Vivek Sood's Blog, page 52

June 18, 2014

No Matter Which Way You Look At It – The New Amazon Smartphone Is A Dud

No matter which way you look at it – the new Amazon May Enter Smartphone Market

A Company Is Known By The Company It Keeps

There I was – stranded at the Heathrow Airport again – and cursing myself for trusting British Airways and Heathrow once more. Every time I fly out of Australia to Europe, I face a choice – whether to fly the national airlines Qantas, or another airline such as Singapore Airline or Emirates. Most of the time I choose Qantas because of my long association with the airline, and the trust it has built with me over those 25 years.

There I was – stranded at the Heathrow Airport again – and cursing myself for trusting British Airways and Heathrow once more. Every time I fly out of Australia to Europe, I face a choice – whether to fly the national airlines Qantas, or another airline such as Singapore Airline or Emirates. Most of the time I choose Qantas because of my long association with the airline, and the trust it has built with me over those 25 years.

However, when it comes to its alliance partners, Qantas leaves a lot to be desired. Iberia managed to lose my baggage and left me with no clothes to wear to an important meeting, British Airways and Heathrow almost always continue to amaze me with how low a company can fall in short space of time – and then continue to fall further almost on every experience, American Airlines does little to beat its rivals in the US and in my view none of these match Qantas in service or aircraft presentation.

On the other hand, the rival alliance has some strong airlines – Singapore Airlines, Lufthansa to name a couple – that will beat any of Qantas alliance partners hands down. This creates dilemma for me every time I fly internationally out of Australia. My latest experience with British Airways and Heathrow Airport has convinced me that no matter how much I love Qantas, I have to stop allowing that to interfere with my comfort, safety and convenience in other locations where Qantas hands over the relationship to its alliance partners – who do have keep the same standards.

I wonder how many other passengers – especially frequent business travelers – feel the same way about their preferred airline where they dislike the alliance partners so much that they are switching loyalties for that reason.

But the airlines are not the only companies that lose customers, or suppliers because of their partners. Most industries have now morphed into business networks of supply chains that compete with other business networks of supply chains for customer dollars. This transformation in business world is best highlighted by my using the sports of soccer and hockey as an example.

While many companies are still grasping the full implications of this massive shift in the business landscape, others have already adjusted to the new reality where A-team players only play the game A-team while the others are left to play with the rest. This not only applies to your supply chain partners, but also to the knowledge intermediaries such as the universities, consultants and brokers.

They used to say that a person is known by the company s/he keeps. I think, in the modern commercial world of networked businesses, we have come to a stage where a company is known by the company it keeps. All the attempts at social media corporate manipulations are futile if your business network and supply chain partners carry a millstone of bad reputation around their neck. Some of that bad reputation will rub off on to your business – no matter how much you try the social media management.

They used to say that a person is known by the company s/he keeps. I think, in the modern commercial world of networked businesses, we have come to a stage where a company is known by the company it keeps. All the attempts at social media corporate manipulations are futile if your business network and supply chain partners carry a millstone of bad reputation around their neck. Some of that bad reputation will rub off on to your business – no matter how much you try the social media management.

June 17, 2014

Business Model Transformation: Lessons From Soccer And Hockey – Part 2

In the previous blog in this series I wrote about the Brazilian soccer teams transformation from an individualistic style of play to a network style game. In early 90s, more than two decades since the last World Cup championship title and Brazil faced an interesting juxtaposition – continue with what led to past success of PELE and his peers, or move on with the new rules of the game.

In the previous blog in this series I wrote about the Brazilian soccer teams transformation from an individualistic style of play to a network style game. In early 90s, more than two decades since the last World Cup championship title and Brazil faced an interesting juxtaposition – continue with what led to past success of PELE and his peers, or move on with the new rules of the game.

The new rules were clear – minimise the individual wizardry of foot play, dribbling and nimble dexterous touches, and replace these with the power-play of networks of players moving in formations to conquer the opponents by outwitting them, by outsmarting them, and by outnetworking them using a better method.

Having lived and worked in South America – Chile, Argentina and Brazil in early 90’s I witnessed this transformation and saw how Brazilians successfully lifted the cup in 1994. Many other South American teams continue to struggle between the past and the future, despite the knowledge and example of Brazil’s successful methods. Uruguay, Chile and Colombia come to mind as good examples.

