Howard Yu's Blog, page 5

November 17, 2020

Why Your Company Emphasizes Experimentation When Shared Priorities Should Come First

Strategy is about making tradeoffs. Without making tough choices, a team ends up making a millimeter of progress in a million directions. The only way to win is to generate tremendous momentum toward accomplishing a few things that are truly vital.

That means having shared priorities. Unfortunately, most management teams disagree on their companies’ objectives. A group of researchers at MIT asked management teams at 124 companies to list priorities. Only 27% of the companies studied had more than two thirds of the top executives on the same page. In other words, 73% of the companies had top leaders who couldn’t agree.

This is why you see a lot of companies talk about the process of innovation in general, but avoid specifics.

Corporate alignment turns out to be an exception.

When Strategy Fails to Get Results

I teach innovation and run executive training programs. Recently, I had a call with the chief financial officer (CFO) of a multinational based in North America. It’s an electronic device manufacturer with tens of billions of dollars of revenue a year. It has tens of thousands of employees worldwide. The company has placed sustainability and innovation at the core of its new strategy.

I asked the CFO what needed to change about the way the company measured managerial performance. Surely, a new strategy would yield new outcomes. Were there any changes in key performance indicators?

“Nothing. We have rolled out our measurement system over the last decade. I’ve taught it with my people,” he said.

“Oh.”

“Sure, we need to do all that sustainability stuff, and maybe a bit of diversity too. But I’ve spoken with our largest shareholders. Seriously, don’t confuse our managers. Please.”

But his boss, the energetic CEO, is set to pursue the new strategy. The human resource department has been tasked with rolling out a massive training program (which is why I have a job) to teach their managers “agility,” “design thinking,” and “diversity management.” The aim is to unleash the potential for innovation among their employees.

Predictably, all the new initiatives will be measured against the existing financial system at some point. At that point, they will all get shut down because their profitability looks lackluster in comparison.

Most Executives Handle Difficult Conversations by Ignoring Them

There is a simple reason why shared commitment is rare in big companies. We all hate arguments, especially in the workplace. Unless it’s about personal compensation, it’s best to avoid a heated debate.

Smart managers know this, and pick their battles carefully. Today’s enemy can be tomorrow’s best friend. They don’t know who they will depend on down the road. So when discussing a company’s strategy, they prefer the status quo. They default to the incremental. They do this to avoid conflicts and build consensus.

And so, the head of sales, the financial controller, the director of operations, and the digital officer can each interpret the same corporate strategy vastly differently. Their departmental priorities don’t align.

But shared goals and a shared viewpoint are needed. They’re the only way to turn a company around. The story of Microsoft shows us so.

What A Committed Innovation Effort Looks Like, And Why You Need It

In 2014, Satya Nadella took over Microsoft. In an open letter to employees, he wrote, “I am 46. I’ve been married for 22 years and we have 3 kids. . . . I buy more books than I can finish. I sign up for more online courses than I can complete. I fundamentally believe that if you are not learning new things, you stop doing great and useful things.”

Under Nadella, Microsoft transitioned to a subscription model. It won big in cloud computing. It ramped up its augmented-reality offerings. It scaled Azure, Microsoft 365 and HoloLens.

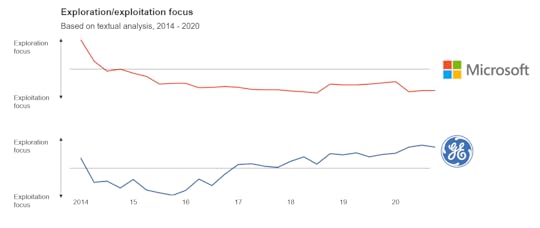

You may think Microsoft under Nadella is open-minded, inquisitive, and creative. But in fact, the company is laser-focused. On the explore-exploit spectrum, Microsoft doesn’t aimlessly explore new space. It commits to exploiting its chosen arenas.

My research team at IMD took everything The Wall Street Journal, the standard-bearer of business journalism, has reported about Microsoft. We fed all of it to an algorithm. We wanted to see how Microsoft has talked about itself in interviews. We looked at how journalists have described it over the years.

Well, Microsoft has become far more focused under Nadella than ever before. From what the CEO has said in interviews to the way journalists have reported on what Microsoft did, it’s clear that the company has narrowed its focus to only a few areas. Its employees still conduct a lot of experiments. But they all fall under a few areas and are measured against the new yardstick.

General Electric, in contrast, has kept exploring. We saw GE couldn’t commit itself to a few areas of innovation, and still less to making tangible progress in those.

Figures are compiled by the authors with data from the Wall Street Journal

Doing the Hard Thing About Innovation

The hard part about innovation is scaling up. A company may keep exploring in the name of being open-minded when, in truth, it’s because leaders can’t agree and prioritize. They are avoiding difficult conversations.

But of course, leadership cannot “agree to disagree” forever. As we’ve argued here before, contrary to common belief, a company can, in fact, explore itself into oblivion.

Stay healthy,

PS. Have you ever initiated a difficult conversation with your own team in order to arrive at a shared viewpoint? What was it like? How did you manage it? Have you seen the top management team at your company do so too? What was the effect? Join the discussion below…

November 10, 2020

Here’s Why Your Company Can Easily Hire The Wrong Person To Lead A New Business

Be very careful that the person in charge of a new business is responsible for its immediate need, not the forecast.

Everyone knows the impetus for growth. Every company wants to develop a new business. Here is a common scene.

You work in a big company. You hear about your CEO bringing out a new business. It calls for big innovation. The company would charge the offering with new pricing. New talents are recruited. A senior executive is appointed. The whole thing will report to the C-suite.

You see much fanfare, and those behind the project expect everyone to pitch in. The launch will bring in much-needed growth for the company.

But it doesn’t take off. The project disappears quietly. No one brings it up ever.

What just happened?

When Companies Pay Too Much Attention to a Stellar Record

Big companies are careful when filling senior positions. They would hire executive search firms or scrutinize internal candidates. When hiring someone to lead a new business, they look for someone who has a track record and is able to explain how they make it work.

More commonly, big companies are looking to hire people who can make an organization grow fast. They need to have the skills to run not a twenty-five-person team but a two-hundred-person team.

But new businesses, when they get started, are not usually big. What these companies end up doing is hiring someone for a future job.

They miss the “here and now.”

What Makes an Effective Executive for a Big Organization

When you run a large organization, you tend to become very good at certain tasks, such as complex decision making, prioritization, organizational design, process improvement, and organizational communication.

What you do essentially is to amplify the projects already started by others. That’s because you cannot personally carry out activities one by one. You have to pull levers—like training, incentive schemes, and organizational design—to get the desired outcomes. In fact, you can get results at scale only by working indirectly.

