Doug Henwood's Blog, page 12

December 21, 2023

fresh audio product: COP28, Argentina

Just added to my radio archive (click on date for link):

December 21, 2023 environmental journalist Tina Gerhardt on the recently concluded COP28 environmental summit, where limited good intentions were uttered and oil contracts were signed • historian Forrest Hylton on Javier Milei, the new libertarian/authoritarian president of Argentina

December 14, 2023

Fresh audio product: what’s driving Israel’s war on Gaza, what’s with philanthropy

Just added to my radio archive (click on date for link):

December 14, 2023 Joel Schalit, editor of The Battleground, on what it is in Israeli politics and society that’s behind the carnage in Gaza • Amy Schiller, author of The Price of Humanity, on what’s wrong with philanthropy and how to fix it

December 8, 2023

Fresh audio product: Gaza in a global context, Israeli spying on US campuses, fascism: this year’s model

Just added to my radio archive (click on date for link):

December 7, 2023 Trita Parsi on the global context of the Gaza war • James Bamford, author of this article, on how Israel spies on US campuses • Alberto Toscano, author of Late Fascism, on the latest iteration of the rough beast

December 4, 2023

The private equity racket

This is the edited version of a talk I gave at New York City political education event on private equity, December 2, 2023. My fellow panelists were Kim Phillips-Fein and Holden Taylor.

You’ve always got to start somewhere, so I think I’ll start as the 19th century was turning into the 20th. As the scale and technical complexity of production increased, the previously existing world of businesses that were run either as sole proprietorships or small partnerships were inadequate to the task. They gave way to what would become the large, professionally managed corporation, many of which were assembled from smaller pieces by the likes of J.P. Morgan. Morgan hated competition as a destructive force, and while his preference for private monopolies controlled by the likes of him is not our social ideal, neither should we romanticize the old world of small competitive firms. In his book on the Morgans (which I reviewed long ago, here), Vincent Carosso quotes an unnamed socialist observing on JP’s death: “We grieve that he could not live longer, to further organize the productive forces of the world, because he proved in practice what we hold in theory, that competition is not essential to trade and development.” Competition has never been a socialist virtue.

These new large firms were marked by what later would be called the separation of ownership from control. The official owners were outside investors, stockholders, who could sell those shares to other investors if they liked but they had little influence over corporate policy. That was set by an increasingly professionalized caste of formally trained managers. The first US business school, Wharton, was founded in 1881, and over the next couple of decades others sprang to life, including Harvard’s in 1908. The professionals’ victory wasn’t complete; financial operators still played a big role in what we call today corporate governance—how firms are run and for whom.

But with the crash of 1929, the financial operators who’d manipulated and cheated their way through the Roaring Twenties, were beaten back, their freedom to maneuver greatly hobbled first by shame (and a few prison sentences) and then by the regulatory reforms of the 1930s. Legal scholars and economists began reflecting on what it meant that it meant that shareholders were now mostly millions of dispersed individuals—concentrated among the affluent, of course, but incapable of communicating with each other about the companies they owned—and managers were largely free to run their firms. Sure, dissatisfied shareholders could sell their stock, but they had no leverage over their hired managerial hands.

That began to change in the 1970s, when, at the same time, institutional investors like pension funds replaced individuals as stockholders and corporate performance deteriorated with the stagflation of the 1970s. In the early post-World War II decades, profits, dividends, and share prices rose more or less reliably; that was no longer true. The major financial markets, stocks and bonds, had one of their most miserable decades in history. And these institutional stock owners were roused to action, led by the buyout artists who would become the commanders of the Shareholder Revolution. Their organizing revolutionary doctrine was that getting profits up, and therefore stock prices, was the only point of business enterprise; all notions of responsibility and stakeholdership should be junked in favor of pure profit maximization.

the Shareholder RevolutionThe roots of modern private equity were in the early post-World War II years, but things didn’t really get rolling for a few more decades. In the lead were the trio Jerome Kohlberg, Henry Kravis, and George Roberts (Henry’s cousin), who were working at the investment firm Bear Stearns in the mid-1960s. They started small, doing debt-financed buyouts of family-owned companies in the 1960s and 1970s. The trio founded their own eponymous firm, Kohlberg Kravis Roberts, in 1976; many others soon followed. KKR would become one of the giants of PE. Kohlberg died in 2015; Kravis and Roberts are no longer running the show but still serve as co-executive chairs.

