Vivek Sood's Blog, page 48

January 11, 2015

Who is going to win the battle of Titans (Apple, Amazon & Google)

As everybody knows, three giants in the tech and software world have amassed an incomparable power in recent years from their networks and their strategies. With a vast range of products, they have stitched up the market amongst themselves. But what are the strengths and weaknesses of each giant?

What are the deep business and supply chain implications of the battle of these Titans?

Each one of them is a Business-to-Business Network in its own way with excellent partners and supply chain participants. Apple has its own ecosystem, which is not just their customers, but also thousands of programmers and app developers as well as millions of sellers on iTunes. That is Apple‘s biggest strength.

The same goes for Amazon, with an ecosystem including a very large customer base as well as thousands of sellers that sell their products on their website.

On the other hand, almost everybody uses Google as a search engine, which means they have the largest market share now in the mobile operating systems with Android. Google also owns YouTube and many other digital properties. Each one of them has a formidable Supply Chain, Business-to-Business Network or Supply Network in its own right.

Yet now, all three of them are facing problems in different ways.

Apple is facing problems because its success has always been based on creating the next big product, especially if you look at Apple’s history (iPod à iPhone à iPad). Now, Apple is launching the new Apple watch, which is not a very successful product in my mind. IPhone 6 is obviously just a minor update of the previous successful iPhone. That is where Apple is currently failing. However, they are creating some really innovative services such as Apple-Pay, which allows you to use your mobile as a NFC-based payment option, and Apple-SIM, which allows you to roam at a very low cost in foreign countries.

Apple continues to profit from past supply chain and product successes, and sits on top of huge pile of cash. Amazon, on the other hand, does not make much profit, although it has a very high growth rate of revenue (it grew by around $24 billion in two years) and still growing.

Source: http://time.com/money/3656571/apple-amazon-google/

But they invested in a number of things, which did not turn out that well. This type of experimentation is in the DNA of the company, and at the moment, it is not a big problem, at least not yet. Nonetheless, a couple of these investment, noted by analysts and commentators, have raised red flags in my mind. Amazon Fresh seems to be a resurrection of the business model of an failed company called Webvan, which invested $1 billion in this field and went bankrupt in two years.

Amazon also continues to invest in expanding its business in India, which is a very competitive environment. With local market players who know the local characteristics much better, and a chaotic marketplace, this is perhaps the most uncertain field for Amazon in my view. The competition may not even be from other B2C e-commerce companies; every man with a mobile phone and a bicycle is a potential competitor. Amazon persists in investing in these two markets.

This could be much more harmful to Amazon than their mobile phones or other hardware devices that they keep creating every few months. They are losing money on those but for a purpose: they are trying to lock customers into the Amazon Network. Nevertheless, these products will never replace iPhones/iPads or equivalent Samsung products and will always be number two in customers’ minds.

The question is: Where is Amazon’s next platform for growth?

Amazon’s “unsexy” B2B business, a “$8 trillion bet”, has been growing silently in the background, perhaps making it eight times bigger than Alibaba and the biggest 5-STAR Business Network on earth.

AmazonSupply, a wholesale and distribution hub, started in 2005 and has grown to carry 2.2 million products, ranging from office equipment to industrial components, materials and more. After nearly 15 years of languishing on the wayside, the B2B exchanges are finally coming true, slowly.

Already, wholesalers are whispering about the threats from AmazonSupply; although many specialty wholesalers and distributors are somewhat confident that their turf is safe from the giant’s claws due to their highly segmented market.

Nonetheless, AmazonSupply, Alibaba, or B2B exchanges, could become so powerful that they will suck small players into their enormous vacuum of suppliers. The process can even accelerate if trust keeping mechanisms are built into B2B exchanges.

Seller and buyer ratings, as well as seller/buyer protection seen on sites such as eBay and PayPal are not enough to cover the sheer size of B2B transactions. Even the current rating system on Alibaba will not suffice, should this attractive market grow in the years to come.

Looking at Google, basically revenues of advertisements relating to search engine are stagnating/saturating. Fake clicks are being identified much more easily. People are becoming more careful of what they are spending on online advertisements. Android and YouTube are two engines of growth for Google. Google has declared a strategy of continuing investment in its YouTube products

It is easy to argue that Apple has the best chance of leading the pack in 5 years’ time depending on what kind of new hardware they manage to create in the next 2-3 years. Google and Amazon are probably equal second depending on whether Amazon succeeds in its strategy to capture Business-to-Business markets or whether Google manages to monetise YouTube as much as they can.

