Andrew Rogerson's Blog, page 9

November 9, 2020

CA Dreaming: The Differences Between Running a Medical Practice in California vs. Elsewhere

As one of the largest economies in the United States, California is attractive to those seeking to run a medical practice for a number of reasons. With the sixth-largest economy in the world, if it were a country, a lifestyle and weather to die for, and unparalleled recreation, it might seem like a no brainer to move a medical practice to California or purchase an existing one. So selling a medical practice in California should be easy, right?

Well, that is true to an extent. Selling a medical practice in California does have some advantages, but when it comes to vetting your buyer and finding someone who is qualified to buy your business, it’s important to keep some things in mind. Because running a medical practice is different in California than elsewhere. This is something that sellers and their buyers need to be aware of.

So what are those differences?

Licensing and Running a Medical Practice in California

You would think that you could simply find a physician who wants to move to California from another state, and they could simply purchase your business. That can be true, but licensing in California is different, and that doctor must be licensed by the Medical Board of California.

Of course, there is a workaround for this if it is clear that the physician will be easily certified, or their certifications will transfer. You can stay on and work with the new owner as they navigate the process. It is important to understand this comes with some risk, though. If for some reason the buyer’s certification is not approved, you could end up in an awkward situation. It is always best to ensure your buyer has the right qualifications before selling your business.

California Taxes

No one loves to talk about taxes. Even tax accountants get bored talking about taxes. But it’s a necessary topic in California because a lot of the ways you run a medical practice depend on how the company is structured and where the practice is located.

There are also regional and local taxes to consider, along with regulations about billing practices. The new California medical practice owner must understand that how taxes worked in their home state is likely not the way they work for California health care providers.

Differences also emerge from the way the sale itself is structured. Your business broker can help both you and your buyer understand this process, but even if they have purchased medical practices in other states or regions, your buyer will find some differences in California.

Privacy Concerns

The California Consumer Privacy Act is similar to the GDPR in the European Union, but with greater restrictions in some areas. This initiative has actually further been strengthened by the passage of Proposition 24, which is even stricter than the CCPA. What it really means is that you must be careful how you store, share, and handle private personal information.

These regulations are strict and carry hefty fines for violations, and they are especially important to businesses like medical practices where personal information is gathered on a daily basis. Being hyper-aware of these laws and appropriate security measures is key to a successful California medical practice.

While it does seem likely that several other states will follow California’s lead in this area, at the moment California stands out as extremely different and stricter in this area of business.

Making the Transition Easier

Understand these things are not designed to discourage sellers from selling a medical practice in California or buyers from buying. Rather, they are intended to offer information and help you lay out a plan to make any transition simpler. So here are some tips for you.

Make sure your buyer is qualified or assured of the qualifications they will need to own and operate a medical practice in California.

Make sure your buyer has the financing in place to be able to purchase your California medical practice.

Have a transition plan. Determine the amount of time you will say on and help introduce your buyer to patience, vendors, key staff, and more. This makes the takeover smoother for everyone.

Hire a Certified Business Broker to help you sell your business. They will help qualify your buyer, assist you during due diligence, and be with you all the way through the process to escrow and closing.

There is no foolproof way to make every transition perfect. But with the help of a business broker and by helping your buyer understand the things that make running a medical practice in California unique, you can ensure the best transition possible.

Need help in understanding how to get your medical practice ready to sell? Let’s start by learning what your business is worth. Contact Rogerson Business Services today for a business valuation which will enable us to talk about the best exit plan for selling your business.

The post CA Dreaming: The Differences Between Running a Medical Practice in California vs. Elsewhere appeared first on Rogerson Business Services | CA Certified Business Broker.

October 28, 2020

California Small Business Loan Guarantee Program

The United States provides a unique Small Business finance program to assist with the selling and buying of privately held businesses and real estate. These programs are under the administration of the Small Business Administration or SBA.

Small businesses use the SBA 7(A)-loan program for business acquisitions. Similarly, the SBA 504 loan program is for real estate transactions.

These SBA loan programs are unique to the United States. Other countries around the world do not have a similar program to support their business owners. In Canada, for example, if a business owner wants to sell their business, they typically require the buyer to provide an acceptable down payment and the seller then takes the risk and provides the balance as seller finance.

Because of the success of the program in the United States, Australia is considering a similar business model, but they are yet to implement it as they are not sure whether it will be politically acceptable.

California Small Business Loan Guarantee Program alternative

Most business owners with a business in California may not realize but there is an alternative or additional option to an SBA 7(A) loan.

The program is called the California Small Business Loan Guarantee (CSLB) Program and is under the management of the iBank.

Because it is a State of California initiative, this loan program is only available to a business that is in California and the employees are in California. There are some tweaks to this rule. For example, if the business has most of their employees living in California but a small percentage outside California, the lender can adjust the loan amount by considering the percentage of employees outside California.

Features of the California Small Business Loan Guarantee Program (CSLB)

Some of the highlights of a California State Loan Guarantee Program include:

The primary use of this loan program is for borrowers that are NOT eligible for SBA financing.

A typical California State Loan Guarantee Program loan is for a period of 7 years. This is shorter than the SBA 7(A) loan which is typically 10 years. The California State Loan Guarantee Program may extend longer than 7 years, with consideration given on a case by case basis.

The California State Loan Guarantee Program assists banks that offer these loans by providing a maximum loan guarantee for 80% of the loan to a maximum of $1.25 million. For example, if a bank offers a business a loan of $2 million, the maximum amount of loan guarantee the bank will receive is 80% of $1,250,000 or $1 million. If a bank therefore approves a loan up to $ 2million, they are opening themselves up to a $750,000 loan underwriting exposure with no guarantee.

