Adam Leitman Bailey's Blog

September 22, 2025

Crain’s Names Adam Leitman Bailey, P.C., As the Second Best Law Firm To Work For In NYC With Under 50 Employees. This is the 7th Time Adam Leitman Bailey, P.C., Has Won This Award.

From Crain’s:

“In New York, success is measured not only by the bottom line but by the ability to attract and keep talent in one of the most competitive markets in the world. Companies that thrive here understand that culture, recognition and opportunity are just as critical as revenue growth.

This year, Crain’s unveils its 2025 Best Places to Work in New York City — a ranking of the firms setting the standard for employee satisfaction and workplace innovation. From profit-sharing and extended family leave to DEI programs, mentorship tracks and quirky cultural traditions, these employers show how serious investment in people fuels long-term performance.

In a city where every advantage matters, these organizations prove that investing in employees is as critical as investing in clients. They’ve created workplaces that reflect New York itself: ambitious, diverse and relentless.

Methodology: Crain’s partners with Workforce Research Group, which researches the registered companies and reviews their employer questionnaire. Questionnaires, which are worth 20% of their final score, include PTO, benefits, “fun” perks, training, and diversity, equity, and inclusion initiatives and much more. Participating companies pay Workforce to send out an employee engagement survey that is worth 80% of their score. The survey, in part, looks at employee experience, role satisfaction, workplace culture, training, leadership and work-life balance. From there, Workforce Research Group provides Crain’s with a ranked list. This year, we have 81 Best Places to Work in New York City.”

July 28, 2025

New York State Bar Association Releases Updated Edition of Real Estate Titles: The Practice of Real Estate Law in New York

By Jennifer Andrus

July 25, 2025

The New York State Bar Association announces the release of the newly revised edition of Real Estate Titles: The Practice of Real Estate Law in New York. The 5th edition of this reference book is an invaluable resource for all real estate professionals. Written and updated by many of the leading real estate practitioners and dedicated to co-author, Michael J. Berey, this title’s in-depth coverage is unparalleled in this area of practice. This book is the all-time best-selling book ever sold by the New York State Bar Association.

All aspects of real estate transactions are covered in 34 chapters, including contracts of sale, title search, mortgages, deeds, liens and real estate financing. All practitioners will benefit from this publication, from the beginning real estate practitioner to those dealing with the most complex issues.

Michael Berey and Adam Leitman Bailey

Michael Berey and Adam Leitman BaileyThis edition is dedicated to the memory of co-author Michael J. Berey who died shortly before it was released. Adam Leitman Bailey pays loving tribute to his friend and co-author.

“A tremendous loss for the legal community but at the same time Mike Berey poured himself and his time into writing and editing Real Estate Titles and leaves behind what I am sure he considered the greatest book on real estate law every written,” he wrote. “I am the one truly honored to write, edit and collaborate with a legend and master of real estate law–my good friend Mike Berey. And I am so glad that we have Real Estate Titles–not only to remember him by but to continue to learn from his teachings.”

“Mike was our Oracle,” added real estate attorney and friend Richard Fries. “His mastery of real estate law, title, tax, administrative law, statutes and regulations was legendary.”

Real Estate Titles: The Practice of Real Estate Law in New York, edited by Adam Leitman Bailey and Michael Berey, is available as a free e-book as part of your New York State Bar Association membership. A print edition is also available to members at a discounted rate. NYSBA membership includes access to our full library of e-books and hundreds of online forms, at no additional charge.

June 24, 2025

May 21, 2025

4th-generation resident of rent-stabilized Manhattan apartment fights eviction

Gabrielle Vines lives in an apartment in Fort George that’s both cluttered and empty. There are giant storage bins filled with her grandmother’s possessions, an old washing machine that’s no longer in use and a closet stuffed with photo albums. But Vines has hesitated to make the space her own.

[…]Strict criteria to pass down a rent-stabilized apartmentRent stabilization is a New York program that limits how much building owners can raise the rent for qualifying units. Family members — by blood, marriage or emotional and financial dependence — can claim succession rights for a rent-stabilized apartment, but only if they can prove they lived there with the tenant for at least two years immediately before their death or permanent departure. There are exceptions to the two-year requirement, including for people who are full-time students, like Vines was when she says she was living with her grandmother.

Vines doesn’t contest that she lived part of the week in her dorm. But she said she spent long weekends, holidays and spring break with her grandmother and sometimes slept over when she had time in the middle of the week. Vines provided Gothamist with medical records from 2022 and 2023 that list the Fort George apartment as her address, as well as food receipts from businesses in the neighborhood. She also shared screenshots of text exchanges with her grandmother from different points in 2022 where they coordinated plans for their time together.

But Adam Leitman Bailey, a real estate attorney not connected to the case, said a common benchmark for a primary residence is staying there at least 183 days a year. He said the student exception typically applies to people who were already living in the unit for an extended amount of time before enrolling in school.

“She’s got a losing case,” he said. “There’s no doubt.”

Sherwin Belkin, another real estate lawyer, said a family member can also establish that an apartment was their primary residence if they used the address on government documents, like a driver’s license or a voter registration.

“Prescriptions and magazines and those things are nice, but they’re not as weighty for most judges as publicly declared documents,” he said.

Deutch, the building owner, said it’s up to the courts and the state Division of Housing and Community Renewal to decide whether Vines qualifies to keep the apartment. Vines is due in court Wednesday for a hearing in her case. A spokesperson for the state agency said it doesn’t comment on pending applications for succession rights.

Legislators updated the state’s rent regulation laws in 2019 to prevent landlords from leasing rent-stabilized units at market rate when the tenant dies or moves out. Since the new laws took effect, Leitman Bailey said, it’s become less common for property owners to try to evict relatives in these situations. He said they don’t have the same incentives to vacate those apartments, because they can’t hike up the rent nearly as much as they once could.

“They can’t afford to pay their expenses. They can’t afford to pay the mortgage, the repairs, the super,” he said. “They believe the law is intended to bankrupt landlords.”

But he and Belkin both said there are a few reasons why a landlord might be inclined to pursue eviction if they believe a relative doesn’t qualify for succession. In this case, they said, the owner might also be able to boost his income if a new tenant with a housing subsidy moves in. Property records for the building show the owner is allowed to collect more than the rent-stabilized amount for tenants receiving rental assistance.

The monthly amount could vary, depending on what the paying agency approves. As of January 2024, the maximum amount the federal Section 8 program and the city’s own aid program would pay is $3,027. That’s more than three times the approximately $900 a month Vines said her grandmother paid. The property owner has not accepted Vines’ attempts at paying rent.

Deutch said if he brought in a new tenant, he would only be able to rent the unit for “marginally better than what it’s currently rented for.” He said there are some benefits he could get but declined to say what those benefits might be.

“When you start to manage as much as we manage, you do become part of these people’s families,” he said. “That’s a fortunate truth, but unfortunate in a sense, too, because at the end of the day, we need to be able to collect the rent in order to pay our bills.”