Equally likely, new competitors might emerge on the horizon – like superUber! That will be very interesting to see.

=================================================================

ABOUT VIVEK SOOD:

ABOUT VIVEK SOOD:

Vivek is the Global Supply Chain Strategist and Author who works globally with large and mid-size corporations to FIX their Business-to-Business Networks in order to their multiply profits.

In that last 14 years he created several new breakthroughs in Supply Chain – including business transformations led by SCM 3.0. His more than 400 projects have spanned approximately 84 countries on five continents, with clients ranging from fortune 500 companies to innovative green technology companies.

Get free extracts of his books and see why thousands of executives at the world’s leading corporations trust Global Supply Chain Group to build brilliant business-to-business network strategy.

We are rapidly growing and hiring. Exceptional (world’s best) Outsourcing Experts, Logisticians, Strategists and Supply Chain should contact me directly.

Follow Vivek here and @GlobalSupplyCG

=================================================================

If you are a HR professional, recruitment or HR consultant – and you think your clients might benefit from these insights about business transformations – feel free to forward this blog series via email or linkedin. The nature of your industry is changing rapidly as a result of forces mentioned in this article.

The post Who is going to win the battle of Titans (Apple, Amazon & Google) appeared first on Global Supply Chain Group | Management And Strategy Consultants.

Coming re-alignment of the natural gas supply chains on a global scale

Traditionally, the natural gas market in Europe was served by Russia, while Asia got most of its natural gas from the Middle East. That is why prices of natural gas in Asia were much higher than anywhere else in the world (between $11 to $12 /m BTU).

Source: http://www.businessweek.com/articles/2014-11-06/u-dot-s-dot-natural-gas-exports-will-fire-up-in-2015 .

However, things are changing rapidly and the total supply chain on a global level for natural gas is realigning in front of our eyes right now.

Let us start with some very obvious developments and then connect the dots with other developments that are less so. Then let’s circle back and look at the supply chain implications of these developments on the downstream petro-chemical businesses.

Firstly, the sanctions against Russia are changing the landscape of natural gas supply in Europe. One of the side effects of these sanctions is that Europe will be granted its wish not to be dependent on Russia.

Secondly, a development which is equally well known is the abundance of natural gas in North America, especially in the United States. Fracking and shale gas have created a boom in USA where the prices of gas plummeted a few years ago to nearly 30%-40% of prices elsewhere, and have stayed depressed since.

Not too long ago, despite pleas from US manufacturers who use natural gas as the feedstock, the USA has granted permission to export natural gas. The first terminal in the USA is nearing completion at a place called Sabine Pass. Thus, they will start exporting by the end of 2015. It will be exporting a very large amount of natural gas to wherever the demand is. And guess where the demand will be?

It will be in Europe, because they want to stop buying from Russia (for the simple reasons listed above). “We’re going to represent 25 percent of the gas sold to Spain. We’re going to feed enough gas to England to heat 1.8 million homes.” Says Souky, CEO of Cheniere Energy Inc and Sabine Pass Liquefaction.

Source: http://www.businessweek.com/articles/2014-11-06/u-dot-s-dot-natural-gas-exports-will-fire-up-in-2015 .

Cheniere Sabine Pass LNG site - source: Wikipedia

Hence, Russia is starting to find a permanent market in China. They have already made a deal which lasts 30 years to sell natural gas for $400 billion.

Source: http://www.bbc.com/news/business-27503017 .

“The agreement, signed at a summit in Shanghai, is expected to deliver some 38 billion cubic metres of natural gas a year eastward to China’s burgeoning economy, starting around 2018.”

“But the financial details are a “commercial secret”, so we don’t know how much he had to give away to get it. Certainly China needs the gas to help it cut its coal-fired smog levels, and it wants to diversify supply. But it had the luxury of time in which to negotiate, something Mr Putin was short of.”

“The perceived motive for the deal is that Russia needs a second market for its gas, so it can face up to European sanctions. Given that the “Power of Siberia” pipeline won’t start pumping gas into Chinese factories until 2018 at the earliest, its economic effect on the European crisis will be limited.”