If a borrower successfully receives a loan, there is a 2.5% loan fee of the guarantee portion.

A condition of the loan is that the borrower may not have more than 750 employees.

Benefits of the California Small Business Loan Guarantee Program

There are several positive features of the California Small Business Loan Guarantee Program. These include:

A loan is available to use for nearly any industry; even the cannabis industry is eligible.

A loan is also available to use for a Stock sale or an Asset sale.

A loan can be used to buy out a partner, unlike an SBA loan.

Loans may be used for different purposes including:

Business acquisitions,

Buying a franchise,

Bridge Loans,

Equipment purchases,

Working Capital,

Inventory,

Building Purchases and Construction.

How to use a California Small Business Loan

If the time is right to value and sell your California business, your chances of success increase with having your business pre-approved for finance so if a qualified buyer comes along, both parties are able to work together and close the sale.

There is typically a quick turnaround time on getting a loan approved with less forms required than an SBA loan.

An accurate business valuation is the first step to successfully sell a business.

With an accurate business valuation in place, there are many steps to successfully sell a business. Here is a summary of the Twenty Four steps it typically takes to sell a business.

If you have questions about selling your business or would like more detail, the link to this article about selling a business will help.

If you still have questions about valuing or selling your California business, you are welcome to schedule a 30-minute conversation. Simply click this link to schedule a call with me and find a date and time that works for you. The rest happens automatically.

The post California Small Business Loan Guarantee Program appeared first on Rogerson Business Services | CA Certified Business Broker.

October 27, 2020

The CCPA and Selling a Business in the California IT Industry

The introduction of CCPA, the California Consumer Privacy Act, has had a direct impact on a lot of businesses, especially the IT industry. For some businesses that do business internationally and were already compliant with the General Data Privacy Requirements (GDPR) passed by the EU, there were only a few necessary tweaks, and they were ready.

But since the CCPA went into effect on July 1, 2020, the impact on running and selling an IT business in California has already been felt. Here are the three most important things to consider and that has and will have the greatest impact.

CCPA and a Customer’s Rights to Access Data

This is a big one for a lot of IT companies, who typically not only store data from their customers, but also provide resources to customers and clients to store the data they gather about their customers.

The biggest takeaway is a reverse transparency: records from the last 12 months must be readily available to a customer should they request them. Even though many companies store lifetime data for customers, they are rarely set up to share that data with the customer or with anyone else.

The reason is simple: data privacy. When a company collects data, they need to protect it from hackers or other nefarious interests. This means data is encrypted and access is extremely restricted in most cases. And if you think your company is immune, look at the recent breach at Barnes and Noble, including their Nook division, where there was a serious security breach and loss of customer data.

This is a hard act to balance. Before releasing customer data to the customer, companies, in partnership with their IT providers, need to provide an identity verification process and ensure that only the data requested is released, and the privacy of the rest of the customer data is preserved.

When it comes to selling or even thinking about selling your IT business, you must have safeguards in place to comply with these requests and this act. Even in the brief time since it has been in place, there have already been challenges by consumers, some of which have resulted in hefty fines or even lawsuits.

Opting Out of the Sale of Data

If you are an app developer, and you develop an add-on or an enhancement to a current application, the ideal situation would be that you market and therefore sell it to those who already use that or similar apps. So you approach the app developer and purchase their list of customers or access to that list, and ta-da! A built-in audience.

Not anymore, at least not easily. The consumer can opt-out of sharing that data with you or anyone else, and if you use that data anyway (or are the seller of that data) you can face hefty fines and lawsuits.

What this means, especially to the tight-knit IT community is that the sharing of lists, formerly a common practice, must be done differently to avoid potential trouble. You can advertise your product to another’s list, but you can’t organize a drip campaign to those leads or move them to your own list without their consent.

While this impacts marketing primarily, it can affect the value of your business when the buyer looks at your potential reach and the viability of your product and future ones. A shift in marketing strategy is essential before you decide to sell your business, and above all else, you must be in compliance and litigation free.

Think of it this way: most buyers are leery of liability involved when buying a business that has a lawsuit pending against it. If you are even thinking about exiting strategy and selling your California IT business, this is something you must consider.

A Consumer’s Right to Sue

Perhaps the biggest impact of the recent Barnes and Noble breach, something hard to face for a brand and industry-facing hardship during the pandemic is the potential for lawsuits. Not only can the consumer sue your business for not providing them with the data you collect about them or for selling that data illegally, but they can sue if you lose their data.

This is the dilemma many IT companies currently face. Data must be secure but accessible when necessary. It cannot be sold, and it must be protected at all costs. A large enough breach even handled impeccably, can bankrupt a company.

And again, no buyer will typically be interested in buying a business that is facing potential litigation, at least not for the seller’s asking price. In fact, it can seriously hurt the value of your business, and the buyer may want the previous owner to assume the liability for that suit.

This is not something IT companies have to deal with tomorrow or can ignore or put off. It’s vital to business success and especially important if you want to sell your business.

Has CCPA impacted your IT business? Are you thinking of selling your IT business? Or do you simply want to know the value of your business in order to make a decision? Contact us at Rogerson Business services today. We can help you by starting with a business valuation, and when you are ready to sell we can help you every step of the way. We want to be your California business broker!

The post The CCPA and Selling a Business in the California IT Industry appeared first on Rogerson Business Services | CA Certified Business Broker.

October 22, 2020

Work from Anywhere: The Impact on a California IT Business Preparing to Sell

One bright spot in the COVID pandemic has been the IT industry. With companies shifting employees to remote work, businesses starting from home, and other factors, tech both big and small has seen a significant boost, and the California IT business is no exception.

