Febin John James's Blog, page 3

August 13, 2018

Is the Music Industry Unfair to Its Artists?

This paid story is brought to you by eMusic.

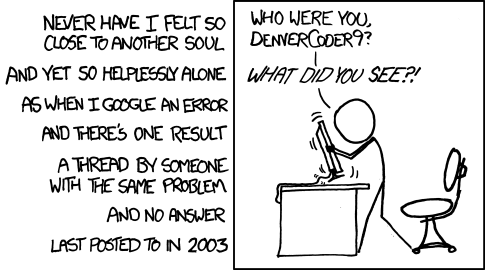

This paid story is brought to you by eMusic.In the following viral video, Liam Gallagher groans that he is forced to make his own cup of tea because “no one buys records anymore”.

https://medium.com/media/be9e8a3813a030bcd6d2ea07d9db299f/hrefIn the earlier days things were simple, if you make a hit record, you would be rich. But, things have changed now!

In the streaming model, consumers only pay based on their consumption. If you are an artist who uploads content on youtube, for each streaming play you receive $0.0007.

In order for you to accumulate the national minimum wage ($1,472), you require 2,102,857 streaming plays(estimated).

It doesn’t help the service provider either, spotify has a rolling debt. They operate on investments instead of profits. Hence, how can they incentivize artists appropriately?

But, this doesn’t mean people spend less on music. In fact, last year’s music revenue has been the highest in comparison with the past ten years.

Where does the money go?The money goes to the most successful labels. Last year, the top 2% of music got 93% of streams (The rich are getting richer).

If $1000 was the revenue generated, the streaming provider takes $300, publishers and labels get a split of $600. Artists and songwriters are left with $100.

According to a story in theverge, Spotify paid Sony Music up to $42.5 million in advances. Now, how can Spotify regain the money? How can it make sure Sony’s music get enough streams? Are the algorithm used by Spotify to push music to its users transparent?

Established labels have used their leverage to enforce shady contracts with service providers like Spotify. Hence, restricting fans from discovering new tracks.

This is the problem eMusic wants to solve. But, what’s their strategy? Can they pull it off?eMusic would start by onboarding independent artists. This will help fans discover new tracks. Hence, they won’t be listening to songs pushed by algorithms negotiated in gloomy contracts.

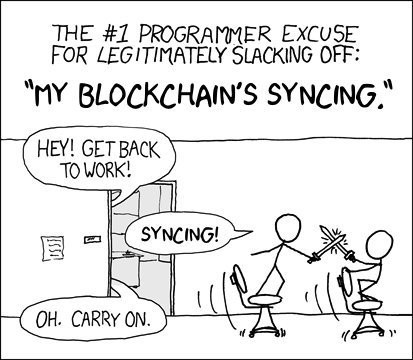

They plan to use the public blockchain, Ethereum. If engineered well, this can reduce costs. Savings accumulating by cutting down on infrastructure costs will be used to attract artists and labels.

Artists can use their platform to upload their work and control its distibution. They will choose their distribution partners. They can also use the platform’s store to sell their content immediately

The key feature is transparency, which service providers like Spotify don’t offer. All the transactions which happens through eMusic are recorded into an untamperable database. This feature is called immutability and it is one of the fundament principles behind blockchain.

These list of transactions are visible to the public. Hence, an artist would be able to see who used their music, price their content was bought for and their revenue split.

eMusic plans to give a 50/50 split on revenue. It would be split between the asset owner (artist/label) and the service provider where their content would be distributed.

eMusic is also developing a crowdfunding platform that would help the artist raise money to create new works through a crowdsale(SEC-registered). Hence, fans would be able to actively support their favourite artists and become part of their journey.

Another important benefit artists get from eMusic is immediate access to royality payments. Since the agreements are made on a smart contract, payments don’t require eMusic’s consent. As an when the transaction happens, the split is shared to the artist’s wallet almost immediately.

ChallengeseMusic’s infrastructure relies on Ethereum’s blockchain. The cost of writing and executing code on Ethereum is not fixed. It’s variable according to marketing conditions. However, eMusic plans to keep costly computations of-chain.eMusic brings a new layer of currency to the market in the form of tokens. Artists might want to be incentivized in USD, it could be a hassle for them to use it until cryptocurrency is widely accepted. If eMusic can incentivize artists in the currency they are convinent with, it shouldn’t be a problem.eMusic needs to go beyond independent artists and bring in big players to attract more users. This part could be challenging, since established players might still have the leverage. However, this is not an unsolvable problem.However, unlike other ICOs, eMusic already got a profitable businesseMusic started selling music in 1998, 5 years before iTunes.In 2008, they reached 250 million mp3 downloads and were only second to iTunes.In 2009, they started carrying major-label content.In the years 2014–2017, they have evolved by offering competitive services to its users.ConclusionThe streaming model has changed the way people consume music. The new model has brought in complications and made it hard for artists to earn their living. However, people are not spending any less on music when compared to the previous years. A major chunk of revenue is eaten by the established players.

eMusic is trying to solve this problem, by incentivizing artists a fair revenue split. They plan to cut cost and bring in transparency by using Ethereum’s blockchain. But, they have certain technical and economical challenges to overcome.

Though there are other players in the market, eMusic has years of experience in the industry and already got a profitable business.

To learn more, please visit eMusic and read their whitepaper. We hope you to see you at our Telegram and Discord groups.

Claps Please

July 27, 2018

How to Create Your Identity Effortlessly on a Blockchain

This paid story is brought to you by Safebit

This paid story is brought to you by SafebitYou can create a social identity for yourself by creating a profile on a social networking site like Facebook. You can use that identity to seamlessly signup on Medium. You don’t have to re-enter first name, last name, etc. Medium integrates Facebook APIs and transfers your information with your consent.

But, what about creating your identity on the blockchain?

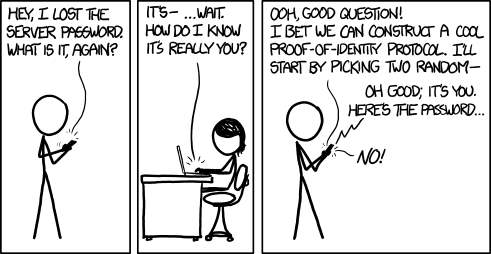

Creating an identity on a blockchain is not easy. Consider a bitcoin wallet, you need to generate a private key and a public key. But, look at this public key, does it speak for you?

