Vivek Sood's Blog, page 55

February 11, 2014

Why This Management Consultant Needs Your Advice on Outsourced Marketing?

By: Vivek Sood, Managing Director – Global Supply Chain Group

I was in a hard bind. I just came out of a meeting with a highly polished marketing professional, who was pitching to our company for outsourced marketing work. She had correctly diagnosed that similar to many small companies, ours did not have any real marketing capability. Most of our sales came from word-of-mouth and repeat customers. We are so good at our work that the quality of our work draws in more work. But, therein also lies the conundrum.

I was in a hard bind. I just came out of a meeting with a highly polished marketing professional, who was pitching to our company for outsourced marketing work. She had correctly diagnosed that similar to many small companies, ours did not have any real marketing capability. Most of our sales came from word-of-mouth and repeat customers. We are so good at our work that the quality of our work draws in more work. But, therein also lies the conundrum.

Whenever we come up against the big brands in top-tier strategy consulting firms, most people have never heard of our company, and hence they are reluctant to award the contract to us. And, rightly so. After all trust is the basis of all action, more so when a company chooses its strategic advisor. We try and combat the brand unawareness through providing testimonials from CEOs who have used our service in the past, and give examples of the results from our past projects. However, the extra due diligence puts strain on many people looking to make a quick decision.

We have recognized the need for at least some marketing as our business grows. However, most of it has been ad-hoc efforts of amateurs, with the help of  some junior designers. Mind you, we are very good at what we principally do – which is helping companies multiply their profits using the full power of their global supply networks. But, none of us has the marketing flair, experience or down on the ground knowledge of how it is done in a day-to-day manner.

some junior designers. Mind you, we are very good at what we principally do – which is helping companies multiply their profits using the full power of their global supply networks. But, none of us has the marketing flair, experience or down on the ground knowledge of how it is done in a day-to-day manner.

For example, this lady who was pitching for outsourced marketing work took one look at the cover of my latest book and exclaimed ‘that is so 90s that it will never fly off the shelves’. Before meeting her, I thought it was perfect! But suddenly, I could see her point of view and the cover did start to look staid and stolid. I think that comment probably applied to all the marketing material we had.

On reflection, I can now genuinely resonate with the quote “If you think it’s expensive to hire a professional, wait until you hire an amateur.”

We ask our clients and potential clients to trust us as the guides and coaches on their supply chain transformation projects because our people have led more than 400 of these large scale projects in every conceivable situation, and all with great results. Yet, when it came to marketing our own business, it never occurred to me to go out and look for people who have an equally impressive track record in marketing.

For the last 14 years, I have been making the classic mistake that I see a lot of our clients making – persisting by ad-hoc means and sheer will power to win in a field where our own capabilities were never going to be world class. It would have been far savvier to admit this lack of capability and find a way to bring it into our company.

However, the decision was not that simple either. Otherwise, I would not be up at 5 am writing this blog piece to document my thoughts. There were several complicating factors. First was that while the lady I spoke to was obviously very good at marketing her company, I did not know what real capabilities lie behind the façade. I was unsure how much personal time she would be able to devote to our business once we had engaged their company, and did not want to be in a situation where we were dealing mainly with a sub-ordinate who was not as good as her in marketing. After all, in our business, the person who sells the job is also responsible for delivering it. In this way, no  false promises are made in the sales process and nothing is lost in translation between the sales team and the delivery team.

false promises are made in the sales process and nothing is lost in translation between the sales team and the delivery team.

Secondly, their rates were quite high – almost comparable to what we charge our clients. But our clients being large companies can not only afford these, but also get a way bigger business impact for their expenditure. In our case, the worst scenario is our full quarter’s profits could be easily wiped out simply by spending on marketing and design projects that yielded no tangible benefits on the sales. Of course, we would be carefully managing the process, but it would certainly put in place an unnecessary tense situation which does not exist at the moment.

The third question was how we square this with our current team of amateur marketers, designers and other sundry bunch of free-lancers who all are genuinely doing their best, and yet falling short of world class. I do not see them as responsible for the current muddle we are in, that is my own responsibility. After all I created that team, and I was responsible for setting the benchmarks. My own ignorance of what constitutes world class in marketing cannot be their mistake. So, I feel responsible for taking as many of them as we can on this transformation journey so that they also upgrade their skills and thinking, while we revamp our marketing portfolio.

Last, but not the least, all this marketing effort might distract us from our core business of serving clients to our best possible capabilities. This could become especially a problem if the tensions listed in second complication surface where their firm is looking to expand their revenues while we are managing our costs carefully. After all someone famously said ‘about half of my marketing dollars are wasted, I just don’t know which ones’. Being a lifelong operational person, I am not used to wasting a single cent!

So, what should I do?

Here is my proposed course of action:

Collect more data – ask the company for clarifying information on the four points above. In fact, I will send the lady this blog itself so that she can fully picture our decision making process.

Collect more expert opinions – request people who are in a position to comment to share their own experiences in similar situations.

Analyse the data and reflect on the expert opinions.

Try and create appropriate measurable metrics to gauge ROI

Put in place appropriate ‘checks’ to manage the engagement

With this in mind, if you are one of those people in a position to share your experience with marketing investments, please do. No doubt, what goes around, comes around.

February 6, 2014

McDonald’s myth-buster video goes viral – rise of social engagement using supply chain transparency

By Vivek Sood

The global fast food franchise has recently released a video showing how McNuggets are made to curb rumours about nasty ingredients. In the clip, supply chain manager Nicoletta Stefou from McDonald’s Canada headquarters walks the audience through the process, with particular emphasis on how “pink goop” is never part of the production line.

McDonald Social Engagement – Supply Chain Transparency

As an attempt to debunk the long held myth of “McNuggetification”, the video was also aired during this week’s Super Bowl on Canadian TV. Since the mysterious pink substance namely “pink goop” appeared on the Internet around 4 years ago, McDonald’s has come under attack from sceptical consumers, health advocates and food bloggers.

