Doug Henwood's Blog, page 2

August 14, 2025

Fresh audio product: a democratically planned economy, co-ops today

Just added to my radio archive (click on date for link):

August 14, 2025 Aaron Benanav, author of this article, outlines possibilities for a democratically planned economy • Jerome Nikolai Warren on the possibilities for cooperatives

August 7, 2025

Fresh audio product: anti-wokeness, MTG dissents

Just added to my radio archive (click on date for link):

August 7, 2025 Jodi Dean, author of this article, on why going anti-woke is very wrong • Emily Jashinsky on Marjorie Taylor Greene’s use of the word “genocide,” and other curious developments on the right

August 3, 2025

That 3% GDP growth number was bizarre

While the jobs numbers had this big kind of mysterious revision, if they didn’t have the revision, then the jobs numbers were fully consistent with a 3% GDP growth we also so last week, and that’s even before the Big Beautiful Bill passes…

By now, the news that the Bureau of Labor Statistics (BLS) reported weak job growth for July and revised its estimates for May and June down very substantially has spread beyond the usual audience of connoisseurs. Though those revisions were large by historical standards, there’s nothing “mysterious” about them; such revisions happen every month. But the weak numbers annoyed Trump, who did the only thing a Trump could do: he fired the head of the BLS, a scrupulously honest and competent organization.

Fox brought on Kevin Hassett, director of Trump’s National Economic Council, to comment. A choice line from his observations serves as the epigraph to this little post. It seems he doesn’t understand the first thing about the second quarter GDP numbers—or if he does, he’s not disclosing it. They were quite bizarre.

Apologies for the ensuing wonkiness.

The headline quarterly growth number, released on July 27, 3.0%, is respectable. That number comes from annualizing the change from the first quarter to the second. The change from a year earlier, 2.0%, is on the weak side. But when you look at where the growth came from, it’s hardly a sound foundation for braggadocio.

Consumption, which accounts for two-thirds of GDP, was up just 1.4% in real terms for the quarter, less than half the long-term average.* It’s at the 22nd percentile of all quarters since the numbers begin in 1947 (meaning 78% of the quarters had a higher number). Real investment fell by 15.8% (quarterly rate annualized again), putting it at the 10th percentile of the last 313 quarters. Much of that decline came from corporations liquidating the inventories they accumulated in the first quarter to hedge against the oncoming tariffs. Business investment in structures declined too, as did residential investment (building houses).

But the real kicker to growth came from a sharp reduction in imports, where were boosted in the first quarter by that tariff-hedging inventory stocking. (In GDP arithmetic, exports are an addition to growth and imports, a subtraction, since we’re sending money abroad to produce things that weren’t made here. A decline in imports translates into an addition to GDP) Government spending was barely up overall, and federal nonmilitary spending was down 11.2%. The federal retrenchment was offset by a rise in state and local spending.

Those are growth rates. Looked at another way, the contributions of the components of GDP to the total, and the outsized contribution of net exports comes clearer. Of the 3.0% headline growth number, 1.0 point came from consumption—but investment subtracted 3.1 points. If you take out the inventory liquidation, which contributed -3.2 to the headline (that’s a negative sign there), business fixed investment (buildings and machines, basically) contributed 0.3, well below recent averages. Net exports—exports less imports—added 5.0 points to growth, and imports alone 5.2 points. In other words, without that outsized contribution from the decline in imports, GDP would have been down 1.8% for the quarter.

So, Hassett is fantasizing about the pre-revision job numbers being consistent with 3.0% growth. He does have a funny way with numbers. After all, he’s the guy who thought the Dow Jones Industrial Average should have been 36,000 in 1999, when it was over 25,000 points below that. It eventually got there—22 years after Hassett thought it should.