897c59e1c04dab8748f7f9a2e2c7fd96d16bf700d389ba4153dba3d1bebdccf9You need an identity that communicates your personality or individuality.

@ BlockchainCoderNow compare this identity with the public key. BlockchainCoder is a personalised identity that speaks for me. Creating such identities effortlessly is one of the features Safebit provides you.

Creating an Identity on Safebit

Creating an Identity on SafebitThe next hassle is managing multiple identities. In Bitcoin, you have to generate separate keys for a new wallet. Managing them is a pain, you have a lot of keys to remember.

My Identities on Safebit

My Identities on SafebitHowever, our users don’t have to go through such hassles. You can manage all your identities in one place.

But, the problems on typical blockchain identities don’t end there. An identity created on a blockchain is not transferable to a different blockchain. Because blockchain are not capable of speaking to each other yet.

Safebit is not a place only for identities. It’s also a platform which provides developers easy to use SDK to deploy blockchain apps. Our platform has the capability to speak with multiple blockchains and hence you can take your identity wherever you go.

Let’s see how seamlessly you can use your identities.

Sigbit allows you to sign a message permanently on the blockchain. Let’s now sign a message(Blockchain are awesome) using the BlockchainCoder Identity.

In a simple click, Sigbit signed our message.

We help our users effortlessly and securely create, manage and use identities across apps and blockchains. We are currently on a private alpha. If you need an invite, you can request one by joining our telegram group.

Claps Please

July 19, 2018

How to Create Your Identity Effortlessly on a Blockchain

You can create a social identity for yourself by creating a profile on a social networking site like Facebook. You can use that identity to seamlessly signup on Medium. You don’t have to re-enter first name, last name, etc. Medium integrates Facebook APIs and transfers your information with your consent.

But, what about creating your identity on the blockchain?

Creating an identity on a blockchain is not easy. Consider a bitcoin wallet, you need to generate a private key and a public key. But, look at this public key, does it speak for you?

897c59e1c04dab8748f7f9a2e2c7fd96d16bf700d389ba4153dba3d1bebdccf9You need an identity that communicates your personality or individuality.

@ BlockchainCoderNow compare this identity with the public key. BlockchainCoder is a personalised identity that speaks for me. Creating such identities effortlessly is one of the features Safebit provides you.

Creating an Identity on Safebit

Creating an Identity on SafebitThe next hassle is managing multiple identities. In Bitcoin, you have to generate separate keys for a new wallet. Managing them is a pain, you have a lot of keys to remember.

My Identities on Safebit

My Identities on SafebitHowever, our users don’t have to go through such hassles. You can manage all your identities in one place.

But, the problems on typical blockchain identities don’t end there. An identity created on a blockchain is not transferable to a different blockchain. Because blockchain are not capable of speaking to each other yet.

Safebit is not a place only for identities. It’s also a platform which provides developers easy to use SDK to deploy blockchain apps. Our platform has the capability to speak with multiple blockchains and hence you can take your identity wherever you go.

Let’s see how seamlessly you can use your identities.

Sigbit allows you to sign a message permanently on the blockchain. Let’s now sign a message(Blockchain are awesome) using the BlockchainCoder Identity.

In a simple click, Sigbit signed our message.

We help our users effortlessly and securely create, manage and use identities across apps and blockchains. We are currently on a private alpha. If you need an invite, you can request one by joining our telegram group.

Claps Please

July 8, 2018

How We Plan to Empower Blockchain Innovators

This paid story is brought to you by Safebit

This paid story is brought to you by Safebit“Ten years in, nobody has come up with a use for blockchain.”

“Blockchain is a solution in search of a problem.”

Don’t allow such statements lead you to despair! Look at the progress we made so far. Bitcoin is an autonomous bank. Ethereum is a platform where anyone can build their own autonomous organizations. These are not fictional concepts but functional applications.

But, blockchain still lacks the escape velocity to take off. It wasn’t until Apple launched its app store, the mobile apps took off. The app store changed everything, it created a new market. They made it easy and simple for individuals/organizations to develop, deploy and sell apps. It was powerful to make teenage coders millionaires.

Blockchain has to acquire this escape velocity and we are waiting for a market leader. Presently blockchain has issues in the following areas.

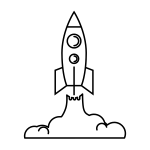

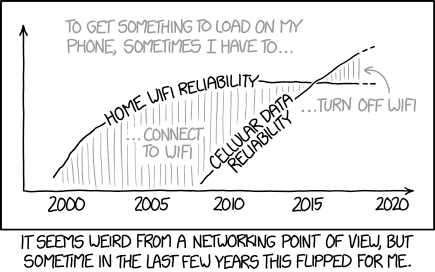

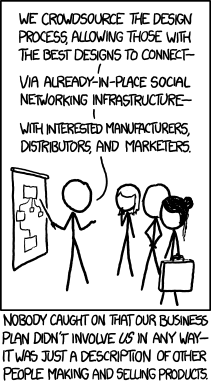

User Adoption Credits : xkcd

Credits : xkcdThe concept of public/private keys, wallets, etc are difficult for the layman to understand and use. Humans are prone to mistakes, if one loses their private key there are no means of recovery. Managing one’s assets in different wallets is a pain.

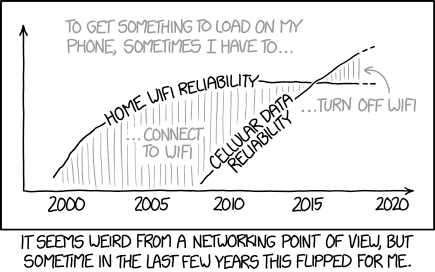

Developer Adoption Credits : xkcd

Credits : xkcdProgramming blockchain applications require a different approach. If you consider Ethereum, reading data is free but writing comes with a cost. So one needs to write code that minimizes writing costs. Likewise, different platforms have different infrastructure and operational costs. These platforms evolve at a rapid pace. It’s difficult for a developer to learn multiple blockchain languages and be updated with the rapid infrastructure changes. Deploying natively on different chains for optimized costs is a hassle.

