Foster Dickson's Blog, page 89

October 11, 2015

A writer-editor-teacher’s quote of the week #88

When you hear someone extol the virtues of a liberal education, you will probably hear him or her say that “it teaches you how to think.” I’m sure that’s true. But for me, the central virtue of a liberal education is that it teaches you how to write, and writing makes you think. Whatever you do in life, the ability to write clearly, cleanly and reasonably quickly will prove to be an invaluable skill.

– from Chapter Three, “Learning to Think,” in In Defense of a Liberal Education by Fareed Zakaria

Filed under: Education, Teaching, Writing and Editing

October 8, 2015

Chasing Ghosts: Great-Great-Uncle Herbert

My great-great-uncle Herbert’s portrait – an oil painting three feet tall and two feet wide, framed ornately in faux gold – hung in my family’s formal living room when I was growing up. This somewhat elegant and mildly majestic item was out of place in our little 1950s ranch-style house, even in the formal front room where the floors were hardwood (rather than carpeted) and an ancestor’s name was attached to every piece of furniture: Mother’s china cabinet or Grandmother’s buffet. His calm, kind, bespectacled expression hovered in the background during holiday dinners, and I had looked at him so many times I barely even thought about his face. Nearby, on a thin section of wall by a window, hung a much-smaller colorized photograph of his wife, great-great-aunt Viola Matilda Dickson, who was my father’s father’s father’s sister.

Herbert Wilber Coleman, who married my great-great aunt, would otherwise be of little consequence to me, except that Viola’s baby brother James Davis Dickson – who was my great-grandfather – would name his middle child, Herbert Coleman Dickson, after his much-older brother-in-law. Then, years later, Herbert Coleman Dickson got married, had a family of his own, and named his middle child – my father – Herbert Coleman Dickson, Jr. Had my father not been so strongly opposed to this tradition, having hated living in his father’s shadow, I or my brother could easily have been Herbert Coleman Dickson III.

Great-great-uncle Herbert was born in 1868 and died in 1934. It appears that he first married a woman named Ella Kent in 1892, though she died in 1894. Two years later, he married great-great-aunt Viola in 1896. The 1897 city directory for Montgomery lists them living in Clifton House, which was her father’s boarding house, and Herbert’s job was listed as manager of Southern Art Company. Throughout the 1900s, 1910s, 1920s and early 1930s, the city directories continually list them at various addresses around downtown Montgomery. It appears that they had no children. There were none in 1900 and there remain none in 1930, when the couple are 61 and 53 years old, respectively.

Great-great-uncle Herbert was born in 1868 and died in 1934. It appears that he first married a woman named Ella Kent in 1892, though she died in 1894. Two years later, he married great-great-aunt Viola in 1896. The 1897 city directory for Montgomery lists them living in Clifton House, which was her father’s boarding house, and Herbert’s job was listed as manager of Southern Art Company. Throughout the 1900s, 1910s, 1920s and early 1930s, the city directories continually list them at various addresses around downtown Montgomery. It appears that they had no children. There were none in 1900 and there remain none in 1930, when the couple are 61 and 53 years old, respectively.

Herbert Coleman worked as a photographer back in the days of glass negatives and the big hand-held flash. His name appears often enough when searching local historical records. One page on the Alabama Pioneers website features one of his photographs of a steamboat, and a 2006 issue of the Montgomery Genealogical Society’s magazine had his work on the cover. More recently, writer Karren Pell mentioned Herbert and Viola in a blog post for Montgomery’s Midtown Living; a 1924 Capitol Heights neighborhood newsletter had discussed the couple’s home renovation. The remnants of Herbert Coleman’s life in Montgomery in the early 20th century are out there in plain view.

However, as prevalent as he was in Montgomery when married Viola, great-great uncle Herbert has been a hard man to trace in the years before that. The 1880 census shows an HW Coleman, 11 or 12 years old, living in Pensacola with his father WS Coleman, a “retail grocer” who was born in Alabama; his mother WD Coleman, a younger sister AD Coleman, and a 30-year-old schoolteacher “sister-in-law,” whose entry was butchered by the census taker, but I think it reads MA Fountain. Herbert’s mother’s maiden name could have also been Willie Fontaine, so that WD could be her, with her sister’s last name of Fountain incorrectly spelled. Yet, in a Florida Census from 1885, WS Coleman in Escambia County – with two kids, Herbert and Ada, so presumably the same guy – is married to a woman named Dorsey Coleman, but there’s no MA Fountain there. So it’s possible that his mother’s full name was Willie Dorsey Fontaine Coleman. All in all, I’m not even sure if they’re the right people.

