Andrew Rogerson's Blog, page 8

June 21, 2021

How to Sell your California Small Business Confidentially

Getting ready to sell your small business confidentially can be time-consuming, but it doesn’t always have to be. Properly planning how to sell a California small business with a business exit plan will help you confidently pass your business into the hands of someone else. A great business broker can make sure they complete the process quickly […]

The post How to Sell your California Small Business Confidentially appeared first on Rogerson Business Services | CA Certified Business Broker.

May 24, 2021

How to Grow Your Business Through Acquisitions?

Do you own a business and are looking to grow? Growing a business can take place through a business acquisition strategy or organically based on the products or services you are offering and their acceptance in the market. Growing the business faster can happen with marketing and advertising to get the products and services in […]

The post How to Grow Your Business Through Acquisitions? appeared first on Rogerson Business Services | CA Certified Business Broker.

May 12, 2021

10 Tips on How to List a California Small Business for Sale

If you are a small business owner in California and looking to learn how to list a California small business for sale, you came to the perfect post. You know you won’t be working forever. Maybe you are considering retirement. Or maybe you’re thinking about moving on to another life-changing event. Regardless, it is important […]

The post 10 Tips on How to List a California Small Business for Sale appeared first on Rogerson Business Services | CA Certified Business Broker.

How to Sell My Business in California

Whether you’re looking for a new business venture, looking to accomplish a new life-changing event, or a Baby Boomer looking to retire or move into something new, you’ve decided to sell your business in California. You’ve spent a lot of time, money, and hard work building your business, and now you’re looking to get maximum […]

The post How to Sell My Business in California appeared first on Rogerson Business Services | CA Certified Business Broker.

May 5, 2021

Top 8 Mistakes to Avoid When Selling your Business in California

Are you selling your business in California? Are you wondering how to avoid not getting what you deserve for your company? Maybe you know you could get a good price right now, or you may be ready to move on to a new business venture. It may be time for you to retire. It’s important […]

The post Top 8 Mistakes to Avoid When Selling your Business in California appeared first on Rogerson Business Services | CA Certified Business Broker.

January 2, 2021

Help for California business owners as we welcome 2021

It goes without saying, 2020 was a difficult year.

Especially if you were a business owner.

Especially if you were a business owner in California, as you were dealing with COVID-19, wildfires, a difficult Presidential election, tariffs and much more.

If you have made it to 2021, congratulations. Perhaps you know some business owners that would welcome some help so they can recover and make their business bigger and stronger.

California Relief Grant program

The State of California is offering grants to small businesses that qualify.

The program is called the California Relief Grant program.

One of the lenders that the State of California has asked to handle the application process is called Lendistry.

Here is a link to a very detailed PDF about the program.

California Relief Grant program

Here is a link to create an account and start the application process.

California Relief Grant application

The California Relief Grant program is not a first-come, first-serve program and will not close early.

There have been technical issues for some applicants because there are so many applicants, but an application can still be submitted for first-round consideration any time before January 8, 2021, at 11:59 PM.

You may know a California business owner that could benefit from this information and so you are welcome to forward this to them.

PPP loan – Round One

If you are like me, you are getting your financial statements in shape to file your business and personal tax return. If your business was able to qualify and you were successful with your application, the CARES Act was signed into law on March 27, 2020 offering different forms of help to business owners.

If your business took a PPP loan, here are some simple suggestions to get your Income Statement of P&L in shape to present to your CPA or tax preparer. This help will also assist you if you plan to value or sell your business in 2021.

A key point regarding a PPP loan is that it is a loan.

The loan proceeds should therefore be shown on the Balance Sheet as a Note Payable as it is a liability.

Please do not show the loan proceeds on the Income Statement as income.

To be a little clearer, if the PPP loan is forgiven, for income reporting purposes show it as follows:

On the Income Statement or P&L only, put a fancy label on it so your tax preparer understands and asks you questions. For example, “Gain on Extinguishment of Debt.” (This will then be removed when the income statement activity is placed in your Income Tax Return.)

Income Tax Return. If the loan is forgiven, the loan amount will result in “Loan Forgiveness Income”, but this income WILL NOT be subject to income recognition which means it will not be subject to tax. As a result, the forgiven loan amount will not be included as income in the income tax return.

With regard to expenses, the Income Statement will reflect the expenses paid with the PPP loan proceeds. Thankfully, with the passing of the second stimulus bill in late December 2020 and the subsequent signature of the President, expenses paid with the PPP loan will now be tax deductible.

Be aware, for a business owner in California, we must wait and see if the State of California clarifies the tax treatment of the PPP loan and related benefits.

PPP loan – Round Two and the Second Stimulus effective late December 2020

With the Second Stimulus now passed into law at the end of December 2020, there are different benefits for different business owners.

This includes a PPP loan – Round Two for businesses that qualify.

This also includes assistance for business owners with an SBA loan plus those looking to buy a business in 2021 using an SBA loan.

Because there is different help for different business owners from the Second Stimulus, lets look at each benefit separately.

PPP loan – Round two:

A second PPP loan called a “PPP second draw” loan for smaller & harder-hit businesses with a maximum new loan amount of $2 million.

Eligibility: In order to receive a second PPP loan under this section, an eligible entity must:

Employ not more than 300 employees.

Have used or will use the full amount of its first PPP loan – Round One.

Demonstrate at least a 25% reduction in gross receipts in the first, second, or third quarter of 2020 relative to the same 2019 quarter.

Selection of Covered Period for forgiveness:

Borrowers can elect a covered period ending at the point of the borrower’s choosing between 8 & 24 weeks after loan origination.

Loan terms:

Borrowers may receive a loan amount of up to 2.5X the average monthly payroll 3 costs during the year prior to the loan or the previous calendar up to a maximum of $2 million.

Full forgiveness:

This will still require the same 60/40 allocation between payroll and non- payroll costs or the same rule in place for PPP loan – Round one.

Help for borrowers with an existing SBA Loan:

The second stimulus signed into law late December 2020 includes help for business buyers with an SBA loan. There is also help for new borrowers but let us cover those borrowers with an existing SBA loan.