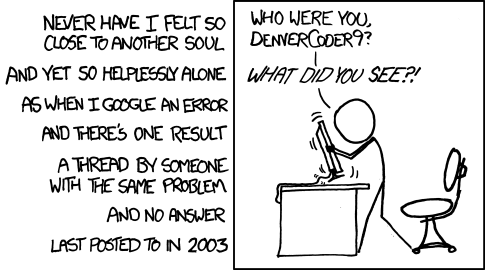

Business Adoption Credits : xkcd

Credits : xkcdCrafting profitable business models on blockchain needs a new way of thinking. If you consider decentralized exchanges, most of them charge low service fee. An organization cannot sustain by charging such low fee. Issuing tokens can help organizations raise huge investment. However, tokens bring additional friction with respect to usability.

If customers want to use your companies service today and they don’t have your token, they have to wait until the trade order is filled. Presently the wait time takes days/weeks.

Hiring talent is another problem, experienced developers in this field are so scarce and expensive.

Reliability Credits : xkcd

Credits : xkcdNetwork congestion is a common problem in blockchains. This problem would affect your customers who are trying to do transactions with your organization.

If you have important data on the blockchain and you are unable to retrieve it when you need the most, you will have a serious problem. Hence one must account for such issues and build some backup infrastructure that might have additional costs.

These are some of the technical, financial and economical problems blockchain faces. These are problems that hard to solve, but they are not impossible. Those who solve such hard problems are likely to leave a mark.

Our Idea

We are a bunch of idealistic and determined individuals based out of Israel who dare to solve challenges and empower blockchain innovators through our platform Safebit .

In the earlier days of software, it was a pain to deploy applications on different platforms. Java solved this issue by giving the ability to deploy applications cross-platform.

SafebitSafebit is a cross-chain and cross-platform cryptocurrency wallet. We have a user-friendly interface that allows you to manage your crypto assets like you manage your Gmail/Facebook account.

It also has the ability to support hardware wallets like Trezor, Ledger, etc. Our APIs makes us highly extendible, anyone who wants to build a new wallet/applications can easily plug into our platform.

Credits : xkcdPowerful APIs to Manage User’s Blockchain Accounts

Credits : xkcdPowerful APIs to Manage User’s Blockchain AccountsOur APIs makes us highly extensible, anyone who wants to build a new wallet/applications can plug easily into our platform. It provides an experience similar to o-auth to manage user’s blockchain accounts.

Since we offer cross-chain support developers don’t have to go through the hassles of learning native language and infrastructure. We also provide libraries for developers that simplifies the process of writing smart contracts.

Our platform minimizes the need for costly experts. Any developer with good API experience would be able to make scalable blockchain applications using our platform. Hence saving time, cost and efforts.

Collaboration Network

Collaboration is at the heart of open innovation. Our platform makes it easy and simple for individuals and organization to collaborate with each other.

IdentitiesInstead of sending crypto assets to a public key, you can send it a user’s email Id or username. Since the public key address is too long and a hassle when it comes to transacting huge amounts. If the user sends the assets to a wrong person you can’t revert the transaction back. Sending money to a username or email id is much simpler.

HandshakesHandshakes are similar to accepting a Facebook friend request. It allows users to build social and financial connections with each other.

Collaborative IdentityWith collaborative identity, you can approve a transaction only if two people agree. The system can also be used to restrict functionalities of users based on their roles. On a Facebook business page, an admin has certain functionalities which editors and advertisers don’t enjoy. Collaborative identity makes it easy to configure the level of security as required.

You have several options:1. Ignore blockchain until it’s too late.

2. Be a critique and gain short-term attention.

3. Be an innovator who would dare to solve hard problems and leave a permanent mark in the blockchain revolution.

If you choose the third option, you can join us to build the future together! Please connect with us on Telegram , Reddit & Facebook . Claps Please

July 6, 2018

How to create a blockchain team

How does one go about making a great blockchain team? What is the skillset to look for? What makes a bad team?

Let’s take an example of a blockchain system to understand its components. Once we understand the individual components, we will have insights on whom to hire in order to build great blockchain solutions. If we consider the first blockchain consensus algorithm, Proof of Work, the system is made up of ideas from cryptography, game theory and computer networks.

Cryptography helps us secure our blockchain system from unauthorized access. Depending on the level of security required in your application, you need a developer who understands encryption at a deeper level. This is important because using the wrong encryption can put your blockchain at risk. However, if you are using blockchain frameworks, you don’t need an expert but someone who understands the fundamentals of encryption will be good enough.

Game theory helps in incentivizing people to behave in a desired manner. In Proof of Work systems, game theory is used to reward miners who dedicate their computers for the system to function. It contributes to engineering moral behavior among the actors. With blockchain solutions, there could be actors who will try to game the system. Understanding human behavior and engineering it through a system is a critical skill required to make great blockchain solutions.

Peer-to-Peer computer networks help computers in a network communicate, share data and reach a consensus. On blockchain systems which need to work at scale, engineers who understand computer networks are indispensable. We also need a system architect who can fit these pieces together according to the requirements of a given problem or requirement.

Hence we need the following people:Crypto DeveloperUser ResearcherNetwork EngineerSystem ArchitectThe end users of a blockchain are mostly non-technical users. We need to make sure they have an interface they can easily use. This is critical because the data written on a blockchain is irreversible. Hence, we need a great User Experience Designer to give non-technical users a seamless experience.

5. User Experience Designer

These don’t have to be separate people, one person can play multiple roles. A system architect and network engineer could be the same person. The role of a user experience designer and user researcher can be played by one person.

RolesCrypto DeveloperA crypto developer will decide what level of security is required for a given solution. There’s a trade-off between the level of security required and network speed. As such, a platform can provide great security, but be slow and consume a lot of resources.

Based on the client’s requirements, the crypto developer will choose an appropriate mechanism required to ensure security. They will also foresee threats from advanced technology like quantum computers and update the system’s security.