At first the buyout deals engineered by KKR and its early colleagues were small and financially sensible, but as the Roaring Eighties really got roaring, the deals and the loans that financed them got bigger. The archetypal deal of the decade was called a leveraged buyout, or LBO (which inspired the name for the newsletter I ran from 1986 to 2013). LBOs involved borrowing lots of money to take over companies, cutting costs sharply, and then offloading the property a few years later by going public again or selling it to someone else, like another buyout boutique or to the public by a stock offering. The LBO movement’s principal mode of funding was junk bonds, high-interest rate debt most famously associated with the rogue brokerage Drexel Burnham Lambert, run from an X-shaped desk in Beverly Hills by Michael Milken, who later went to jail for securities fraud. Milken assembled a coterie of buyout artists armed with money he could raise in an instant from his investors’ circle and for a decade they wilded their way across the corporate landscape.

The decade saw over 2,000 LBOs worth over $250 billion. Many of them were hostile takeovers, meaning unwelcome by management. It was quite an episode of intraclass warfare, as stodgy old-line CEOs were attacked by takeover artists and displaced. Along with KKR and the gang, raiders like Boone Pickens and Carl Icahn became household names, at least in households that got the Wall Street Journal home delivered.

There was a theory behind all the turmoil. Its chief proponent was Michael Jensen, a professor at the Harvard Business School, who wrote a series of papers arguing that corporate management was wasting money that should instead be going to shareholders, who in Jensen’s worldview were paramount for undisclosed reasons, on things like perks and employment. The ideal, he argued, was a world in which “alternative managerial teams compete for the rights to manage corporate resources.” Corporations should not be stable institutions, but instead exist in a state of capitalist permanent revolution. Managers, Jensen argued, should be paid principally in stock, so they’d think and act like shareholders, instead of being paid fixed salaries. And, he further counseled, loading up firms with debt would serve as an excellent disciplinary device: having to cover the interest bill would force the closure or sale of weaker divisions and cost-cutting in the survivors.

The mania is usually said to have kicked off with the 1982 buyout of Gibson Greeting Cards, a deal lead by former Treasury Secretary and political reactionary William Simon. The investors kicked in about a million dollars of a total purchase price of $80 million. Less than a year and a half later, Gibson went public by floating $290 million in stock. Simon personally made $60 million. This success inspired many imitations. The mania peaked with KKR’s 1989 buyout of RJR Nabisco, universally seen as a debacle. The company was sold off piece by piece and ceased to exist a decade later; 2,000 workers lost their jobs.

RJR’s fall was the emblematic end to the Roaring Eighties. Hundreds of firms found themselves unable to service their debts. Bankruptcies replaced buyouts in the headlines and Drexel got put out of business by the government. But the turmoil had a lasting effect on class relations. The challenge of servicing large debts meant firms had to hammer away at costs, and for most, their major cost is labor. Wage-cutting and mass layoffs hammered working class living standards and self-confidence. For the dwindling number of workers with unions, concessions became the norm, and workers were often grateful to have a job at all. That deferential reflex persisted for decades and may only now be lifting.

PE goes straightAt the top, the Shareholder Revolution transformed executive pay: Jensen’s dream of having CEOs paid in stock was realized, and the antagonism that characterized financial market–executive relations in the 1980s was resolved, largely on finance’s terms. PE began reviving from the early 1990s hangover, newly respectable, no longer associated with unsavory takeover artists and felonious investment bankers, and CEOs, their hearts with the stock price, often welcomed takeover offers.