Likewise, I’m not 100% sure, from the records I’ve found, that the Herbert Coleman who was married to Ella Kent was the same Herbert Coleman who married Viola Dickson.

Nonetheless, the man for whom my father and grandfather were named seems to have been a stand up guy, known for good work. In the records that I am sure about, he was married to Viola for 37 years, until he passed away, and maintained a respectable career. There’s none of the moving around and career changing that Viola’s father, David Madison Dickson, Jr. had done for most of his adult life.

Great-great-uncle Herbert and great-great-aunt Viola are buried side by side in Montgomery’s Greenwood Cemetery. Viola Matilda Dickson Coleman outlived her husband by a good bit, having passed away in 1960. And their framed portraits are still hanging in a Dickson household, Herbert’s majestic oil painting on one wall with Viola’s colorized face nearby.

Filed under: Alabama, Black Belt, Family History, Local Issues

October 5, 2015

Recycling in Montgomery: Done for now . . .

The Montgomery Advertiser reported today that the city’s IREP recycling facility is closing up shop, at least for the time being. What Mayor Todd Strange calls a “temporary suspension” is due to a “massive change in the commodities market.” Apparently, the recycled materials can’t be sold for enough money to keep the facility going. About the closure, the Advertiser reports:

Montgomery Clean City Commission Director Susan Carmichael found out about the closure Monday morning and said there isn’t a long-term alternative in place. The city was providing collection bins for recyclables, but those bins were then taken to IREP.

I’ve been following news coverage of this story for several years now. Today’s news is surprising to me, since IREP won an economic development award earlier this year. But not everyone agrees that IREP is so wonderful. We’ll see what happens. Worse come to worst:

If IREP isn’t able to re-open the center, Strange said the city would eventually gain ownership of the $35 million facility. He said they’re hoping to avoid that.

Filed under: Alabama, Local Issues, The Environment

October 4, 2015

A writer-editor-teacher’s quote of the week #87

We’re both alive . . . and for all I know, that’s what hope is.

– spoken by Henry II (Peter O’Toole) to his wife, Eleanor of Acquitane (Katherine Hepburn), near the end of A Lion in Winter (1968)

Filed under: Film/Movies, Teaching, Writing and Editing

October 1, 2015

October’s Southern Movie of the Month

You couldn’t ask for a better cast than the one in 1977’s Greased Lightning. Starring Richard Pryor and Beau Bridges, the movie also features Pam Grier and Cleavon Little, with lesser roles played by Civil Rights icon Julian Bond and singer-songwriter Richie Havens. Even though you wouldn’t think of a Richard Pryor movie from the late 1970s being rated PG, this one is— and it’s pretty clean. Made about the same time and in the same style as Smokey and the Bandit (1977) and TV’s Dukes of Hazzard (1979 – 1985), Greased Lightning tells the story of Wendell Scott, the first black stock car-racing star.

Scott’s story begins with a quaint prelude to his racing days, told through an bike-racing episode when he was a boy presumably in the late 1920s. He and his pal Peewee are riding along, minding their own business, when they encounter a group of white boys blocking the road. Chided by a white bully, young Wendell agrees to the contest, and of course he wins. This little scene sets up much of the movie’s plot, which involves racing, road blocks, and racism.

After the credits roll, a grown-up Wendell Scott – now played by Richard Pryor – comes home to Danville, Georgia in 1947, after his military service is over. He gets off the bus, kisses his mother like a good Southern boy should, and heads to the house, where a surprise party is waiting for him. Once inside, he quickly steals the girl of his dreams, Mary (Pam Grier) from another pal (Julian Bond), and makes it clear to her that he has no intention of getting a job at the mill like everyone else.

Married to Mary and frustrated by his inability to make a living driving a taxi in small-town Georgia, Wendell takes to running moonshine with Peewee (Cleavon Little). Here, we start to get into the absurd stereotypes of rural Southern whites. The moonshine brewers that Wendell picks up from are dirty-faced, overall-wearing, rifle-toting hicks, and the buffoonish sheriffs are only slightly more sinister than Boss Hogg and Roscoe P. Coltrane. Wendell and Peewee evade them over and over for years, and given the stupidity of the small force, we know why. With just a little bit of Brer Rabbit trickery, the pair outsmart the local yokels.