Vines said it would be devastating to lose an apartment with four generations of history. She said she can still imagine Venta-Perez cooking when she sits in the kitchen.

“I miss her so much,” Vines said. “I just want to make her proud. And I want to keep her around, and her spirit, for as long as possible.”

David Brand contributed reporting.

January 7, 2025

Our 25th Anniversary

25 years ago today, Adam Leitman Bailey, P.C. was born.

We have been kicked in the teeth and beaten down to the core. We had moments of not knowing if we had the strength to carry on another hour in pursuit of justice for that client who needed us to hang on. And we have never given up on a case, a matter, a deal point, or anything that has mattered to a client.

We were built to do the impossible, create miracles, and find that unicorn. 25 years ago today, we opened our doors trying to create the finest real estate law firm in New York. We certainly have worked the hardest, sweated the most, and put together some of the best work product.

Over and over again, our belief in ourselves in seeking justice and fighting against injustice has propelled us into the firm we are today 25 years later.

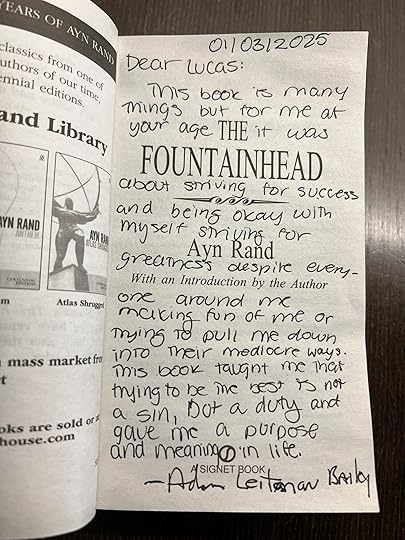

The Fountainhead by Ayn Rand

This was one of my most inspirational coming of age books entering college. I explain why in the inscription to the young man.

June 3, 2024

Adam Leitman Bailey, P.C. Gets Sponsor to Cure all Defects in New Construction Condominium in Record Time

Adam Leitman Bailey, P.C. was retained by the board of managers of a new construction condominium in Upper Manhattan to assist in getting the sponsor to fulfill its obligations pursuant to the condominium offering plan.

The building had recently turned over to resident control after the sponsor had majority control of the board of managers for several years. During this time, the sponsor-controlled board neglected a number of necessary repairs including, but not limited to, sprinkler system issues.

In particular, the sprinkler system pipes were not adequately insulated, which caused them to freeze and explode in common areas of the building on multiple occasions. The resulting damage in each instance was tremendous. Additional issues included, among other things, improper air balancing throughout the building and improperly installed windows and balcony doors.

Adam Leitman Bailey, P.C. jumped into action to assist the board in getting their building fixed using a protocol that Adam Leitman Bailey, P.C. has successfully implemented on myriad buildings.

The first step was to engage an engineer on behalf of the client to conduct a top-to-bottom building investigation. The purpose of having Adam Leitman Bailey, P.C. retain the engineer instead of the client is to preserve the confidentiality of the findings.

Once the engineer was retained, Adam Leitman Bailey, P.C. assisted the client in arranging access for the engineer throughout the building and individual units that were experiencing issues.

Next, the engineer prepared a comprehensive forensic report detailing each of the issues, ranging from more severe (life safety issues) to less severe (cosmetic issues). Adam Leitman Bailey, P.C. then reviewed the report and worked with the engineer to make it as persuasive as possible, before sending it along with a Notice of Claim letter to the building’s sponsor/developer.

From that point, given our firm’s reputation, the sponsor is often quick to commence repairing the building. In this case, with the board’s engineer overseeing the repairs, the sponsor fixed all the issues identified in the engineering report within a matter of months. This is a tremendous win in this type of case, which typically can drag on for many months if not years. Not to mention that we saved our client hundreds of thousands of dollars in repairs that it would have otherwise had to take on itself.

Had the sponsor not taken on the repairs after receiving the engineering report, we would have engaged in settlement meetings with the parties, engineers, and attorneys for both sides present. This is often a step we take in settling construction defect cases, as it enables the parties and, more importantly, their respective engineers, the opportunity to sit down and discuss the defects and agree on the next steps for each (i.e., additional probes, testing, and/or sponsor’s agreement to fix by a date certain).

Rachel Sigmund McGinley and Adam Leitman Bailey represented the condo board in this matter.

May 20, 2024

Adam Leitman Bailey, P.C. – The Inside View

A real (e)

state

of mind and dreams of the concrete jungle define the ambitious lawyers at this boutique, with prowess in

“anything you could possibly think of in the real estate world.”

A real (e)

state

of mind and dreams of the concrete jungle define the ambitious lawyers at this boutique, with prowess in

“anything you could possibly think of in the real estate world.”

It’s a well-known fact that New York City boasts an impressive skyline, with the iconic Empire State Building, Rockefeller Center, and Chrysler Building dotting its streets. You could call it a real estate lawyer’s dream, especially considering the years of history mapped onto its cityscape. However, in among these landmarks and across the water from the Statue of Liberty, you’ll find One Battery Park Plaza, home to Adam Leitman Bailey, P.C. The building itself is a sight to see, but the firm on its 18th floor has a reputation that’s just as imposing as its home. “We’re the largest single-person-owned real estate firm in New York, and we follow our own path,” says eponymous founder Adam Leitman Bailey. “We came back from COVID in September 2020, earlier than lots of other firms. We won’t let anything get in the way of pleasing our clients and bringing them success.” The small headcount (of just over 20 lawyers!) and a single office location haven’t got in the way either, and Bailey explains how “although we’re all in the office full-time, we have a few attorneys based in different counties and they can get to the courts there.”

“It’s well known in the real estate industry, so it was on my radar long before I joined.”You could probably say ALB’s reputation is public property at this point, and is backed up by Bailey’s own top-tier real estate litigation ranking from our colleagues at Chambers USA. Associates had also heard all the rage about ALB, and were more than happy to tell us how “it’s well known in the real estate industry, so it was on my radar long before I joined.” Another source was keen to join a firm that “packed a big punch in NYC!” However, others were drawn to “the firm culture and way attorneys here treat younger associates, interns and externs. It’s very collaborative and nothing like the horror stories I’ve heard about elsewhere.” The people who feel at home at ALB, according to Bailey, “are really smart and want to be successful, and those who do really well here are willing to work hard to become great attorneys.”

STRATEGY & FUTURE“I don’t have a commercial strategy – you can write that down!” Bailey quips. “We know we’re very lucky that we have to turn down at least a third of the cases coming in as we don’t have enough attorneys, but I think we’ll lose quality if we get too big.” However, Bailey tells us that the firm has expanded in the past year, taking on a greater number of younger associates: “We’ve been hiring laterals over younger students, which we’ve never done before, but that’s where there’s more talent in the market right now.” Recruitment is the first prong of ALB’s plan to be the best at what it does, and this is strengthened by the firm’s narrow focus of one type of law in one state. Fortunately, “it could not be a better time to be a real estate attorney,” according to Bailey, who explains how “real estate is in chaos. Every case is bet-the-company, and we’re so honored to have been brought in to work on and win some of the biggest cases in New York.”