Take training as an example. Intel’s legendary CEO Andy Grove describes it as “the highest-leverage activities a manager can perform.”

Say you are putting together a four-hour lecture for ten people, Grove hypothesizes. You spend another four hours to prepare. These ten people will spend the next twenty thousand hours working.

So even if your training only yields a 0.5 percent improvement in their work, the company will save one hundred hours of human work. Eight hours of work results in one hundred hours of productivity gain. What can beat that?

This is the sort of payback the top executive of a large company must seek out.

Obviously, that’s a very different world for someone who is building a new business.

What It Takes to Build a New Business

At the birth of a new business, the emphasis is on creating both a product and a market. There is no organization to design. There are no processes to improve. The person in charge of the new business must channel their entire physical and mental energies into making and selling these new offerings.

Content-free executives add no value in this environment. They need to be technically oriented and product-driven. There is no room for people who are masters of soft skills but who lack deep knowledge about the product itself.

Here lies the big difference. For a top executive who runs an enormous business unit, most of the work is “incoming.” Requests come from employees, customers, or suppliers. But if you are in charge of a new business, you can’t wait for incoming emails.

There will be none. Nothing happens unless you make it happen. There is no inertia that puts your business in motion.

By definition, a new business is going to stand still unless there’s massive input from you personally. In all likelihood, you need to take eight to ten new initiatives a day to stir up momentum.

Now you ask, “Who, in my big company, has that sort of stamina? How many self-starters are there in the company?”

What Executives You Have

What’s shown here are two different people who work at different rhythms. Consequently, when appointing a leader to develop a new business, be sure to ask at least these three questions:

Has the person personally built a new business before?

Is the person now in charge adding real value or merely passing information along?

Is the person trying out new ideas, new techniques, and new technologies firsthand? Is the person directly trying them out, not just reading about them?

When things cannot be outsourced or delegated, they get really hard. That’s why big companies often can’t grow new businesses.

Stay healthy,

PS. What’s the track record of your company in appointing new business leaders? What works well? Why do you think it does? Join the discussion below…

November 4, 2020

A Blockbuster IPO Delays, What Happens To Fintech And Ant Exactly?

Clarity matters, especially during turbulent times. Almost buried in the main news this week is the world’s largest stock listing getting shut down right before its launch. Ant Group, the financial technology giant, was set to raise $34.5 billion in the Shanghai and Hong Kong stock exchange, which would have translated into a market valuation of $313 billion.

If the initial public offering (IPO) were to happen, Ant Group would have exceeded the size of JPMorgan Chase, Goldman Sachs, and Wells Fargo. But then this IPO veers off course.

Chinese authorities have cited “major issues” for halting the IPO, but major issues do not show up this late in the game. A record 19.05 trillion yuan ($2.85 trillion) worth of bids was received from retail investors for Ant’s shares on Shanghai’s Star Market, exceeding the supply of shares 870 times.

All these point to Jack Ma, the founder of Alibaba who personally controls 8.8% of Ant. He gave a talk last month in Shanghai criticizing regulators in China. “We shouldn’t use the way to manage a train station to regulate an airport,” Ma said. “We cannot regulate the future with yesterday’s means.”

Now we know who the real boss is.

Why You Need Clear Thinking Now

If you are like me, this is too much drama. There is too much information. What you and I want to know is really the future of finance. We want to know that the sort of fintech made by Ant will continue to gain traction.

If you work in the financial sector, you want to know if these innovations will still spread around the world. If you are retail investors, you want to know if the creditability of the Chinese stock market has been annihilated. Should you still diversify your pension plan with Chinese holdings or not?

In short, we have too many data points. We need clarity instead, to make decisions on things within our control.

How Future-ready Are Your Banks?

At the Center for Future Readiness at the IMD business school, we have been tracking companies’ readiness. In the financial sector, this is evaluated based on firms’ ability to leverage robo-advisory, artificial intelligence, mobile services, and blockchain. These are capabilities that CEOs have long recognized.

Here is what we have found. Those who ranked high in our study turned out to have followed a set of distinct logic. They acted less like a bank. They orchestrated ecosystems. They scaled fast.

Ranking

Company Name

1. ANT GROUP

2. MASTERCARD

3. SQUARE, INC.

4. VISA INC.

5. PAYPAL HOLDINGS, INC.

6. JPMORGAN CHASE & CO.

7. PING AN INSURANCE (GROUP) CO. OF CHINA LTD

8. CREDIT SUISSE AG

9. BANK OF AMERICA CORPORATION

10. ALLIANZ SE

11. AMERICAN EXPRESS COMPANY

12. UBS AG

13. WELLS FARGO & COMPANY

14. AXA SA

15. HSBC HOLDINGS PLC

Rankings of leading financial services companies based on a “leap readiness index.” To arrive at these rankings, we relied on hard market data. This included 7 categories with 23 measurements.

Note that every financial institute—regardless of ranking—has its own digital strategy. But the top players scale digital innovation faster than others, and Ant does it to an extreme extent.

I remember visiting Ant’s headquarters in Hangzhou 18 months ago. Sitting down with a manager, I asked about staff growth. Despite the runaway growth in revenue, Ant was not on a hiring binge.

“You don’t need more people?” I asked.

“No. We automate everything once a new business stabilizes.”

“So where do those people go?”

“They go to develop another new business,” the manager said.

A business is built by humans and then run by machines. Then the humans are redeployed to other ventures. It is the logical thing to do. However, only a few companies besides Ant could do it with such ferocity. You may ask, is Ant totally unique? Is this a new strategy unseen by the world?

Not really. If you were to look at Visa, Mastercard, PayPal, Square, or Ping An, they are all on the same trajectory. What that means is this: The kind of fintech revolution wrought by Ant will not stop. Ant or not, the inevitable remains the same.

Should I Invest in Ant When It’s Ready Again?

There is no single authority responsible for regulating fintech products and services. The main regulatory bodies include the People’s Bank of China (PBOC), the China Banking and Insurance Regulatory Commission (CBIRC), and the China Securities Regulatory Commission (CSRC). In other words, it is a diffused political system.

But since they can pause the world’s largest IPO, this also meant they share a similar viewpoint. They all want to send chills down Jack Ma’s back. His success is a story tied to the national narrative, both in substance and in form. Any deviation from it will have consequences. No one is too big to attack.

And so Ant is likely, and already is, regulated like any other banks. That means meeting the same capital requirement, auditing criteria, and compliance standard. It will be a challenge for a data-driven, AI-first enterprise like Ant. It will mean that, for the first time, software programmers at Ant need to still move fast but not break things.

Is it still a good investment opportunity? Well, depending on the revised price level. Here’s one way to look at it.