Eventually, though Wendell does get caught. Years have gone by, his kids are growing up, and though he no longer needs the money, it’s what he does. The police have him set up, using another black moonshine runner who has gotten caught. Barricaded into the small downtown, Wendell is taken to jail on Easter. But he won’t stay there long.

The local racetrack owner has another idea for the sheriff: put Wendell Scott on the track, allowing the local good ol’ boys to go after him, to draw some heavy ticket sales from both whites and blacks. Though that race doesn’t go well for Wendell – he barely finishes after he is forced off the track into the woods by local greaser Hutch (Beau Bridges) – he does survive. His moonshine-running career is over, and his racing career has begun, with the help of volunteer mechanic Woodrow (Richie Havens).

By now, it’s 1955, which we learn from a race announcer, and Wendell, Peewee and Woodrow are struggling against Deep Southern racism and trying to get into the racing business. After an initial rocky start with him, Hutch becomes a friend and partner to Wendell and Woodrow. However, all of the whites aren’t so amicable; Wendell is not just racing to win, he is trying not to get killed. This is where we meet yet another villain in the story: Beau Wells, an adult version of the bike-race bully in the beginning. Wells is the cocky local unbeatable who has it out for Wendell Scott.

After a montage of racing footage, meant to make a big leap in time, we meet up with the cast again in the mid-1960s, once they have gotten into big-time NASCAR racing. The next time we really pick up the film’s story, Scott has had a bad crash and is in the hospital. His racing career is over— or is it?

Of course it’s not! Wendell’s Scott’s story ends on a far more triumphant note than that. He can’t just crash and quit.

Despite a lack of sponsorship and objections from Mary, Wendell registers for the Grand National, where he will once again face Beau Wells. The race is tough one, but in the end Wendell Scott wins, even though he ran the last twenty laps with only three lugnuts on his rear tire. As the ending credits roll, Wendell Scott is vindicated, holding up the checkered flag in front of the huge cheering crowd, a right that was denied to him in his first-ever win.

I know when you were reading this and first saw Greased Lightning, you were thinking, “That’s the song from Grease!” Actually, this 1977 bio-pic about a Deep Southern racer came out a year before that infamous John Travolta/Olivia Newton-John musical, so the title was no rip-off.

Though the cast of this movie is strong, sadly the movie isn’t. imdb.com has it with 6.1 stars, which is kind of generous. Audiences gave it a similar 3.3 out of 5 on Rotten Tomatoes. Though Richard Pryor, Cleavon Little and Beau Bridges are good actors, too many things about the movie are distracting. Though Pam Grier is as beautiful as she always is, her acting in this one is pretty weak. The movie also doesn’t handle time well; I found myself having to look for clues about how much time had passed, like children growing up and makes of cars. I don’t know how you make a mediocre movie when you’ve got a great story and a great cast, but somehow these folks managed.

Filed under: Film/Movies, Georgia, The Deep South

September 29, 2015

Sallie Mae and Me, part two

*Continued from an earlier post, “Running Down the Devil, or Sallie Mae and Me”

In a New York Times opinion piece entitled “Why I Defaulted on My Student Loans,” published last June, writer Lee Siegel made the following assertion:

It struck me as absurd that one could amass crippling debt as a result, not of drug addiction or reckless borrowing and spending, but of going to college. Having opened a new life to me beyond my modest origins, the education system was now going to call in its chits and prevent me from pursuing that new life, simply because I had the misfortune of coming from modest origins.

Siegel’s situation, and sentiments, are similar to mine. When I was young, my parents were hard-working people who had not gone to college themselves. Through their diligent work ethic and frugal life choices, they were able to send me first to a private school then to college. (The teaching certificate and master’s degree were my choices later.) My parents’ constant admonitions to me were: work hard, make the most of opportunities, and do better for yourself. Those lessons, which I applied, led me to the situation I described in part one. I saw a good opportunity, albeit one I had to work for, and I took the long-haul view that my upbringing and my education gave me: the rewards will come . . . later.

Yet Siegel and I differ, too. Siegel wrote about defaulting on student loans– and the havoc that follows. Right now, I have no such intentions. My concerns are similar though: how and why this student-loan “arrangement is legal, but not moral.” Yet, while I believe firmly that Sallie Mae/Navient is messing me over, I don’t believe that defaulting on money that I applied for, accepted and spent willingly would be right either. I haven’t yet paid off the principle of what I borrowed, and I recognize my obligation to pay at least that.