Extension of SBA loan Payments:

The second stimulus bill extends $3.5 billion in funding to extend SBA loan payments to September 30, 2021.

This includes the payment of principal & interest (P&I) on SBA loans guaranteed by the SBA under the 7(a)/504 established under the CARES Act that was signed into law in March 2020.

All borrowers with qualifying loans approved by the SBA prior to the CARES Act will receive an additional three months of P&I, starting in February 2021. Going forward, those payments will be capped at $9,000 per borrower per month.

After the three-month period described above, borrowers considered to be underserved, will receive an additional five months of P&I payments, also capped at $9,000 per borrower per month.

This includes borrowers with any 7(a) or 504 loan in the hardest-hit sectors, as measured by the severity of sector-wide job losses since the start of the pandemic: accommodation and food services (72); arts, entertainment, and recreation (71); educational services (61); mining and logging (213); apparel (315); clothing and clothing accessory stores (448); sporting goods, hobby, book, and music stores (451); air transportation (481); transit and ground passenger transportation (485); scenic and sightseeing transportation (487); publishing industries, except Internet (511); motion picture and sound recording industries (512); broadcasting, except Internet (515); rental and leasing services (532); and personal and laundry services (812).

The government will pay SBA payments of P&I on the first 6 months of newly approved SBA loans approved between February 1 and September 30, 2021, also capped at $9,000 per month.

Help for borrowers of a new SBA Loan:

One important piece of the bill is that for new SBA 7(a) and 504 loans, borrowers will not have to pay the 7(a)-guaranty fee for loans funded by Sept. 30, 2021.

Other changes are possible as the SBA needs to interpret the new laws.

Is the time right to value and sell your California business?

Selling any business whether it’s in manufacturing, healthcare, construction or any other industry is never easy and straight forward.

The first step, if this is something you are considering doing is to get a business valuation. If you would like to learn more about how to value your business, simply go to this page on my website – Successfully valuing your business. If you would like to know the value of your business, this is a service we provide. To prepare a personal business valuation for you we would need the last 3 years tax returns of the business, a recent Profit and Loss Statement and a Balance Sheet. Here is a link to see a Sample Business Valuation.

Perhaps you are a Do It Yourselfer and would prefer to learn the steps to value your business. We have that option for you and this link will start you on the Steps to Value Your Business.

Contact Us to value and sell your business

If you have questions about the value of your business or the steps it takes to sell a business, use the “Contact Us” page to introduce yourself and we will get back to you.

The post Help for California business owners as we welcome 2021 appeared first on Rogerson Business Services | CA Certified Business Broker.

November 29, 2020

Valuing and selling my California business in 2021

As we move into the close of 2020, there is no doubt it is tempting to look at this year with enormous regret and frustration.

If we own and operate a business in California … and it is still operating … and we have our health, there is no choice but to be grateful. As we are entrepreneurs, it is as good as it gets as we now have hope from a vaccine to defeat the Coronavirus, a difficult 2020 election is close to resolution, if you look at the US Stock market it just hit an all-time high, interest rates to borrow money and build a business are at an all-time low, technology is bringing change and innovation and there is plenty more.

Many entrepreneurs are weary or want to move away from the day-to-day responsibility of owning and operating a business.

So how does 2021 look if you want to value and sell your business in California?

Why valuing and selling a California business is different

If you are asking yourself the question, is California a good place to own and operate a business and you are reading the news, you may be hearing businesses are leaving California in droves.

There is no question, there are challenges. However, a good question is, why would you do business in any other state when there are some many things going for it?

The State of California is going through challenges in 2020 as it has been hit hard by COVID-19. The San Francisco Bay area has been hit exceptionally hard as homelessness from COVID-19 has shut down the 6 Bay Area counties where the cost of living is so high.

You might ask yourself the question, “If California has so many regulations and it is more complicated to sell a business there, why are there so many businesses in California?

The answer to that question is quite simple: there are a variety of industries in California, and the economy is strong. First Research provides some amazing statistics.

State job growth rose 1.8% in October 2019 from a year ago; national job growth rose 1.4%

State unemployment averaged 3.7% in October 2019; the national average was 3.6%

Personal income rose 5.2% to $2635.3 trillion in Q2 2019 from a year ago.

Tax revenue increased by 8.3% in Q2 2019 from a year ago.

The area defined as Southern California, if it were a country rather than part of a state, would have the sixth-largest economy in the world. Northern California is home to a large portion of the tech sector and Silicon Valley. The Central Valley in California produces about 40% of the agriculture products consumed in the United States. The manufacturing industry is robust in comparison to many other parts of the country.

Of course, that results in a variety of support industries as well. From HVAC and custom home remodeling to medical practices and auto repair shops, there is no end to the types of businesses that can be operated successfully in California.

To do so, though, it is necessary to know that there are challenges to doing business here.

What is happening in your industry?

COVID-19 has had a direct impact on every industry in the United States. Probably the business that has had the most positive impact is Amazon. As some-one said, Amazon was built for a pandemic.

For those of us that are not Jeff Bezos, it has been necessary to watch what is happening in our industry and react.

There are 15 industries that I have actively assisted with the valuation and sale of a business. These industries are:

Manufacturing,

Construction,

Medical Practice or Healthcare,

Information Technology,

Wholesale Distribution,

Business Services,

Industrial Products,

Telecommunications,

Education Business,

Automotive,

Logistics,

Consumer Products,

Industrial Services,

Packaging,

Aerospace or Defense Business.

Questions to prepare and have answers if selling your business

If you are considering selling your business be it in 2021 or 2022, consider your answers to the following questions, as potential buyers will ask most if not all of these questions.

How and what has been the affect from COVID-19 on the operations of the company?

How are the changes in technology impacting the company?

What emerging technologies are influencing the company’s product development strategy?

What are the key drivers of demand for the company’s products?

What new geographic markets look most promising to the company?

How much does the company rely on third-party suppliers?

How many patents does the company hold?

Who is the company’s primary consumer base?

How important is the company’s brand to its success?

What complementary products or services does the company offer and market?

What percentage of the company’s revenue do R&D expenditures account?

What policies does the company have in place to account for, or collect, products or services after their useful life?

What is the company’s pricing strategy?

What challenges does the company face in recruiting new employees?