What keeps them from making a full transition to the future method? That is a topic for a future blog post. In this blog I am thinking about another sport which I personally played growing up in Punjab, India.

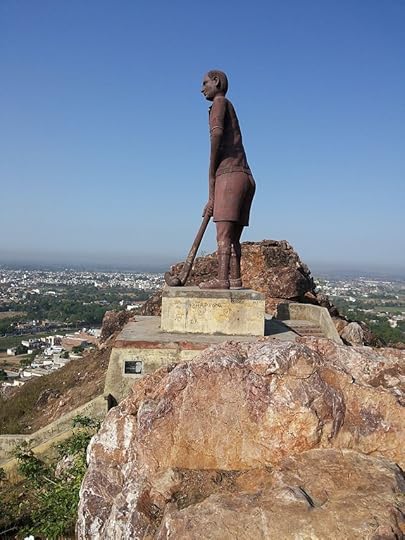

Indian hockey crisis

CC BY-SA 3.0

Just as success stories provide impactful learning opportunity, stories of failure are sometimes provide even bigger learning opportunities. Seeing where others fall, the traps and landmines they encounter can also guide you to the right path. Take the story of India’s hockey for instance.

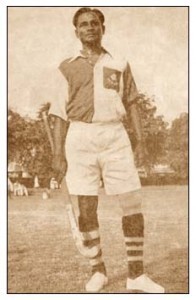

I grew up in India which was mad with field hockey at that time. And for a good reason. Believe it or not, at one stage India was the top team in field hockey in the world. In fact, the boarding school I went to in Punjab was in a Maharaja’s palace, not very far away from a dusty village which had the unique claim of having sent 5 out of 11 national hockey players who won the a gold medal for India. The peak of India’s hockey was from 1928 to 1956, during which six consecutive Olympic gold medals were brought home. Their exploits were legendary. Even today you can talk to the Indian hockey affectionados – or simply google the name Dhyan Chand – to get a flavour of what I am talking about.

However, at some point in the early 50s, the nature of hockey started changing. The grass field was replaced with Astroturf; the wooden hockey sticks were replaced with the ones made of composite fibre or other man-made material. As it happened to soccer, the way of playing hockey was also changing from individual wizardry with a stick to network of players playing in formations, passing a ball rapidly to each other in order to outwit their opponents.

field was replaced with Astroturf; the wooden hockey sticks were replaced with the ones made of composite fibre or other man-made material. As it happened to soccer, the way of playing hockey was also changing from individual wizardry with a stick to network of players playing in formations, passing a ball rapidly to each other in order to outwit their opponents.

For a multitude of reasons, Indian hockey players, coaches, administrators and other staff members never managed to get their act together. Many said it was a lack of commitment, pure ignorance or a rest-on-laurels attitude.

I still remember training for hockey at a young age where the coaches emphasised individual skill, practice and dedication over formations, teamwork and game-plans. In their mistaken belief that what worked in the past will also work in the future, they continued to tell us legends about individual players practicing barefoot for whole nights in the moonlight with misshapen wooden sticks.

The Indian Hockey Federation (IHF) did not encourage practicing or even building Astroturf facilities. Moreover, instead of having the will to change, there seemed to be more of the will to blame. Fingers were pointed without any point made or scored. Even though still considered as a national sport, field hockey has failed to capture its own golden age essence and the glory seems to have been transferred to cricket.

From being a default player in every final of hockey, India is nowhere to be seen on the world’s hockey map today.

So what can be learnt from this sad tale of Indian hockey? Are the lessons same as those from the happy story of Brazilian soccer? Which story make the lesson more graphic and useful? Can businesses use any of this knowledge for the changing business landscape? What is changing in the business landscape that makes transformation necessary? Is there a better method for business transformations?

We will address these questions in the third and final blog in this series.