Ant has made a $3.5 billion profit in six months. Let us assume it stops growing for the next six. It will still end the year with $7 billion. Compare that with a truly mature tech company like Netflix, whose P/E ratio is around 80. Ant would still have an estimated valuation of $560 billion.

But maybe you want to use a Chinese firm as a benchmark. Let’s take Tencent, another Chinese technology giant with a fast-growing payments business. It is trading at about 40x earnings. Applying the same multiple to Ant, that would imply a $280 billion valuation. Again, it’s assuming no profit growth in the second half of the year. Such a scenario is virtually impossible. Ant’s profit for the first half exceeded the full-year total for 2019.

A $280 billion valuation is still huge. Obviously, all eyes will still be watching the IPO of the decade, delayed.

Stay healthy,

PS. Who are your favorite fintech disruptors? How do you see the future of retail banking? Given the current circumstance, any thoughts on Chinese tech giants versus those from Silicon Valley? Join in the discussion below. I’d love to hear from you.

This article is originally published on Forbes, co-authored with Jialu Shan, a research fellow at the Global Center for Digital Business Transformation, an IMD-Cisco initiative.

The post A Blockbuster IPO Delays, What Happens To Fintech And Ant Exactly? appeared first on Howard Yu.

Blockbuster IPO Delays, What Happens To Fintech And Ant Exactly?

Clarity matters, especially during turbulent times. Almost buried in the main news this week is the world’s largest stock listing getting shut down right before its launch. Ant Group, the financial technology giant, was set to raise $34.5 billion in the Shanghai and Hong Kong stock exchange, which would have translated into a market valuation of $313 billion.

If the initial public offering (IPO) were to happen, Ant Group would have exceeded the size of JPMorgan Chase, Goldman Sachs, and Wells Fargo. But then this IPO veers off course.

Chinese authorities have cited “major issues” for halting the IPO, but major issues do not show up this late in the game. A record 19.05 trillion yuan ($2.85 trillion) worth of bids was received from retail investors for Ant’s shares on Shanghai’s Star Market, exceeding the supply of shares 870 times.

All these point to Jack Ma, the founder of Alibaba who personally controls 8.8% of Ant. He gave a talk last month in Shanghai criticizing regulators in China. “We shouldn’t use the way to manage a train station to regulate an airport,” Ma said. “We cannot regulate the future with yesterday’s means.”

Now we know who the real boss is.

Why You Need Clear Thinking Now

If you are like me, this is too much drama. There is too much information. What you and I want to know is really the future of finance. We want to know that the sort of fintech made by Ant will continue to gain traction.

If you work in the financial sector, you want to know if these innovations will still spread around the world. If you are retail investors, you want to know if the creditability of the Chinese stock market has been annihilated. Should you still diversify your pension plan with Chinese holdings or not?

In short, we have too many data points. We need clarity instead, to make decisions on things within our control.

How Future-ready Are Your Banks?

At the Center for Future Readiness at the IMD business school, we have been tracking companies’ readiness. In the financial sector, this is evaluated based on firms’ ability to leverage robo-advisory, artificial intelligence, mobile services, and blockchain. These are capabilities that CEOs have long recognized.

Here is what we have found. Those who ranked high in our study turned out to have followed a set of distinct logic. They acted less like a bank. They orchestrated ecosystems. They scaled fast.

Ranking

Company Name

1. ANT GROUP

2. MASTERCARD

3. SQUARE, INC.

4. VISA INC.

5. PAYPAL HOLDINGS, INC.

6. JPMORGAN CHASE & CO.

7. PING AN INSURANCE (GROUP) CO. OF CHINA LTD

8. CREDIT SUISSE AG

9. BANK OF AMERICA CORPORATION

10. ALLIANZ SE

11. AMERICAN EXPRESS COMPANY

12. UBS AG

13. WELLS FARGO & COMPANY

14. AXA SA

15. HSBC HOLDINGS PLC

Rankings of leading financial services companies based on a “leap readiness index.” To arrive at these rankings, we relied on hard market data. This included 7 categories with 23 measurements.

Note that every financial institute—regardless of ranking—has its own digital strategy. But the top players scale digital innovation faster than others, and Ant does it to an extreme extent.

I remember visiting Ant’s headquarters in Hangzhou 18 months ago. Sitting down with a manager, I asked about staff growth. Despite the runaway growth in revenue, Ant was not on a hiring binge.

“You don’t need more people?” I asked.

“No. We automate everything once a new business stabilizes.”

“So where do those people go?”

“They go to develop another new business,” the manager said.

A business is built by humans and then run by machines. Then the humans are redeployed to other ventures. It is the logical thing to do. However, only a few companies besides Ant could do it with such ferocity. You may ask, is Ant totally unique? Is this a new strategy unseen by the world?

Not really. If you were to look at Visa, Mastercard, PayPal, Square, or Ping An, they are all on the same trajectory. What that means is this: The kind of fintech revolution wrought by Ant will not stop. Ant or not, the inevitable remains the same.

Should I Invest in Ant When It’s Ready Again?

There is no single authority responsible for regulating fintech products and services. The main regulatory bodies include the People’s Bank of China (PBOC), the China Banking and Insurance Regulatory Commission (CBIRC), and the China Securities Regulatory Commission (CSRC). In other words, it is a diffused political system.

But since they can pause the world’s largest IPO, this also meant they share a similar viewpoint. They all want to send chills down Jack Ma’s back. His success is a story tied to the national narrative, both in substance and in form. Any deviation from it will have consequences. No one is too big to attack.

And so Ant is likely, and already is, regulated like any other banks. That means meeting the same capital requirement, auditing criteria, and compliance standard. It will be a challenge for a data-driven, AI-first enterprise like Ant. It will mean that, for the first time, software programmers at Ant need to still move fast but not break things.

Is it still a good investment opportunity? Well, depending on the revised price level. Here’s one way to look at it.

Ant has made a $3.5 billion profit in six months. Let us assume it stops growing for the next six. It will still end the year with $7 billion. Compare that with a truly mature tech company like Netflix, whose P/E ratio is around 80. Ant would still have an estimated valuation of $560 billion.

But maybe you want to use a Chinese firm as a benchmark. Let’s take Tencent, another Chinese technology giant with a fast-growing payments business. It is trading at about 40x earnings. Applying the same multiple to Ant, that would imply a $280 billion valuation. Again, it’s assuming no profit growth in the second half of the year. Such a scenario is virtually impossible. Ant’s profit for the first half exceeded the full-year total for 2019.

A $280 billion valuation is still huge. Obviously, all eyes will still be watching the IPO of the decade, delayed.

Stay healthy,

PS. Who are your favorite fintech disruptors? How do you see the future of retail banking? Given the current circumstance, any thoughts on Chinese tech giants versus those from Silicon Valley? Join in the discussion below. I’d love to hear from you.