Who are the company’s primary competitors for top talent?

What incentives does the company use to attract and retain employees?

In which quarter does the company earn most of its revenue?

What portion of the company’s products are purchased using credit financing?

What opportunities exist for the company to provide additional products or services?

What is happening in the businesses for sale market?

With COVID-19 in full swing during most of 2020, it would be tempting to think that businesses for sale are not selling.

If that is your perception, you would be wrong.

Here are two reports for you.

The first is from BizBuySell and their 3rd Quarter of 2020 Insight Report. The second is from the M&A Source and IBBA and their 3rd Quarter of 2020 Market Pulse report. I am a member of both the M&A Source and the IBBA.

BizBuySell 3rd Quarter of 2020 Insight Report

Below are some data points including charts from the BizBuySell’s Insight Report. The BizBuySell’s Insight report looks at small business confidence and recent business for sale transactions to get a snapshot of what is happening in the Businesses for sale market.

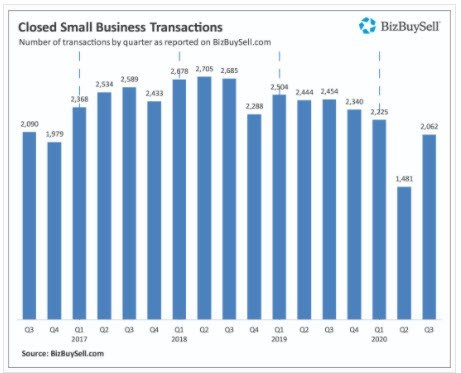

Closed Transactions

The 3rd Quarter of 2020 of BizBuySell’s Insight Report shows a steady upward trend in sales since the pandemic hit very early in 2020. In April 2020, the transactions showed a 51% year over year decline. However, that was the low point of the market with decline in July 2020 declining to 21% in July, and then in September 2020, declining to just 5% fewer deals in September 2020.

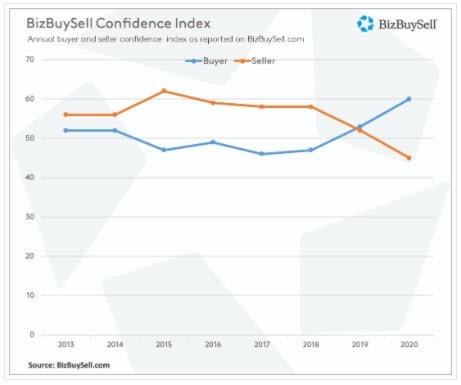

Confidence Index

As is normal in the capitalist system, the reason behind the resurgence appears to be demand driven.

According to BizBuySell’s 2020 Small Business Confidence Study, buyer confidence reached a record high of 60 compared to 53 a year ago.

The Small Business Confidence Index scores sentiment on a range from 0 to 100 using survey responses from over 2,300 small business owners, with 50 representing neutral confidence and 100 representing certainty and an idealized, perfect environment. Of buyers surveyed, 57% believe they can buy a business for a better value than last year. This is a dramatic turn as just 17% believed the same when asked in 2019.

Separately, owner confidence fell to a low of 45, down from 52 in 2019, with the primary driver being concerns over business value. Owners validate buyer sentiment, with 68% surveyed believing they would have received a better value if they had sold last year – almost double the 37% surveyed in 2019. Intuitively, 71% of these owners pin lower value on being impacted by the pandemic.

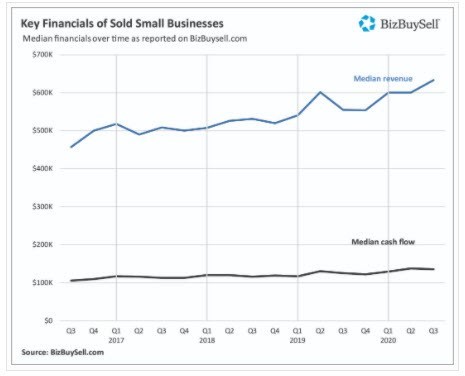

Revenue and Cash flow metrics

The chart below, highlights the following:

In the 3rd Quarter of 2020, the number of closed transactions dropped by 16%.

The businesses that sold were able to exhibit solid growth as the median revenue of sold businesses grew 14.2% from $554,764 to $633,494.

Additionally, the median Cash Flow increased 8.1% from $125,000 to $135,119.

The average Multiple of Cash flow reported has remained consistent at 1.5% growth, from 2.37 in Q3 2019 to 2.41 in Q3 2020.

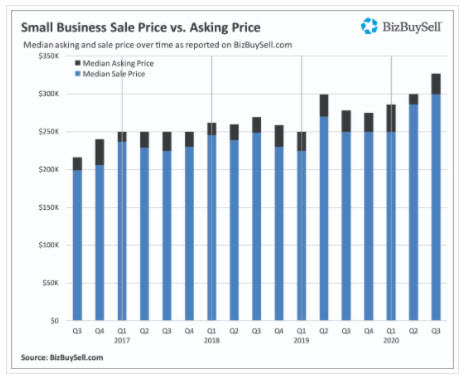

Sale Price V Asking Price

During the 3rd Quarter of 2020, the median sale price of businesses sold was $299,500 which is a jump from a year ago by 19.8%.

The listing price or asking price saw a similar increase from a year ago by 17.6% from $299,500 to $327,000.

These strong increases are an indication of the types of businesses transacting in the COVID-19 era. With many businesses negatively impacted by the pandemic, buyers with means are paying a premium for resilient businesses that are thriving well past pre-pandemic levels. At the same time, the impacted businesses which would have sold prior to the pandemic are now having a challenging time or staying on the sidelines altogether.

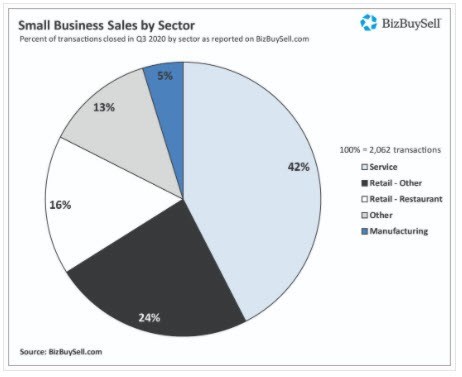

Sales by Industry sector

The BizBuySell Insight report deals primarily with Main Street businesses. This therefore includes restaurants, bars, hair salons and other non-essential businesses that have been hit hardest by COVID-19.