Related articles

What Business Executives Can Learn From The Story of Brazil’s Soccer Transformation

What Business Executives Can Learn From The Story of Brazil’s Soccer Transformation Hockey is a poor man’s game, says Balbir Singh Sr

Hockey is a poor man’s game, says Balbir Singh Sr

June 15, 2014

What Business Executives Can Learn From The Story of Brazil’s Soccer Transformation

In the early 90s, more than two decades since its last World Cup championship title, Brazil hungered for the trophy more than any other country on earth.

In the early 90s, more than two decades since its last World Cup championship title, Brazil hungered for the trophy more than any other country on earth.

Yet the scars from its 1950 campaign were still not totally erased. Dubbed as the saddest day in Brazilian soccer history, July 16 1950 was the day Brazil lost the championship to Uruguay right on their home soil, and the winner’s speech prepared for Brazil had to be scrapped.

At this point, you may be wondering what the Brazilian soccer story has to do with business. Surprisingly, the analogy can ring more bells than you think.

Brazilian soccer dilemma

Back to the 1990s, during the run-up to World Cup of 1994, coach Carlos Alberto Parreira was determined not to let history happen again. But, he only knew too well the magnitude of challenge faced by Brazilian National soccer team.

determined not to let history happen again. But, he only knew too well the magnitude of challenge faced by Brazilian National soccer team.

On one hand, the cheering of endeared crowds as soccer legend Pelé and his teammates lifted the World Cup trophy in 1970 still reverberated in his head. On the other hand, the grief-stricken silence of nationwide fans as they watched Uruguay took away their dream in 1950 was hauntingly real.

Somewhere in between the past and present, coach Parreira pondered upon the Brazilian samba-inspired way of playing soccer. In a country where every schoolboy dreamed of being Pelé, arguably the best soccer player in Brazil’s history and the most well-known on earth, it was hard to tell people to play differently. Brazilian children were always taught to play soccer with flair. They were enamored with the wizardry of foot play and dribbling, of playing soccer with very nimble dexterous patches of feet.

But the famous method of Pelé was not working anymore. The dry spell of World Cup titles despite fiery displays of skills between 1971 up till the early 90s stood as a daunting reminder.

What previous coaches did not realize was soccer had changed a lot on the global landscape since Brazil’s last creative zenith in 1970. As the sport became increasingly popular in Europe, people there started to practice their own soccer philosophy which seemed to counteract Brazil’s individualistic and improvisational style.

Germany, Italy and the Netherlands began to make their names more prominent in the World Cup finals. Soccer was played on Astroturf by powerful players and teams who played like network of players passing the ball rapidly to each other rather than keeping it to themselves. In other words, the network structural, defensive and strength-based style of European soccer had trounced the individual Brazilian wizardry.

The champion’s comeback

Coach Parreira knew the painful time had come for a total transformation. It was not as though Brazil had never had that spark of Europe’s tactical organization before. In fact, in the very last year of Pelé’s appearance in a World Cup, Brazil did adopt a compactness-based style where the team attacked in blocks with some cohesiveness between different sectors. The job of coach Parreira then was to ignite the will to change, even if it meant starting from the root.

While it was not possible to change the entire soccer mentality from 5-year-old children in time for the upcoming World Cup, he determined that he would have to change the selection practices. In fact, his idea was so humongous that it was almost equal to creating a holistic large-scale business transformation that most CEOs have to do at least once every three to five years in their businesses today.

While it was not possible to change the entire soccer mentality from 5-year-old children in time for the upcoming World Cup, he determined that he would have to change the selection practices. In fact, his idea was so humongous that it was almost equal to creating a holistic large-scale business transformation that most CEOs have to do at least once every three to five years in their businesses today.

Fortunately, in 1994, Brazil made it, they won their fourth World Cup champion title. Despite being rather flat and lacking in flamboyant, spectacular footwork, the functional Brazilian unit defeated Italy and marked its successful re-assertion as a formidable team. Under coach Parreira’s guidance the team was able to learn the new model of the game, putting behind the time when it seemed the entire future of South American soccer was in doldrums.

There is a lot to learn from this transformation feat of Brazilian and South American soccer. Their teams have moved from an individual-based game to a network of players moving together in formations, conquering the opponents by outwitting them, by outsmarting them, and by outnetworking them by using a better method.

There is a lot to learn from this transformation feat of Brazilian and South American soccer. Their teams have moved from an individual-based game to a network of players moving together in formations, conquering the opponents by outwitting them, by outsmarting them, and by outnetworking them by using a better method.