“We don’t know what it is or where it came from, but it has nothing to do with our chicken McNuggets”, Nicoletta Stefou said.

Pink goop refers to “lean finely textured beef”, which contains inedible meat trimmings. According to McDonald’s official ingredient list for its McNuggets, the item is made from chicken breast, water, modified corn starch, salt, seasoning, and natural rosemary extract.

Vivek Sood, CEO of Global Supply Chain Group, said: “This story stems from McDonald’s decision to reply to a customer’s question about the “pink goop” rumour, which can be seen as a triumph in terms of corporate social engagement.

While we already saw a similar attempt in 2008, it is hard to ignore McDonald’s recent move with factors such as: the inclusion of the company’s supply chain executive, the Super Bowl timing, the reference to the ingredient list and so on.”

In 2013, ABC News (US) was sued for defamation by Beef Products Inc, makers of “lean finely textured beef” in a lawsuit that ran up to US$1.2 billion. McDonald’s intended to use the transparency card to distance itself from all the noise.

Chief Executive Officer Don Thompson said in October 2013: “Customers want to hear more about transparency. They want to hear about provenance and where the food is from.”

With the “Your questions” section on the official website, McDonald’s is serious about improving consumer perception of its food. Earlier this year, the company also announced the plan to stay committed to “sustainable beef.”

“Quite clearly, McDonald’s wants to build trust, engagement and credibility via transparent supply networks. Through the latest video, the company has set the scene for a new business model that thrives on social engagement.

After all, customers are king. I think soon enough there will be a title for a Chief Engagement Officer, who is responsible for addressing supply chain transparency issues and spotting potential opportunities to add value to the brand.”, said Vivek Sood.

February 3, 2014

Globalisation – big solution that we need for today’s big problems

By Vivek Sood

No matter which country you look at today – you see big problems. Emerging problems are currently grappling with massive monetary expansionism triggered by a need to keep currency stability in face of periodic bouts of Quantitative Easings. For example see the article “Rajan Warns of Policy Breakdown as Emerging Markets Fall”.

China is grappling with its own issues – including commodities stockpiles and shadow banking – Copper Caps Longest Fall Since 1995 on China Industry Use. Europe continues to be a basket case and US recovery is in doubt – both are well documented in financial press and tweetosphere.

It appears that these problems are so massive that there is no way out of them. At national and even regional level – being close to the problems – it appears that there is no resolution is sight. Again, this type of thinking is well document in the financial press and tweetosphere – hence I am not giving any specific links.

My key point for this blog is that ‘a problem cannot be solved with the same mindset that created it’. A local, or regional mind-set with never solve the problems that were created with this mind-set. If you look at it from a global perspective the problems do not look as big.

Before your biases make you stop reading let me reiterate what I wrote in my book “The 5-STAR Business Network“.

Whatever be the reasons, or the outcomes, of this current global economic scenario, it cannot be denied that eventually only the business will lead recovery in the economy. The failures of command economies in the erstwhile Soviet bloc have demonstrated beyond doubt that statist policies, while good short term band-aid solutions, can rarely lead to true economic prosperity.

Globalization has been blamed by both the extreme right and extreme left for a host of economic ills facing various nations. Having seen the effects of globalization at close quarters in more than 100 countries, I cannot disagree more. In my view the results attributed to globalization are more attributable to other factors such as human malfeasance, institutionalized corruption even in the highest places, laziness, a sense of entitlement to riches without working for them and herd mentality leading to action without thinking and many such factors – all part of basic human nature.

It will be fair to say that one of the most alarming trend has been the continued shifting of the global manufacturing capacity to China. Just like a giant vacuum cleaner, China has sucked in the manufacturing capability from rest of the world at an intense pace over the past 15 years. Isolated stories of reversal of this trend apart, China continues with its policy of government aided industrial expansion far and wide beyond what might be good for Chinese or global economy. Its companies invest even in industries where labour provides little competitive advantage, and China has little capability advantage. This sets up a scene for an international showdown either on economic front or on a military/political front – either of which scenarios will be an unwelcome backlash against globalization leading to a reversal of global economic fortunes.

In the midst of this macro situation, business continue to suffer from intense uncertainty and anxiety. Investment decisions are delayed for months, if not years due to inability to project cash flows and the expected rate of returns for the investors. Waiting for consumer spending to pick up has been futile so far.

The intense volatility in the commodity prices is leading to speculation and perhaps even manipulation in the commodity markets on a global level. At a micro level, this volatility in the prices of raw materials has made it nearly impossible to make and keep budgets, make any price promises, and stabilize customer-supplier relationships in a stable manner professed by traditional supply chain management pundits.

Yes, I have seen the impact of globalization on ground in more than 100 countries. And yes, it is largely positive. Does Globalization mean doing away with the rule of law? Obviously, no.

I cannot imagine today’s big problems will be solved any other way. That is why Globalization is inevitable and good. Companies, institutions and governments will do well to prepare for it, and position their constituencies appropriately.

Globalisation – big problems need a big solution

By Vivek Sood

No matter which country you look at today – you see big problems. Emerging problems are currently grappling with massive monetary expansionism triggered by a need to keep currency stability in face of periodic bouts of Quantitative Easings. For example see the article “Rajan Warns of Policy Breakdown as Emerging Markets Fall”.

China is grappling with its own issues – including commodities stockpiles and shadow banking – Copper Caps Longest Fall Since 1995 on China Industry Use. Europe continues to be a basket case and US recovery is in doubt – both are well documented in financial press and tweetosphere.

It appears that these problems are so massive that there is no way out of them. At national and even regional level – being close to the problems – it appears that there is no resolution is sight. Again, this type of thinking is well document in the financial press and tweetosphere – hence I am not giving any specific links.

My key point for this blog is that ‘a problem cannot be solved with the same mindset that created it’. A local, or regional mind-set with never solve the problems that were created with this mind-set. If you look at it from a global perspective the problems do not look as big.