THE WORKAssociates explained that litigation makes up most of the firm’s work, but were pleased to note that “we handle anything you could possibly think of in the real estate world.” Attorneys find work through the free-market system, though interviewees mentioned that “there are partners I work with more often than others, but I’ll sometimes take on tasks for other partners here and there.” Despite this open work assignment system, insiders were clear that “the firm is big on externs, interns and younger associates getting their feet wet.”

The real estate litigation group handles a range of general real estate matters, condo, and cooperative disputes and foreclosure title cases (to name a few), alongside a landlord-tenant group that deals with both residential and commercial matters. “We represent both landlord and tenants on those matters, though most of our work is landlord-side,” an interviewee explained. “Seeing both sides is helpful for us as growing attorneys as it makes it easier to craft arguments both in opposition and in favor of either.” Though rare, our litigator interviewees had also had the chance to work with their transactional colleagues, noting: “We collaborate every once in a while on things like closing disputes, or other questions on our cases.” Whatever the case, associates were pleased that “you don’t just focus on one specific aspect of real estate law on matters. Things come up out of nowhere which require you to use creativity to analyze and apply the law, so with every case you train your mind to think outside the box.”

“I’m in court almost every day.”Juniors were also grateful for the level of responsibility, and were more than happy to tell us, “I’m not sequestered to specific tasks. I’m involved in all stages of litigation and have my own cases that I handle, with carte blanche to do whatever I need to do to serve the client’s best interests.” So it probably comes as no surprise that ALB’s litigators spend plenty of time in court, and can get lots of experience arguing, strategizing and working with clients. “I’m in court almost every day,” a junior explained: “I learned how to do my job very quickly because attorneys have entrusted me with so much responsibility.” Other stages of cases such as discovery, taking depositions, and drafting pleadings and motions are all standard tasks for juniors, who felt they’re “treated as equals” regardless of experience. “I have meaningful discussions with others about what works best on cases,” an interviewee gratefully highlighted. “It’s very rewarding to work with people who listen, understand and let you take control, so there are plenty of cases where we’ve gone with one of my ideas and it’s worked!”

Real estate clients: Co-op Board on the Upper East Side, US Rof, multiple NYC business owners. Represented a New York real estate developer in a $100m dispute concerning NYU’s rights to use and access a condominium on East 78th Street.

CAREER DEVELOPMENT“I know I’m going to continue to grow here, and I’ll be a warrior of an attorney because of how much partners have invested in me,” an associate said on career development at ALB. However, interviewees were also clear that ALB lawyers all have their own style, so juniors can learn “bits and pieces from different people to develop my own preferences. They don’t enforce their own styles onto attorneys, but explain things to us so we can understand what works and makes sense.” However, juniors felt that such feedback structures were typically more informal: “I would be surprised if I handed in work and didn’t hear back, whether that’s comprehensive constructive criticism or something a bit more casual.” “If you want to become partner, the ability to bring in clients helps, but it’s mostly about dedication to your work.”When it comes to long-term progression, sources mentioned that “if you want to become partner, the ability to bring in clients helps, but it’s mostly about dedication to your work.” Bailey echoes this sentiment, explaining how “the key is doing a great job. It’s not always winning or losing. In fact, I always say that if you’re not making mistakes, you’re not trying hard enough!” The formula seems to work, as interviewees highlighted long-term retention as a strength of the firm, with plenty of associates who have stayed with the firm since they were externs. According to Bailey, there is also no forced retirement age, meaning greener and more senior attorneys work together on matters. “I believe the older you are, the more wisdom you have,” he explains. “It’s amazing how all the generations work together, and it’s made us a better firm.”

PRO BONO & CULTUREWhile legal pro bono is neither a requirement nor billable for attorneys at ALB, there are opportunities to get involved with the firm’s not-for-profit program, ‘Building Foundations and Dreams’. Bailey explains how the firm works with schools to support underprivileged students in pursuing their goals: “the focus of the charity is education, and helping kids become successful when they might not have the means to access the best schools.” The firm offers scholarship and externship positions through this program, and current associates can set up lunches with those involved to answer any questions they may have. While the more junior associates typically spend the most time with interns and externs, interviewees explained how “everyone at the firm can ask them to take on projects, such as research and drafting, and we’ll guide them as supervisors. I’ve sat down with interns to go through documents together, and it feels like I’m immediately giving back.” “Partners who have been here for over ten years want to foster a culture where teaching younger attorneys is at the forefront.”Sources felt that such relationships across experience levels were indicative of the firmwide “no jerk policy,” and associates were keen to explain how “partners who have been here for over ten years want to foster a culture where teaching younger attorneys is at the forefront.” For instance, one associate boasted: “I’m comfortable with the people I work with! I could pick up my phone and text a partner, ‘hi, do you know what this means?’ That’s how close we are.” Apart from a few remote attorneys, everyone is back into the office full-time – with their own individual office which has “a view of the water or at least of something interesting,” says Bailey – meaning there are plenty of opportunities to socialize day-to-day. Insiders had attended happy hours and firm parties, and one source especially appreciated the birthday celebrations: “We have a mini celebration for every birthday in the office, where everyone goes into the conference room to wish them a happy birthday and eat some cake!” Being at such a small firm, juniors felt they could “get to know colleagues as individuals” and appreciated the “entrepreneurial, friendly and helpful” personalities.

HOURS & COMPENSATIONBillable hours: 1,600 target(with revenue sharing program)

“This is a phenomenal place to work for people who are ambitious and hungry to be successful,” says Bailey, citing the revenue-sharing program which allows attorneys to “work as much or as little as they want, depending on how much money they want to make.” Essentially, your earnings are calculated on a cash collected basis in which you earn a third of what you bill, and anything exceeding your base salary becomes part of your profit sharing bonus. However, there is also a discretionary bonus based on performance and interactions at the firm. This cash collection method was valued by associates as “a strong incentive to not only bill, but to realize the profits from the work you’re billing. It’s important as an attorney to understand how the business operates, and this teaches you to not only make sure you bill enough, but to also follow up with the clients who are less enthusiastic about paying!”

The more entrepreneurial approach to compensation means that attorneys can have more control and flexibility over their work-life balance. Day to day, this meant that some interviewees aimed for eight billable hours per day, while others liked to keep to a 9 to 6 average workday. However, this wasn’t the case for all, and one interviewee shared how “I wake up early to come to work just because I like the work I do. I wake up and go to sleep thinking about how to solve client issues!” So, while monitoring your own schedule and workload is a key part of the job, juniors felt that “if I’m ever struggling or find myself underwater, I don’t feel uncomfortable asking a partner for help. The support here is great.” ALB has long since offered manicures and massages for its employees for when the going does get tough and it’s time to de-stress, and this recently started back up for the first time since the pandemic.

