm a libertarian, a natalist, an atheist, a credentialist, an economist, an optimist, a behavioral economist, an elitist, a public choicer, a dualist, a Szaszian, a moral realist, an anti-communist, a pacifist, a hereditarian, a Masonomist, a moral intuitionist, a free-market Keynesian, a deontologist, a modal realist, a Huemerian, a Darwinian, the other kind of libertarian (=a believer in free will), and much more. I could spend hours adding additional labels to the list.

New Cities

In 2009, the percentage of the planet's population living in urban areas crossed the 50% threshold…this year the population of the world's cities will grow by a further 65 million people, equal in size to the total population of France…

As recently as 1990 the United States had the highest number of one million plus inhabitant urban agglomerations globally with a total of 33….by the year 2020 China will lead the world with 121 followed by India with 58…

Remarkably, in 2009 China generated some 40.9% of GDP from just 16.6% of its population living in the 35 largest cities.

From an interesting Credit Suisse report, Opportunities in an urbanizing world (pdf).

I was surprised at how close the association is between state level GDP and the urbanization rate (Ryan Avent in The Gated City and Matt Yglesias in The Rent is Too Dammed High make similar points.)

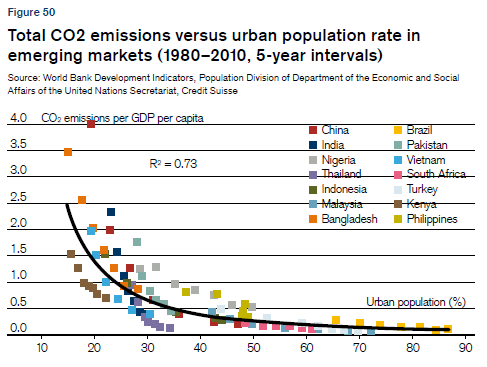

Urban dwellers also have much lower levels of carbon dioxide production than rural dwellers [Addendum: this seems to be per unit of GDP]. Moreover, the half of the world's population that lives in cities occupies only approximately 2.7% of the world's land area.

Hat tip: Gulzar at Urbanomics.

Markets in Everything: Prison Consultants

NYTimes: Mr. Levine is a prison consultant. The business — which entails advising people who are facing jail time on how to prepare for life on the inside, deal with medical issues, transfer to other prisons and even reduce their sentences…The consultants [also] teach prison etiquette.

For example? "Never walk across a wet floor," Mr. Mulholland advised, saying you might mess up the work of the prisoner manning the mop. And then he might kill you.

Prison consultancy seems to be one of the few businesses where the owners aggressively advertise their criminal record:

Mr. Levine said he thought the competition would thin out over time because the competitors lack marketing smarts. Besides, he argued, he has the criminal CV to back up the marketing.

If they handed out diplomas for prison savvy, he said, "These guys have maybe an associate degree. I have like a Ph.D. or above."

Indeed, "some prison consultants say that others are so lacking in expertise that their businesses are practically criminal enterprises."

Tyler Cowen's Blog

- Tyler Cowen's profile

- 844 followers