I have one other objection to this notion that defaulting is OK. One reason that people like me end up paying back double our original loan amount is: we are paying our own loans and the loans of those who default, too. When someone defaults, do we really think that a corporation like Sallie Mae/Navient is going to look at a financial loss and say, Oh well . . . I guess that one didn’t work out. No, they’re going to find another way to recoup it— from people like me. So, where I concur with Lee Siegel about the predicament, I disagree about the solution.

On my new quest for— should I call it justice? . . . the first thing I did was to write to Sallie Mae/Navient and ask for information my original loan amounts and my first payment date. I wanted to be sure of how much money I had accepted and when I actually started paying it back, before I started mouthing off, declaring and decrying— and then realizing I was wrong.

Sallie Mae/Navient responded to my request quickly, within a few days, and I’ll be honest that the loan amounts were more than I remembered. I thought I would be much closer to paying off the real principle than I am. All my little $204 payments for more than six years have not added up to half of what I borrowed, but what’s sadder than that is: only half of what I’ve sent has gone to reduce the principle balance; the rest has gone to interest.

The next step, if I am ever going to make this right, was to research options to get my loans reduced or “forgiven.”

As a public school teacher, the best option that I’ve seen so far was the Teacher Loan Forgiveness Program, which allows for “forgiveness” of up to $17,500 in student loans. If I were to get it, that maximum amount would cut my loan balance by more than half, effectively reducing my accrued interest at the same time, which might get me closer to paying back what I actually borrowed.

I looked over the criteria, using the information I got from Sallie Mae/Navient, and I almost qualified for the program. I have no outstanding balances; I’m not in default; my loans were not made before the end of five years teaching; I’ve never taught for AmeriCorps; and I’ve been teaching for at least five consecutive years. I’m eligible in every way but one: the school system in which I teach is qualified for Title I, but the school where I teach is not on their Annual Directory of Designated Low-Income Schools for Teacher Cancellation Benefits.

Sigh . . .

The information says that, to be on that list, a school has to have 30% of its students eligible for Title I funding. So, unwilling to give up yet, being that close, I decided to try to find out more

No matter what, I knew that I wouldn’t ever get that maximum $17,500. The program will cancel 15% of the loans from the first and second years of service, 20% from the third and fourth years, and 30% from the fifth year. Even if they cancelled the most money possible, for me those percentages wouldn’t amount to $17,500. The good news would be: the program allows for cancellation not only of principle but of accrued interest, too.

Since the program appeared on the FAFSA website, common sense told me to call them first.

The discussions with the FAFSA people did not go well. When I called the help line for FAFSA, I was told by an automated message that I needed an FSA ID. I had never heard of such a thing, so I hung up and went back to the FAFSA website to find out what that is. Apparently, I either don’t have one or lost it years ago, so I needed to set one up. When I typed in the first information that the set-up requested, that brought up my old address, where I lived when I had gotten the loans. So they know me, I thought. Not so fast. As I completed the requested information, including four separate security questions, I checked the little box that I did agree to the terms-and-conditions, and clicked “Submit.” Instead of receiving an FSA ID, I was re-routed to the log-in home page where a red error message appeared: the website had a problem processing my request.

I started over, did the whole set-up process over again— and got the same result.

I was starting to get aggravated, which is usually a bad time to dial a 1-800 customer service line, but I did that anyway. When the recording told me again about the FSA ID that I was not able to set up, I leaned into my phone, which was on speaker, and said, “Customer Service” as loudly and audibly as I could. “One moment, please,” it replied.

The young man at FAFSA customer service was about as helpful as the FSA ID website. I told him that I wanted to know more about the Teacher Loan Forgiveness program, and he asked what my specific question was. (Instead of answering me, he wanted more information about my request for more information.) I explained that my school isn’t on the eligible list, and I wanted to ask someone why, or what it might take to get my school on the list. The young man said that FAFSA doesn’t make those lists; the lists are provided to them.

“By who?” I asked

“The federal government,” he replied.

I explained pointedly that I wasn’t able to hang up with him and call “the federal government.” I needed to know who to call to ask that question. He put me on hold.

Only Title I schools are on that list, the young man said when he came back, and if I wanted to know more about the list, then I needed to call whoever handles my student loans. I told him, I thought I was talking to the people who handled my student loans. No, he said, then asked, Who do you send your payments to? The next exchange went something like this:

“Sallie Mae/Navient.”