Thirty percent (30%) more restaurants sold in Q3 versus Q2, while maintaining the same median sale price of $150,000. This is a positive sign for a sector that has been hurt by the pandemic and prone to asset sales.

Elsewhere service businesses saw a 35% gain in transactions versus the Q2, with retail businesses jumping 50% and manufacturing doubling in volume though with a lower sample size.

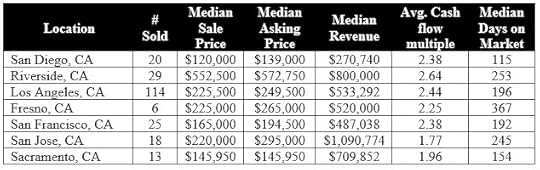

What is happening with businesses sold in California?

The State of California has a large and diverse economy. Because the State of California is so large, it is useful to look at some regional statistics from San Diego, CA in the south to Sacramento, CA in the north and five other regions.

Closed Businesses for Sale Transaction for California regions during 3rd Quarter, 2020

Market Pulse 3rd Quarter of 2020 report

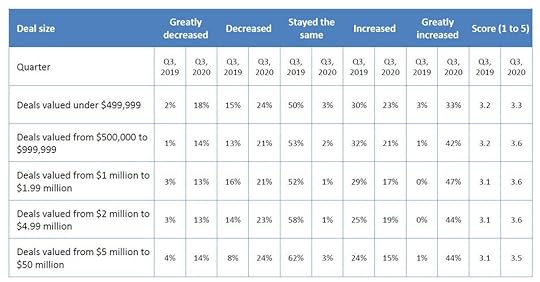

Below are some data points including charts from the IBBA and M&A Source Market Pulse report 3rd Quarter of 2020 report.

The survey is obviously conducted each quarter. For the 3rd Quarter of 2020, there were 25 questions given to the members of the International Business Brokers Association (IBBA), its Affiliates/Chapters and/or the M&A Source.

The responses were collected from October 01 to October 15, 2020 and where appropriate, compared against the results from the same period in 2019.

The goal of the Market Pulse Report is to provide quality information on a quarterly basis for both Main Street and Lower Middle Market transactions.

There are 9 slides in this series.

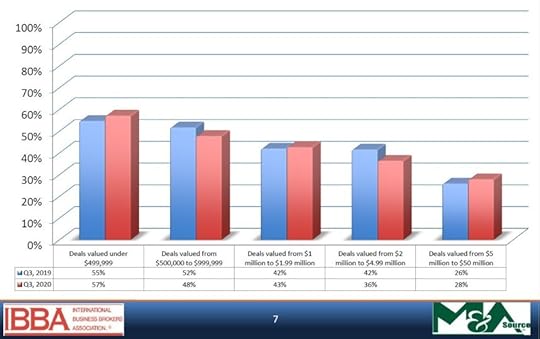

Typical size of business transaction.

This first chart provides a summary of the typical size of business transactions by breaking them down into 5 categories and comparing them to the 3rd Quarter of 2019 and the 3rd Quarter of 2020.

The 5 categories are:

Deals with a value of under $499,999,

Deals with a value from $500k to $999,999,

Deals with a value from $1mm to 1.99mm,

Deals with a value from $2mm to $4.99mm,

Deals with a value from $5mm to $50.00mm.

Business transactions sold by Deal Size in 3rd Quarter of 2019 Versus 3rd Quarter of 2020.

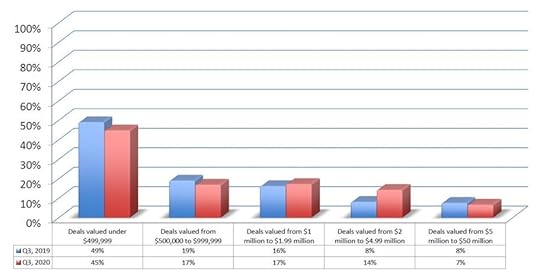

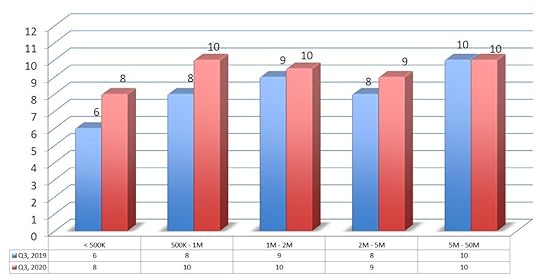

This second chart looks at the number of business sales that closed in the 3rd Quarter of 2019 in comparison to the 3rd Quarter of 2020.

As you would expect, the smaller the deal size the more businesses sold.

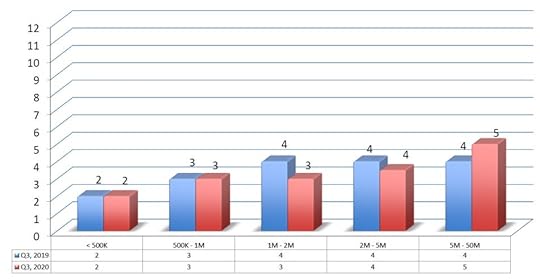

Change in new clients by Deal Size in 3rd Quarter of 2019 Versus 3rd Quarter of 2020.

This third chart shows the activity in business owners deciding to list their business for sale. The chart looks at the size of the business transactions and compares this to the 3rd Quarter of 2019 to the 3rd Quarter of 2020.

In most categories, there is an increase in the number of business owners deciding to sell their business in the 3rd Quarter of 2020 when comparing to the 3rd Quarter of 2019.

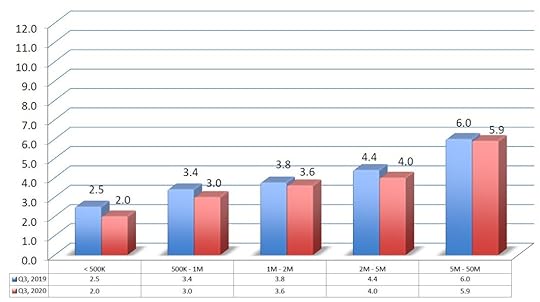

Median number of months from Listing to the Close of the sale of the business

This fourth chart shows the Median number of months from when the business is first listed or advertised for sale and the sale of the business finally closes.

