That 3% GDP growth number was bizarre

While the jobs numbers had this big kind of mysterious revision, if they didn’t have the revision, then the jobs numbers were fully consistent with a 3% GDP growth we also so last week, and that’s even before the Big Beautiful Bill passes…

By now, the news that the Bureau of Labor Statistics (BLS) reported weak job growth for July and revised its estimates for May and June down very substantially has spread beyond the usual audience of connoisseurs. Though those revisions were large by historical standards, there’s nothing “mysterious” about them; such revisions happen every month. But the weak numbers annoyed Trump, who did the only thing a Trump could do: he fired the head of the BLS, a scrupulously honest and competent organization.

Fox brought on Kevin Hassett, director of Trump’s National Economic Council, to comment. A choice line from his observations serves as the epigraph to this little post. It seems he doesn’t understand the first thing about the second quarter GDP numbers—or if he does, he’s not disclosing it. They were quite bizarre.

Apologies for the ensuing wonkiness.

The headline quarterly growth number, released on July 27, 3.0%, is respectable. That number comes from annualizing the change from the first quarter to the second. The change from a year earlier, 2.0%, is on the weak side. But when you look at where the growth came from, it’s hardly a sound foundation for braggadocio.

Consumption, which accounts for two-thirds of GDP, was up just 1.4% in real terms for the quarter, less than half the long-term average.* It’s at the 22nd percentile of all quarters since the numbers begin in 1947 (meaning 78% of the quarters had a higher number). Real investment fell by 15.8% (quarterly rate annualized again), putting it at the 10th percentile of the last 313 quarters. Much of that decline came from corporations liquidating the inventories they accumulated in the first quarter to hedge against the oncoming tariffs. Business investment in structures declined too, as did residential investment (building houses).

But the real kicker to growth came from a sharp reduction in imports, where were boosted in the first quarter by that tariff-hedging inventory stocking. (In GDP arithmetic, exports are an addition to growth and imports, a subtraction, since we’re sending money abroad to produce things that weren’t made here. A decline in imports translates into an addition to GDP) Government spending was barely up overall, and federal nonmilitary spending was down 11.2%. The federal retrenchment was offset by a rise in state and local spending.

Those are growth rates. Looked at another way, the contributions of the components of GDP to the total, and the outsized contribution of net exports comes clearer. Of the 3.0% headline growth number, 1.0 point came from consumption—but investment subtracted 3.1 points. If you take out the inventory liquidation, which contributed -3.2 to the headline (that’s a negative sign there), business fixed investment (buildings and machines, basically) contributed 0.3, well below recent averages. Net exports—exports less imports—added 5.0 points to growth, and imports alone 5.2 points. In other words, without that outsized contribution from the decline in imports, GDP would have been down 1.8% for the quarter.

So, Hassett is fantasizing about the pre-revision job numbers being consistent with 3.0% growth. He does have a funny way with numbers. After all, he’s the guy who thought the Dow Jones Industrial Average should have been 36,000 in 1999, when it was over 25,000 points below that. It eventually got there—22 years after Hassett thought it should.

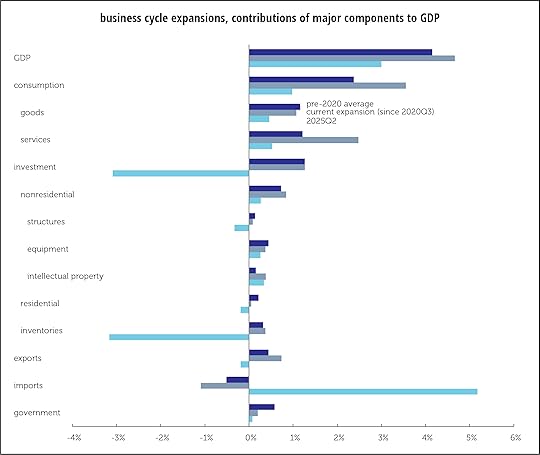

The strangeness of it all is brought out by the graph below, which shows the contributions of the various components of GDP to the total, for the average of all expansions (that is, excluding recessions) from the late 1940s through 2020, for the latest expansion (which began just after the brief covid panic in 2020Q3), and the latest quarter (the second of 2025). A few things stand out:

GDP growth in the current expansion has been healthy, but mainly because of the initial sharp rebound from the pandemic shock (the dreaded Biden economy). But the latest quarter was weak by historical standards both recent and long-term.Consumption has been a major contributor to growth in this expansion, but it was very soggy in 2025Q2.Investment has been about average, though equipment investment has lagged its historical average. Residential investment is barely positive.Imports have been more of a drag on growth than usual in this expansion, but the 2025Q2 boost is a real switcheroo.Government spending is extremely contained.Either Kevin Hassett doesn’t know what he’s talking about or he’s making things up. Or possibly both.

* Gross domestic product (GDP) is the total value of goods and services produced in the US. The classic formula for GDP is Y = C + I + G + (X – M). Translated into English, that means GDP (Y) is the sum of consumption plus investment plus government spending plus exports less imports. (X – M) is also known as net exports. The letter conventions may look strange. Y is income, but calling it I would confuse things with Investment, which has rights to the I. Similar with the use of M for imports.

Doug Henwood's Blog

- Doug Henwood's profile

- 30 followers