Before your biases make you stop reading let me reiterate what I wrote in my book “The 5-STAR Business Network“.

Whatever be the reasons, or the outcomes, of this current global economic scenario, it cannot be denied that eventually only the business will lead recovery in the economy. The failures of command economies in the erstwhile Soviet bloc have demonstrated beyond doubt that statist policies, while good short term band-aid solutions, can rarely lead to true economic prosperity.

Globalization has been blamed by both the extreme right and extreme left for a host of economic ills facing various nations. Having seen the effects of globalization at close quarters in more than 100 countries, I cannot disagree more. In my view the results attributed to globalization are more attributable to other factors such as human malfeasance, institutionalized corruption even in the highest places, laziness, a sense of entitlement to riches without working for them and herd mentality leading to action without thinking and many such factors – all part of basic human nature.

It will be fair to say that one of the most alarming trend has been the continued shifting of the global manufacturing capacity to China. Just like a giant vacuum cleaner, China has sucked in the manufacturing capability from rest of the world at an intense pace over the past 15 years. Isolated stories of reversal of this trend apart, China continues with its policy of government aided industrial expansion far and wide beyond what might be good for Chinese or global economy. Its companies invest even in industries where labour provides little competitive advantage, and China has little capability advantage. This sets up a scene for an international showdown either on economic front or on a military/political front – either of which scenarios will be an unwelcome backlash against globalization leading to a reversal of global economic fortunes.

In the midst of this macro situation, business continue to suffer from intense uncertainty and anxiety. Investment decisions are delayed for months, if not years due to inability to project cash flows and the expected rate of returns for the investors. Waiting for consumer spending to pick up has been futile so far.

The intense volatility in the commodity prices is leading to speculation and perhaps even manipulation in the commodity markets on a global level. At a micro level, this volatility in the prices of raw materials has made it nearly impossible to make and keep budgets, make any price promises, and stabilize customer-supplier relationships in a stable manner professed by traditional supply chain management pundits.

Yes, I have seen the impact of globalization on ground in more than 100 countries. And yes, it is largely positive. Does Globalization mean doing away with the rule of law? Obviously, no.

I cannot imagine today’s big problems will be solved any other way. That is why Globalization is inevitable and good. Companies, institutions and governments will do well to prepare for it, and position their constituencies appropriately.

February 2, 2014

Why Satya Nadella will make a good CEO for Microsoft?

By Vivek Sood

Vivek Sood is the world’s foremost authority on Supply Chains which are the commercial engines sitting deep within modern economies and driving them. He is a Chartered Financial Analyst (CFA), and has done courses from Harvard, MIT, and University of London. As the Managing Director of Global Supply Chain Group, he works as a consultant to CEOs and boards of directors of large global corporations, and helps them multiply profits by using the full power of global supply networks. He is also the author of “The 5-STAR Business Network”.

Wires are abuzz with the talk about Satya Nadella – who seems to be the front runner for the job of Microsoft CEO. Many profiles have emerged online – e.g. see the article Satya Nadella: The man who may soon become Microsoft CEO. Google’s Sunder Pichai was also in the race. Microsoft is at a stage of lifecycle where it is transitioning from a traditional corporation into a 5-STAR Business Network in order to compete better with the likes of Google and Apple. Smaller, nimbler competitors such as Contactually, Asana, MailChimp – and countless others – are creating easy to use web-based applications and deriving far higher per user revenues than Microsoft manages to achieve. In a few more years both its cash cows will be fully milked, and no new ones are in sight!

So what kind of person is needed at the helm at Microsoft at this very moment? What does it take to transform a business from a losing traditional business to a winning 5-STAR Business Network. Ability to integrate internal fiefdoms and build closely linked external networks ranks topmost.

Most people in a company climb up the departmental ladder with a tunnel vision – to reach right up to the top of the pyramid. For example see a typical climb for a CFO in a company who might start in budgeting or auditing arm of the finance department and slowly rise up to the rank of a CFO. Similar ladders exist for Chiefs of marketing, sales, IT, Operations, HR or even product departments.

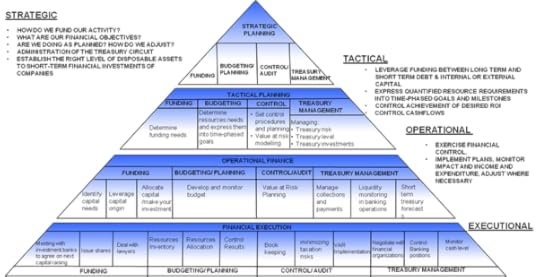

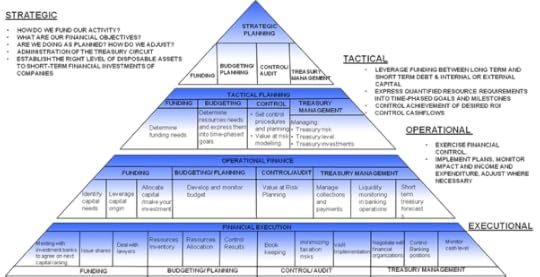

Figure 1: Activities carried out in a typical Finance Department

However, the role of the CEO is very different. Instead of the tunnel vision acuity, you need a peripheral vision acuity.

Why?

In order to weave all these fiefdoms together into a cohesive organisation.

For example, my experience from shipboard command shows that most captains have to rely a lot on the chief engineer and hence seemed to favour chief engineers over chief officers. After all they had been chief officers themselves and could do the role themselves, if they ever had to. But, despite all their engineering knowledge, most captains could never replicate the knowledge base of a chief engineer. That is why those captains who get the best co-operation from the chief engineers, are generally the most successful.