This means it is a great time to be in the IT industry and if you are in that industry, it may be a great time to sell. But what does the work from anywhere revolution mean to IT companies, particularly if you are thinking of selling in 2021? Here are some things to consider.

Remote Work

Not only are your customers working remotely, making your services more in demand, but your employees are likely working from anywhere as well. This offers some challenges when selling your business. Your buyer will want to know about key employees, their loyalty, and their productivity.

This also may create another challenge for a new owner. Once the sale is announced, introducing someone new to remote workers comes with its own unique challenges. While this can be navigated when onboarding employees, it can be even more disconcerting when introducing a new business owner who might bring a lot of changes.

A remote workforce does not mean you can’t sell your business. Tech companies have operated on this model for years, and the IT industry is better poised to handle this transition than most. It is something you need to consult with your business broker with and keep in mind when you are ready to sell.

Security

Many IT companies have their own on-site servers with built-in physical and digital security to protect intellectual property and the work your team is doing. What about when they go remote? There are still security options, but you need to have these in place so you can show any buyer that you are taking active steps to protect the things that set your company apart.

These steps can include:

Proprietary VPN software

Firewalls and Vaults

Encrypted Cloud Data Rooms

Password protected company asset access.

These are just a few of the things you can do, and those in the IT industry know better than most the steps that will protect your company data and your employee information. It pays to be vigilant though. Even Twitter is not immune to security breaches.

Your California IT Business Location?

While it used to be that your location was vital to your business, that is not as true anymore. While there are still distinct advantages in being located close to Silicon Valley and San Francisco, many of your employees may never visit your headquarters.

While this may have seemed unrealistic pre-COVID, the work from anywhere environment means that not everyone has to physically be in the pitch meeting. Tools like Zoom, Microsoft Teams, and others mean collaboration can happen from anywhere.

It is still a good idea to talk about your lease with your landlord if you have one and examine or renegotiate terms before you sell. However, in the commercial space, it is a renters market at the moment, and you may have options that were not viable even last year.

Your buyer may think that location is not as important for IT companies as it once was, but that may not be true in your case. If you ship physical parts to local companies or work closely with them in some other physical way, let your buyer know that location does matter.

Keeping Your California IT Business Up to Date

Finally, just because you have decided to sell your IT business in California doesn’t mean you can afford to relax and fall behind the improvements happening in your field. In fact, quite the opposite is true.

Buyers are looking for businesses that are profitable, growing, and on the cutting edge. Even during the process of the sale, it is important that you run your business just as well or better than you did before you decided to sell.

Remember, you must still work to serve your clients and customers, meet your employee needs, and carry on business as usual.

This is why, when you decide to sell your California IT business, you need a Certified Business Broker on your side. They will help coordinate and “quarterback” many aspects of selling your business, from listing to marketing to finding a qualified buyer. A good business broker will be by your side every step of the way all the way to escrow and closing.

But it all starts with knowing what your business is worth now. Even if you plan to sell in the next year, the time to start preparing is now. Are you ready to sell or do you want to start a conversation about your exit plan and what your business is worth now?

No matter what your reason for wanting to sell, whether you want to retire or move on to another business adventure, we want to talk to you. We’d love to be your business broker every step of the way. Give us a call or contact us here.

The post Work from Anywhere: The Impact on a California IT Business Preparing to Sell appeared first on Rogerson Business Services | CA Certified Business Broker.

October 15, 2020

The COVID California Construction Industry Boom: How Long Will It Last?

There is some good news coming out of the COVID pandemic for those who run or want to sell a business in the California construction industry. The construction industry is strong right now, which makes owning a business in many areas of the construction industry desirable and also makes these businesses attractive to buyers.

But how long will this construction boom last, and what is the future for the construction industry in California?

Low Interest Rates

First, one of the most significant drivers for the construction boom is low interest rates. It looks like if the Fed holds true to its current strategy that no matter who is in office, these interest rates will last a long time in an effort to combat inflation.

What this means to new home buyers is that their mortgage will cost them less over the term of the loan, and payments will be lower. This means if they are in a good financial position, they can afford more house than they might have been able to otherwise. This is good news for new construction, as buyers are attracted to the ability to customize their home from the start.

For those who are refinancing, it means they can afford to take out equity for home renovations, an area we will talk more about in a moment. For those in the construction industry working in remodels of kitchens, baths, landscaping, or other niches, this is a boom time.

As long as low interest rates prevail, homeowners will seek more options for home purchasing or remodeling, and those are both good for the California Construction Industry.

The Stimulus Package Redux?

The longer the COVID crisis continues the more likely it is that Congress will pass one or more new stimulus packages. While there is little agreement on what they might look like, and whether there will be any action before or after the current election, the one thing that is clear is most lawmakers are in favor of doing something.

Many homeowners and potential home buyers took the opportunity to use stimulus funds toward a down payment or home remodeling or repairs. If a second stimulus package were to emerge, it’s likely this trend would continue. The package would likely include some help for small businesses as well, creating additional opportunities in the construction industry.

Home Time

Why the trend toward remodeling? More time at home often reveals the “flaws” in their home more clearly to homeowners. They may engage in projects they were putting off because now they have to live with them on a daily basis.

The other reason is simple. Making that bedroom into a home office may seem like a simple thing, but it does come with challenges. Making it into a full-time workspace means more work than many people realize, and once workers are spending more time remote than in their office downtown, the more important making changes becomes.

This is a great opportunity for construction specialists, and the above-mentioned interest rates and stimulus along with renovation stipends offered by some employers make this a great time to be in the California construction industry.