PE entered another winter in the early 2000s, after the collapse of the late 1990s tech bubble, only to rise again. Deals got huge once again, and big PE firms like Blackstone, TPG, and Carlyle were all over them. An innovation in the period was PE firms going public by selling stock, notably Blackstone in early 2007. (At the time, I wrote in The Nation that the timing suggested that the great bubble of that decade was about to pop—those Blackstone guys are clever; the great financial crisis was underway just months later.) Blackstone was careful to keep all the voting rights for itself and took first cut of profits. A number of other PE firms followed; it was like free money.

The early 1990s were time of relative calm, financially. The economy was in what some on Wall Street called a “contained depression,” which they thought was a good thing since it meant the Fed would keep interest rates low and credit easy. That marked the onset of a change in the politics of money and credit. The hard money Wall Street of the late 1970s and early 1980s, when Fed chair Paul Volcker drove up interest rates towards 20% to break inflation was giving way to a Wall Street that loved a generous Fed, since it raised asset values and made it easy to borrow.

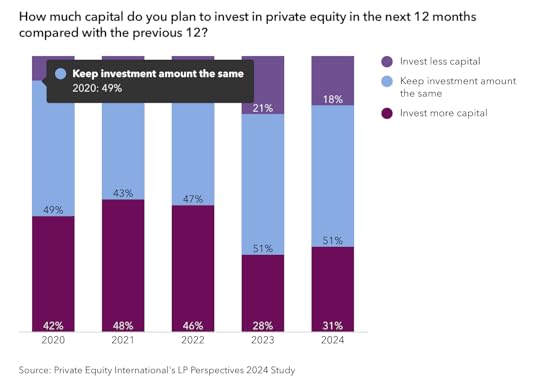

By the middle of the decade, the old LBO movement was reborn as private equity. PE stumbled some during the Great Recession following the 2008 financial crisis, and then boomed, as the Fed (led by PE alum—Carlyle specifically—Jay Powell) printed money in large quantities, stumbled briefly during the covid spill, and then soared along with everything from bitcoin to Nikes. Higher rates and tighter financial conditions have slowed it down over the last year or two, but these guys do have a habit of shrugging off adversity.

Today, a typical private equity firm is managed by a smallish staff that uses money contributed by institutional investors like pension funds and university endowments to buy up whole companies. They’re a worldwide phenomenon, but their spiritual home is in the US, as is the bulk of their money. Typically, they run the firms they own for a few years, cutting costs and rearranging their components, and then sell them, either to the public in a stock offering or to another private equity firm. Also typically, PE operators load the firms they own up with debt to pay themselves fees and dividends. These are not meant to be long-term relationships. The idea is to contribute as little as possible, extract as much as possible, and “exit” (the term of art) a few years later.

And those fees! The typical structure is 2 and 20, short for 2% of assets under management plus 20% of the profits. Since that could never be enough, they add to the take with whatever they can extract from their portfolio companies, as they are called. Top executives’ pay is very tax-favored; attempts to remove that break have always collapsed. When Obama suggested repealing it in 2010, Blackstone head Steve Schwarzman likened the suggestion to Hitler’s invasion of Poland in 1939.

PE has become a major presence in the US economic landscape. According to the industry’s trade association, the American Investment Council, 12 million people work at 32,000 PE-owned companies, about 8% of the total workforce.

PE’s appeal for outside investors is that the vehicles supposedly offer higher returns than the public stock markets, but the evidence for that proposition is shaky. In fact, it’s hard to argue, when taking risk into account, that the high fees produce better returns than what’s offered by a Vanguard index fund with fees close to 0.

Some of the big names in the field include Blackstone, The Carlyle Group (DC-based, unusually, and with deep associations with the federal government and the national security state in particular), TPG Inc. Silver Lake, and Bain (what made Mitt Romney rich). Let’s take a quick look at Blackstone.