His response was, “Yeah, whichever one of those handles your loans.”

“They’re the same company. They changed their name.”

“Oh,” he said.

I decided not to spend any more time with the young man at FAFSA. Despite the Teacher Loan Forgiveness program being listed on their website, their own customer service guy didn’t answer my questions, then directed me to someone else who couldn’t either: Sallie Mae/Navient.

I imagined calling sweet Sallie Mae and saying to her, Excuse me, Sallie Mae, will you help me cancel out some of the tens of thousands of dollars that I owe you? And I was sure she’d say, Of course I will, sweetheart.

But that’s not how the conversation went. The corporate mouthpiece at Sallie Mae/Navient said lots of things that I knew were coming but still dreaded hearing, namely when I asked about loan forgiveness programs, he said, “No, those loans are going to need to be paid off.” That got my Irish up!

Our conversation didn’t go well after that. He interrupted me a lot, and I got angrier with every self-righteous statement that he made. He suggested that I make a “lump-sum” payment every once in a while, to get my principle down, and I asked him if he has any spare money laying around, because I don’t.

However aggravating he was, Sallie Mae/Navient’s guy did give me three things I could use: one little shred bit of hope, and one fact that I am a little frightened about, and he also told me to call the Department of Education about the eligible school list, which is more than FAFSA’s guy could do.

The hopeful nugget was: according to him, my current $204 payments will pay off my loans in about eighteen years. (That beats the 200+ years that I estimated.) I don’t know what kind of funny math he’s using – maybe it’s Common Core math – but I like it. Granted, I’ll be nearly sixty in eighteen years, but it’s nice to hear that my wife won’t be paying off my loans with my life insurance. However, eighteen years of $204 payments means that I’ll still be sending them another $44,000. Personally, I’d rather use that money for other things.

The thing that scared me was: of my five separate loans, the three with lower rates are variable-rate loans. He really got under skin when I asked, “Variable, what does that mean?” and he started to define the word variable for me. No, no, no . . . what do you mean by variable? According to yet another cubicle-dweller who knows he is being recorded by his employer, “the government” changes those rates every August— could go up, could go down – according to “the economy.”

Lord, help me! My student loan interest rate is dependent upon “the government” and its ideas about “the economy.” August just passed, so I need to keep an eye on my rates. All it’ll take is some constipated bureaucrat with an itchy trigger finger and I’ll be paying even more interest.

I may be no closer to having my student loan balance reduced, but I do know a little more than when I started calling around. I already suspected but know now that I will never, ever, ever be eligible for the Teacher Loan Forgiveness program, because I can’t go back in time and retroactively get my school a Title I label for the years I’d need it to be. As far as I can tell, I’m qualified for the program in every other way.

In my efforts to make some sense out of my student-loan predicament, I have gotten far. I have been rebuffed by the empty rhetoric of the lowest-level pawns at FAFSA and Sallie Mae/Navient. But I’m a hard-headed SOB, and I won’t quit that easily. I could call the Department of Education about my school’s Title I status, but that’s not going to change. May I’ll Lee Siegel and see how that default thing is going.

Nah, let’s see what else is going on . . .

Filed under: Education, Social Justice

September 27, 2015

A writer-editor-teacher’s quote of the week #86

In every century the way that artistic forms are structured reflects the way in which science or contemporary culture views reality.

— from chapter one, “The Poetics of the Open Work,” in The Role of the Reader by Umberto Eco

Filed under: Education, Reading, Teaching, Writing and Editing

September 22, 2015

What’s it take to make it out there? Literacy, that’s what.

Wouldn’t it be nice if there were a formula? Heck, even an instruction book! Here’s what you do, and you’ll be fine . . . Two centuries ago, the German writer Heinrich von Kleist called it the Lebensplan, the idea that planning one’s life extremely effectively could reduced or eliminate the pitfalls. We’ve been trying to figure these things out for longer than human history has been recorded; we’re still working on it . . . but we’ve got some good clues.

Back in February, the Pew Research Center’s Fact Tank published “The skills Americans say kids need to succeed in life,” which – I guess – was yet another effort to declare what “the right way” is. Topping the list, “Communication” and “Reading” were at #1 and #2, and “Writing” and “Logic” were at #5 and #6. Literacy skills and critical thinking skills. In the accompanying article, we also find out that:

College-educated Americans were more likely to point to communication, writing, logic and science skills as important when compared with those with a high school education or less.