In the next blog in this series I will talk about another national team – in another sport – which never made the transformation. I am closely connected to that team and there is much to learn from them too – though it is not as happy story.

May 25, 2014

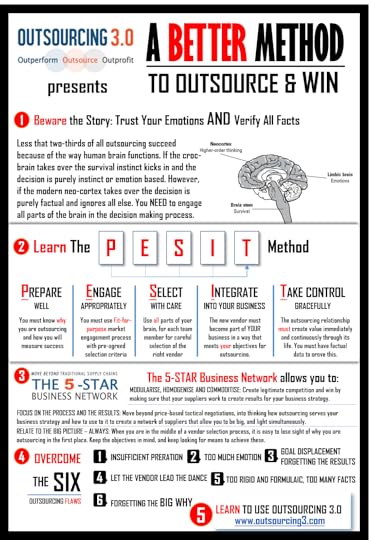

A Better Method to Outsource and Win

Beware the Story: Trust Your Emotions AND Verify All Facts

Less that two-thirds of all outsourcing succeed because of the way human brain functions. If the croc-brain takes over the survival instinct kicks in and the decision is purely instinct or emotion based. However, if the modern neo-cortex takes over the decision is purely factual and ignores all else. You NEED to engage all parts of the brain in the decision making process.

May 12, 2014

The Last Miles of Amazon

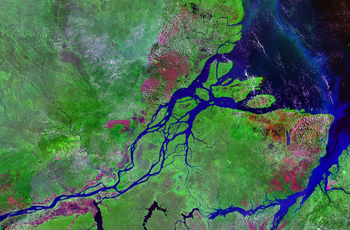

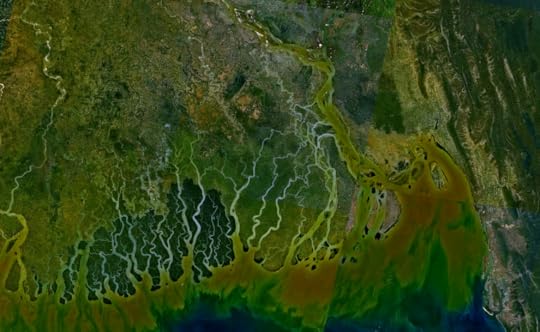

A false-color satellite photograph of the Amazon River in Brazil. (Photo credit: Wikipedia)

Rivers become amazingly complex in their last few miles. If you have not yet done that try and navigate the Amazon delta from the sea up the river – it is an enlightening experience. As a former ships master, I have had the privilege of navigating up a number of rivers – Ganges, Amazon, St Lawrence, Houston, Delaware, Hudson, Nile, Mississippi, and many others.

The complexity of the naturally evolved network of the rivers’ last miles must be seen to be believed. You can get lost for your entire life in the intricate network if you do not retain tight control over your perspective. Today, GPS would be a big help but even then you will need a good map and good navigation skills.

Here are a few pictures from google maps of the last miles of the rivers that I navigated:

The last mile of every network is almost always the most intricate, complex and difficult to navigate. Think of the human body. The 60,000 miles of blood vessels move blood from the heart to various organs and disperse into smaller veins as they go. To get to our fingertips, blood travels in the smallest blood vessels, capillaries, which are less than 1mm long each.

So you can imagine how sophisticated the network is and utmost caution is needed at all times. The same applies to businesses.

If you get it right – you will win. Amazon is in news for its attempts to set up the last mile services. This will put them in competition with FedEx and UPS in the territory they have owned for decades. Their core competence is delivery to the last miles. Will Amazon be able to outcompete them?

In Amazon’s arsenal is predictive shipping. At the beginning of this year, Amazon has received a patent for its “anticipatory shipping” technique. Possessing intimate knowledge of their customers, sometimes even more than the customers themselves, Amazon can control the entire end-to-end supply chain, they can create shops, they can change the entire e-commerce sphere.

The odds seem to be in their favour. They can hire and learn from UPS or FedEx. Infrastructure can be bought off the shelf. They also have very high quality self-developed software.

But the jury is still out. If they fail – they will lose their shirt.