Relocation and the California Construction Industry

Finally, there is another trend driving the California construction industry, and that is relocation. Remote work means that employees can work from anywhere, and what that means is two things: first, people are relocating places further away from expensive city living where they can also get more land for the money they are spending.

As some people relocate, the value of homes in the city changes. So does the desire for those who stay to make changes and remodel. These two complementing drivers mean that more rural construction will see a boom. Urban remodels and changes add to the overall increase in construction work.

There are several additional factors related to COVID as well. Retail and other spaces are being renovated with social distancing measures and ways to protect customers and employees. Offices are changing, and spaces need renovation and in some cases expansion to meet new requirements.

While some of these changes are temporary ones, others are responses that should have happened long ago and will be ongoing for some time.

So how long will the COVID construction boom last? It is hard to say, but construction is almost always a great industry to be a part of.

Are you ready to sell your business in the California construction industry? Now may be a great time. The first place to start is with a business valuation. Before you sell your business, you really need to know what it is actually worth.

If you wonder if your business is ready to sell, if you are ready for a business valuation, or you are ready to sell your business, contact us today. We’d love to help, and we’d love to be your business broker.

The post The COVID California Construction Industry Boom: How Long Will It Last? appeared first on Rogerson Business Services | CA Certified Business Broker.

October 9, 2020

Running and Selling a Business in the California IT Industry

The IT industry has been booming for quite some time. From robots that flip burgers and giant ones that kneel, stand, and walk to your local data center, the future of 5G, and the “work from anywhere” revolution, internet technology, the internet of things, and big data all offer huge opportunities. One of the places that is happening most is in the California IT industry.

This can mean big business, and it can also be great news if you are a company in the IT industry and looking to sell your business. So what does running and selling a business look like in the California IT industry? Here are some clues.

Recent Changes in the IT Industry

First, the IT industry has changed worldwide. The COVID pandemic has forced companies to think of remote work differently, and more people have adopted the work from anywhere philosophy. This means data centers and other server locations in residential and other areas have had to step up their game. Changes came fast and furious last March, and these companies are working hard to keep pace.

But it also means companies that offer support for those who work from home, and now do pretty much everything from home, are booming as well. They include things like app development for:

Exercise at home.

Health apps, especially those that connect similar groups of people.

Work sharing apps, like Zoom and Slack, and other smaller players that offer extensions and add-ons.

Video calling devices similar to Zoom’s own hardware and Facebook Portal.

Food delivery and ordering apps.

Healthy cooking and recipe apps.

Family activity apps.

Finally, the less fun but necessary contact tracing apps.

The industry is wide and open to a lot of innovation. This means that if you have a thriving company ready to sell, finding buyers is much simpler. It also means if you need to grow your company to be more profitable before you sell, opportunity abounds.

The Forecast

According to First Research, the IT industry has grown 7.3% in 2020, and projections say it will grow even more before 2029, at a rate of 11%. As more technology becomes a vital part of our lives, every part of the sector is experiencing growth. There are several examples:

Autonomous vehicles which require extreme AI.

High-speed internet even in rural areas, and faster and more extensive cellular networks.

The gathering and analysis of big data.

The shift to a “work from anywhere” environment.

The development of health-related apps, group sharing on a large scale through video chat, and other developments mentioned above also provide both opportunities and challenges that are driving growth.

One of those drivers is consumer privacy and security.

Unique California Challenges

Last year, the passage of GDPR had websites and companies that did business in Europe scrambling to meet new, stricter requirements for storing, protecting, and using customer data. For companies who did business internationally, this was just the first step. Next came the California Consumer Privacy Act.

The way the act is written, it not only applies to those companies based in California but any company that does business with residents of California. Since the California economy would be the sixth-largest in the world if it were a country of its own, that means it affects nearly every company. Similar to GDPR with some additional protections, the act is good for consumers, but does offer challenges to software and app developers, and those who build e-commerce websites or offer software as a service with a subscription model.

Another California challenge is AB-5, the new law governing what defines an employee vs. an independent contractor. Since many app designers and web developers work as independent contractors rather than employees or on short-term contracts, this means that California companies must re-evaluate these relationships. This impacts contractors who live outside of California but do business with companies located in the state.

There are other factors. Licensing, environmental regulation, and taxation are also different in California. Taxes tend to be higher than in other states. Regulation tends to be stricter in the areas of zoning, employer responsibilities, and others.

But while there are challenges, California is also filled with some great opportunities for IT companies and those who own them.

Unique California IT Industry Opportunities

To start with the opportunities in California, one only has to say two words: Silicon Valley. The proximity to some of the highest-profile tech companies and startups in the world makes owning an IT business in California highly desirable and profitable. From Apple to Facebook and others, California is the place to be.

This is shifting with the remote work from anywhere mentality that has developed as a result of COVID, but there are still big plusses to being physically close to some of the best talent the world has to offer.

And that’s the other factor. California has some of the best universities in the world, training the programmers and IT professionals of the future in our own back yard. For IT companies, that means you have a choice of great employees to choose from starting with young college graduates easy to make a difference to seasoned pros.

California is also a diverse state. People come from all over the United States and the world to settle in California due to the great climate, the lifestyle, and the variety of activities available. Your company can hire the best and the brightest no matter what their background without even looking beyond those in the state itself.

There are a lot of advantages to running an IT business in California, and if you are ready to sell your business, you can use those factors to entice the right buyer at the right time.

The Future of the California IT Industry and the Timing of Selling Your Business

The California economy is an interesting one. There is constant talk of change, people moving away to other parts of the country, yet construction, new home starts, and other factors show that people are moving to and staying in California. There are a variety of reasons for this, including the above-mentioned lifestyle, the colleges and schools, and the opportunities that come as a result.