This article is originally published on Forbes, co-authored with Jialu Shan, a research fellow at the Global Center for Digital Business Transformation, an IMD-Cisco initiative.

The post Blockbuster IPO Delays, What Happens To Fintech And Ant Exactly? appeared first on Howard Yu.

October 28, 2020

When You Shouldn’t Keep Your Options Open for Innovation

Big companies have everything they need to innovate. They have R&D labs. They can hire talent. They buy startups. But all of that is the easy part. The issue is that people can mistake the development of ideas for innovation. What really matters is scaling and execution. Without those, a firm can’t survive.

I teach executive programs, and managers who come to my class already know a lot. Some run design thinking workshops, while others have done venture sprints. They use the business model canvas and practice failing forward. They clearly see where their companies must leap next.

And yet, their companies get stuck. Inquisitive, explorative companies with big R&D budgets get stuck in history.

You’ve heard of these stories too. Kodak exploring digital photography. GE exploring the Internet of Things (IoT). Nokia exploring smartphones. These were early movers who squandered their time. They ultimately lagged behind within their own industries. Why can’t these visionaries scale? How did sweet dreams turn into nightmares?

Don’t confuse experimentation with innovation

Here is a common understanding among most people: An innovative company takes risks. It experiments. It keeps its options open. It explores different arenas. It prizes learning.

But what if this perception is dead wrong? I mean, what if an innovative company needs to stay focused? What if an innovative company needs to minimize failure? What if an innovative company needs to first exploit all it can from the current opportunity before it moves on to the next?

These questions matter. Because if you are unclear, you make the wrong choices. You decentralize the wrong areas. You empower people with the wrong responsibilities. You build the wrong culture. You squander time.

To find out the answers, I need to examine a company that has indisputably turned itself around. Here is an ideal candidate: Microsoft. This is a company that was once seen as a staid operation with diminishing prospects for growth. But later, it transformed into an innovator that has scaled its new offerings worldwide.

I can feed everything that’s ever been written about Microsoft into an algorithm.

But first, a bit of history.

The importance of culture in scaling innovation

Remember Steve Ballmer? He was the CEO of Microsoft after Bill Gates. Under Ballmer, Microsoft tripled its annual revenue from $23 billion to nearly $78 billion. It introduced Windows 7, which ruled the PC market for almost a decade. But everything other than the PC was a flop.

Microsoft was losing out to Amazon, Apple, and Google in music players, e-readers, and smartphones. Its new products, like Zune, Vista, Kin, and Bing, were duds. The company took a $900 million write-down on unsold Surface tablet inventory.

Ballmer stepped down in 2014.

This is how the next CEO, Satya Nadella, introduced himself. In an open letter to employees, he wrote, “I am 46. I’ve been married for 22 years and we have 3 kids. . . . I buy more books than I can finish. I sign up for more online courses than I can complete. I fundamentally believe that if you are not learning new things, you stop doing great and useful things.”

Under Nadella, Microsoft transitioned to a subscription model. It won big in cloud computing. It ramped up its offerings on augmented reality. It scaled Azure, Microsoft 360, and HoloLens.

You may think Microsoft under Ballmer was hypercompetitive, laser focused, and efficient. You may think Microsoft under Nadella is open-minded, inquisitive, and creative. On the explore-exploit continuum, I once thought that Baller was on the exploit end while Nadella is on the explore side. All these are great theories.

They are just wrong.

Big data, big rhetoric

My research team took everything that the press has written about Microsoft and fed it to an algorithm. You can feed the algorithm with annual reports, investors’ conference calls, analyst reports, or press releases. In this analysis, we’ve fed it with the standard-bearer of business journalism: Wall Street Journal. All of it. We want to see how Microsoft has talked about itself in interviews and how journalists have described it over the years.

Well, Microsoft under Ballmer was more explorative than it is under Nadella. From the way journalists reported what Microsoft did to what the CEO said in interviews, it’s clear that Microsoft had been a company that kept its options open. It had been very open to new ideas. It ventured further away from where it had been.

Only after Nadella arrived would Microsoft narrow its focus to a few areas. Yes, it scanned all available options. But most importantly, it started to make relentless progress in the chosen few.

How others see you and how you see yourself

This very ability to focus demands a certain mindset. It needs executives to be obsessed with product performance as opposed to simply “trying things out.” If you are going to focus on cloud computing and nothing else, you will need to make sure the service you launch is world class. You have no plan B. You are “averse” to failure because you can’t afford to fail.

That’s what we saw in the data. Under Nadella, Microsoft is seen as taking less risk. Journalists see it as the company working harder to prevent failures. There is no more undisciplined experimentation. There is less unaccounted autonomy. Product performance is demanded. Results are required.

We wanted to cross-check this result with how Microsoft talked about themselves. Do they also change the way they talk in earnings calls? They do. Under Nadella, Microsoft is a more committed organization. It doesn’t place its bets everywhere. It doesn’t keep all its options open.

The curious thing about innovation

To innovate, you’ve got to have an idea, of course. But anyone can launch a mobile app for a new service. Anyone can display a prototype at trade shows. What you really need is a team of people to advance the thing with the same chosen goal. Scale that to 1,000 people or 10,000 or 100,000. You start to see that the problem is in scaling up. Unless you do, the needle won’t move.

The danger is that executives continue to explore for too long when the company has, in fact, explored enough. You know what trends matter to your sector the most. You know who’s disrupting you right now. You know where to leap next. But the company suffers from a commitment issue: the inability to exploit that new opportunity.

Contrary to common belief, companies can, in fact, explore themselves into oblivion.

Stay healthy,

PS. Where have you seen a company suffer from commitment issues when evidence becomes so clear? Why do you think it hesitates? What do you think is needed for a company to move from noncommittal exploration to determined exploitation of a new opportunity?

This article is co-authored with Angelo Boutalikakis, a research associate at the LEAP Readiness Project.

The post When You Shouldn’t Keep Your Options Open for Innovation appeared first on Howard Yu.

October 21, 2020

“Be prepared” Is A Good Motto For Companies

The coronavirus crisis has shown that firms who bounce back first are the ones who have embraced digital transformation.

Chance favors the prepared. And that includes times of crisis. One way to understand the pandemic’s impact is knowing how it speeds up business trends. These trends are neither seasonal nor cyclical; they are consistent over time. They have been evident to senior executives for a long while.

Carmakers have to de-emphasize mechanical engineering, aware of the need to increase software capabilities for self-driving vehicles. Retail banks must evolve from a physical branch network of human bankers. They understand the need to advance mobile services based on AI. These are long-term trends that have been articulated, researched, and generally accepted. Similar examples abound across industries.

You may ask if a company has embraced change ahead of time, would they be more resilient during crises? The short answer is yes.