“Things feel possible here.” DIVERSITY, EQUITY & INCLUSION“We’re still committed to not hiring from Ivy League schools, even now we’re hiring younger attorneys and not just externs,” says Bailey, whose recruitment strategy focuses around “hiring people who are hungry for success rather than pushing a specific diversity quota.” So, while there’s no formal diversity track at the firm, associates felt “a strong spread of different genders, religions and ethnicities.” Sources were especially reassured by the representation of women at the firm, noting how “there are women in high positions who’ve been here for 20 years. That’s not always common.” Another interviewee praised the general attitude towards diversity, noting how “the firm is doing a good job in terms of making everyone here feel comfortable. Things feel possible here.”

Read the original article here.

May 3, 2024

Foreclosure Abuse Prevention Act in a Nutshell

In 2022, the New York State Legislature enacted the Foreclosure Abuse Prevention Act (FAPA), thereby amending several interrelated provisions of the Civil Practice Law and Rules (CPLR), the Real Property Actions and Proceedings Law (RPAPL), and the General Obligations Law (GOL), which affect how and when the statute of limitations may be invoked by defaulting borrowers to defeat foreclosure actions brought against them by their lenders.

This article will examine the background leading to the FAPA legislative amendments and how they have been construed, in recent Appellate Division decisions, where courts have been required to determine their application.

Background

FAPA was enacted to reverse the ruling of the Court of Appeals in Freedom Mortgage Corporation v. Engel, 37 NY3d 1 (2021), in which, the court seeing a “need for clarity and consistency,” in the “application of the statute of limitations,” to the “timeliness” of bringing “a mortgage foreclosure claim” that “[affects] real property ownership,” had adopted “a clear rule” holding that “where the maturity of the debt has been validly accelerated by commencement of a foreclosure action, the noteholder’s voluntary withdrawal of that action revokes the election to accelerate, absent the noteholder’s contemporaneous statement to the contrary.” (Emphasis added).

The court’s ruling had the effect of extending the statute of limitations well beyond the six-year statute of limitations that would otherwise limit a lender’s right to foreclose and elect to accelerate the maturity of the debt on a borrower’s second loan default.

The Legislature saw Freedom Mortgage as one of a series of court decisions that had “exacerbated” an “ongoing problem with abuses of the judicial foreclosure process and lenders’ attempts to manipulate statutes of limitations,” thereby “[giving] mortgage lenders and loan servicers opportunities to avoid strict compliance with remedial statutes and manipulate statutes of limitations to their advantage.” (Assembly Mem in Support of 2022 Assembly Bill A7737B, L2022, Ch. 821 at 1).

The Legislative Amendments

The primary legislative action aimed at ending manipulation of the statutes of limitation in foreclosure actions is set forth in CPLR §213(4), which prescribes that “an action upon a bond or note, the payment of which is secured by a mortgage upon real property, or upon a bond or note and mortgage so secured, or upon a mortgage of real property, or any interest therein,” must be commenced within six years, but which also prescribes, per new subdivisions (4)(a) and 4(b), that:

(a) In any action on an instrument described under this subdivision, “if the statute of limitations is raised as a defense, and if that defense is based on a claim that the instrument at issue was accelerated prior to, or by way of commencement of a prior action, a plaintiff shall be estopped from asserting that the instrument was not validly accelerated,” and

(b) In any action seeking cancellation and discharge of record of an instrument described under [RPAPL §1501(4), i.e., “where a person claims an estate or interest in real property” or where a municipality has purchased an estate or interest in real property at a tax sale], a defendant shall be estopped from asserting that the period allowed by the applicable statute of limitations for the commencement of an action upon the instrument has not expired because the instrument was not validly accelerated prior to, or by way of commencement of a prior action,

unless [as to both (a) and (b)] the prior action was dismissed based on an expressed judicial determination, made upon a timely interposed defense, that the instrument was not validly accelerated. (Emphasis added).

In addition, CPLR §203 (Method of computing periods of limitation generally) was amended by the addition of subdivision (h) (Claim and action upon certain instruments) which prescribes that:

Once a cause of action upon an instrument described in [CPLR 213(4)] has accrued, no party may, in form or effect, unilaterally waive, postpone, cancel, toll, revive, or reset the accrual thereof, or otherwise purport to effect a unilateral extension of the limitations period prescribed by law to commence an action and to interpose the claim, unless expressly prescribed by statute. (Emphasis added).

CPLR §3217 (Voluntary discontinuance) was amended to similar effect, by adding new subdivision “e”, prescribing that, “whether on motion, order, stipulation or by notice,” the voluntary discontinuance of actions described under CPLR 213(4) “shall not, in form or effect, waive, postpone, cancel, toll, extend, revive or reset the limitations period to commence an action and to postpone a claim, unless expressly prescribed by statute.”

While the Legislature did not eliminate the right, granted by GOL §17-105, for parties to negotiate and waive “the expiration of the time limited for commencement of an action to foreclose a mortgage of real property or a mortgage for a lease of real property…by the express terms of a writing signed by the party to be charged…to make the time…run from the date of the waiver or promise,” even if “a shorter period of limitation than that otherwise applicable,” GOL §17-105(4) now expressly prescribes that such waiver or agreement “shall not, in form or effect, postpone, cancel, reset, toll, revive or otherwise extend the time limited for commencement of an action to foreclose a mortgage for a greater time or in any other manner than that provided in this section, unless it is made as provided in this section.” (Emphasis added).

The Legislature also enacted CPLR 205-a, which is expressly applicable only to cases brought under CPLR §213(4), to replace the six-month grace period contained in CPLR §205(a)(Termination of action), which permits a plaintiff to commence a new action, “within six months after the termination of a prior action, upon the same transaction or occurrence or series of transactions or occurrences alleged in the previously terminated prior action,” under certain conditions specified therein, “provided that the new action would have been timely commenced at the time of the commencement of the prior action and that service upon defendant is effected within such six-month period.”

Instead, CPLR §205-a prescribes that, where the prior action was commenced under CPLR 213(4) but terminated “for any form of neglect” [including, but not limited to those specified in CPLR §§3126, 3215, 3216, and 3404] the permission otherwise given to commence a new action, “upon the same transaction or occurrence or series of transactions or occurrences,” within six-months of the terminated action, is expressly excluded from the six-month grace period. (Emphasis added).

Finally, in further response to Freedom Mortgage, RPAPL §1301 (Separate Action for Mortgage Debt) was amended to prescribe, in subdivision “3,” that while a foreclosure action is pending “or after final judgment for the plaintiff therein, no other action shall be commenced or maintained to recover any part of the mortgage debt, including an action to foreclose the mortgage, without leave of the court in which the former action was brought,” and “the procurement of such leave shall be a condition precedent to the commencement of such other action and the failure to procure such leave shall be a defense to such other action. In addition, subdivision “4” was added prescribing that “[i]f any action to foreclose a mortgage or recover any part of the mortgage debt is adjudicated to be barred by the applicable statute of limitations, any other action seeking to foreclose the mortgage or recover any part of the same mortgage debt shall also be barred by the statute of limitations.” Emphasis added).