User ResearcherA user researcher will understand the client’s requirements or the given problem statement. They define the actors of a system and their behavior. In Proof of Work systems, we have miners and users. If we consider an automobile supply chain, we have manufacturers, distributors, retailers, customers, etc.

The user researcher must understand what these people contribute to the system. They should also design a plan to make the system foolproof from the selfish behavior of its actors.

Network EngineerA network engineer is responsible for making the peer-to-peer network work at scale. They make sure data is communicated efficiently to the intended recipient only.

System ArchitectThe system architect will incorporate insights from the user researcher, crypto developer, network engineer and user experience designer. They will be responsible for the integrity and scalability of the system.

User Experience DesignerA user experience engineer will design the application in such a way that it’s seamless for a non-technical user. He will have to test the application with users several times and incorporate their feedback to build a great solution.

Summarising team members and their roles:A crypto developer who ensures security in the system.A user researcher who understands client’s requirements and the actors of a system.A network engineer who designs the blockchain network for robustness and scalability.A system architect who incorporates insights from the above people to design a robust system.A user experience designer who make the experience seamless for end users.The number of people required for each role can vary as per the requirement of the project. There can be multiple crypto developers, network engineers, etc. Since these people come from diverse backgrounds, they are likely to have complementary skills and they would make a great team.

A team with only a bunch of developers is a bad idea.Conclusion

The blockchain is a system that ensures transparency and integrity. It borrows ideas from different fields such a cryptography, game theory and computer networks.Complicated systems can be difficult for end users, hence a user experience researcher who can make things seamless for an end user is indispensable.The team members can play multiple roles and there need not be a separate person for each role. Teams with diverse background and complementary skills set are likely to make a great team.

Author

Febin John James is one of the top writers in Innovation and Technology on Medium. He writes for publications like Hackernoon, FreeCodeCamp, etc.

Blockchain Business Review from Apla provides high-quality educational material from the world of blockchain to inform the business community of the competitive advantage that can be gained by integrating distributed ledger data storage within organizations. Our mission is to promote knowledge about blockchain and its uses in both the private and public sector and demonstrate the value of blockchain integration.

How to create a blockchain team was originally published in Apla on Medium, where people are continuing the conversation by highlighting and responding to this story.

July 5, 2018

How We Plan to Empower Blockchain Innovators

“Ten years in, nobody has come up with a use for blockchain.”

“Blockchain is a solution in search of a problem.”

Don’t allow such statements lead you to despair! Look at the progress we made so far. Bitcoin is an autonomous bank. Ethereum is a platform where anyone can build their own autonomous organizations. These are not fictional concepts but functional applications.

But, blockchain still lacks the escape velocity to take off. It wasn’t until Apple launched its app store, the mobile apps took off. The app store changed everything, it created a new market. They made it easy and simple for individuals/organizations to develop, deploy and sell apps. It was powerful to make teenage coders millionaires.

Blockchain has to acquire this escape velocity and we are waiting for a market leader. Presently blockchain has issues in the following areas.

User AdoptionThe concept of public/private keys, wallets, etc are difficult for the layman to understand and use. Humans are prone to mistakes, if one loses their private key there are no means of recovery. Managing one’s assets in different wallets is a pain.

Developer Adoption Credits : xkcd

Credits : xkcdProgramming blockchain applications require a different approach. If you consider Ethereum, reading data is free but writing comes with a cost. So one needs to write code that minimizes writing costs. Likewise, different platforms have different infrastructure and operational costs. These platforms evolve at a rapid pace. It’s difficult for a developer to learn multiple blockchain languages and be updated with the rapid infrastructure changes. Deploying natively on different chains for optimized costs is a hassle.

Business Adoption Credits : xkcd

Credits : xkcdCrafting profitable business models on blockchain needs a new way of thinking. If you consider decentralized exchanges, most of them charge low service fee. An organization cannot sustain by charging such low fee. Issuing tokens can help organizations raise huge investment. However, tokens bring additional friction with respect to usability.

If customers want to use your companies service today and they don’t have your token, they have to wait until the trade order is filled. Presently the wait time takes days/weeks.

Hiring talent is another problem, experienced developers in this field are so scarce and expensive.

Reliability Credits : xkcd

Credits : xkcdNetwork congestion is a common problem in blockchains. This problem would affect your customers who are trying to do transactions with your organization.

If you have important data on the blockchain and you are unable to retrieve it when you need the most, you will have a serious problem. Hence one must account for such issues and build some backup infrastructure that might have additional costs.

These are some of the technical, financial and economical problems blockchain faces. These are problems that hard to solve, but they are not impossible. Those who solve such hard problems are likely to leave a mark.

Our Idea

We are a bunch of idealistic and determined individuals based out of Israel who dare to solve challenges and empower blockchain innovators through our platform Safebit .

In the earlier days of software, it was a pain to deploy applications on different platforms. Java solved this issue by giving the ability to deploy applications cross-platform.

SafebitSafebit is a cross-chain and cross-platform cryptocurrency wallet. We have a user-friendly interface that allows you to manage your crypto assets like you manage your Gmail/Facebook account.

It also has the ability to support hardware wallets like Trezor, Ledger, etc. Our APIs makes us highly extendible, anyone who wants to build a new wallet/applications can easily plug into our platform.

Credits : xkcdPowerful APIs to Manage User’s Blockchain Accounts

Credits : xkcdPowerful APIs to Manage User’s Blockchain AccountsOur APIs makes us highly extensible, anyone who wants to build a new wallet/applications can plug easily into our platform. It provides an experience similar to o-auth to manage user’s blockchain accounts.

Since we offer cross-chain support developers don’t have to go through the hassles of learning native language and infrastructure. We also provide libraries for developers that simplifies the process of writing smart contracts.

Our platform minimizes the need for costly experts. Any developer with good API experience would be able to make scalable blockchain applications using our platform. Hence saving time, cost and efforts.

Collaboration Network

Collaboration is at the heart of open innovation. Our platform makes it easy and simple for individuals and organization to collaborate with each other.

IdentitiesInstead of sending crypto assets to a public key, you can send it a user’s email Id or username. Since the public key address is too long and a hassle when it comes to transacting huge amounts. If the user sends the assets to a wrong person you can’t revert the transaction back. Sending money to a username or email id is much simpler.