The future of IT is California is even stronger as a result. Green energy initiatives, the multiple industries that IT supports in the state, and the increasing development and innovation that happens here are unlikely to slow any time soon.

What does that mean for selling your IT business? Buyers are eager to invest in companies that are profitable and future-proof or likely to make money going forward. What does that mean when it comes to preparing your business to sell?

Be profitable, or become profitable before you sell.

Be up to date. Be a part of things that are trending.

Innovate and plan for tomorrow. Don’t just dream, document those plans.

Get your financial house in order. Private equity groups and others are looking for companies that make due diligence easy, and they often are your buyer if you have an IT business.

Have an exit plan early. You should run your business like you plan to sell it tomorrow even if your plan to sell is a few years off.

Do you have questions about selling your IT business? Do you wonder if you are ready to sell now, or should wait? The place to start is with a business valuation. You can’t sell a business until you know what it is worth, and many companies have independent valuations done on a regular basis to document growth. We can help with a business valuation, and that’s the best place to start.

Then when you are ready to sell, we can help you through every step of that process from getting your business ready for due diligence to securely exchanging information with your potential buyer to the final escrow and closing process. Give us a call or contact us today! We’d love to help you sell your IT business as soon as you are ready.

The post Running and Selling a Business in the California IT Industry appeared first on Rogerson Business Services | CA Certified Business Broker.

October 1, 2020

Ed Goldman and The Goldman State interviews Andrew Rogerson

Ed Goldman is the author of THE GOLDMAN STATE and writes a thrice-weekly online column. When he was younger and more foolish, Ed was a daily columnist for the Sacramento Business Journal, as well as a monthly columnist both for Sacramento Magazine and Comstock’s Business Magazine. Ed is also the author of five books including Don’t Cry For Me, Ardent Reader; And Now, With Further Ado; But I Digress…, two plays and one musical.

Ed has taught journalism, public relations and marketing courses at three California State University campuses, two community colleges and the University of California Extension. In 1982, he founded Goldman Communications, Inc., a multiple award-winning marketing, PR and advertising consultancy. He would like to be the victim of a corporate takeover.

Although Ed is no longer young and foolish, he’s still foolish as he chose to revisit a conversation he had about 7 years ago and re-interview Andrew Rogerson, the Certified Business Broker that is Rogerson Business Services. So there are no misunderstandings, here is part of the interview Ed had with Andrew directly from The Goldman State.

This past March, just as the world was beginning its pandemic shutdown, Andrew Rogerson still was able to help one of his clients sell a medical-supply manufacturing business for $3.1 million.

“I get a success fee when that happens,” he says. And if the company wouldn’t have sold despite Rogerson’s best efforts? “Oh sometimes I get a thank-you note,” he says in his deadpan, Aussie accent, which somehow can make a situation sound funny rather than frustrating.

For the past 15 years, Rogerson, who’s 64, has been helping clients sell a variety of California businesses—as well as advise them on how to do valuations on companies and equipment, invest in franchises, buy companies and execute a diversity of tactical moves in the industry sector. What he provides through his firm, Rogerson Business Services, are pretty much one-off transactions—meaning, that while he gets plenty of referrals from satisfied customers, he rarely gets repeat business.

“They sell their company, they’re done with me,” he says in a tone that may define the word chipper. “And that’s just fine.”

I first wrote about Rogerson seven years ago, for the Sacramento Business Journal. At the time, he told me his Down Under back-story—how, when he was 21 years old, his grandfather gave him $10,000, which Rogerson used to build a house in his native Melbourne. “My dad was a plumber,” he said, “and everybody pitched in.”

Rogerson still believes in collaboration, many homes and five businesses later—including his ownership of an executive-suites complex, an office equipment business and both retail and wholesale travel agencies (one of which he says he sold for “240 percent of the original purchase price” just before that industry was largely rendered obsolete by the Internet). To help a client sell or buy a business he might bring in attorneys, accountants and an escrow company. In California, buying a business especially becomes a multi-player transaction.

That’s collaboration.

You are welcome to read the rest of the article on Ed’s website, the Goldman State.

The post Ed Goldman and The Goldman State interviews Andrew Rogerson appeared first on Rogerson Business Services | CA Certified Business Broker.

Andrew Rogerson’s Client Value his Valuations

Recently, Andrew Rogerson, the Certified Business Broker that is Rogerson Business Services, was interviewed by Ed Goldman for The Goldman State:

This past March, just as the world was beginning its pandemic shutdown, Andrew Rogerson still was able to help one of his clients sell a medical-supply manufacturing business for $3.1 million.

“I get a success fee when that happens,” he says. And if the company wouldn’t have sold despite Rogerson’s best efforts? “Oh sometimes I get a thank-you note,” he says in his deadpan, Aussie accent, which somehow can make a situation sound funny rather than frustrating.

For the past 15 years, Rogerson, who’s 64, has been helping clients sell a variety of California businesses—as well as advise them on how to do valuations on companies and equipment, invest in franchises, buy companies and execute a diversity of tactical moves in the industry sector. What he provides through his firm, Rogerson Business Services, are pretty much one-off transactions—meaning, that while he gets plenty of referrals from satisfied customers, he rarely gets repeat business.

“They sell their company, they’re done with me,” he says in a tone that may define the word chipper. “And that’s just fine.”

Andrew Rogerson photo by Nick Kalfountzos

I first wrote about Rogerson seven years ago, for the Sacramento Business Journal. At the time, he told me his Down Under back-story—how, when he was 21 years old, his grandfather gave him $10,000, which Rogerson used to build a house in his native Melbourne. “My dad was a plumber,” he said, “and everybody pitched in.”