FAPA’s Experience in the Courts Thus Far

Since enactment of FAPA (as prescribed in the statutory amendments noted above), as this article is written, there have been 37 decisions of the Appellate Divisions in which FAPA has been construed and applied.

The final history of the FAPA amendments, depending on how the courts ultimately decide the Constitutionality of FAPA’s retroactive application, remains to be seen, but judging by the recent case law construing FAPA, it does appear that the Legislature has largely succeeded in “FAPA’s aim: ‘to thwart and eliminate abusive and unlawful litigation tactics that have been adopted and pursued in mortgage foreclosure actions to manipulate the law and judiciary to yield to expediency and the convenience of mortgage banking and servicing institutions at the expense of the finality and repose that statutes of limitations are meant to ensure.’” (Assembly Mem in Support, supra; see also Senate Introducer’s Mem in Support of 2022 N.Y. Senate Bill S5473D at 1).

Recent Cases

Most of the extant appellate decisions were issued in 2023, the first year after the enactment of FAPA in December 2022. Four appellate decisions have been issued thus far in 2024. Not surprisingly, virtually all the decisions involve cases commenced prior to FAPA’s enactment. Therefore, the court opinions deal mainly with either (a) explaining why arguments advanced on appeal, for extending the limitations period, made previously in the appeal without consideration of FAPA’s effect on the case, are now barred by FAPA, or (b) addressing and rejecting arguments which contend that FAPA does not bar the action before the court. The overwhelming number of appellate decisions issued to date have applied the FAPA amendments with the results the Legislature intended, i.e., barring lenders from extending the statute of limitations, to permit a second or even a third foreclosure action to proceed against a borrower, where doing so is precluded by one or more of the FAPA amendments.

The cases fall mainly into three categories: (1) where the lender (or a series of lenders) brought a second, or even a third, foreclosure action against the borrower, and the borrower contends, under CPLR §§213(4)(a) or (b), that the initial prior action was voluntarily dismissed, without an express judicial determination that the loan was not validly accelerated; (2) where the lender contends that the current action was brought after the dismissal of a prior action, but within the grace period provided by CPLR 205(a) and/or CPLR 205-a; and (3) where a lender or a series of lenders have previously brought foreclosure actions against the borrower, which have either been voluntarily dismissed, or dismissed for lack of standing, and the borrower is seeking a judgment, under RPAPL §1501(4), to cancel or discharge of record the subject mortgage.

Other issues raised in the cases are (a) whether the retroactive application of FAPA violates the Due Process and/or Contract Clauses of the U.S. Constitution and/or the New York State Constitution, and (b) whether a successful borrower is entitled to an award of attorney’s fees under Real Property Law §282.

Voluntary Discontinuance of Prior Actions and Voluntary Deacceleration:

• GMAT Legal Title Trust 2014-1 v. Kator, 213 AD3d 915, 184 NYS3d 805 (2d Dept. 2023). The appeal in GMAT was argued on November 14, 2022, before FAPA’s enactment on December 30, 2022, and the Second Department’s decision was issued within eight weeks of FAPA’s enactment. It is emblematic of all the appellate decisions that have followed it in rejecting a lender’s contention that a prior foreclosure action, which was voluntarily dismissed, did not accelerate the loan at issue, and, therefore, the statute of limitations does not bar the current action.

The plaintiff lender commenced the foreclosure action against the defendant borrower more than six years after the underlying debt had been accelerated by the lender’s predecessor-in- interest. The defendant contended that the action was time barred. After a non-jury trial, judgment was entered in favor of the borrower.

On appeal, the lender argued that its predecessor-in-interest had lacked standing to commence the prior action, and, therefore, “the debt at issue was not validly accelerated.” The court held, however, that “the 2007 action was voluntarily discontinued, it was not dismissed ‘based on an expressed judicial determination, made upon a timely interposed defense, that the instrument was not validly accelerated,” citing CPLR 213(4)(a).

The court went on to explain that “FAPA had the effect of nullifying [the holding in Freedom Mortgage],” and that the voluntary discontinuance of a foreclosure action is now governed by amended CPLR §3217(e) whereby “[i]n any action on an instrument described in CPLR 213(4), the voluntary discontinuance of such action, whether on motion, order, stipulation or by notice, shall not, in form or effect, waive, postpone, cancel, toll, extend, revive or reset the limitations period to commence an action and to interpose a claim, unless expressly prescribed by statute.”

• S. Bank N.A. v. Simon, 213 AD3d 1041, 191 NYS3d 61 (2d Dept. 2023). In Simon, the Second Department followed its holding in GMAT. In September 2008, the plaintiff commenced an action to foreclose the mortgage at issue (the 2008 action), but in November 2008, the plaintiff, by affirmation, voluntarily discontinued the 2008 action.

In March 2016, the plaintiff commenced the second action to foreclose the mortgage. The defendant asserted the statute of limitations as an affirmative defense and counterclaimed to cancel and discharge of record the mortgage and to recover attorney’s fees.

The plaintiff lender, on appeal from defendant’s successful motion for summary judgment, cited Freedom Mortgage, contending that its “voluntary discontinuance of the 2008 action revoked its acceleration of the mortgage debt in the 2008 action, and thus, the instant action [was] timely.” The court, citing GMAT, supra, and CPLR 3217(e) and CPLR 203(h), held that “the voluntary discontinuance of the 2008 action did not ‘in form or effect, waive, postpone, cancel, toll, extend, revive or reset the limitations period to commence an action and to interpose a claim, unless expressly prescribed by statute.”

For similar rulings, see ARCPE 1, LLC v. DeBrosse, 217 AD3d 999, 193 NYS3d 51 (2d Dept. 2023); and Bank of New York Mellon v. Norton, 219 AD3d 680, 195 NYS2d 103 (2d Dept. 2023).

• HSBC Bank USA v. Gifford, 224 AD3d 447, __ NYS3d __ (1st 2024). In Gifford, the defendant borrower “demonstrated prima facie that the [current] action was commenced more than six years after plaintiff commenced a prior foreclosure action in 2013, which accelerated the loan.” The court noted that the prior dismissal “was based on plaintiff’s failure to comply with RPAPL §1304” (which requires that home loan mortgagors be given 90-day notice of their default “before a lender, an assignee or a mortgage loan servicer commences legal action against the borrower”), and “not on a failure to serve a default notice constituting a precondition for acceleration, and there was no express determination that the loan was not validly accelerated.”

The court held, therefore, that “plaintiff’s argument that the dismissal of the prior foreclosure action also resulted in the loan not having been validly accelerated in 2013 is unavailing.”

However, the plaintiff also argued that the action was timely “because it deaccelerated the loan through a letter mailed to defendant in June 2018.” Despite an affidavit of an employee providing evidentiary foundation for the mailing of the letter, the Court cited CPLR §203(h) and held, “[t]hus, if CPLR §203(h) [which prohibits a unilateral waiver of the accrual of an acceleration of the loan] applies to this previously commenced action, the 2018 letter purporting to restart the running of the statute of limitations on a loan is ineffective, regardless of whether or not the letter was pretextual.” (Emphasis added).