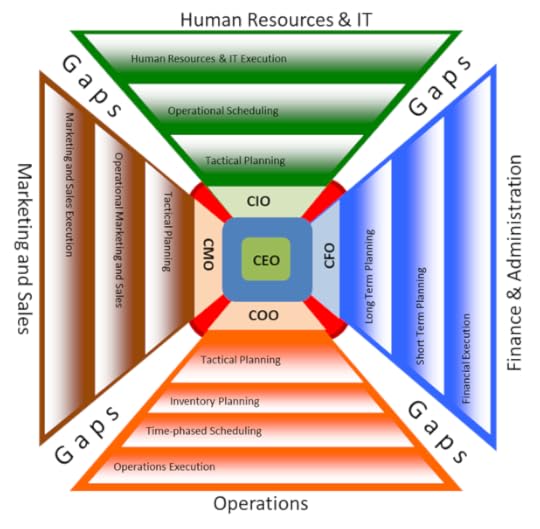

A modern organisation is far more complex than the shipboard company. Reporting to a CEO is a complement of 5-10 people and each of them is a potential candidate for the role. Boards prefer executive for the CEO role who can integrate the gaps between the various points of views and get the best performance out of the entire team.

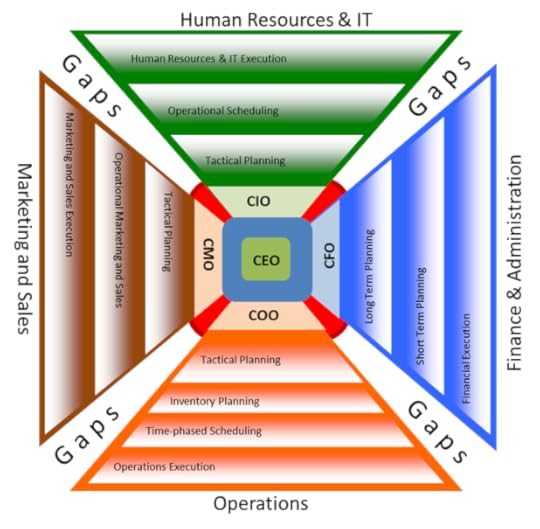

Figure 2: CEOs core team

While each contender with a real chance is really good at the functional area they come from – whether it is sales, or marketing, or finance or operations – the one that can integrate the entire team and engender a unique shared vision of future that the board can buy into generally get the nod.

Inevitably there are gaps between the functional areas. There are also parts of the functional areas that outsourced to third parties – whether in logistics, or IT or marketing. Integrating these external parties into the organisation’s fabric in such a way that they start sharing organisation’s vision as functioning as responsible part of the team is even more difficult. Chief Executives of future will distinguish themselves on this capability – to integrate useful outsiders into the organisation’s fabric, to outsource strategically, to build a business network of mutually dependent entities and to get this network working in unison towards the shared vision.

So, how does all this apply to Microsoft?

Besides Google, no other company is as dispersed as Microsoft is today. Ranging from its traditional core offerings to cloud based offering and hardware business – Microsoft needs a person who can integrate the key strengths of each internal group with needed outside expertise in order to come up with offerrings that customers want in significant volume. Microsoft has to stop playing catch up all the time, and start leading from the front. It has to once again create innovative products that customers really want, and will pay gladly for. It has to make its products easy to use – as easy as other cloud-based and mobile applications being sold by its competitors mentioned earlier.

All rounder, shy, humble, super nice, collaborative, very technical, deeply engaged, a visionary leader and strong willed – are the words used again and again to describe Satya Nadella, e.g. in the article “Satya Nadella: ‘Mr Nice guy’ could finish first as Microsoft’s next CEO“. The article goes on to state :

That’s how colleagues, friends and a cross section of industry leaders and technology industry watchers describe 45-year-old Nadella. Calling Nadella “among the brightest brains at Microsoft”, Ravi Venkatesan, former chairman of Microsoft India, said “Nadella’s strength lies in building relationships.”

…

Nadella fought the hard battles within Microsoft and brought in collaboration within teams,” says Staten James, vice president & principal analyst Forrester research. On what makes Nadella a frontrunner for the CEO job, James adds, “Microsoft’s culture is unique and would take an outsider quite a while to understand and affect change upon. Nadella has already shown that he can drive the kind of change needed for Microsoft.”

That is exactly what is required at Microsoft at the moment. This is the reason why Why Satya Nadella will make a good CEO for Microsoft.

January 29, 2014

Even bigger troubles with big data

By Vivek Sood

Troubles in big data are starting to emerge. I have written about these earlier, and warned the clients to first make sure their small data is working as intended before jumping into big data. If you cannot control your small data, your ERP system, your EIS or your cloud then forget about BIG data. All you will have is a big mess instead of a small mess.

Despite companies spending hundreds of millions of dollars in their systems renewal efforts, user satisfaction remains stubbornly low. As I say in my book ‘The 5-STAR Business Network’:

Not too many years ago, a very large corporation operating worldwide, made news with the downgrading of their earnings expectations due to supply chain system’s implementation setbacks. The expectation was that the new system would reduce the new production cycle from 1 month to 1 week. Furthermore, it would better match the demand and supply of its products to place the correct products in the right locations and quantities, all at the right time – a very lofty goal. The company spent an enormous amount of money, exceeding US $400 million in order to achieve its aim. However, the software system ‘never worked right’. It caused the factories to crack out too many unpopular products and not enough of the trendier ones in high demand. While making the earning downgrade, the CEO asked the rhetorical question, ‘is this what we get for $400 million?’

The market analysts were not surprised. One respected market analyst [AMR] commented, ‘fiascos like this occur all the time but are usually kept quiet unless they seriously hurt the bottom line.’ Another respected market analyst commented that while the CEO made it sound like it was a surprise for him, if he did not have checkpoints for the projects, he does not have control over his company. A third analyst commented that companies are confused by escalating market hype and too often underestimate the complexity and risks. Another [Forrester Research] commented ‘when the software projects go bad companies are more likely going to scurry up and cover it up because they fear that they are the only ones having trouble. But far from it; our conversation and research reveals this company was not unique or the only one having this kind of trouble‘.