On the other hand, a new terminal and new export from Australia have come on line in Gladstone in Queensland at the cost of $60 billion.

“The first shipment of liquefied natural gas (LNG) has left Gladstone in Queensland bound for Asia.”

“It’s the culmination of several years of an intense activity on Curtis Island where three separate facilities, costing an estimated $60 billion, have been constructed.”

“Construction started on the Queensland Curtis LNG (QCLNG) project in 2010, the first in the world to turn coal seam gas (CSG) into transportable LNG.”

Source: http://www.abc.net.au/news/2015-01-06/firstlngfromcsgshipleavesqueensland/6002446

They can start their first export today, right now going to Asia. But, as the natural gas demand in Europe expands and the natural gas prices in Europe and Asia are starting to equalize, Australia’s gas can be also sent to Europe.

In the end, what will happen?

The natural gas prices around the world will start equalizing. Right now there is a huge unbalance. In the USA, the price is only about $4 / m BTU whereas in Asia, it is around $11 to $12 / m BTU and Europe about $9 / m BTU.

Source: http://www.businessweek.com/articles/2014-11-06/u-dot-s-dot-natural-gas-exports-will-fire-up-in-2015 .

As the new Supply Chains realign themselves, prices in the three nations should stabilize and equalize. At the same time, the US will become the major exporter of natural gas for the first time in its history and Europe will be the biggest importer of the US. It will bring North America and Europe closer together because of energy dependencies in the same way it will cement Russia and Asia’s relationship in the future.

Today, Australia is aligned with Asia but they could eventually align with both Europe and Asia in the future.

Besides the obvious geo-political readjustments based on energy market realignment what else will change as a result?

The biggest implication is for the downstream petro-chemical and manufacturing businesses. A diverse range of industries such as plastics, polypropylene, resins, chemical fertilizers, industrial explosives, shipping, and a constellation of associated supply networks will have to totally re-think their global supply chain strategies in the coming 1-3 years simply because all the old assumptions in these industries will eventually be thrown out of the window. The supply of gas and availability of ships will again, drive the manufacturing footprints in these industries. Plants are not difficult to dismantle and move, though the overall costs can be a big factor in manufacturing footprint redesign.

===================================================================================

ABOUT VIVEK SOOD:

ABOUT VIVEK SOOD:

Vivek is the Global Supply Chain Strategist and Author who works globally with large and mid-size corporations to FIX their Business-to-Business Networks in order to their multiply profits.

In that last 14 years he created several new breakthroughs in Supply Chain – including business transformations led by SCM 3.0. His more than 400 projects have spanned approximately 84 countries on five continents, with clients ranging from fortune 500 companies to innovative green technology companies.

Get free extracts of his books and see why thousands of executives at the world’s leading corporations trust Global Supply Chain Group to build brilliant business-to-business network strategy.

We are rapidly growing and hiring. Exceptional (world’s best) Outsourcing Experts, Logisticians, Strategists and Supply Chain should contact me directly.

Follow Vivek here and @GlobalSupplyCG

===================================================================================

If you are a HR professional, recruitment or HR consultant – and you think your clients might benefit from these insights about business transformations – feel free to forward this blog series via email or linkedin. The nature of your industry is changing rapidly as a result of forces mentioned in this article.

The post Coming re-alignment of the natural gas supply chains on a global scale appeared first on Global Supply Chain Group | Management And Strategy Consultants.

January 7, 2015

How Google is Looking to Change the Corporate World in 2015, Again

By Vivek Sood

The Corporate World in 2015

Changing Business Models – Push television/video to YouTube:

Videos ad revenues from YouTube in the US would hit $1.13 billion by the end of 2014. In 2015, Google is making a huge change in the way it has been promoting YouTube: they are going to put significantly higher focus on it.

(Source: http://www.cnet.com/au/news/4-things-to-expect-from-google-in-2015)

Why Google is making this move? Let us unpack Google’s strategy.

Google’s traditional advertising revenue from SEO is starting to stagnate. Among the explanations, one is all robotics clicks are starting to disappear because Marketing Managers have begun to understand that not all clicks are from interested costumers. So they are questioning more and more: Are the clicks they are paying for actually leading to customer purchase or not?