For a similar ruling, see US Bank Trust, N.A. v. Reizes, 222 AD3d 907, 202 NYS3d 407 (2d Dept. 2023).

The Application of CPLR 205(A) and 205-A Grace Periods

Perhaps the most litigated issue thus far in FAPA cases is when does the six-month grace period, provided in CPLR 205(a) and 205-a, apply to new foreclosure actions, filed within six-months of the termination of a prior action upon the same transaction or occurrence or series of transactions or occurrences. The cases show that, due to the prevalence of multiple assignments of the underlying notes and loans, determining the application of the grace period can be extremely confusing and uncertain.

• Johnson v. Cascade Funding Mortgage Trust 2017-1, 220 AD3d 929, 196 NYS3d 796 (2d Dept. 2023). In Johnson, a foreclosure action commenced on September 26, 2011 (the 2011 action) was dismissed on March 25, 2019, for the lender’s failure to comply with the 90-day pre-foreclosure notice required by RPAPL §1304.

In June 2019, the borrower commenced an action under RPAPL §1501(4) to cancel and discharge of record the mortgage. The lender asserted a counterclaim to foreclose the mortgage, and the borrower moved for summary judgment, asserting that the second foreclosure action, in the form of the counterclaim, was time barred because it was commenced on Sept. 4, 2019, more than six years after the commencement of the 2011 action.

The lender argued that the foreclosure counterclaim was timely because it was commenced within six months of the March 25, 2019 dismissal of the 2011 action. In rejecting the lender’s argument, the Court noted that the “recently enacted [FAPA] replaced the savings provision of CPLR §205(a) with CPLR §205-a in actions upon instruments described in CPLR §213(4).”

The court further noted that “while Cascade established that it interposed its counterclaim to foreclose the mortgage within the six-month period provided under CPLR §205-a on September 4, 2019, Cascade is an assignee of the original plaintiff and has not pleaded nor proved that it is acting on behalf of the original plaintiff. Therefore, Cascade is not entitled to the benefit of the savings provision of CPLR §205-a.”

• Sperry Associates Federal Credit Union v. John, 218 AD3d 707, 193 NYS3d 209 (2d Dept. 2023). Sperry is a case where the Second Department concluded that CPLR §205-a permitted the lender to enjoy the benefit of the six-month grace period to commence the instant action in January 2019, despite having commenced two prior foreclosure actions against the borrower in January 2012 (the 2012 action on “the February note”) and in February 2013 (the 2013 action on “the March note”).

The 2012 action was dismissed for lack of personal jurisdiction. The 2013 action was also dismissed for lack of personal jurisdiction on June 23, 2016. The lender appealed the dismissal of the 2013 action, and the Second Department affirmed the dismissal of the complaint. During the pendency of that appeal, the lender commenced a third action (the 2017 action) which was dismissed under CPLR §3211(a)(4), by reason of a prior action pending between the same parties and for the same causes of action, “and that ‘the 2013 [action] is on appeal.’” (Emphasis added).

Thereafter the lender commenced the instant action in January 2019 (the 2019 action) against the borrower “to recover the indebtedness due under the March note. The borrower moved, pursuant to CPLR §3211(a)(defense founded upon documentary evidence), to dismiss the 2019 action as time barred “arguing that the debt due under the March note was accelerated and that the six-year statute of limitations period began to run on the March note in January 2012 when the plaintiff commenced the 2012 action.”

The plaintiff argued that, even if the defendant could establish that the complaint in the 2012 action accelerated the debt due under the March note, this action was nevertheless timely commenced pursuant to CPLR §205(a).” Supreme Court granted the borrower’s motion to dismiss the complaint under CPLR §3211(a) and did not address the lender’s CPLR §205(a) argument.

The Second Department, on appeal, held that, “even assuming that the defendant established that the filing of the complaint in the 2012 action validly accelerated the debt under the March note, the plaintiff demonstrated it was entitled to commence this action within six months after the termination of the 2017 action.” As the court explained, although the “defendant [borrower] contended that the six-month extension of time pursuant to CPLR 205-a is not available to a plaintiff where the prior action was dismissed pursuant to CPLR 3211(a)(4)…such an interpretation would be contrary to the plain language of CPLR 205(a) and CPLR 205-a, which each clearly set forth the circumstances in which [CPLR 205(a) and CPLR 205-a] do not apply, and a dismissal pursuant to CPLR 3211(a)(4) is not one of the enumerated circumstances.” (Emphasis added).

Other Issues

FAPA’s Constitutionality. To date, due to appellate challenges to FAPA, on constitutional grounds, having thus far been made only in cases commenced prior to FAPA’s enactment, all such challenges have been remanded to the respective Supreme Courts from which the appeals have been made.

The “Standing” Issue. Although CPLR §213(4) bars the bringing of a second foreclosure action unless a prior action was dismissed “based on an expressed judicial determination, made upon a timely interposed defense, that the instrument was not validly accelerated,” it is unclear whether CPLR §213(4) permits a second action to be brought, more than six years after the commencement of the first action, if the prior action was dismissed on “standing” grounds.

In GMAT, supra, the Court rejected the lender’s contention that its predecessor-in-interest had lacked standing to commence the prior action, and, therefore, “the debt at issue was not validly accelerated.” The Court held instead that, because the prior action had been voluntarily discontinued, the dismissal was not “based on an expressed judicial determination, made upon a timely interposed defense, that the instrument was not validly accelerated.”

However, in U.S Bank N.A. v. Pearl-Nwabueze, 218 AD3d 834 (2d Dept. 2023), the Court held that the defendant borrower’s contention “that the plaintiff in the instant action lacked standing because the plaintiff in the 2008 action lacked standing is without merit,” and, therefore, “the plaintiff demonstrated, prima facie, that the debt was never validly accelerated.” It is not clear whether the holdings of these two Second Department decisions can be reconciled.

The “Attorney Fees” Issue. Thus far, in the appellate cases where the successful borrower sought an award of attorney fees, the court decisions have rejected the claim because the borrowers either (a) had “not established that they [were] a prevailing party within the meaning of [Real Property Law §282],” Johnson, supra, 220 AD3d at 932, or (b) had not complied with the express terms of the statute by having failed to assert a claim for an award of attorney’s fees in the trial court. See, e.g., U.S. Bank N.A. v. Armand, 220 AD3d 963, 199 NYS3d 137 (2d Dept. 2023).

Conclusion

Undoubtedly, as future foreclosure appeals are made from cases commenced after FAPA’s enactment, the foreclosure legal landscape is likely to settle into a pattern that conforms with the Legislature’s intent to restore the “finality and repose that statutes of limitations are meant to ensure.”

Adam Leitman Bailey is the founding partner of Adam Leitman Bailey, P.C., and John M. Desiderio is a partner and chair of the firm’s real estate litigation group. Jacklyn DiRienzo, a litigation extern and student at the Hofstra University Maurice A. Deane School of Law, assisted in the preparation of this article.