The smaller the business the quicker the sale closes. However, it still takes take being a minimum of two months to a maximum of five months.

Additionally, there is no question that it has recently been taking longer to close the sale of a business in 2020 due to COVID-19 and the banks being slower to process their loan approvals.

Median number of months from Offer to the Close of the sale of the business

This fifth chart shows the Median number of months from when the seller received a Letter Of Intent or Offer for the business and the sale of the business finally closes.

The smaller the business the quicker the sale closes. However, it still takes take being a minimum of two months to a maximum of five months.

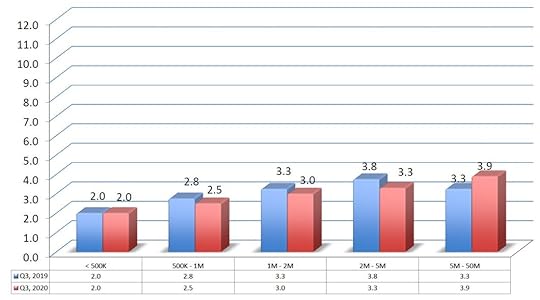

Median SDE Multiple Paid

This sixth chart shows the Median SDE multiple paid when comparing the 3rd Quarter of 2019 and the 3rd Quarter of 2020.

It is interesting to note that the multiple paid increases as the EBITDA increases.

It is also interesting to note that the multiple paid in 2019 in each category was higher than 2020 except if the value of the business was between $5 million and $50 million.

Median EBITDA Multiple Paid

This seventh chart shows the Median EBITDA multiple paid when comparing the 3rd Quarter of 2019 and the 3rd Quarter of 2020.

It is interesting to note that the multiple paid increases as the EBITDA increases.

It is also interesting to note that the multiple paid in 2019 in each category was higher than 2020.

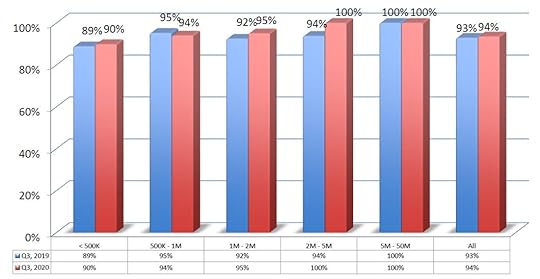

Median Percentage of Final Selling Price Versus Asking Price.

This eighth chart shows the expectations of the Business Intermediaries and M&A Advisors about the median percentage of final selling or sold price compares to the asking price. The comparison is for the 3rd Quarter of 2019 and the 3rd Quarter of 2020.

It is interesting to note that the higher the final selling the price, the greater the chances of the business selling.

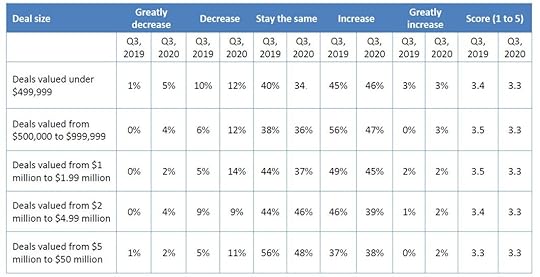

Expectations of Business Listings / Engagements from New Client in the Next 3 months

This ninth and final chart shows the expectations of the Business Intermediaries and M&A Advisors about new businesses coming to market in October, November, or December 2020 compares to the same period in 2019.

What is happening in the M&A Market?

The M&A Market, according to different perspectives on the website called The Middle Market, Private Equity will be in a strong position to make targeted acquisitions.

This is because:

Financing is readily available at historically low interest rates. This especially applies to Private Equity with a strong track record.

Businesses that now come onto the market means Private Equity will see the performance of these businesses from 2016-2019, but more importantly, during 2020 and COVID-19. If a business was able to perform well in 2020, the expectation is that the business will be worth more than those businesses that did not.

COVID-19 and 2020 came with a lot of uncertainty. With different vaccines now starting to ship, the goal is to move the country to at least a 75% rate of vaccination and this will manage the spread of the virus. An equal uncertainty has been the normal 4-year cycle of a Presidential election. For all intents and purposes, this has now been decided and the market is beginning to see the policies and personalities of the new administration. Tax policy may change but the expectation is that it will not be too much different.

An interesting side effect from COVID-19 has been a reduction in travel and more working-from-home and ‘Zoom meeting.’ If a business for sale is well run and financial statements are clean, it is much easier for a buyer and their acquisition team to focus. If the buyer really wants to see the business before making a final decision, drone technology is a simple way to allow that to happen.

How do I make my business in California sellable in 2021?

Do you remember the movie, Field of Dreams? If so, you will remember these classic lines from Field of Dreams; ‘If you build it, they will come.’ Perhaps this is a little optimistic, but if you prepare and build the right components, it will increase your chances of selling your business in California in 2021.

Owning and operating a business in California, already comes with challenges. This is not an exhaustive list, but it does include:

The minimum wage is higher than in many other states. If you hire entry-level workers at this pay rate, your bottom line will be affected, and business buyers will need to be aware of this.

In 2020, the California Consumer Privacy Act is being put into place. This act goes further than GDPR in some areas and not as far in others, but it is likely a precursor to Federal action on consumer privacy.

California Assembly Bill 5 (often abbreviated as AB4) went into effect this year as well, and it regulates which workers can be considered independent contractors and which ones will have to be considered employees. If you normally sub-contract work in your business, you will want to pay close attention to this change in regulation.

Changes in business technology that originate in Silicon Valley disrupt industries closest to them in California first, often a pressure point for businesses to keep up with their competition.

California has a high level of consumer protection. This therefore includes licensing requirements for common types of business such as the construction industry, auto repair industry, medical practices, and more.