Despite their lofty goals, many of the large information technology deployment projects derail. It takes time for the word to filter out because, in most cases, the executives involved in the process are far too embarrassed to talk about what happened. They do mutter among themselves; after several similar instances the mutterings become more vocal and a trend emerges where a number of people start talking about the shortcomings of the system itself or the implementation process or of the time taken for implementation. Because the cost of this failure is so high – greater than $400 Million in the above case – it is instructive to understand the real root causes of this failure.

All the above problems with small data are only multiplied big time when they apply to big data. However, this blog post is not about these small problems. Most companies survive these small problems by stumbling through them.

Now even BIGGER problems are emerging with Big Data. Target was always one of the poster childs of big data. Highlighted in Charles Duhigg’s book and several newspaper articles were its capabilities of predictive behavioural scoring in order to maximise the revenues.

Kashmir Hill, writing in Forbes magazine online in February 2012, cited New York Times in an instance of How Target Figured Out A Teen Girl Was Pregnant Before Her Father Did. [1]

Target assigns every customer a Guest ID number, tied to their credit card, name, or email address that becomes a bucket that stores a history of everything they’ve bought and any demographic information Target has collected from them or bought from other sources. [They] ran test after test, analyzing the data, and before long some useful patterns emerged. … Take a fictional Target shopper named Jenny Ward, who is 23, lives in Atlanta and in March bought cocoa-butter lotion, a purse large enough to double as a diaper bag, zinc and magnesium supplements and a bright blue rug. There’s, say, an 87 percent chance that she’s pregnant and that her delivery date is sometime in late August.

The anecdote quoted in the article by Kashmir Hill where a father storms angrily into target demanding an apology for encouraging his teenage daughter to get pregnant by mailing her coupons of baby stuff, only to retract the demand later on when he discovers that she was indeed already pregnant, demonstrated the power of predictive business intelligence. This article as well as the New York Times article [2] by Charles Duhigg and the book it is based on The Power of Habit: Why We Do What We Do in Life and Business also by Charles Duhigg.

I quoted this example in my book as well, and cited Target’s ability cautiously. Back of my mind were the concerns about data integrity and security – which have now come true.

This holiday season, Target was one of the two large retailers who felt the brunt of the hackers. As per this news report in NBC:

Target said Wednesday that the cyber criminals who breached its system used credentials they stole from one of the retailer’s vendors.

“The ongoing forensic investigation has indicated that the intruder stole a vendor’s credentials, which were used to access our system,” Target spokeswoman Molly Snyder said in a statement.

She declined to elaborate on what type of credentials were taken from the vendor.

Meanwhile, the Justice Department is investigating the hacking, Attorney General Eric Holder said Wednesday.

While target is not the only one to have suffered such lapses – it is one of the most serious. Reminds me of the joke where a bank robber was asked why did he always rob banks, and he replied because that is where the money is. The news report quoted above shows the magnitude of the theft.

Target has said a breach of its networks during the busy holiday shopping period resulted in the theft of about 40 million credit and debit card records and 70 million other records with customer information such as addresses and telephone numbers.

Target has not yet specified which vendor was responsible for breach, and whether it was an IT vendor, or a supply chain vendor. Target was not the only one though. Nieman Marcus was another high profile retailer in similar situation, albeit on smaller scale. In fact there were more; in the news report above:

Reuters reported Jan. 23 that the FBI has warned U.S. retailers to prepare for more cyber attacks after discovering about 20 hacking cases in the past year that involved the same kind of malicious software used against Target.

Final point this episode highlights is the axiom that you will always pay for your vendors sins. I use the example of BP’s oil rig in my book to illustrate that point. Will write on this aspect of the episode in a later blog.

EVEN BIGGER TROUBLE WITH BIG DATA

EVEN BIGGER TROUBLE WITH BIG DATA

By Vivek Sood

Vivek Sood is the world’s foremost authority on Supply Chains which are the commercial engines sitting deep within modern economies and driving them. He is a Chartered Financial Analyst (CFA), and has done courses from Harvard, MIT, and University of London. As the Managing Director of Global Supply Chain Group, he works as a consultant to CEOs and boards of directors of large global corporations, and helps them multiply profits by using the full power of global supply networks. He is also the author of “The 5-STAR Business Network”.

Troubles in big data are starting to emerge. I have written about these earlier, and warned the clients to first make sure their small data is working as intended before jumping into big data. If you cannot control your small data, your ERP system, your EIS or your cloud then forget about BIG data. All you will have is a big mess instead of a small mess.

Despite companies spending hundreds of millions of dollars in their systems renewal efforts, user satisfaction remains stubbornly low. As I say in my book ‘The 5-STAR Business Network’:

Not too many years ago, a very large corporation operating worldwide, made news with the downgrading of their earnings expectations due to supply chain system’s implementation setbacks. The expectation was that the new system would reduce the new production cycle from 1 month to 1 week. Furthermore, it would better match the demand and supply of its products to place the correct products in the right locations and quantities, all at the right time – a very lofty goal. The company spent an enormous amount of money, exceeding US $400 million in order to achieve its aim. However, the software system ‘never worked right’. It caused the factories to crack out too many unpopular products and not enough of the trendier ones in high demand. While making the earning downgrade, the CEO asked the rhetorical question, ‘is this what we get for $400 million?’

The market analysts were not surprised. One respected market analyst [AMR] commented, ‘fiascos like this occur all the time but are usually kept quiet unless they seriously hurt the bottom line.’ Another respected market analyst commented that while the CEO made it sound like it was a surprise for him, if he did not have checkpoints for the projects, he does not have control over his company. A third analyst commented that companies are confused by escalating market hype and too often underestimate the complexity and risks. Another [Forrester Research] commented ‘when the software projects go bad companies are more likely going to scurry up and cover it up because they fear that they are the only ones having trouble. But far from it; our conversation and research reveals this company was not unique or the only one having this kind of trouble‘.