Google’s traditional business is under threat from those who are more in touch with the changing SEO landscape, and are now starting to demand value for money.

At the same time, Market penetration of Search Engines is saturating. Thus, the growth in their market is not as high as it was in the last decade. Google has to search for new revenues of growth and YouTube is one of those new revenues.

YouTube is a growing business. Why? Because an average American, European or Australian still watches numbers of hours every week on televisions and Google is capable of facilitating high quality contents available on demand on any screen at anytime.

Transitioning consumers from cable television or Free-to-air television to online YouTube consumption will have huge implications for the business models of traditional television, as well as Marketing and advertising companies.

Big budget TV advertising will start to diminish. Most of the YouTube’s ads can be produced on much smaller budgets. Because of the fact that customers can be very highly profiled on Google/YouTube, using Google Analytics, one big ad can be replaced by a multiple of highly targeted storyboards speaking directly to each of the niche segments. Typically big advertising agencies are not very good at speaking to the small niches.

That means a number of small advertising companies who are good at low budget niche advertising will crop up. These companies maybe eventually be acquired by large advertising companies, under one umbrella, but they need to have reasonable amount of autonomy and independence to operate on small budgets and retain their key characteristics.

The CEOs and Executives need to know this: their entire world of Sales & Marketing is going to change in the next five years due to the breakdown of the traditional television and advertising model .

The public should know that more and more relevant and highly targeted programs will be available on YouTube, in paid and free formats. On-demand will become the norm: when you want it, where you want it, how you want it, big screens, small screens, tablets, and smartphones.

This change will also have implications for recorders like TiVos and PVRs – people will stop using those, or use less and less of personal video recorders. So if you are thinking of buying one those things, hold off because the price is going to fall!

The post How Google is Looking to Change the Corporate World in 2015, Again appeared first on Global Supply Chain Group | Management And Strategy Consultants.

January 1, 2015

Understanding and Using Resistance – in Business Transformations Using SCM 3.0

ລາວ: ການຈັດການຕ້ອງເຮັດໃຫ້ດີ (Photo credit: Wikipedia)

19 years ago, when studying for MBA, our Professor in Change Management, Dexter Dunphy told us that Change Management is nothing but management of downside. I understood that his point was every change has a downside – and as a change manager, the most important job you have to do is to understand the downside of the change being proposed, and manage it well enough. When I became a management consultant with a top-tier strategy house after my MBA, I took his dictum to heart, and it served me well through several change management projects. Those who were most affected by change appreciated the fact that the change was managed in a sensitive and caring manner – rather than imposed abruptly.

Auroville boutique (Photo credit: Wikipedia)

After a few years, when we started our current boutique consulting house, I started to notice another pattern. This was that many companies could accelerate their change management by skipping one entire generation of Supply Chain Management (SCM) in their efforts to make their businesses more modern. In other words, change management would entail moving from SCM 0.0 to SCM 1.0 or from SCM 1.0 to SCM 2.0 or from SCM 2.0 to SCM 3.0. On the other hand, many companies would want to take up an accelerated path – jumping 2 steps at a time – e.g. SCM 0.0 to SCM 2.0 or from SCM 1.0 to SCM 3.0. This enabled them to frequently leapfrog their competitors, and transform their businesses rapidly and systematically. This was nothing different from many companies skipping a generation of Microsoft Windows when they upgraded their operating systems – for example skipping Windows Vista and jumping from Windows XP to Windows 7.0. The reasons were different, yet the methods were similar.

While change management entailed managing the downside for those who were affected by change, business transformation was more about understanding and managing resistance. By now, downside management has already become a big enough industry – just look at the number of large outplacement consulting houses, HR consultancies, and the booming business they do through the ups and downs of business cycles.

Business Transformations will lead to a second boom in these. If a business keeps up with the SCM evolution and moves with it, there will be a greater need for leadership training, corporate cultural adjustment, collaboration training and less outplacement and redundancies.

And, there will be a need for understanding, managing and using resistance to further business transformation.

What is the nature of resistance? What is the reason? How to identify 4 different types of resistance? How to use resistance to accelerate positive business transformations? That will be the topic of my next blog.