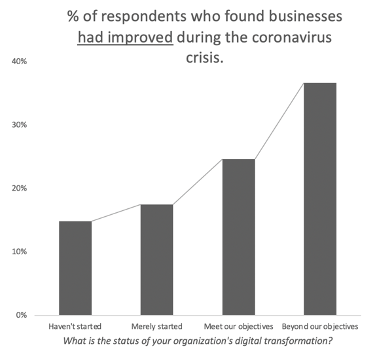

At the Centre for Future Readiness at IMD, we have been tracking companies’ readiness. This year, we partnered with CommonWealth in Taiwan to survey executives about their progress in digital transformation. We had responses from more than 3,000 executives from three comparable economies: Sweden, Switzerland, and Taiwan. With this data, we were able to determine why some companies are more resilient than others.

We first asked if their corporate strategies explicitly mentioned digital transformation. The assumption is if you are serious about building up new capabilities around digital technology, you would state it.

For retailing, it could be advanced data analytics and e-commerce. In banking, it could be robo-advisory services, AI, or mobile services. For traditional manufacturers, it is often advanced automation. While the exact capabilities differ across sectors, executives and CEOs recognize they are all part of one journey towards “digital transformation”.

The result is clear. Companies that include digital transformation in their official strategy suffer less. During this crisis, companies that didn’t do so have suffered more. For them, the pandemic has had a more negative impact.

Then of course, putting something on a strategy statement is different from actually doing it. So we asked executives to describe the results of their digital initiatives. Again, we saw varying degrees of impact from the coronavirus. The more prepared a company, the further they are along with the digital transformation. Then they might even see businesses improve during crisis time.

Compiled by the authors

This shouldn’t be a surprise. It affirms the wisdom of Warren Buffett who, in a letter to our shareholders in 2001, said: “You only find out who is swimming naked when the tide goes out.” He was referring to the economic consequences of 9/11. The aftermath of the terrorist attacks exposed the weak players, especially within the financial sector.

Today, the pandemic has exposed firms across a wider swathe of industries. It has had a much deeper and long-lasting impact. It has revealed companies who underestimated or ignored the speed of digitization. They now realize the enormous cost of such ignorance.

So yes, resilience matters. It is about your readiness for future capabilities. Some have been aggressive in their investment during good times. They don’t just talk about digital transformation – they allocate resources aggressively, set goals, and then deliver. At first glance, this does not seem relevant to crisis management.

But it is. When disaster struck, they were able to kick into high gear to pivot. At the minimum, if you have invested in a digital supply chain, it’s easier to shift suppliers. You would know what’s missing when you have all the information at your fingertips. If you didn’t, you are probably calling local managers on the phone, asking them to fill out Excel spreadsheets by hand.

Similarly, if you have invested in digital sales and marketing, it’s easier to shift your market focus. You can quickly estimate the drop in demand. You can spend your time strategizing the right move. But if you’re doing stuff manually, it’s just hard to cope.

This is how the great pergence arrives. By the time the crisis has passed, those who end up unscathed will move on to their next conquest. That’s why chance favors the prepared and the ready.

PS. Have you seen any traditional companies that do especially well during the pandemic? Did the pandemic speed up your company’s digital transformation? If so how? Join the discussion below. We’ll love to hear your thoughts.

This article is co-authored with Jialu Shan, a research fellow at the Global Center for Digital Business Transformation, an IMD-Cisco initiative.

The post “Be prepared” Is A Good Motto For Companies appeared first on Howard Yu.

October 15, 2020

Not Excited About The New iPhone 12? Apple Is Prepared

Apple brought all its usual glamor to the unveiling of its latest iPhones 12 on Oct 13. There was breathless exclamation over new colors. There were speeches about chip speed. Then there’s the less breakable ceramic cover. And don’t you think a LIDAR (light detection and ranging) is only for those self-driving cars made by Waymo. The Pro line iPhones also have it now. The LIDAR will boost augmented reality (AR).

The real punch was the new 5G wireless speeds. But here lies the problem. For the first time, Apple and iPhone are ahead of the foundational technology.

Never Be the First. Be the First Who Gets It Right.

Steve Jobs warned against the danger of being too early. “Things happen fairly slowly, you know. They do. These waves of technology, you can see them way before they happen, and you just have to choose wisely which ones you’re going to surf. If you choose unwisely, then you can waste a lot of energy, but if you choose wisely, it actually unfolds fairly slowly. It takes years.”

Jobs was referring to when he waited for two years for broadband. When it finally arrived, he jumped into the window of opportunity with the iPod. Countless others moved earlier than Apple, producing their own MP3 players. They all failed miserably. Before the 2000s, music sharing was possible—on Napster. But it took hours to download an album. With connectivity that poor, even the best-designed hardware made for hopelessly sluggish downloading. Jobs was waiting for the inevitable improvement of broadband to materialize.

Cut to 2020, when Apple is launching an iPhone with a 5G chipset even though networks are far from ready. Around the world, 5G signals are not necessarily faster than 4G.

But CEO Tim Cook has few choices. The past shifts to both 3G and 4G were hugely important in spurring people to upgrade their smartphones. By the law of large numbers, Apple now finds it hard to sustain the same growth rate it saw in 2014, when the iPhone 6 and 6 Plus were released. They became the best-selling iPhone models of all time, selling more than 220 millions units worldwide. Their successors, the iPhone 7 and 7Plus, have sold less than 80 million units to date. It’s hard to know how many iPhone 12s Apple could actually sell. You can listen to my podcast interview at Channel News Asia with Lin Suling and Bryan Ma here.

The fundamental problem is that those faster speeds will be important for video streaming and gaming, but they won’t necessarily make a difference in regular web surfing or email checking. That may make some consumers pause before they spend money on a new phone, particularly given the very uncertain economic times we live in.

If you are a shareholder, please don’t sell your Apple shares quite yet. There is one more trick Apple has to get people to buy the latest iPhone they don’t need.

Everything is a Subscription

Starting in fall 2020, Apple One will be available in over 100 countries, including in the US. Subscribe to Apple One and you’ll get Apple Music, Apple TV+, Apple Arcade, and iCloud storage. Apple Premier will add on Apple News+ and Apple Fitness+.

Apple One alone might not get consumers to buy new iPhones. But if it’s bundled with those phones, it might do just that.

Since last year, people have been able to pay for a new iPhone on a monthly basis. In the US, for example, you can get an iPhone 11 and Apple TV+ for $17/month. Apple also adjusted its AppleCare+ terms. You can subscribe monthly, and AppleCare+ will carry on until you cancel, just like other Apple services such as Apple Music. Of course, Apple has its iPhone Upgrade Program, which bundles a yearly upgrade and AppleCare+. But this shift to selling AppleCare+ on its own is another step to make Apple’s relationship with its customers into a subscription-based one.