Rogerson still believes in collaboration, many homes and five businesses later—including his ownership of an executive-suites complex, an office equipment business and both retail and wholesale travel agencies (one of which he says he sold for “240 percent of the original purchase price” just before that industry was largely rendered obsolete by the Internet). To help a client sell or buy a business he might bring in attorneys, accountants and an escrow company. In California, buying a business especially becomes a multi-player transaction. That’s collaboration.

Read the rest of the Interview here

The post Andrew Rogerson’s Client Value his Valuations appeared first on Rogerson Business Services | CA Certified Business Broker.

Do You Need an Attorney When Selling a California Business?

This is a question people will often ask as a business broker. After all, if you already have a Certified Business Broker and an accountant, do you really need an attorney, too? I mean, aren’t all the contracts pretty standard.

Besides, don’t attorney’s just cost extra, and can they mess up a deal? After all, they think differently than many business people.

The answer, unfortunately, is a little more complex than that.

An Attorney Knows the Ins and Outs of Contract Law

First of all, as a business owner, you are probably aware that contract law, especially in California, can be tricky at best. Even the terms and conditions you agree to with your cell phone provider are more complex than most people can comprehend. While we hit “approve” on those almost without thought, selling your business is a much bigger deal.

Think about it. Selling your business is perhaps the most significant financial event you will have in your life, and it is for most business owners. You want to make sure everything is done correctly in every area possible, and while a business broker may know the law, a contract attorney should be part of your team to double-check any contract before you sign.

Taxes and Liability

One of the biggest areas of dispute between buyers and sellers and a frequent deal killer is the issue of taxes and liability. Both parties want little or no tax liability, especially sellers, as they are looking to exit their business, and often retire and leave business life behind.

Sellers want the maximum profit as quickly as possible, and in the most common type of sale, an asset sale, they want to be able to depreciate the assets they purchase and have as low tax liability as they can from the start.

Often an attorney is your best resource here. They can show how other deals are structured and help come up with a solution that works for everyone involved. Just understand as a seller that the buyer will also have an attorney of their own and that often a compromise will be necessary.

That Pesky Landlord

Another common issue is the negotiation of your lease to allow a takeover by a new buyer, and therefore a new tenant. Often a landlord might see a transfer of ownership as an opportunity to renegotiate lease terms, and even raise the rent.

This can turn into a deal-breaker, and so it is often best to negotiate your lease before you even put your business up for sale. An attorney can look at your lease closely and help you determine what terms are a must-have for a buyer. This can also show your landlord you are serious, and help leverage your position.

Understand that if your landlord is unwilling to negotiate with you ahead of time, you need to let the buyer know early on. That way this doesn’t turn into a deal-breaker later on.

Licensing and Other Concerns

Let’s say you’re selling a medical practice in California, and a doctor or medical group from Texas is interested in purchasing it. Just because that doctor is licensed in Texas does not mean they will meet the qualifications for licensing and operating a medical practice in California. They will need to contact the California Medical Licensing Board to determine their next steps.

But the same is true for other businesses. Contractors must be licensed as well, and there are often local and regional requirements. Your business broker will be aware of many of these, but an attorney can often clear up legal matters like how long a new owner has to become licensed after the purchase, what requirements they have to meet, and they can even help with background and credit checks that might be part of the process.

Remember, as important as it is for your buyer to perform due diligence, it is just as important that you vet your buyer.

There are other important factors an attorney can help with, like determining the way the sale should be structured and other factors. There are a lot of legal intricacies to selling a California business. If your business broker and your attorney work together, they can assure a smooth sale process and hand-off to the new owner. But there is another unique process to consider in California.

Escrow and Closing

In California, for the sale of most businesses, escrow is a requirement. This complicates the process slightly, but between an attorney and your business broker, you can make this part of the process go smoothly.

This final closing is when you will sign the final paperwork that transfers ownership of your business and the money from the buyer to you. By this point, you should feel secure that all paperwork has been filed properly, and that the deal has been completed to your satisfaction, and in a legal way.

The Cons of Hiring an Attorney

Are there cons to hiring an attorney? There can be, and that is why recommendations from your business broker and other business owners are so important. Here are some potential cons.

An attorney may want zero liability for anyone, which can be an impossible task and a deal killer.

You want an attorney to fight for you, but there will be some areas where you need to give.

You and your broker must operate 100% legally. This is not a bad thing, but it is something to be aware of. That means no hiding assets or other “tricks” to avoid taxes without legal loopholes.

Attorneys can take up a lot of time and taking too much time to finalize a deal will often kill it. Be sure your attorney understands urgency and responds in a timely manner.

At Rogerson Business Services, we pride ourselves on integrity and honesty. We deal with every buyer and seller in exactly the same way. We highly recommend having an attorney involved in any transfer of business ownership.

Are you ready to sell your California based business? Check out the industries we specialize in here. We want to be your business broker, and we can get started with a business valuation right away. Contact us today for more information.

The post Do You Need an Attorney When Selling a California Business? appeared first on Rogerson Business Services | CA Certified Business Broker.

September 29, 2020

What is the forecast for the California economy post COVID-19?

COVID-19 has hit the global economy hard and hurting many business owners. For those of us in California, the economy has also been hit hard. In addition, we continuously hear negative news about the California economy regardless of the media we watch or listen or read.

March 16, 2020, was the date the six counties in the San Francisco Bay area came together and mandated the closing of non-essential businesses. This is also called the start of “The Great Lockdown recession.”

That is now over 6 months ago.

We currently have wildfires tearing up the US West Coast, COVID-19, and a US Presidential election just around the corner.

If we look ahead, what does the rest of 2020 and then the next three to four years look like for those of us that own and operate a business and live in California and are thinking of selling or buying?