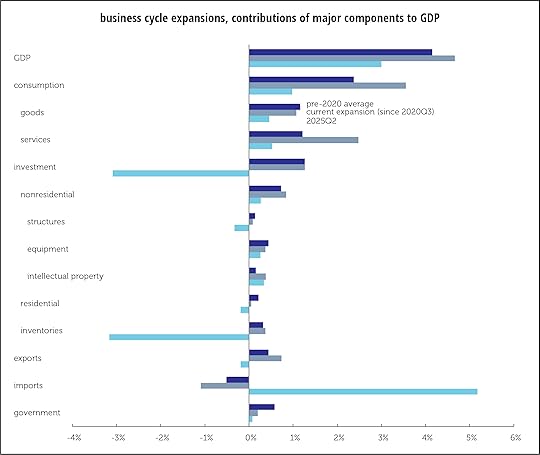

The strangeness of it all is brought out by the graph below, which shows the contributions of the various components of GDP to the total, for the average of all expansions (that is, excluding recessions) from the late 1940s through 2020, for the latest expansion (which began just after the brief covid panic in 2020Q3), and the latest quarter (the second of 2025). A few things stand out:

GDP growth in the current expansion has been healthy, but mainly because of the initial sharp rebound from the pandemic shock (the dreaded Biden economy). But the latest quarter was weak by historical standards both recent and long-term.Consumption has been a major contributor to growth in this expansion, but it was very soggy in 2025Q2.Investment has been about average, though equipment investment has lagged its historical average. Residential investment is barely positive.Imports have been more of a drag on growth than usual in this expansion, but the 2025Q2 boost is a real switcheroo.Government spending is extremely contained.Either Kevin Hassett doesn’t know what he’s talking about or he’s making things up. Or possibly both.

* Gross domestic product (GDP) is the total value of goods and services produced in the US. The classic formula for GDP is Y = C + I + G + (X – M). Translated into English, that means GDP (Y) is the sum of consumption plus investment plus government spending plus exports less imports. (X – M) is also known as net exports. The letter conventions may look strange. Y is income, but calling it I would confuse things with Investment, which has rights to the I. Similar with the use of M for imports.

August 2, 2025

Deporting immigrants kills native jobs too

As Trump and his ICE Sturmabteilung troop stormingly about the country deporting people, there’s an important fact that’s being overlooked: deporting undocumented workers destroys domestic jobs as well. Of course, their nativist campaign is grotesque and revolting in itself, and would be were no native-born bystanders injured by the expulsions. But we should be clear on what damage we’re doing to ourselves as well.

As Ben Zipperer shows in work for the Economic Policy Institute, almost as many native-born workers could lose their jobs as deported immigrants. Using data from the experience of the Secure Communities Program (SCP), a deportation effort launched by the Bush administration in 2008 and expanded under Obama, he finds that the far more ambitious Trump program will hammer native-born employment almost as much as it does foreign-born.

The SCP was small potatoes next to the current program. It resulted in the deportation of more than 450,000 people—not a small number, but only a fraction of what Trump & Co. have in mind. They’re looking to expel a million people a year, roughly three times the immediate pre-Trump rate. But the experience is a useful basis for predicting what might happen over the next three-and-a-half years.

Based on the effects of SCP deportations, Zipperer estimates that over that period, 3.3 million jobs held by immigrants will disappear, plus another 2.6 million held by native-born, for a total of 5.9 million—almost 4% of current total employment. In other words, for every 1,000 immigrants who lose their jobs, almost 800 natives will as well.

It’a not just jobs that will be lost. Zipperer draws on earlier work by, among several others, Troup Howard, Mengqi Wang, and Dayin Zhang that looked at the effects of the SCP on the construction industry. Since the program was too large to implement nationally all at once, it was rolled out in staggered form across the country, allowing comparisons between counties where deportations were well underway to those where it wasn’t introduced yet. They found that counties where the program was introduced exhibited “large and persistent reductions in construction workforce, residential homebuilding, and increases in home prices.” Contrary to the hopes of deporters, native-born workers did not replace the deported foreign-born, nor did native wages rise significantly.

Deporters also claim that immigrants have been raising housing costs and reducing supply for natives. Howard et al.’s work suggests otherwise. While reducing immigrant demand for housing reduced costs briefly, after that brief dip, the hit to new construction led to higher prices and reduced availability over the longer term. As they put it, immigrant labor and native labor are complementary, not in opposition to each other.

According to Zipperer, the effects will be highly concentrated by sector, with 42% of the losses occurring in construction (19% of that sector’s employment), with almost 40% of those job losses hitting natives. As he puts it, “when there are fewer immigrant roofers and framers to build the basic structure of homes, there will be less work available for U.S.-born electricians and plumbers.”

Another sector taking a big hit will be childcare. Though much smaller than construction, deportations could take out 15% of the sector’s jobs—bad news for parents already struggling to find someone to take care of their kids while they work, not to mention for the deportees.