If this sounds complicated, it is. That’s because Apple is running all these different bundles to gather consumer data. It needs behavioral data to calculate the lifetime value of a user. If I give you a new iPhone, how likely is it that you’ll cancel it in six months? How likely are you to break it, so that I’ll will need to replace it for free? If I bundle different services, are you going to upgrade them or not?

All these questions can only be answered by real-world experiments. And you can bet Apple is running those right now.

It’s only a matter of time before Apple offers a variant of the iPhone Upgrade Program that is simply an all-inclusive Apple subscription. You’ll pay one monthly fee, and get everything Apple has to offer. Indeed, in the era of the iPhone 12 and beyond, nothing would show that Apple is a services company more than making the iPhone itself a service.

When that happens, make sure you really stock up Apple shares.

The Hottest Way to Make Money

From Netflix to Amazon Prime, from Disney+ to Microsoft 365, the subscription model is king for one reason: customer adoption. Whenever something turns into a subscription, you no longer pay a lump sum upfront. You pay a small monthly fee and then get habituated. When was the last time you canceled a magazine subscription?

But for a technology company like Apple, subscriptions solve another problem. They help push the technology toward maturity rather than having it pull the consumer over. Here is the scenario. Unless there are lots of phones with 5G chipsets, telecom carriers won’t be very eager to roll out 5G on a large scale. But without a good 5G network, the iPhone 12 won’t have big appeal.

A subscription model will break that cycle. You and I won’t mind having a feature we don’t really use. Since the monthly subscription feels cheap, having a new phone with a nice packaging is already enough. That lowers the barrier to consumption, which in turn creates this push for telecom providers to plunge ahead with 5G rollouts.

Is it a sustainable strategy? We don’t know. But it’s the only viable strategy to keep Apple growing. So the company is trying it.

Stay healthy,

P.S. What about you? Will you buy the new iPhone? What if you could pay via a monthly subscription? Let me know what you think below. Join the discussion.

The post Not Excited About The New iPhone 12? Apple Is Prepared appeared first on Howard Yu.

October 6, 2020

Here’s Why You Should Watch Ant Group’s IPO: The Hottest Startup in the World

There is no point in looking at e-commerce without mentioning Amazon. By the same token, there is no point in looking at the fintech scene without mentioning Ant Group.

Yes, it’s a funny name for a company. But this start-up is anything but small. Ant’s initial public offering (IPO) could come as early as this month. It expects to secure an overall market valuation of between $200 billion and $300 billion. This means Ant, as a fintech upstart, will be bigger than Bank of America, PayPal, Goldman Sachs, or Wells Fargo.

Who Owns Ant Group?

You are not alone if this is the first time you’ve heard of this funny-sounding company. It’s incubated by Alibaba in China. So most of us have never come across Ant’s services. But if you live and work in China, your life depends on it.

At the heart of Ant is a product called Alipay. Alibaba created Alipay back in 2004 as a payment tool for its online marketplaces. At the time, Internet retail was nascent. Logistics was spotty. There was little trust between buyers and sellers on the online platform.

Alipay did something new. It held shoppers’ payments when they ordered. Then it released the money to merchants but only after shoppers confirmed they were satisfied with the goods they received. This way, Alipay deterred scams and prevented fraud.

How did Ant grow so fast?

Like all things in China, Alipay’s growth was epic. It captured a large group of first users. By 2019, the value of mobile payments in China reached $49.7 trillion. Alipay accounted for 55.1% of that market.

But it was collaborations with China’s largest commercial banks, and Jack Ma’s magic touch with regulators, that made Alipay, now part of Ant Group, the king of all fintech disruptors.

Ant goes beyond what PayPal and Apple Pay do. It offers services from payments to credit to insurance to investments within Alipay. Ant calls it the “ubiquitous super app.” More than half of Ant’s 2019 revenue came from financial services. It has more than 711 million monthly active users. This is a very unusual strategy by Silicon Valley standards. But Ant is part of Alibaba. In China, this is commonplace.

What do Ant and Alibaba have in common?

In my CNBC interview, I described how IT companies in China are far more vertically integrated. Silicon Valley’s tech giants tend to be broad in geography but shallow in offerings. In contrast, China’s tech firms tend to concentrate on their home market but go far deeper. The result? Alibaba or Ant Group developed new-to-the-world capabilities that are simply impossible for Western companies to replicate.

China is one of the world’s most competitive marketplaces. Alibaba or Ant has no choice but to keep branching out to new areas to increase “stickiness” with end-users. You can see how the company practically follows users to eliminate any fiction across transactions of all types. Amazon does it via 1-Click on its website. Alibaba and Ant do it everywhere, online, and offline.

Take Alibaba’s Taobao for instance. Its closest cousin would be eBay in the United States. And yet it’s nothing like eBay. Alibaba integrates with Weibo (like Twitter), Cainiao (like UPS), Baozun (like Shopify), Alipay (like PayPal), and AliCloud (like AWS) at a scale seldom found outside China. As a result, it has enabled Alibaba to anticipate demand, curate offerings, and forge new consumer habits to a far deeper extent than we thought possible. And all these are done with advanced artificial intelligence and automation.

How to Buy Ant Group IPO

Ant Group’s upcoming IPO is made available in Hong Kong and Shanghai. The Ant Group’s IPO might be a passive-aggressive escalation of China–U.S. tensions. Ant is snubbing Wall Street. Still, American index funds can include Ant’s H-share, which is listed in Hong Kong.

So is $250 billion a cheap buy? Most start-ups lose money even when they are unicorns. Uber lost $8.5 billion in 2019, the year it was listed on the New York Stock Exchange. It’s still valued at $55 billion today.

Ant has made a $3.5 billion profit in six months. Let’s assume it stops growing for the next six. It’ll still end the year with $7 billion. Compare that with a truly mature tech company like Netflix, whose P/E ratio is around 80. Ant would still have an estimated valuation of $560 billion.

But maybe you want to use a Chinese firm as a benchmark. Let’s take Tencent, another Chinese technology giant with a fast-growing payments business. It’s trading at about 40 times earnings. Applying the same multiple to Ant, that would imply a $280 billion valuation. Again, it’s assuming no profit growth in the second half of the year. Such a scenario is virtually impossible. Ant’s profit for the first half exceeded the full-year total for 2019.

Obviously, all eyes are watching the IPO of the decade. Now buckle up.

Stay healthy,

PS. Who are your favorite FinTech disruptors? How do you see the future of retail banking? Any thoughts on Chinese tech giants versus those from Silicon Valley? Join in the discussion below. I’d love to hear from you.

The post Here’s Why You Should Watch Ant Group’s IPO: The Hottest Startup in the World appeared first on Howard Yu.