The last mile of every network can bankrupt a company because of the sheer complexity, cost and customisation involved. Surely, you wouldn’t want to be in a situation where there was only $5,000 left in your company’s pocket. Not everyone would be as lucky as the founder of FedEx who gambled that amount and turned it into $32,000, just enough to save the company back in the 1970s.

For many others, bankruptcy was inevitable. Webvan filed for bankruptcy in 2001 for being over-optimistic about its “last mile” while the real issue lied in how to get customers to the first mile.

Good Amazon waited. Why? Because their strategies build on each other.

If Amazon succeeds, it will build a 5-STAR Business Network that will give it a substantial, lasting competitive advantage – over not only retailers, but also courier companies and distributors. At a later stage, once it has figured out its own network, it can outsource what is not considered necessary.

What will it outsource?

Practically everything except for customer facing interface. Because that gives it immense strength in the 5-STAR Business Network. Its ability to understand customers and make them the right offers. Fulfilment can be modularised and outsourced – but only once Amazon knows the best way to do it themselves.

Author: Vivek Sood

May 11, 2014

A valuable lesson – how to learn everything about everything

There I was sitting across the desk from the legendary fleet commodore of my company. As a junior officer I could sense the power of the man who had led some of the most daring, and most successful sea voyages of his time. And now he was an admiral of a desk.

There I was sitting across the desk from the legendary fleet commodore of my company. As a junior officer I could sense the power of the man who had led some of the most daring, and most successful sea voyages of his time. And now he was an admiral of a desk.

Yet, even the most senior sea masters and chief engineers trembled invisibly, at least once, if summoned into his office. He had a way of sizing up the people and quickly telling them exactly where they needed to focus.

As I sat across him, he asked “Lad, do you see this sign under my desk?” I glanced at the sign – neatly typewritten and carefully tucked under the glass covering his desk. I started reading it because it seemed interesting. It said:

“A captain is a man who starts knowing a little bit about a few things. As he gains experience, he learns less and less about more and more – till he comes to a point where he knows nothing about everything.

A chief engineer, on the other hand, also starts knowing a little bit about a few things. However, as he gains experience, he learns more and more about less and less – till he knows everything about nothing.”

It was an amusing sign, especially for a junior officer barely into 20s. I cracked a smile and looked at him with puzzled eyes. I was wondering why this serious man with hardly a minute to spare would show me such a frivolous thing.

In his thunderous voice, he asked me: “Which one are you, Lad?”

I answered: “It is obvious, I work on the deck side – so eventually I will become a captain.”

“So, you want to end up knowing nothing about everything?” he asked.

I replied: “Now that you put it this way – no, not really. I want to know about more and more things for sure, but I want also to make sure that I know enough about those things to be able to effectively use that knowledge.”

“Keep that answer in your mind as you gain experience – now you can go and join your ship.”

I wondered if he gave the same lesson to everyone. Then I remembered there were several other sayings taped on his desk.

In the next blog I will write about how to get everything for nothing.

Author: Vivek Sood

May 9, 2014

HOW SUPPLY CHAIN 3.0 CAN LEAD TO TANGIBLE BUSINESS BENEFITS (Part 6 of 6)

Following two benefits outlined in the previous entry, in this last entry of the blog series, let us go over the remaining benefits of Supply Chain 3.0.

Following two benefits outlined in the previous entry, in this last entry of the blog series, let us go over the remaining benefits of Supply Chain 3.0.

By definition, Supply Chain 3.0 improves your cash position

Recall from the previous blog series that “The second measure of interest to us is in Supply Chain 3.0 is the $eed-to-$tore Efficiency. I mentioned that this is the darling of the supply chain crowd especially those coming out of logistics background. Right product, in right place, in right quantity, at right time (there are many other Rs which people add on, but we will stay simple here) – is the catch phrase. The aim is to churn the cash faster so that more of it sticks around for longer.”