Other factors to consider so you can successfully sell your business are:

Separate yourself from the business. It is not unusual for the owner to be the face, decision-maker, policy maker, CEO, CFO, CTO, HR department and more. If you are all these things for your business and you would like to sell the business, put your feet in the shoes of the buyer who worries that when you leave, there will simply be a need to learn too much and take the risk they will make mistakes…and so they will look at other businesses to buy.

Are the financial statements accurate and just as importantly, up to date? The number one cause of a business not being able to sell is because the financial statements are too challenging for the buyer to accept. Conversely, if the financial statements are accurate, this provides a level of comfort for the buyer as they can do their analysis and see if buying the business fits with their investment criteria including the ability to get finance; as most buyers need to do.

The public face of most businesses these days is social media to promote their product or service. If your business just uses personal accounts, this will be a negative for a buyer as all the followers and goodwill that has been built will not be able to transition to a buyer. So, separate your personal and business social media now and be prepared to wait to sell your business.

The size of a business does matter. The higher the gross revenue, the higher the number of identifiable customers, the higher the number of key employees in place and the easier the business generates its revenue the better.

More is not always better. If you have one customer that makes up more than 15% of the gross sales of the business this is a negative. A buyer is looking at customer concentration with a concern if a major customer leaves during the transition of the sale of the business, it may too negatively impact the bottom line and so it is a risk they are not willing to take.

Finally, growth is good. A buyer decides to buy a business for two primary reasons. The first reason is the free cash flow. The free cash flow allows the buyer to repay creditors, pay dividends, pay interest and very often, support the lifestyle of the owner of a privately held business.

How do I make my business in California attractive to buyers?

Each business in each industry has a unique set of factors.

Selling a business is difficult whether you are in the California manufacturing industry with its state and county regulations, environmental laws, or the California construction industry with its consumer protection and union and non-union workforces or a medical practice with the pressures of working in difficult federal and state regulations, idiosyncrasies and overhead of medical billings be they Federal or State or Health Insurance companies and more.

Share the vision of your business

A buyer will buy a business for many reasons. There are two critical reasons that are non-negotiable, and these are:

The cashflow or Sellers Discretionary Earnings the business generates.

The potential of the business…and to state the obvious, it must have positive potential.

An advantage that buyers have in the 2020 COVID-19 environment is that they can see both these factors. That is, all businesses in 2020 have worked under a 100-year event with COVID-19 or this pandemic. Many businesses have been hurt with some businesses having no choice but to close. The hurt businesses are obvious as these include businesses in the restaurant, bar, hair salon and travel industry. However, other industries have been hurt such as a medical billing business that had to close their doors as some medical practices were closed and therefore the business was unable to do the medical billings for the doctor.

If you plan to sell your business, ensure you share the vision of your business so the buyer understands opportunities they may not have considered.

Another critical piece to remember is that the business seller gets to work long days and hours, but they also get to work the hours that suit them. I am working with a business owner that sells forklift trucks and related services. He chose to hire a Sales Manager and provide them with a huge sales incentive. This decision still brings the business a great return on their business but also allows her to live her own lifestyle, which she loves.

As you sell your business, do not forget to sell your lifestyle and cash flow. Make sure you can defend the cash flow as the buyer will probably need a loan and the loan will only be approved if the lender is comfortable with the tax returns and supporting financial statements.

Does a PPP loan affect the value of my business?

The PPP loan forgiveness forms are now readily available. If you want to know the right steps to apply for PPP loan forgiveness it is very simple. Do not ask other business owners what they have done or a well-meaning friend. Simply ask your PPP lender. Some PPP lenders are outsourcing this service, but the PPP lender is responsible for helping you with the PPP loan forgiveness process. If the PPP lender gets it wrong, they will have to answer to the SBA, so they have a huge incentive to get it right.

Before you start the PPP loan forgiveness process, make sure you report it correctly on your financial statements.

Most financial institutions are not recommending showing the income from the PPP loan on the Income Statement or P&L as the expenses are not deductible.

Check with your accountant or bookkeeper with the debit and credit entries they wish you to show. It is likely that when Congress passes a new stimulus, they will tidy up some of the language of these loans as the IRS has issued their guidance and it is probably not what Congress intended with the CARES Act when it was passed.

The next steps

Would you like to value your business so you can decide if it is ready to sell? If so, the first step, is to visit this page on my website for more information – Successfully valuing your business.

To prepare a personal business valuation which includes an 18-page report, the document necessary would be the last 3 years tax returns of the business, a recent Profit and Loss Statement and a Balance Sheet.

This link to a page on my website is to a Sample Business Valuation.

If you are a ‘Do It Yourselfer’ and would prefer to learn the steps to value your business, you can learn more here and sign up for our email service by going to this page of my website – Steps to Value Your Business.

Contact Us to value and sell your business

If you have questions about the value of your business or the steps it takes to sell a business, please reach out to us using the “Contact Us” page to introduce yourself and we will get back to you.

If you still have questions, please send them via email to info@rogersonbusinessservices.com or you are welcome to sign up for our free monthly newsletter by clicking this link and adding your email address.

The post Valuing and selling my California business in 2021 appeared first on Rogerson Business Services | CA Certified Business Broker.

November 24, 2020

Running and Selling a Medical Practice in California

Running and selling a medical practice in California is different than in other states, but there are some similarities, too. People are drawn to California for the climate, the lifestyle, and the multitude of opportunities. If it were its own country, California would be the sixth-largest economy in the world.

It’s no wonder that we have a multitude of medical practices in the state, from general and family practices to specialties of nearly any type. So let’s look at what’s different, and what’s the same about running and selling a medical practice in California.

Licensing and Practicing Medicine in California

First, it is important to understand that licensing in California is different than in other states. If you already run a medical practice here, you know this, but it is important to remember that when you are ready to sell, you need to find a qualified buyer. This means a buyer who has or can quickly obtain certification through the Medical Board of California.

For most physicians or those seeking to purchase a medical practice in California, this is a simple thing. But it is important that the buyer apply early to ensure their practice is in compliance before closing. As a seller, you may have to stay working in the practice for a limited time to ensure a smooth transition.

This is all a part of finding a qualified buyer for your Medical Practice in California.