September 15, 2020

Sleeping On A Problem Is The Best Way To Solve It

To Steve Jobs’s observation, neuroscientists can now add that plentiful sleep is a major factor. Sleep helps in the “seeing” and “connecting.”

In a fascinating experiment, Ullrich Wagner of the University of Lubeck in Germany assigned his study subjects a mathematical puzzle. It consisted of a string of eight numbers. Wagner provided the participants with two rules for generating a second string of numerals. They were told to work through these problems using the rules. The miserably laborious exercise looked a lot like doing long division for an hour or more.

But the sneaky researchers included a hidden rule. A shortcut could be used to quickly arrive at the target answer for all the problems.

After the initial training, some participants were allowed to get a good night’s sleep. Others were less lucky. They remained awake. When everyone returned to the problem eight hours later, those who had slumbered were far more likely to discover the shortcut — almost 60 percent returned with the aha moment. But among those who stayed awake, despite their total effort, only a paltry 20 percent were able to figure out the hidden rule. That’s a threefold difference in creative solutions afforded by sleep.

Try asking any employer which group they would like to hire.

Still, of the many companies I’ve interacted with, none pay real attention to the sleep quality of their employees. They run them down even in a retreat. It’s all too common for a company to host an executive conference in some exotic location. They finish the first day with a late dinner, and they’re out drinking later still. People don’t hit the hay until well past midnight, after clearing their email inbox. Then, the next day, they’re expected to head for a run at 7:00 a.m. in the name of health and well-being. By 8:30 a.m., everyone is back in the conference room to develop some “creative solutions” and “think big.” Why would anyone expect this to work?

This insane, unscientific, sleep-deprived approach also extends into even the most elite business schools. During my time at Harvard Business School, I observed a peculiar work ethic that’s not too distant from toxic masculinity. Dean Jay Light would give a welcome speech reminding the aspiring MBA candidates that earning the degree would involve a lot of hard work. “It will be like drinking from a fire hose,” he said. “There’s going to be many more than 24 hours of work that has to be done every 24 hours.” But the MBAs don’t go to bed on the weekends to pay off their sleep debt. They “work hard and play hard.” They party.

Then comes Monday and more drinking from the fire hose of case studies, theories, and financial analyses. All the professors are world-class, but they constantly wonder why so few aha moments are triggered among the students. With tired brains and exhausted minds, what quality of education are these future business leaders receiving? I don’t know.

Smart bosses do things differently

Dysfunctional culture dies hard. At its core, it’s based on the idea that people need to suffer in order to do great things. Self-flagellation is sometimes born out of necessity, but then other people start practicing it indiscriminately.

Combat soldiers, for instance, can’t just flop down and snooze. When on a patrol, they can drink and eat, but only once they’ve reached a secure position. When they finally get a chance to rest, they must remain vigilant and aware so the enemy doesn’t surprise them. They have no choice but to wake up early every day, no matter their level of exhaustion.

Then there are these senior executives of Fortune 500 companies who wrongly believe they are just as heroic. Their outsized egos imagine a marketing strategy of selling instant coffee and laundry detergent as a military operation. They forget a tour of military duty usually lasts for 12 to 15 months and confuse it with their own corporate careers, which will likely last for decades. One is on a sprint by necessity. The other is on a marathon.

But it doesn’t have to be this way. Smart bosses have figured this out. Some decide that being present in the workplace and making better decisions are important. Staying alert in the office will improve business fundamentals. As Aetna chairman and CEO Mark Bertolini said, “You can’t be prepared if you’re half asleep.”

And why wouldn’t a less torturous approach be superior? Studies have shown driving after staying awake for 24 hours is worse than driving drunk. Why would any CEO put a sleep-deprived accountant in charge of a company’s finances (unless they’re at Enron)?

So Bertolini added an incentive system. Aetna rolled out the option to earn employee bonuses for getting more sleep, using fitness trackers like Fitbit. The company pays $25 a night if an employee gets seven or more hours of uninterrupted sleep for 20 nights in a row. That’s right —they’re getting paid to sleep, up to a total of $500.

Aetna isn’t a small company. It’s a giant insurance company with almost 50,000 employees. Some may scoff at Bertolini’s approach. It sounds parental and patronizing. But many workplaces are tolerating yet another even more paternalistic, but destructive, culture. On Wall Street, interns can’t leave until the big boss leaves his corner office. They jump the moment they receive a text from the big shot. And if you’re not doing the same, you’re not a team player.

What Bertolini overrides is the norm of grinding down employees with incessant emails after working hours. He refuses to burn managers out under a business model of disposability and declining productivity. He doesn’t want people to come to work sick and then cause low morale and contribute to high turnover rates. He’s started a sleep revolution at Aetna.

The payoff of sleeping well

All this is not just whimsical talk. Racking up more consistent and plentiful slumber makes great business sense. Bertolini proved it. Under his 10 years of care, Aetna grew into one of America’s premier insurance companies. At the CEO’s insistence, the company announced it was hiking minimum pay to $16 per hour and eliminating health care costs for employee families living under 300% of the federal poverty level.

That didn’t sit well with his executive team at first. Even the human resources department didn’t think it would be beneficial. Executives had proposed raising pay by a mere 50 cents per hour. The CEO persisted. He saw the new benefits as a financially justifiable strategy to reduce turnover and improve productivity. So there was friction to overcome at the top. There’s even a parting of ways with the head of human resources, but the share price continued to climb. In 2019, at the height of its financial performance, Aetna received federal approval to merge with drugstore giant CVS.

Why the merger? That’s the same question CVS CEO Larry Merlo asked Bertolini. Bertolini referred to CVS’s model as making money on a fee-for-service basis: The more patients visit the drugstore, the more money there is to make. Aetna, as an insurer, doesn’t want patients’ claims. It makes money by keeping people healthy. So there’s a need for change in the health care sector. “You need a different revenue model,” Bertolini told Merlo. “And if you continue doing the things that you’re doing, our revenue model is the right one.”

These are bold moves. Changes in the health care industry don’t come by quarters — they occur over years, decades. It’s a marathon, not a sprint. Aetna needs its people to think outside their routines. Bertolini needs his leadership team to think independently. Employees need to act patiently, but with urgency. Market opportunities, as always, favor only those who are prepared. As author John Ernst Steinbeck said, “A problem difficult at night is resolved in the morning after the committee of sleep has worked on it.”

People need to practice good self-care for the long haul. A great place to start is with sleeping well every night.

Stay healthy,

PS. Have you seen other companies encourage employees to take good care of themselves? With the remote work arrangements during the coronavirus crisis, do you find it easier or harder to enjoy a good night’s sleep? Any tips? Join in the discussion below. I’d love to hear from you.

The post Sleeping On A Problem Is The Best Way To Solve It appeared first on Howard Yu.