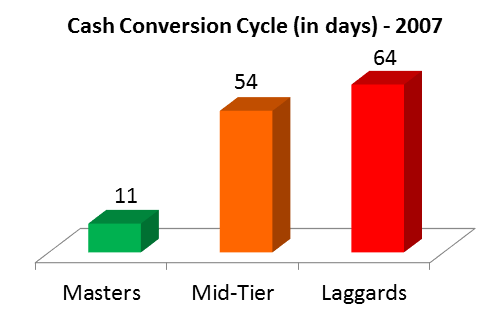

In fact, the data from a systematic study carried out by the Aberdeen Group reveals two critical insights. Firstly, the companies with more robust business networks have far superior cash conversion cycle – nearly 6 times better cash conversion cycle. Take a look at Figure 1 below:

Figure 1: Aberdeen Group, Working Capital Optimization, June 2007

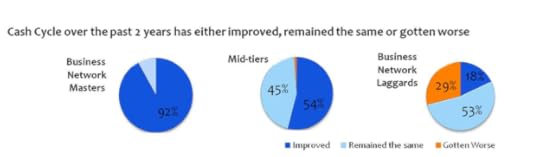

Secondly, and more importantly, their cash conversion cycle actually improved during the 2 years of testing times leading up to the global financial crisis, while the rest of the industry went backwards. As you can see in Figure 2, 92% of business network masters have improved their cash to cash cycle over the two years leading up to the Global Financial Crisis (GFC) while only 18% of business network laggards have improved it, while for 29% of them it became worse.

Figure 2

Is the result shown in figure 2 surprising? Hardly, if you reconsider the story of Nokia vs. Ericsson in the last blog entry. Same catastrophic fire nearly decimated one company while left the other one even stronger to later face onslaught of another supply chain 3.0 hero – that of iPhones.

Supply Chain 3.0 has high velocity

In economic booms, whether accompanied by economic volatility, or economic stability, supply chain 3.0 allows you to realise higher profits, quickly. In fact the potential of your company’s capabilities are multiplied many times over, perhaps by a factor of as much as 100 or more, by the leverage effect provided by your supply chain 3.0.

How?

Let us consider an example – the booming commodities industry. In the last 10 years to 2012, no other industry has boomed as much as the commodities industry. Prices of iron ore, copper, coal, gold etc. have gone up exceptionally during this period. Within this industry, iron ore is one of the largest and most capital intensive operations – dominated by three global giants BHP Billiton and Rio Tinto of Australia, and Vale of Brazil.

In this scenario, to build a large iron-ore producer and exporter from scratch took Andrew Forrest of Fortescue Metals the full extent of supply chain 3.0. To raise finances, to build mining infrastructure, to build and gain access to the logistics infrastructure and to market the product in the international commodities trade, Fortescue Metals built a capacity in 3 years that many of its much bigger rivals would have taken more than 30 years to build. This was only possible through extensive utilisation of business networks that the company built, nurtured and managed effectively into creating a supply chain 3.0.

Supply Chain 3.0 help smooth out the volatility

Recall my earlier example of companies using supply chain 3.0 to configure more flexible labour force through use of sub-contractors and outsourcing. In volatile times this is essential to smooth out the earnings.

Now let us look at a more concrete example, in a highly volatile industry. Global bulk shipping industry is one of the most volatile industries, with the shipping rates falling as much as 94% with a period of 4 weeks, or rising up to 400% with a period of few months. In such a volatile business environment, budgeting and planning can become a nerve-racking exercise for all the companies except those which use their supplier networks to cushion the lean periods with long term contracts and find scarce capacity during the boom periods.

We have only seen a few examples of benefits that supply chain 3.0 – a business network of collaborating entities – can create for businesses. I will discuss more examples and as well as how to get there in future blogs.

Author: Vivek Sood

Will Alibaba and its 40 million accomplices ride roughshod over Corporate America?

Now that all the factories have move to China (or some such places as Vietnam, Bangladesh, Taiwan), and all the customers have moved to the PC (or some such places as mobile phones or tablets) what will happen to all the middlemen? The retailers, the wholesalers, the shopping centres, the warehouse parks, the dealers, the brands, the long established cosy relationships, the long martini lunches, the twice weekly afternoon golf games and the executive chefs in the board rooms?