Demographics and Lifestyle of the People of California

The demographics of the citizens of California are quite varied and depend a lot on the location of your practice in the state. This especially impacts specialists. Geriatric specialists should open practices in areas where there are many retirees. Plastic surgeons may be better off in the star-laden areas of southern California.

General and family practice are important everywhere, and there may even be tax advantages and student loan repayment options for those who work in certain rural communities. So even if you have a smaller practice in a rural area, don’t despair when it is time to sell. There will likely be buyers who are interested in your practice because of the location.

A certified business broker can help you discover this, and find the right buyer who is interested in your type of practice no matter where you live.

Expected Growth of Medical Practices in California

The events of 2020 shook many medical practices and have made it much more difficult for small providers to make a profit. However, there will likely be a resurgence when vaccines become available and restrictions are lifted. Despite these restrictions, the demand for medical practices in California has continued to grow.

According to First Research, medical practice growth is expected to continue at nearly 7% over the next five to seven years. There will be changes though. Telemedicine, digital recordkeeping and security, the changing pharmaceutical industry, and more will mean that medical practitioners will have to be even more tech-savvy.

This is important for qualifying your potential buyer as well. It will also help you sell your practice if you have already adopted much of the needed technology for telemedicine, your EMR and patient communication systems are up to date, and you are using the latest technology in your practice. This shows your buyer that you are on top of current trends, and makes your practice more desirable.

The Sale and Closing Process

Another difference in California is the escrow process as a part of closing. This makes things a little more complicated but offers protection for both buyers and sellers. This is actually an advantage, but it is important that your potential buyer understands how this works. Typically, a business broker will be a huge part of making sure this part of the selling process goes smoothly.

In some other states, escrow is not required and there are other closing differences as well. Even if your buyer has purchased practices or businesses in other states before, the process in California might feel odd or different to them, and even to you. This is where the guidance of your team will be helpful.

Your business broker will be the cornerstone of that team, but it will often include an attorney, an accountant, and perhaps other experts as needed.

Insurance on Both Sides

Insurance and billing are both very important to your medical practice and its success. Taking all major insurance types and carriers, a clean and efficient billing and coding process, and more can make a huge difference to how profitable your practice is, and how desirable it is to a buyer. The better your system, the easier it will be to find a buyer.

Also, California has strict requirements for medical practice insurance, and it is a good idea for your buyer to be pre-approved for these coverages. Otherwise, they may struggle to take over your medical practice. This is another important aspect of finding and keeping a qualified buyer and another area where your business broker can help.

But you may face some unique challenges when it comes to selling your medical practice in California.

Unique Challenges to Selling a Medical Practice in Calfornia

California is one of the most regulated states in the country, and shutdowns and restrictions during 2020 have made running a profitable medical practice challenging, especially for some specialists and small practices without the financial stability offered by large conglomerates.

There will likely be a resurgence of most of these practices as the pandemic eases, but recovery may take time. The most appealing practices for buyers are profitable and running smoothly. Your business valuation may have been impacted by COVID, so you may have to rely on former profitability and future potential to get the price you would like for your practice.

In some cases, waiting to sell until there has been a recovery and things have normalized a bit may be the best answer.

Should You Sell Your Medical Practice in California

Is now the right time to sell your medical practice in California? Should you wait? What steps can you take now to make your business more appealing to potential buyers?

The answer to these questions may seem a bit complicated, and they can be. Clarity starts with performing a business valuation. That way, you will know what your business is worth now, which is the key to making decisions about what to do in the coming year, and if selling your medical practice is the right answer for you.

If you want to know what your practice is worth and what your options are, contact us today for a business valuation. Then we can talk through when might be the right time to sell your business and how to prepare to start the process. Then we’d love to be your business broker and help you through the entire process from finding a qualified buyer to escrow and closing. Reach out to us anytime. We look forward to talking to you about exiting your medical practice in California smoothly.

The post Running and Selling a Medical Practice in California appeared first on Rogerson Business Services | CA Certified Business Broker.

November 20, 2020

7 ways COVID Permanently Changed the California Healthcare Industry

There is no doubt that COVID-19 or the Coronavirus, changed healthcare forever. Some of the changes were ones that have been long overdue but were accelerated by a global pandemic. Others were unexpected and have driven the California Healthcare industry to adapt quickly.

Here are seven ways COVID permanently changes the California Healthcare Industry.

Elective Procedures

At the height of the pandemic and through various stages of relaxing and tightening restrictions, elective procedures were either postponed or put off indefinitely. This not only had an impact on patients seeking care but on the specialist who provided that care and performed less urgent procedures.

This meant that specialists had to expand outside their niche in order to survive and perform procedures they wouldn’t normally do. Some had to open themselves up to more general practice or even hospital rotations to maintain their businesses and sustain their practices.

Some doctors even walked away from their practices, and as restrictions ease, it could be a busy time for those who endured. It also could be a great time for specialists to sell.

At-Home Testing and the California Healthcare Industry

When it comes to procedures like a colonoscopy or other preventative procedures, there was a lot of debate over the risk of entering the hospital and having a test. As a result, companies that had been developing home testing kits flourished.

This even included a limited number of antibody tests for COVID itself, companies like Cologaurd, and others. Testing that could be done at home, by the patient themselves, became a more viable option due to safety and disease transmission concerns.

Telemedicine

Telemedicine was an option before, but there were really specific requirements, and often insurance companies would not pay unless these were met. With the onset of the COVID pandemic, these restrictions were eased, insurance found ways to code and cover such visits, and offices updated technology to facilitate telemedicine.

The good news for medical practices that implementing this technology now will continue to serve them in the future. For those in rural areas, at-risk patients, and others, telemedicine is here to stay.

California Healthcare Industry Record-Keeping and Patient Privacy

At the same time as the COVID vaccine was surging, California was also busy passing additional consumer privacy protections. While this is nothing new, this accelerated the encryption and protection of digital patient records while still making them accessible.

The good news for those in medical technology is that with the development of more widespread privacy protection, the medical industry will benefit from this rapid innovation. Those who provide EMR software and secure cloud services as a part of their business will continue to thrive.

Medical practices large and small can also be reassured they will be in compliance with changing legislation. Your practice will be protected and desirable to buyers looking for profitable, up to date practices.