HandshakesHandshakes are similar to accepting a Facebook friend request. It allows users to build social and financial connections with each other.

Collaborative IdentityWith collaborative identity, you can approve a transaction only if two people agree. The system can also be used to restrict functionalities of users based on their roles. On a Facebook business page, an admin has certain functionalities which editors and advertisers don’t enjoy. Collaborative identity makes it easy to configure the level of security as required.

You have several options:1. Ignore blockchain until it’s too late.

2. Be a critique and gain short-term attention.

3. Be an innovator who would dare to solve hard problems and leave a permanent mark in the blockchain revolution.

If you choose the third option, you can join us to build the future together! Please connect with us on Telegram , Reddit & Facebook . Claps Please

June 27, 2018

Here Is What I Found Trading ERC20 Tokens in Decentralized Exchanges

I am not a trader but wanted to test out how decentralized trading works. In decentralized trading the exchange doesn’t hold your crypto assets, the trade happens directly between traders wallets. I tested out four popular exchanges built on the open protocol 0x.

Radar RelayRadar Relay provides a rich trading experience. It has an intuitive user interface, thus it’s a great tool for first-time traders. You can start trading with a few clicks, it has no signups, filling up forms or verification.

Click on the “Select Wallet” button on the top right corner, select your wallet, approve the request and you are good to go.

The interface is intuitively divided into four sections. In the leftmost part of the screen, you have your wallet functionalities. It shows your ETH balance, token balances, helps you wrath ETH to WETH(a necessary step for trading ERC20 tokens), enable/disable tokens, etc.

In the second section from the left, you can select the token you want to buy or sell and place a market/limit order.

The third and fourth section shows you the stats of the selected token such as price chart, order book, trade history, etc.

In the top right corner, you have buttons, that shows you the volumes of each token and your account section when you can check the orders you placed. Our order on Radar Relay was filled faster when compared to other relayers.

A wide variety of tokens is supported by Radar Relay. They link with other relayers to provide liquidity. You can integrate their APIs to your dApps to help users exchange tokens seamlessly. They provide you with Rest and WebSocket APIs. You can list, place and subscribe to orders using their APIs.

I had a chance to interview the team at Radar Relay.

How do you plan to stand out with respect to other relayers in the market?Like all relayers, we’re living in the future, and trying to work backwards. Along the way, we’ll each need to find our niches. We expect relayers to compete on user experience, token inventory, fees, regulatory strategy, brand equity, product ecosystem, and liquidity. Compared to most relayers we are unique in that we’ve invested heavily in educational resources on Radar itself and, more importantly, the ecosystem as a whole. We believe education is critical to bringing people to the 0x ecosystem as well as into the token economy.What are the challenges you face as one of the pioneers in the decentralized industry?

Relayers like us are defining this category as we create it. It’s a big responsibility and we want to do it right. One of the challenges of category creation is finding regulatory clarity. We hate regulatory arbitrage, it’s naive. We’re working side by side with our attorneys and with regulators to ensure we are role models for regulatory accountability. This takes time and is a challenge, but it’s one we are excited to take on!Tell us about your team and what makes you special.

What started as a small group of guys working in a basement in Colorado has turned into a team of almost 30 people working around the world. We have different backgrounds and experiences, but we’re united in our goal to onboard the world to the token economy. As a team focused on building a multigenerational enduring company, our values of accountability, vision, and impact are hardwired into everything we do.What are your challenges in acquiring, educating and retaining customers?

The flipside of category creation is stewardship and education. To be a citizen in the token economy or to use Radar Relay new mental models are needed and technical hurdles need to be overcome. For example, some new users struggle understanding the difference between having an account on a centralized exchange and having a wallet where they control their private keys and tokens. Once we can get a user to trade, our value proposition clicks, and they become a relayer evangelist!Do you plan to bring additional products to the market?

To execute on our mission of onboarding the world to the token economy we’ll need multiple products for different customer archetypes and use cases. Since launching Radar Relay in October we’ve been average 500%+ monthly volume growth, but we’re just getting started! Our product roadmap includes different types of user interfaces, user tools, and supporting other token categories like collectibles and securities.How do you plan to offer liquidity?

The majority of volume on trading venues comes from automated traders who are typically financial engineers trading programmatically. These automated traders find Radar Relay because they are frustrated and scared to trade on centralized exchanges because of all the hacks and lost funds. We’ve just released our updated API and SDK, hired a business development team, and are excited to grow our network of liquidity partners!Have you guys closed any rounds of funding?

Yes, we raised $3m from an amazing group of investors in the winter of 2017. We optimized for mission alignment, conviction on the space, and ability to move mountains for us. You can read more about the raise here: https://medium.com/radarrelay/radar-relay-fundraising-9873d52a5de5ERC dEX

ERC dEX has a simple UI, like most decentralised exchanges it has no signup. You can start trading with a few clicks. Unlike Radar Relay you have to buy ZRX tokens to start trading. In the upcoming version of their product traders who make market order doesn’t need to hold ZRX at all.

You have to select the token pairs, specify the amount you want to buy/sell to create your order. You can specify a time limit to your order after which the order expires. It provides with candlesticks, order book, etc like most exchanges.

ERC dEX has a strict verification process to list tokens, this measure will protect traders to a certain extent. They also have taken certain measures and initiatives to promote high liquidity. However, our order on ERC dEX took a few days to fill.

They have built a trading toolkit called Aqueduct, it provides APIs developers can use to automate trading. They also have a flexible program that incentivizes partners who can promise them liquidity.

They also have a market-maker program which traders with no coding experience can use to automate trading and backtest strategies. When compared to other decentralized exchanges, ERC dEX has put in more efforts to ensure liquidity.

ERC dEX is built by a strong team with great industry experience. The CEO, David Aktary has worked with companies like IBM, JP Morgan, etc. The CTO, Luke Autry was part of Sharefile which was later acquired by Citrix. We noticed one more thing, all the c-level employees in the team are coders and have maintained a decent Github profile.

I had a chance to interview the CEO of ERC dEX, David Aktary.