Now that all the factories have move to China (or some such places as Vietnam, Bangladesh, Taiwan), and all the customers have moved to the PC (or some such places as mobile phones or tablets) what will happen to all the middlemen? The retailers, the wholesalers, the shopping centres, the warehouse parks, the dealers, the brands, the long established cosy relationships, the long martini lunches, the twice weekly afternoon golf games and the executive chefs in the board rooms?

Many people are asking this question in many different ways. While the scenario above has not transpired, and, yet may never transpire in such a stark detail, many companies are starting to ask what if that happens.

Consider, for instance, all the happenings at Alibaba. The Chinese e-commerce giant went public in the US with an IPO that stirred the world at large and the online retailing world in particular. If you are wondering about the reason, then consider the numbers below.

As per Wall Street Journal

In 2013, the combined transaction volume of Taobao and another Alibaba-run shopping site called Tmall reached $240 billion, says a person with knowledge of the figure.

The total is more than double the size of Amazon.com Inc, triple the size of eBay and one-third larger than the value of all the transactions last year at the two U.S.-based e-commerce giants combined.

People stood up to take notice only when there were widely reported news reports that just in one day (the Chinese version of Black Friday), Alibaba achieved nearly $5.75 billion in sales (on just one of its website), which was three times more sales than the entire country of USA achieved on Black Friday.

Reportedly, almost the entire valuation of Yahoo is based on the value of the shares it holds in Alibaba.com. More such amazing facts are available from this report on Business Insider.

As per The Economist, analysts predict that the Alibaba IPO will value the company somewhere between $55 billion and more than $120 billion.

That would make it the most valuable 5-STAR Business Network on earth – with transactions reportedly surpassing $1 Trillion a year soon.

Lately, Alibaba has partnered with US company ShopRunner to bring American goods to China. It has also been active in “shopping” for lucrative relationships with retailers, buying shares instead of acquiring the whole business.

This is obviously only the beginning of its full potential – although B2B exchanges have been in the offing for nearly 15 years now. Many are warning that as B2B exchanges mature into adulthood, they could easily start to restructure the whole global supply chains.

No wonder the entire media world is going gaga over Alibaba’s prospects. Even those who recognise the hype cannot help but wonder if the sad state of retail is somehow connected to the seemingly unstoppable Alibaba force and the trend it heralds.

For example, one highly respected fellow blogger (Steven Dennis) recently stated in his blog,

As a former Sears senior executive I’ve followed the once mighty brand’s journey from mediocrity to bad to just plain sad. What a long strange trip it’s been.

When I left in late 2003 we were gaining traction in our core full-line department store business and piloting several important growth initiatives. To be fair, whether we could pull off the necessary transformation was highly questionable. But one thing is now certain. The subsequent actions taken under a decade of Eddie Lampert’s leadership have assured the retailer’s demise.

So, what will happen to the retailers, the shopping malls, the brands and the dealers? Will Alibaba, and its Chinese direct suppliers kill all these?

Not so fast! While e-commerce is changing the face of corporate America, there are many reasons Alibaba will not be as successful as projected by the alarmists.

Firstly, there is another company to think about – a home-grown version of it. A yet unknown part of Amazon is AmazonSupply. Predictive shipping and unmanned drones are made more prominent in the news agenda. Meanwhile, Amazon’s “unsexy” B2B business, a “$8 trillion bet”, has been growing silently in the background, perhaps making it eight times bigger than Alibaba and the biggest 5-STAR Business Network on earth.

AmazonSupply, a wholesale and distribution hub, started in 2005 and has grown to carry 2.2 million products, ranging from office equipment to industrial components, materials and more. After nearly 15 years of languishing on the wayside, the B2B exchanges are finally coming true, slowly.

Already, wholesalers are whispering about the threats from AmazonSupply; although many specialty wholesalers and distributors are somewhat confident that their turf is safe from the giant’s claws due to their highly segmented market.

Nonetheless, nobody knows what will happen in future. AmazonSupply, Alibaba, or B2B exchanges, could become so powerful that they will suck small players into their enormous vacuum of suppliers. The process can even accelerate if trust keeping mechanisms are built into B2B exchanges.

Seller and buyer ratings, as well as seller/buyer protection seen on sites such as eBay and PayPal are not enough to cover the sheer size of B2B transactions. Even the current rating system on Alibaba will not suffice, should this attractive market grow in the years to come.