Related articles

The Joy of Windows Updates

The Joy of Windows Updates New Monetization Models, Credit Suisse Technology, Officer Kevin Turner, And Business Model

New Monetization Models, Credit Suisse Technology, Officer Kevin Turner, And Business ModelThe post Understanding and Using Resistance – in Business Transformations Using SCM 3.0 appeared first on Global Supply Chain Group | Management And Strategy Consultants.

Understanding and Using Resistance – in Business Transformations

ລາວ: ການຈັດການຕ້ອງເຮັດໃຫ້ດີ (Photo credit: Wikipedia)

19 years ago, when studying for MBA, our Professor in Change Management, Dexter Dunphy told us that Change Management is nothing but management of downside. I understood that his point was every change has a downside – and as a change manager, the most important job you have to do is to understand the downside of the change being proposed, and manage it well enough. When I became a management consultant with a top-tier strategy house after the MBA, I took his dictum to heart, and it served me well through several change management projects. Those who were most affected by change appreciated the fact that the change was managed in a sensitive and caring manner – rather than imposed abruptly.

Auroville boutique (Photo credit: Wikipedia)

After few years, when we started our current boutique consulting house, I started to notice another pattern. This was that many companies could accelerate their change management by skipping one entire generation of Supply Chain Management (SCM) in their efforts to make their businesses more modern. In other words which change management would entail moving from SCM 0.0 to SCM 1.0 or from SCM 1.0 to SCM 2.0 or from SCM 2.0 to SCM 3.0. On the other hand, many companies would want to down up an accelerated path – jumping 2 steps at a time – e.g. SCM 0.0 to SCM 2.0 or from SCM 1.0 to SCM 3.0. This enabled them to frequently leapfrog their competitors, and transform their businesses rapidly and systematically. This was nothing different than many companies skipping a generation of Microsoft Windows when they upgrade their operating systems – for example skipping Windows Vista and jumping from Windows XP to Windows 7.0. The reasons were different, yet the methods were similar.

While change management entailed managing the downside for those who were affected by change, business transformation was more about understanding and managing the resistance. By now, downside management for the personnel affected by change has already become a big enough industry – just look at the number of large outplacement consulting houses, HR consultancies, and the booming business they do through the ups and downs of the business cycles.

Business Transformations will lead to a second boom in these. If a business keeps up with the SCM evolution and moves with it, there will be more need for leadership training, corporate cultural adjustment, collaboration training and less need for outplacement and redundancies.

And, there will be need for understanding, managing and using resistance to further the business transformation.

What is the nature of resistance? What is the reason? How to identify 4 different types of resistance? How to use resistance to accelerate positive business transformations? That will be the topic of my next blog.

Related articles

The Joy of Windows Updates

The Joy of Windows Updates New Monetization Models, Credit Suisse Technology, Officer Kevin Turner, And Business Model

New Monetization Models, Credit Suisse Technology, Officer Kevin Turner, And Business ModelThe post Understanding and Using Resistance – in Business Transformations appeared first on Global Supply Chain Group | Management And Strategy Consultants.

December 31, 2014

HAPPY NEW YEAR – 2015

The post HAPPY NEW YEAR – 2015 appeared first on Global Supply Chain Group | Management And Strategy Consultants.

December 8, 2014

How do you get a successful supply chain?

Supply Chain Maturity differs at each stage

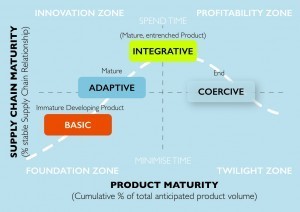

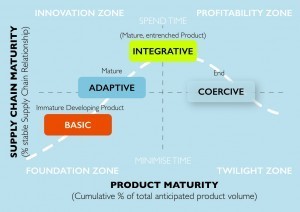

In fact, our supply-chain maturity model shown in figure 8.2 describes four stages of supply-chain, where each stage of product life-cycle is paralleled by a maturity stage of supply chain. As figure 8.2 below shows, there are four relevant zones of operations determined by two key factors on product maturity and supply chain maturity. Zone 1 is the foundation zone in which both the product and the supply chain are quite immature.