Never Stay Awake On A Problem: Sleep On It

To Steve Jobs’s observation, neuroscientists can now add that plentiful sleep is a major factor. Sleep helps in the “seeing” and “connecting.”

In a fascinating experiment, Ullrich Wagner of the University of Lubeck in Germany assigned his study subjects a mathematical puzzle. It consisted of a string of eight numbers. Wagner provided the participants with two rules for generating a second string of numerals. They were told to work through these problems using the rules. The miserably laborious exercise looked a lot like doing long division for an hour or more.

But the sneaky researchers included a hidden rule. A shortcut could be used to quickly arrive at the target answer for all the problems.

After the initial training, some participants were allowed to get a good night’s sleep. Others were less lucky. They remained awake. When everyone returned to the problem eight hours later, those who had slumbered were far more likely to discover the shortcut — almost 60 percent returned with the aha moment. But among those who stayed awake, despite their total effort, only a paltry 20 percent were able to figure out the hidden rule. That’s a threefold difference in creative solutions afforded by sleep.

Try asking any employer which group they would like to hire.

Still, of the many companies I’ve interacted with, none pay real attention to the sleep quality of their employees. They run them down even in a retreat. It’s all too common for a company to host an executive conference in some exotic location. They finish the first day with a late dinner, and they’re out drinking later still. People don’t hit the hay until well past midnight, after clearing their email inbox. Then, the next day, they’re expected to head for a run at 7:00 a.m. in the name of health and well-being. By 8:30 a.m., everyone is back in the conference room to develop some “creative solutions” and “think big.” Why would anyone expect this to work?

This insane, unscientific, sleep-deprived approach also extends into even the most elite business schools. During my time at Harvard Business School, I observed a peculiar work ethic that’s not too distant from toxic masculinity. Dean Jay Light would give a welcome speech reminding the aspiring MBA candidates that earning the degree would involve a lot of hard work. “It will be like drinking from a fire hose,” he said. “There’s going to be many more than 24 hours of work that has to be done every 24 hours.” But the MBAs don’t go to bed on the weekends to pay off their sleep debt. They “work hard and play hard.” They party.

Then comes Monday and more drinking from the fire hose of case studies, theories, and financial analyses. All the professors are world-class, but they constantly wonder why so few aha moments are triggered among the students. With tired brains and exhausted minds, what quality of education are these future business leaders receiving? I don’t know.

Smart bosses do things differently

Dysfunctional culture dies hard. At its core, it’s based on the idea that people need to suffer in order to do great things. Self-flagellation is sometimes born out of necessity, but then other people start practicing it indiscriminately.

Combat soldiers, for instance, can’t just flop down and snooze. When on a patrol, they can drink and eat, but only once they’ve reached a secure position. When they finally get a chance to rest, they must remain vigilant and aware so the enemy doesn’t surprise them. They have no choice but to wake up early every day, no matter their level of exhaustion.

Then there are these senior executives of Fortune 500 companies who wrongly believe they are just as heroic. Their outsized egos imagine a marketing strategy of selling instant coffee and laundry detergent as a military operation. They forget a tour of military duty usually lasts for 12 to 15 months and confuse it with their own corporate careers, which will likely last for decades. One is on a sprint by necessity. The other is on a marathon.

But it doesn’t have to be this way. Smart bosses have figured this out. Some decide that being present in the workplace and making better decisions are important. Staying alert in the office will improve business fundamentals. As Aetna chairman and CEO Mark Bertolini said, “You can’t be prepared if you’re half asleep.”

And why wouldn’t a less torturous approach be superior? Studies have shown driving after staying awake for 24 hours is worse than driving drunk. Why would any CEO put a sleep-deprived accountant in charge of a company’s finances (unless they’re at Enron)?

So Bertolini added an incentive system. Aetna rolled out the option to earn employee bonuses for getting more sleep, using fitness trackers like Fitbit. The company pays $25 a night if an employee gets seven or more hours of uninterrupted sleep for 20 nights in a row. That’s right —they’re getting paid to sleep, up to a total of $500.

Aetna isn’t a small company. It’s a giant insurance company with almost 50,000 employees. Some may scoff at Bertolini’s approach. It sounds parental and patronizing. But many workplaces are tolerating yet another even more paternalistic, but destructive, culture. On Wall Street, interns can’t leave until the big boss leaves his corner office. They jump the moment they receive a text from the big shot. And if you’re not doing the same, you’re not a team player.

What Bertolini overrides is the norm of grinding down employees with incessant emails after working hours. He refuses to burn managers out under a business model of disposability and declining productivity. He doesn’t want people to come to work sick and then cause low morale and contribute to high turnover rates. He’s started a sleep revolution at Aetna.

The payoff of sleeping well

All this is not just whimsical talk. Racking up more consistent and plentiful slumber makes great business sense. Bertolini proved it. Under his 10 years of care, Aetna grew into one of America’s premier insurance companies. At the CEO’s insistence, the company announced it was hiking minimum pay to $16 per hour and eliminating health care costs for employee families living under 300% of the federal poverty level.

That didn’t sit well with his executive team at first. Even the human resources department didn’t think it would be beneficial. Executives had proposed raising pay by a mere 50 cents per hour. The CEO persisted. He saw the new benefits as a financially justifiable strategy to reduce turnover and improve productivity. So there was friction to overcome at the top. There’s even a parting of ways with the head of human resources, but the share price continued to climb. In 2019, at the height of its financial performance, Aetna received federal approval to merge with drugstore giant CVS.

Why the merger? That’s the same question CVS CEO Larry Merlo asked Bertolini. Bertolini referred to CVS’s model as making money on a fee-for-service basis: The more patients visit the drugstore, the more money there is to make. Aetna, as an insurer, doesn’t want patients’ claims. It makes money by keeping people healthy. So there’s a need for change in the health care sector. “You need a different revenue model,” Bertolini told Merlo. “And if you continue doing the things that you’re doing, our revenue model is the right one.”

These are bold moves. Changes in the health care industry don’t come by quarters — they occur over years, decades. It’s a marathon, not a sprint. Aetna needs its people to think outside their routines. Bertolini needs his leadership team to think independently. Employees need to act patiently, but with urgency. Market opportunities, as always, favor only those who are prepared. As author John Ernst Steinbeck said, “A problem difficult at night is resolved in the morning after the committee of sleep has worked on it.”

People need to practice good self-care for the long haul. A great place to start is with sleeping well every night.

Stay healthy,

PS. Have you seen other companies encourage employees to take good care of themselves? With the remote work arrangements during the coronavirus crisis, do you find it easier or harder to enjoy a good night’s sleep? Any tips? Join in the discussion below. I’d love to hear from you.

The post Never Stay Awake On A Problem: Sleep On It appeared first on Howard Yu.