The current trust keeping mechanism in international trade is Letter of Credits, which has been around for hundreds of years. It is defined by Investopedia as:

“A letter from a bank guaranteeing that a buyer’s payment to a seller will be received on time and for the correct amount. In the event that the buyer is unable to make payment on the purchase, the bank will be required to cover the full or remaining amount of the purchase.”

To keep up with the pace of change, new supply chain finance mechanisms must evolve, something that can deal with the increasingly globalised supply chains.

Only with sustained focus on supply chain finance, can B2B exchanges morph into true 5-STAR Business Networks. While traditional sources of supply chain finance have a vested interest in keeping the status quo, new supply chain finance mechanisms have been slow to emerge and remain an opportunity for the likes of Amazon, PayPal and Alibaba. If they crack that nut, the rest is open slather. Once these mechanisms break through, the face of global supply chains and global commerce will change for good.

May 8, 2014

HOW SUPPLY CHAIN 3.0 CAN LEAD TO TANGIBLE BUSINESS BENEFITS (Part 5 of 6)

As you can see, supply chain 3.0 is for everyone, small and big companies. Now let me demonstrate the concrete benefits of having supply chain 3.0 and I promise these are not dull or irrelevant stories.

As you can see, supply chain 3.0 is for everyone, small and big companies. Now let me demonstrate the concrete benefits of having supply chain 3.0 and I promise these are not dull or irrelevant stories.

Supply Chain 3.0 helps leverage your business infrastructure

Over the past several decades, both the global economy as well as the business structures have evolved dramatically to such an extent that now most businesses have no recourse but to strive and create business networks using unique custom designed supply chain 3.0.

Why?

Because no company – not even a company as big as Boeing – has all the resources necessary to create next generation products in shortening product development cycle times.

Faced with competition from A380s and the next generation Airbus planes, Boeing set out to reconfigure a business network of infrastructure to develop, design and build the 787s in record time. Despite the usual development hiccups – trials and tribulations – this drive towards supply chain 3.0 saved tremendous infrastructure costs for Boeing, and created goodwill around the world.

Supply Chain 3.0 helps create resilient and responsive businesses

In my book The 5-STAR Business Network I quote the incident that when the Tsunami flooded the eastern coastal stretch of Japan in March 2011, the ensuing nuclear disaster combined with the devastation caused by the tsunami to disrupt businesses around the world. Japanese economy sits right in the middle of the global business network and it was natural for businesses as diverse as auto manufacturing, electronics, chemicals, petroleum products, computers, metals to experience the disruptive shock.

For example, the price of the Toyota Prius went up by nearly $2,400 due to rumours of shortages. While it is natural for a variety of businesses to experience the disruption, it was remarkable to note that those businesses which had the most responsive and resilient supply chains were the ones to recover from this catastrophe the quickest.

Another stark example of the power of supply chain 3.0 is that of the fire which tipped the balance within an industry. Two stalwarts in the mobile phone industry in March 2000 were equally impacted by the same event – a lightening fire in the chip manufacturing plant of their common supplier, Philips, in New Mexico.

Both Nokia and Ericsson experienced the business disruption to an equal extent as a result. Fire damage to the stocks was extensive. More importantly, the manufacturing capacity was damaged and it was difficult to estimate the time for repairs. Nokia has invested months, if not years, in creating and perfecting a robust and responsive supply chain, while Ericsson’s supply chain was relatively a middle-of-the-line affair that worked well when things were good.

After the fire, Nokia was able to see the full impact of the chip shortage on its own business, as well as the entire industry with a lot more clarity than Ericsson, and even Philips. Moving quickly, it activated other parts of its supply chain to shore up supplies, to redesign some of the chips to manufacture them in other plants, and to take other pre-emptive steps. Ericsson let the situation evolve at its own pace and made decisions more reactively. The resulting gain in profitability and market share for Nokia, and the loss of these for Ericsson tipped the balance of the industry to an extent where within a few years Nokia pulled far ahead of the Ericsson which never caught up with its erstwhile equal rival.

Find out how Supply Chain 3.0 can improve your cash position, help you gain speed and smooth out volatility in the last blog entry of this series.

Author: Vivek Sood