Despite their lofty goals, many of the large information technology deployment projects derail. It takes time for the word to filter out because, in most cases, the executives involved in the process are far too embarrassed to talk about what happened. They do mutter among themselves; after several similar instances the mutterings become more vocal and a trend emerges where a number of people start talking about the shortcomings of the system itself or the implementation process or of the time taken for implementation. Because the cost of this failure is so high – greater than $400 Million in the above case – it is instructive to understand the real root causes of this failure.

All the above problems with small data are only multiplied big time when they apply to big data. However, this blog post is not about these small problems. Most companies survive these small problems by stumbling through them.

Now even BIGGER problem is emerging with the Big Data. Target was always one of the poster childs of big data. Highlighted in Charles Duhigg’s book and several newspaper articles were its capabilities of predictive behavioural scoring in order to maximise the revenues.

Kashmir Hill, writing in Forbes magazine online in February 2012, cited New York Times in an instance of How Target Figured Out A Teen Girl Was Pregnant Before Her Father Did. [1]

Target assigns every customer a Guest ID number, tied to their credit card, name, or email address that becomes a bucket that stores a history of everything they’ve bought and any demographic information Target has collected from them or bought from other sources. [They] ran test after test, analyzing the data, and before long some useful patterns emerged. … Take a fictional Target shopper named Jenny Ward, who is 23, lives in Atlanta and in March bought cocoa-butter lotion, a purse large enough to double as a diaper bag, zinc and magnesium supplements and a bright blue rug. There’s, say, an 87 percent chance that she’s pregnant and that her delivery date is sometime in late August.

The anecdote quoted in the article by Kashmir Hill where a father storms angrily into target demanding an apology for encouraging his teenage daughter to get pregnant by mailing her coupons of baby stuff, only to retract the demand later on when he discovers that she was indeed already pregnant, demonstrated the power of predictive business intelligence. This article as well as the New York Times article [2] by Charles Duhigg and the book it is based on The Power of Habit: Why We Do What We Do in Life and Business also by Charles Duhigg.

I quoted this example in my book as well, and cited Target’s ability cautiously. Back of my mind were the concerns about data integrity and security – which have now come true.

This holiday season, Target was one of the two large retailers who felt the brunt of the hackers. As per this news report in NBC:

Target said Wednesday that the cyber criminals who breached its system used credentials they stole from one of the retailer’s vendors.

“The ongoing forensic investigation has indicated that the intruder stole a vendor’s credentials, which were used to access our system,” Target spokeswoman Molly Snyder said in a statement.

She declined to elaborate on what type of credentials were taken from the vendor.

Meanwhile, the Justice Department is investigating the hacking, Attorney General Eric Holder said Wednesday.

While target is not the only one to have suffered such lapses – it is one of the most serious. Reminds me of the joke where a bank robber was asked why did he always rob banks, and he replied because that is where the money is. The news report quoted above shows the magnitude of the theft.

Target has said a breach of its networks during the busy holiday shopping period resulted in the theft of about 40 million credit and debit card records and 70 million other records with customer information such as addresses and telephone numbers.

Target has not yet specified which vendor was responsible for breach, and whether it was an IT vendor, or a supply chain vendor. Target was not the only one though. Nieman Marcus was another high profile retailer in similar situation, albeit on smaller scale. In fact there were more; in the news report above:

Reuters reported Jan. 23 that the FBI has warned U.S. retailers to prepare for more cyber attacks after discovering about 20 hacking cases in the past year that involved the same kind of malicious software used against Target.

Final point this episode highlights is the axiom that you will always pay for your vendors sins. I use the example of BP’s oil rig in my book to illustrate that point. Will write on this aspect of the episode in a later blog.

January 27, 2014

Amazon shipping items before you order it: creepy or savvy?

After delivery drones, Amazon has created yet another news sensation! This time with predictive shipping and patenting it. In this article, Cathy Morrow Robertson describes Amazon’s latest leap:

After delivery drones, Amazon has created yet another news sensation! This time with predictive shipping and patenting it. In this article, Cathy Morrow Robertson describes Amazon’s latest leap:

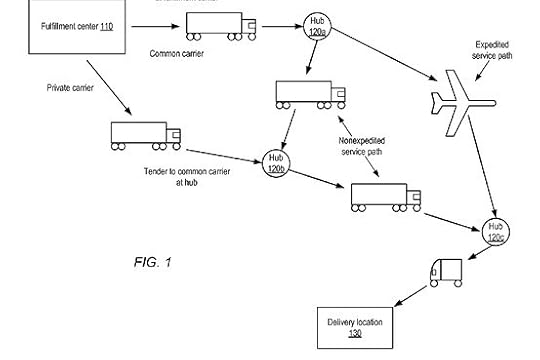

“Based on previous orders, product searches, wish lists, shopping cart contents and other online customer experiences, Amazon has received a patent for what it calls “anticipatory shipping” – shipping products that it expects customers in a specific area will want to purchase.

Flow charts abound in Amazon’s patent filing that outlines the different ways how this shipping will work. Based on analysis of the vast data Amazon collects on customers and visitors to its website (and maybe via social media websites) it will send items to hubs or maybe even by-pass these hubs all together, without specific addresses on the packages, to regions in which it expects the item(s) to sale. These items may be offered at a special price and, if sold, addresses will then be generated and delivered. The use of barcodes are utilized to monitor the packages and there are proposed processes to handle returns outlined in the patent application. For more specifics, read the patent filing in full here.

This new shipping process is what many are describing as a way for Amazon to further cut delivery costs and times- by moving goods closer to the customer ahead of time and then offer same-day or next-day delivery.”

This is even more intense than Google’s predictive search function. Here, Amazon presumes to know more about you than you know yourself. Before you even order something, they will ship it in the knowledge that they can make money doing it! How is this possible?

Before jumping into any analysis, let’s go back a few centuries to before the industrial revolution. Every piece of clothing, every shoe, in fact almost everything was hand made for the individual buyers that needed it. With the industrial revolution, the cost of production went down by such an amount that it paid to mass produce goods in the hope that someone would buy it later. Most of the goods were sold to buyers who walked in as and when they needed the goods and unsold inventory was disposed of at lower prices. Overall, sellers made huge profits due to increased volumes.