How do you plan to stand out with respect to other relayers in the market?We are making the global shared liquidity concept a reality with our Aqueduct network. This network incentivizes everyone in the ecosystem to share liquidity as far and wide as possible. No other relayer has this.We also will be a compliant trading venue for tokenized securities I don’t think any other relayers are doing this either.What are the challenges you face as one of the pioneers in the decentralized industry?

Anyone that doesn’t answer this question with “liquidity” is wrong. Liquidity is the biggest problem with all decentralized exchange. We’re tackling it and making good progress, but it’ll take time.Tell us about your team and what makes you special?

We’re unique in the 0x relayer space in that our team not only comes from a software engineering background, but we also have deep finance and business experience and connections. This helps us in many ways.What are your challenges in acquiring, educating and retaining customers?

We have a couple of challenges here.

Liquidity begets liquidity — users will go wherever that liquidity is, so we have a bit of a starting problem. As I said before, we’re solving that, but it takes time.

We’re US-based, dealing in a business where the regulations may be a bit unclear. We’re doing everything we can to be as compliant as possible, but doing so may mean sacrificing taking an action that would otherwise bring us a large infusion of users. This is a sacrifice we’re willing to make to realize our long-term goals.Do you plan to bring additional products to the market?

Absolutely. We currently have 3 products in the market: our ERC dEX relayer for token spot trading, our Aqueduct liquidity network, and our Market Maker Automation Toolkit. We know we’re going to be adding compliant security token spot trading, but we may also add products using other protocols. Some we’ve been seriously considering include dY/dX, b0x, and others.How do you plan to offer liquidity?

We have over 80 members in our liquidity network, including large market makers like Hehmeyer Trading and other relayers like Bamboo Relay, Shark Relay, and Amadeus Relay.We are the only relayer that collects fees and uses those fees to incentivize liquidity providers. We do this through our Market Maker programs. We have two levels to this program, our institutional program and our Designated Market Maker program, which is intended to democratize the market making process. I recently published a blog on this and the benefits of signing up, with as little as $100 committed. We’ve had nearly 60 people sign up in the few days after that blog was published.Have you guys closed any rounds of funding?

We have mostly bootstrapped to date, but are now about halfway through a seed round. Interested investors should reach out to finance@ercdex.com.Paradex

Paradex offers a decent trading experience. You can begin by connecting your wallet. You need to select the token pair by click on the market button on the top bar. They have a limited number of tokens to trade.

Once you have selected the token at the price you want to buy/sell you can place the order by authorizing the Metamask wallet.

Paradex offers a decent trading experience. You can begin by connecting your wallet. You need to select the token pair by click on the market button on the top bar. They have a limited number of tokens to trade.

Once you have selected the token at the price you want to buy/sell you can place the order by authorizing the Metamask wallet.

Your order will be visible on the open order book until its filled. Our order on Paradex took almost two hours to fill.

DDEXTrading in DDEX is similar to trading with Radar Relay. Connect the MetaMask wallet, wrap ether and make an order. Once you make an order, it will be listed in the open order section. DDEX doesn’t provide time-limited orders like Radar Relay.

DDEX uses Hydro protocol as a network layer, that promises faster transactions and high liquidity. They also provide APIs to automate trading. Our order on DDEX took two to three hours to fill.

I also reached out to the DDEX team, they responded to my queries.

How do you plan to stand out with respect to other relayers in the market?1. Execution, Hydro Protocol is one of a few shared liquidity protocol which has product live build on top of Ethereum main net and 0x Protocol.

2. Geographical location, DDEX is the only 0x Relayer in the Asia Pacific Region.

3. Mobile first, DDEX native app Beta is testing on both iOS and Android. Since crypto is 24/7, DEX with native wallet build in-app will have a better user experience than PC version DEX.What are the challenges you face as one of the pioneers in the decentralized industry?

Limited Ethereum wallet users compare to other Million DAU appTell us about your team and what makes you special.

Hydro Protocol team is based in both Beijing and Seattle. Team members are from Microsoft, Palantir, Baidu, Google, Facebook, Bank of Americ, Alibaba, Classbox, Zhenfund. Talent from both tech world and financial service market.What are your challenges in acquiring, educating and retaining customers?

The geographical location makes the team special. Since exchange is a segmented marker caused by culture barrier and regulation barrier.

The general adoption of DEX is really low. We need time to educate the market and create niche market compared to centralized exchange.Do you plan to bring additional products to the market?

The mobile DDEX app will be the first DEX in the world to have its own wallet + DEX in one install.How do you plan to offer liquidity

Our API document is easy to read and implement. Also, we work with several market making firm across the globe and have an in-house quant group.Have you guys closed any rounds of funding?

Hydro Protocol raised a private sale round in Jan 2018 with 30 institutional investors participated in the round, including FBG, Inblockchain, Zhenfund, Danhua Capital, Garry Tan, Alexis Ohaninan, Nirvana Capital, Draper DragonConclusion

It’s the early days of relayers, it is too early to conclude on the winner. As of now, Radar Relay offers a great trading experience. Liquidity is a common challenge every relayer face. Though dEX’s have taken measures to gain high liquidity, it would take time to see results.

This story is part of our “Deep Dive Into ERC20 Ecosystem” Series. The third part of the story will be published soon. In the next story, we will be explaining the future potential of 0x.

Claps Please

June 26, 2018

Here is Our Review of Decentralised Exchanges Built on 0x

In our previous story, we introduced 0x. In this story, we have reviewed popular relayers built on 0x, here is our take.

Radar Relay

Radar RelayRadar relay provides a rich trading experience. It has an intuitive user interface, thus it’s a great tool for first-time traders. You can start trading with a few clicks, it has no signups, filling up forms or verifications.

Click on the “Select Wallet” button on the top right corner, select your wallet, approve the request and you are good to go.

The interface is intuitively divided into four sections. In the leftmost part of the screen, you have your wallet functionalities. It shows your ETH balance, token balances, helps you wrath ETH to WETH(a necessary step for trading ERC20 tokens), enable/disable tokens, etc.

In the second section from the left, you can select the token you want to buy or sell and place a market/limit order.

The third and fourth section shows you the stats of the selected token such as price chart, order book, trade history, etc.