Recently Passed Real Estate Nightmare Legislation

A review of some of the most noteworthy landlord-tenant related legislation of 2023 and early 2024 involving criminal background checks, stopping short-term tenancies, flood histories and rent regulation.

While readers with differing interests will disagree about the cost/benefit effects of recent enactments (both legislative and regulatory) regarding the landlord-tenant relationship, all can agree that these enactments have the purpose of restricting real estate profitability for owners and further limiting a landlords’ rights of self-determination in managing their own property. While federal law has been relatively quiet in landlord-tenant enactments, of late, both New York State and New York City have been quite active.

Along with these, however, there have been a few enactments that have had the effect of moving landlord liability for tenant illegality to more focused tenant liability for that same misconduct. Thus, this article reviews some of the most noteworthy landlord-tenant related legislation of 2023 and early 2024.

Where the law remains in complete disarray, at the moment, is with respect to legalized marijuana, legalized at the state, but still not yet at the federal level. Under New York State law, nearly any building may house a legal (for state purposes) marijuana dispensary.

There have also been substantial new regulations and legislation enacted in regard to rent stabilization.

Criminal Background ChecksTo take effect on Jan. 1, 2025 is The Fair Chance For Housing Act (New York City Administrative Code 8-102a et seq), in which the New York City Council enacted restrictions on the use of criminal background checks in renting residential property. In the broadest terms, the law prohibits a landlord from barring from a rental those whose criminal cases did not result in a conviction, misdemeanor convictions that are older than three years, and felony convictions that are older than five years. Landlords may nonetheless bar housing to those who are on sex offense registries. Also barred from being refused housing are those who have received a pardon, a certificate of relief from disabilities, or some other vacatur or nullification of the conviction.

One thing uniting all of these categories of exemption from rental discrimination is that for none of them is there an assurance either that the prospective tenant did not actually do the illegal conduct nor that the prospective tenant is unlikely to commit such conduct again.

One needs to remember that even an out and out acquittal after trial only adheres to the criminal concept of the presumption of innocence for criminal purposes. Many have been the examples through history of those found criminally not-guilty, but nonetheless civilly liable.

The criminal bar for conviction is “beyond a reasonable doubt,” a tough standard. The civil bar for a finding of civil liability is normally “fair preponderance of the evidence,” a relatively relaxed standard. Thus, it may be more likely that a person did the bad things without it having being enough for the prosecutor to get a criminal conviction, but with it being a reason for a landlord to believe that this person presents a danger to the building.

Under this provision, a landlord may not run a criminal background check at all until after having made a binding rental offer that can only be revoked based on a criminal background check conducted in accordance with the fair chance housing process set forth in subparagraph (5), or upon an unrelated material omission, misrepresentation, or change in the qualifications for tenancy that was not known at the time the conditional offer.

Thus, it will be exceedingly difficult for the prospective landlord who said “no” because of the results of the criminal background check to demonstrate that there was something else that motivated the refusal.

We understand the City Council’s desire to give someone a fresh start. But we also understand landlords’ desire to protect their property and the well-being of their other tenants. This provisions applies to all units in multiple dwellings in New York City, regardless of whether they are rent regulated or not.

The complexities of the law are such that any landlord not seeking to run afoul of it will need to contract the services of a company that does compliant background checks for a living. However, the law requires the landlord to check the legitimacy of that third-party provider, but does not say how such a check is to take place. The enactment does not create or even allude to a licensing process for such third party providers.

Transient OccupancyIn 2023, New York City’s law (Administrative Code §26-3101 et seq) requiring registration of apartments to be rented for fewer than 30 consecutive days. Previous enforcement by NYC against short term rentals had been against landlords, leaving it to them to find the means to stop their tenants from engaging in using the internationally famous short-term rental agencies. These enforcement efforts proved extraordinarily difficult for landlords: catching the tenants in advertising and renting the places out. The hotel industry was up in arms against these uses of apartments as de facto hotel rooms and advocates of rent stabilization were equally outraged as tenants were receiving, on a monthly basis, often three times or more the legal rent they were to be paying their landlords. In numerous instances, the tenants were not actually tenants at all, but were only using the apartments for hoteling.

Landlords faced tens of thousands of dollars in penalties under the old system. But according to all reports, it was not the revenue the City was seeking from these violations, but the actual cessation of the short term rentals. This, to a substantial extent, §26-3101 et seq has achieved. The penalties are severe.

Under §26-3101 et seq, the tenant seeking to do short term rentals has to register the premises with the City for such purposes. Under the provisions, in order to effect such registration, the tenant must show that he has a lease that allows such use of the apartment. No commercially available lease has such allowance. All commercially available residential lease forms prohibit any subletting, thus, effectively, foreclosing these kinds of transient rentals. All such rentals fall well within common law understandings of sublets.

Further, the City announced that it will not register any rent regulated apartments for short term use.

While 2023 did not see the complete elimination of short term, transient use of conventional apartments, 2024, it appears, will go far to completing the process.

Flood ZonesEffective June 21, 2023, under RPL §231-b, all leases in New York regardless of the rent regulatory status, regardless of whether it is a single family home on up to a huge apartment house, all residential leases must advise tenants the flood history of the leased premises.

For this purpose, New York Homes and Community Renewal has provided at //hcr.ny.gov/system/files/documents/2023/08/2023-c-4-new-york-state-real-property-law-section-231-b-compliance.pdf not only an announcement of the new requirement, but a model form for compliance. There is little remarkable in the form as it recites the statute approximately verbatim.

Much of the statute (and the form) is absolutely straightforward. It requires disclosing whether the premises (or part of them) are in a floodplain, 100-year floodplain, or 500-year floodplain. Since all of these designations, under the statute, are with specific reference to FEMA maps, there is no ambiguity with regard to these provisions. This is important because recent history is teaching that floods are occurring more often than the names of the floodplains would imply. Whatever disputes there may be about the science of the causes of the more frequent flooding, the increased frequency is readily documentable.

However, both within the statute and the form is a requirement for disclosure that, “The leased premises has experienced flood damage due to a natural flood event, such as heavy rainfall, coastal storm surge, tidal inundation, or river overflow, which is detailed as follows.”

The problem is that the statute never defines “natural flood event,” except, to the extent that it be considered a definition of sorts, with the ensuing phrase “such as.” What immediately follows the “such as” is four items, three of which are essentially regional in nature, “coastal storm surge, tidal inundation, or river overflow,” even if only for a relatively small region such as, for example, a single city block. However, there is nothing intrinsically regional in “heavy rainfall,” at least, when that phrase follows “the leased premises has experienced flood damage due to.” Here, the question is not whether neighboring buildings have also experienced damage from heavy rain, but only whether this building has.

While regional floods of the kinds described in the statute are never the fault of individual landowners, floods to particular buildings caused by a heavy rain can be where, for example, the building is in serious need of repointing, has defective gutters or leaders, or has broken windows. Those kinds of conditions, put together with a heavy rain can indeed effect heavy flood damage.