Later, methodologies including statistical analysis of buyers’ aggregate demand patterns yielded better inventory optimisation opportunities to lower costs even further in this make-to-stock world.

Now, Amazon is moving the goal post one step closer to buyers with this new paradigm of ship-to-stock. This heralds a massive transition from the industrial revolution to the information revolution. As more and more data about customers is collated, verified, parsed and analysed, behavioural patterns emerge allowing Amazon to identify buying triggers and propensity.

I do not want to go into a lot of detail of BIG DATA or behavioural pattern scoring through business intelligence algorithms. That they are very effective is illustrated by several case studies in my book “The 5-STAR Business Networks”. I write not only about Amazon, but also Target and other retailers, who use these advanced techniques to optimise their profits for each and every transaction. This is called Transaction Optimisation Profitability (TOP) in my above named book, which include differential pricing, bundling, customised offerings, coupons, and other means of sophisticated revenue maximisationThis drive to simultaneously minimize the costs and maximise the revenues on each and every transaction is called Transaction Optimisation Profitability (TOP) in my above named book. Amazon’s reported leap to ship-to-stock may even help it stay on top of the TOP game.

In one swoop it will dismantle one of the biggest objections to online shopping – having to wait for the items. At the same time, with its superior knowledge of you, the customer, they can offer just the right price that will entice you to make the purchase once the item is shipped. As a backup for unpurchased items, it will have to negotiate very good shipping rates for returns with the courier companies who are benefiting immensely from the online shopping boom (where are people who predicted the death of courier companies after faxes and emails replaced physical paper?)

An even more sophisticated strategy would be to buy or create a chain of specialist stores where a package with your name on will always be waiting for you just in case you want to purchase what you have been browsing online. This will totally change the face of retail from “Stack it high, and sell it low (or, in some cases sell it high)” to “stack it close, sell it fast”.

There will be several possible consequences. Not only could this be the final nail in the coffin of traditional retail as we have known it for the last 50 years, but it could also mean that only a few traditional retailers (those who are well advanced with their own big data applications) will be able to survive such a massive business model transformation. I would not like to name those most likely to become the road-kill but it seems likely that Target will give Amazon stiff competition.

Moreover, you may find that Amazon is in the market to buy one of the smaller chains with access to the last mile – e.g. 7-11, or another corner store. Alternatively, you may find them starting their own chain similar to Fed-Ex Kinko and the UPS store. If you are working in the private equity arena, then you will notice that such chains as Pack-and-Send will become far more valuable in future.

I have tried to keep the technical jargon to minimum in this above blog post, and focused mainly on the business impact. Yet, some of the terminology or concepts may not be fully understandable to some non-technical people. Got something to ask or discuss, please feel free to contact me (I am sure you can find how). Over the next couple of weeks, keep an eye on more blogs on the fate of traditional retail, how Amazon’s trendsetting move will impact industries as diverse as shopping centres and courier companies.

On a final note, it also raises interesting questions about patents – because you could argue that allowing patents on predictive shipping is the same as allowing patents on mass production or the industrial revolution!

AMAZON SHIPPING ITEMS BEFORE YOU ORDER IT: CREEPY OR SAVVY?

After delivery drones, Amazon has created yet another news sensation! This time with predictive shipping and patenting it. In this article, Cathy Morrow Robertson describes Amazon’s latest leap:

After delivery drones, Amazon has created yet another news sensation! This time with predictive shipping and patenting it. In this article, Cathy Morrow Robertson describes Amazon’s latest leap:

“Based on previous orders, product searches, wish lists, shopping cart contents and other online customer experiences, Amazon has received a patent for what it calls “anticipatory shipping” – shipping products that it expects customers in a specific area will want to purchase.

Flow charts abound in Amazon’s patent filing that outlines the different ways how this shipping will work. Based on analysis of the vast data Amazon collects on customers and visitors to its website (and maybe via social media websites) it will send items to hubs or maybe even by-pass these hubs all together, without specific addresses on the packages, to regions in which it expects the item(s) to sale. These items may be offered at a special price and, if sold, addresses will then be generated and delivered. The use of barcodes are utilized to monitor the packages and there are proposed processes to handle returns outlined in the patent application. For more specifics, read the patent filing in full here.

This new shipping process is what many are describing as a way for Amazon to further cut delivery costs and times- by moving goods closer to the customer ahead of time and then offer same-day or next-day delivery.”

This is even more intense than Google’s predictive search function. Here, Amazon presumes to know more about you than you know yourself. Before you even order something, they will ship it in the knowledge that they can make money doing it! How is this possible?

Before jumping into any analysis, let’s go back a few centuries to before the industrial revolution. Every piece of clothing, every shoe, in fact almost everything was hand made for the individual buyers that needed it. With the industrial revolution, the cost of production went down by such an amount that it paid to mass produce goods in the hope that someone would buy it later. Most of the goods were sold to buyers who walked in as and when they needed the goods and unsold inventory was disposed of at lower prices. Overall, sellers made huge profits due to increased volumes.

Later, methodologies including statistical analysis of buyers’ aggregate demand patterns yielded better inventory optimisation opportunities to lower costs even further in this make-to-stock world.

Now, Amazon is moving the goal post one step closer to buyers with this new paradigm of ship-to-stock. This heralds a massive transition from the industrial revolution to the information revolution. As more and more data about customers is collated, verified, parsed and analysed, behavioural patterns emerge allowing Amazon to identify buying triggers and propensity.

I do not want to go into a lot of detail of BIG DATA or behavioural pattern scoring through business intelligence algorithms. That they are very effective is illustrated by several case studies in my book “The 5-STAR Business Networks”. I write not only about Amazon, but also Target and other retailers, who use these advanced techniques to optimise their profits for each and every transaction. This is called Transaction Optimisation Profitability (TOP) in my above named book, which include differential pricing, bundling, customised offerings, coupons, and other means of sophisticated revenue maximisationThis drive to simultaneously minimize the costs and maximise the revenues on each and every transaction is called Transaction Optimisation Profitability (TOP) in my above named book. Amazon’s reported leap to ship-to-stock may even help it stay on top of the TOP game.