Figure 8.2: Supply chain marity model (Source: Baddock and Sood)

As the name implies, in this zone the foundation for the future business is being laid. The next zone on the top left quarter of the matrix – the Innovation zone – implies a relatively mature supply chain, but a developing product. As the name suggests, this is the zone where both product and process innovations are rapidly taking place. The profitability zone on the top right quadrant is where both the product and the supply chains are relatively mature and while incremental innovation might be still possible. This zone is primarily focused on enhanced profitability. Finally, the twilight zone on the bottom right corner is when the product is reaching the end of its profitable life cycle and the supply chain becomes brittle.

Profitability Zone and Innovation Zone are the two most productive zones

Needless to say the more time spent in the profitability zone the more a company can reap rewards of its efforts. However, to maintain fresh product lines, to constantly stay on cutting edge and to retain long term leadership, companies will have to also spend some time in the innovation zone. Intuitively, companies want to spend time in the top two quadrants and minimize their time in the bottom two quadrants. In fact, overlapped on the four zones is a typical supply chain maturity cycle we observe. We will discuss this conundrum in more detail in Chapter 11 where we observe the Advanced Product Phasing strategies of the 5-STAR Network businesses.

TABLE 8.1 – Supply Chain Maturity Model

Initially, in the introductory stage of the product life-cycle, the supply chain is still very basic. In this improvisational stage of supply-chain, the key focus of supply-chain team is to really just gather enough material somehow, from somewhere, to make the product or to keep the research and development team supplied with raw material. They are not doing any advanced planning at this stage. They are not even aware of all the raw materials or all the parts, which will be required for making this product. Bill of Materials may not exist or, if it does, it is incomplete. There is no supply-chain planning mechanism besides this Bill of Material. There is no supply-chain control mechanism either. Even a budget does not yet exist, or it might be just a very rudimentary budget. At this stage of supply-chain maturity, the companies are not worried about its efficiency at all. There is no supply-chain collaboration with its partners for this simple reason: we don’t even know who they will be.

Figure 8.3: Basic/Improvised Supply Chain

To read more get the book on http://5starbusinessnetwork.com/ or download 3 free chapters.

Vivek Sood is the world’s foremost authority on Global Supply Chains which are the commercial engines sitting deep within modern economies and driving them. He is a Chartered Financial Analyst (CFA), and has done courses from Harvard, MIT, and University of London. As the Managing Director of Global Supply Chain Group, he works as a consultant to CEOs and boards of directors of large global corporations, and helps them multiply profits by using the full power of global supply networks. He is also the author of “The 5-STAR Business Network”.

The post How do you get a successful supply chain? appeared first on Global Supply Chain Group | Management And Strategy Consultants.

How do you get a successful Supply Chain?

Supply Chain Maturity differs at each stage

In fact, our supply-chain maturity model shown in figure 8.2 describes four stages of supply-chain, where each stage of product life-cycle is paralleled by a maturity stage of supply chain. As figure 8.2 below shows, there are four relevant zones of operations determined by two key factors on product maturity and supply chain maturity. Zone 1 is the foundation zone in which both the product and the supply chain are quite immature.

Figure 8.2: Supply chain marity model (Source: Baddock and Sood)

As the name implies, in this zone the foundation for the future business is being laid. The next zone on the top left quarter of the matrix – the Innovation zone – implies a relatively mature supply chain, but a developing product. As the name suggests, this is the zone where both product and process innovations are rapidly taking place. The profitability zone on the top right quadrant is where both the product and the supply chains are relatively mature and while incremental innovation might be still possible. This zone is primarily focused on enhanced profitability. Finally, the twilight zone on the bottom right corner is when the product is reaching the end of its profitable life cycle and the supply chain becomes brittle.

Profitability Zone and Innovation Zone are the two most productive zones

Needless to say the more (…)

For a successful Supply Chain, read more on http://5starbusinessnetwork.com/

The post How do you get a successful Supply Chain? appeared first on Global Supply Chain Group | Management And Strategy Consultants.

November 26, 2014

Five Key Cornerstones of The 5-STAR Business Network

So what are these 5 key cornerstones of the super networked businesses that lead to these networks being called the 5-STAR Business Networks? As an aid to memory, I have given them mnemonic names in order, shown below (see the complete structure in the book):

Before talking about each of the five cornerstones, it must be pointed out that innovation, efficiency, optimisation, product phasing or outsourcing are not new paradigms. For example, a study of human civilisation is a study in innovation. Similarly, the Industrial Revolution of the early 20th century primarily focused on increased efficiencies using time and motion studies designed by Taylor and his followers. 5 STAR Business Networks enable businesses to do these regular activities in a much better manner than would have been possible otherwise. As we will see with the help of several examples and cases studies, aided by technologies, an open collaborative mindset and a focus on the bottom line, these businesses are achieving better results through superior methods.