In the top right corner, you have buttons, that shows you the volumes of each token and your account section when you can check the orders you placed. Our order on Radar Relay was filled faster when compared to other relayers.

A wide variety of tokens is supported by Radar Relay. They link with other relayers to provide liquidity. You can integrate their APIs to your dApps to help users exchange tokens seamlessly. They provide you with Rest and WebSocket APIs. You can list, place and subscribe to orders using their APIs.

ERC dEXERC dEX has a simple UI, like most decentralised exchanges it has no signup. You can start trading with a few clicks. Unlike Radar Relay you have to buy ZRX tokens to start trading. In the upcoming version of their product traders who make market order doesn’t need to hold ZRX at all.

You have to select the token pairs, specify the amount you want to buy/sell to create your order. You can specify a time limit to your order after which the order expires. It provides with candlesticks, order book, etc like most exchanges.

ERC dEX has a strict verification process to list tokens, this measure will protect traders to a certain extent. They also have taken certain measures and initiatives to promote high liquidity. However, our order on ERC dEX took a few days to fill.

They have built a trading toolkit called Aqueduct, it provides APIs developers can use to automate trading. They also have a flexible program that incentivizes partners who can promise them liquidity.

They also have a market-maker program which traders with no coding experience can use to automate trading and backtest strategies. When compared to other decentralized exchanges, ERC dEX has put in more efforts to ensure liquidity.

ERC dEX is built by a strong team with great industry experience. The CEO, David Aktary has worked with companies like IBM, JP Morgan, etc. The CTO, Luke Autry was part of Sharefile which was later acquired by Citrix. We noticed one more thing, all the c-level employees in the team are coders and have maintained a decent Github profile.

How do you plan to stand out with respect to other relayers in the market?We are making the global shared liquidity concept a reality with our Aqueduct network. This network incentivizes everyone in the ecosystem to share liquidity as far and wide as possible. No other relayer has this.We also will be a compliant trading venue for tokenized securities I don’t think any other relayers are doing this either.What are the challenges you face as one of the pioneers in the decentralized industry?

Anyone that doesn’t answer this question with “liquidity” is wrong. Liquidity is the biggest problem with all decentralized exchange. We’re tackling it and making good progress, but it’ll take time.Tell us about your team and what makes you special?

We’re unique in the 0x relayer space in that our team not only comes from a software engineering background, but we also have deep finance and business experience and connections. This helps us in many ways.What are your challenges in acquiring, educating and retaining customers?

We have a couple of challenges here.

Liquidity begets liquidity — users will go wherever that liquidity is, so we have a bit of a starting problem. As I said before, we’re solving that, but it takes time.

We’re US-based, dealing in a business where the regulations may be a bit unclear. We’re doing everything we can to be as compliant as possible, but doing so may mean sacrificing taking an action that would otherwise bring us a large infusion of users. This is a sacrifice we’re willing to make to realize our long-term goals.Do you plan to bring additional products to the market?

Absolutely. We currently have 3 products in the market: our ERC dEX relayer for token spot trading, our Aqueduct liquidity network, and our Market Maker Automation Toolkit. We know we’re going to be adding compliant security token spot trading, but we may also add products using other protocols. Some we’ve been seriously considering include dY/dX, b0x, and others.How do you plan to offer liquidity?

We have over 80 members in our liquidity network, including large market makers like Hehmeyer Trading and other relayers like Bamboo Relay, Shark Relay, and Amadeus Relay. We are the only relayer that collects fees and uses those fees to incentivize liquidity providers. We do this through our Market Maker programs. We have two levels to this program, our institutional program and our Designated Market Maker program, which is intended to democratize the market making process. I recently published a blog on this and the benefits of signing up, with as little as $100 committed. We’ve had nearly 60 people sign up in the few days after that blog was published.Have you guys closed any rounds of funding?

We have mostly bootstrapped to date, but are now about halfway through a seed round. Interested investors should reach out to finance@ercdex.com.Paradex

Paradex offers a decent trading experience. You can begin by connecting your wallet. You need to select the token pair by click on the market button on the top bar. They have a limited number of tokens to trade.

Once you have selected the token at the price you want to buy/sell you can place the order by authorizing the Metamask wallet.

Paradex offers a decent trading experience. You can begin by connecting your wallet. You need to select the token pair by click on the market button on the top bar. They have a limited number of tokens to trade.

Once you have selected the token at the price you want to buy/sell you can place the order by authorizing the Metamask wallet.

Your order will be visible on the open order book until its filled. Our order on Paradex took almost two hours to fill.

DDEXTrading in DDEX is similar to trading with Radar Relay. Connect the MetaMask wallet, wrap ether and make an order. Once you make an order, it will be listed in the open order section. DDEX doesn’t provide time-limited orders like Radar Relay.

DDEX uses Hydro protocol as a network layer, that promises faster transactions and high liquidity. They also provide APIs to automate trading. Our order on DDEX took two to three hours to fill.

How do you plan to stand out with respect to other relayers in the market?1. Execution, Hydro Protocol is one of a few shared liquidity protocol which has product live build on top of Ethereum main net and 0x Protocol.

2. Geographical location, DDEX is the only 0x Relayer in the Asia Pacific Region.

3. Mobile first, DDEX native app Beta is testing on both iOS and Android. Since crypto is 24/7, DEX with native wallet build in-app will have a better user experience than PC version DEX.What are the challenges you face as one of the pioneers in the decentralized industry?

Limited Ethereum wallet users compare to other Million DAU appTell us about your team and what makes you special.

Hydro Protocol team is based in both Beijing and Seattle. Team members are from Microsoft, Palantir, Baidu, Google, Facebook, Bank of Americ, Alibaba, Classbox, Zhenfund. Talent from both tech world and financial service market.What are your challenges in acquiring, educating and retaining customers?

The geographical location makes the team special. Since exchange is a segmented marker caused by culture barrier and regulation barrier.

The general adoption of DEX is really low. We need time to educate the market and create niche market compared to centralized exchange.Do you plan to bring additional products to the market?