And those kinds of conditions appear to be included within the scope of the statute. Unlike the FEMA map provisions of the statute which clearly speak to the current FEMA map and not historical ones, this local flood provision of the statute speaks entirely to history.

What the statute leaves completely unanswered is how long that history is. There is nothing about the disclosure of history that has some kind of limitations period associated with it. There is nothing in any other statute that gives some kind of definition to it.

The only conclusion one can draw is that the statute, as written, calls for a complete history from the beginning of the universe, since the word “premises” is not restricted to the current building. Naturally, in construing statutes, one is to avoid absurd results. The absurdity is easily relieved here by restricting the landlord’s obligation to disclose what the landlord does know or by the exercise of some kind of standard (reasonable application, due diligence, or some other standard a court may find) should know.

There are no cases construing this statute. We therefore simply do not know what the standard of inquiry, if any, is. Taking this interpretation in its most conservative form, we would recommend that even if landlords are disclosing some historical event, they should include the qualifier “and nothing else to the landlord’s knowledge.” If there is no event being disclosed, then the form should be filled out with the phrase, “nothing to the landlord’s knowledge.”

Since we do not know the standard of inquiry about the history of the building, we cannot advise whether contracts for sale or residential rental properties should or should not include representations about the flood history of the property.

The statute, by its terms, only seems to refer to original leases, but the DHCR Advisory suggests using the Rider on renewals as well. This should not be a violation of the rent stabilization requirement that all renewals be on the same terms and conditions because there is nothing in this Rider that is a term or a condition. It is only a disclosure. By the same logic, any leases landlords entered since the effective date of this statute, should be repaired by the owner sending out the rider now, if it had not been done previously.

Cannabis DispensariesThe law and its enforcement when it comes to cannabis is still in a state of disarray. While New York is one of about half the American states to legalize marijuana for recreational use, the Federal government has not legalized it and shows little reason to believe that it will legalize it before a higher proportion of states have done so.

However, federal authorities seem to be taking no action against individuals. New York, however, enacted Article 222 of the Penal Law, largely focused on setting forth what is legal. Also enacted is The Cannabis Law which sets forth who may sell marijuana (previously called “marihuana” in New York law and currently called “cannabis.”)

The unauthorized sale of cannabis is the problem landlords are facing. Under the Cannabis Law, New York State licenses dispensaries for the sale of cannabis. Sale through any other means is illegal. However, under the original program, New York was limiting its licenses to those who had previously been convicted of marijuana related offenses. This led to extreme difficulty in obtaining a dispensary license and a pair of lawsuits that essentially shut the process down until the end of 2023. However, reports are that the State is now issuing those dispensary licenses.

Outside of that system, local district attorneys are calling upon landlords to shut down these illegal dispensaries by means of RPAPL 715-A, a new statute, crafted for this very purpose, but largely modeled on RPAPL 715, an old law originally created for the purpose of shutting down houses of prostitution, with relaxed standards of proof compared to those of other eviction proceedings.

Unlike other summary proceedings, it has a provision allowing for treble damages to the landlord, relatively liberal discovery provisions against the tenant, and allows for the landlord’s attorneys’ fees, provided, of course, the landlord succeeds in the proceeding. The final sentence of the statute allows for the possibility of the landlord also bringing a proceeding under RPAPL 715.

However, since this law came into effect less than a year ago, there are no officially reported decisions construing it. However, there are unreported cases adding some further common law requirements to the proceeding:

1. That there was more than one unauthorized sale;

2. That the tenant knew of the sale taking place; and

3. That there is not other meaningful business activity taking place at the premises other than the illegal sale of cannabis.

The courts have thus far indulged the presumption that if there is only one sale, both of these criteria fail because of a failure to meet a standard of ongoing conduct and because an employee of the tenant may be running their own illegal dispensary unknown to their boss. Under this reading, the tenant’s liability is not absolute.

The third criterion we listed applies only to 715-a proceedings. RPAPL 715 has no requirement of “solely or primarily” regarding the illegal activity in order to sustain a proceeding.

While this area is so new, it is hard to predict what the authorities will do to make 715-a more effective. The police could work harder to show the ongoing activity and the named tenant’s acquiescence. The District Attorney could decline to push for these cases (which consume considerable governmental resources) except in the most strident circumstances. The Legislature could relax the requirements. This is clearly a law that is in a state of flux.

Rent StabilizationOn Nov. 8, 2023, the state’s Division of Homes and Community Renewal (DHCR) adopted massive amendments to the Rent Stabilization Code, too numerous to be confined to this single article. On Dec. 22, 2023, the governor signed into law a statute that is a bit of a grab bag of new enactments, all of them anti-landlord, some of which further codify the provisions of the Nov. 8 DHCR provisions.

When the State Legislature enacted the Housing Stability and Tenant Protection Act in 2019, it, at a stroke, rendered many provisions of the Rent Stabilization Code obsolete. Much of the Nov. 8 DHCR enactment simply codifies into the Code the abolition. Thus, as one of many examples, the enactment deletes all of the provisions for luxury decontrol of normal rent stabilized apartments. Many others are the codifications of 2019 law into the 2023 Rent Stabilization Code.

One major question left open by the 2019 law was what would happen with apartments that were some form of recombination of earlier existing apartments. This process came shortly to be known in the industry as “Frankensteining Apartments.” The upshot of both the new regulations and the new statute are that if an owner does anything to rearrange the allocation of square footage of the various apartments in a building, all apartments that had their footprint changed come under Rent Stabilization.

The laws then go on to give a method for recalculating the rents for the various apartments in a purely mathematical fashion. There is, under the design of the law, no need for DHCR intervention and no use for comparing these apartments to any other apartments. The recalculations have the net effect of the rent roll of the building as a whole not moving upwards.

Thus, unless there is an issue of necessary reconfiguration for some other kind of building code compliance, the owner has no financial incentive to do the reconfiguration.

Also addressed in the new laws are different ways of looking at “fraud” than the prevailing case law had indicated, for purposes of determining tenants’ rights when an owner took luxury decontrol while a building was undergoing J51 or 421-a. However, the interpretation, enforceability, and durability of those new interpretations are so subject to question at the present juncture as to be far beyond the scope of an overview article such as this.

ConclusionThis article examined a variety of new enactments, including one not yet in effect. It is clear that all of these enactments require a greater body of case law to clarify their metes and bounds. Indeed, case law may not be enough. The legislatures themselves may need to polish these laws a bit and litigation challenging the rent regulatory laws will soon be filed.

The damage that the majority in the State Legislator has completed may be a record of poor governing and as a result the real estate economy has entered chaos. Rent regulatory apartment rents can barely be raised and many building owners cannot afford to maintain their buildings or pay for repairs. Most of these buildings are worth a fraction of their sales price from the day before these laws were originally passed. Thousands of construction jobs have been lost and even more developers have left New York to find safer places to plant their money.

Adam Leitman Bailey is the founding partner and Dov Treiman is the landlord-tenant managing partner of Adam Leitman Bailey, P.C.