Before talking about each of the five cornerstones, it must be pointed out that innovation, efficiency, optimisation, product phasing or outsourcing are not new paradigms. For example, a study of human civilisation is a study in innovation. Similarly, the Industrial Revolution of the early 20th century primarily focused on increased efficiencies using time and motion studies designed by Taylor and his followers. 5 STAR Business Networks enable businesses to do these regular activities in a much better manner than would have been possible otherwise. As we will see with the help of several examples and cases studies, aided by technologies, an open collaborative mindset and a focus on the bottom line, these businesses are achieving better results through superior methods.

We will examine each of these five cornerstones of the 5 STAR Business Network in great detail in the following five chapters (e.g. in the book). In this article, we will use an example of one company that is positioning itself as the super networked business of this century by using all five of these very astutely.

Amazon is a successful example of an emerging Global Business Network

The 5 STAR Business Network

(see the complete structure in the book)

When Amazon was founded in 1994, it was but one of the hundreds or thousands of businesses aspiring to make it big on the Internet. Just like all its peers, initially the markets and analysts were starry-eyed about Amazon’s success, and later, when the dot-com bubble burst, and the trend reversed, few people gave it much chance of success. Yet it defied the naysayers and continued to sell at PE ratios exceeding 100 on the stock markets.

What is the secret of Amazon’s success? What allowed Jeff Bezos to build the largest online retailer in the world, where customers can acquire anything that they desire over the Internet?

Admittedly, the company started with a first-moved advantage in its segment: books. Amazon was one of the first major companies to sell books online. The business was founded in 1994 and by 1995 the website was launched. Initially, the company was exclusively an online bookstore. However, it transformed to sell millions of products to a large and valuable consumer base. Today, the company sells everything from electronics to clothing, furniture and even food.

If you had to ask this simple question to 100 people – “Who on earth today is the world’s most customer-centric corporation?” Amazon would figure very high on the list. Amazon has achieved low prices, a wide inventory selection, convenience, and truly gives customers what they want. As a result, Amazon has evolved into a Fortune 500 business and continues to grow as a world-class electronic commerce platform.

The company grew its annual revenue from US $19 billion in 2008 to US $24.5 billion in 2009 to US $48 Billion in 2011, all the while continuing to invest in future businesses and maintaining a healthy cash flow. How does it do this? In an article in Forbes (April 2012) Jeff Bezos offers some tantalizing clues. Bezo’s main message is to base his strategy on things that will not change.

For Amazon, their purpose is simple: offer wider selection, lower prices and quick, dependable delivery. Another significant lesson Bezos reveals is obsessing over customers. Amazon starts with the customer and subsequently works its process backwards. The company even designates specific roles performed by trained employees known as customer experience bar raisers. This is one topic that Bezos takes exceedingly serious. But, to some extent, every corner store does these things just as well. Why, then, is that would a corner store owner be lucky to grow his lowly sales by a couple of percentage points, while Amazon grew its sales to $48 billion from $24 billion in just 3 years.

Amazon achieves high marks on all five key cornerstones of success of Global Business Networks

Let us take a more in-depth look behind the curtains. Jeff Bezos, on the record, said that you have to be willing to be misunderstood for long periods of time. While several of Amazon’s designs look like a bust at first, if the new idea makes strategic sense to him, Bezos goes for it knowing full well that people will initially misconstrue the design. In general, this is what innovation is – people are going to misunderstand it because it is new.

Overall, the business philosophy is rather simple: make online shopping simple and suitable so that the customer does not think twice about buying instantly with one click (Anders, George. “Jeff Bezos’s Top 10 Leadership Lessons.” Forbes. 4 Apr. 2012). The complexity lies in how this simple business philosophy is translated into consistent action, resulting in nearly a billion customer visits a year. There is nothing simple in the complex execution of this simple business philosophy.