The mobile DDEX app will be the first DEX in the world to have its own wallet + DEX in one install.How do you plan to offer liquidity

Our API document is easy to read and implement. Also, we work with several market making firm across the globe and have an in-house quant group.Have you guys closed any rounds of funding?

Hydro Protocol raised a private sale round in Jan 2018 with 30 institutional investors participated in the round, including FBG, Inblockchain, Zhenfund, Danhua Capital, Garry Tan, Alexis Ohaninan, Nirvana Capital, Draper DragonConclusion

It’s the early days of relayers, it is too early to conclude on the winner. As of now, Radar Relay offers a great trading experience. Liquidity is a common challenge every relayer face. Though dEX’s have taken measures to gain high liquidity, it would take time to see results.

This story is part of our “Deep Dive Into ERC20 Ecosystem” Series. The third part of the story will be published soon. In the next story, we will be explaining the future potential of 0x.

Claps Please

June 25, 2018

How Can 0x Help You Build Decentralised Applications

Open frameworks played an important role on the internet we see today. If you want to build a web app from scratch you have to do a lot of things yourself (listening to requests from port 80, writing a wrapper to interact with your database, etc).

But, people hardly code from scratch. Instead, they use MVP frameworks like Laravel, CodeIgniter, Django, Flask, etc. You can reuse their code which was refined over time by the community. This process can save you time and help you take your ideas to market faster.

Building autonomous systems that can facilitate transactions on Ethereum from scratch is hard and time-consuming. Your code needs to be optimised because you have to pay for the computational power utilised.

0x is an open protocol that provides you the architecture to enable decentralised trading. In other words you can build a decentralised exchange using 0x APIs.

What is a Decentralised Exchange?In a decentralized exchange, trading happens directly between people’s wallets. The decenteralised exchange doesn’t hold their user’s assets.

Traders create an order at the price in which they want to buy or sell and pre-authorises a transaction. The order is broadcasted through out the network, traders who are willing to counter the order fills it.

If Sara wants to exchange BAT for ETH, she specifies the price at which wants to sell it and create an order in a decentralized exchange. The decentralised exchange pings her wallet to take her approval in order to pre-authorise the transaction.

After her approval, the order is visible to other traders who can choose to fill the trade. Mark chooses to fill the trade, he authorizes the transaction through his wallet.

The trade happens, Sara’s BAT token get transferred to Mark’s wallet and his ETH is sent to her wallet. The trade didn’t require a middleman to hold tokens.

With the help of 0x, you can focus on the core business logic and worry less about the architecture. 0x smart contracts are rent free and open source. It is backed by a strong community who continuously refine and optimise its code.

You can use their APIs to easily program money or even build a decentralised exchange/relayer. We already have a lot of projects built on top of 0x. Radar Relay, ERC Dex, DDEX, Paradex (Acquired by Coinbase) are the popular relayers built on 0x.

They are called relayers because they use 0x’s infrastructure to enable trading. These relayers can charge its users a fee for its services. This is a win-win situation for both 0x and relayers because they will individually market and compete to build quality services on top of 0x.

When relayers attract more users, 0x will start growing as an open platform. This would also enhance 0x architecture since its open source and contributed by the community. Relayers thus don’t have to worry about maintenance and system upgrades, they can focus on the core business model.

How Does Trading Happen on 0x?

How Does Trading Happen on 0x?In order for the trading to happen, we need a system to create, match and fill orders. As discussed in the earlier example, Sara creates the order and Mark sees the order and chooses to fill it.

These created orders need not be filled. Frequently writing data on Ethereum is inefficient and costly. 0x uses a brilliant approach and take the order creating, matching and filling process off-chain.

0x matches orders by broadcasting signed messages across the network, only when an order is filled, trade is executed on the blockchain. This approach reduces the load on the blockchain and enables efficient trading.

The Four Key Components of 0x Protocol0x protocol is made up of four key components. Makers, takers, relayers and smart contracts. Let’s see how these components worth together to enable decentralized trading.

Relayers offers interfaces(web or mobile apps) to users. There is a fee for using the 0x platform which needs to be paid using ZRX. Relayers offer competitive pricing to its users.

The makers are users who want to sell or buy tokens. In one of the earlier examples we discussed, Sara is a maker who wants to trader her BAT tokens. Makers use the relayer’s interface(eg. Radar Relay) to create orders by authorizing the transaction using their private keys.

The order will contain parameters like the tokens they like to trade, the price at which they want to buy or sell, the relayer fee and time in which the order will expire if it’s not filled.

Relayers validates the maker’s order and appends it to their order book. These orders are also visible to other traders using the relayer. When a trader chooses to fill the order created by the maker he becomes a taker. Some relayers automatically matchmakers who make opposite orders.

Once the order is matched, the Ethereum smart contract executes the order on-chain. Tokens get exchanged directly between the wallets of maker and taker. The relayer receives the agreed amount of fee.

Relayers are only one of the use cases of 0x, the potential applications of 0x are infinite, let’s have a look at some of the application.

Applications of 0xThe process of creating a decenteralised organization on Ethereum, issuing tokens, developing code to manage the governance by voting, etc requires technical resources. It’s also time-consuming and costly.

Aragon is a decentralised application that uses 0x protocol to help users easily built decentralised organisations on Ethereum.

Fintech products that help people invest their money efficiently aren’t something new. However, these products lack transparency.

Auctus is retirement planning platform that makes use of the 0x protocol. You get human and robotic advisory to help you manage your assets efficiently. Advisors are incentivised based on their advice.

A lot of experts who make predictions, most of these predictions fail. What if we can make them accountable for their predictions?

Augur is a prediction market platform that uses 0x protocol. An expert can make predictions on the platform by holding their money. If their prediction comes true they are incentivised else they lose their money.

The kind of applications that can be built on 0x is vast. We are yet to see its true potential. You can have a look at the story “18 Ideas for 0x Relayers in 2018” written by Tom Schmidt from the 0x team.

This story is part of our “Deep Dive Into ERC20 Ecosystem” Series. The second part of the story will be published soon. In the next story, we will be reviewing relayers built on top of 0x.

Claps Please

June 22, 2018

They can cryptographically sign a message using their wallets, smart contracts can verify them.

They can cryptographically sign a message using their wallets, smart contracts can verify them.