Blackstone, founded in 1985 by Pete Peterson (now dead) and Steve Schwarzman (now #34 on the Bloomberg Billionaires List, worth, if you can call it that, $38 billion) has been the biggest player in private equity for most recent years. It sometimes loses the top spot to KKR, as it did last year, but it’s back on top now. (Along with PE, they also have real estate and hedge fund divisions.) It has a trillion dollars under management, about a third of it in the private equity division. Just 250 people work in the PE segment, which works out to $1.2 billion of capital to allocate per employee. (KKR has about 2,000 employees.) New investments over the year ending in June were about $29 billion, and proceeds from sales of companies came to $24 billion, numbers taken together that suggest a lot of turnover. For top management, the game is very lucrative; last year, Schwarzman’s pay was one and a quarter billion.

Among the 200 companies it owns, who all together have half a million employees: Emerson Climate Technologies, Ancestry.com, Bumble, and Reese Witherspoon’s Hello Sunshine. A fuller list than appears on their web landing page would include some recognizable names, but they’re mostly not headliners. A trip through KKR’s holdings leaves a similar impression.

Over the last couple of decades, PE has left a pile of corporate corpses in its wake, with some of its highest-profile victims in retail. Many shopping mall stalwarts who’ve disappeared over the last decade or two—most notoriously, Toys R Us— were driven under by PE’s depredations. You could argue that the decline of brick-and-mortar retail meant these stores were doomed anyway, but it’s not clear why vulture investors should drink their last drops of blood rather than the workers. PE firms are very active in the nursing home sector, which were already dominated by thin staffing and low wages. PE means thinner and lower. Dentistry chains are another popular target; there, they’re encouraging pointless root canals to boost the cash flow.

scattered speculationsFinally, a couple of sociological notes on the growth of PE.

• Liza Featherstone and I did a piece for In These Times back in 2018 showing how deeply invested public pension funds are in private equity (and many unions are happy to play along—and not only in the US: the Ontario teachers’ fund is a notorious partner of PE firms). They’re in search of higher returns, but as I said earlier, management fees eat up much of the notional gains. The PE strategy is deeply anti-worker; cutting labor costs is central to any debt-extraction strategy. Interest and fees must be paid.

Pension fund investment in PE has a long history. Back in the early 1980s, when KKR was first getting started and was desperate to legitimate itself with big institutional investors, it got a seal of approval from the Oregon state pension board. Other funds soon followed. As KKR’s George Roberts told the Oregon pension board in 2013, “You all are our longest standing partner. We always start with you.” Given that these funds are managed in the name of workers, this is class treason.

• PE a fitting symbol for a bourgeoisie that has lost any sense of mission. In the last Gilded Age, rampaging capitalists like Carnegie built libraries and like Rockefeller build cathedrals and universities. Now, our shallow and ludicrous titans use their riches to shoot themselves into space. They seem not to think they need to legitimate themselves; their money is enough.

PE’s strategy of asset stripping is an extreme example, but rates of net investment—net that is net of depreciation—which is accounting’s way to measuring decay—in both the private and public sectors are very low. Contrary to the worrywarts, profit rates have long recovered from their 1970s lows, and the capitalist class is rolling in money. Its financial branch, however, is claiming more of the corporate surplus for itself, thanks in no small part to the practice of corporations buying up their own stock to boost its price, one of the durable legacies of the Shareholder Revolution.

• The rightward move of the Republican party has been greatly lubricated by the increasing wealth and political engagement of these private actors, the PE titans like Schwarzman and the Charles Koch and his circle, which is heavy with the heads of private corporations like Koch himself. Schwarzman was an economic adviser to Trump, whatever that means, and was one of the last respectable businesspeople to break with him. Kravis, by the way, is a more establishment-style Republican—but he was not above giving a million to Trump’s inaugural festivities.