As an English Language Arts teacher, I work all day long trying to inculcate these values. Reading, thinking and writing constitute the ability to receive, understand and share information and ideas. What could be more important? Every “good job” anyone can name requires those skills, even jobs in STEM fields.

Moreover, what does it mean not to have these skills? According to two of DoSomething.org’s 11 facts about literacy in America:

2. 2/3 of students who cannot read proficiently by the end of 4th grade will end up in jail or on welfare. Over 70% of America’s inmates cannot read above a 4th grade level.

and

5. Nearly 85% of the juveniles who face trial in the juvenile court system are functionally illiterate, proving that there is a close relationship between illiteracy and crime. More than 60% of all inmates are functionally illiterate.

Reading, thinking and writing may not keep a person out of prison, but statistically speaking, it’s in your best interest to know how.

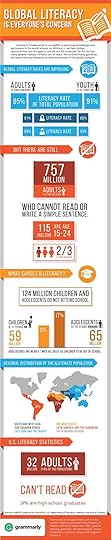

Sadly, too many people, young and old, suffer from illiteracy. I use the word “suffer” appropriately here; to be illiterate is a root cause of which many social ills are the symptoms. Recently, I posted about Grammarly and International Literacy Day— from their infographic, we learn some really ugly truths about how widespread illiteracy still is.

Yet, we can’t take these statistics and make out a set of altruistic proclamations. Statistics tell general truths and shouldn’t dictate specific policies. The current fads with “data-driven” solutions and poll-driven conclusions lack a certain amount of humanity anyway. Let this be clear about this: no one skill can guarantee that a child will “succeed in life.” These pollsters and social scientists and corporate profiteers may be looking at the same stats that I am, but their end-all-be-all products are more about drawing them a paycheck than anything else.

Me, I’m not selling anything, and I know what means more than every workbook and website ever made, more than any curriculum or accountability measure ever designed: reading at home with caring adults. That doesn’t cost a dime, and it works. When the adults at home read to their children, those children achieve greater academic success earlier than those who don’t. Coupling those stats with the ones from DoSomething.org, the gap in potential outcomes, between a child who is read-to versus a child who is not, does not leave much of a choice.

A widespread push for literacy is about more than having a generation of young people who are “college and career ready.” The stakes are higher than economic boosterism. According to the Literacy Council of Central Alabama website, which operates in the area where I live:

According to the National Center for Education Statistics, approximately 16% of adults in the State of Alabama are functionally illiterate. That means there are more than 92,000 adults in Central Alabama who do not read well enough to earn a GED or fill out a job application or understand the label on a prescription bottle. Illiteracy is a personal tragedy for the person as well as a public dilemma for our community. Many of our state’s ills can be directly attributed to our low levels of education. Of those 92,000 functionally illiterate adults, some are working in menial jobs, some are in prisons or homeless shelters, and many more are living on welfare. If we could teach these adults to read, what changes would we see in their lives? What changes would we see in our communities?

In the Information Age, literacy is a key component of basic citizenship. Illiteracy is not a crime, but the inability to function in a literate society leaves a person very few options for leading a healthy, productive life. Imagine being unable to read the label on a prescription bottle . . .

If you or someone you know needs help, please find a literacy center near you.

Filed under: Alabama, Education, Reading, Social Justice, Teaching, Writing and Editing

September 20, 2015

A writer-editor-teacher’s quote of the week #85

“And after all,” he went on, flicking his terrible little forked tongue in and out as he spoke, “it may be that to eat and be eaten are the same thing in the end. My wisdom tells me that this is probably so. We are all made of the same stuff, remember, we of the Jungle, you of the City. The same substances composes us – the tree overhead, the stone beneath us, the bird, the beast, the star – we are all one, all moving to the same end. Remember that when you no longer remember me, my child.”

– spoken by the Hamadryad in Chapter 10, “Full Moon,” in Mary Poppins by PL Travers

Filed under: Reading, Teaching, Writing and Editing

September 17, 2015

Grammarly and International Literacy Day

Even though I’m a little late, I wanted to share this infographic from a blog post on Grammarly with my readers. I tell my students (maybe too often) that “writing is a privilege,” and if they don’t believe it, they should go talk to someone who can’t. Reading and and writing are integral skills for life in modern society, and sadly, many people still don’t have those skills . . .

Filed under: Education, Reading, Teaching, Writing and Editing