Therein lies the dilemma of the modern business world – the quest for simplicity at the highest level, underpinned by the highest level of sophistication reminiscent of Nano-technology under the hood. Almost all successful businesses do this dance of 5-STAR business network well, but Amazon does it exceptionally well on almost all 5 fronts. There are many other businesses – well-known ones – that could be a poster child for the emerging trend of global business networks we showcase in the book “The 5-Star Business Network”. However, no one is more successful, more visible, has higher potential and is more assured of its role in this revolution. That is why Amazon is a prime example of the 5 STAR Business Networks, demonstrating FAR Innovation, $t$ Efficiency, TOP, APP, and lastly, ROM.

Read more on the book “The 5-Star Business Network”, written by Vivek Sood

The post Five Key Cornerstones of The 5-STAR Business Network appeared first on Global Supply Chain Group | Management And Strategy Consultants.

November 24, 2014

Super Networked Businesses

Super Networked Businesses

Extract from the book “The 5-Star Business Network”, written by Vivek Sood

I was shocked when I heard of the bankruptcy of Hostess Brands Inc. The $2.5 billion maker of Twinkies and Wonder Bread had about 33 plants, 565 distribution centers and 570 bakery outlet stores across the United States. I have no doubt tons of e-ink will be spilt on dissecting the saga and pinning the blame on the unions, management, workers, and government. However, from my perspective, the business model of the company was passé long time ago. In this article, we contrast the Hostess Brands business model with that of the top-rung players in the food industry – the so-called ABCD: Archer Daniels, Bunge, Cargill and Dreyfuss. Even you skim parts the book “The 5-Star Business Network”, I urge you to read carefully, think and use the material in this article because it could make the difference between your company becoming the Hostess of your industry, or one of the ABCDs.

Business Model has changed and most people are yet to understand the profound change

It is a well-known aphorism in the circles of architecture that the form follows function. In other words, the structure of a particular unit evolves to facilitate the functioning of that unit. If the form does not match the function, the structure or the function eventually changes.

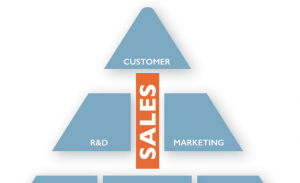

While researching the book, we examined the organization structure of more than 50 companies, almost all of them looked like variations of the generic structure given in the figure below (see the complete structure in the book)

Traditional Organisation Structure

Titles and structure in organisational structure vary enormously. However, most companies agree this is the best way to look at how they are organised to serve their customers’ needs.

At the same time, most of these companies evolved at least two decades ago so their functioning has become almost entirely customer-centric, with their customers’ priorities driving most of the business workings.

In our work with corporations, we have often found the supply network structure frequently results in limiting the effectiveness of the organisation. The traditional structure of the organisation shown above frequently stifles customer responsiveness and innovation. In the modern outsourced globalised world, a traditional structure with strict hierarchies and internal walls between departments is a hindrance, rather than an aid for achieving success in business.

In today’s hypercompetitive world of consumer electronics, Apple is a standout among peers as great as Sony, Samsung, Panasonic, Motorola, Nokia and Dell. With convergence, all of these companies are vying for their share of the consumer’s wallet with increasingly similar products doing similar things. What did Apple do that its market value now surpasses Microsoft’s? How did it manage to get over the entrenched competitive advantage of companies such as Sony, Motorola or Nokia?

Your organization chart is the wrong model for your business

Our work in global supply network strategies and supply network design has convinced us that a modern distributed organisation needs to look at redesigning its explicit structure to keep up with the realities of the business world, which has changed tremendously in the last 20 years. A typical supply chain now runs seamlessly across multiple continents, through boundaries of several organisations, to finally serve a customer with a unique product. To do so, organisations have created de facto structures, which are far different from the traditional structures that they have put in their organisation charts.

The purists might argue that this discussion does not really matter if organisations are already acting in accordance with a de facto structure – an argument which holds some merit. However, people who make up an organisation respond to the explicitly shown structure (see the complete structure in the book) with much more enthusiasm and clarity that to a defacto or mutually understood structure. I believe that organisations should formalise their defacto structures and use them to gain further competitive advantage. For this purpose we have created the following model (see the complete structure in the book)

Customer Centric Organisation Structure

Read more on “The 5-Star Business Network”, written by Vivek Sood

The post Super Networked Businesses appeared first on Global Supply Chain Group | Management And Strategy Consultants.