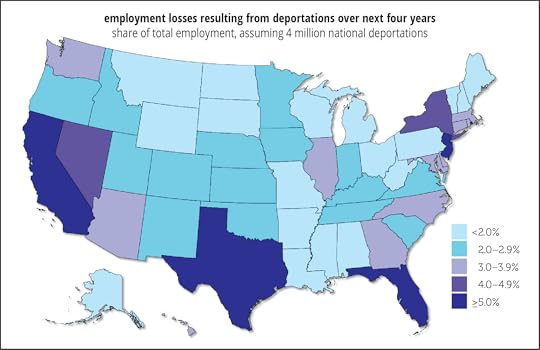

And although job losses are likely to hit every state—nationally, losses will be just over half as large as those between 2008 and 2010, the Great Recession—the effects will be concentrated in a few, notably California, Texas, Florida, New Jersey, Nevada, and New York. (Map below.) For three states—Texas, New York, and Massachusetts—projected job losses will be larger than they were in the Great Recession.

We’re already seeing early signs of job loss in California. Using Current Population Survey data, researchers at the University of California Merced found the number of people reporting for private sector work was down 3.1% from May 11 to June 8—with citizens down more than noncitizens. Deportations intensified after June 6, so things were just getting going by the closing date of the UC Merced study. The didn’t find similar developments in other states, but California has been a deportation headliner and may be a taste of things to come.

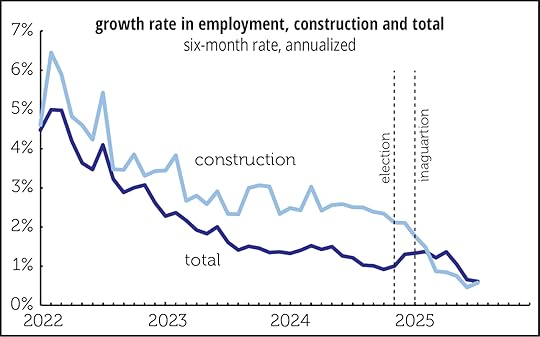

And we’re already seeing early signs of a hit to construction nationally. As the graph below shows, job growth in construction was running well ahead of overall growth from 2022 (when the job market began to stabilize after the covid shock) into late 2024. Since the election, and especially since the inauguration, construction’s advantage has disappeared, and is now running behind overall growth. Of course, with Trump purging the Bureau of Labor Statistics, we may not have data like this in the coming months.

Can we take all this winning?

July 31, 2025

Fresh audio product: Zohran and the cops, the lies of AI

Just added to my radio archive (click on date for link):

July 31, 2025 Alex Vitale on Zohran Mamdani, the NYPD, and policing generally (Nation article here) • Dwayne Monroe on the AI mania

July 25, 2025

Fresh audio product: Trump’s world, a tour d’horizon; checks and balances and elites

Just added to my radio archive (click on date for link):

July 24, 2025 Anatol Lieven looks at US relations with the world under the Trump regime, specifically Russia–Ukraine, Israel–Palestine, and US self-evisceration • Samuel Moyn, author of this article, on checks & balances and the need for better elites

July 17, 2025

Fresh audio product: Trump, Trump, never enough Trump

July 17, 2025 Adam Gaffney, co-author of this article, on Trump & Co.’s cuts to health care and research • Alan Beattie tries to make sense of Trump’s nonsensical trade policy

July 10, 2025

fresh audio product: less work please

July 10, 2025 Juliet Schor, author of Four Days a Week, on experiments in reducing the workweek • Katherine Moos and Noé Martin Wiener, authors of this paper, on overwork among teachers

July 7, 2025

fresh audio product: NATO summit, private equity

Just added to my radio archive (click on date for link):

July 3, 2025 Lily Lynch, author of this report, on the NATO summit • Megan Greenwell, author of Bad Company, on the depredations of private equity

June 26, 2025

Fresh audio product: Iran, fake work

Just added to my radio archive (click on date for link):

June 26, 2025 Sohrab Ahmari, US editor of UnHerd, on Iran, Israel, and the US • Leigh Claire La Berge, author of Fake Work, on the ludicrous side of capitalism

Doug Henwood's Blog

- Doug Henwood's profile

- 30 followers