In one swoop it will dismantle one of the biggest objections to online shopping – having to wait for the items. At the same time, with its superior knowledge of you, the customer, they can offer just the right price that will entice you to make the purchase once the item is shipped. As a backup for unpurchased items, it will have to negotiate very good shipping rates for returns with the courier companies who are benefiting immensely from the online shopping boom (where are people who predicted the death of courier companies after faxes and emails replaced physical paper?)

An even more sophisticated strategy would be to buy or create a chain of specialist stores where a package with your name on will always be waiting for you just in case you want to purchase what you have been browsing online. This will totally change the face of retail from “Stack it high, and sell it low (or, in some cases sell it high)” to “stack it close, sell it fast”.

There will be several possible consequences. Not only could this be the final nail in the coffin of traditional retail as we have known it for the last 50 years, but it could also mean that only a few traditional retailers (those who are well advanced with their own big data applications) will be able to survive such a massive business model transformation. I would not like to name those most likely to become the road-kill but it seems likely that Target will give Amazon stiff competition.

Moreover, you may find that Amazon is in the market to buy one of the smaller chains with access to the last mile – e.g. 7-11, or another corner store. Alternatively, you may find them starting their own chain similar to Fed-Ex Kinko and the UPS store. If you are working in the private equity arena, then you will notice that such chains as Pack-and-Send will become far more valuable in future.

I have tried to keep the technical jargon to minimum in this above blog post, and focused mainly on the business impact. Yet, some of the terminology or concepts may not be fully understandable to some non-technical people. Got something to ask or discuss, please feel free to contact me (I am sure you can find how). Over the next couple of weeks, keep an eye on more blogs on the fate of traditional retail, how Amazon’s trendsetting move will impact industries as diverse as shopping centres and courier companies.

On a final note, it also raises interesting questions about patents – because you could argue that allowing patents on predictive shipping is the same as allowing patents on mass production or the industrial revolution!

December 29, 2013

Why Most CXOs Will Never Make It To CEO And What They Can Do About It?

Kevin1 was a brilliant finance executive. After doing a few years in an accountancy practice he had joined a company in its finance department and steadily risen in rank over the years to become its Chief Finance Officer. The board trusted his numbers as well as his prudent judgment.

Yet, when third time in five years Kevin was overlooked for promotion to the role of CEO of his company he shared his frustration with me. He has worked the board, and knew each of the members, even the new ones, well enough to regarded as a reliable ‘colleague’. They knew that he would not mind taking up the challenge and were also aware that two of their last three choices did not turn out to be that brilliant. Yet they were reluctant to hand over the mantle to him.

He had already proven his case by his excellent leadership of the finance function as well as his strategic thought process. What else did he need to do to prove to the board the most obvious thing – that they were ignoring the best candidate for the job.

We started discussing perceptions and his indispensability as the CFO, but soon we got past that discussion and started drawing figures on paper napkins. It was clear that he had a great coverage of the entire length and breadth of the finance function as we went through the pyramid that later turned into figure 1 below.

Figure 1: Activities carried out in a typical Finance Department

Whether it was funding, or budgeting, or financial control or treasury management he had made his mark on the business. He was proud that the auditors, investment bankers as well as the commercial bankers were all very complimentary of his accomplishments. Despite knowing all this, the board would not give him the final nod.

As the discussion meandered from the finance function to the CEO’s role another figure on the paper napkin illustrated the conundrum. This figure was later turned into figure 2 after a few revisions. As I discussed my experience from shipboard command that most captains had to rely a lot on the chief engineer and hence seemed to favour chief engineers over chief officers. After all they had been chief officers themselves and could do the role themselves, if they ever had to. But, despite all their engineering knowledge, most captains could never replicate the knowledge base of a chief engineer. Most successful captains were those who seemed to get the best co-operation from the chief engineers and knew how to get it.

A modern organisation is far more complex than the shipboard company. Reporting to a CEO is a complement of 5-10 people and each of them is a potential candidate for the role. It appeared in Kevins case that, whether by design or not, the board preferred an executive for the CEO role who could integrate the gaps between the various points of views and get the best performance out of the entire team.

Just by law of numbers there are between 5-10 internal candidates, in addition to all the external potential hires, for each role of CEO. While many of them may not be serious contenders, there are still enough contenders to make each race an interesting contest.

Figure 2: CEOs core team

While each contender with a real chance is exceptionally good at the functional area they come from – whether it is sales, or marketing, or finance or operations – the one that can integrate the entire team and engender a unique shared vision of future, that the board can buy into, generally get the nod.

Inevitably, as shown in figure 2, there are gaps between the functional areas. There are also parts of the functional areas that outsourced to third parties – whether in logistics, or IT or marketing or other areas. Integrating these external parties into the organisation’s fabric in such a way that they start sharing organisation’s vision and functioning as a responsible part of the team is even more difficult. In my view Chief Executives of future will distinguish themselves on this capability – to integrate useful outsiders into the organisation’s fabric, to outsource strategically, to build a business network of mutually dependent entities and to get this network working in unison towards the shared vision.

So, what can you do about it?

To become a successful CEO in future, strategic thinking will not be enough. An ability to create a vision of the future, will not be sufficient either. Going beyond that, you will need to be able to engender that shared vision throughout the organisation, know how to bridge the inevitable functional gaps, identify the key external parties that are useful to your vision and bring them into your organisations’ business network and make them a productive part of this network. I discuss more about business networks in my book ‘The 5-STAR Business Networks’ and a free download of the first three chapters is available from this link.

Notes:

Names and events have been modified significantly to protect the confidentiality of the people involved. However, the substantive material is, more or less, reproduced faithfully.