At a recent conference for the California Association of Business Brokers, I was able to attend via Zoom a presentation from Dr. Robert Eyler. Dr. Eyler is the President of Economic Forensics and Analytics (EFA) as well as a Professor of Economics at Sonoma State University.

Dr. Eyler gave about a 90-minute presentation. I have condensed what I consider some of the highlights into this article with a specific focus to help a business owner in California decide if they should sell their business in the next 6 months or so. Perhaps it may be better to hang onto the business for a while with the expectation that the California economy may get better.

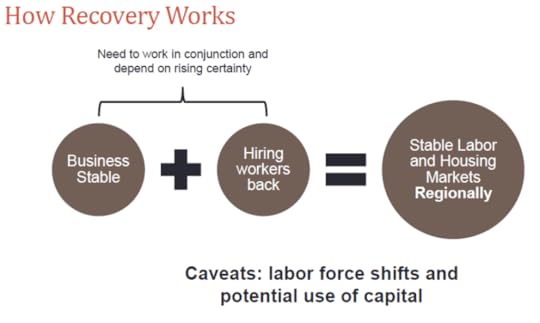

What does it take for an economy to recover?

Dr. Eyler explains that the most important item in an economic recovery is jobs.

For jobs to return, businesses need to be stable, so they are then willing to take the risk to hire back workers and indeed take on new hires.

The following slide presents a simple but effective graphic of how recovery works.

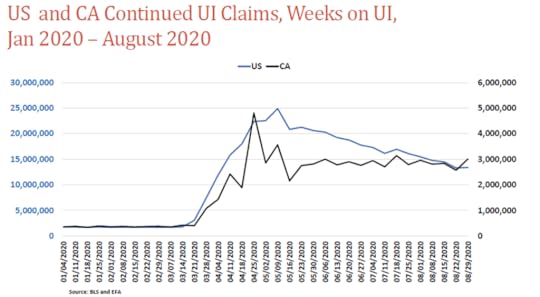

US and California Unemployment claims

From January 2020 to the end of August 2020, the US and California unemployment claims tended to track each other.

This is interesting as the Great Lockdown in California first went into effect on March 16, 2020, which immediately created a spike in unemployment claims, but the US unemployment claims began to rise at almost the exact same time.

The peak unemployment claims for the US and California were not far apart; about April 25, 2020, for California and May 09, 2020, for the US economy.

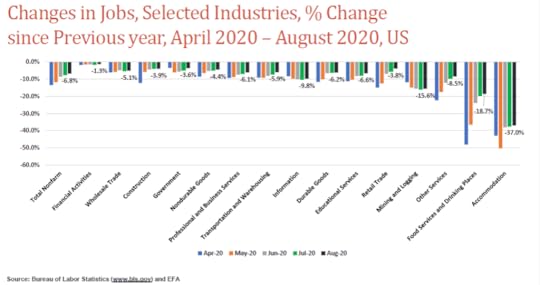

Not all industries in the California economy were affected

The influence of the loss of jobs has not been across all industries equally.

In fact, and it makes perfect sense, due to COVID-19 and shelter in place, some industries have been devastated while some industries have thrived due to the effects of the CARES Act and the stimulus to the economy.

As the graphic below shows, the California industries affected severely are:

Food Services and Drinking places as restaurants and bars were closed.

Accommodation as the travel industry came to a screaming halt from the collapse of both domestic and international tourism.

‘Other Services’ as this includes places like hair salons were brought to an immediate halt.

Mining and Logging have been affected but I am guessing this is more to do with mining (and drilling for oil due its drop in demand due to “Work From Home) while the logging industry is adjusting as the housing and commercial construction industries adapt due a slowdown and normalization.

Where does the US economy go from here?

If you have been following the business and political media, Congress has been doing its level best to pass a second round of the CARES Act or fiscal stimulus.

The Democrats want to pass legislation that includes trillions of dollars and the Republicans want it to be much smaller.

If any legislation passes it will provide job security for many businesses and their employees and stimulate the economy.

Additionally, the Federal Reserve has said its policy going forward after their September 2020 meeting is to keep interest rates near zero. This will be for at least the next 12 months if not further into 2022 or indeed 2023.

Hurricane Sally has dumped huge amounts of rain on the southeast corner of the United States. This has brought a large amount of damage which will also see re-building and stimulation to the economy.

What is happening to the California economy?

The California economy is under a challenge from different pressures. Something we are not talking about in too much detail at the moment, but the west coast wildfires hitting California, Oregon, and Washington have been devasting. I was told by one fire manager there is an ‘open checkbook’ to fight the fires. After the fires are brought under control, there will be re-building which will stimulate the west coast economies.

The four major areas to watch for the California economy are, according to Professor Robert Eyler:

Jobs

Housing

Business closures and incomes, and

Consumption behavior – what, how and when are consumers spending

In southern California, Los Angeles County is hurting as tourism and the movie industry have been shut down. Orange County, due to its tech sector, is not doing as badly.

The rural counties in California are doing well as there is a drain of residents from the more expensive southern California and Bay area counties plus they are more reliant on agriculture which continues to be stable.

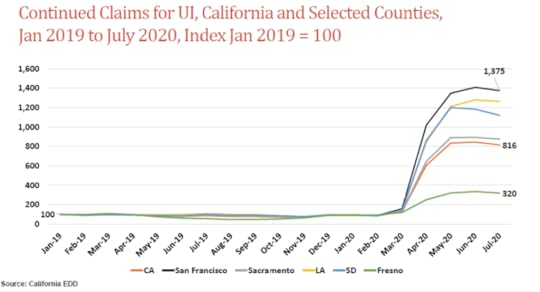

What is happening to the California job market?