Cleanliness Standards

Social distancing, sanitizing surfaces, and more have come into the forefront of nearly every business. Medical practices are cleaning waiting areas and patient rooms more thoroughly and more often. Many are even closing waiting areas, and having patients arrive on time, check-in while in their cars, and are escorting them inside when the doctor is ready for them.

This means that cross-infection that is often a risk during doctor visits has been lowered and in many cases nearly eliminated. The new systems are working so well, some offices have no plan to reopen waiting areas the same way they were before.

“Stacking” Patients

A common medical practice is stacking patients, or intentionally overbooking the doctor’s schedule. That way if there is a cancellation, that slot is not empty. The lack of waiting areas and the undesirable risk of patients waiting in patient rooms for too long of periods has lowered this practice, which means two things:

Patient satisfaction is on the rise. Patients don’t like to wait, and this practice makes doctors stick more stringently to a schedule.

Appointments are kept more regularly. As appointments are harder to come by and requirements are stricter, it is unlikely your patient will cancel.

These are good things, overall, and things many would say should have been a part of medical practice for a long time.

Profit and Loss

What does all this mean to profit and loss? That depends on the medical practice, how well doctors and staff pivot, and the cooperation of patients.

Specialties will need to recover from COVID lows, but that recovery may be rapid when restrictions ease.

Some practices are selling to larger conglomerates to protect them against cashflow variables.

General practice and family practice are in reasonable shape and even growing. Post-COVID, it is anticipated this will continue to be a “healthy” industry.

Patient Stacking and other methods are no longer profitable, but things like telemedicine are, and medical practices can capitalize on those things.

Just like any other business, the medical industry will have its ups and downs. But overall, the medical field will continue to be a desirable and profitable business in most fields.

Should You Sell Your California Medical Practice in 2021?

There may be a couple of reasons you want to sell your California medical practice in 2021. Perhaps you are burned out and the idea of enduring an economic recovery that seems a bit uncertain is too much for you. Maybe it is time to retire and exit your business for good.

Maybe your practice is thriving, but you are ready to move on to another practice or area of specialization. If your business is profitable and growing even during a pandemic, it may be quite appealing to California buyers and even large conglomerates.

Want to know what your business is worth? Do you wonder if 2021 is the year when you should sell your California medical practice? Contact us today. We’d love to talk about your options, and if you are ready to sell, we’d love to be your business broker.

The post 7 ways COVID Permanently Changed the California Healthcare Industry appeared first on Rogerson Business Services | CA Certified Business Broker.

November 16, 2020

Proposition 24 and its Impact on Selling a Business in California

Among other hot topics this election season, California’s Proposition 24 took a top spot. This among other measures in the United States and around the world at strengthening consumer privacy protections, third-party data gathering, and how consumers can control their own data and how it is used. The European Union paved the way with GDPR, and the California Consumer Privacy Act soon followed. But what California adopts often has a pretty widespread impact, especially in the United States, because of the massive presence the state has in the tech industry. So what does it mean when it is time for selling a business in California? Well, that depends on the California industry you are in, and how you already deal with both consumer data and advertising.

Customer Data and Privacy and Selling a Business in California

The fact that companies have to share whatever data they may collect about an individual and be transparent about how it is used is already well-established by the protections of GDPR and the CCPA. But Proposition 24 takes things a bit farther, allowing customers to stop businesses from selling or sharing their personal information, including what we often consider anonymized data.

This includes race, religion, genetic details, location, and sexual orientation. But it doesn’t just give consumers the right to stop this action. If this type of sharing, even just sharing among similar industries, or selling demographic information is a part of your business model, you will have to adjust right away.

Advertising and Marketing

Just as important, even more so in some cases, is the tighter restrictions established about how websites gather your data and share it with their advertising partnerships. What does this have to do with your California business?

Facebook and Google, two of the largest digital platforms in the world, rely heavily on data from third-party applications to make their marketing platforms more robust. That means for businesses who run Facebook and Google ads, targeting may be less robust. Some IT and app development companies may have to rethink a part of their business model, otherwise, they risk becoming obsolete as this type of restriction is adopted more widely.

For some eCommerce or retail businesses who rely heavily on digital advertising, this could present a serious challenge and will likely impact your bottom line.

Confidentiality and Liability

There isn’t some kind of workaround for this law, even a temporary one. In fact, it likely spells the future of confidentiality and liability when it comes to how you handle, share, sell, and deal with even the most mundane parts of customer data.

It also means the digital marketing landscape is changing. This not only has meaning for marketing and IT companies, but also for nearly every business. New technology is emerging that will help this transition, but your business will have to pivot to new models.

The other key is to be prepared. Because if you violate these standards in any way, you could face serious fines from the State of California, the EU (if you have customers there), and potentially more even if your business is located outside California or you have locations in other states.

But what does all this mean when you are selling a business in California?

Proposition 24 and Selling a Business in California

When you are preparing to exit your business and sell it, there are a lot of factors that go into your business valuation. This can include what the future of your industry looks like. So if your business is being impacted by a law like Proposition 24 or other legislation, it could have an effect on your business valuation.

So what do you do?

Make sure your privacy policies and terms and conditions on your website are up to date and in compliance with California law and the GDPR.

Do the same for your CRM and the provider who holds your email list. If you use a major provider like MailChimp, ActiveCampaign, or CovertKit, they will do this automatically for you, but be sure you update all forms on your website and other places with the correct information.

Have consumer data available in case a customer requests theirs.

Limit the data you collect and store to just the information you need.

Avoid fines and litigation by ensuring you are in compliance. Have a plan in place for consumer personal data requests.

As this type of legislation becomes more common, how you handle consumer data will become a part of due diligence, and even a question buyers will ask early on in the purchase process.

Are you thinking of exiting your business in 2021 or even beyond? Start with a conversation and then a business valuation. We can help you understand the impact of Proposition 24 and other factors on selling your business. When you’re ready, we’d love to be your business broker and walk you through the process every step of the way, from finding a qualified buyer to the Escrow process. Contact us today!

The post Proposition 24 and its Impact on Selling a Business in California appeared first on Rogerson Business Services | CA Certified Business Broker.