Trump’s business style was not unlike that of PE. He ran a real estate firm with a small staff and no outside shareholders. Like a private equity guy, Trump loaded up his casinos with debt and pocketed much of the proceeds of the loans. That’s what happened with his Atlantic City casinos; it’s pretty hard to lose money in that business but Trump’s all went bankrupt. He did fine, though. What unites these guys—PE mavens, the Koch circle—is that they don’t want to answer to anyone or anything other than their own money, neither shareholders nor the government.

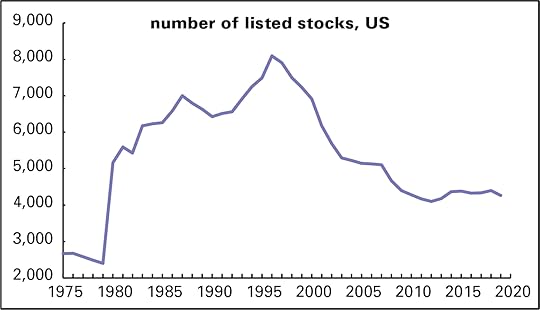

• This is all of great political importance, but there’s also something of theoretical interest here too. Over the last few decades, we’ve seen a sharp decline in the number of listed companies (those whose stock trades on public markets) alongside the rise of the fully private firm. (Graph above.) Marx described the emergence of the joint-stock corporation, with its separation of ownership and management, as “the abolition of the capitalist mode of production within the capitalist mode of production itself, and hence a self-abolishing contradiction.”

The self-abolition now looks to be of the public corporate form. The modest gains in transparency and accountability that have come with the public corporation and its disclosure requirements are being junked in favor of opacity and unchecked boss power. I suppose this is appropriate to a period of reaction, but it doesn’t sound like a good development.

November 30, 2023

Fresh audio product: political economy—the feline angle; understanding capitalism to smash it

Just added to my radio archive (click on date for link):

November 30, 2023 Leigh Claire La Berge, author of Marx for Cats, on political economy and the human–feline relationship • Michael Zweig, author of Class, Race, and Gender, on understanding capitalism in order to transform it

November 16, 2023

Fresh audio product: the mind of the “ecoterrorist,” the collective mind of Israel

Just added to my radio archive (click on date for link):

November 16, 2023 Christopher Ketcham, author of this Harper’s article, looks inside the mind of an “ecoterrorist” • Neve Gordon on what in Israeli society leads to bombing hospitals

November 9, 2023

Fresh audio product: wars, economic policy preferences

Just added to my radio archive (click on date for link):

November 9, 2023 Anatol Lieven on the wars in Gaza and Ukraine and the global standing of US power • Ilyana Kuziemko and Suresh Naidu, co-authors of this paper, on class differences in economic policy preferences (predistributionist vs. redistributionist)

November 2, 2023

Fresh audio product: Arab citizens of Israel and Israel’s plans for Gaza; Nagorno-Karabakh and the latest version of the new world disorder

Just added to my radio archive (click on date for link):

November 2, 2023 Amjad Iraqi on what it’s like to be a Palestinian citizen of Israel, and when what the Israeli state has in mind for Gaza • Georgi Derluguian (author of this article) on how the expulsion of Armenians from Nagorno-Karabakh is an example of the latest iteration of the new world disorder

October 26, 2023

Fresh audio product: war in Gaza, the life and work of Joan Didion

Just added to my radio archive (click on date for link):

October 26, 2023 Rami Khouri, a Palestinian American journalist and scholar, analyzes the war in Gaza • Evelyn McDonnell, author of The World According to Joan Didion, on her life and work

October 19, 2023

Fresh audio product: UAW strike strategy, corps making money of publicly financed research

October 19, 2023 Stephanie Ross on the UAW’s innovative strike strategy against the Big Three automakers • Christopher Morten and Amy Kapczynski on how Corporate America profits off publicly funded research and how to stop them from doing that [apologies for lack of Gaza material—plenty due in coming weeks]

Doug Henwood's Blog

- Doug Henwood's profile

- 30 followers