As the graphic below shows, about March 16, 2020, was the date the California Governor and local state California counties went into shutdown mode.

As the graphic below shows, from about March 16, San Francisco County and Los Angeles county that has been in place to the end of June 2020. In July 2020, the numbers are starting to decline with San Francisco, Los Angeles, San Diego, and Sacramento counties about the state of California average while Fresno shows much greater stability.

Watch the CA housing market

Just as jobs are important, so too is the housing sector. If housing prices decline and decline quickly this is very much a negative as this affects consumer confidence and what flows from it.

As the graphic below shows, the median listing price for a house in 5 different counties in California from July 2016 to July 2020 is within the normal range with Los Angeles County, Sacramento County, and Fresno County, in fact, seeing increases.

What is happening to Small Businesses in the California Economy?

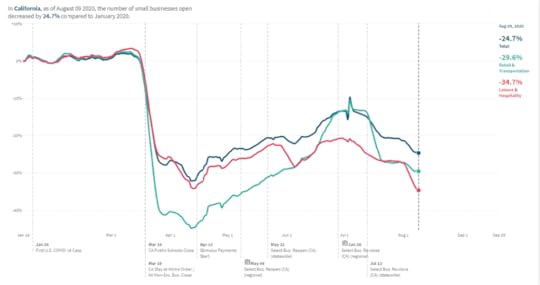

As the graphic below shows from www.tracktherecovery.org, as of August 09, 2020, and compared to January 2020 the State of California saw a statewide decrease of small businesses open by 24.7% or the dark green line.

Two industry sectors have been hit by a decrease in the number of small businesses being open. These are the Retail and Transportation sector which saw a 29.6% decrease as of August 09, 2020, when compared to January 2020 or the light green line. The other industry sector was leisure and hospitality and it saw a 34.7 decline as of August 09, 2020, when compared to January 2020 or the red line.

CARES Act and supporting California businesses with PPP Loans less than $150,000

There can be no doubt that the Federal government passing of the CARES Act and the support it gave to businesses via the SBA PPP Loan program and SBA Economic Injury Disaster Loan program was real and helped many industries.

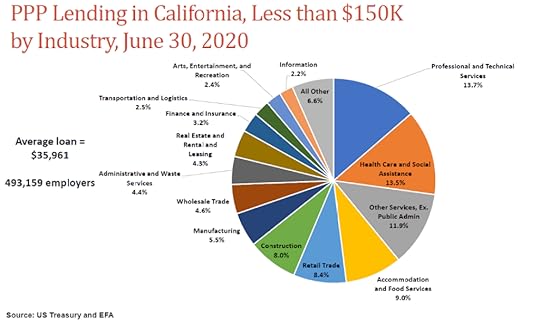

For those businesses that received a loan of less than $150,000, the average loan size was $35,961.

Below is a pie chart of the PPP lending in California by industry sector. This is at June 30, 2020, for loans up to $150,000.

CARES Act and supporting California businesses with PPP Loans greater than $150,000

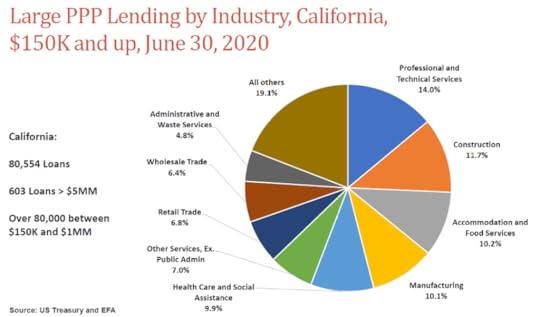

For those businesses in California that received a loan greater than $150,000, there were 80,554 loans approved. Of those loans, there were 603 loans approved for an amount greater than $5 million. Additionally, there were over 80,000 loans approved between $150,000 and $1 million.

Below is a pie chart of the PPP lending in California by industry sector. This is at June 30, 2020 and for loans from $150,000 and up.

Is it the right time to sell my California business?

Despite what is happening in the economy, and there is more than plenty happening, the decision to value and then sell your business remains an incredibly personal decision.

The labor marketing is recovering as we can see with unemployment claims. This is great news as it represents stability as we move into the ‘new normal.’

Interest rates are at historically incredibly low levels. This is also great news as it helps businesses not only with their borrowing costs but also homeowners who are refinancing to provide them with additional discretionary spending.

The upcoming Federal elections are moving to a conclusion and the removal of uncertainty that will affect investment decisions.

COVID-19 is waiting for a vaccine and that appears to be closer and closer.

Housing prices are stable and so providing an orderly market for those that want to buy or sell.

For those of us in California, one of the few negatives is that we can probably expect an increase in taxes.

One of the biggest factors to consider is the industry sector your business is in. More stable industry sectors in California seem to be manufacturing, construction, warehousing, and logistics.

If you are thinking of selling your business and want the process to be as clean and successful as possible, the first place to start is with a business valuation.

An accurate business valuation is not only important to the seller but it’s important as a buyer may require finance such as an SBA loan to buy a business and an SBA lender will want the details of the business being sold to be presented clearly and cleanly.

Once the business valuation is clear, there are many steps to successfully sell a business. Here is a summary of the Twenty Four steps it typically requires. If you would like more detail, here is a more comprehensive explanation about selling a business.

If you have questions about valuing or selling your California business, you are welcome to schedule a 30-minute conversation with me. Simply click this link to see my calendar and schedule a call with me by choosing a date and time that works for you. The rest happens automatically. I want to be your business broker and help you sell your business to the right buyer at the right time.

The post What is the forecast for the California economy post COVID-19? appeared first on Rogerson Business Services | CA Certified Business Broker.